Single Euro Payments Area (SEPA): Self-Regulation Under Competition Scrutiny ARTICLES

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Authorisation Service Sales Sheet Download

Authorisation Service OmniPay is First Data’s™ cost effective, Supported business profiles industry-leading payment processing platform. In addition to card present POS processing, the OmniPay platform Authorisation Service also supports these transaction The OmniPay platform Authorisation Service gives you types and products: 24/7 secure authorisation switching for both domestic and international merchants on behalf of merchant acquirers. • Card Present EMV offline PIN • Card Present EMV online PIN Card brand support • Card Not Present – MOTO The Authorisation Service supports a wide range of payment products including: • Dynamic Currency Conversion • Visa • eCommerce • Mastercard • Secure eCommerce –MasterCard SecureCode, Verified by Visa and SecurePlus • Maestro • Purchase with Cashback • Union Pay • SecureCode for telephone orders • JCB • MasterCard Gaming (Payment of winnings) • Diners Card International • Address Verification Service • Discover • Recurring and Installment • BCMC • Hotel Gratuity • Unattended Petrol • Aggregator • Maestro Advanced Registration Program (MARP) Supported authorisation message protocols • OmniPay ISO8583 • APACS 70 Authorisation Service Connectivity to the Card Schemes OmniPay Authorisation Server Resilience Visa – Each Data Centre has either two or four Visa EAS servers and resilient connectivity to Visa Europe, Visa US, Visa Canada, Visa CEMEA and Visa AP. Mastercard – Each Data Centre has a dedicated Mastercard MIP and resilient connectivity to the Mastercard MIP in the other Data Centre. The OmniPay platform has connections to Banknet for both European and non-European authorisations. Diners/Discover – Each Data Centre has connectivity to Diners Club International which is also used to process Discover Card authorisations. JCB – Each Data Centre has connectivity to Japan Credit Bureau which is used to process JCB authorisations. UnionPay – Each Data Centre has connectivity to UnionPay International which is used to process UnionPay authorisations. -

New Debit Card Solutions At

New Debit Card Solutions Debit Mastercard and Visa Debit are ready Swiss Banking Services Forum, 22 May 2019 Philippe Eschenmoser, Head Cards & A2A, Swisskey Ltd Maestro/V PAY Have Established Themselves As the “Key to the Account” – Schemes, However, Are Forcing Market Entry For Successor Products Response from the Maestro and V PAY are successful… …but are not future-capable products schemes # cards Maestro V PAY on Lower earnings potential millions8 for issuers as an alternative payment traffic products (e.g. 6 credit cards, TWINT) Issuer 4 V PAY will be 2 decommissioned by VISA Functional limitations: in 20211 – Visa Debit as 0 • No e-commerce the successor 2000 2018 • No preauthorizations Security and stability have End- • No virtualization proven themselves customer High acceptance in CH and Merchants with an online MasterCard is positioning abroad in Europe offer are demanding an DMC in the medium term online-capable debit as the successor to Standard product with an Merchan product Maestro integrated bank card t 2 1: As of 2021 no new V PAY may be issued TWINT (Still) No Substitute For Debit Cards – Credit Cards With Divergent Market Perception TWINT (still) not alternative for debit Credit cards a no alternative for debit Lacking a bank card Debit function Limited target group (age, ~1.1 M 1 ~10 M. creditworthiness...) Issuer ~48.5 k ~170 k1 No direct account debiting DMC/ Visa Debit Potentially high annual fee End-customer Lower customer penetration Banks and merchants DMC/ P2P demand an online- Higher costs Merchant Visa Debit -

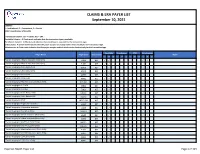

Claims and Remits Payer List

CLAIMS & ERA PAYER LIST September 10, 2021 LEGEND: I = Institutional, P = Professional, D = Dental COB = Coordination of Benefits Transaction Column: 837 = Claims, 835 = ERA Available Column: A Check-mark indicates that the transaction type is available. Enrollment Column: A Check-mark indicates that enrollment is required for the transaction type. COB Column: A Check-mark Indicates that the payer accepts secondary claims electronically for the transaction type. Attachments: A Check-mark indicates that the payer accepts medical attachments electronically for the transaction type. Available Enrollment COB Attachments Payer Name Payer Code Transaction Notes I P D I P D I P D I P D *Carisk Imaging to Allstate Insurance (Auto Only) E1069 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Allstate Insurance (Auto Only) E1069 835 ✓ ✓ *Carisk Imaging to Geico (Auto Only) GEICO 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Geico (Auto Only) GEICO 835 ✓ ✓ *Carisk Imaging to Nationwide A0002 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Nationwide A0002 835 ✓ ✓ *Carisk Imaging to New York City Law Department NYCL001 837 ✓ ✓ ✓ ✓ *Carisk Imaging to NJ-PLIGA E3926 837 ✓ ✓ ✓ ✓ *Carisk Imaging to NJ-PLIGA E3926 835 ✓ ✓ *Carisk Imaging to North Dakota WSI NDWSI 837 ✓ ✓ ✓ ✓ *Carisk Imaging to North Dakota WSI NDWSI 835 ✓ ✓ *Carisk Imaging to NYSIF NYSIF1510 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Progressive Insurance E1139 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Progressive Insurance E1139 835 ✓ ✓ *Carisk Imaging to Pure (Auto Only) PURE01 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Safeco Insurance (Auto Only) E0602 837 ✓ ✓ ✓ ✓ -

Submission to the Reserve Bank of Australia Response to EFTPOS

Submission to the Reserve Bank of Australia Response To EFTPOS Industry Working Group By The Australian Retailers Association 13 September 2002 Response To EFTPOS Industry Working Group Prepared with the assistance of TransAction Resources Pty Ltd Australian Retailers Association 2 Response To EFTPOS Industry Working Group Contents 1. Executive Summary.........................................................................................................4 2. Introduction......................................................................................................................5 2.1 The Australian Retailers Association ......................................................................5 3. Objectives .......................................................................................................................5 4. Process & Scope.............................................................................................................6 4.1 EFTPOS Industry Working Group – Composition ...................................................6 4.2 Scope Of Discussion & Analysis.............................................................................8 4.3 Methodology & Review Timeframe.........................................................................9 5. The Differences Between Debit & Credit .......................................................................10 5.1 PIN Based Transactions.......................................................................................12 5.2 Cash Back............................................................................................................12 -

DEBIT CARD POLICY 1. Debit Card a Debit Card Is a Plastic Card That

DEBIT CARD POLICY 1. Debit Card A debit card is a plastic card that provides the cardholder electronic access to his/her bank account(s). It is an instrument that can be used to: Avail of banking services such as cash withdrawal, balance enquiry etc., from any ATM and Micro ATM. Make payments to merchants against purchase, withdrawal of cash at POS or both within the prescribed limit by RBI at merchant outlets. e-Commerce transactions. 2. Understanding a Debit Card. a) Card Number: It is a 16 or 19 digit number linked to customer’s bank account. First 6 digits represent Bank’s identification no., next 4 digits represent Branch Sol ID. Remaining digits indicates serial number of the cards issued by that particular branch. Currently Bank issue debit cards with 16 digit length. b) Name of the Person: Person authorized to use the card. This field is present only on personalized card. c) Valid Date: It is in mm/yy format. The card is valid till the last day of the month. d) Card Verification Value (CVV) /CVV2: A 03 (Three) digit number printed on the back side of every debit card. This is used for validation of online transactions. e) Magnetic Strip: Important information regarding the debit card is stored in electronic format here and hence any kind of scratches or exposure to magnetic fields will cause damage to the card. f) EMV Chip Card: EMV stands for Europay, MasterCard and Visa. EMV is a global standard for credit and debit payment cards based on chip card technology. -

Multi-Lateral Mechanism of Cash Machines: Virtue Or Hassel

International Journal of Engineering Technology Science and Research IJETSR www.ijetsr.com ISSN 2394 – 3386 Volume 4, Issue 10 October 2017 Multi-Lateral Mechanism of Cash Machines: Virtue or Hassel Peeush Ranjan Agrawal1 and Sakshi Misra Shukla2 1 Professor, School of Management studies, MNNIT, Allahabad, Uttar Pradesh,India 2Assistant Professor, Department of MBA, S.P. Memorial Institute of Technology, Allahabad, India ABSTRACT Automated Teller Machines or Cash Machines became an organic constituent of the banking sector. The paper envisionsthe voyage that these cash machines have gone through since their initiation in the foreign banks operating in India. The study revolves around the indispensible factors in the foreign banking environment like availability, connectivity customer base, security, network gateways and clearing houses which were thoroughly reviewed and analyzed in the research paper. The methodology of the research paper includes literature review, derivation of variables, questionnaire formulation, pilot testing, data collectionand application of statistical tools with the help of SPSS software. The paper draws out findings related to the usage, congregation, multi-lateral functioning, security and growth of ATMs in the foreign banks operating in the country. The paper concludes by rendering recommendations to theforeign bankers to vanquish the stumbling blocks of the cash machines functioning. Keywords: ATMs, Cash Machines, Anywhere Banking, Foreign Banking, Online Banking 1. INTRODUCTION The Automated Teller Machine (ATM) has become an integral part of banking operations. Initially perceived as ‘cash machines’, which dispenses cash to depositors, ATMs can accept deposits, sell postage stamps, print statements and be used at institutions where the depositor does not have an account. -

Assessing Payments Systems in Latin America

Assessing payments systems in Latin America An Economist Intelligence Unit white paper sponsored by Visa International Assessing payments systems in Latin America Preface Assessing payments systems in Latin America is an Economist Intelligence Unit white paper, sponsored by Visa International. ● The Economist Intelligence Unit bears sole responsibility for the content of this report. The Economist Intelligence Unit’s editorial team gathered the data, conducted the interviews and wrote the report. The author of the report is Ken Waldie. The findings and views expressed in this report do not necessarily reflect the views of the sponsor. ● Our research drew on a wide range of published sources, both government and private sector. In addition, we conducted in-depth interviews with government officials and senior executives at a number of financial services companies in Latin America. Our thanks are due to all the interviewees for their time and insights. May 2005 © The Economist Intelligence Unit 2005 1 Assessing payments systems in Latin America Contents Executive summary 4 Brazil 17 The financial sector 17 Electronic payments systems 7 Governing institutions 17 Electronic payment products 7 Banks 17 Conventional payment cards 8 Clearinghouse systems 18 Smart cards 8 Electronic payment products 18 Stored value cards 9 Credit cards 18 Internet-based Payments 9 Debit cards 18 Payment systems infrastructure 9 Smart cards and pre-paid cards 19 Clearinghouse systems 9 Direct credits and debits 19 Card networks 10 Strengths and opportunities 19 -

Application for a Maestro Card

CREDIT SUISSE (Switzerland) Ltd. Application for a Maestro Card Surname, First name / Company Date of birth This application refers to the following account no. IBAN (International Bank Account Number) (hereinafter referred to as the Client) 1. Application for a Maestro Card The Client hereby applies for a Maestro card from Credit Suisse (Switzerland) Ltd. (hereinafter referred to as the Bank). For him/herself, or For the following person (hereinafter referred to as the Authorized Cardholder): Mr. Ms. Surname First name Street/no. Postcode/town Domicile Date of birth Nationality Language of correspondence Card imprint 1st line 2nd line (automatic: cardholder; poss. manual entry of max. 24 characters) (poss. the account holder) The Authorized Cardholder is granted limited account The following services are available with the Maestro card: access rights for this card (Corporate Clients: not Cash withdrawals at ATMs in Switzerland and abroad possible for joint signatory authority). Cashless payment for goods and services in Switzerland Account access rights enable the Authorized Cardholder and abroad to: The Maestro card has a Maestro PIN (Personal query and print out account information at Credit Identification Number) for the use of ATMs and Maestro Suisse ATMs (current account balance, last five terminals at points of sale. transactions) make cash deposits at Credit Suisse ATMs equipped for that purpose. To be completed by the Bank Client no. (CIF) Client no. (CIF) Account holder ________________________________________ Authorized -

Mastercard® Guide to Benefits for Credit Cardholders

MasterCard® Guide to Benefits for Credit Cardholders MasterCard® Cardholder Core Credit Benefits + MasterRental + Purchase Assurance + Travel Assistance Services Important information. Please read and save. This Guide to Benefits contains detailed information about insurance and retail protection services you can access as a preferred cardholder. This Guide supersedes any guide or program description you may have received earlier. To file a claim or for more information on any of these services, call the MasterCard Assistance Center at 1-800-MasterCard: 1-800-627-8372, or en Español: 1-800-633-4466. “Card” refers to MasterCard® card and “Cardholder” refers to a MasterCard® cardholder. MasterCard Guide to Benefits Benefits that are always with you KEY TERMS: and words that appear in bold and Legal disclosures. The following Key Terms apply to the following benefits: MasterRental, Purchase Assurance and Extended Warranty. A. To get coverage: Key Terms: You must initiate and then pay for the entire rental agreement (tax, gasoline, and airport fees are not considered rental charges) Throughout this document, You and Your refer to the with your covered card and/or the accumulated points from your cardholder or authorized user of the covered card. We, Us, covered card at the time the vehicle is returned. If a rental and Our refer to New Hampshire Insurance Company, an AIG company promotion/discount of any kind is initially applied company. toward payment of the rental vehicle, at least one (1) full day of rental must be billed to your covered card. Administrator means Sedgwick Claims Management Services, You must decline the optional collision/damage waiver (or similar Inc., you may contact the administrator if you have questions coverage) offered by the rental company. -

Card Processing Guide - MOI 2015.Qxp GP 07/09/2015 17:45 Page 1

JM3150_Card Processing Guide - MOI 2015.qxp_GP 07/09/2015 17:45 Page 1 CARD PROCESSING GUIDE MERCHANT OPERATING INSTRUCTIONS SERVICE. DRIVEN. COMMERCE JM3150_Card Processing Guide - MOI 2015.qxp_GP 07/09/2015 17:45 Page 2 CONTENTS SECTION PAGE Welcome 1 Global Payments 1 About This Document 1 An Introduction To Card Processing 3 The Anatomy Of A Card Payment 3 Transaction Types 4 Risk Awareness 4 Card Present (CP) Transactions 9 Cardholder Verified By PIN 9 Cardholder Verified By Signature 9 Cardholder Verified By PIN And Signature 9 Contactless Card Payments 10 Checking Cards 10 Examples Of Card Logos 13 Examples Of Cards And Card Features 14 Accepting Cards Using An Electronic Terminal 18 Authorisation 19 ‘Code 10’ Calls 24 Account Verification/Status Checks 25 Recovered Cards 26 Refunds 27 How To Submit Your Electronic Terminal Transactions 29 Using Fallback Paper Vouchers 30 Card Not Present (CNP) Transactions 33 Accepting Mail And Telephone Orders 33 Accepting Internet Orders 34 Authorisation Of CNP Transactions 36 Confirming CNP Orders 38 Delivering Goods 39 Collection Of Goods 39 Special Transaction Types 40 Bureau de Change 40 Dynamic Currency Conversion (DCC) 41 Foreign Currency Transactions 41 Gratuities 42 Hotel And Car Rental Transactions 42 Prepayments/Deposits/Instalments 44 Purchase With Cashback 44 Recurring Transactions 45 Global Iris 48 HomeCurrencyPay 50 An Introduction To HomeCurrencyPay 50 JM3150_Card Processing Guide - MOI 2015.qxp_GP 07/09/2015 17:45 Page 3 SECTION PAGE Card Present (CP) HomeCurrencyPay Transactions -

OPERA V5 OPI Installation and Reference Guide Release 20.1 F26820-01 Copyright © 2010, 2020, Oracle And/Or Its Affiliates

Oracle® Hospitality Payment Interface OPERA V5 OPI Installation and Reference Guide Release 20.1 F26820-01 July 2020 Oracle Hospitality Payment Interface OPERA V5 OPI Installation and Reference Guide Release 20.1 F26820-01 Copyright © 2010, 2020, Oracle and/or its affiliates. All rights reserved. This software and related documentation are provided under a license agreement containing restrictions on use and disclosure and are protected by intellectual property laws. Except as expressly permitted in your license agreement or allowed by law, you may not use, copy, reproduce, translate, broadcast, modify, license, transmit, distribute, exhibit, perform, publish, or display any part, in any form, or by any means. Reverse engineering, disassembly, or decompilation of this software, unless required by law for interoperability, is prohibited. The information contained herein is subject to change without notice and is not warranted to be error-free. If you find any errors, please report them to us in writing. If this software or related documentation is delivered to the U.S. Government or anyone licensing it on behalf of the U.S. Government, then the following notice is applicable: U.S. GOVERNMENT END USERS: Oracle programs, including any operating system, integrated software, any programs installed on the hardware, and/or documentation, delivered to U.S. Government end users are "commercial computer software" pursuant to the applicable Federal Acquisition Regulation and agency-specific supplemental regulations. As such, use, duplication, disclosure, modification, and adaptation of the programs, including any operating system, integrated software, any programs installed on the hardware, and/or documentation, shall be subject to license terms and license restrictions applicable to the programs. -

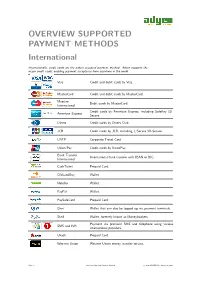

OVERVIEW SUPPORTED PAYMENT METHODS International

OVERVIEW SUPPORTED PAYMENT METHODS International Internationally, credit cards are the widest accepted payment method. Adyen supports the major credit cards, enabling payment acceptance from anywhere in the world. Visa Credit and debit cards by Visa. MasterCard Credit and debit cards by MasterCard. Maestro Debit cards by MasterCard. International Credit cards by American Express, including SafeKey 3D- American Express Secure. Diners Credit cards by Diners Club. JCB Credit cards by JCB, including J/Secure 3D-Secure. UATP Corporate Travel Card. Union Pay Credit cards by UnionPay. Bank Transfer International bank transfer with IBAN or BIC. International CashTicket Prepaid Card. ClickandBuy Wallet. Neteller Wallet. PayPal Wallet. PaySafeCard Prepaid Card. Qiwi Wallet that can also be topped up via payment terminals. Skrill Wallet, formerly known as Moneybookers. Payment via premium SMS and telephone using various SMS and IVR international providers. Ukash Prepaid Card. Western Union Western Union money transfer service. Page 1 Overview Supported Payment Methods c 2012 ADYEN BV - August 23, 2012 Europe Loyalty cards Support for various loyalty and store cards. Austria Bank Transfer Offline bank transfer. Sofortbanking Online banking supporting various local banks. Belgium Bank Transfer Offline bank transfer. BanContact / Mr. Debit card in Belgium. Cash Sofortbanking Online banking supporting various local banks. Denmark Primarily credit card and the local debit scheme. Bank Transfer Offline bank transfer. Dankort Local debit card scheme. Open Invoice Payments on credit by open invoice. Finland Primarily Credit Card. Besides this there is a very good market share for online banking. Bank Transfer Offline bank transfer. Ålandsbanken Online banking. Handelsbanken Online banking. Nordea Online banking.