OVERVIEW SUPPORTED PAYMENT METHODS International

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mobile Banking

Automated teller machine "Cash machine" Smaller indoor ATMs dispense money inside convenience stores and other busy areas, such as this off-premise Wincor Nixdorf mono-function ATM in Sweden. An automated teller machine (ATM) is a computerized telecommunications device that provides the customers of a financial institution with access to financial transactions in a public space without the need for a human clerk or bank teller. On most modern ATMs, the customer is identified by inserting a plastic ATM card with a magnetic stripe or a plastic smartcard with a chip, that contains a unique card number and some security information, such as an expiration date or CVVC (CVV). Security is provided by the customer entering a personal identification number (PIN). Using an ATM, customers can access their bank accounts in order to make cash withdrawals (or credit card cash advances) and check their account balances as well as purchasing mobile cell phone prepaid credit. ATMs are known by various other names including automated transaction machine,[1] automated banking machine, money machine, bank machine, cash machine, hole-in-the-wall, cashpoint, Bancomat (in various countries in Europe and Russia), Multibanco (after a registered trade mark, in Portugal), and Any Time Money (in India). Contents • 1 History • 2 Location • 3 Financial networks • 4 Global use • 5 Hardware • 6 Software • 7 Security o 7.1 Physical o 7.2 Transactional secrecy and integrity o 7.3 Customer identity integrity o 7.4 Device operation integrity o 7.5 Customer security o 7.6 Alternative uses • 8 Reliability • 9 Fraud 1 o 9.1 Card fraud • 10 Related devices • 11 See also • 12 References • 13 Books • 14 External links History An old Nixdorf ATM British actor Reg Varney using the world's first ATM in 1967, located at a branch of Barclays Bank, Enfield. -

Payments Insights. Opinions. Volume 24

#payments insights. opinions. Tap. Touch. Speak. Grab and Seven themes impacting the future of payments go. The way we make payments is changing faster than any Winners in the future payments ecosystem will be those that make the right decisions other area of financial services. today. Understanding these seven key themes reshaping payments will help leaders make those decisions and determine how best to differentiate themselves in this New technology and changing fast-changing landscape. customer expectations are shattering the status quo and ushering in a growing number Continued on page 3 of new players that are challenging the traditional role of banks. Volume 24 03 Seven themes impacting the future of payments Understanding the themes transforming payments can help banks make strategic investment decisions and emerge as winners. 07 Why real-time payments are the new normal — and how payments providers can adapt As RTP schemes expand, providers will need to assess readiness and define a clear strategy for platforms, operations, risk and customer experience. Editorial 10 How the mPOS business model expands This newsletter comes to you as many of us prepare to meet again at beyond payments acceptance Sibos – the world’s premier financial services event, held this year in London, 23 to 26 September 2019. EY is a proud sponsor of Sibos, and commends As pure payments acceptance becomes a their efforts to bring together the global financial services and payments commodity for smaller merchants and fees from transaction processing come under community. pressure, mPOS providers are putting a This year’s theme is an exciting one that touches on many of the issues we strategic focus on value-added services to are covering in this #payments issue: “Thriving in a hyperconnected world” continue their high growth. -

NPCI Appoints FIME to Set up the Certification Body for India's

NPCI appoints FIME to set up the certification body for India’s Payment Scheme, RuPay FIME to define, manage and execute certification programme for RuPay 6 March 2014 – National Payments Corporation of India (NPCI), the umbrella organisation of all retail payment systems in the country, has appointed advanced secure-chip testing provider FIME to deliver its RuPay certification programme. NPCI will utilise FIME’s expertise in setting up EMV®-based certification board for its card payment scheme- RuPay. FIME will define the certification specification, laboratory setup, test plan specification, test tools and operate the certification board for RuPay. FIME will also be involved in setting up the certification process including the associated administrative and business operations. This certification board will be effective from March 2014. This will ensure all payment cards and point-of-sale terminals deployed under the brand align to the requirements of RuPay specifications. It will also ensure necessary infrastructural alignment of acquirers and issuers with the payment system. Prakash Sambandam, Director of FIME India says: “Many countries have, or are in the process of migrating to the EMV payment standard. Transitioning to a chip payment infrastructure will take time and require the implementation of new product development cycles. Adhering to RuPay, an EMV payment scheme will ensure that the products achieve the required functional and security standards and perform as intended, once live in the marketplace. This level of compliance is vital to ensure product interoperability and security optimisation”. In addition to enhanced security, the new payment platform presents opportunities to deliver advanced payment solutions – such as mobile and contactless payments – which are based on secure-chip technology. -

CANADA Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT CANADA Executive Summary Banking The Canadian central bank is the Bank of Canada / Banque du Canada. The bank is based in Ottawa and its authority derives from the Bank of Canada Act. Canada does not apply central bank reporting requirements. Resident entities are permitted to hold fully convertible foreign currency bank accounts domestically and outside Canada. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Canada. Canada has 32 domestic banks and 24 subsidiaries of foreign banks that are permitted to offer the full range of wholesale and retail banking services. There are also five cooperative credit associations that are federally regulated. In addition, 33 foreign banks have established branches in Canada. Payments Canada’s two main interbank payment clearing systems are LVTS and ACSS. The most important cashless payment instruments in Canada are electronic credit transfers in terms of value and card payments in terms of volume. Although their usage is falling, checks remain an important form of payment. The increased use of electronic and internet banking has led to a growth in the use of electronic payments such as electronic credit transfers and direct debits. Card payments have increased steadily, especially in the retail sector. Liquidity Management Canadian-based companies have access to a variety of short-term funding alternatives. There is also a range of short-term investment instruments available. Cash concentration is the more common technique used by Canadian companies to manage company and group liquidity. Of the available techniques, zero-balancing is the most commonly used. -

Authorisation Service Sales Sheet Download

Authorisation Service OmniPay is First Data’s™ cost effective, Supported business profiles industry-leading payment processing platform. In addition to card present POS processing, the OmniPay platform Authorisation Service also supports these transaction The OmniPay platform Authorisation Service gives you types and products: 24/7 secure authorisation switching for both domestic and international merchants on behalf of merchant acquirers. • Card Present EMV offline PIN • Card Present EMV online PIN Card brand support • Card Not Present – MOTO The Authorisation Service supports a wide range of payment products including: • Dynamic Currency Conversion • Visa • eCommerce • Mastercard • Secure eCommerce –MasterCard SecureCode, Verified by Visa and SecurePlus • Maestro • Purchase with Cashback • Union Pay • SecureCode for telephone orders • JCB • MasterCard Gaming (Payment of winnings) • Diners Card International • Address Verification Service • Discover • Recurring and Installment • BCMC • Hotel Gratuity • Unattended Petrol • Aggregator • Maestro Advanced Registration Program (MARP) Supported authorisation message protocols • OmniPay ISO8583 • APACS 70 Authorisation Service Connectivity to the Card Schemes OmniPay Authorisation Server Resilience Visa – Each Data Centre has either two or four Visa EAS servers and resilient connectivity to Visa Europe, Visa US, Visa Canada, Visa CEMEA and Visa AP. Mastercard – Each Data Centre has a dedicated Mastercard MIP and resilient connectivity to the Mastercard MIP in the other Data Centre. The OmniPay platform has connections to Banknet for both European and non-European authorisations. Diners/Discover – Each Data Centre has connectivity to Diners Club International which is also used to process Discover Card authorisations. JCB – Each Data Centre has connectivity to Japan Credit Bureau which is used to process JCB authorisations. UnionPay – Each Data Centre has connectivity to UnionPay International which is used to process UnionPay authorisations. -

04 April 2013 PCI Council Announces New Affiliate Members WAKEFIELD, Mass., 4 April, 2013

Media Contacts Laura K. Johnson, Ella Nevill PCI Security Standards Council +1-781-876-6250 [email protected] Twitter @PCISSC PCI SECURITY STANDARDS COUNCIL ANNOUNCES NEW AFFILIATE MEMBERS — First cohort of PCI SSC Affiliate members comprised of global payment security experts— WAKEFIELD, Mass., 4 April, 2013 — Today the PCI Security Standards Council (PCI SSC), an open, global forum for the development of payment card security standards announced that three organizations have joined the Council as the first Affiliate members. The Australian Payment Clearing Association (APCA), Cartes Bancaires CB and Interac Association will participate in this new capacity effective 1 April, 2013. The Council introduced the Affiliate membership class in 2012 as part of a continued drive to leverage industry expertise and broaden global input into the standards development process. Affiliate membership is open to regional and national organizations that define standards and influence adoption by their constituents who process, store or transmit cardholder data. This category offers Affiliate members the opportunity to become active participants on PCI working groups, in addition to playing an integral role in the standards development process. The Australian Payments Clearing Association (APCA) is the self-regulatory body set up by the payments industry to improve the safety, reliability, equity, convenience and efficiency of the Australian payments system. APCA represents 90 members that include the Reserve Bank of Australia, major and regional banks, building societies, credit unions, large retailers and other principal payments service providers. Cartes Bancaires CB, (Groupement des Cartes Bancaires CB), based in Paris, France, is an Economic Interest Consortium (GIE), and the governing body of the CB payment system. -

Account Selection Made Easy Money Management Tools

ACCOUNT SELECTION MADE EASY MONEY MANAGEMENT TOOLS Recordkeeping As an online or mobile Banking Customer, you can view your account transactions whenever you wish. Banking, you can view, print and save copies of cheques that have cleard through your Canadian accounts service is free of charge. Automatic transfers Pre-authorized payments and direct deposits Overdraft protection6 FINDING THE PERFECT FIT FOR MANAGING YOUR MONEY Easy, exible banking, to suit all your needs Bank the way you want (ATMs) or in branch ® ATM cash withdrawals throughout Canada secure way to send, request and receive money directly from one bank account to another © ATMs cash withdrawals around the world EASY ACCESS ATMs, Mobile, Telephone and Online Banking. Your Online Banking Telephone Banking ATMs Interac® Debit Interac® e-Transfer Use Online Banking to send/request money to/from anyone with an email address or cellphone number and a bank account at a Canadian nancial institution. International ATM withdrawals Cirrus©2 ATM. First Nations Bank of Canada branch service The Exchange® Network Withdraw cash or make deposits at participating ATMs displaying e Exchange® Network symbol. Looking for a convenient way to needs? Our chequing accounts have what you need to take care of your bill payments, deposits, withdrawals and Value Account Transactions Included 12 included Additional Fees Interac® ATM withdrawal $1.50 each Cirrus©2 ATM (inside U.S. and Mexico) $3 each Cirrus©2 ATM (outside Canada, U.S. and Mexico) $5 each Interac® e-Transfers sent $1.50 each Receive a Fullled Interac® Money Request $1.50 Fulfill an Interac® e-Transfer Money Request free Recordkeeping Options Additional Features Monthly Fees and Rebates Value Plus Account Transactions Included Additional Fees Interac® ATM withdrawal $1.50 each Cirrus©2 ATM (inside U.S. -

New Debit Card Solutions At

New Debit Card Solutions Debit Mastercard and Visa Debit are ready Swiss Banking Services Forum, 22 May 2019 Philippe Eschenmoser, Head Cards & A2A, Swisskey Ltd Maestro/V PAY Have Established Themselves As the “Key to the Account” – Schemes, However, Are Forcing Market Entry For Successor Products Response from the Maestro and V PAY are successful… …but are not future-capable products schemes # cards Maestro V PAY on Lower earnings potential millions8 for issuers as an alternative payment traffic products (e.g. 6 credit cards, TWINT) Issuer 4 V PAY will be 2 decommissioned by VISA Functional limitations: in 20211 – Visa Debit as 0 • No e-commerce the successor 2000 2018 • No preauthorizations Security and stability have End- • No virtualization proven themselves customer High acceptance in CH and Merchants with an online MasterCard is positioning abroad in Europe offer are demanding an DMC in the medium term online-capable debit as the successor to Standard product with an Merchan product Maestro integrated bank card t 2 1: As of 2021 no new V PAY may be issued TWINT (Still) No Substitute For Debit Cards – Credit Cards With Divergent Market Perception TWINT (still) not alternative for debit Credit cards a no alternative for debit Lacking a bank card Debit function Limited target group (age, ~1.1 M 1 ~10 M. creditworthiness...) Issuer ~48.5 k ~170 k1 No direct account debiting DMC/ Visa Debit Potentially high annual fee End-customer Lower customer penetration Banks and merchants DMC/ P2P demand an online- Higher costs Merchant Visa Debit -

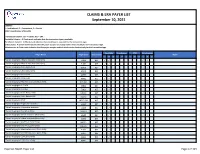

Claims and Remits Payer List

CLAIMS & ERA PAYER LIST September 10, 2021 LEGEND: I = Institutional, P = Professional, D = Dental COB = Coordination of Benefits Transaction Column: 837 = Claims, 835 = ERA Available Column: A Check-mark indicates that the transaction type is available. Enrollment Column: A Check-mark indicates that enrollment is required for the transaction type. COB Column: A Check-mark Indicates that the payer accepts secondary claims electronically for the transaction type. Attachments: A Check-mark indicates that the payer accepts medical attachments electronically for the transaction type. Available Enrollment COB Attachments Payer Name Payer Code Transaction Notes I P D I P D I P D I P D *Carisk Imaging to Allstate Insurance (Auto Only) E1069 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Allstate Insurance (Auto Only) E1069 835 ✓ ✓ *Carisk Imaging to Geico (Auto Only) GEICO 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Geico (Auto Only) GEICO 835 ✓ ✓ *Carisk Imaging to Nationwide A0002 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Nationwide A0002 835 ✓ ✓ *Carisk Imaging to New York City Law Department NYCL001 837 ✓ ✓ ✓ ✓ *Carisk Imaging to NJ-PLIGA E3926 837 ✓ ✓ ✓ ✓ *Carisk Imaging to NJ-PLIGA E3926 835 ✓ ✓ *Carisk Imaging to North Dakota WSI NDWSI 837 ✓ ✓ ✓ ✓ *Carisk Imaging to North Dakota WSI NDWSI 835 ✓ ✓ *Carisk Imaging to NYSIF NYSIF1510 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Progressive Insurance E1139 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Progressive Insurance E1139 835 ✓ ✓ *Carisk Imaging to Pure (Auto Only) PURE01 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Safeco Insurance (Auto Only) E0602 837 ✓ ✓ ✓ ✓ -

Interim Report-The Committee for Promoting Use of Advanced Means

Interim Report The Committee for Promoting November Use of Advanced Means of 2015 Payment in Israel Interim Report of the Committee for Promoting Use of Advanced Means of Payment in Israel Table of Contents 1. Introduction .................................................................................................................... 2 2. Executive summary ........................................................................................................ 3 3. Introduction .................................................................................................................... 6 4. Overview of advanced means of payment world-wide .................................................. 8 5. Overview of advanced means of payment in Israel ..................................................... 10 6. Advantages of using advanced means of payment ....................................................... 17 7. Alternatives for conducting transactions using advanced means of payment in the current payment systems .......................................................................................................... 19 8. Barriers to using advanced means of payment ............................................................. 23 9. Risk associated with use of advanced means of payment ............................................ 26 10. Legal aspects related to promoting use of advanced means of payment...................... 31 11. Summary and recommendations ................................................................................. -

Mabuhay Miles Travel Card – Frequently Asked Questions

Mabuhay Miles Travel Card – Frequently Asked Questions 1. Why should I use the Mabuhay Miles Travel Card over other cards? Your Mabuhay Miles Travel Card earns 1 Mile for every Php100 (or its equivalent in foreign currency) spent. It is the only Travel Card that contains a PHP wallet so you can use it both in domestic and international transactions. It is a multi‐currency card that will allow you to spend in the supported local currency without worry of fluctuating exchange rates. By being able to spend using the local currency, it will also allow you to manage your funds better while you travel. Skip the call to your bank when converting your points to Miles. Your Miles will be credited directly to your Mabuhay Miles account, not to your Travel Card account. 2. What’s the difference between the existing Mabuhay Miles Membership Card and this new Mabuhay Miles Travel Card? For Elite, Premiere Elite or Million Miler members, your Mabuhay Miles Membership Card will 1) remain solely as a membership card and 2) will indicate your tier status and benefits. The Travel Card will function as your multi‐currency prepaid card. For Classic members, the Travel Card will serve as both the membership card and the multi‐ currency prepaid card. 3. Where can I use my Mabuhay Miles Travel Card? You can use the currencies in your Travel Card in stores worldwide that accept UnionPay. You can also use your Travel Card to withdraw cash and check your currency balance at BancNet ATMs in the Philippines and international ATMs that accept UnionPay. -

Submission to the Reserve Bank of Australia Response to EFTPOS

Submission to the Reserve Bank of Australia Response To EFTPOS Industry Working Group By The Australian Retailers Association 13 September 2002 Response To EFTPOS Industry Working Group Prepared with the assistance of TransAction Resources Pty Ltd Australian Retailers Association 2 Response To EFTPOS Industry Working Group Contents 1. Executive Summary.........................................................................................................4 2. Introduction......................................................................................................................5 2.1 The Australian Retailers Association ......................................................................5 3. Objectives .......................................................................................................................5 4. Process & Scope.............................................................................................................6 4.1 EFTPOS Industry Working Group – Composition ...................................................6 4.2 Scope Of Discussion & Analysis.............................................................................8 4.3 Methodology & Review Timeframe.........................................................................9 5. The Differences Between Debit & Credit .......................................................................10 5.1 PIN Based Transactions.......................................................................................12 5.2 Cash Back............................................................................................................12