Multi-Lateral Mechanism of Cash Machines: Virtue Or Hassel

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mobile Banking

Automated teller machine "Cash machine" Smaller indoor ATMs dispense money inside convenience stores and other busy areas, such as this off-premise Wincor Nixdorf mono-function ATM in Sweden. An automated teller machine (ATM) is a computerized telecommunications device that provides the customers of a financial institution with access to financial transactions in a public space without the need for a human clerk or bank teller. On most modern ATMs, the customer is identified by inserting a plastic ATM card with a magnetic stripe or a plastic smartcard with a chip, that contains a unique card number and some security information, such as an expiration date or CVVC (CVV). Security is provided by the customer entering a personal identification number (PIN). Using an ATM, customers can access their bank accounts in order to make cash withdrawals (or credit card cash advances) and check their account balances as well as purchasing mobile cell phone prepaid credit. ATMs are known by various other names including automated transaction machine,[1] automated banking machine, money machine, bank machine, cash machine, hole-in-the-wall, cashpoint, Bancomat (in various countries in Europe and Russia), Multibanco (after a registered trade mark, in Portugal), and Any Time Money (in India). Contents • 1 History • 2 Location • 3 Financial networks • 4 Global use • 5 Hardware • 6 Software • 7 Security o 7.1 Physical o 7.2 Transactional secrecy and integrity o 7.3 Customer identity integrity o 7.4 Device operation integrity o 7.5 Customer security o 7.6 Alternative uses • 8 Reliability • 9 Fraud 1 o 9.1 Card fraud • 10 Related devices • 11 See also • 12 References • 13 Books • 14 External links History An old Nixdorf ATM British actor Reg Varney using the world's first ATM in 1967, located at a branch of Barclays Bank, Enfield. -

Xoom Rolls out Domestic Money Transfer Services in the U.S

Xoom Rolls Out Domestic Money Transfer Services in the U.S. November 12, 2019 PayPal's international money transfer service works with Walmart and Ria to offer cash pick-up in minutes at 4,700 Walmart and 175 Ria locations across the country SAN JOSE, Calif., Nov. 12, 2019 /PRNewswire/ -- Xoom, PayPal's international money transfer service, today rolled out the ability for customers to send money to recipients in the U.S. for the first time. Through strategic alliances with Walmart and Ria, Americans can now use Xoom to send money fast for cash pick-up typically in minutes at nearly 5,000 locations across the country*. Xoom's services potentially benefit more than 44 million foreign-born people in the U.S.1 who send remittances to family and friends in their home countries. With the introduction of domestic money transfer services, Xoom will now serve even more customers, including more than half of Americans who make domestic person-to-person (P2P) payments2. Using Xoom's mobile app or website, consumers will have the ability to send money quickly and securely for cash pick-up at any Walmart or Ria-owned store in the U.S. "Many of our customers in the U.S. already send money to loved ones in the country, and they usually prefer that the money is available right away," shared Julian King, Xoom's Vice President and General Manager. "This rollout reinforces our commitment to make money transfers fast, easy and affordable for everyone, whether they are at home or on-the-go." "At Ria, we are delighted to further consolidate our relationship with Xoom and Walmart," said Juan Bianchi, CEO of Euronet's Money Transfer Segment. -

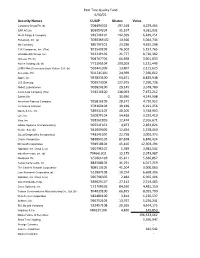

Pear Tree Quality Fund 6/30/21

Pear Tree Quality Fund 6/30/21 Security Names CUSIP Shares Value Compass Group Plc (b) '20449X302 197,348 4,229,464 SAP AG (b) '803054204 31,197 4,381,931 Wells Fargo & Company '949746101 142,399 6,449,251 Facebook, Inc. (a) '30303M102 14,566 5,064,744 3M Company '88579Y101 23,286 4,625,298 TJX Companies, Inc. (The) '872540109 76,502 5,157,765 UnitedHealth Group, Inc. '91324P102 21,777 8,720,382 Unilever Plc (b) '904767704 66,698 3,901,833 Roche Holding Ltd. (b) '771195104 109,203 5,131,449 LVMH Moët Hennessy-Louis Vuitton S.A. (b) '502441306 13,407 2,115,625 Accenture Plc 'G1151C101 24,969 7,360,612 Apple, Inc. '037833100 64,471 8,829,948 U.S. Bancorp '902973304 127,975 7,290,736 Abbott Laboratories '002824100 29,145 3,378,780 Coca-Cola Company (The) '191216100 138,093 7,472,212 Safran SA 0 30,650 4,249,998 American Express Company '025816109 28,572 4,720,952 Johnson & Johnson '478160104 38,189 6,291,256 Merck & Co., Inc. '589331107 48,205 3,748,903 Lyft, Inc. '55087P104 54,438 3,292,410 Visa, Inc. '92826C839 12,474 2,916,671 Adobe Systems Incorporated (a) '00724F101 4,873 2,853,824 Nestle, S.A. (b) '641069406 12,654 1,578,460 Quest Diagnostics Incorporated '74834L100 22,758 3,003,373 Oracle Corporation '68389X105 87,878 6,840,424 Microsoft Corporation '594918104 45,416 12,303,194 Alphabet, Inc. Class C (a) '02079K107 1,589 3,982,542 salesforce.com, inc. -

VX690 User Manual

Sivu 1(36) 28.9.2016 VX690 User Manual English Author: Verifone Finland Oy Date: 28.9.2016 Pages: 20 Sivu 2(36) 28.9.2016 INDEX: 1. BEFORE USE ............................................................................................................................... 5 1.1 Important ......................................................................................................................................... 5 1.2 Terminal Structure ......................................................................................................................... 6 1.3 Terminal start-up and shutdown .................................................................................................. 6 1.4 Technical data ................................................................................................................................ 7 1.5 Connecting cables ......................................................................................................................... 7 1.6 SIM-card.......................................................................................................................................... 8 1.7 Touchscreen ................................................................................................................................... 8 1.8 Using the menus ............................................................................................................................ 9 1.9 Letters and special characters.................................................................................................... -

NPCI Appoints FIME to Set up the Certification Body for India's

NPCI appoints FIME to set up the certification body for India’s Payment Scheme, RuPay FIME to define, manage and execute certification programme for RuPay 6 March 2014 – National Payments Corporation of India (NPCI), the umbrella organisation of all retail payment systems in the country, has appointed advanced secure-chip testing provider FIME to deliver its RuPay certification programme. NPCI will utilise FIME’s expertise in setting up EMV®-based certification board for its card payment scheme- RuPay. FIME will define the certification specification, laboratory setup, test plan specification, test tools and operate the certification board for RuPay. FIME will also be involved in setting up the certification process including the associated administrative and business operations. This certification board will be effective from March 2014. This will ensure all payment cards and point-of-sale terminals deployed under the brand align to the requirements of RuPay specifications. It will also ensure necessary infrastructural alignment of acquirers and issuers with the payment system. Prakash Sambandam, Director of FIME India says: “Many countries have, or are in the process of migrating to the EMV payment standard. Transitioning to a chip payment infrastructure will take time and require the implementation of new product development cycles. Adhering to RuPay, an EMV payment scheme will ensure that the products achieve the required functional and security standards and perform as intended, once live in the marketplace. This level of compliance is vital to ensure product interoperability and security optimisation”. In addition to enhanced security, the new payment platform presents opportunities to deliver advanced payment solutions – such as mobile and contactless payments – which are based on secure-chip technology. -

CANADA Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT CANADA Executive Summary Banking The Canadian central bank is the Bank of Canada / Banque du Canada. The bank is based in Ottawa and its authority derives from the Bank of Canada Act. Canada does not apply central bank reporting requirements. Resident entities are permitted to hold fully convertible foreign currency bank accounts domestically and outside Canada. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Canada. Canada has 32 domestic banks and 24 subsidiaries of foreign banks that are permitted to offer the full range of wholesale and retail banking services. There are also five cooperative credit associations that are federally regulated. In addition, 33 foreign banks have established branches in Canada. Payments Canada’s two main interbank payment clearing systems are LVTS and ACSS. The most important cashless payment instruments in Canada are electronic credit transfers in terms of value and card payments in terms of volume. Although their usage is falling, checks remain an important form of payment. The increased use of electronic and internet banking has led to a growth in the use of electronic payments such as electronic credit transfers and direct debits. Card payments have increased steadily, especially in the retail sector. Liquidity Management Canadian-based companies have access to a variety of short-term funding alternatives. There is also a range of short-term investment instruments available. Cash concentration is the more common technique used by Canadian companies to manage company and group liquidity. Of the available techniques, zero-balancing is the most commonly used. -

Authorisation Service Sales Sheet Download

Authorisation Service OmniPay is First Data’s™ cost effective, Supported business profiles industry-leading payment processing platform. In addition to card present POS processing, the OmniPay platform Authorisation Service also supports these transaction The OmniPay platform Authorisation Service gives you types and products: 24/7 secure authorisation switching for both domestic and international merchants on behalf of merchant acquirers. • Card Present EMV offline PIN • Card Present EMV online PIN Card brand support • Card Not Present – MOTO The Authorisation Service supports a wide range of payment products including: • Dynamic Currency Conversion • Visa • eCommerce • Mastercard • Secure eCommerce –MasterCard SecureCode, Verified by Visa and SecurePlus • Maestro • Purchase with Cashback • Union Pay • SecureCode for telephone orders • JCB • MasterCard Gaming (Payment of winnings) • Diners Card International • Address Verification Service • Discover • Recurring and Installment • BCMC • Hotel Gratuity • Unattended Petrol • Aggregator • Maestro Advanced Registration Program (MARP) Supported authorisation message protocols • OmniPay ISO8583 • APACS 70 Authorisation Service Connectivity to the Card Schemes OmniPay Authorisation Server Resilience Visa – Each Data Centre has either two or four Visa EAS servers and resilient connectivity to Visa Europe, Visa US, Visa Canada, Visa CEMEA and Visa AP. Mastercard – Each Data Centre has a dedicated Mastercard MIP and resilient connectivity to the Mastercard MIP in the other Data Centre. The OmniPay platform has connections to Banknet for both European and non-European authorisations. Diners/Discover – Each Data Centre has connectivity to Diners Club International which is also used to process Discover Card authorisations. JCB – Each Data Centre has connectivity to Japan Credit Bureau which is used to process JCB authorisations. UnionPay – Each Data Centre has connectivity to UnionPay International which is used to process UnionPay authorisations. -

Location Optimization of ATM Networks

Location Optimization of ATM Networks Somnath Basu Roy Chowdhury Biswarup Bhaacharya Sumit Agarwal Indian Institute of Technology Indian Institute of Technology Indian Institute of Technology Kharagpur, West Bengal 721302 Kharagpur, West Bengal 721302 Kharagpur, West Bengal 721302 [email protected] [email protected] [email protected] ABSTRACT & infrastructure, potential criminal activity, maintenance & power ATMs enable the public to perform nancial transactions. Banks costs etc. e companies also consider the cost of seing up an ATM try to strategically position their ATMs in order to maximize trans- in such locations and the amount of return that can be estimated. actions and revenue. In this paper, we introduce a model which At last the companies can analyze whether the entire venture is provides a score to an ATM location, which serves as an indicator of successful. its relative likelihood of transactions. In order to eciently capture We dene a similar problem where we consider the ATM loca- the spatially dynamic features, we utilize two concurrent prediction tions of dierent banks in the state of California, USA. e location models: the local model which encodes the spatial variance by con- features like the population density, average income, living stan- sidering highly energetic features in a given location, and the global dard can be gathered from the given zipcodes. We try to form a model which enforces the dominant trends in the entire data and logical inference of the features at hand in order to assign accu- serves as a feedback to the local model to prevent overing. e rate priority to the appropriate features. -

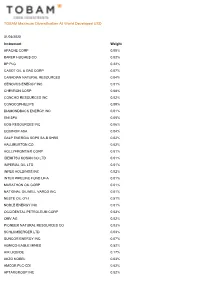

TOBAM Maximum Diversification All World Developed USD

TOBAM Maximum Diversification All World Developed USD 31/03/2020 Instrument Weight APACHE CORP 0.00% BAKER HUGHES CO 0.02% BP PLC 0.22% CABOT OIL & GAS CORP 0.07% CANADIAN NATURAL RESOURCES 0.04% CENOVUS ENERGY INC 0.01% CHEVRON CORP 0.08% CONCHO RESOURCES INC 0.02% CONOCOPHILLIPS 0.09% DIAMONDBACK ENERGY INC 0.01% ENI SPA 0.05% EOG RESOURCES INC 0.06% EQUINOR ASA 0.04% GALP ENERGIA SGPS SA-B SHRS 0.02% HALLIBURTON CO 0.02% HOLLYFRONTIER CORP 0.01% IDEMITSU KOSAN CO LTD 0.01% IMPERIAL OIL LTD 0.01% INPEX HOLDINGS INC 0.02% INTER PIPELINE FUND LP-A 0.01% MARATHON OIL CORP 0.01% NATIONAL OILWELL VARCO INC 0.01% NESTE OIL OYJ 0.51% NOBLE ENERGY INC 0.01% OCCIDENTAL PETROLEUM CORP 0.03% OMV AG 0.02% PIONEER NATURAL RESOURCES CO 0.03% SCHLUMBERGER LTD 0.03% SUNCOR ENERGY INC 0.07% AGNICO-EAGLE MINES 0.52% AIR LIQUIDE 0.17% AKZO NOBEL 0.03% AMCOR PLC-CDI 0.02% APTARGROUP INC 0.02% TOBAM Maximum Diversification All World Developed USD 31/03/2020 Instrument Weight AVON RESOURCES LTD 0.20% BALL CORP 0.06% CCL INDUSTRIES INC - CL B 0.01% CHR HANSEN HOLDING A/S 0.05% CLARIANT AG-REG 0.01% CORTEVA INC 0.04% CRODA INTERNATIONAL PLC 0.02% EMS-CHEMIE HOLDING AG-REG 0.01% FIRST QUANTUM MINERALS LTD 0.01% FORTESCUE METALS GROUP LTD 0.04% FRANCO-NEVADA CORP 1.01% GIVAUDAN-REG 0.07% INTL FLAVORS & FRAGRANCES 0.04% JAMES HARDIE INDUSTRIES-CDI 0.01% KANSAI PAINT CO LTD 0.01% KIRKLAND LAKE GOLD LTD 0.31% LINDE PLC 0.03% MARTIN MARIETTA MATERIALS 0.03% MOSAIC CO/THE 0.01% NEWCREST MINING LTD 0.60% NEWMONT CORP 1.89% NIPPON PAINT CO LTD 0.03% NORTHERN STAR RESOURCES -

PIN Debit Networks November 7, 2013

Meeting Between Federal Reserve Board Staff and Representatives of PIN Debit Networks November 7, 2013 Participants: Louise Roseman, Stephanie Martin, Jeffrey Marquardt, Susan Foley, David Mills, Samantha Pelosi, Mark Manuszak, Krzysztof Wozniak, Tyler Standage, Aaron Rosenbaum, and Linda Healey (Federal Reserve Board) Terry Maher (Baird Holm LLP); Leah Work (CO-OP Financial Services); Jonathan Genovese and Rob Rankin (Jeanie Network); Cathy Morrissey (NETS); Robert Woodbury (NYCE Payments Network); Judith McGuire (PULSE); Scott Dobesh and Terry Dooley (Shazam Network); Nancy Loomis (Star Network); Paul Tomasofsky (Two Sparrows Consulting) Summary: Representatives of several PIN debit networks met with Federal Reserve Board staff to discuss their observations of market developments related to deployment of EMV (i.e., chip-based) debit cards in the United States. Issues discussed included (i) technological aspects of EMV payment cards with a focus on methods for enabling multiple networks on an EMV card, and (ii) the network participants’ views of issuer, merchant, and payment card network concerns related to EMV deployment, particularly as those concerns pertain to Regulation II’s prohibition on network exclusivity and merchant routing restrictions. In particular, the network representatives stressed the importance of industry adoption of an EMV model that best facilitates merchant routing choice, and expressed concern that the current approach advocated by Visa and MasterCard does not meet this objective. A copy of the presentation the -

Online User Guide

Online User Guide Terms and conditions and fees apply to the use of your card. Minimum and maximum transfer amounts may apply. Refer to the PDS. Gobsmacked Loyalty Pty Ltd ABN 60 098 218 216 (AFSL 444609) is the issuer of the card. The PDS is available on the above link. You should consider the PDS in deciding whether or not to acquire or keep the card. Moorebank Sports Club Limited is responsible for the Infinity Plus Rewards program and promotions and the conversion of reward points to monetary value. Refer to the Moorebank Sports Club Limited reward promotions and program terms and conditions. Infinity Plus Prepaid eftpos Card So you’ve got your new Moorebank Sports Club Infinity Plus Prepaid eftpos Card. Now what do you do? This User Guide will explain how to start using your Infinity Plus Card for everyday purchases. If you have any enquiries at all whilst you are a Infinity Plus cardholder please visit Moorebank Sports Club and we will help you. Please refer to the Product Disclosure Statement (PDS) for the terms and conditions governing the use of the Infinity Plus Card. A copy of the PDS is also available online at www.moorebanksports.com.au Table of Contents WHAT IS THE INFINITY PLUS PREPAID eftpos CARD? GETTING STARTED Activate my Infinity Plus Card At the Club At home USING MY INFINITY PLUS CARD Card Loads How do I transfer my rewards onto my Infinity Plus Card? How do I load my card with extra funds so I can spend more? Making Purchases Where can I use my Infinity Plus Card? INFINITY PLUS CARDHOLDER ACCOUNT PAGE Features PIN -

04 April 2013 PCI Council Announces New Affiliate Members WAKEFIELD, Mass., 4 April, 2013

Media Contacts Laura K. Johnson, Ella Nevill PCI Security Standards Council +1-781-876-6250 [email protected] Twitter @PCISSC PCI SECURITY STANDARDS COUNCIL ANNOUNCES NEW AFFILIATE MEMBERS — First cohort of PCI SSC Affiliate members comprised of global payment security experts— WAKEFIELD, Mass., 4 April, 2013 — Today the PCI Security Standards Council (PCI SSC), an open, global forum for the development of payment card security standards announced that three organizations have joined the Council as the first Affiliate members. The Australian Payment Clearing Association (APCA), Cartes Bancaires CB and Interac Association will participate in this new capacity effective 1 April, 2013. The Council introduced the Affiliate membership class in 2012 as part of a continued drive to leverage industry expertise and broaden global input into the standards development process. Affiliate membership is open to regional and national organizations that define standards and influence adoption by their constituents who process, store or transmit cardholder data. This category offers Affiliate members the opportunity to become active participants on PCI working groups, in addition to playing an integral role in the standards development process. The Australian Payments Clearing Association (APCA) is the self-regulatory body set up by the payments industry to improve the safety, reliability, equity, convenience and efficiency of the Australian payments system. APCA represents 90 members that include the Reserve Bank of Australia, major and regional banks, building societies, credit unions, large retailers and other principal payments service providers. Cartes Bancaires CB, (Groupement des Cartes Bancaires CB), based in Paris, France, is an Economic Interest Consortium (GIE), and the governing body of the CB payment system.