Mastercard® Guide to Benefits for Credit Cardholders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

VX690 User Manual

Sivu 1(36) 28.9.2016 VX690 User Manual English Author: Verifone Finland Oy Date: 28.9.2016 Pages: 20 Sivu 2(36) 28.9.2016 INDEX: 1. BEFORE USE ............................................................................................................................... 5 1.1 Important ......................................................................................................................................... 5 1.2 Terminal Structure ......................................................................................................................... 6 1.3 Terminal start-up and shutdown .................................................................................................. 6 1.4 Technical data ................................................................................................................................ 7 1.5 Connecting cables ......................................................................................................................... 7 1.6 SIM-card.......................................................................................................................................... 8 1.7 Touchscreen ................................................................................................................................... 8 1.8 Using the menus ............................................................................................................................ 9 1.9 Letters and special characters.................................................................................................... -

See Fee Chart

List of all fees for inPOWER Prepaid Mastercard®. All fees Amount Details Get started Pay-As-You- Plan options Monthly Plan Go Plan New Card Account There is no fee to open a card account. $0.00 $0.00 Monthly usage Monthly Plan: You will be charged $7.95 each month you are enrolled in the Monthly Plan. The fee descriptor that will be shown on transaction history statements is: Monthly Maintenance Fee Monthly Plan: To qualify for a $2.00 credit each month, you must receive a qualifying direct deposit of paychecks and/or government benefits totaling at least $100.00 in one (1) calendar month. If you are currently enrolled in the Monthly Plan, you will automatically be enrolled in the plan to receive the credit, and if you are in the Pay-As-You-Go plan, you can visit a Pay-O-Matic Location to change to your plan. Plan fee $0.00 $7.95 You may switch between the Pay-As-You-Go Plan and the Monthly Fee Plan one time during any ninety (90) day period. Changes made on or before the 19th of the month will take effect on the 24th of each month. Changes made on or after the 20th of the month will not be effective until the following month, on the 24th. The fee descriptor that will be shown on the transaction history statement for the credit is: Monthly Maintenance Fee Credit Per Month. A $5.00 fee will be charged during each month in which there have been no cardholder-initiated, balance-changing transactions for at least ninety (90) calendar days. -

Authorisation Service Sales Sheet Download

Authorisation Service OmniPay is First Data’s™ cost effective, Supported business profiles industry-leading payment processing platform. In addition to card present POS processing, the OmniPay platform Authorisation Service also supports these transaction The OmniPay platform Authorisation Service gives you types and products: 24/7 secure authorisation switching for both domestic and international merchants on behalf of merchant acquirers. • Card Present EMV offline PIN • Card Present EMV online PIN Card brand support • Card Not Present – MOTO The Authorisation Service supports a wide range of payment products including: • Dynamic Currency Conversion • Visa • eCommerce • Mastercard • Secure eCommerce –MasterCard SecureCode, Verified by Visa and SecurePlus • Maestro • Purchase with Cashback • Union Pay • SecureCode for telephone orders • JCB • MasterCard Gaming (Payment of winnings) • Diners Card International • Address Verification Service • Discover • Recurring and Installment • BCMC • Hotel Gratuity • Unattended Petrol • Aggregator • Maestro Advanced Registration Program (MARP) Supported authorisation message protocols • OmniPay ISO8583 • APACS 70 Authorisation Service Connectivity to the Card Schemes OmniPay Authorisation Server Resilience Visa – Each Data Centre has either two or four Visa EAS servers and resilient connectivity to Visa Europe, Visa US, Visa Canada, Visa CEMEA and Visa AP. Mastercard – Each Data Centre has a dedicated Mastercard MIP and resilient connectivity to the Mastercard MIP in the other Data Centre. The OmniPay platform has connections to Banknet for both European and non-European authorisations. Diners/Discover – Each Data Centre has connectivity to Diners Club International which is also used to process Discover Card authorisations. JCB – Each Data Centre has connectivity to Japan Credit Bureau which is used to process JCB authorisations. UnionPay – Each Data Centre has connectivity to UnionPay International which is used to process UnionPay authorisations. -

SAFE and SECURE PAYMENTS: the MASTERCARD APPROACH Global Point of View

SAFE AND SECURE PAYMENTS: THE MASTERCARD APPROACH Global point of view For nearly 50 years MasterCard has been safeguarding the way you pay. We have been innovating solutions driven by data and insights to increase the safety and security of electronic payments. Our safety and security guarantee: we want to give consumers the peace of mind to pay with confidence, and our goal is to build a world beyond cash where every person, every payment and every device is protected. Consumers need a safe and simple experience when making a payment, wherever they are in the world and whether they tap, click or swipe. MasterCard is investing time and money to continuously enhance the technology to detect and prevent fraud so that consumers can be confident that their money is safe. In the rare event that fraud1 does occur, we ensure consumer peace of mind by limiting or eliminating cardholder liability2. EXECUTIVE summary MasterCard is the leading technology company delivering electronic payments and the leader in safety and security • Technology and payment methods are changing every day – payments are becoming faster, smarter and more sophisticated. • Cards remain one of the safest ways to pay, with only 6 cents for every $100 spent on major global cards lost to fraud. MasterCard’s safety and security measures have already reduced this number to 5 cents. • We are investing in innovative payment and security solutions so consumers have a safe, secure and convenient payment experience. Safety and security is our number one priority. MasterCard guarantees safety and security with smart technology to ensure we are always one step ahead of fraudsters 1. -

New Debit Card Solutions At

New Debit Card Solutions Debit Mastercard and Visa Debit are ready Swiss Banking Services Forum, 22 May 2019 Philippe Eschenmoser, Head Cards & A2A, Swisskey Ltd Maestro/V PAY Have Established Themselves As the “Key to the Account” – Schemes, However, Are Forcing Market Entry For Successor Products Response from the Maestro and V PAY are successful… …but are not future-capable products schemes # cards Maestro V PAY on Lower earnings potential millions8 for issuers as an alternative payment traffic products (e.g. 6 credit cards, TWINT) Issuer 4 V PAY will be 2 decommissioned by VISA Functional limitations: in 20211 – Visa Debit as 0 • No e-commerce the successor 2000 2018 • No preauthorizations Security and stability have End- • No virtualization proven themselves customer High acceptance in CH and Merchants with an online MasterCard is positioning abroad in Europe offer are demanding an DMC in the medium term online-capable debit as the successor to Standard product with an Merchan product Maestro integrated bank card t 2 1: As of 2021 no new V PAY may be issued TWINT (Still) No Substitute For Debit Cards – Credit Cards With Divergent Market Perception TWINT (still) not alternative for debit Credit cards a no alternative for debit Lacking a bank card Debit function Limited target group (age, ~1.1 M 1 ~10 M. creditworthiness...) Issuer ~48.5 k ~170 k1 No direct account debiting DMC/ Visa Debit Potentially high annual fee End-customer Lower customer penetration Banks and merchants DMC/ P2P demand an online- Higher costs Merchant Visa Debit -

How to Find the Best Credit Card for You

How to find the best credit card for you Why should you shop around? Comparing offers before applying for a credit card helps you find the right card for your needs, and helps make sure you’re not paying higher fees or interest rates than you have to. Consider two credit cards: One carries an 18 percent interest rate, the other 15 percent. If you owed $3,000 on each and could only afford to pay $100 per month, it would cost more and take longer 1. Decide how you plan to pay off the higher-rate card. to use the card The table below shows examples of what it might You may plan to pay off your take to pay off a $3,000 credit card balance, paying balance every month to avoid $100 per month, at two different interest rates. interest charges. But the reality is, many credit card holders don’t. If you already have a credit card, let APR Interest Months history be your guide. If you have carried balances in the past, or think 18% = $1,015 41 you are likely to do so, consider 15% = $783 38 credit cards that have the lowest interest rates. These cards typically do not offer rewards and do not The higher-rate card would cost you an extra charge an annual fee. $232. If you pay only the minimum payment every month, it would cost you even more. If you have consistently paid off your balance every month, then you So, not shopping around could be more expensive may want to focus more on fees and than you think. -

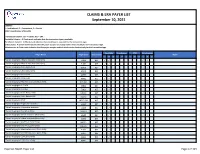

Claims and Remits Payer List

CLAIMS & ERA PAYER LIST September 10, 2021 LEGEND: I = Institutional, P = Professional, D = Dental COB = Coordination of Benefits Transaction Column: 837 = Claims, 835 = ERA Available Column: A Check-mark indicates that the transaction type is available. Enrollment Column: A Check-mark indicates that enrollment is required for the transaction type. COB Column: A Check-mark Indicates that the payer accepts secondary claims electronically for the transaction type. Attachments: A Check-mark indicates that the payer accepts medical attachments electronically for the transaction type. Available Enrollment COB Attachments Payer Name Payer Code Transaction Notes I P D I P D I P D I P D *Carisk Imaging to Allstate Insurance (Auto Only) E1069 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Allstate Insurance (Auto Only) E1069 835 ✓ ✓ *Carisk Imaging to Geico (Auto Only) GEICO 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Geico (Auto Only) GEICO 835 ✓ ✓ *Carisk Imaging to Nationwide A0002 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Nationwide A0002 835 ✓ ✓ *Carisk Imaging to New York City Law Department NYCL001 837 ✓ ✓ ✓ ✓ *Carisk Imaging to NJ-PLIGA E3926 837 ✓ ✓ ✓ ✓ *Carisk Imaging to NJ-PLIGA E3926 835 ✓ ✓ *Carisk Imaging to North Dakota WSI NDWSI 837 ✓ ✓ ✓ ✓ *Carisk Imaging to North Dakota WSI NDWSI 835 ✓ ✓ *Carisk Imaging to NYSIF NYSIF1510 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Progressive Insurance E1139 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Progressive Insurance E1139 835 ✓ ✓ *Carisk Imaging to Pure (Auto Only) PURE01 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Safeco Insurance (Auto Only) E0602 837 ✓ ✓ ✓ ✓ -

Unionpay: Visa and Mastercard's Tough Chinese Rival

1.35% AXP American Express Co $66.0 USD 0.87 1.32% Market data is delayed at least 15 minutes. Company Lookup Ticker Symbol or Company Go Among the myriad designer brands at the Harrods flagship store in London, Chinese housewife Li Yafang spotted a corporate logo she knows from back home: the red, blue, and green of UnionPay cards. “It’s very convenient,” said Li, 39, as a salesperson rang up a £1,190 ($1,920) Prada Saffiano Lux handbag. With 2.9 billion cards in circulation—equal to 45 percent of the world’s total last year—UnionPay has grown into a payments processing colossus just 10 years after the company was founded. Now accepted in 135 countries, its share of global credit- and debit-card transaction volume for the first half of 2012 rose to 23.8 percent, propelling it to No. 2 behind Visa International (V), according to the Nilson Report, an industry newsletter. “UnionPay has absolute dominance in China, and it’s now expanding beyond that to become a top global player,” says James Friedman, an analyst at Susquehanna International Group. “Their numbers show they are already in the league of Visa and MasterCard (MA).” Yin Lian, UnionPay’s name in Mandarin, means “banks united,” which reflects its ownership structure. Its founding shareholders were 85 Chinese banks, led by the five biggest state-owned lenders. UnionPay’s top managers are former senior officials at the People’s Bank of China, the nation’s central bank. (The company would not make executives available for interviews.) At home, the Shanghai-based firm enjoys a big competitive edge: The government requires that all automated teller machines and Chinese merchants use UnionPay’s electronic payments network to process payments in the local currency. -

Visa Inc. and the Global Payments Industry1

W14186 VISA INC. AND THE GLOBAL PAYMENTS INDUSTRY1 Professors Neil Bendle and Dan Horne wrote this case solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G 0N1; (t) 519.661.3208; (e) [email protected]; www.iveycases.com. Copyright © 2014, Richard Ivey School of Business Foundation Version: 2014-05-29 Amy Wilkins2 was nervous. She was preparing for what was arguably the most important job interview of her career. She was fascinated by the global payments industry and working at Visa Inc. would be a dream come true. To prepare for her interview, Wilkins wanted to make sure she clarified her understanding of the payments industry and sat down to complete her analysis. She knew that a strong performance in the interview would give her an excellent chance to get her dream job. It was a risk, but she decided to be bold – she would come up with a recommendation for some action that Visa should take. VISA COMPANY HISTORY Bank of America launched the first successful credit card, the Bank Americard. -

Mastercard Frequently Asked Questions Platinum Class Credit Cards

Mastercard® Frequently Asked Questions Platinum Class Credit Cards How do I activate my Mastercard credit card? You can activate your card and select your Personal Identification Number (PIN) by calling 1-866-839-3492. For enhanced security, RBFCU credit cards are PIN-preferred and your PIN may be required to complete transactions at select merchants. After you activate your card, you can manage your account through your Online Banking account and/or the RBFCU Mobile app. You can: • View transactions • Enroll in paperless statements • Set up automatic payments • Request Balance Transfers and Cash Advances • Report a lost or stolen card • Dispute transactions Click here to learn more about managing your card online. How do I change my PIN? Over the phone by calling 1-866-297-3413. There may be situations when you are unable to set your PIN through the automated system. In this instance, please visit an RBFCU ATM to manually set your PIN. Can I use my card in my mobile wallet? Yes, our Mastercard credit cards are compatible with PayPal, Apple Pay®, Samsung Pay, FitbitPay™ and Garmin FitPay™. Click here for more information on mobile payments. You can also enroll in Mastercard Click to Pay which offers online, password-free checkout. You can learn more by clicking here. How do I add an authorized user? Please call our Member Service Center at 1-800-580-3300 to provide the necessary information in order to qualify an authorized user. All non-business Mastercard account authorized users must be members of the credit union. Click here to learn more about authorized users. -

2020 Annual Report Discover Card • $71 Billion in Loans a Leading • Leading Cash Rewards Program

2020 Annual Report Discover Card • $71 billion in loans A Leading • Leading cash rewards program Student Loans Digital Bank • $10 billion in student loans and Payments • Offered at more than 2,400 colleges Personal Loans • $7 billion in loans • Debt consolidation and major purchases Partner Home Loans • $2 billion in mortgages Discover is one of the largest digital banks in the United • Cash-out refinance and home loans States, offering a broad array of products, including credit cards, personal loans, student loans, deposit products Deposit Products and home loans. • $63 billion in direct-to-consumer deposits • Money market accounts, certificates The Discover brand is known for rewards, service and of deposit, savings accounts and checking value. Across all digital banking products, Discover seeks accounts to help customers meet their financial needs and achieve brighter financial futures. Discover Network Discover Global Network, the global payments brand of • $181 billion volume Discover Financial Services, strives to be the most flexible • 20+ network alliances and innovative payments partner in the United States and around the world. Our Network Partners business provides payment transaction processing and settlement services PULSE Debit Network on the Discover Network. PULSE is one of the nation’s • $212 billion volume leading ATM/debit networks, and Diners Club International is a global payments network with acceptance around Diners Club International the world. • $24 billion volume To my fellow shareholders, A year has passed since our world changed virtually overnight as we faced the greatest public health crisis in a century and the resulting economic contraction. We remain grateful to those on the front lines of this battle, including healthcare and emergency workers, and everyone who has taken personal risk to make sure the essential services of our society keep running. -

Submission to the Reserve Bank of Australia Response to EFTPOS

Submission to the Reserve Bank of Australia Response To EFTPOS Industry Working Group By The Australian Retailers Association 13 September 2002 Response To EFTPOS Industry Working Group Prepared with the assistance of TransAction Resources Pty Ltd Australian Retailers Association 2 Response To EFTPOS Industry Working Group Contents 1. Executive Summary.........................................................................................................4 2. Introduction......................................................................................................................5 2.1 The Australian Retailers Association ......................................................................5 3. Objectives .......................................................................................................................5 4. Process & Scope.............................................................................................................6 4.1 EFTPOS Industry Working Group – Composition ...................................................6 4.2 Scope Of Discussion & Analysis.............................................................................8 4.3 Methodology & Review Timeframe.........................................................................9 5. The Differences Between Debit & Credit .......................................................................10 5.1 PIN Based Transactions.......................................................................................12 5.2 Cash Back............................................................................................................12