Interchange Fee Regulation on the Application Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mobile Banking

Automated teller machine "Cash machine" Smaller indoor ATMs dispense money inside convenience stores and other busy areas, such as this off-premise Wincor Nixdorf mono-function ATM in Sweden. An automated teller machine (ATM) is a computerized telecommunications device that provides the customers of a financial institution with access to financial transactions in a public space without the need for a human clerk or bank teller. On most modern ATMs, the customer is identified by inserting a plastic ATM card with a magnetic stripe or a plastic smartcard with a chip, that contains a unique card number and some security information, such as an expiration date or CVVC (CVV). Security is provided by the customer entering a personal identification number (PIN). Using an ATM, customers can access their bank accounts in order to make cash withdrawals (or credit card cash advances) and check their account balances as well as purchasing mobile cell phone prepaid credit. ATMs are known by various other names including automated transaction machine,[1] automated banking machine, money machine, bank machine, cash machine, hole-in-the-wall, cashpoint, Bancomat (in various countries in Europe and Russia), Multibanco (after a registered trade mark, in Portugal), and Any Time Money (in India). Contents • 1 History • 2 Location • 3 Financial networks • 4 Global use • 5 Hardware • 6 Software • 7 Security o 7.1 Physical o 7.2 Transactional secrecy and integrity o 7.3 Customer identity integrity o 7.4 Device operation integrity o 7.5 Customer security o 7.6 Alternative uses • 8 Reliability • 9 Fraud 1 o 9.1 Card fraud • 10 Related devices • 11 See also • 12 References • 13 Books • 14 External links History An old Nixdorf ATM British actor Reg Varney using the world's first ATM in 1967, located at a branch of Barclays Bank, Enfield. -

Payment Initiation API Specification V1.0 Contents

Coventry Building Society Payment Initiation API Specification V1.0 Contents Coventry Building Society .................................................................................................................................................... 1 Version control ..................................................................................................................................................................... 4 Overview .............................................................................................................................................................................. 5 Document Overview ........................................................................................................................................................ 5 Design Principles ............................................................................................................................................................. 5 RESTful APIs ............................................................................................................................................................... 5 Idempotency ................................................................................................................................................................ 6 Payment API - Scheme Agnostic ................................................................................................................................ 6 Status Codes .............................................................................................................................................................. -

Standards at Transactional and Aggregated Level

Standards at transactional and aggregated level 7th May 2014 eSupervision Workshop, Rome Overview The value, need and ability to capture transactions in a standard way in repositories as a foundation for regulatory analysis using the example of ISO 20022 The value of and need for connecting the transactional and detailed-level data standards and models (ISO 20022, ACORD, FpML, FIBO, FIX) with regulatory or aggregated data standards (XBRL, SDMX, XML) First, a look at internationally developed data standards for financial services and the ISO 20022 standard International Standards for Financial Services, ISO/TC68 ISO Technical Committee TC68 Financial Services SC2 SC4 SC7 ISO 20022 Security Securities Core Banking Standard ISO 20022 WG5 Registration ISO 20022 Technical LEI Management Standard Standard Group ISO 17442 Technical Registration Support Authority Group Standard Evaluation Groups Standards Managed by ISO/TC68/SC2, Security ISO TC68/SC2 Financial Services, Security Published Standards – ISO 9564 Personal Identification Number (PIN) management and security – ISO 11568 Key management (retail) – ISO 13491 Secure cryptographic devices (retail) – ISO 13492 Key management related data element -- Application and usage of ISO 8583 data elements 53 and 96 – ISO 15782 Certificate management for financial services (PKI) – ISO 16609 Requirements for message authentication using symmetric techniques – ISO 21188 Public key infrastructure management for financial services - Practices and policy framework Technical Reports ISO 13569 Information -

Securetrust Service Description Web Risk Monitoring

SecureTrust Service Description Web Risk Monitoring Copyright © 2018 Trustwave Holdings, Inc. All rights reserved. 1 SecureTrust WRM Service Description - January 27, 2021 WEB RISK MONITORING (WRM) ................................................................................................................ 3 SERVICE DESCRIPTION ................................................................................................................................. 3 BASE SERVICE FEATURES ............................................................................................................................. 3 WRM Overview ....................................................................................................................................... 3 Content Monitoring ................................................................................................................................. 5 Merchant Intelligence.............................................................................................................................. 5 Malware Monitoring ................................................................................................................................ 7 Custom Monitoring.................................................................................................................................. 8 Transaction Laundering Detection (TLD) ............................................................................................... 8 Merchant MCC Code Matching ............................................................................................................. -

Authorisation Service Sales Sheet Download

Authorisation Service OmniPay is First Data’s™ cost effective, Supported business profiles industry-leading payment processing platform. In addition to card present POS processing, the OmniPay platform Authorisation Service also supports these transaction The OmniPay platform Authorisation Service gives you types and products: 24/7 secure authorisation switching for both domestic and international merchants on behalf of merchant acquirers. • Card Present EMV offline PIN • Card Present EMV online PIN Card brand support • Card Not Present – MOTO The Authorisation Service supports a wide range of payment products including: • Dynamic Currency Conversion • Visa • eCommerce • Mastercard • Secure eCommerce –MasterCard SecureCode, Verified by Visa and SecurePlus • Maestro • Purchase with Cashback • Union Pay • SecureCode for telephone orders • JCB • MasterCard Gaming (Payment of winnings) • Diners Card International • Address Verification Service • Discover • Recurring and Installment • BCMC • Hotel Gratuity • Unattended Petrol • Aggregator • Maestro Advanced Registration Program (MARP) Supported authorisation message protocols • OmniPay ISO8583 • APACS 70 Authorisation Service Connectivity to the Card Schemes OmniPay Authorisation Server Resilience Visa – Each Data Centre has either two or four Visa EAS servers and resilient connectivity to Visa Europe, Visa US, Visa Canada, Visa CEMEA and Visa AP. Mastercard – Each Data Centre has a dedicated Mastercard MIP and resilient connectivity to the Mastercard MIP in the other Data Centre. The OmniPay platform has connections to Banknet for both European and non-European authorisations. Diners/Discover – Each Data Centre has connectivity to Diners Club International which is also used to process Discover Card authorisations. JCB – Each Data Centre has connectivity to Japan Credit Bureau which is used to process JCB authorisations. UnionPay – Each Data Centre has connectivity to UnionPay International which is used to process UnionPay authorisations. -

Czech Standard for Open Banking (V 3.0)

Banking Activities Standards Standard ČBA Czech Standard for Open Banking Version 3.0 Public from: 1.4. 2019 Valid from: 1.1. 2020 1 Changes Date Note Author 15.11.2017 Basic document v.01 ČS Petr Michalík 27.7.2018 Document version 1.2 - Correction of typing errors, new error codes, new ČS Petr Michalík chart visualizations, coupled payment type codes in response to initiation of payment (Chapter 4.24.2.1) and general element descriptions added / specified. 9.4.2018 Document v.02.0 -- An extension to initiate Instant Payment has been ČS Petr Michalík added to the standard. Any further processing of such initiated payment is done according to the rules of this scheme. Chapter 3.2.4, 4.24.1 and 4.25 18.5.2018 Added new request header parameters for original TPP identification ČS Petr Michalík 19.9.2018 Extended description of the use of certificates in chaper 1.4.8 ČS Petr Michalík 2.10.2018 New request body element “redirectUrl”. Address in this element ČS Petr Michalík is used by the federated bank authorization to redirect back to the TPP application after authorization is complete. Chapter 3.2.10.1 and example in chapter 5.11.1 2.10.2018 Error response extension for NO_PART error code during ČS Petr Michalík payment initiation. Chapter 3.2.4 and new example in chapter 5.5.6 1.12.2018 Specification the use of the character set for each resource. ČS Petr Michalík Chapter 1.2.5, 3.1.1, 3.2.1, 3.3.1, 3.2.3, 3.2.4 – 11, 3.3.3 21.12.2018 Final public document COBS 2.0 ČS Petr Michalik 3.1.2019 New version document – v.03 ČS Petr Michalík 4.1.2019 Standing order resource for PIS services ČS Petr Michalík Chapters 3.2.12 – 3.2.18 4.1.2019 For each source, information on the implementation obligation has been ČS Petr Michalík added (see resource parameter Mandatory: yes/no) 5.1.2019 Consent management resources (POST and DELETE) ČS Petr Michalík See Chapter 1.6.x 12.1.2019 Common header parameters ČS Petr Michalík See Chapter 1.5 and changes in the header parameters specifications of the all defined resources. -

Payments and Market Infrastructure Two Decades After the Start of the European Central Bank Editor: Daniela Russo

Payments and market infrastructure two decades after the start of the European Central Bank Editor: Daniela Russo July 2021 Contents Foreword 6 Acknowledgements 8 Introduction 9 Prepared by Daniela Russo Tommaso Padoa-Schioppa, a 21st century renaissance man 13 Prepared by Daniela Russo and Ignacio Terol Alberto Giovannini and the European Institutions 19 Prepared by John Berrigan, Mario Nava and Daniela Russo Global cooperation 22 Prepared by Daniela Russo and Takeshi Shirakami Part 1 The Eurosystem as operator: TARGET2, T2S and collateral management systems 31 Chapter 1 – TARGET 2 and the birth of the TARGET family 32 Prepared by Jochen Metzger Chapter 2 – TARGET 37 Prepared by Dieter Reichwein Chapter 3 – TARGET2 44 Prepared by Dieter Reichwein Chapter 4 – The Eurosystem collateral management 52 Prepared by Simone Maskens, Daniela Russo and Markus Mayers Chapter 5 – T2S: building the European securities market infrastructure 60 Prepared by Marc Bayle de Jessé Chapter 6 – The governance of TARGET2-Securities 63 Prepared by Cristina Mastropasqua and Flavia Perone Chapter 7 – Instant payments and TARGET Instant Payment Settlement (TIPS) 72 Prepared by Carlos Conesa Eurosystem-operated market infrastructure: key milestones 77 Part 2 The Eurosystem as a catalyst: retail payments 79 Chapter 1 – The Single Euro Payments Area (SEPA) revolution: how the vision turned into reality 80 Prepared by Gertrude Tumpel-Gugerell Contents 1 Chapter 2 – Legal and regulatory history of EU retail payments 87 Prepared by Maria Chiara Malaguti Chapter 3 – -

Effects of Automated Teller Machine on the Performance of Nigerian Banks

American Journal of Applied Mathematics and Statistics, 2014, Vol. 2, No. 1, 40-46 Available online at http://pubs.sciepub.com/ajams/2/1/7 © Science and Education Publishing DOI:10.12691/ajams-2-1-7 Effects of Automated Teller Machine on the Performance of Nigerian Banks Jegede C.A.* Department of Accounting and finance, Lagos State University, Ojo, Nigeria *Corresponding author: [email protected] Received August 07, 2013; Revised August 24, 2013; Accepted February 07, 2014 Abstract This study investigates the effects of ATM on the performance of Nigerian banks. Available studies have concentrated on the significant dimensions of ATM (automated teller machine) service quality and its effect on customer satisfaction with a bias against ATM producers. The study is motivated by the astronomical challenges confronting the proliferation of ATM infrastructure and attendant financial losss to banks which are often under- reported. Also, there are serious debate on the relevance of ATM technology as most countries in the world are moving away from the virus technology to the more secured chip cards free of credit and debit frauds. Questionnaire was used to collect the data from a convenience sample of 125 employees of five selected banks in Lagos State with interswitch network. Therefore, data collected through the questionnaire were analyzed statistically by using the Software Package for Social Science (SPSS Version 20.0 for Student Version) and chi-square technique. The results indicate that less than the benefits, the deployment of ATMs terminals have averagely improved the performance of Nigerian banks because of the alarming rate of ATM fraud. -

New Debit Card Solutions At

New Debit Card Solutions Debit Mastercard and Visa Debit are ready Swiss Banking Services Forum, 22 May 2019 Philippe Eschenmoser, Head Cards & A2A, Swisskey Ltd Maestro/V PAY Have Established Themselves As the “Key to the Account” – Schemes, However, Are Forcing Market Entry For Successor Products Response from the Maestro and V PAY are successful… …but are not future-capable products schemes # cards Maestro V PAY on Lower earnings potential millions8 for issuers as an alternative payment traffic products (e.g. 6 credit cards, TWINT) Issuer 4 V PAY will be 2 decommissioned by VISA Functional limitations: in 20211 – Visa Debit as 0 • No e-commerce the successor 2000 2018 • No preauthorizations Security and stability have End- • No virtualization proven themselves customer High acceptance in CH and Merchants with an online MasterCard is positioning abroad in Europe offer are demanding an DMC in the medium term online-capable debit as the successor to Standard product with an Merchan product Maestro integrated bank card t 2 1: As of 2021 no new V PAY may be issued TWINT (Still) No Substitute For Debit Cards – Credit Cards With Divergent Market Perception TWINT (still) not alternative for debit Credit cards a no alternative for debit Lacking a bank card Debit function Limited target group (age, ~1.1 M 1 ~10 M. creditworthiness...) Issuer ~48.5 k ~170 k1 No direct account debiting DMC/ Visa Debit Potentially high annual fee End-customer Lower customer penetration Banks and merchants DMC/ P2P demand an online- Higher costs Merchant Visa Debit -

AUTOMATED TELLER MACHINE (Athl) NETWORK EVOLUTION in AMERICAN RETAIL BANKING: WHAT DRIVES IT?

AUTOMATED TELLER MACHINE (AThl) NETWORK EVOLUTION IN AMERICAN RETAIL BANKING: WHAT DRIVES IT? Robert J. Kauffiiian Leollard N.Stern School of Busivless New 'r'osk Universit,y Re\\. %sk, Net.\' York 10003 Mary Beth Tlieisen J,eorr;~rd n'. Stcr~iSchool of B~~sincss New \'orl; University New York, NY 10006 C'e~~terfor Rcseai.clt 011 Irlfor~i~ntion Systclns lnfoornlation Systen~sI)epar%ment 1,eojrarcl K.Stelm Sclrool of' Busir~ess New York ITuiversity Working Paper Series STERN IS-91-2 Center for Digital Economy Research Stem School of Business Working Paper IS-91-02 Center for Digital Economy Research Stem School of Business IVorking Paper IS-91-02 AUTOMATED TELLER MACHINE (ATM) NETWORK EVOLUTION IN AMERICAN RETAIL BANKING: WHAT DRIVES IT? ABSTRACT The organization of automated teller machine (ATM) and electronic banking services in the United States has undergone significant structural changes in the past two or three years that raise questions about the long term prospects for the retail banking industry, the nature of network competition, ATM service pricing, and what role ATMs will play in the development of an interstate banking system. In this paper we investigate ways that banks use ATM services and membership in ATM networks as strategic marketing tools. We also examine how the changes in the size, number, and ownership of ATM networks (from banks or groups of banks to independent operators) have impacted the structure of ATM deployment in the retail banking industry. Finally, we consider how movement toward market saturation is changing how the public values electronic banking services, and what this means for bankers. -

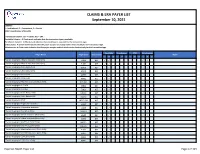

Claims and Remits Payer List

CLAIMS & ERA PAYER LIST September 10, 2021 LEGEND: I = Institutional, P = Professional, D = Dental COB = Coordination of Benefits Transaction Column: 837 = Claims, 835 = ERA Available Column: A Check-mark indicates that the transaction type is available. Enrollment Column: A Check-mark indicates that enrollment is required for the transaction type. COB Column: A Check-mark Indicates that the payer accepts secondary claims electronically for the transaction type. Attachments: A Check-mark indicates that the payer accepts medical attachments electronically for the transaction type. Available Enrollment COB Attachments Payer Name Payer Code Transaction Notes I P D I P D I P D I P D *Carisk Imaging to Allstate Insurance (Auto Only) E1069 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Allstate Insurance (Auto Only) E1069 835 ✓ ✓ *Carisk Imaging to Geico (Auto Only) GEICO 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Geico (Auto Only) GEICO 835 ✓ ✓ *Carisk Imaging to Nationwide A0002 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Nationwide A0002 835 ✓ ✓ *Carisk Imaging to New York City Law Department NYCL001 837 ✓ ✓ ✓ ✓ *Carisk Imaging to NJ-PLIGA E3926 837 ✓ ✓ ✓ ✓ *Carisk Imaging to NJ-PLIGA E3926 835 ✓ ✓ *Carisk Imaging to North Dakota WSI NDWSI 837 ✓ ✓ ✓ ✓ *Carisk Imaging to North Dakota WSI NDWSI 835 ✓ ✓ *Carisk Imaging to NYSIF NYSIF1510 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Progressive Insurance E1139 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Progressive Insurance E1139 835 ✓ ✓ *Carisk Imaging to Pure (Auto Only) PURE01 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Safeco Insurance (Auto Only) E0602 837 ✓ ✓ ✓ ✓ -

GBIC Approval Scheme

GBIC Approval Scheme Version 1.11 11.10.2018 GBIC Approval Scheme Content 1 Management Summary ................................................................................................... 8 2 Introduction .................................................................................................................... 11 2.1 Scope ................................................................................................................... 11 2.2 Objectives ............................................................................................................ 11 2.3 GBIC as Approval Authority .................................................................................. 12 2.4 Starting Points ...................................................................................................... 13 2.4.1 Development of the GBIC Approval Scheme ............................................. 13 2.4.2 Extension to Other Payment Schemes and Approval Bodies .................... 14 2.4.3 Necessity of a Common and Uniform Approval Scheme for Payment Schemes .................................................................................... 14 3 Approval Policy .............................................................................................................. 16 3.1 Overall Objectives ................................................................................................ 16 3.1.1 Compliance with Legal Requirements ....................................................... 16 3.1.2 Interoperability .........................................................................................