Application for a Maestro Card

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Authorisation Service Sales Sheet Download

Authorisation Service OmniPay is First Data’s™ cost effective, Supported business profiles industry-leading payment processing platform. In addition to card present POS processing, the OmniPay platform Authorisation Service also supports these transaction The OmniPay platform Authorisation Service gives you types and products: 24/7 secure authorisation switching for both domestic and international merchants on behalf of merchant acquirers. • Card Present EMV offline PIN • Card Present EMV online PIN Card brand support • Card Not Present – MOTO The Authorisation Service supports a wide range of payment products including: • Dynamic Currency Conversion • Visa • eCommerce • Mastercard • Secure eCommerce –MasterCard SecureCode, Verified by Visa and SecurePlus • Maestro • Purchase with Cashback • Union Pay • SecureCode for telephone orders • JCB • MasterCard Gaming (Payment of winnings) • Diners Card International • Address Verification Service • Discover • Recurring and Installment • BCMC • Hotel Gratuity • Unattended Petrol • Aggregator • Maestro Advanced Registration Program (MARP) Supported authorisation message protocols • OmniPay ISO8583 • APACS 70 Authorisation Service Connectivity to the Card Schemes OmniPay Authorisation Server Resilience Visa – Each Data Centre has either two or four Visa EAS servers and resilient connectivity to Visa Europe, Visa US, Visa Canada, Visa CEMEA and Visa AP. Mastercard – Each Data Centre has a dedicated Mastercard MIP and resilient connectivity to the Mastercard MIP in the other Data Centre. The OmniPay platform has connections to Banknet for both European and non-European authorisations. Diners/Discover – Each Data Centre has connectivity to Diners Club International which is also used to process Discover Card authorisations. JCB – Each Data Centre has connectivity to Japan Credit Bureau which is used to process JCB authorisations. UnionPay – Each Data Centre has connectivity to UnionPay International which is used to process UnionPay authorisations. -

New Debit Card Solutions At

New Debit Card Solutions Debit Mastercard and Visa Debit are ready Swiss Banking Services Forum, 22 May 2019 Philippe Eschenmoser, Head Cards & A2A, Swisskey Ltd Maestro/V PAY Have Established Themselves As the “Key to the Account” – Schemes, However, Are Forcing Market Entry For Successor Products Response from the Maestro and V PAY are successful… …but are not future-capable products schemes # cards Maestro V PAY on Lower earnings potential millions8 for issuers as an alternative payment traffic products (e.g. 6 credit cards, TWINT) Issuer 4 V PAY will be 2 decommissioned by VISA Functional limitations: in 20211 – Visa Debit as 0 • No e-commerce the successor 2000 2018 • No preauthorizations Security and stability have End- • No virtualization proven themselves customer High acceptance in CH and Merchants with an online MasterCard is positioning abroad in Europe offer are demanding an DMC in the medium term online-capable debit as the successor to Standard product with an Merchan product Maestro integrated bank card t 2 1: As of 2021 no new V PAY may be issued TWINT (Still) No Substitute For Debit Cards – Credit Cards With Divergent Market Perception TWINT (still) not alternative for debit Credit cards a no alternative for debit Lacking a bank card Debit function Limited target group (age, ~1.1 M 1 ~10 M. creditworthiness...) Issuer ~48.5 k ~170 k1 No direct account debiting DMC/ Visa Debit Potentially high annual fee End-customer Lower customer penetration Banks and merchants DMC/ P2P demand an online- Higher costs Merchant Visa Debit -

AUTOMATED TELLER MACHINE (Athl) NETWORK EVOLUTION in AMERICAN RETAIL BANKING: WHAT DRIVES IT?

AUTOMATED TELLER MACHINE (AThl) NETWORK EVOLUTION IN AMERICAN RETAIL BANKING: WHAT DRIVES IT? Robert J. Kauffiiian Leollard N.Stern School of Busivless New 'r'osk Universit,y Re\\. %sk, Net.\' York 10003 Mary Beth Tlieisen J,eorr;~rd n'. Stcr~iSchool of B~~sincss New \'orl; University New York, NY 10006 C'e~~terfor Rcseai.clt 011 Irlfor~i~ntion Systclns lnfoornlation Systen~sI)epar%ment 1,eojrarcl K.Stelm Sclrool of' Busir~ess New York ITuiversity Working Paper Series STERN IS-91-2 Center for Digital Economy Research Stem School of Business Working Paper IS-91-02 Center for Digital Economy Research Stem School of Business IVorking Paper IS-91-02 AUTOMATED TELLER MACHINE (ATM) NETWORK EVOLUTION IN AMERICAN RETAIL BANKING: WHAT DRIVES IT? ABSTRACT The organization of automated teller machine (ATM) and electronic banking services in the United States has undergone significant structural changes in the past two or three years that raise questions about the long term prospects for the retail banking industry, the nature of network competition, ATM service pricing, and what role ATMs will play in the development of an interstate banking system. In this paper we investigate ways that banks use ATM services and membership in ATM networks as strategic marketing tools. We also examine how the changes in the size, number, and ownership of ATM networks (from banks or groups of banks to independent operators) have impacted the structure of ATM deployment in the retail banking industry. Finally, we consider how movement toward market saturation is changing how the public values electronic banking services, and what this means for bankers. -

EMF Implementing EMV at The

Implementing EMV®at the ATM: Requirements and Recommendations for the U.S. ATM Community Version 2.0 Date: June 2015 Implementing EMV at the ATM: Requirements and Recommendations for the U.S. ATM Community About the EMV Migration Forum The EMV Migration Forum is a cross-industry body focused on supporting the EMV implementation steps required for global and regional payment networks, issuers, processors, merchants, and consumers to help ensure a successful introduction of more secure EMV chip technology in the United States. The focus of the Forum is to address topics that require some level of industry cooperation and/or coordination to migrate successfully to EMV technology in the United States. For more information on the EMV Migration Forum, please visit http://www.emv- connection.com/emv-migration-forum/. EMV is a trademark owned by EMVCo LLC. Copyright ©2015 EMV Migration Forum and Smart Card Alliance. All rights reserved. The EMV Migration Forum has used best efforts to ensure, but cannot guarantee, that the information described in this document is accurate as of the publication date. The EMV Migration Forum disclaims all warranties as to the accuracy, completeness or adequacy of information in this document. Comments or recommendations for edits or additions to this document should be submitted to: ATM- [email protected]. __________________________________________________________________________________ Page 2 Implementing EMV at the ATM: Requirements and Recommendations for the U.S. ATM Community TABLE OF CONTENTS -

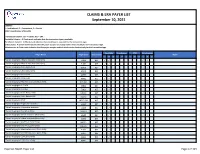

Claims and Remits Payer List

CLAIMS & ERA PAYER LIST September 10, 2021 LEGEND: I = Institutional, P = Professional, D = Dental COB = Coordination of Benefits Transaction Column: 837 = Claims, 835 = ERA Available Column: A Check-mark indicates that the transaction type is available. Enrollment Column: A Check-mark indicates that enrollment is required for the transaction type. COB Column: A Check-mark Indicates that the payer accepts secondary claims electronically for the transaction type. Attachments: A Check-mark indicates that the payer accepts medical attachments electronically for the transaction type. Available Enrollment COB Attachments Payer Name Payer Code Transaction Notes I P D I P D I P D I P D *Carisk Imaging to Allstate Insurance (Auto Only) E1069 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Allstate Insurance (Auto Only) E1069 835 ✓ ✓ *Carisk Imaging to Geico (Auto Only) GEICO 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Geico (Auto Only) GEICO 835 ✓ ✓ *Carisk Imaging to Nationwide A0002 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Nationwide A0002 835 ✓ ✓ *Carisk Imaging to New York City Law Department NYCL001 837 ✓ ✓ ✓ ✓ *Carisk Imaging to NJ-PLIGA E3926 837 ✓ ✓ ✓ ✓ *Carisk Imaging to NJ-PLIGA E3926 835 ✓ ✓ *Carisk Imaging to North Dakota WSI NDWSI 837 ✓ ✓ ✓ ✓ *Carisk Imaging to North Dakota WSI NDWSI 835 ✓ ✓ *Carisk Imaging to NYSIF NYSIF1510 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Progressive Insurance E1139 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Progressive Insurance E1139 835 ✓ ✓ *Carisk Imaging to Pure (Auto Only) PURE01 837 ✓ ✓ ✓ ✓ *Carisk Imaging to Safeco Insurance (Auto Only) E0602 837 ✓ ✓ ✓ ✓ -

Submission to the Reserve Bank of Australia Response to EFTPOS

Submission to the Reserve Bank of Australia Response To EFTPOS Industry Working Group By The Australian Retailers Association 13 September 2002 Response To EFTPOS Industry Working Group Prepared with the assistance of TransAction Resources Pty Ltd Australian Retailers Association 2 Response To EFTPOS Industry Working Group Contents 1. Executive Summary.........................................................................................................4 2. Introduction......................................................................................................................5 2.1 The Australian Retailers Association ......................................................................5 3. Objectives .......................................................................................................................5 4. Process & Scope.............................................................................................................6 4.1 EFTPOS Industry Working Group – Composition ...................................................6 4.2 Scope Of Discussion & Analysis.............................................................................8 4.3 Methodology & Review Timeframe.........................................................................9 5. The Differences Between Debit & Credit .......................................................................10 5.1 PIN Based Transactions.......................................................................................12 5.2 Cash Back............................................................................................................12 -

DEBIT CARD POLICY 1. Debit Card a Debit Card Is a Plastic Card That

DEBIT CARD POLICY 1. Debit Card A debit card is a plastic card that provides the cardholder electronic access to his/her bank account(s). It is an instrument that can be used to: Avail of banking services such as cash withdrawal, balance enquiry etc., from any ATM and Micro ATM. Make payments to merchants against purchase, withdrawal of cash at POS or both within the prescribed limit by RBI at merchant outlets. e-Commerce transactions. 2. Understanding a Debit Card. a) Card Number: It is a 16 or 19 digit number linked to customer’s bank account. First 6 digits represent Bank’s identification no., next 4 digits represent Branch Sol ID. Remaining digits indicates serial number of the cards issued by that particular branch. Currently Bank issue debit cards with 16 digit length. b) Name of the Person: Person authorized to use the card. This field is present only on personalized card. c) Valid Date: It is in mm/yy format. The card is valid till the last day of the month. d) Card Verification Value (CVV) /CVV2: A 03 (Three) digit number printed on the back side of every debit card. This is used for validation of online transactions. e) Magnetic Strip: Important information regarding the debit card is stored in electronic format here and hence any kind of scratches or exposure to magnetic fields will cause damage to the card. f) EMV Chip Card: EMV stands for Europay, MasterCard and Visa. EMV is a global standard for credit and debit payment cards based on chip card technology. -

Multi-Lateral Mechanism of Cash Machines: Virtue Or Hassel

International Journal of Engineering Technology Science and Research IJETSR www.ijetsr.com ISSN 2394 – 3386 Volume 4, Issue 10 October 2017 Multi-Lateral Mechanism of Cash Machines: Virtue or Hassel Peeush Ranjan Agrawal1 and Sakshi Misra Shukla2 1 Professor, School of Management studies, MNNIT, Allahabad, Uttar Pradesh,India 2Assistant Professor, Department of MBA, S.P. Memorial Institute of Technology, Allahabad, India ABSTRACT Automated Teller Machines or Cash Machines became an organic constituent of the banking sector. The paper envisionsthe voyage that these cash machines have gone through since their initiation in the foreign banks operating in India. The study revolves around the indispensible factors in the foreign banking environment like availability, connectivity customer base, security, network gateways and clearing houses which were thoroughly reviewed and analyzed in the research paper. The methodology of the research paper includes literature review, derivation of variables, questionnaire formulation, pilot testing, data collectionand application of statistical tools with the help of SPSS software. The paper draws out findings related to the usage, congregation, multi-lateral functioning, security and growth of ATMs in the foreign banks operating in the country. The paper concludes by rendering recommendations to theforeign bankers to vanquish the stumbling blocks of the cash machines functioning. Keywords: ATMs, Cash Machines, Anywhere Banking, Foreign Banking, Online Banking 1. INTRODUCTION The Automated Teller Machine (ATM) has become an integral part of banking operations. Initially perceived as ‘cash machines’, which dispenses cash to depositors, ATMs can accept deposits, sell postage stamps, print statements and be used at institutions where the depositor does not have an account. -

Assessing Payments Systems in Latin America

Assessing payments systems in Latin America An Economist Intelligence Unit white paper sponsored by Visa International Assessing payments systems in Latin America Preface Assessing payments systems in Latin America is an Economist Intelligence Unit white paper, sponsored by Visa International. ● The Economist Intelligence Unit bears sole responsibility for the content of this report. The Economist Intelligence Unit’s editorial team gathered the data, conducted the interviews and wrote the report. The author of the report is Ken Waldie. The findings and views expressed in this report do not necessarily reflect the views of the sponsor. ● Our research drew on a wide range of published sources, both government and private sector. In addition, we conducted in-depth interviews with government officials and senior executives at a number of financial services companies in Latin America. Our thanks are due to all the interviewees for their time and insights. May 2005 © The Economist Intelligence Unit 2005 1 Assessing payments systems in Latin America Contents Executive summary 4 Brazil 17 The financial sector 17 Electronic payments systems 7 Governing institutions 17 Electronic payment products 7 Banks 17 Conventional payment cards 8 Clearinghouse systems 18 Smart cards 8 Electronic payment products 18 Stored value cards 9 Credit cards 18 Internet-based Payments 9 Debit cards 18 Payment systems infrastructure 9 Smart cards and pre-paid cards 19 Clearinghouse systems 9 Direct credits and debits 19 Card networks 10 Strengths and opportunities 19 -

Automated Teller Machine Usage and Customers' Satisfactionin Nigeria

Global Journal of Management and Business Research: C Finance Volume 14 Issue 4 Version 1.0 Year 2014 Type: Double Blind Peer Reviewed International Research Journal Publisher: Global Journals Inc. (USA) Online ISSN: 2249-4588 & Print ISSN: 0975-5853 Automated Teller Machine usage and Customers’ Satisfaction in Nigeria By Odusina, Ayokunle Olumide Abraham Adesanya Polytechnic, Nigeria. Abstract- This paper endeavors to investigate ATM Usage and Customers’ Satisfaction in Nigeria. It was discovered that despite the increasing number of ATM installations in Nigeria. Customers’ needs are not satisfactorily met as customers are always seen on queue in large numbers at various ATM designated centers as well as poor service delivery of some of these machine. The research engages comparative analysis of three banks in Ogun State, Metropolis of Nigeria viz-a- viz First Bank, Guaranty Trust Bank and Skye Bank. However, questionnaires were distributed to the respondents. A total of 200 respondents answered the questionnaire cutting across the three banks, the chi-square statistical tool was used to analyze the data and the results showed a positive and significant relationship between ATM Usage and Customers’ Satisfaction. Keywords: ATM, bank, customers’ satisfaction, nigeria. GJMBR-C Classification : JEL Code: G19 AutomatedTellerMachineusageandCustomersSatisfactioninNigeria Strictly as per the compliance and regulations of: © 2014. Odusina, Ayokunle Olumide. This is a research/review paper, distributed under the terms of the Creative Commons Attribution-Noncommercial 3.0 Unported License http://creativecommons.org/licenses/by-nc/3.0/), permitting all non-commercial use, distribution, and reproduction in any medium, provided the original work is properly cited. Automated Teller Machine usage and Customers’ Satisfaction in Nigeria Odusina, Ayokunle Olumide Abstract - This paper endeavors to investigate ATM Usage and the available staff on the other hand. -

Health Savings Account Investments

Humana Access Online User Guide Simplify your healthcare finances with convenient, online access to your tax-advantaged spending account 1 Humana Access Contents Getting Started ............................................................................................................................................. 2 HOW TO REGISTER YOUR SPENDING ACCOUNT ..................................................................................... 2 REGISTRATION – STEP 1 ........................................................................................................................... 3 REGISTRATION – STEP 2 ........................................................................................................................... 3 REGISTRATION – STEP 3 ........................................................................................................................... 3 REGISTRATION – STEP 4 ........................................................................................................................... 4 Quick Reference Guide ................................................................................................................................. 5 USING YOUR HUMANA ACCESS MASTERCARD DEBIT CARD .................................................................. 5 CHECKING YOUR ACCOUNT BALANCE(S) ................................................................................................. 7 ACCOUNT TRANSACTIONS ...................................................................................................................... -

All Card Benefits

ALL CARD BENEFITS TRAVEL $200 Airline Fee Credit1 You can receive up to $200 in credits annually for incidental airline fees charged to your Card. Eligible charges include:* • Baggage fees • Flight-change fees • In-flight food and beverage purchases • Airport lounge day passes *American Express relies on accurate airline transaction data to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your enrolled Card after 4 weeks, simply call the number on the back of the Card. See terms & conditions for more details. Enroll Now> Airport Club Access Program2 Enjoy complimentary lounge access with your Business Platinum Card. Your spouse and children under the age of 21, or up to two companions may enter the club as complimentary guests. Participating lounges include: • American Airlines Admirals Club® • Delta Sky Club® • US Airways® Club – enter regardless of the airline you are flying Find Lounges> Priority Pass™ Select3 Make your international travels more comfortable with worldwide lounge access. • Available at over 600 participating airport lounges in 100 countries • It doesn’t matter what class or airline you fly • Lounge access is complimentary and there’s no fee to enroll • To enter, simply present your Priority Pass Select Card • Guests are charged $27 each Enroll Now> 20% Travel Bonus4 When you use the Pay with Points® program to book all or even part of your trip, you’ll get 20% of the Membership Rewards® points you used credited back to your account. • Book any airline, anywhere, anytime • No seat restrictions or blackout dates Book Now> Global Entry5 Bypass arrival lines at most major U.S.