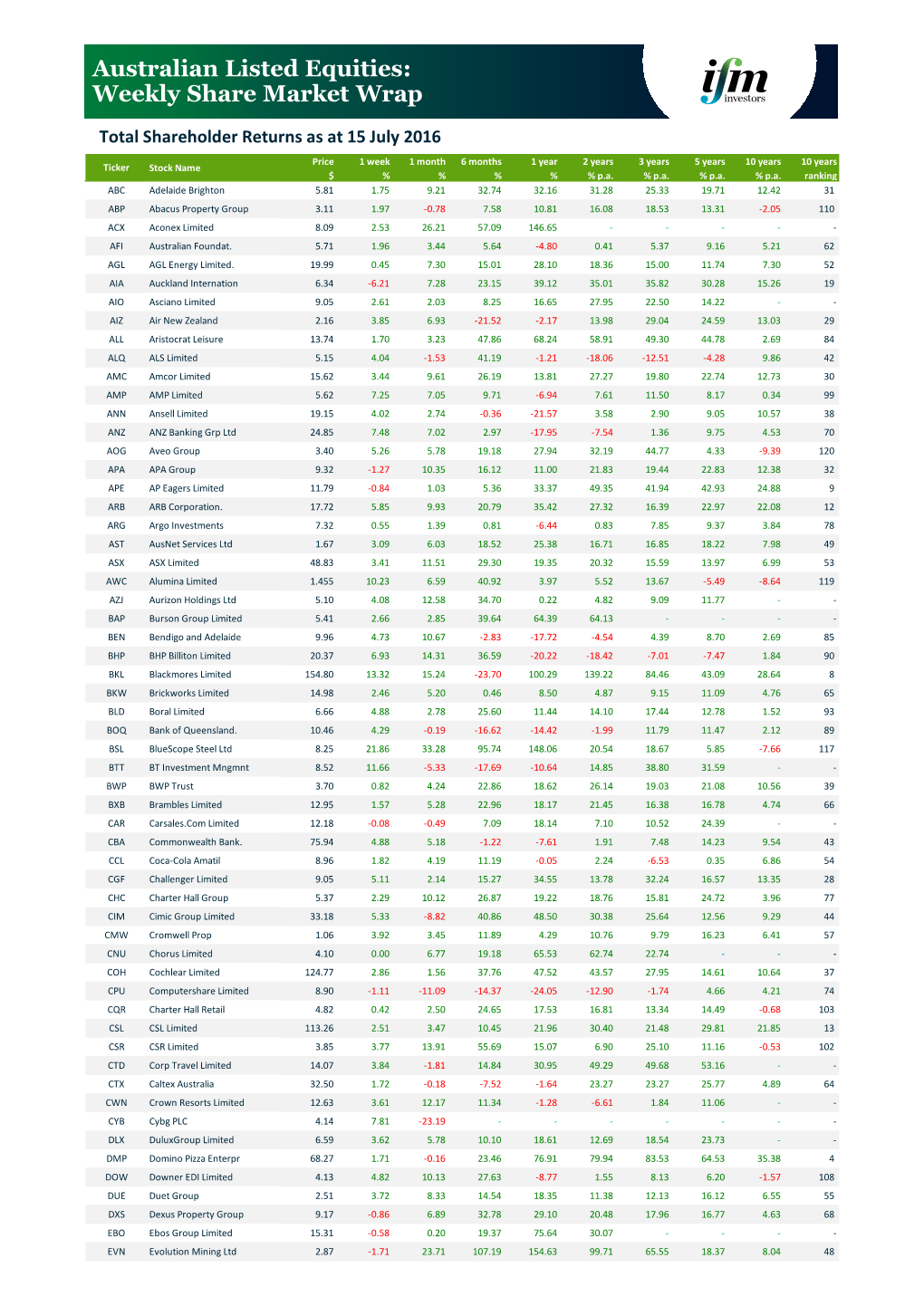

Australian Listed Equities: Weekly Share Market Wrap

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Half Year Results Presentation 2 1H21 RESULTS PRESENTATION 15 April 2021

1H21 INVESTOR MATERIALS 15 April 2021 Half Year ended 28 February 2021 BANK OF QUEENSLAND LIMITED ABN 32 009 656 740. AFSL NO 244616. CONTENTS 1H21 RESULTS PRESENTATION 3 ABOUT BOQ 30 1H21 RESULTS 34 PORTFOLIO QUALITY 38 CAPITAL, FUNDING & LIQUIDITY 45 DIVISIONAL RESULTS 52 ECONOMIC ASSUMPTIONS 56 Bank of Queensland Limited 2021 Half Year Results Presentation 2 1H21 RESULTS PRESENTATION 15 April 2021 Half Year ended 28 February 2021 BANK OF QUEENSLAND LIMITED ABN 32 009 656 740. AFSL NO 244616. AGENDA INTRODUCTION Cherie Bell, General Manager Investor Relations RESULTS OVERVIEW George Frazis, Managing Director and CEO FINANCIAL DETAIL AND PORTFOLIO QUALITY Ewen Stafford, Chief Financial Officer and Chief Operating Officer SUMMARY & OUTLOOK George Frazis, Managing Director and CEO Q&A George Frazis, Managing Director and CEO Ewen Stafford, Chief Financial Officer and Chief Operating Officer Bank of Queensland Limited 2021 Half Year Results Presentation 4 RESULTS OVERVIEW GEORGE FRAZIS MANAGING DIRECTOR AND CEO 1H21 OVERVIEW 1. Statutory profit growth of 66%, cash net profit up 9%, and EPS growth of 3%1, reflecting strong growth whilst managing margin, costs and lower impairments 2. Good business momentum, with strong housing loan growth of 1.6x system and improved NIM to 1.95% 3. Delivering on the strategic transformation, over the last three halves, with go live of the first phase of the retail digital banking platform, and acquisition of ME Bank announced 4. Asset quality remains sound, reflected by loan impairment expense to GLAs reducing to 10bps and arrears reducing over the half. Prudent provision levels maintained 5. Capital strength to support business growth and transformation investment with CET1 of 10.03% 6. -

2017 Annual Report 1 I Sirtex 2017 Highlights

2017 ANNUAL REPORT 1 I SIRTEX 2017 HIGHLIGHTS DOSES SOLD 2017 12,578 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 CONTENTS ABOUT SIRTEX 03 2017 FINANCIAL SUMMARY Sirtex Medical Limited is an Australian- 05 CHAIRMAN’S REPORT based global healthcare business working to 09 CHIEF EXECUTIVE OFFICER’S REPORT improve outcomes for people with cancer. 18 ENVIRONMENTAL, SOCIAL AND Our lead product is a targeted radiation GOVERNANCE therapy known as SIR-Spheres® Y-90 resin 22 BOARD OF DIRECTORS microspheres. It is available in more than 23 KEY MANAGEMENT PERSONNEL 40 countries, within over 1,090 certified hospitals to treat patients with 24 FINANCIAL REPORT inoperable liver cancer. Our business revolves around helping medical professionals understand and use our product to improve clinical outcomes and the quality of life for people with liver cancer. While at the same time, we work closely with government and private payers to ensure our patients receive the appropriate reimbursement for our product. We are challenging established practices and developing innovative new therapies that promise to improve the health and lives of many people suffering from cancer or other diseases. Our ongoing success is based on a commitment to serving our customers, professionalism, continuous improvement and innovation. ANNUAL REPORT 2017 I 2 DOSE SALES 12,578 +5.4% REVENUE $234.3m +0.8% NET LOSS AFTER TAX $26.3m -149.0% THE AMERICAS EUROPE, MIDDLE ASIA PACIFIC EAST, AFRICA Boston, United States Frankfurt, -

2005 Washington H. Soul Pattinson and Company Limited and Controlled Entities A.B.N

WASHINGTON H. SOUL PATTINSON AND COMPANY LIMITED A.B.N. 49 000 002 728 DIRECTORS’ ANNUAL REPORT and FINANCIAL STATEMENTS 2005 WASHINGTON H. SOUL PATTINSON AND COMPANY LIMITED AND CONTROLLED ENTITIES A.B.N. 49 000 002 728 FINANCIAL SUMMARY 2001 2002 2003 2004 2005 $000 $000 $000 $000 $000 Before non regular items Total sales revenue 906,448 334,307 340,624 392,854 597,104 Operating profit after taxation and excluding outside equity............................ 45,756 65,987 78,706 81,508 105,109 Total assets employed................................ 1,381,008 1,092,348 1,115,282 1,414,693 2,220,042 Shareholders’ funds.................................. 643,017 668,436 729,926 867,509 1,260,448 Operating profit after taxation and excluding outside equity as a percentage of shareholders’ funds... 7.1% 9.9% 10.8% 9.4% 8.3% Earnings per share on adjusted issued capital (cents)..... 19.17 27.65 32.98 34.16 44.04 Ordinary Dividends per share (cents)................... 11.5 14.0 17.0 20.0 25.0 Special Dividends per share (cents).................... 4.0 5.0 5.0 10.0 15.0 After non regular items Operating profit after taxation and excluding outside equity ........................... 56,751 72,741 88,307 155,925 421,455 Earnings per share on adjusted issued capital (cents) .. 23.78 30.48 37.00 65.34 176.61 WASHINGTON H. SOUL PATTINSON AND COMPANY LIMITED A.B.N. 49 000 002 728 DIRECTORS: ROBERT D. MILLNER Chairman of Directors Director since 1984 MICHAEL J. MILLNER Non-Executive Director - Deputy Chairman Director since 1997 PETER R. -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 15 April 2016 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 1.665 -4.31 2.78 134.51 208.33 - - - - - ABC Adelaide Brighton 5.10 -1.16 6.03 26.15 17.04 19.09 19.37 12.82 10.84 34 ABP Abacus Property Group 3.10 2.99 5.08 -0.47 12.76 20.70 17.15 11.90 -1.96 105 AFI Australian Foundat. 5.53 0.18 -1.60 -4.25 -7.23 0.42 5.09 6.71 5.22 58 AGL AGL Energy Limited. 18.24 -0.65 0.55 15.71 25.25 14.52 10.63 9.90 6.32 53 AHG Automotive Holdings. 3.85 -0.52 -3.78 -1.13 -2.98 4.35 4.94 12.70 14.45 22 AIA Auckland Internation 5.75 -1.88 0.45 25.03 28.95 28.14 37.37 30.93 14.31 23 AIO Asciano Limited 8.84 1.14 -1.67 13.83 38.00 31.68 21.04 13.79 - - AIZ Air New Zealand 2.70 -0.37 9.76 4.19 3.16 27.56 39.16 31.16 13.06 24 ALL Aristocrat Leisure 10.12 4.01 1.50 14.85 23.98 45.00 42.39 29.35 -1.72 102 ALQ ALS Limited 4.38 15.57 1.15 -16.29 -1.83 -16.66 -16.64 -6.48 10.25 37 AMC Amcor Limited 14.76 1.17 4.53 15.59 5.97 25.73 23.23 20.98 11.71 29 AMP AMP Limited 5.79 5.46 2.84 3.13 -8.72 11.19 8.68 4.71 1.17 88 ANN Ansell Limited 19.68 13.30 14.42 3.31 -32.90 7.34 12.16 9.27 7.39 47 ANZ ANZ Banking Grp Ltd 23.85 7.05 -6.07 -13.17 -28.60 -9.52 0.33 6.22 3.50 72 AOG Aveo Group 3.30 0.30 4.10 16.20 24.07 30.19 38.74 -1.59 -9.34 119 APA APA Group 8.71 0.46 5.83 1.14 -1.03 22.97 17.57 21.10 11.78 28 APE AP Eagers Limited 10.00 4.06 -0.58 0.99 24.34 45.68 30.49 -

June 2011 Yearly Report

Alleron Investment Management Limited Yearly Report June 2011 Portfolio performance and attribution analysis Market commentary Portfolio commentary Since Inception (Annualised) Year to Date Global markets were lead, over Positives: financial year, by the strong per- CEU: The company’s revenue such Portfolio +10.297% +4.468% formance of the US market which that cash flow now funds their dis- Benchmark + 6.158% +11.503% responded strongly to Federal Re- tribution and reduces their risk pro- serve Bank policy of a second round file. Top 3 and bottom 3 performing stocks of quantitative easing. This along AXA: The stock price was sup- Top 3: ConnectEast Group (CEU), AXA Asia Pacific Holdings with continued government spend- (AXA), Oil Search (OSH). ported by the accepted takeover ing allowed the US economy and offer from AMP and AXA SA. company earnings to maintain Bottom 3: Seven West Media Limited (SWM), Resmed Inc. (RMD), growth into the beginning of 2011. OSH: The company has secured Computershare (CPU). While growth in the US continued, offtake agreements to their LNG European countries were besieged output which remains on schedule. Portfolio changes by the familiar problem of periph- Negatives: Stocks joined or increased significantly: eral nation debt and increased risks of sovereign debt default. Contrar- SWM: Company earnings were hurt Downer Limited (+2.25% New Stock): An Engineering and Contract- ily, strong activity in emerging by weak advertising activity from ing company. The company has developed a strong order book pro- economies has forced monetary uncertainly over the resource tax. viding significant growth potential and has cleared the way to success- authorities there to tighten policy to RMD: Earnings translation was hurt fully complete troubled contracts. -

FY21 Results Overview

Annual Report 2021 01 Chorus Board and management overview 14 Management commentary 24 Financial statements 60 Governance and disclosures 92 Glossary FY21 results overview Fixed line connections1 Broadband connections1 FY21 FY20 FY21 FY20 1,340,000 1,415,000 1,180,000 1,206,000 Fibre connections1 Net profit after tax FY21 FY20 FY21 FY20 871,000 751,000 $47m $52m EBITDA2 Customer satisfaction Installation Intact FY21 FY20 FY21 FY21 $649m $648m 8.2 out of 10 7.5 out of 10 (target 8.0) (target 7.5) Dividend Employee engagement score3 FY21 FY20 FY21 FY20 25cps 24cps 8.5 out of 103 8.5 This report is dated 23 August 2021 and is signed on behalf of the Board of Chorus Limited. Patrick Strange Mark Cross Chair Chair Audit & Risk Management Committee 1 Excludes partly subsidised education connections provided as part of Chorus’ COVID-19 response. 2 Earnings before interest, income tax, depreciation and amortisation (EBITDA) is a non-GAAP profit measure. We monitor this as a key performance indicator and we believe it assists investors in assessing the performance of the core operations of our business. 3 Based on the average response to four key engagement questions. Dear investors Our focus in FY21 was to help consumers especially important because fixed wireless services don’t capitalise on the gigabit head start our fibre provide the same level of service as fibre - or even VDSL in network has given New Zealand. We knocked most cases – and these service limitations often aren’t made clear to the customer. on about a quarter of a million doors and supported our 100 or so retailers to connect As expected, other fibre companies continued to win copper customers in those areas where they have overbuilt our another 120,000 consumers to fibre. -

Monthly NTA and Performance Update

Absolute Equity Performance Fund Limited Monthly NTA and Performance Update As at 31 January 2018 Net Tangible Assets (NTA) NTA* Performance NTA before tax $1.122 1 month 1.27% NTA after tax $1.123 3 months 2.59% $ currency notation refers to Australian Dollars. 12 months 16.02% Since inception (annualised) 3.52% Portfolio Performance *Before tax. These calculations are unaudited and intended to illustrate the performance of the investment portfolio minus corporate expenses. They are calculated on a pre-dividend NTA basis. ‘Since inception (annualised)’ is annualised NTA performance since listing at $1.065 after listing related expenses The Company’s Portfolio returned +1.27% for January 2018 and the majority of pair positions were profitable. Performance was positive despite the significant headwind of a very strong $A/$US. The Company is Company Details net long $US-exposed companies and in the short term, currency swings ASX code AEG can influence performance. In the long run, company fundamentals overwhelm currency. Listing date 16 December 2015 Share price $1.080 In a quiet month for company news the most notable was a strong quarterly NTA* per share $1.122 profit update from Resmed which contributed to our long Resmed / short Ansell pair being amongst our strongest pairs. Long JB Hi-Fi / short Super Market capitalisation $109,365,375 Retail was also rewarded, driven by industry feedback that some retailers Shares on Issue 101,264,236 had experienced better Christmas sales than feared. The pair has been profitable over 12 months, particularly since Amazon announced it will *Before tax ex-dividend start a local business. -

June 2019 42

y 4 6 Equit 2019 June High Conviction High Quarterly NewsletterQuarterly No. Selector Fund In this quarterly edition, we review performance and attribution for the quarter. We highlight the importance of innovation and culture within organisations and profile ResMed and Cochlear, two leading healthcare businesses. We visit Fisher & Paykel Healthcare in New Zealand and look at one of the biggest growth industries in the world today, cyber security. Photo. Selector analyst trekking through the Atlas Mountains and local Berber kids. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 8, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612 www.selectorfund.com.au P Selector is a boutique fund manager. Our team, combined, have over 150 years of experience in financial markets. We believe in long-term wealth creation and building lasting relationships with our investors. We focus on stock selection, the funds are high conviction, concentrated and index unaware. As a result, the portfolios have low turnover and produce tax effective returns. Selector has a 15-year track record of outperformance and we continue to seek businesses with leadership qualities, run by competent management teams, underpinned by strong balance sheets and with a focus on capital management. Selector High Conviction Equity Fund Quarterly Newsletter #64 CONTENTS IN BRIEF – JUNE QUARTER 3 PORTFOLIO OVERVIEW 5 PORTFOLIO CONTRIBUTORS 7 MARKET INSIGHTS AND OBSERVATIONS 13 INNOVATION + CULTURE = SUCCESS 17 RESMED INC. 20 WAKE-UP CALL 31 FISHER & PAYKEL HEALTHCARE – JUNE 2019 42 RISK OUT…UPFRONT 45 COMPANY VISIT DIARY – JUNE 2019 QUARTER 57 2 Selector Funds Management IN BRIEF – JUNE QUARTER Dear Investor, Looking back on 2019, it would be fair to say that few identify the businesses we want to own on a case by case foresaw how the events of the financial year would basis, understand them to the best of our abilities and unfold. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

JMAD Media Ownership Report

JMAD New Zealand Media Ownership Report 2014 Published: 2014 December 5 Author: Merja Myllylahti This New Zealand Ownership Report 2014 is the fourth published by AUT’s Centre for Journalism, Media and Democracy (JMAD). The report finds that the New Zealand media market has failed to produce new, innovative media outlets, and that all the efforts to establish non-profit outlets have proved unsustainable. The report confirms the general findings of previous reports that New Zealand media space has remained highly commercial. It also confirms the financialisation of media ownership in the form of banks and fund managers. The report also observes that in 2014 convergence between New Zealand mass media and the communications sector generally was in full swing. Companies, such as Spark (former Telecom NZ), started to compete head-to-head with the traditional broadcasters on the online on-demand video and television markets. The American online video subscription service Netflix is entering the NZ market in March 2015. Additionally, the report notes evidence of uncomfortable alliances between citizen media, politicians, PR companies and legacy media. As Nicky Hager’s Dirty Politics book revealed, the National Party and PR practitioners used the Whale Oil blog to drive their own agendas. Also, events related to Maori TV, TVNZ and Scoop raise questions about political interference in media affairs. It is now evident that the boundaries between mainstream media, bloggers, public relations practitioners and politicians are blurring. Key events and trends concerning New Zealand media Financialisation of mass media ownership confirmed Substantial changes in Fairfax, APN and MediaWorks ownership Competition heats up in online television and video markets Turbulence at Maori TV Blurred lines among politicians, bloggers, journalists and PR practitioners The JMAD New Zealand media ownership reports are available here: http://www.aut.ac.nz/study- at-aut/study-areas/communications/media-networks/journalism,-media-and-democracy-research- centre/journalists-and-projects 1 1. -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

16 August 2021 Company Announcements Office Australian

16 August 2021 Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 2021 FULL YEAR RESULTS – ANNUAL REPORT Seven West Media Limited (ASX: SWM) attaches the Annual Report for the year ended 26 June 2021. This release has been authorised to be given to ASX by the Board of Seven West Media Limited. For further information, please contact: Investors/Analysts Media Alan Stuart Rob Sharpe T: +61 2 8777 7211 T: +61 437 928 884 E: [email protected] E: [email protected] Seven West Media Limited / 50 Hasler Road, Osborne Park WA 6017 Australia / PO Box 7077, Alexandria NSW 2015 Australia T +61 2 8777 7777 / ABN 91 053 480 845 Repositioned for growth. Annual Report 2021 Big Brother Contents Our Strategy Who We Are 2 Our Strategic Priorities and Performance Dashboard 4 Executive Letters Letter from the Chairman 6 Letter from the Managing Director and Chief Executive Officer 8 Review of Operations Group Performance – Key Highlights and Summary of Financial Performance 11 Seven Network 17 The West 20 Corporate Social Responsibility Risk, Environment, People and Social Responsibility 22 Seven in the Community 28 Governance Board of Directors 33 Corporate Governance Statement 36 Directors’ Report 47 Remuneration Report 52 Auditor’s Independence Declaration 73 Financial Statements Financial Statements 74 Directors’ Declaration 132 Independent Auditor’s Report 133 Investor Information 138 Shareholder Information 139 Company Information 141 1 Section 1: Our Strategy Seven West Media Limited Annual Report 2021 Who We Are Transforming to lead Seven West Media is being transformed to drive long-term success.