FY21 Results Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

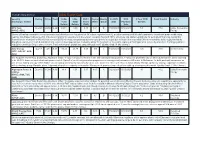

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

Bringing the Future Faster

6mm hinge Bringing the future faster. Annual Report 2019 WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Bringing the future faster Spark New Zealand Annual Report 2019 Bringing the future faster Contents Build customer intimacy We need to understand BRINGING THE FUTURE FASTER and anticipate the needs of New Zealanders, and Spark performance snapshot 4 technology enables us Chair and CEO review 6 to apply these insights Our purpose and strategy 10 to every interaction, Our performance 12 helping us serve our Our customers 14 customers better. Our products and technology 18 Read more pages 7 and 14. Our people 20 Our environmental impact 22 Our community involvement 24 Our Board 26 Our Leadership Squad 30 Our governance and risk management 32 Our suppliers 33 Leadership and Board remuneration 34 FINANCIAL STATEMENTS Financial statements 38 Notes to the financial statements 44 Independent auditor’s report 90 OTHER INFORMATION Corporate governance disclosures 95 Managing risk framework roles and 106 responsibilities Materiality assessment 107 Stakeholder engagement 108 Global Reporting Initiative (GRI) content 109 index Glossary 112 Contact details 113 This report is dated 21 August 2019 and is signed on behalf of the Board of Spark New Zealand Limited by Justine Smyth, Chair and Charles Sitch, Chair, Audit and Risk Management Committee. Justine Smyth Key Dates Annual Meeting 7 November 2019 Chair FY20 half-year results announcement 19 February 2020 FY20 year-end results announcement 26 August 2020 Charles Sitch Chair Audit and Risk Management Committee WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Create New Zealand’s premier sports streaming business Spark Sport is revolutionising how New Zealanders watch their favourite sports events. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Annual Report Year Ended 30 June 2019

Annual Report Year Ended 30 June 2019 GENERAL Year in Review 4 Creating Value 6 Performance 8 Diversity Snapshot 12 Chair’s Review 14 Chief Executive Officer’s Review 15 Delivering Our Group Strategy 16 About SkyCity 24 Auckland 27 Hamilton 31 Adelaide 32 Queenstown 34 International Business 35 Our Risk Profile and Management 36 Our Board 40 Our Senior Leadership Team 44 SUSTAINABILITY Our Sustainability 48 Our Sustainability Pillars Our Customers 52 Our People 58 Our Communities 72 Our Suppliers 78 Our Environment 84 Independent Limited Assurance Statement 91 CORPORATE GOVERNANCE STATEMENT AND OTHER DISCLOSURES Corporate Governance Statement 92 Director and Employee Remuneration 104 Shareholder and Bondholder Information 118 Directors’ Disclosures 121 Company Disclosures 123 This annual report is dated 14 August 2019 and is signed on behalf of the Board of directors of SkyCity Entertainment Group Limited (SkyCity or the company and, together with its subsidiaries, the Group) by: FINANCIAL STATEMENTS Independent Auditor’s Report 127 Income Statement 134 Statement of Comprehensive Income 135 Rob Campbell Bruce Carter Balance Sheet 136 Chair Deputy Chair Statement of Changes in Equity 137 An electronic copy of this annual report is available in the Investor Centre section of the company’s Statement of Cash Flows 138 website at www.skycityentertainmentgroup.com Notes to the Financial Statements 139 Reconciliation of Normalised Results to Reported Results 174 GRI CONTENT INDEX 178 ABOUT THIS ANNUAL REPORT GLOSSARY 182 Unless otherwise stated, all dollar amounts in this annual report are expressed in New Zealand dollars. DIRECTORY 183 Where appropriate, information is also provided in relation to activities that have occurred after 30 June 2019, but prior to publication of this annual report. -

2021–24 Media Rights Sales

Media rights sales: 2021-24 UEFA Europa League™/ UEFA Europa Conference League™ Last Update: 24 August 2021 The media content rights sales process for the UEFA Europa League and the UEFA Europa Conference League (seasons 2021/22, 2022/23 and 2023/24) will be conducted on a market-by-market basis with such media rights being offered on a platform neutral basis and in accordance with the principles established by the European Commission. The sales process will usually be effected initially by means of an ‘Invitation to Submit Offer’ (ISO) process under which qualified media content distributors will be invited to submit offers before the submission deadline (as indicated in the Schedule A below) for the media rights in their respective territories. Schedule B lists the relevant territories for which media rights agreements have been signed (including details of the respective partners). The sales process will be administered on behalf of UEFA by TEAM Marketing, UEFA’s exclusive marketing agency for the exploitation of certain media and commercial rights relating to its club competitions. All enquiries in respect of the acquisition of such rights should therefore be directed to TEAM Marketing at the following e-mail address: [email protected]. Further communications and updates shall be provided as and when UEFA commences the media content rights sales process in respect of any other territories. Schedule A: ISO list The list of dates (subject to changes at UEFA’s discretion) on which an ISO has been or will be issued is, by territory, as follows: -

Dow Jones Sustainability Australia Index

Effective as of 23 November 2020 Dow Jones Sustainability Australia Index Company Country Industry Group Comment Australia and New Zealand Banking Group Limited Australia Banks National Australia Bank Limited Australia Banks Westpac Banking Corporation Australia Banks CIMIC Group Limited Australia Capital Goods Brambles Limited Australia Commercial & Professional Services Downer EDI Limited Australia Commercial & Professional Services Tabcorp Holdings Limited Australia Consumer Services The Star Entertainment Group Limited Australia Consumer Services Janus Henderson Group plc United Kingdom Diversified Financials Oil Search Limited Papua New Guinea Energy Woodside Petroleum Ltd Australia Energy Coles Group Limited Australia Food & Staples Retailing Fisher & Paykel Healthcare Corporation Limited New Zealand Health Care Equipment & Services Asaleo Care Limited Australia Household & Personal Products Insurance Australia Group Limited Australia Insurance QBE Insurance Group Limited Australia Insurance Suncorp Group Limited Australia Insurance Addition Amcor plc Switzerland Materials Addition BHP Group Australia Materials Boral Limited Australia Materials Evolution Mining Limited Australia Materials Fletcher Building Limited New Zealand Materials Fortescue Metals Group Limited Australia Materials IGO Limited Australia Materials Iluka Resources Limited Australia Materials Incitec Pivot Limited Australia Materials Newcrest Mining Limited Australia Materials Orocobre Limited Australia Materials Rio Tinto Ltd Australia Materials South32 Limited -

New Zealand Guide

WridgWays Global Guide to Living in New Zealand Image source: Photo by Laura Smetsers on Unsplash Disclaimer: Though WridgWays strives to maintain the materials in this document, keeping them as accurate and current as possible, the information is collected for reference purpose. WridgWays assumes no liability for any inaccurate or incomplete information, nor for any actions taken in reliance thereon. Table of Contents 1. General Information 2 2. Culture, Lifestyle and Language 4 3. Visa and Migration 7 4. Housing 8 5. Banking Services 11 6. Medical Services 12 7. Schooling 16 8. Utilities 18 9. Telecommunications 19 10. Public Transport 20 11. Driving 23 12. Moving your Pet 27 13. Household Goods Shipment and Customs Information 28 14. Shopping 29 1 1. General Information Geographic Location Main Locations New Zealand or Aotearoa, the Māori name, is an island country in Almost three-quarters of the population live on the North Island of the southwestern Pacific Ocean, with a total land area spanning New Zealand. Of this, one-third of the population live in the largest city, 268,021 km2. It consists of two main landmasses, the North Island Auckland. (Te Ika-a-Mui) and the South Island (Te Waipounamu), and Auckland is the commercial heart and international hub of New approximately 600 smaller islands. Aotearoa’s literal translation Zealand. It is considered one of the world's most liveable cities, and is “land of the long white cloud.” The country is long and narrow, offers a culturally diverse and cosmopolitan lifestyle. 1,600 kilometres north to south, and 400 kilometres at its widest point. -

Annual Telecommunications Monitoring Report

ANNUAL TELECOMMUNICATIONS MONITORING REPORT 2014 CONTENTS EXECUTIVE SUMMARY 3 INTRODUCTION 5 Purpose of this report 6 Data sources 6 MARKET OVERVIEW 7 700MHz spectrum auction completed 7 Orcon sold again 7 Telecom becomes Spark 7 Wholesale copper pricing reduced but not finalised 8 Fibre becoming more common 8 New online streaming services keep arriving 8 2degrees buys Snap 8 UFB continues to underpin high level of telecommunications investment 9 Broadband connections of all types continue to grow 10 Calling volumes continue opposing trends 11 Total revenue declines again 12 RETAIL FIXED-LINE MARKET 13 Market overview 13 Fall in calling largely continues 15 All but broadband revenues continue to fall 16 Spark’s retail and wholesale voice share continues to decline 17 Further consolidation in broadband market 18 Broadband subscribers using more data 19 Mixed results in broadband price benchmarking 21 Broadband prices continued to trend down in 2014 23 Significant rise in average broadband speed 24 RETAIL MOBILE MARKET 25 Market overview 25 Spark claws back market share while 2degrees marks time 26 Mobile voice minutes per connection continue to climb 28 Off-net calling shows strongest growth 29 Texting continues to slide from peak 29 Mobile data consumption nearly doubles again 30 New Zealand below average price for all levels of mobile phone usage 30 Mobile prices have fallen dramatically in recent years 31 Mobile broadband still expensive 32 THE TELECOMMUNICATIONS CONSUMER 34 THE 2014 YEAR IN REVIEW 47 LIST OF DEFINED TERMS AND ABBREVIATIONS 54 2 Commerce Commission Annual Telecommunications Monitoring Report 2014 Executive Summary This is the Commerce Commission’s eighth annual telecommunications market monitoring report. -

Deal Flow Participation

Deal Flow Participation 3 September 2021 Security Code Issuer Offer Name Role Listing Date Country WIA070.NZ Wellington International Airport Wellington International Airport Fixed Rate Bond Distribution Aug-20 NZ FCL.AX FINEOS FINEOS (FCL) Institutional Placement Distribution Aug-20 AU SYD.AX Sydney Airport Sydney Airport (SYD) Shortfall Bookbuild Distribution Aug-20 AU TAH.AX Tabcorp Tabcorp (TAH) Shortfall Bookbuild Distribution Aug-20 AU IPL020.NZ Investore Property Investore Property Fixed Rate Bond Distribution Sep-20 NZ ORE.AX Orocobre Orocobre (ORE) Institutional Placement Distribution Sep-20 AU MCY030.NZ Mercury Energy Mercury Energy Green Bond Distribution Sep-20 NZ SUM030.NZ Summerset Summerset Fixed Rate Bonds Distribution Sep-20 NZ ABY.AX Adore Beauty Adore Beauty IPO Co-Manager Oct-20 AU VHP.NZ Vital Healthcare Vital Healthcare Placement Distribution Oct-20 NZ OCA010.NZ Oceania Oceania Bond Offer Distribution Oct-20 NZ ARG030.NZ Argosy Argosy Green Bond Distribution Oct-20 NZ CGFPC.AX Challenger Capital Challenger Capital Notes 3 IPO Distribution Oct-20 AU HPG.AX Hipages Group Holdings Hipages IPO Distribution Nov-20 NZ BOQPF.AX Bank of Queensland Limited Bank of Queensland Capital Notes 2 IPO Co-Manager Nov-20 AU BENPH.AX Bendigo and Adelaide Bank Ltd Bendigo and Adelaide Bank Capital Notes IPO Co-Manager Nov-20 AU SML.NZ Synlait Milk Limited Synlait Milk Placement Distribution Nov-20 NZ IAG.NZ Insurance Australia Group Limited IAG Placement Distribution Nov-20 NZ WBCPJ.AX Westpac Banking Corporation Westpac Capital Notes -

2020 Notice of Annual Meeting

2020 Notice of Annual Meeting Dear Shareholder Annual Meeting of Shareholders The SkyCity Board invites you to participate in the Friday 16 October 2020 commencing at 1.00pm 2020 Annual Meeting of SkyCity Entertainment (New Zealand time) Group Limited. Business and Agenda of the Meeting Given the ongoing impacts of the COVID-19 A. Chair’s Address pandemic, particularly in relation to domestic and B. Chief Executive Officer’s Address international travel, and the possibility of social C. General Business and Shareholder Questions distancing requirements and restrictions on mass Response to questions submitted prior to the gatherings being maintained or reintroduced in Annual Meeting (to the extent the questions the event of a resurgence of COVID-19 infections have not already been addressed in the in New Zealand, this year’s Annual Meeting above addresses) and questions raised at the will be held virtually via an online platform on Annual Meeting Friday 16 October 2020 commencing at 1.00pm D. Resolutions (New Zealand time). Shareholders will be asked to consider and, Instructions and further details on how to participate if thought appropriate, pass the following in the virtual Annual Meeting are set out in the ordinary resolutions: Explanatory Notes in this Notice of Meeting and the 1. To re-elect Rob Campbell accompanying Virtual Meeting Guide. Rob Campbell retires from office at the Annual Meeting and, being eligible, The SkyCity Board and management look forward to offers himself for re-election welcoming you to the 2020 Annual Meeting. 2. To re-elect Sue Suckling Sue Suckling retires from office at the On behalf of the SkyCity Board Annual Meeting and, being eligible, offers herself for re-election 3. -

Utility Report Card Security Rating Price Yield 12-Mo

Conrad’s Utility Investor Utility Report Card Security Rating Price Yield 12-Mo. 3-Mo. DVD / Payout Quality Ex-DVD DVD 3-Year DVD Debt/ Capital Industry (Exchange: Ticker) Total Total Share Ratio Grade Date Payment Growth Return Return (CAD) Date AES Corp Buy<28 24.64 2.44 43.81 -0.66 0.15 39.1 B 7/30/2021 8/16/2021 5.3 77.2 Utility, Renewable (NYSE: AES) Energy Shares of leading renewable energy generator and developer are low priced at 14.3 times expected next 12 months earnings with Moody's upgrade to investment grade credit rating nearing. Alto Maipo hydro project in Chile is on track for full operations in December, company has built 100% of tunnels and starts negotiations for permanent financing, remaining financial share of project is $46 mil, has invested $972 mil. Asset encumbered by lower spot prices for output due to faster than expected Chilean renewables build, output limited by drought in country near term but financial risk to parent now appears low. Company plans 72 megawatt of new solar capacity in Michigan for in service by mid-2022. Earnings guidance mid-point remains $1.54 per share in 2021, 7-9% annual profit growth rate target through 2025. Quality Grade B (No Change). AGL Energy Buy<7 4.9 6.33 -50.46 -23.89 0.25 100 C 8/24/2021 10/6/2021 -6.6 36.6 Int'l Electricity (OTC: AGLXY, ASX: AGL) See August 13 Alert "AGL Bottoming, Algonquin a Buy." FY2021 (end June 30) are in line with management guidance, FY2022 net profit after tax on which dividends are set is expected to be 25-30% lower on weak wholesale power market.