ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 24 September 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2005 Washington H. Soul Pattinson and Company Limited and Controlled Entities A.B.N

WASHINGTON H. SOUL PATTINSON AND COMPANY LIMITED A.B.N. 49 000 002 728 DIRECTORS’ ANNUAL REPORT and FINANCIAL STATEMENTS 2005 WASHINGTON H. SOUL PATTINSON AND COMPANY LIMITED AND CONTROLLED ENTITIES A.B.N. 49 000 002 728 FINANCIAL SUMMARY 2001 2002 2003 2004 2005 $000 $000 $000 $000 $000 Before non regular items Total sales revenue 906,448 334,307 340,624 392,854 597,104 Operating profit after taxation and excluding outside equity............................ 45,756 65,987 78,706 81,508 105,109 Total assets employed................................ 1,381,008 1,092,348 1,115,282 1,414,693 2,220,042 Shareholders’ funds.................................. 643,017 668,436 729,926 867,509 1,260,448 Operating profit after taxation and excluding outside equity as a percentage of shareholders’ funds... 7.1% 9.9% 10.8% 9.4% 8.3% Earnings per share on adjusted issued capital (cents)..... 19.17 27.65 32.98 34.16 44.04 Ordinary Dividends per share (cents)................... 11.5 14.0 17.0 20.0 25.0 Special Dividends per share (cents).................... 4.0 5.0 5.0 10.0 15.0 After non regular items Operating profit after taxation and excluding outside equity ........................... 56,751 72,741 88,307 155,925 421,455 Earnings per share on adjusted issued capital (cents) .. 23.78 30.48 37.00 65.34 176.61 WASHINGTON H. SOUL PATTINSON AND COMPANY LIMITED A.B.N. 49 000 002 728 DIRECTORS: ROBERT D. MILLNER Chairman of Directors Director since 1984 MICHAEL J. MILLNER Non-Executive Director - Deputy Chairman Director since 1997 PETER R. -

Appendix 4E Carsales.Com Ltd Results for Announcement to the Market

Appendix 4E carsales.com Ltd ABN 91 074 444 018 Results for Announcement to the Market Full-year ended 30 June 2020 (Previous corresponding period: Full-year ended 30 June 2019) A$’000 Revenue from continuing operations Down (5.25%) to 395,585 Profit for the year after tax Up 38.84% to 116,953 Net profit for the period attributable to members Up 36.49% to 114,668 Adjusted net profit* for the period attributable to members Up 6.17% to 138,189 Franked Amount amount Dividends/Distribution per security per security 2019 Final Dividend paid 25.0 cents 25.0 cents 2020 Interim Dividend paid 22.0 cents 22.0 cents 2020 Final Dividend declared 25.0 cents 25.0 cents 2020 final dividend dates Record date for determining entitlements to the dividends 23rd September 2020 Latest date for dividend reinvestment plan participation 24th September 2020 Dividend payable 7th October 2020 30 June 2019 30 June 2020 30 June 2019 Restated*** Net tangible assets backing per ordinary share** (138.1 cents) (128.9 cents) (158.4 cents) * The presentation of adjusted net profit provides the best measure to assess the performance of the Group by excluding COVID-19 Dealer Support Package, fair value gain arising from discontinuing the equity method (net of NCI), gain on associate investment dilution (net of NCI), loss on disposal of subsidiary, one-off transaction and restructure costs, one-off bad debt expenses, changes in fair value of put option liabilities and deferred consideration, one-off tax adjustment, option unwinding discount and non-cash acquired intangible amortisation from the reported IFRS measure. -

FY21 Results Overview

Annual Report 2021 01 Chorus Board and management overview 14 Management commentary 24 Financial statements 60 Governance and disclosures 92 Glossary FY21 results overview Fixed line connections1 Broadband connections1 FY21 FY20 FY21 FY20 1,340,000 1,415,000 1,180,000 1,206,000 Fibre connections1 Net profit after tax FY21 FY20 FY21 FY20 871,000 751,000 $47m $52m EBITDA2 Customer satisfaction Installation Intact FY21 FY20 FY21 FY21 $649m $648m 8.2 out of 10 7.5 out of 10 (target 8.0) (target 7.5) Dividend Employee engagement score3 FY21 FY20 FY21 FY20 25cps 24cps 8.5 out of 103 8.5 This report is dated 23 August 2021 and is signed on behalf of the Board of Chorus Limited. Patrick Strange Mark Cross Chair Chair Audit & Risk Management Committee 1 Excludes partly subsidised education connections provided as part of Chorus’ COVID-19 response. 2 Earnings before interest, income tax, depreciation and amortisation (EBITDA) is a non-GAAP profit measure. We monitor this as a key performance indicator and we believe it assists investors in assessing the performance of the core operations of our business. 3 Based on the average response to four key engagement questions. Dear investors Our focus in FY21 was to help consumers especially important because fixed wireless services don’t capitalise on the gigabit head start our fibre provide the same level of service as fibre - or even VDSL in network has given New Zealand. We knocked most cases – and these service limitations often aren’t made clear to the customer. on about a quarter of a million doors and supported our 100 or so retailers to connect As expected, other fibre companies continued to win copper customers in those areas where they have overbuilt our another 120,000 consumers to fibre. -

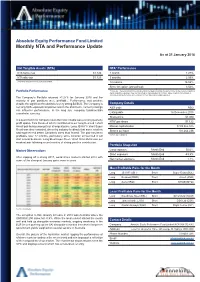

Monthly NTA and Performance Update

Absolute Equity Performance Fund Limited Monthly NTA and Performance Update As at 31 January 2018 Net Tangible Assets (NTA) NTA* Performance NTA before tax $1.122 1 month 1.27% NTA after tax $1.123 3 months 2.59% $ currency notation refers to Australian Dollars. 12 months 16.02% Since inception (annualised) 3.52% Portfolio Performance *Before tax. These calculations are unaudited and intended to illustrate the performance of the investment portfolio minus corporate expenses. They are calculated on a pre-dividend NTA basis. ‘Since inception (annualised)’ is annualised NTA performance since listing at $1.065 after listing related expenses The Company’s Portfolio returned +1.27% for January 2018 and the majority of pair positions were profitable. Performance was positive despite the significant headwind of a very strong $A/$US. The Company is Company Details net long $US-exposed companies and in the short term, currency swings ASX code AEG can influence performance. In the long run, company fundamentals overwhelm currency. Listing date 16 December 2015 Share price $1.080 In a quiet month for company news the most notable was a strong quarterly NTA* per share $1.122 profit update from Resmed which contributed to our long Resmed / short Ansell pair being amongst our strongest pairs. Long JB Hi-Fi / short Super Market capitalisation $109,365,375 Retail was also rewarded, driven by industry feedback that some retailers Shares on Issue 101,264,236 had experienced better Christmas sales than feared. The pair has been profitable over 12 months, particularly since Amazon announced it will *Before tax ex-dividend start a local business. -

Industry Associations & ASX Companies

Industry Associations, ASX Companies, Shareholder Interests and Lobbying CONTENTS About the Authors ........................................................................................................................ 3 ACCR ............................................................................................................................................ 3 About ISS-caer ............................................................................................................................. 3 About the Report .......................................................................................................................... 4 Foreword ...................................................................................................................................... 4 Introduction .................................................................................................................................. 5 Report Structure .......................................................................................................................... 6 PART 1 - Background ................................................................................................................... 8 What is an Industry Association? .............................................................................................. 8 Advantages and Disadvantages of Belonging to an Industry Association ........................... 10 Australian Legislation and Regulations Covering Industry Associations ............................. 11 -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

16 August 2021 Company Announcements Office Australian

16 August 2021 Company Announcements Office Australian Securities Exchange Limited 20 Bridge Street SYDNEY NSW 2000 2021 FULL YEAR RESULTS – ANNUAL REPORT Seven West Media Limited (ASX: SWM) attaches the Annual Report for the year ended 26 June 2021. This release has been authorised to be given to ASX by the Board of Seven West Media Limited. For further information, please contact: Investors/Analysts Media Alan Stuart Rob Sharpe T: +61 2 8777 7211 T: +61 437 928 884 E: [email protected] E: [email protected] Seven West Media Limited / 50 Hasler Road, Osborne Park WA 6017 Australia / PO Box 7077, Alexandria NSW 2015 Australia T +61 2 8777 7777 / ABN 91 053 480 845 Repositioned for growth. Annual Report 2021 Big Brother Contents Our Strategy Who We Are 2 Our Strategic Priorities and Performance Dashboard 4 Executive Letters Letter from the Chairman 6 Letter from the Managing Director and Chief Executive Officer 8 Review of Operations Group Performance – Key Highlights and Summary of Financial Performance 11 Seven Network 17 The West 20 Corporate Social Responsibility Risk, Environment, People and Social Responsibility 22 Seven in the Community 28 Governance Board of Directors 33 Corporate Governance Statement 36 Directors’ Report 47 Remuneration Report 52 Auditor’s Independence Declaration 73 Financial Statements Financial Statements 74 Directors’ Declaration 132 Independent Auditor’s Report 133 Investor Information 138 Shareholder Information 139 Company Information 141 1 Section 1: Our Strategy Seven West Media Limited Annual Report 2021 Who We Are Transforming to lead Seven West Media is being transformed to drive long-term success. -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

Australian Equities Lending Margins Effective 21 April 2021

Australian Equities Lending Margins Effective 21 April 2021 Stock ASX Margin Stock ASX Margin Stock ASX Margin Code Rate Code Rate Code Rate A2B Australia A2B 40% AusNet Services AST 70% Costa Group Holdings CGC 60% The A2 Milk Company A2M 65% ASX ASX 75% Challenger Financial Australian Agricultural Company AAC 55% AUB Group AUB 50% Services Group CGF 70% Adelaide Brighton ABC 70% Australian United Challenger Capital Notes CGFPA 60% Abacus Property Group ABP 60% Investment Company AUI 70% Challenger Capital Notes 2 CGFPB 60% Audinate Group AD8 40% Aventus Retail Property Group AVN 50% Challenger Capital Notes 3 CGFPC 60% Adairs ADH 40% Alumina AWC 70% Charter Hall Group CHC 70% APN Industria REIT ADI 40% Accent Group AX1 40% Champion Iron CIA 50% Australian Ethical Amaysim Australia AYS 40% Cimic Group CIM 70% Investment Limited AEF 40% Aurizon Holdings AZJ 75% Carlton Investments CIN 50% Australian Foundation Bapcor BAP 60% Centuria Industrial REIT CIP 60% Investment Company AFI 75% Baby Bunting Group BBN 40% Collins Foods CKF 50% Ainsworth Game Technology AGI 40% Bendigo & Adelaide Bank BEN 70% Class CL1 40% AGL Energy AGL 75% Bendigo & Adelaide Bank BENHB 65% Clean Teq Holdings CLQ 40% AGL Energy USFDS AGLHA 75% Bendigo & Adelaide Bank CPS BENPE 65% Clover Corporation CLV 40% Automotive Holdings Group AHG 55% Bendigo & Adelaide Bank CPS BENPF 65% Charter Hall Long Wale REIT CLW 60% Asaleo Care AHY 50% Bendigo & Adelaide Bank CPS BENPG 65% Centuria Metropolitan REIT CMA 50% Auckland International Airport AIA 70% Bell Financial Group -

Monthly Investment Report As at 30 November 2017 Solaris Core Australian Equity Fund - Performance Alignment (APIR: SOL0001AU)

Monthly Investment Report as at 30 November 2017 Solaris Core Australian Equity Fund - Performance Alignment (APIR: SOL0001AU) Market Review The S&P/ASX200 Accumulation Index finished up 1.6% for the month of November with the Real Estate sector leading the way, up 5.3%. The sector outperformed after a period of weak performance and a rotation to defensives during the month. The Australian market underperformed the S&P500 (+2.8%) with U.S. GDP growth exceeding expectations and renewed hope over the potential for the Trump administration’s proposed corporate tax cuts. In company news, the Santos Limited share price was up 12.9% after the press reported a potential takeover bid from Harbour Energy. An indicative offer in August from Harbour Energy proposed to acquire the company for $4.55 per share, however this proposal was rejected by the board. S&P/ASX200 Top & Bottom performing sectors for the month ending 30 November: The best performing sectors in the S&P/ASX200 Accumulation Index for the month were Consumer Durables & Apparel (+13.3%), Capital Goods (+6.1%) and Automobiles & Components (+5.9%). The worst performing sectors included Telecommunication Services (-1.6%), Banks (-1.4%) and Food Beverage & Tobacco (-0.9%). S&P/ASX200 Top & Bottom performing stocks for the month ending 30 November: The top 5 performing stocks in the S&P/ASX200 Accumulation Index for the month were Orocobre Limited (+29.3%), Speedcast International Limited (+24.5%), Syrah Resources Limited (+22.3%), News Corporation (+18.1%) and Credit Corp Group Limited (+14.3%). The bottom 5 performers included Webjet Limited (-17.7%), Orica Limited (-17.3%), Corporate Travel Management Limited (-15.4%), Nanosonics Limited (-15.3%) and ALS Limited (-12.7%). -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 02 March 2018 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 12.11 2.89 41.31 136.99 450.45 172.57 - - - - ABC Adelaide Brighton 6.71 -3.17 0.90 17.51 25.64 19.93 19.93 16.49 9.33 47 ABP Abacus Property Grp. 3.44 0.00 -5.49 -2.22 14.48 13.15 8.30 14.82 -1.94 113 AFI Australian Foundat. 6.06 -0.66 -2.53 4.58 9.57 8.95 2.86 5.97 4.48 77 AGL AGL Energy Limited. 21.47 -0.42 -5.41 -9.87 -8.38 12.64 16.55 10.72 10.44 40 AIA Auckland Internation 5.92 -0.50 -2.95 -0.08 -9.11 3.61 14.22 23.94 12.61 30 AIZ Air New Zealand 3.02 5.96 4.86 -3.73 43.40 18.90 12.05 30.24 12.15 32 ALL Aristocrat Leisure 23.98 -1.96 -1.96 14.54 43.91 55.66 48.93 46.20 9.54 43 ALQ ALS Limited 7.10 1.28 0.85 -9.80 19.41 34.61 11.55 -5.15 6.78 63 ALU Altium Limited 19.96 0.10 28.13 97.93 179.50 91.94 72.34 82.96 44.32 3 AMC Amcor Limited 14.03 0.93 -1.57 -9.77 1.89 3.52 4.09 14.96 11.64 34 AMP AMP Limited 5.27 0.38 2.56 7.23 10.10 5.17 -2.02 4.40 0.41 103 ANN Ansell Limited 25.74 2.14 2.36 19.76 20.64 24.17 2.56 12.52 8.89 52 ANZ ANZ Banking Grp Ltd 28.57 0.46 -1.86 -0.74 -3.76 14.82 -2.02 5.27 7.05 60 APA APA Group 7.82 -4.97 -5.31 -8.52 -4.27 1.28 -1.92 10.97 14.13 23 ARG Argo Investments 8.06 -0.25 -1.73 4.92 10.05 9.57 3.86 7.74 3.78 82 AST AusNet Services Ltd 1.635 -1.80 -4.11 -3.65 5.85 12.17 8.25 11.72 7.71 56 ASX ASX Limited 57.85 -0.43 3.69 7.47 14.89 20.40 12.70