Financial Report and Registration Document 2018 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Most Attractive Employers in the France Professionals

The Most Attractive Employers in the France Professionals 1 About us Universum is a global leader in employer branding. Over the past 30 years, we have established ourselves in 50 markets globally and our diverse workforce is physically present in 20 countries. Our services include actionable research, strategic consulting, and data-driven communications and social media solutions for talent branding, sourcing, and analytics. We are a trusted partner to over 1,700 clients, including many Fortune 500 companies, as well as to global media partners that publish our annual rankings and trend reports. We work with over 2,000 universities, alumni groups, and professional organizations to gather insights from students and professionals in order to advise employers on how to attract and retain talent that fits their culture and purpose. On an annual basis, Universum surveys over 1,500,000 students and professionals worldwide. Did your company rank in the top 100? Learn more Please contact us to receive your badge. 2 Where do you rank? AN ESSENTIAL RESOURCE by the respondents. It’s so important to secure the very best young ACTIONABLE ASSESSMENTS talent out there, which is why HR and C-level But this preview is only the beginning. By leaders around the world refer to Universum’s becoming a member you can access research. Drawing on the opinions of more Universum’s full report, which contains than 10.000 professionals in France, this company-specific findings and custom insights preview of the 2018 Talent Survey gives a and recommendations that are critical when it clear indication of where your organization comes to developing your employer branding ranks when it comes to its potential to attract strategy. -

European Esg-Sri Virtual Conference

SAVE THE DATE PARTICIPATING COMPANIES SOCIETE GENERALE CORPORATE & INVESTMENT BANKING IS DELIGHTED TO INVITE YOU TO THE ADEVINTA GECINA SAINT GOBAIN AGEAS GLAXOSMITHKLINE SHELL AIR FRANCE KLM GROUPE BRUXELLES SALZGITTER EUROPEAN AIR LIQUIDE LAMBERT SANOFI AKZO NOBEL GROUPE PSA SAP ALBIOMA GROUPE SEB SARTORIUS STEDIM BIOTECH ESG-SRI ALLIANZ HEIDELBERGCEMENT SCOR ALD AUTOMOTIVE HOCHTIEF SCHNEIDER ELECTRIC ALSTOM HSBC SIEMENS AMUNDI INTESA SANPAOLO SIGNIFY VIRTUAL KINGFISHER ARCELORMITTAL SIKA ASML KLEPIERRE SODEXO ASSA ABLOY ENI SOCIETE GENERALE CONFERENCE ASTRAZENECA LEGRAND SOITEC ATLAS COPCO LEONARDO SPA SOLVAY SA ATOS LINDE SPIE BASF LLOYDS BANKING STMICROELECTRONICS Sustainable & Positive Impact BAYER AG METRO SUEZ BBVA MERSEN SWEDISH MATCH Finance BOOHOO NATIXIS SWISS RE BP NATURGY TARKETT BUREAU VERITAS NEXANS THALES CAPGEMINI NEXITY TELEPERFORMANCE 17, 18 & 19 NOVEMBER 2020 - “Generating impact in a world in transition” CARLSBERG NESTLE TIKEHAU CAPITAL • Dialogues on ESG and SRI involving over 110 companies and institutional investors, in one CASINO NORMA GROUP TOTAL to one / one to few / fireside chat. COVESTRO NOVARTIS UNIPER CREDIT AGRICOLE NOVO NORDISK VALEO • 7 panels and keynote webinars dedicated to Sustainable & Positive Impact Finance CREDIT SUISSE OMV VEOLIA open to all participants: CRODA ORANGE VESTAS PERNOD RICARD The green economic relaunch post pandemic crisis, placing fight against climate change and loss of DAIMLER VICAT biodiversity at the heart of economic policies DEUTSCHE POST PHILIPS VINCI EDF PLASTIC OMNIUM -

Business Proposals in View of a 2015 International Climate Change Agreement at COP 21 in Paris

20 May 2015 Business proposals in view of a 2015 international climate change agreement at COP 21 in Paris * By May 20th 2015, Chairmen / Chief Executive Officers (CEOs) of 59 international companies and 7 organizations already support the “Business proposals for COP 21”. In order to ensure worldwide awareness of the Business community before COP 21, they call on their counterparts to join them in the coming weeks before the September Climate Week in New York (contact: [email protected] jointly managed by French Business Associations: MEDEF, Afep and Cercle de l’Industrie). 7 supporting organizations: UN GLOBAL President of Business Europe Afep Cercle de l’Industrie MEDEF SYNTEC INGENIERIE COMPACT WBCSD Emma Pierre PRINGUET Philippe VARIN Pierre GATTAZ Nicolas JACHIET Peter BAKKER MARCEGAGLIA President President President President President 59 supporting Chairmen / CEOs from international companies: AIRBUS GROUPE AIR LIQUIDE ALSTOM AREVA ARKEMA AVIVA France AXA Denis RANQUE Benoît POTIER Patrick KRON Philippe VARIN Thierry le HENAFF Nicolas SCHIMEL Henri de CASTRIES Chairman Chairman & CEO Chairman & CEO Chairman Chairman & CEO CEO Chairman & CEO BASF BNP PARIBAS BOUYGUES BPCE COMPAGNIE DE SAINT CREDIT AGRICOLE SA DCNS Kurt BOCK Jean LEMIERRE Martin BOUYGUES François PEROL GOBAIN Jean-Marie SANDER Hervé GUILLOU Chairman & CEO Chairman Chairman & CEO Chairman Pierre-André de Chairman & CEO Chairman CHALENDAR Chairman & CEO DSM EDF EGIS ENGIE ERAMET FFP FONCIERE DES Feike SIJBESMA Jean-Bernard LEVY Nicolas JACHIET Gérard MESTRALLET Patrick -

Mieux Vivre 2014

rapport d’activité et de développement durable 2014 2014www.groupeseb.com mieux vivre une relation de confiance et d’engagement Actionnaires, une écoute personnalisée Le Service Actionnaires est votre interlocuteur privilégié pour toutes vos questions relatives à l’action SEB et à vos démarches (transfert de votre compte au nominatif, fiscalité…). Jacqueline SALAÜN – Responsable du Service Actionnaires – et Delphine LE GOUEVEC – Gestionnaire Service Relations Actionnaires – sont à votre écoute et vous accompagnent au quotidien. Service Actionnaires +33 (0)4 72 18 16 41 - [email protected] Parallèlement, le Service Titres assure la gestion des actions inscrites au nominatif : prise en charge des ordres d’achat ou de vente, gestion des données personnelles, convocation à l’Assemblée Générale, paiement du dividende. Service Titres SEB - BP2S – Corporate Trust Services [email protected] +33 (0)1 57 43 90 00 - https://planetshares.bnpparibas.com Investisseurs et analystes, une relation active et transparente Le Groupe SEB place la relation avec ses publics financiers (analystes financiers, investisseurs institutionnels, actionnaires...) sous le signe de la confiance et du respect. Tout au long de l’année, Isabelle POSTH – Directrice de la Communication Financière et des Relations Investisseurs – et Emmanuel FOURRET – Investor Relations Manager – vont à la rencontre de ces publics dans le cadre de réunions régulières, de roadshows, de rendez-vous ponctuels en France et à l’étranger ainsi qu’à travers des conférences téléphoniques. Direction de la Communication Financière et des Relations Investisseurs [email protected] +33 (0)4 72 18 16 40 Parties prenantes, un engagement responsable La préservation des grands équilibres passe par une philosophie d’entreprise fondée sur le sens de la responsabilité, la solidarité et l’engagement. -

CDP Climate Change Report 2016 France and Benelux Edition

CDP Climate Change Report 2016 France and Benelux edition On behalf of 827 investors with US$100 trillion in assets CDP Report 2016 | October 2016 Report writer Scoring Partners Key Messages 21 companies achieved the top score entering the CDP A List. 151 companies responded Their emissions represent 28% of the total reported emissions, and a decrease of 6 Mt of CO2e. to CDP in Benelux and Schneider Electrics, Royal Philips, L’Oréal, Atos, France, accounting for 81% Proximus ING Group and Royal BAM Group were also leaders in 2016. Bic scored A also in 2013, of the market capitalization KPN was graded A in 2011, 2012 and 2013 and in the region. Renault was part of the leaders in 2014. AkzoNobel, Bouygues, DSM, EDF, ENGIE, Group PSA, ICADE, Klépierre, Michelin, SUEZ and VEOLIA , are joining the list for the first time this year. Integrating climate change into business strategy is becoming main stream but targets lack ambition. 131 out of 141 companies have included climate change into their business strategy. 114 of them set specific targets and initiatives to reduce their climate impact. 2020 is the most common target year, while leaders distinguish themselves by setting long term targets, as far as 2050 and beyond. 53% of the companies managed to decrease their emissions in 2016. For 115 companies that responded also last year the emissions decreased from 723 Mt CO2e to 712 Mt CO2e meaning a 2% decrease of total emissions. From these 115 15% of the companies companies, 61 decreased their emissions by average of 14%. achieved A. -

Important Disclaimer Important Disclosures

IMPORTANT DISCLAIMER Disclaimer for SG Sales and Trade Ideas English Version French Version Belgian Flemish Version Dutch Version Italian Version Spanish Version IMPORTANT DISCLOSURES ( View Historic ) As of September 27th, 2021 SG G and/or its affiliates act as market maker or liquidity provider in the equities securities of undefined. ((Pre02) 1&1 Drillisch AG 1U1.DE 3i III.L A.P. Moller-Maersk B MAERSKb.CO A2A Spa A2.MI Aareal Bank ARLG.DE AB Science ABS.PA ABB ABBN.S Abbott Laboratories ABT.N AbbVie ABBV.N ABN Amro ABNd.AS About You YOUG.DE Accenture ACN.N Acciona ANA.MC Acciona Energía ANE.MC Accor ACCP.PA Acea Spa ACE.MI Acerinox ACX.MC Ackermans & van Haaren ACKB.BR ACS ACS.MC Addiko Bank AG ADKO.VI Adecco ADEN.S Adevinta ADEV.OL Adidas ADSGn.DE ADO Properties ADJ.DE ADT Inc ADT.N ADVA Optical ADAG.DE Adyen ADYEN.AS AEDAS Homes SA AEDAS.MC Aedifica AOO.BR Aegon AEGN.AS Aena AENA.MC Aéroports de Paris ADP.PA AES Corporation AES.N AG Barr plc BAG.L Ageas AGES.BR Agfa-Gevaert Group AGFB.BR Agora SA AGOP.WA Ahold Delhaize AD.AS AIG AIG.N Air France-KLM AIRF.PA Air Lease Corporation AL.N Air Liquide AIRP.PA Air Products APD.N Airbus Group AIR.PA Aixtron AIXGn.DE Aker BP AKERBP.OL Akka Technologies AKA.PA AKTIA BANK AKTIA.HE AkzoNobel AKZO.AS Albioma ABIO.PA Alcoa HWM.N Alcon ALCC.S ALD Automotive ALDA.PA Alior Bank ALRR.WA Allianz SE ALVG.DE Allied Irish Banks AIBG.I Ally Financial ALLY.N ALMIRALL ALM.MC Alphabet GOOGL.OQ Alstom ALSO.PA Alstria Office REIT-AG AOXG.DE Altarea Cogedim IMAF.PA Alten LTEN.PA Altice USA ATUS.N Altria MO.N -

Issue Price: 99.169 Per Cent. ______

€ 500,000,000 1.375 per cent. Notes due 16 June 2025 ______________________ Issue Price: 99.169 per cent. ______________________ This document constitutes a prospectus (the "Prospectus") for the purposes of Article 6 of Regulation (EU) 2017/1129, as amended (the "Prospectus Regulation"). The € 500,000,000 1.375 per cent. notes of SEB (the "Issuer") maturing on 16 June 2025 (the "Notes") will be issued on 16 June 2020 (the "Issue Date"). Interest on the Notes will accrue from, and including, the Issue Date at the rate of 1.375 per cent. per annum, payable annually in arrear on 16 June in each year, and for the first time on 16 June 2021 for the period from, and including, the Issue Date to, but excluding, 16 June 2021, as further described in "Terms and Conditions of the Notes – Interest" of this Prospectus. Unless previously redeemed or purchased and cancelled, the Notes will be redeemed at par on 16 June 2025 (the "Maturity Date"). The Notes may, and in certain circumstances shall, be redeemed before this date, in whole only but not in part, at their principal amount, together with, any accrued interest, notably in the event that certain French taxes are imposed (see "Terms and Conditions of the Notes - Taxation"). The Notes may also be redeemed at the option of the Issuer (i) in whole or in part at any time prior to the Residual Maturity Call Option Date, at the relevant Make-whole Redemption Amount (see "Terms and Conditions of the Notes— Redemption and Purchase –Make-whole redemption option") or (ii) in whole but not in part at their -

Important Disclosures

IMPORTANT DISCLOSURES As of January 16th 2017, SG or its affiliates have received compensation for investment banking services in the past 12 months from: View Historic 2I RETE GAS nocode371 Abbott Laboratories ABT.N AbbVie ABBV.N Abertis ABE.MC Accenture ACN.N ACS ACS.MC Adani Transmission Ltd ADAI.NS Adecco ADEN.S AES Corporation AES.N African Development Bank nocode788 Agence Francaise de Developpement nocode746 AIG AIG.N Air France-KLM AIRF.PA Air Liquide AIRP.PA AkzoNobel AKZO.AS Alcatel-Lucent ALUA.PA Alstom ALSO.PA Alstria Office REIT-AG AOXG.DE Altarea Cogedim IMAF.PA America Movil SAB de CV AMXL.MX American Honda Finance Corp nocode104 American Tower Corporation AMT.N Amorim Energia nocode029 Anadarko Petroleum Corp APC.N Anheuser-Busch InBev ABI.BR Apollo Global Management LLC APO.N ArcelorMittal ISPA.AS Areva AREVA.PA Aroundtown Property Holdings PLC ALATP.PA ASIT Biotech ASIT.BR ASSYSTEM ASY.PA AT&T Inc T.N Atalian nocode600 Autoroutes Paris-Rhin-Rhone APRR.PA Aviva AV.L Axa AXAF.PA 1 Bacardi nocode099 BAM GROEP BAMN.AS Banca MPS BMPS.MI Banca Popolare di Sondrio BPSI.MI Banco de Sabadell SABE.MC Banco Popular POP.MC Banco Santander SAN.MC Bank Gospodarki Krajowej nocode118 Bank of America BAC.N Bank of China Ltd 601988.SS Bank of Montreal BMO.TO Bank Pocztowy nocode088 Bank Westfaelische Landschaft Bodenkreditbank nocode576 Banque Federative du Credit Mutuel (BFCM) nocode415 Banque PSA nocode60 Barclays BARC.L Barry Callebaut AG BARN.S BBVA BBVA.MC Belfius nocode032 BG Group BG.L BHF KLEINWORT BENSON BHFKB.BR BioMérieux BIOX.PA BiSoho S.A.S. -

Document De Référence Et Rapport Financier Annuel 2015

FINANCIAL REPORT2015 AND REGISTRATION DOCUMENT CONTENTS PROFILE 2 CONSOLIDATED FINANCIAL STATEMENTS AFR 135 5 5.1. Financial summary 136 5.2. Consolidated ratios 137 INTRODUCTION TO THE GROUP AFR 5 5.3. Financial statements 138 1.1. History 6 5.4. Notes to the Consolidated Financial 1 1.2. Business sector 7 Statements 143 1.3. A profi table growth strategy 9 5.5. Statutory auditors’ report on the 1.4. Risk factors 15 consolidated fi nancial statements 200 CORPORATE GOVERNANCE 23 COMPANY FINANCIAL STATEMENTS AFR 203 2.1. Implementation framework for corporate governance principles 24 6 6.1. Financial statements 204 2 2.2. Management structure 24 6.2. Notes to the SEB S.A. fi nancial statements 206 2.3. Composition, organisation and operation 6.3. Five-year fi nancial summary 218 of the Board of Directors 25 6.4 Statutory auditors’ report on the fi nancial 2.4. Group management bodies 46 statements 219 2.5. Remuneration policy 47 2.6. Chairman’s report on internal control 70 2.7 Statutory Auditor’s report 76 INFORMATION CONCERNING THE COMPANY AND ITS SHARE CAPITAL AFR 221 CORPORATE SOCIAL RESPONSIBILITY 77 7 7.1. Information concerning the company 222 3.1. Commitment and management 78 7.2. Information on share capital 225 3.2. Stakeholders 80 7.3. Financial authorisations 229 3 7.4. Employee shareholding 230 3.3. Challenges and roadmap 84 3.4. Reporting process 86 7.5. Stock market and dividend information 233 3.5. Ethical compliance 87 3.6. Responsible employment policy 91 3.7. -

2017 France Reptrak®

2017 France RepTrak® March 2017 Reputation Institute | 20 Years of Reputation Leadership 1 Welcome to the France RepTrak® 100 • The RepTrak® study is the largest reputation study, with over 30.000 ratings collected in Q1, 2017 • Reputation results for 300 companies – CAC 40 – SBF 120 – Global RepTrak 100 • Respondents are qualified at 2 tiers: – Familiarity: Respondent must be “somewhat” or “very” familiar – RepTrak® Pulse: 75% completion of RepTrak® pulse rating to be included Reputation Institute | 20 Years of Reputation Leadership 2 RepTrak® is a registered trademark of Reputation Institute. Copyright © 2017 Reputation Institute. All rights reserved. 2017 France RepTrak® Study: Demographic Profile • GENDER • Male = 45% 100,0% • Female = 55% • AGE 90,0% • 18-24 years = 15% 80,0% • 25-34 years= 20% • 35-44 years = 22% 70,0% • 45-64 years = 43% 60,0% 50,0% • INCOME 40,0% • Low Income = 52% Familiarity 30,0% • Middle Income = 38% • High Income = 1% 20,0% • N/A = 8 10,0% • REGIONS 0,0% • North = 23% 40,00 45,00 50,00 55,00 60,00 65,00 70,00 75,00 80,00 85,00 • West = 29% • East = 31% RepTrak® Pulse • Ile de France (Paris) = 17% Reputation Institute | 20 Years of Reputation Leadership 3 RepTrak® is a registered trademark of Reputation Institute. Copyright © 2017 Reputation Institute. All rights reserved. Why Measure Reputation? • The success of your company depends on getting people to support you. Reputation is an emotional bond… …that ensures • Customers buy your products… • The general public recommend your company… • Policy makers and regulators give you a license to operate… • The financial community invest in you… • The media report favorably on your point of view… • Employees deliver on your strategy… Reputation Institute | 20 Years of Reputation Leadership 4 RepTrak® is a registered trademark of Reputation Institute. -

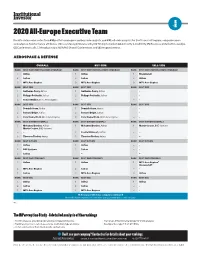

2020 All-Europe Executive Team Results Are Based on Votes from 691 Portfolio Managers and Buy-Side Analysts, and 491 Sell-Side Analysts

R +R 2020 All-Europe Executive Team Results are based on votes from 691 portfolio managers and buy-side analysts, and 491 sell-side analysts. For Best Investor Program, companies were evaluated on 8 performance attributes: (1) Consistency, (2) Granularity, (3) Timing to market, (4) Authority & credibility, (5) Business & Market Knowledge, (6) Conference calls, (7) Productivity of NDR/RD Shows/ Conferences, and (8) Responsiveness. AEROSPACE & DEFENSE OVERALL BUY-SIDE SELL-SIDE RANK BEST INVESTOR RELATIONS PROGRAM RANK BEST INVESTOR RELATIONS PROGRAM RANK BEST INVESTOR RELATIONS PROGRAM 1 Airbus 1 Airbus 1 Rheinmetall 2 Safran 2 Safran 2 Airbus 3 MTU Aero Engines 3 MTU Aero Engines 3 MTU Aero Engines RANK BEST CEO RANK BEST CEO RANK BEST CEO 1 Guillaume Faury, Airbus 1 Guillaume Faury, Airbus – – 2 Philippe Petitcolin, Safran 2 Philippe Petitcolin, Safran – – 3 Reiner Winkler, MTU Aero Engines – – – – RANK BEST CFO RANK BEST CFO RANK BEST CFO 1 Dominik Asam, Airbus 1 Dominik Asam, Airbus – – 2 Bernard Delpit, Safran 2 Bernard Delpit, Safran – – 3 Peter Kameritsch, MTU Aero Engines 3 Peter Kameritsch, MTU Aero Engines – – RANK BEST IR PROFESSIONALS RANK BEST IR PROFESSIONALS RANK BEST IR PROFESSIONALS 1 Mohamed Denden, Airbus* 1 Mohamed Denden, Airbus 1 Martin Cooper, BAE Systems Martin Cooper, BAE Systems* – – 2 Cecilia Matissart, Safran – – 3 Thorsten Fischer, Airbus 3 Thorsten Fischer, Airbus – – RANK BEST IR TEAM RANK BEST IR TEAM RANK BEST IR TEAM 1 Airbus 1 Airbus – – 2 BAE Systems 2 Safran – – 3 Safran – – – – RANK BEST INVESTOR DAYS RANK BEST INVESTOR DAYS RANK BEST INVESTOR DAYS 1 Airbus 1 Airbus 1 MTU Aero Engines* Rheinmetall* 2 MTU Aero Engines 2 Safran – – 3 Safran 3 MTU Aero Engines 3 Airbus RANK BEST ESG RANK BEST ESG RANK BEST ESG 1 Airbus 1 Airbus 1 Airbus 2 Safran 2 Safran – – 3 MTU Aero Engines 3 MTU Aero Engines – – 18 Aerospace & Defense companies nominated Not ranked in the top three? Contact II to get your rankings for each category. -

Palmarès Des Principaux Déposants De Brevets À L’Inpi 2020

PALMARÈS DES PRINCIPAUX DÉPOSANTS DE BREVETS À L’INPI 2020 STATISTIQUES INPI JUIN 2021 « Il est au cœur des missions de l’INPI d’armer tous les acteurs de notre économie, des plus grandes ÉDITO aux plus petites structures, à un Pascal Faure même niveau Directeur Général de connaissance Cette édition 2020 du palmarès des déposants de brevets en France et d’utilisation – qui, compte tenu des 18 mois de décalage entre dépôt et publication de la propriété des brevets, n’inclut pas encore la période de crise sanitaire que nous traversons – est une fois encore largement dominée par les grands industrielle. » groupes, pour qui stratégie d’innovation et stratégie de propriété industrielle sont indissociables. Les grands acteurs de l’économie française s’affichent naturellement en tête, et notamment, aux tous premiers rangs, ceux du transport. Fait encourageant : la place de la recherche publique progresse par rapport à 2019. Pour mieux appréhender la réalité des projets collabo- ratifs entre acteurs publics de la recherche et entreprises, l’INPI, pour la deuxième fois cette année, a observé les co-dépôts de brevets entre Auteurs recherche et industrie. Une bonne connaissance du lien public/privé Mickaël Chion est en effet nécessaire, car nous savons que ces projets communs sont Emmanuelle Fortune souvent porteurs d’innovations susceptibles d’apporter des ruptures Laurence Sekkat technologiques majeures, et par conséquent d’importantes retombées économiques. Maquette C’est précisément pour accompagner ces acteurs et pour simplifier leur Grafikmente coopération sur le volet propriété intellectuelle que l’INPI a lancé, en 2020, le programme « Alliance PI ». Son objectif ? Fluidifier, renforcer INPI 2021 et pérenniser les relations entre public et privé et sécuriser les résultats de leur recherche, par l’utilisation de pratiques de propriété industrielle pertinentes, solides et équilibrées.