Cdp Global Supply Chain Report 2020 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

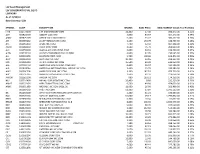

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As Of: 9/30/19 Base Currency: USD

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As of: 9/30/19 Base Currency: USD SYMBOL CUSIP DESCRIPTION SHARES BASE PRICE BASE MARKET VALUE% of Portfolio FITB 316773100 5TH 3RD BANCORP COM 14,400 27.38 394,272.00 0.51% ABT 002824100 ABBOTT LAB COM 3,600 83.67 301,212.00 0.39% ABBV 00287Y109 ABBVIE INC COM USD0.01 5,100 75.72 386,172.00 0.50% AYI 00508Y102 ACUITY BRANDS INC COM 1,400 134.79 188,706.00 0.24% AFL 001055102 AFLAC INC COM 7,400 52.32 387,168.00 0.50% AGCO 001084102 AGCO CORP COM 3,500 75.70 264,950.00 0.34% ALK 011659109 ALASKA AIR GROUP INC COM 3,000 64.91 194,730.00 0.25% ALSN 01973R101 ALLISON TRANSMISSION HOLDING 4,900 47.05 230,545.00 0.30% ALL 020002101 ALLSTATE CORP COM 5,700 108.68 619,476.00 0.80% ALLY 02005N100 ALLY FINL INC COM 10,200 33.16 338,232.00 0.44% MO 02209S103 ALTRIA GROUP INC COM 15,500 40.90 633,950.00 0.82% AAL 02376R102 AMERICAN AIRLINES INC COM USD1 6,800 26.97 183,396.00 0.24% AIG 026874784 AMERICAN INTERNATIONAL GROUP INC COM 3,400 55.70 189,380.00 0.24% AMP 03076C106 AMERIPRISE FINL INC COM 3,200 147.10 470,720.00 0.61% ABC 03073E105 AMERISOURCEBERGEN CORP COM 2,600 82.33 214,058.00 0.28% AMGN 031162100 AMGEN INC COM 900 193.51 174,159.00 0.22% NLY 035710409 ANNALY CAP MGMT INC COM 26,400 8.80 232,320.00 0.30% AMAT 038222105 APPLIED MATERIALS INC COM 9,500 49.90 474,050.00 0.61% ARNC 03965L100 ARCONIC INC COM USD1.00 11,900 26.00 309,400.00 0.40% T 00206R102 AT&T INC COM 51,300 37.84 1,941,192.00 2.50% BK 064058100 BANK NEW YORK MELLON CORP COM STK 4,300 45.21 194,403.00 0.25% BAC 060505104 -

Large Firm Dynamics and Secular Stagnation: Evidence from Japan and the U.S

Bank of Japan Working Paper Series Large Firm Dynamics and Secular Stagnation: Evidence from Japan and the U.S. Yoshihiko Hogen* [email protected] Ko Miura** [email protected] Koji Takahashi*** [email protected] No.17-E-8 Bank of Japan June 2017 2-1-1 Nihonbashi-Hongokucho, Chuo-ku, Tokyo 103-0021, Japan ***Research and Statistics Department (currently at the Monetary Affairs Department) *** Research and Statistics Department *** Research and Statistics Department (currently at the Financial System and Bank Examination Department) Papers in the Bank of Japan Working Paper Series are circulated in order to stimulate discussion and comments. Views expressed are those of authors and do not necessarily reflect those of the Bank. If you have any comment or question on the working paper series, please contact each author. When making a copy or reproduction of the content for commercial purposes, please contact the Public Relations Department ([email protected]) at the Bank in advance to request permission. When making a copy or reproduction, the source, Bank of Japan Working Paper Series, should explicitly be credited. Large Firm Dynamics and Secular Stagnation: Evidence from Japan and the U.S. Yoshihiko Hogeny Ko Miuraz Koji Takahashix June 2017 Abstract Focusing on the recent secular stagnation debate, this paper examines the role of large …rm dynamics as determinants of productivity ‡uctuations. We …rst show that idiosyncratic shocks to large …rms as well as entry, exit, and reallocation e¤ects account for 30 to 40 percent of productivity ‡uctuations in Japan and the U.S. -

Ingredion Annual Report 2021

Ingredion Annual Report 2021 Form 10-K (NYSE:INGR) Published: February 24th, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-13397 INGREDION INCORPORATED (Exact name of registrant as specified in its charter) Delaware 22-3514823 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 5 Westbrook Corporate Center, Westchester, Illinois 60154 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code (708) 551-2600 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, par value $0.01 per share INGR New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

Features & Benefits

NOVATION TM 4600 Description: Pregelatinized food starch refined from waxy maize Appearance: Fine, cream / off-white coloured powder Features Benefits 4600 Consumer friendly simple "starch" labelling Potential for marketing and labelling claims (e.g. can enable TM a no additives claim*). Ideal in wide range of foods, where thickening combined with clean, simple consumer friendly Classed as a food ingredient in the EU labelling is a requirement. May be used in foods labelled as organic, permitted within 5% of the ingredients of non- organic origin. *depends on other ingredients in the recipe Cold water swelling For the food manufacturer requiring instant thickening. NOVATION 4600 is a fine powder and therefore may require dispersion with other dry ingredients or oil to avoid lumping. Bland flavour profile Allows the inherent flavours within a recipe to be NOVATION delivered cleanly with no masking. Excellent process tolerance Will withstand moderate amounts of heat and shear in a process. Suitable for a wide range of applications from mayonnaise production to fruit preparations for pie fillings. Smooth, short texture Improved textural properties and gloss when compared to a traditional drum dried product. Shelf life stable Provides thickening and stability to applications and does not gel over life. APPLICATION AND USAGE INFORMATION Application Summary: NOVATION 4600 is a functional native food starch with cold water swelling properties. It has been designed as a thickener and stabilising agent for a wide range of cold prepared food products. Typical applications include: Chilled dips & dressings: For chilled dips and dressings where a “clean label” is a must this product excels. -

Itraxx Japan Series 35 Final Membership List March 2021

iTraxx Japan Series 35 Final Membership List March 2021 Copyright © 2021 IHS Markit Ltd T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List...........................................3 2 iTraxx Japan Series 35 Final vs. Series 34................................................ 5 3 Further information .....................................................................................6 Copyright © 2021 IHS Markit Ltd | 2 T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List IHS Markit Ticker IHS Markit Long Name ACOM ACOM CO., LTD. JUSCO AEON CO., LTD. ANAHOL ANA HOLDINGS INC. FUJITS FUJITSU LIMITED HITACH HITACHI, LTD. HNDA HONDA MOTOR CO., LTD. CITOH ITOCHU CORPORATION JAPTOB JAPAN TOBACCO INC. JFEHLD JFE HOLDINGS, INC. KAWHI KAWASAKI HEAVY INDUSTRIES, LTD. KAWKIS KAWASAKI KISEN KAISHA, LTD. KINTGRO KINTETSU GROUP HOLDINGS CO., LTD. KOBSTL KOBE STEEL, LTD. KOMATS KOMATSU LTD. MARUB MARUBENI CORPORATION MITCO MITSUBISHI CORPORATION MITHI MITSUBISHI HEAVY INDUSTRIES, LTD. MITSCO MITSUI & CO., LTD. MITTOA MITSUI CHEMICALS, INC. MITSOL MITSUI O.S.K. LINES, LTD. NECORP NEC CORPORATION NPG-NPI NIPPON PAPER INDUSTRIES CO.,LTD. NIPPSTAA NIPPON STEEL CORPORATION NIPYU NIPPON YUSEN KABUSHIKI KAISHA NSANY NISSAN MOTOR CO., LTD. OJIHOL OJI HOLDINGS CORPORATION ORIX ORIX CORPORATION PC PANASONIC CORPORATION RAKUTE RAKUTEN, INC. RICOH RICOH COMPANY, LTD. SHIMIZ SHIMIZU CORPORATION SOFTGRO SOFTBANK GROUP CORP. SNE SONY CORPORATION Copyright © 2021 IHS Markit Ltd | 3 T180614 iTraxx Japan Series 35 Final Membership List SUMICH SUMITOMO CHEMICAL COMPANY, LIMITED SUMI SUMITOMO CORPORATION SUMIRD SUMITOMO REALTY & DEVELOPMENT CO., LTD. TFARMA TAKEDA PHARMACEUTICAL COMPANY LIMITED TOKYOEL TOKYO ELECTRIC POWER COMPANY HOLDINGS, INCORPORATED TOSH TOSHIBA CORPORATION TOYOTA TOYOTA MOTOR CORPORATION Copyright © 2021 IHS Markit Ltd | 4 T180614 iTraxx Japan Series 35 Final Membership List 2 iTraxx Japan Series 35 Final vs. -

Docket No.: 20-0606 Meeting: 5/10/21 Deadline: 5/21/21 M E M O R a N D U M______

Docket No.: 20-0606 Meeting: 5/10/21 Deadline: 5/21/21 M E M O R A N D U M___________________________________________________ TO: The Commission FROM: Jessica L. Cardoni, Administrative Law Judge DATE: May 7, 2021 SUBJECT: Northern Illinois Gas Company d/b/a Nicor Gas Company Proposed Revenue-Neutral Tariff Filing to Address Issues Arising From the Storage Study Presented in Docket No. 18- 1775. (tariffs filed on June 30, 2020) RECOMMENDATION: Grant Motion to Modify Oral Argument Time Allotment. I. PROCEDURAL HISTORY On June 30, 2020, Northern Illinois Gas Company d/b/a Nicor Gas Company (“Nicor Gas” or the “Company”) filed tariffs with the Illinois Commerce Commission (“Commission”) to revise its Transportation program. The tariff filing was based on a study (“Storage Study”) assessing the implications of how Transportation customers currently use storage. Staff of the Commission (“Staff”) participated in this proceeding. Petitions to Intervene were filed on behalf of Constellation NewEnergy – Gas Division, LLC (“CNEG”); Cargill, Inc., Caterpillar Inc., Sterling Steel Company, Ingredion Incorporated, and ExxonMobil Power & Gas Services, Inc., who collectively formed the Illinois Industrial Energy Consumers (“IIEC”); Grain and Feed Association of Illinois (“GFAI”); Illinois Competitive Energy Association (“ICEA”); Retail Energy Supply Association (“RESA”); Illinois Manufacturer’s Association (“IMA”); Illinois Asphalt Pavement Association (“IAPA”); Nucor Steel Kankakee, Inc. (“Nucor”); Sequent Energy Management, L.P. (“Sequent”); and Illinois Energy, USA, LLC (“IE”). The Administrative Law Judge granted these Petitions to Intervene. An evidentiary hearing was held on February 10, 2021, and a Proposed Order was served on April 7, 2021. Briefs on Exceptions (“BOEs”) were filed on April 21, 2021 by the following parties: Nicor Gas, Staff, CNEG, ICEA, RESA, and IIEC. -

Financial Report and Registration Document 2018 Contents

FINANCIAL REPORT AND REGISTRATION DOCUMENT 2018 CONTENTS Editorial from the Chairman and CEO 2 An extensive and diversified offering 4 5 Consolidated Financial Statements 199 Business model 6 5.1. Financial Statements 200 5.2. Notes to the Consolidated Financial Corporate Social Responsibility 8 Statements 205 5.3. Statutory Auditors’ report Board of Directors 10 on the consolidated fi nancial statements 268 5.4. History of signifi cant consolidated items Key figures 2018 12 and ratios 273 1 Introduction to the Group 15 6 Company financial statements 275 1.1. Business sector 16 6.1. Financial statements 276 1.2. A profi table growth strategy 19 6.2. Notes to the SEB S.A. fi nancial statements 278 1.3. Organization and internal control 29 6.3. Five-year fi nancial summary 294 1.4. Risk factors 36 6.4. Statutory auditors’ report on the fi nancial statements 295 2 Corporate governance 53 7 Information concerning the company 2.1. Implementation framework for corporate governance principles 54 and its share capital 299 2.2. Management structure 54 7.1. Information concerning the company 300 2.3. Composition, organization and operation 7.2. Information on share capital 303 of the Board of Directors 55 7.3. Financial authorizations 309 2.4. Group management bodies 82 7.4. Employee shareholding 310 2.5. Remuneration policy 83 7.5. Stock market and dividend information 313 3 Corporate Social Responsibility 113 8 Annual General Meeting 315 3.1. Commitment and management 114 8.1. Agenda for the Combined Annual General 3.2. Non-Financial Performance Statement Meeting of 22 May 2019 316 (DPEF) & Duty of Vigilance 117 8.2. -

2012 Annual Report

Ingredients of a Great Company 2012 Annual Report INGREDION NORTH AMERICA Ingredion Incorporated is a leading global Large stable market with targeted ingredient provider to the food, beverage, growth opportunities and a strong brewing and pharmaceutical industries as position in Mexico. well as numerous industrial sectors. Our ingredients are a vital part of everyday life. % We make starch and sweetener ingredients 57 2012 net sales that add taste, texture and performance to a wide variety of beverages and prepared foods. Our products are used to provide health and wellness solutions as well as pharmaceutical ingredients for IV applications. We also supply ingredients to the personal care, paper and corrugated industries and to the emerging bio-materials sector. Headquartered in Westchester, IL, Ingredion Incorporated has manufacturing, R&D and sales offices in over 40 countries and employs more than 11,000 people worldwide. SOUTH AMERICA Potential to continue building upon strong business model and capitalize on favorable macroeconomic trends. % 22 2012 net sales We will continue to build on our successful business model, which employs a regional approach with a global perspective. +20% +14% +13% 10-YEAR DILUTED EARNINGS PER SHARE 10-YEAR CASH FROM OPERATIONS 10-YEAR NET SALES COMPOUND ANNUAL GROWTH RATE COMPOUND ANNUAL GROWTH RATE COMPOUND ANNUAL GROWTH RATE EUROPE, MIDDLE EAST, AFRICA Growth opportunities in health and wellness and clean label in Europe. % 8 2012 net sales ASIA PACIFIC Strong potential for growth driven by population -

Ranking of Stocks by Market Capitalization(As of End of Jan.2018)

Ranking of Stocks by Market Capitalization(As of End of Jan.2018) 1st Section Rank Code Issue Market Capitalization \100mil. 1 7203 TOYOTA MOTOR CORPORATION 244,072 2 8306 Mitsubishi UFJ Financial Group,Inc. 115,139 3 9437 NTT DOCOMO,INC. 105,463 4 9984 SoftBank Group Corp. 98,839 5 6861 KEYENCE CORPORATION 80,781 6 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 73,587 7 9433 KDDI CORPORATION 71,225 8 7267 HONDA MOTOR CO.,LTD. 69,305 9 8316 Sumitomo Mitsui Financial Group,Inc. 68,996 10 7974 Nintendo Co.,Ltd. 67,958 11 7182 JAPAN POST BANK Co.,Ltd. 66,285 12 6758 SONY CORPORATION 65,927 13 6954 FANUC CORPORATION 60,146 14 7751 CANON INC. 58,005 15 6902 DENSO CORPORATION 54,179 16 4063 Shin-Etsu Chemical Co.,Ltd. 53,624 17 8411 Mizuho Financial Group,Inc. 52,124 18 6594 NIDEC CORPORATION 52,025 19 9983 FAST RETAILING CO.,LTD. 51,647 20 4502 Takeda Pharmaceutical Company Limited 50,743 21 7201 NISSAN MOTOR CO.,LTD. 49,108 22 8058 Mitsubishi Corporation 48,497 23 2914 JAPAN TOBACCO INC. 48,159 24 6098 Recruit Holdings Co.,Ltd. 45,095 25 5108 BRIDGESTONE CORPORATION 43,143 26 6503 Mitsubishi Electric Corporation 42,782 27 9022 Central Japan Railway Company 42,539 28 6501 Hitachi,Ltd. 41,877 29 9020 East Japan Railway Company 41,824 30 6301 KOMATSU LTD. 41,162 31 3382 Seven & I Holdings Co.,Ltd. 39,765 32 6752 Panasonic Corporation 39,714 33 4661 ORIENTAL LAND CO.,LTD. 38,769 34 8766 Tokio Marine Holdings,Inc. -

The Most Attractive Employers in the France Professionals

The Most Attractive Employers in the France Professionals 1 About us Universum is a global leader in employer branding. Over the past 30 years, we have established ourselves in 50 markets globally and our diverse workforce is physically present in 20 countries. Our services include actionable research, strategic consulting, and data-driven communications and social media solutions for talent branding, sourcing, and analytics. We are a trusted partner to over 1,700 clients, including many Fortune 500 companies, as well as to global media partners that publish our annual rankings and trend reports. We work with over 2,000 universities, alumni groups, and professional organizations to gather insights from students and professionals in order to advise employers on how to attract and retain talent that fits their culture and purpose. On an annual basis, Universum surveys over 1,500,000 students and professionals worldwide. Did your company rank in the top 100? Learn more Please contact us to receive your badge. 2 Where do you rank? AN ESSENTIAL RESOURCE by the respondents. It’s so important to secure the very best young ACTIONABLE ASSESSMENTS talent out there, which is why HR and C-level But this preview is only the beginning. By leaders around the world refer to Universum’s becoming a member you can access research. Drawing on the opinions of more Universum’s full report, which contains than 10.000 professionals in France, this company-specific findings and custom insights preview of the 2018 Talent Survey gives a and recommendations that are critical when it clear indication of where your organization comes to developing your employer branding ranks when it comes to its potential to attract strategy. -

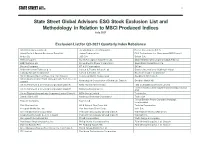

State Street Global Advisors ESG Stock Exclusion List and Methodology in Relation to MSCI Produced Indices July 2021

1 State Street Global Advisors ESG Stock Exclusion List and Methodology in Relation to MSCI Produced Indices July 2021 Exclusion List for Q3-2021 Quarterly Index Rebalance Adani Enterprises Limited Jacobs Engineering Group Inc. Reinet Investments S.C.A. Adani Ports & Special Economic Zone Ltd. Japan Tobacco Inc. RLX Technology, Inc. Sponsored ADR Class A Airbus SE JBS S.A. Safran S.A. Altria Group Inc Korea Aerospace Industries, Ltd. Saudi Arabian Oil Company (Saudi Aramco) BAE Systems plc Korea Electric Power Corporation Saudi Basic Industries Corp. Boeing Company KT & G Corporation SK Inc. British American Tobacco p.l.c. Larsen & Toubro Infotech Ltd Smoore International Holdings Limited Canopy Growth Corporation Larsen & Toubro Ltd. Southern Copper Corporation China National Nuclear Power Co. Ltd. Class A Lockheed Martin Corporation Swedbank AB Class A China Northern Rare Earth (Group) High-Tech Co., Ltd. Metallurgical Corporation of China Ltd. Class A Swedish Match AB Class A China Petroleum & Chemical Corporation Class A MMC Norilsk Nickel PJSC Tata Consultancy Services Limited Teva Pharmaceutical Industries Limited Sponsored China Petroleum & Chemical Corporation Class H Motorola Solutions, Inc. ADR China Shipbuilding Industry Company Limited Class A MTN Group Limited Textron Inc. Danske Bank A/S Northrop Grumman Corporation Thales SA Tokyo Electric Power Company Holdings, Eastern Company Nutrien Ltd. Incorporated Elbit Systems Ltd Oil & Natural Gas Corp. Ltd. Toshiba Corporation Freeport-McMoRan, Inc. Pan American Silver Corp. Vale S.A. General Dynamics Corporation PetroChina Company Limited Class A Wal-Mart de Mexico SAB de CV Grupo Mexico S.A.B. de C.V. Class B PetroChina Company Limited Class H Walmart Inc.