LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As Of: 9/30/19 Base Currency: USD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

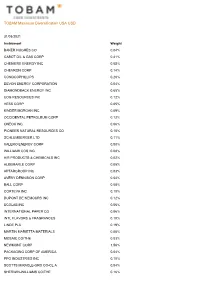

TOBAM Maximum Diversification USA USD

TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight BAKER HUGHES CO 0.04% CABOT OIL & GAS CORP 0.41% CHENIERE ENERGY INC 0.05% CHEVRON CORP 0.14% CONOCOPHILLIPS 0.20% DEVON ENERGY CORPORATION 0.04% DIAMONDBACK ENERGY INC 0.65% EOG RESOURCES INC 0.12% HESS CORP 0.05% KINDER MORGAN INC 0.09% OCCIDENTAL PETROLEUM CORP 0.12% ONEOK INC 0.06% PIONEER NATURAL RESOURCES CO 0.10% SCHLUMBERGER LTD 0.11% VALERO ENERGY CORP 0.08% WILLIAMS COS INC 0.08% AIR PRODUCTS & CHEMICALS INC 0.02% ALBEMARLE CORP 0.05% APTARGROUP INC 0.03% AVERY DENNISON CORP 0.04% BALL CORP 0.08% CORTEVA INC 0.10% DUPONT DE NEMOURS INC 0.12% ECOLAB INC 0.06% INTERNATIONAL PAPER CO 0.06% INTL FLAVORS & FRAGRANCES 0.10% LINDE PLC 0.19% MARTIN MARIETTA MATERIALS 0.06% MOSAIC CO/THE 0.03% NEWMONT CORP 1.56% PACKAGING CORP OF AMERICA 0.04% PPG INDUSTRIES INC 0.10% SCOTTS MIRACLE-GRO CO-CL A 0.04% SHERWIN-WILLIAMS CO/THE 0.16% TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight VULCAN MATERIALS CO 0.06% WESTROCK CO-WHEN ISSUED 0.03% 3M CO 0.31% ALLEGION PLC 0.03% AMERICAN AIRLINES GROUP INC 0.20% ARCONIC INC 0.04% AXON ENTERPRISE INC 0.03% C.H. ROBINSON WORLDWIDE INC 0.12% CARLISLE COS INC 0.02% CATERPILLAR INC 0.35% CLARIVATE ANALYTICS PLC 0.07% COPART INC 0.06% COSTAR GROUP INC 0.09% CUMMINS INC 0.11% DEERE & CO 0.11% DELTA AIR LINES INC 0.09% EMERSON ELECTRIC CO 0.15% EQUIFAX INC 0.06% EXPEDITORS INTL WASH INC 0.05% FASTENAL CO 0.08% FEDEX CORP 0.20% GENERAC HOLDINGS INC 0.06% GENERAL ELECTRIC CO 0.32% HEICO CORP-CLASS A 0.02% HUNT (JB) TRANSPRT SVCS -

United Airlines Holdings Annual Report 2021

United Airlines Holdings Annual Report 2021 Form 10-K (NASDAQ:UAL) Published: March 1st, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission Exact Name of Registrant as Specified in its Charter, State of I.R.S. Employer File Number Principal Executive Office Address and Telephone Incorporation Identification No. Number 001-06033 United Airlines Holdings, Inc. Delaware 36-2675207 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 001-10323 United Airlines, Inc. Delaware 74-2099724 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered United Airlines Holdings, Inc. Common Stock, $0.01 par value UAL The Nasdaq Stock Market LLC Preferred Stock Purchase Rights The Nasdaq Stock Market LLC United Airlines, Inc. None None None Securities registered pursuant to Section 12(g) of the Act: United Airlines Holdings, Inc. None United Airlines, Inc. None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act United Airlines Holdings, Inc. Yes ☒ No ☐ United Airlines, Inc. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Download All Holdings (PDF)

AMG GW&K High Income Fund - Portfolio Holdings as of February 28, 2021 Name Sector Asset Class Country Currency Par/Shares Price ($) Market Value ($) % of Fund Starwood Property Trust Inc Fixed 4.75% Mar 2025 Corporate Bond US USD 262,000 102.22 $267,810 2.52% HCA Inc Fixed 5.38% Feb 2025 Corporate Bond US USD 236,000 112.25 $264,910 2.49% Delta Air Lines Inc Fixed 7.38% Jan 2026 Corporate Bond US USD 225,000 116.57 $262,274 2.47% United Airlines Holdings Inc Fixed 5.00% Feb 2024 Corporate Bond US USD 254,000 102.63 $260,668 2.45% Apache Corp Fixed 4.63% Nov 2025 Corporate Bond US USD 251,000 103.63 $260,099 2.45% General Electric Co Floating Perpetual Corporate Bond US USD 271,000 94.56 $256,255 2.41% Howmet Aerospace Inc Fixed 6.88% May 2025 Corporate Bond US USD 220,000 115.75 $254,639 2.39% Hudbay Minerals Inc Fixed 4.50% Apr 2026 144A Corporate Bond CA USD 250,000 101.38 $253,445 2.38% Service Properties Trust Fixed 7.50% Sep 2025 Corporate Bond US USD 223,000 113.47 $253,033 2.38% American Axle & Manufacturing Inc Fixed 6.25% Apr 2025 Corporate Bond US USD 243,000 103.01 $250,314 2.35% JPMorgan Chase & Co Floating Perpetual Corporate Bond US USD 245,000 102.00 $249,900 2.35% Penske Automotive Group Inc Fixed 3.50% Sep 2025 Corporate Bond US USD 243,000 101.75 $247,253 2.32% Ford Motor Co Fixed 4.35% Dec 2026 Corporate Bond US USD 231,000 106.57 $246,186 2.31% Sprint Corp Fixed 7.13% Jun 2024 Corporate Bond US USD 211,000 115.14 $242,956 2.28% Ovintiv Exploration Inc Fixed 5.63% Jul 2024 Corporate Bond US USD 206,000 109.65 $225,881 -

Ingredion Annual Report 2021

Ingredion Annual Report 2021 Form 10-K (NYSE:INGR) Published: February 24th, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-13397 INGREDION INCORPORATED (Exact name of registrant as specified in its charter) Delaware 22-3514823 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 5 Westbrook Corporate Center, Westchester, Illinois 60154 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code (708) 551-2600 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, par value $0.01 per share INGR New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Features & Benefits

NOVATION TM 4600 Description: Pregelatinized food starch refined from waxy maize Appearance: Fine, cream / off-white coloured powder Features Benefits 4600 Consumer friendly simple "starch" labelling Potential for marketing and labelling claims (e.g. can enable TM a no additives claim*). Ideal in wide range of foods, where thickening combined with clean, simple consumer friendly Classed as a food ingredient in the EU labelling is a requirement. May be used in foods labelled as organic, permitted within 5% of the ingredients of non- organic origin. *depends on other ingredients in the recipe Cold water swelling For the food manufacturer requiring instant thickening. NOVATION 4600 is a fine powder and therefore may require dispersion with other dry ingredients or oil to avoid lumping. Bland flavour profile Allows the inherent flavours within a recipe to be NOVATION delivered cleanly with no masking. Excellent process tolerance Will withstand moderate amounts of heat and shear in a process. Suitable for a wide range of applications from mayonnaise production to fruit preparations for pie fillings. Smooth, short texture Improved textural properties and gloss when compared to a traditional drum dried product. Shelf life stable Provides thickening and stability to applications and does not gel over life. APPLICATION AND USAGE INFORMATION Application Summary: NOVATION 4600 is a functional native food starch with cold water swelling properties. It has been designed as a thickener and stabilising agent for a wide range of cold prepared food products. Typical applications include: Chilled dips & dressings: For chilled dips and dressings where a “clean label” is a must this product excels. -

Docket No.: 20-0606 Meeting: 5/10/21 Deadline: 5/21/21 M E M O R a N D U M______

Docket No.: 20-0606 Meeting: 5/10/21 Deadline: 5/21/21 M E M O R A N D U M___________________________________________________ TO: The Commission FROM: Jessica L. Cardoni, Administrative Law Judge DATE: May 7, 2021 SUBJECT: Northern Illinois Gas Company d/b/a Nicor Gas Company Proposed Revenue-Neutral Tariff Filing to Address Issues Arising From the Storage Study Presented in Docket No. 18- 1775. (tariffs filed on June 30, 2020) RECOMMENDATION: Grant Motion to Modify Oral Argument Time Allotment. I. PROCEDURAL HISTORY On June 30, 2020, Northern Illinois Gas Company d/b/a Nicor Gas Company (“Nicor Gas” or the “Company”) filed tariffs with the Illinois Commerce Commission (“Commission”) to revise its Transportation program. The tariff filing was based on a study (“Storage Study”) assessing the implications of how Transportation customers currently use storage. Staff of the Commission (“Staff”) participated in this proceeding. Petitions to Intervene were filed on behalf of Constellation NewEnergy – Gas Division, LLC (“CNEG”); Cargill, Inc., Caterpillar Inc., Sterling Steel Company, Ingredion Incorporated, and ExxonMobil Power & Gas Services, Inc., who collectively formed the Illinois Industrial Energy Consumers (“IIEC”); Grain and Feed Association of Illinois (“GFAI”); Illinois Competitive Energy Association (“ICEA”); Retail Energy Supply Association (“RESA”); Illinois Manufacturer’s Association (“IMA”); Illinois Asphalt Pavement Association (“IAPA”); Nucor Steel Kankakee, Inc. (“Nucor”); Sequent Energy Management, L.P. (“Sequent”); and Illinois Energy, USA, LLC (“IE”). The Administrative Law Judge granted these Petitions to Intervene. An evidentiary hearing was held on February 10, 2021, and a Proposed Order was served on April 7, 2021. Briefs on Exceptions (“BOEs”) were filed on April 21, 2021 by the following parties: Nicor Gas, Staff, CNEG, ICEA, RESA, and IIEC. -

2012 Annual Report

Ingredients of a Great Company 2012 Annual Report INGREDION NORTH AMERICA Ingredion Incorporated is a leading global Large stable market with targeted ingredient provider to the food, beverage, growth opportunities and a strong brewing and pharmaceutical industries as position in Mexico. well as numerous industrial sectors. Our ingredients are a vital part of everyday life. % We make starch and sweetener ingredients 57 2012 net sales that add taste, texture and performance to a wide variety of beverages and prepared foods. Our products are used to provide health and wellness solutions as well as pharmaceutical ingredients for IV applications. We also supply ingredients to the personal care, paper and corrugated industries and to the emerging bio-materials sector. Headquartered in Westchester, IL, Ingredion Incorporated has manufacturing, R&D and sales offices in over 40 countries and employs more than 11,000 people worldwide. SOUTH AMERICA Potential to continue building upon strong business model and capitalize on favorable macroeconomic trends. % 22 2012 net sales We will continue to build on our successful business model, which employs a regional approach with a global perspective. +20% +14% +13% 10-YEAR DILUTED EARNINGS PER SHARE 10-YEAR CASH FROM OPERATIONS 10-YEAR NET SALES COMPOUND ANNUAL GROWTH RATE COMPOUND ANNUAL GROWTH RATE COMPOUND ANNUAL GROWTH RATE EUROPE, MIDDLE EAST, AFRICA Growth opportunities in health and wellness and clean label in Europe. % 8 2012 net sales ASIA PACIFIC Strong potential for growth driven by population -

AMERICAN CENTURY INVESTMENT TRUST Form NPORT-P Filed 2021

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-08-24 | Period of Report: 2021-06-30 SEC Accession No. 0001145549-21-048495 (HTML Version on secdatabase.com) FILER AMERICAN CENTURY INVESTMENT TRUST Mailing Address Business Address 4500 MAIN STREET 4500 MAIN STREET CIK:908406| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 0331 KANSAS CITY MO 64111 KANSAS CITY MO 64111 Type: NPORT-P | Act: 40 | File No.: 811-07822 | Film No.: 211201694 816-531-5575 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document American Century Investments® Quarterly Portfolio Holdings High-Yield Fund June 30, 2021 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document High-Yield - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 86.4% Aerospace and Defense — 2.0% Bombardier, Inc., 6.00%, 10/15/22(1) 96,000 96,316 Bombardier, Inc., 7.50%, 3/15/25(1)(2) 305,000 314,341 Howmet Aerospace, Inc., 5.125%, 10/1/24 175,000 193,590 Rolls-Royce plc, 5.75%, 10/15/27(1) 250,000 275,695 TransDigm, Inc., 6.25%, 3/15/26(1) 1,000,000 1,056,250 TransDigm, Inc., 6.375%, 6/15/26 520,000 539,354 TransDigm, Inc., 4.625%, 1/15/29(1) 500,000 501,645 2,977,191 Airlines — 1.2% American Airlines, Inc. / AAdvantage Loyalty IP Ltd., 5.50%, 4/20/26(1) 504,000 534,240 United Airlines Holdings, Inc., 5.00%, 2/1/24(2) 555,000 577,930 United Airlines Pass Through Trust, 4.875%, 7/15/27 235,832 250,458 United Airlines, Inc., 4.625%, 4/15/29(1) 373,000 386,521 1,749,149 Auto Components — 0.7% Goodyear Tire & Rubber Co. -

List of CA100+ Non-Disclosers 142 of 167 CA100+ Target Companies (85%) Have Not Published a Review of Their Alignment with Industry Associations on Climate Change

List of CA100+ Non-Disclosers 142 of 167 CA100+ target companies (85%) have not published a review of their alignment with industry associations on climate change. A full list is below: • A.P. Moller - Maersk • CEZ, A.S. • Adbri Ltd • China National Offshore Oil Corporation (CNOOC) Limited • AES Corporation • China Petroleum & Chemical • Air France KLM S.A. Corporation (Sinopec) • Air Liquide • China Shenhua Energy • Airbus Group • China Steel Corporation • American Airlines Group Inc. • Coal India • American Electric Power Company, Inc. • Coca-Cola Company • Anhui Conch Cement • Colgate-Palmolive Company • ANTAM (Aneka Tambang) • CRH • Bayer AG • Cummins Inc. • Berkshire Hathaway • Daikin Industries, Ltd. • Bluescope Steel Limited • Daimler AG • BMW • Dangote Cement Plc • Boeing Company • Danone S.A. • Boral Limited • Delta Air Lines, Inc. • Bumi Resources • Devon Energy Corporation • Bunge Limited • Dominion Energy, Inc • Canadian Natural Resources Limited • Dow Inc • Caterpillar Inc. • E.ON SE • CEMEX S.A.B. De C.V. • Ecopetrol Sa • Centrica • EDF List of CA100+ Non-Disclosers 1 • Enbridge Inc. • LafargeHolcim Ltd • ENEL SpA • Lockheed Martin Corporation • ENEOS Holdings • Lukoil OAO • ENGIE • LyondellBasell Industries Cl A • Eni SpA • Marathon Petroleum • Eskom Holdings Soc Limited • Martin Marietta Materials, Inc. • Exelon Corporation • National Grid Plc • Fiat Chrysler Automobiles NV • Naturgy • FirstEnergy Corp. • Nestlé • Formosa Petrochemical • NextEra Energy, Inc. • Fortum Oyj • Nippon Steel Corporation • Gazprom • Nissan Motor Co., Ltd. • General Electric Company • Nornickel (MMC Norilsk Nickel OSJC) • General Motors Company • NRG Energy, Inc. • Grupo Argos • NTPC Ltd • Grupo Mexico • Occidental Petroleum Corporation • Hitachi, Ltd. • Oil & Natural Gas Corporation • Hon Hai Precision Industry • Oil Search • Honda Motor Company • Orica • Iberdrola, S.A. -

Chicago's Largest Publicly Traded Companies | Crain's Book of Lists

Chicago’s Largest Publicly Traded Companies | Crain’s Book of Lists 2018 Company Website Location Walgreens Boots Alliance Inc. www.walgreensbootsalliance.com Deerfield, IL Boeing Co. www.boeing.com Chicago, IL Archer Daniels Midland Co. www.adm.com Chicago, IL Caterpillar Inc. www.caterpillar.com Peoria, IL United Continental Holdings Inc. www.unitedcontinental-holdings.com Chicago, IL Allstate Corp. www.allstate.com Northbrook, IL Exelon Corp. www.exeloncorp.com Chicago, IL Deere & Co. www.deere.com Moline, IL Kraft Heinz Co. www.kraftheinz-company.com Chicago, IL Mondelez International Inc. www.mondelez-international.com Deerfield, IL Abbvie Inc. www.abbvie.com North Chicago, IL McDonald’s Corp. www.aboutmcdonalds.com Oak Brook, IL US Foods Holding Corp. www.USfoods.com Rosemont, IL Sears Holdings Corp. www.searsholdings.com Hoffman Estates, IL Abbott Laboratories www.abbott.com North Chicago, IL CDW Corp. www.cdw.com Lincolnshire, IL Illinois Tool Works Inc. www.itw.com Glenview, IL Conagra Brands Inc. www.conagrabrands.com Chicago, IL Discover Financial Services Inc. www.discover.com Riverwoods, IL Baxter International Inc. www.baxter.com Deerfield, IL W.W. Grainger Inc. www.grainger.com Lake Forest, IL CNA Financial Corp. www.cna.com Chicago, IL Tenneco Inc. www.tenneco.com Lake Forest, IL LKQ Corp. www.lkqcorp.com Chicago, IL Navistar International Corp. www.navistar.com Lisle, IL Univar Inc. www.univar.com Downers Grove, IL Anixter International Inc. www.anixter.com Glenview, IL R.R. Donnelly & Sons Co. www.rrdonnelly.com Chicago, IL Jones Lang LaSalle Inc. www.jll.com Chicago, IL Dover Corp. www.dovercorporation.com Downers Grove, IL Treehouse Foods Inc. -

Ctpf Illinois Economic Opportunity Report

CTPF ILLINOIS ECONOMIC OPPORTUNITY REPORT As Required by Public Act 096-0753 for the period ending June 30, 2021 202 1 TABLE OF CONTENTS TABLE I 1 Illinois-based Investment Manager Firms Investing on Behalf of CTPF TABLE II Illinois-based Private Equity Partnerships, Portfolio Companies, 2 Infrastructure, and Real Estate Properties in the CTPF Portfolio TABLE III 14 Illinois-based Public Equity Market Value of Shares Held in CTPF’s Portfolio TABLE IV 18 Illinois-based Fixed Income Market Value of Shares Held in CTPF’s Portfolio TABLE V Domestic Equity Brokerage Commissions Paid to Illinois-based 19 Brokers/Dealers TABLE VI 20 International Equity Brokerage Commissions Paid to Illinois-based Brokers/Dealers TABLE VII Fixed Income Volume Traded through Illinois-based Brokers/Dealers 21 (par value) 2021 CTPF ILLINOIS ECONOMIC OPPORTUNITY REPORT REQUIRED BY PUBLIC ACT 096-0753 FOR THE PERIOD ENDING JUNE 30, 2021 TABLE I Illinois-based Investment Manager Firms Investing on Behalf of CTPF Table I identifies the economic opportunity investments made by CTPF with Illinois-based investment management companies. As of June 30, 2021, Total Market/Fair Value of Illinois-based investment managers was $3,121,157,662.18 (23.74%) of the total CTPF investment portfolio of $13,145,258,889.14. Market/Fair Value % of Total Fund Investment Manager Firms Location As of 6/30/2021 (reported in millions) Adams Street Chicago $ 319.69 2.43% Ariel Capital Management Chicago 83.44 0.63% Attucks Asset Management Chicago 274.06 2.08% Ativo Capital Management1 Chicago -

Growing Exponentially | 2013 Annual Report Darcell Creswell (2013 Graduate) Girls 4 Science Participant Receiving Scholarship from Board Member Elaine Harris

1 Girls 4 Science: Growing Exponentially | 2013 Annual Report Darcell Creswell (2013 graduate) Girls 4 Science Participant receiving scholarship from Board member Elaine Harris Participating in Girls 4 Science has made it clear to me that the infl uence of women in science, technology, engineering and math is every woman’s legacy from birth. I am now more interested in subjects like Horticulture, Genetics and Engineering because of the mentors who took time out of their schedules to facilitate themed fi eld trips and class activities while I was in G4S. I am very thankful to have been recognized as a 2013 G4S scholarship recipient and I will use my education at Western Illinois University to continue to “overcome barriers and excel in STEM. ” Contents 1 Girls 4 Science Graduate, Darcell Creswell 3 Letter from the Executive Director, Jackie Lomax 4 Girls 4 Science: Girls Growing Exponentially 5 Partnerships Helping Girls 4 Science Grow Exponentially 6 Girls 4 Science 2013 Report Card 7 Oh the Places You’ll Go- 2013 Explorations 8 Girls 4 Science Sites of Operation 9 Girls 4 Science Graduate, Leona Barnes 10 Girls 4 Science Accomplishments: Heights Reached 11 Letter from the Board President, Linda Boasmond 12 Girls 4 Science Leadership 13 Girls 4 Science Financial Report: 2013 in Review 14 2013 Giving List 15 Girls 4 Science Volunteers The mission of Girls 4 Science (G4S) is to increase science literacy amongst girls ages 10-18 through scientifi c discovery and collaboration with external partnerships. 3 Girls 4 Science: Growing Exponentially | 2013 Annual Report irls 4 Science (G4S) continues to make great strides for science, technology, engineering and Letter from mathematics equality through its Saturday Science Academy program.