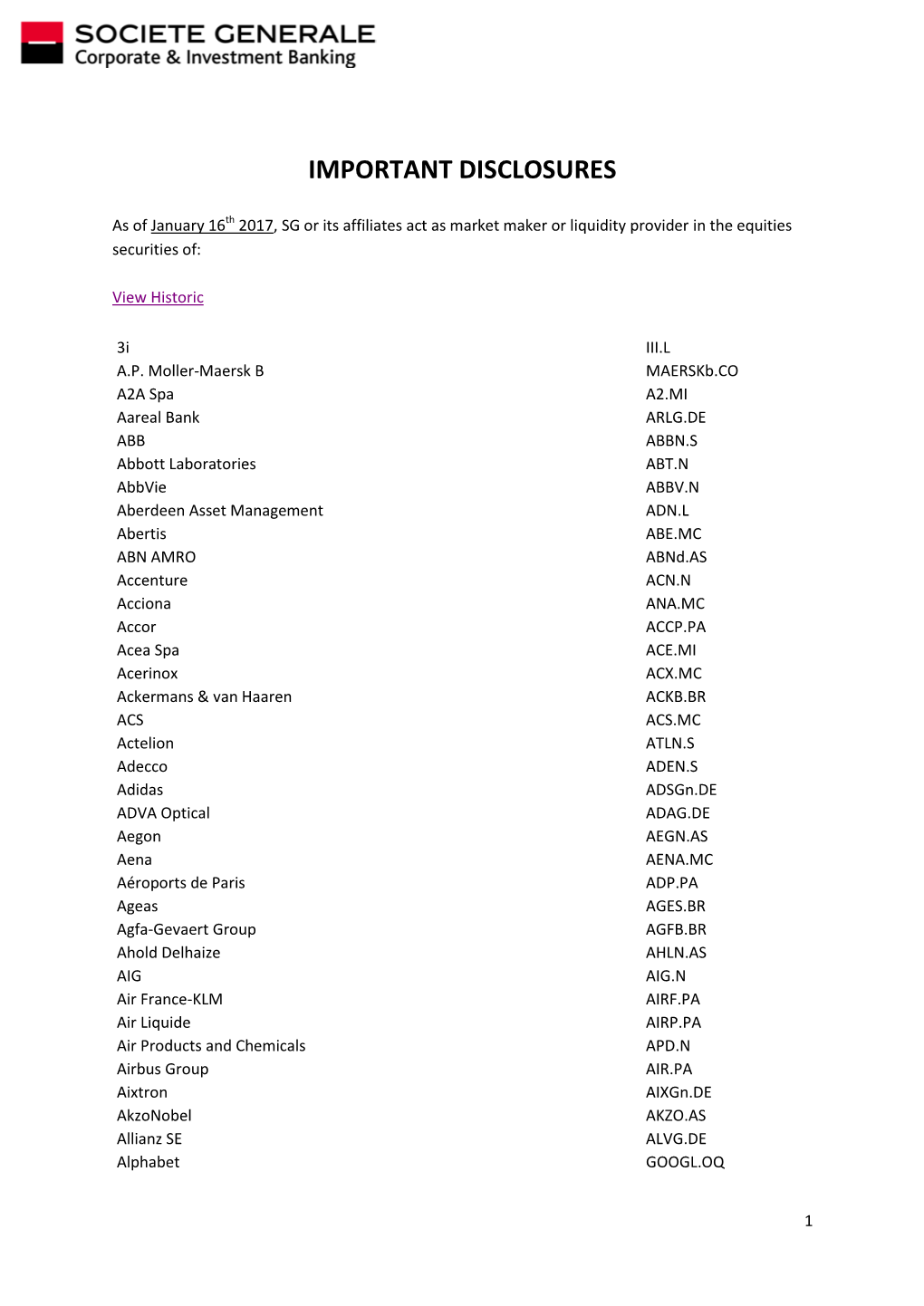

Important Disclosures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Liste Des Actions Concernées Par L'interdiction De Positions Courtes Nettes

Liste des actions concernées par l'interdiction de positions courtes nettes L’interdiction s’applique aux actions listées sur une plate-forme française et relevant de la compétence de l’AMF au titre du règlement 236/2012 (information disponible dans les registres ESMA). Cette liste est fournie à titre informatif. L'AMF n'est pas en mesure de garantir que le contenu disponible est complet, exact ou à jour. Compte tenu des diverses sources de données sous- jacentes, des modifications pourraient être apportées régulièrement. Isin Nom FR0010285965 1000MERCIS FR0013341781 2CRSI FR0010050773 A TOUTE VITESSE FR0000076887 A.S.T. GROUPE FR0010557264 AB SCIENCE FR0004040608 ABC ARBITRAGE FR0013185857 ABEO FR0012616852 ABIONYX PHARMA FR0012333284 ABIVAX FR0000064602 ACANTHE DEV. FR0000120404 ACCOR FR0010493510 ACHETER-LOUER.FR FR0000076861 ACTEOS FR0000076655 ACTIA GROUP FR0011038348 ACTIPLAY (GROUPE) FR0010979377 ACTIVIUM GROUP FR0000053076 ADA BE0974269012 ADC SIIC FR0013284627 ADEUNIS FR0000062978 ADL PARTNER FR0011184241 ADOCIA FR0013247244 ADOMOS FR0010340141 ADP FR0010457531 ADTHINK FR0012821890 ADUX FR0004152874 ADVENIS FR0013296746 ADVICENNE FR0000053043 ADVINI US00774B2088 AERKOMM INC FR0011908045 AG3I ES0105422002 AGARTHA REAL EST FR0013452281 AGRIPOWER FR0010641449 AGROGENERATION CH0008853209 AGTA RECORD FR0000031122 AIR FRANCE -KLM FR0000120073 AIR LIQUIDE FR0013285103 AIR MARINE NL0000235190 AIRBUS FR0004180537 AKKA TECHNOLOGIES FR0000053027 AKWEL FR0000060402 ALBIOMA FR0013258662 ALD FR0000054652 ALES GROUPE FR0000053324 ALPES (COMPAGNIE) -

Document De Référence 2014 Document De Référence

DOCUMENT DE RÉFÉRENCE 2014 DBV TECHNOLOGIES 2014 DOCUMENT DE RÉFÉRENCE DOCUMENT 2014 DE RÉFÉRENCE DBV TECHNOLOGIES Société Anonyme au capital de 1 966 166,10 euros Green Square Bâtiment D, 80/84 rue des Meuniers 92220 Bagneux 441 772 522 R.C.S. Nanterre En application de son règlement général, notamment de l’article 212-13, l’Autorité des marchés financiers a enregistré le présent document de référence le 02 juillet 2015 sous le numéro R.15-057. Ce document ne peut être utilisé à l’appui d’une opération financière que s’il est complété par une note d’opération visée par l’AMF. Il a été établi par l’émetteur et engage la responsabilité de ses signataires. L’enregistrement, conformément aux dispositions de l’article L. 621-8-1-I du code monétaire et financier, a été effectué après que l’AMF a vérifié que le document est complet et compréhensible et que les informations qu’il contient sont cohérentes. Il n’implique pas l’authentification par l’AMF des éléments comptables et financiers présentés. Incorporation par référence : En application de l’article 28 du règlement européen 809/2004, les éléments suivants sont inclus par référence dans le présent document de référence : • Les comptes annuels établis conformément aux principes comptables français au 31 décembre 2013, les comptes établis selon le référentiel IFRS tel qu’adoptés dans l’Union européenne au 31 décembre 2013, et les rapports des commissaires aux comptes y afférents, présentés respectivement aux pages 153 à 190, 191 à 208, 209 et 210-211 du documents de référence n° R.14-017 enregistré par l’Autorités des marchés financiers le 16 avril 2014 ; • Les comptes annuels établis conformément aux principes comptables français au 31 décembre 2012, les comptes établis selon le référentiel IFRS tel qu’adoptés dans l’Union européenne au 31 décembre 2012, et les rapports des commissaires aux comptes y afférents, présentés respectivement aux pages 134 à 162, 163 à 178, 180, 181-182 du document de référence n° R.13-015 enregistré par l’Autorité des marchés financiers le 24 avril 2013. -

Actions Synthétiques France Heures De Négociation : 9:00 - 17:30 (CET) Frais Et Commissions : 0.1% Du Montant De La Transaction, Min

Actions Synthétiques France Heures de négociation : 9:00 - 17:30 (CET) Frais et Commissions : 0.1% du montant de la transaction, min. 8 EUR (Marge sur commission: 70% - 99.9%). Symbole Instrument dont le prix est basé sur Nombre d'actions par lot Taille minimale d'un ordre en lots Vente à découvert Taux d'emprunt de titre (%) AC.FR Accor SA CFD 1 1 OUI -3 ACA.FR Credit Agricole SA CFD 1 1 OUI -3 ADP.FR Aeroports de Paris CFD 1 1 OUI -3 AF.FR Air France-KLM CFD 1 1 OUI -3 AI.FR Air Liquide SA CFD 1 1 OUI -3 AIR.FR Airbus Group NV CFD 1 1 NON - AKE.FR Arkema SA CFD 1 1 OUI -3 ALO.FR Alstom SA CFD 1 1 OUI -3 ALT.FR Altran Technologies SA CFD 1 1 OUI -3 ATO.FR AtoS CFD 1 1 OUI -3 BB.FR Societe BIC SA CFD 1 1 OUI -3 BIM.FR BioMerieux CFD 1 1 OUI -3 BN.FR Danone CFD 1 1 OUI -3 BNP.FR BNP Paribas CFD 1 1 OUI -3 BOL.FR Bollore SA CFD 1 1 OUI -3 BVI.FR Bureau Veritas SA CFD 1 1 OUI -3 CA.FR Carrefour SA CFD 1 1 OUI -3 CAP.FR Cap Gemini SA CFD 1 1 OUI -3 CGG.FR CGG SA CFD 1 1 NON - CNP.FR CNP Assurances CFD 1 1 OUI -3 CO.FR Casino Guichard Perrachon SA CFD 1 1 OUI -3 COFA.FR Coface SA CFD 1 1 OUI -4,5 CS.FR AXA SA CFD 1 1 OUI -3 DEC.FR JCDecaux SA CFD 1 1 OUI -3 DG.FR Vinci SA CFD 1 1 OUI -3 DSY.FR Dassault Systemes CFD 1 1 OUI -3 EDEN.FR Edenred CFD 1 1 OUI -3 EDF.FR EDF SA CFD 1 1 OUI -3 EI.FR Essilor International SA CFD 1 1 OUI -3 ELE.FR Euler Hermes Group CFD 1 1 OUI -4,5 EN.FR Bouygues SA CFD 1 1 OUI -3 ENGI.FR ENGIE CFD 1 1 OUI -3 ENX.FR Euronext NV CFD 1 1 OUI -3 EO.FR Faurecia CFD 1 1 OUI -3 ERA.FR Eramet CFD 1 1 OUI -5 ERF.FR Eurofins -

Financial Report and Registration Document 2018 Contents

FINANCIAL REPORT AND REGISTRATION DOCUMENT 2018 CONTENTS Editorial from the Chairman and CEO 2 An extensive and diversified offering 4 5 Consolidated Financial Statements 199 Business model 6 5.1. Financial Statements 200 5.2. Notes to the Consolidated Financial Corporate Social Responsibility 8 Statements 205 5.3. Statutory Auditors’ report Board of Directors 10 on the consolidated fi nancial statements 268 5.4. History of signifi cant consolidated items Key figures 2018 12 and ratios 273 1 Introduction to the Group 15 6 Company financial statements 275 1.1. Business sector 16 6.1. Financial statements 276 1.2. A profi table growth strategy 19 6.2. Notes to the SEB S.A. fi nancial statements 278 1.3. Organization and internal control 29 6.3. Five-year fi nancial summary 294 1.4. Risk factors 36 6.4. Statutory auditors’ report on the fi nancial statements 295 2 Corporate governance 53 7 Information concerning the company 2.1. Implementation framework for corporate governance principles 54 and its share capital 299 2.2. Management structure 54 7.1. Information concerning the company 300 2.3. Composition, organization and operation 7.2. Information on share capital 303 of the Board of Directors 55 7.3. Financial authorizations 309 2.4. Group management bodies 82 7.4. Employee shareholding 310 2.5. Remuneration policy 83 7.5. Stock market and dividend information 313 3 Corporate Social Responsibility 113 8 Annual General Meeting 315 3.1. Commitment and management 114 8.1. Agenda for the Combined Annual General 3.2. Non-Financial Performance Statement Meeting of 22 May 2019 316 (DPEF) & Duty of Vigilance 117 8.2. -

Euro Stoxx® Multi Premia Index

EURO STOXX® MULTI PREMIA INDEX Components1 Company Supersector Country Weight (%) SARTORIUS STEDIM BIOTECH Health Care France 1.59 IMCD Chemicals Netherlands 1.25 VOPAK Industrial Goods & Services Netherlands 1.15 BIOMERIEUX Health Care France 1.04 REMY COINTREAU Food, Beverage & Tobacco France 1.03 EURONEXT Financial Services France 1.00 HERMES INTERNATIONAL Consumer Products & Services France 0.94 SUEZ ENVIRONNEMENT Utilities France 0.94 BRENNTAG Chemicals Germany 0.93 ENAGAS Energy Spain 0.90 ILIAD Telecommunications France 0.89 DEUTSCHE POST Industrial Goods & Services Germany 0.88 FUCHS PETROLUB PREF Chemicals Germany 0.88 SEB Consumer Products & Services France 0.87 SIGNIFY Construction & Materials Netherlands 0.86 CARL ZEISS MEDITEC Health Care Germany 0.80 SOFINA Financial Services Belgium 0.80 EUROFINS SCIENTIFIC Health Care France 0.80 RATIONAL Industrial Goods & Services Germany 0.80 AALBERTS Industrial Goods & Services Netherlands 0.74 KINGSPAN GRP Construction & Materials Ireland 0.73 GERRESHEIMER Health Care Germany 0.72 GLANBIA Food, Beverage & Tobacco Ireland 0.71 PUBLICIS GRP Media France 0.70 UNITED INTERNET Technology Germany 0.70 L'OREAL Consumer Products & Services France 0.70 KPN Telecommunications Netherlands 0.68 SARTORIUS PREF. Health Care Germany 0.68 BMW Automobiles & Parts Germany 0.68 VISCOFAN Food, Beverage & Tobacco Spain 0.67 SAINT GOBAIN Construction & Materials France 0.67 CORBION Food, Beverage & Tobacco Netherlands 0.66 DAIMLER Automobiles & Parts Germany 0.66 PROSIEBENSAT.1 MEDIA Media Germany 0.65 -

Putnam Panagora Market Neutral Fund Q3 Portfolio Holdings

Putnam PanAgora Market Neutral Fund The fund's portfolio 5/31/20 (Unaudited) INVESTMENT COMPANIES (46.1%)(a) Shares Value Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. 640 $3,635 State Street Institutional U.S. Government Money Market Fund 3,939,067 3,939,067 Total investment companies (cost $3,943,561) $3,942,702 UNITS (11.0%)(a) Units Value Acamar Partners Acquisition Corp.(NON) 419 $4,291 Alussa Energy Acquisition Corp. (Cayman Islands)(NON) 856 8,483 Amplitude Healthcare Acquisition Corp.(NON) 2,947 29,529 B. Riley Principal Merger Corp. II(NON) 2,620 26,174 CC Neuberger Principal Holdings I(NON) 2,652 27,024 Chardan Healthcare Acquisition 2 Corp.(NON) 2,652 26,493 CHP Merger Corp.(NON) 2,747 27,745 CIIG Merger Corp.(NON) 4,529 45,335 Collective Growth Corp.(NON) 2,803 27,890 DFP Healthcare Acquisitions Corp.(NON) 2,866 28,746 dMY Technology Group, Inc.(NON) 2,885 29,196 East Stone Acquisition Corp.(NON) 4,230 42,089 FinServ Acquisition Corp.(NON) 831 8,194 Foley Trasimene Acquisition Corp.(NON) 2,626 26,917 Fortress Value Acquisition Corp.(NON) 2,652 26,547 Galileo Acquisition Corp.(NON) 888 8,827 GigCapital3, Inc.(NON) 2,833 28,160 Gores Holdings IV, Inc.(NON) 1,306 13,844 Greenrose Acquisition Corp.(NON) 3,350 32,931 GX Acquisition Corp.(NON) 417 4,233 Healthcare Merger Corp.(NON) 2,705 28,105 InterPrivate Acquisition Corp.(NON) 2,918 29,180 Jaws Acquisition Corp.(NON) 2,620 27,038 Juniper Industrial Holdings, Inc.(NON) 841 8,418 Landcadia Holdings II, Inc.(NON) 1,165 12,174 LGL Systems Acquisition Corp.(NON) 2,568 25,629 Lifesci Acquisition Corp.(NON) 2,866 29,806 LIV Capital Acquisition Corp. -

The Most Attractive Employers in the France Professionals

The Most Attractive Employers in the France Professionals 1 About us Universum is a global leader in employer branding. Over the past 30 years, we have established ourselves in 50 markets globally and our diverse workforce is physically present in 20 countries. Our services include actionable research, strategic consulting, and data-driven communications and social media solutions for talent branding, sourcing, and analytics. We are a trusted partner to over 1,700 clients, including many Fortune 500 companies, as well as to global media partners that publish our annual rankings and trend reports. We work with over 2,000 universities, alumni groups, and professional organizations to gather insights from students and professionals in order to advise employers on how to attract and retain talent that fits their culture and purpose. On an annual basis, Universum surveys over 1,500,000 students and professionals worldwide. Did your company rank in the top 100? Learn more Please contact us to receive your badge. 2 Where do you rank? AN ESSENTIAL RESOURCE by the respondents. It’s so important to secure the very best young ACTIONABLE ASSESSMENTS talent out there, which is why HR and C-level But this preview is only the beginning. By leaders around the world refer to Universum’s becoming a member you can access research. Drawing on the opinions of more Universum’s full report, which contains than 10.000 professionals in France, this company-specific findings and custom insights preview of the 2018 Talent Survey gives a and recommendations that are critical when it clear indication of where your organization comes to developing your employer branding ranks when it comes to its potential to attract strategy. -

Designated Sponsor Erfordernis D 20210526

Aktien der Liquiditätskategorie A* gültig ab 26. Mai 2021 ISIN Instrument XLM Umsatz AT0000A0E9W5 S+T AG O.N. 35.97 4,280,782.85 DE0005089031 UTD.INTERNET AG NA 16.07 7,772,202.57 DE0005111702 ZOOPLUS AG 51.91 4,208,078.51 DE0005140008 DEUTSCHE BANK AG NA O.N. 5.40 111,925,300.01 DE0005158703 BECHTLE AG O.N. 14.58 12,440,739.68 DE0005190003 BAY.MOTOREN WERKE AG ST 3.92 116,673,048.94 DE0005190037 BAY.MOTOREN WERKE VZO 28.08 5,185,694.74 DE0005200000 BEIERSDORF AG O.N. 6.23 32,370,380.77 DE0005313704 CARL ZEISS MEDITEC AG 16.63 13,469,738.82 DE0005408116 AAREAL BANK AG 25.45 5,802,419.24 DE0005408884 LEONI AG NA O.N. 73.50 3,114,435.16 DE0005419105 CANCOM SE O.N. 25.16 5,547,456.62 DE0005439004 CONTINENTAL AG O.N. 7.21 58,481,792.62 DE0005470306 CTS EVENTIM KGAA 21.36 7,096,059.32 DE0005470405 LANXESS AG 12.23 15,402,539.66 DE0005493365 HYPOPORT SE NA O.N. 60.33 3,344,480.07 DE0005545503 1+1 DRILLISCH AG O.N. 27.93 4,681,191.15 DE0005550636 DRAEGERWERK VZO O.N. 50.73 3,327,527.09 DE0005552004 DEUTSCHE POST AG NA O.N. 3.95 119,438,574.31 DE0005557508 DT.TELEKOM AG NA 3.70 154,511,909.75 DE0005565204 DUERR AG O.N. 22.09 7,100,402.33 DE0005659700 ECKERT+ZIEGLER AG O.N. 44.12 3,806,078.02 DE0005664809 EVOTEC SE INH O.N. -

2019 Financial Statements

Blue Action Fund Frankfurt am Main/Germany Annual financial statements for the financial year from 1 January to 31 December 2019 Blue Action Fund, Frankfurt am Main/Germany Balance sheet as at 31 December 2019 Equity and Assets liabilities 31 Dec. 2019 31 Dec. 2018 31 Dec. 2019 31 Dec. 2019 31 Dec. 2018 31 Dec. 2018 EUR EUR EUR EUR EUR EUR A. Fixed assets A. Equity I. Foundation capital I. Property, plant and equipment 1. Initial endowment 2,000,000.00 2,000,000.00 Operating and office equipment 3,809.00 1,614.01 2. Spendable capital 2,395,975.10 2,550,000.00 4,395,975.10 4,550,000.00 II. Financial assets II. Reserves Investment securities 33,684,484.81 21,370,955.83 1. Capital reserves 72,685,736.33 49,154,224.60 33,688,293.81 21,372,569.84 2. Earnings reserves 6,406,917.80 7,113,443.84 79,092,654.13 56,267,668.44 B. Current assets III. Funds carried forward 0.00 258,119.79 I. Other assets 179,568.83 201,103.25 83,488,629.23 61,075,788.23 II. Bank balances 53,784,348.45 42,423,038.27 B. Provisions 53,963,917.28 42,624,141.52 Other provisions 139,411.49 119,836.96 C. Liabilities 1. Liabilities from conditionally repayable 4,006,827.23 2,500,000.00 donations 2. Trade payables 2,886.21 14,512.17 3. Other liabilities 14,456.93 286,574.00 4,024,170.37 2,801,086.17 87,652,211.09 63,996,711.36 87,652,211.09 63,996,711.36 Blue Action Fund, Frankfurt am Main/Germany Statement of profit and loss for the financial year from 1 January to 31 December 2019 2019 2019 2018 2018 EUR EUR EUR EUR 1. -

Registration Document 2018

2018 Registration Document including the annual financial report MORE THAN 310 YEARS OF HISTORY WENDEL at a glance 2 to 28 Contents GROUP PRESENTATION 29 INFORMATION ON THE COMPANY AND 1.1Corporate history 30 ITS¬SHARE CAPITAL 395 1 1.2Business 31 7 7.1Information on the Company 396 1.3Corporate governance 32 7.2Principal by-laws 396 1.4Internal organization 34 7.3How to take part in shareholders’ Meetings 398 1.5Investment model and business development strategy 40 7.4Information on share capital 400 1.6Corporate Social Responsibility (CSR) 44 7.5 Principal new investments and acquisitions of controlling 1.7Subsidiaries and associated companies 44 interests 404 1.8Shareholder information 69 7.6Financial authorizations 405 7.7 Share buybacks 407 CORPORATE GOVERNANCE, RISK 7.8 Transactions on Company securities by corporate FACTORS AND INTERNAL CONTROLS 75 officers 411 7.9 Shareholder agreements 412 2 2.1Corporate governance 76 7.10 Factors likely to have an impact in the event 2.2Risk factors 127 of a takeover offer 415 2.3Risk management and internal control systems 138 SHAREHOLDERS' MEETING OF MAY¬16, NON-FINANCIAL INFORMATION 151 2019 417 3.1Wendel 152 8 8.1 Statutory Auditors' special report on related-party 3 3.2 Wendel’s subsidiaries reviewed by an independent agreements and commitments 418 verifier 168 8.2Statutory Auditors’ report on the reduction in capital 424 3.3 Independent third-party report on the statement of non-financial performance shown in the management 8.3 Statutory Auditors’ report on the issue of shares report 250 -

ESMA Report on Application of AMP 2020

Report To the European Commission on the application of accepted market practices 16 December 2020 | ESMA70-156-3782 ESMA REGULAR USE Table of Contents 1 Executive Summary ....................................................................................................... 2 2 Background .................................................................................................................... 3 3 Information on the legal situation of AMPs established under MAD and AMPs established under MAR ............................................................................................................................ 5 3.1 CNMV ..................................................................................................................... 5 3.2 CMVM ..................................................................................................................... 6 3.3 CONSOB ................................................................................................................ 6 3.4 AMF ........................................................................................................................ 6 4 Application of the established AMPs............................................................................... 7 4.1 AMP established by the CNMV under MAR ............................................................ 7 4.2 AMP established by the CMVM under MAR ............................................................ 8 4.3 AMP established by CONSOB under MAD and MAR ............................................. -

Aareal Bank Group – Annual Report 2012 Key Group Figures Our Business Model: Two Strong Pillars

THE FOUNDATIONS OF CHANGE Aareal Bank Group – Annual Report 2012 KEY GROUP FIGURES OUR BUSINESS MODEL: TWO STRONG PILLARS 01 Jan - 01 Jan - Change 31 Dec 2012 31 Dec 2011 € mn € mn € mn Income Statement Operating profit 176 185 -9 Net income/loss after non-controlling interests 105 114 -9 Indicators Cost/income ratio (%) 1) 40.9 43.9 Earnings per share (€) 1.75 2.11 RoE before taxes (%) 7.2 8.3 RoE after taxes (%) 4.8 5.7 31 Dec 2012 31 Dec 2011 Change Change € mn € mn € mn % Portfolio Data Property financing 23,304 23,986 -682 -3 In the Structured Property Financing segment, we finance In the Consulting /Services segment, Germany is our core of which: international 19,991 20,425 -434 -2 commercial property – particularly offices, shopping centres, market; we are also active in several European countries. Property financing under management 2) 23,496 24,239 -743 -3 logistics properties and hotels. We facilitate property pro- The segment offers a wide range of services to the German of which: international 19,991 20,425 -434 -2 jects for our domestic and international clients within the institutional housing industry – specifically, IT systems and Equity 2,352 2,169 183 8 framework of a three-continent strategy covering Europe, related consultancy services, combined with integrated Total assets 45,734 41,814 3,920 9 North America and Asia. In this context, our particular pay ments systems, as well as a comprehensive range of strength lies in the success we have in combining local services for managing property portfolios.