Putnam Panagora Market Neutral Fund Q3 Portfolio Holdings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notice of Convocation of the 14Th Annual General Meeting of Shareholders

Disclaimer: Please note that the following is a translation of the original Japanese documents prepared only for reference purposes. The Japanese original shall take precedence in the case of any discrepancies between this translation and the original. The Company assumes no responsibility for direct, indirect or any other forms of damages arising from this translation. Securities code: 9412 June 9, 2021 To Our Shareholders, Shinji Takada, Representative Director, Chairman SKY Perfect JSAT Holdings Inc. 8-1, Akasaka 1-chome, Minato-ku, Tokyo Notice of Convocation of the 14th Annual General Meeting of Shareholders We would like to inform you that the 14th Annual General Meeting of Shareholders of SKY Perfect JSAT Holdings Inc. (the “Company”) will be held as described below. For the sake of preventing the spread of new coronavirus (COVID-19) infections and ensuring safety at the meeting venue, shareholders are requested to refrain from attending the meeting where possible. In lieu of attending the meeting, you can exercise your voting rights in advance either in writing or via the Internet, etc. Please review the attached Reference Documents for General Meeting of Shareholders and exercise your voting rights following the “Guide to Exercising Voting Rights in Advance” on page 4 by 5:30 p.m. Japan time on Thursday, June 24, 2021. Please visit the Company’s website for a video of the meeting to be posted on a later date. Details 1. Date and Time: Friday, June 25, 2021, at 10:00 a.m. (The reception will commence at 9:00 a.m.) The reason the date for this Annual General Meeting of Shareholders is far apart from the date of that in the previous year (July 30, 2020) is that with telecommuting applied to all officers and employees from the perspective of preventing the spread of COVID-19 infections and ensuring safety, delays in major operations were unavoidable last year, so the meeting was postponed to July. -

1332 Nippon Suisan Kaisha, Ltd. 50 1333 Maruha Nichiro Corp. 500 1605 Inpex Corp

Nikkei Stock Average - Par Value (Update:August/1, 2017) Code Company Name Par Value(Yen) 1332 Nippon Suisan Kaisha, Ltd. 50 1333 Maruha Nichiro Corp. 500 1605 Inpex Corp. 125 1721 Comsys Holdings Corp. 50 1801 Taisei Corp. 50 1802 Obayashi Corp. 50 1803 Shimizu Corp. 50 1808 Haseko Corp. 250 1812 Kajima Corp. 50 1925 Daiwa House Industry Co., Ltd. 50 1928 Sekisui House, Ltd. 50 1963 JGC Corp. 50 2002 Nisshin Seifun Group Inc. 50 2269 Meiji Holdings Co., Ltd. 250 2282 Nh Foods Ltd. 50 2432 DeNA Co., Ltd. 500/3 2501 Sapporo Holdings Ltd. 250 2502 Asahi Group Holdings, Ltd. 50 2503 Kirin Holdings Co., Ltd. 50 2531 Takara Holdings Inc. 50 2768 Sojitz Corp. 500 2801 Kikkoman Corp. 50 2802 Ajinomoto Co., Inc. 50 2871 Nichirei Corp. 100 2914 Japan Tobacco Inc. 50 3086 J.Front Retailing Co., Ltd. 100 3099 Isetan Mitsukoshi Holdings Ltd. 50 3101 Toyobo Co., Ltd. 50 3103 Unitika Ltd. 50 3105 Nisshinbo Holdings Inc. 50 3289 Tokyu Fudosan Holdings Corp. 50 3382 Seven & i Holdings Co., Ltd. 50 3401 Teijin Ltd. 250 3402 Toray Industries, Inc. 50 3405 Kuraray Co., Ltd. 50 3407 Asahi Kasei Corp. 50 3436 SUMCO Corp. 500 3861 Oji Holdings Corp. 50 3863 Nippon Paper Industries Co., Ltd. 500 3865 Hokuetsu Kishu Paper Co., Ltd. 50 4004 Showa Denko K.K. 500 4005 Sumitomo Chemical Co., Ltd. 50 4021 Nissan Chemical Industries, Ltd. 50 4042 Tosoh Corp. 50 4043 Tokuyama Corp. 50 WF-101-E-20170803 Copyright © Nikkei Inc. All rights reserved. 1/5 Nikkei Stock Average - Par Value (Update:August/1, 2017) Code Company Name Par Value(Yen) 4061 Denka Co., Ltd. -

Liste Des Actions Concernées Par L'interdiction De Positions Courtes Nettes

Liste des actions concernées par l'interdiction de positions courtes nettes L’interdiction s’applique aux actions listées sur une plate-forme française et relevant de la compétence de l’AMF au titre du règlement 236/2012 (information disponible dans les registres ESMA). Cette liste est fournie à titre informatif. L'AMF n'est pas en mesure de garantir que le contenu disponible est complet, exact ou à jour. Compte tenu des diverses sources de données sous- jacentes, des modifications pourraient être apportées régulièrement. Isin Nom FR0010285965 1000MERCIS FR0013341781 2CRSI FR0010050773 A TOUTE VITESSE FR0000076887 A.S.T. GROUPE FR0010557264 AB SCIENCE FR0004040608 ABC ARBITRAGE FR0013185857 ABEO FR0012616852 ABIONYX PHARMA FR0012333284 ABIVAX FR0000064602 ACANTHE DEV. FR0000120404 ACCOR FR0010493510 ACHETER-LOUER.FR FR0000076861 ACTEOS FR0000076655 ACTIA GROUP FR0011038348 ACTIPLAY (GROUPE) FR0010979377 ACTIVIUM GROUP FR0000053076 ADA BE0974269012 ADC SIIC FR0013284627 ADEUNIS FR0000062978 ADL PARTNER FR0011184241 ADOCIA FR0013247244 ADOMOS FR0010340141 ADP FR0010457531 ADTHINK FR0012821890 ADUX FR0004152874 ADVENIS FR0013296746 ADVICENNE FR0000053043 ADVINI US00774B2088 AERKOMM INC FR0011908045 AG3I ES0105422002 AGARTHA REAL EST FR0013452281 AGRIPOWER FR0010641449 AGROGENERATION CH0008853209 AGTA RECORD FR0000031122 AIR FRANCE -KLM FR0000120073 AIR LIQUIDE FR0013285103 AIR MARINE NL0000235190 AIRBUS FR0004180537 AKKA TECHNOLOGIES FR0000053027 AKWEL FR0000060402 ALBIOMA FR0013258662 ALD FR0000054652 ALES GROUPE FR0000053324 ALPES (COMPAGNIE) -

Important Notice the Depository Trust Company

Important Notice The Depository Trust Company B #: 12945-20 Date: February 10, 2020 To: All Participants Category: Dividends | International From: Global Tax Services Attention: Managing Partner/Officer, Cashier, Dividend Mgr., Tax Mgr. BNY Mellon | ADRs | Qualified Dividends for Tax Year 2019 Subject: Bank of New York Mellon Corporation (“BNYM”), as depositary for these issues listed below has reviewed and determined if they met the criteria for reduced U.S. tax rate as “qualified dividends” for tax year 2019. The Depository Trust Company received the attached correspondence containing Tax Information. If applicable, please consult your tax advisor to ensure proper treatment of these events. Non-Confidential DTCC Public (White) 2019 DIVIDEND CERTIFICATION CUSIP DR Name Country Exchange Qualified 000304105 AAC TECHNOLOGIES HLDGS INC CAYMAN ISLANDS OTC N 000380105 ABCAM PLC UNITED KINGDOM OTC Y 001201102 AGL ENERGY LTD AUSTRALIA OTC Y 001317205 AIA GROUP LTD HONG KONG OTC N 002482107 A2A SPA ITALY OTC Y 003381100 ABERTIS INFRAESTRUCTURAS S A SPAIN OTC Y 003725306 ABOITIZ EQUITY VENTURES INC PHILIPPINES OTC Y 003730108 ABOITIZ PWR CORP PHILIPPINES OTC Y 004563102 ACKERMANS & VAN HAAREN BELGIUM OTC Y 004845202 ACOM CO. JAPAN OTC Y 006754204 ADECCO GROUP AG SWITZERLAND OTC Y 007192107 ADMIRAL GROUP UNITED KINGDOM OTC Y 007627102 AEON CO LTD JAPAN OTC Y 008712200 AIDA ENGR LTD JAPAN OTC Y 009126202 AIR LIQUIDE FRANCE OTC Y 009279100 AIRBUS SE NETHERLANDS OTC Y 009707100 AJINOMOTO INC JAPAN OTC Y 015096209 ALEXANDRIA MINERAL - REG. S EGYPT None N 015393101 ALFA LAVAL AB SWEDEN SWEDEN OTC Y 021090204 ALPS ELEC LTD JAPAN OTC Y 021244207 ALSTOM FRANCE OTC Y 022205108 ALUMINA LTD AUSTRALIA OTC Y 022631204 AMADA HLDGS CO LTD JAPAN OTC Y 023511207 AMER GROUP HOLDING - REG. -

Fidelity® Emerging Markets Index Fund

Quarterly Holdings Report for Fidelity® Emerging Markets Index Fund January 31, 2021 EMX-QTLY-0321 1.929351.109 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 92.5% Shares Value Shares Value Argentina – 0.0% Lojas Americanas SA rights 2/4/21 (b) 4,427 $ 3,722 Telecom Argentina SA Class B sponsored ADR (a) 48,935 $ 317,099 Lojas Renner SA 444,459 3,368,738 YPF SA Class D sponsored ADR (b) 99,119 361,784 Magazine Luiza SA 1,634,124 7,547,303 Multiplan Empreendimentos Imobiliarios SA 156,958 608,164 TOTAL ARGENTINA 678,883 Natura & Co. Holding SA 499,390 4,477,844 Notre Dame Intermedica Participacoes SA 289,718 5,003,902 Bailiwick of Jersey – 0.1% Petrobras Distribuidora SA 421,700 1,792,730 Polymetal International PLC 131,532 2,850,845 Petroleo Brasileiro SA ‑ Petrobras (ON) 2,103,697 10,508,104 Raia Drogasil SA 602,000 2,741,865 Bermuda – 0.7% Rumo SA (b) 724,700 2,688,783 Alibaba Health Information Technology Ltd. (b) 2,256,000 7,070,686 Sul America SA unit 165,877 1,209,956 Alibaba Pictures Group Ltd. (b) 6,760,000 854,455 Suzano Papel e Celulose SA (b) 418,317 4,744,045 Beijing Enterprises Water Group Ltd. 2,816,000 1,147,720 Telefonica Brasil SA 250,600 2,070,242 Brilliance China Automotive Holdings Ltd. 1,692,000 1,331,209 TIM SA 475,200 1,155,127 China Gas Holdings Ltd. 1,461,000 5,163,177 Totvs SA 274,600 1,425,346 China Resource Gas Group Ltd. -

NISSHIN SEIFUN GROUP INC. a Message from the Management

Delivering Good Health and Reliability To Shareholders Business Report 2004 (April 1, 2003 to March 31, 2004) NISSHIN SEIFUN GROUP INC. A Message from the Management CONTENTS A Message from the Management .............1 Interview with the Chairman and the President ....................................3 Feature: Redistributing Profits to Shareholders.......................................7 Feature: Food Product Safety Initiatives ....8 Topics......................................................9 Outline of Nisshin Seifun Group ...............11 Review of Operations..............................13 Osamu Shoda Hiroshi Hasegawa New Products.........................................16 Chairman President Consolidated Financial Highlights ..............17 Forecast for Consolidated Business Performance...........................17 Consolidated Financial Statements..........19 Non-Consolidated Financial Statements...20 Stock Information...................................21 Corporate Data / Investor Information .....22 * The financial data in this report are prepared from the financial statements issued for domestic reporting purpose in accordance with the provisions set forth in the Japanese Securities and Exchange Law and accounting principles generally accepted in Japan. 1 We are pleased to report to you that on a consolidated basis we “Delivering Good Health and Reliability,” in order to further expand achieved our highest levels ever for both net sales and ordinary our operations. In so doing, we will work to fully maximize the income. Net -

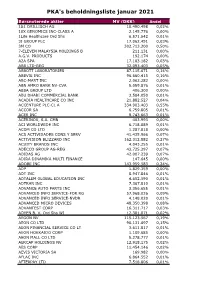

PKA's Beholdningsliste Januar 2021

PKA's beholdningsliste januar 2021 Børsnoterede aktier MV (DKK) Andel 1&1 DRILLISCH AG 10.490.498 0,02% 10X GENOMICS INC-CLASS A 2.145.776 0,00% 1Life Healthcare Ord Shs 6.571.542 0,01% 3I GROUP PLC 17.062.491 0,03% 3M CO 302.713.200 0,50% 7-ELEVEN MALAYSIA HOLDINGS B 211.131 0,00% A.G.V. PRODUCTS 192.174 0,00% A2A SPA 17.183.182 0,03% ABB LTD-REG 32.093.403 0,05% ABBOTT LABORATORIES 87.115.671 0,14% ABBVIE INC 96.660.415 0,16% ABC-MART INC 2.062.282 0,00% ABN AMRO BANK NV-CVA 5.059.876 0,01% ABSA GROUP LTD 406.300 0,00% ABU DHABI COMMERCIAL BANK 3.584.050 0,01% ACADIA HEALTHCARE CO INC 21.882.527 0,04% ACCENTURE PLC-CL A 334.903.403 0,55% ACCOR SA 6.759.805 0,01% ACER INC 8.743.663 0,01% ACERINOX, S.A. CMN 403.993 0,00% ACI WORLDWIDE INC 6.718.889 0,01% ACOM CO LTD 1.287.818 0,00% ACS ACTIVIDADES CONS Y SERV 41.435.966 0,07% ACTIVISION BLIZZARD INC 162.312.882 0,27% ACUITY BRANDS INC 4.043.255 0,01% ADECCO GROUP AG-REG 43.725.297 0,07% ADIDAS AG 42.007.239 0,07% ADIRA DINAMIKA MULTI FINANCE 147.645 0,00% ADOBE INC 143.959.583 0,24% ADP 1.829.359 0,00% ADT INC 8.947.846 0,01% ADTALEM GLOBAL EDUCATION INC 4.652.590 0,01% ADTRAN INC 7.367.810 0,01% ADVANCE AUTO PARTS INC 3.356.655 0,01% ADVANCED INFO SERVICE-FOR RG 57.968.026 0,09% ADVANCED INFO SERVICE-NVDR 4.148.020 0,01% ADVANCED MICRO DEVICES 48.350.398 0,08% ADVANTEST CORP 16.311.717 0,03% ADYEN B. -

Document De Référence 2014 Document De Référence

DOCUMENT DE RÉFÉRENCE 2014 DBV TECHNOLOGIES 2014 DOCUMENT DE RÉFÉRENCE DOCUMENT 2014 DE RÉFÉRENCE DBV TECHNOLOGIES Société Anonyme au capital de 1 966 166,10 euros Green Square Bâtiment D, 80/84 rue des Meuniers 92220 Bagneux 441 772 522 R.C.S. Nanterre En application de son règlement général, notamment de l’article 212-13, l’Autorité des marchés financiers a enregistré le présent document de référence le 02 juillet 2015 sous le numéro R.15-057. Ce document ne peut être utilisé à l’appui d’une opération financière que s’il est complété par une note d’opération visée par l’AMF. Il a été établi par l’émetteur et engage la responsabilité de ses signataires. L’enregistrement, conformément aux dispositions de l’article L. 621-8-1-I du code monétaire et financier, a été effectué après que l’AMF a vérifié que le document est complet et compréhensible et que les informations qu’il contient sont cohérentes. Il n’implique pas l’authentification par l’AMF des éléments comptables et financiers présentés. Incorporation par référence : En application de l’article 28 du règlement européen 809/2004, les éléments suivants sont inclus par référence dans le présent document de référence : • Les comptes annuels établis conformément aux principes comptables français au 31 décembre 2013, les comptes établis selon le référentiel IFRS tel qu’adoptés dans l’Union européenne au 31 décembre 2013, et les rapports des commissaires aux comptes y afférents, présentés respectivement aux pages 153 à 190, 191 à 208, 209 et 210-211 du documents de référence n° R.14-017 enregistré par l’Autorités des marchés financiers le 16 avril 2014 ; • Les comptes annuels établis conformément aux principes comptables français au 31 décembre 2012, les comptes établis selon le référentiel IFRS tel qu’adoptés dans l’Union européenne au 31 décembre 2012, et les rapports des commissaires aux comptes y afférents, présentés respectivement aux pages 134 à 162, 163 à 178, 180, 181-182 du document de référence n° R.13-015 enregistré par l’Autorité des marchés financiers le 24 avril 2013. -

Demae-Can / 2484

Demae-can / 2484 COVERAGE INITIATED ON: 2017.12.25 LAST UPDATE: 2021.06.25 Shared Research Inc. has produced this report by request from the company discussed herein. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, neutral analysis. To highlight any biases, we clearly attribute our data and findings. We always present opinions from company management as such. The views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. Demae-can / 2484 RCoverage LAST UPDATE: 2021.06.25 Research Coverage Report by Shared Research Inc. | https://sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the Trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the later Business section. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 5 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- 6 Highlights ------------------------------------------------------------------------------------------------------------------------------------------------------------ -

Selectively Hedged Global Equity Portfolio-Institutional Class As of March 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Selectively Hedged Global Equity Portfolio-Institutional Class As of March 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a fund-of-funds and generally allocates its assets among other mutual funds, but has the ability to invest in securities and derivatives directly. The holdings listed below contain both the investment holdings of the corresponding underlying funds as well as any direct investments of the fund. -

Japan-Brazil Space Sector Workshop Agenda

Japan-Brazil Space Sector Workshop Sergio Sobral de Oliveira Auditorium (IAI building) INPE’s headquarters São José dos Campos, SP, Brazil Agenda Day1: August 26 Welcome and Opening Remarks 9:00 João BRAGA: Vice Director and Coordinator of Regional Centers, INPE 9:05 Himilcon de Castro CARVALHO: Director of Space Policy and Strategic Investments, AEB 9:10 Tomonori NISHIMURA: Chairman of Space Industry Mission, Senior Vice President, NEC Corporation 9:15 Shuichi KANEKO: Director, Space Industry Office, Ministry of Economy, Trade and Industry (METI) 9:20 Introduction of Participants Brazilian Space Activities – Part 1: Space Program and Space Engineering 9:40 Overview of the Brazilian Space Program – AEB - Himilcon de Castro CARVALHO 9:50 INPE - Institutional Video 10:10 Space Engineering and Technology (ETE-INPE) – Mario QUINTINO 10:20 Integration and Testing Laboratory (LIT-INPE) – Ciro HERNANDES 10:30 Satellite Tracking and Control Center (CRC – INPE) – Pawel ROZENFELD 10:40 Q&A / Discussions 11:00 - 11:15: Break Japanese Space Industry – Part 1 11:15 Shigeyoshi HATA: Senior Vice President: The Society of Japanese Aerospace Companies(SJAC) [Satellite System] 11:25 ・NEC Corporation - Shigeki KUZUOKA 11:35 ・Mitsubishi Electric Corporation - Tadahiko INADA [Launch Vehicle] 11:45 ・IHI Aerospace Co., Ltd. - Shigeki KINAI 11:55 ・Mitsubishi Heavy Industries, Ltd. - Shoichiro ASADA 12:05 ・IHI Corporation - Kazunori KAWASAKI 12:15 Q&A / Discussions 13:00 - 14:15: Lunch Break Brazilian Space Industry 14:30 ・Brazilian Aerospace Private Sector (AIAB) – Walter BARTELS 14:50 ・Equatorial – César GHIZONI 15:10 ・Fibraforte - Jadir Nogueira BARBOSA 15:30 ・Star One – Lincoln OLIVEIRA 16:00 Q&A / Discussions 16:15 - 16:30: Break Japanese Space Industry - Part 2 [Satellite Application Service] 16:30 ・Mitsubishi Corporation– George TAKAHASHI 16:45 ・SKY Perfect JSAT Corporation - Takaomi NAGASHIMA 17:00 ・PASCO CORPORATION – Kenichi MIYAKAWA 17:15 ・Japan Space Imaging Corporation (JSI) - Masahiro ONUKI 17:30 ・Hitachi, Ltd. -

2013 Annual Report on Form 10-K

Annual Report 13 Create Meaningful Connections About LivePerson LivePerson, Inc. (NASDAQ: LPSN, TASE: LPSN) offers a cloud-based platform that enables businesses to proactively connect in real-time with their customers via chat, voice, and content delivery at the right time, through the right channel, including websites, social media, and mobile devices. This "intelligent engagement" is driven by real-time behavioral analytics, producing connections based on a true understanding of business objectives and customer needs. More than 8,500 companies rely on LivePerson's platform to increase conversions and improve customer experience, including Cisco, Hewlett-Packard, IBM, Microsoft, Verizon, Sky, Walt Disney, PNC and Orbitz. LivePerson is headquartered in New York City with offices in Atlanta, Amsterdam, London, Melbourne, San Francisco, Santa Monica, Tokyo and Tel Aviv. Annual Revenue (in millions) Quarterly Revenue (in millions) 2011 2012 2013 $180 $50 46.9 178 45.2 $160 $45 43.2 42.5 42.5 157 $40 39.7 $140 38.5 36.8 36.5 $35 34.3 133 31.9 $120 30.4 $30 $100 110 $25 $80 87 $20 $60 $15 $40 $10 $20 2009 2010 2011 2012 2013 Q1 Q2 Q3 Q4 Safe Harbor Statement Statements in this report regarding LivePerson that are not historical facts are forward-looking statements and are subject to risks and uncertainties that could cause actual future events or results to differ materially from such statements. Any such forward-looking statements, including but not limited to financial guidance, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.