Securities Report 163Rd Fiscal Term (April 1, 2006 to March 31, 2007)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NISSHIN SEIFUN GROUP INC. a Message from the Management

Delivering Good Health and Reliability To Shareholders Business Report 2004 (April 1, 2003 to March 31, 2004) NISSHIN SEIFUN GROUP INC. A Message from the Management CONTENTS A Message from the Management .............1 Interview with the Chairman and the President ....................................3 Feature: Redistributing Profits to Shareholders.......................................7 Feature: Food Product Safety Initiatives ....8 Topics......................................................9 Outline of Nisshin Seifun Group ...............11 Review of Operations..............................13 Osamu Shoda Hiroshi Hasegawa New Products.........................................16 Chairman President Consolidated Financial Highlights ..............17 Forecast for Consolidated Business Performance...........................17 Consolidated Financial Statements..........19 Non-Consolidated Financial Statements...20 Stock Information...................................21 Corporate Data / Investor Information .....22 * The financial data in this report are prepared from the financial statements issued for domestic reporting purpose in accordance with the provisions set forth in the Japanese Securities and Exchange Law and accounting principles generally accepted in Japan. 1 We are pleased to report to you that on a consolidated basis we “Delivering Good Health and Reliability,” in order to further expand achieved our highest levels ever for both net sales and ordinary our operations. In so doing, we will work to fully maximize the income. Net -

Putnam Panagora Market Neutral Fund Q3 Portfolio Holdings

Putnam PanAgora Market Neutral Fund The fund's portfolio 5/31/20 (Unaudited) INVESTMENT COMPANIES (46.1%)(a) Shares Value Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. 640 $3,635 State Street Institutional U.S. Government Money Market Fund 3,939,067 3,939,067 Total investment companies (cost $3,943,561) $3,942,702 UNITS (11.0%)(a) Units Value Acamar Partners Acquisition Corp.(NON) 419 $4,291 Alussa Energy Acquisition Corp. (Cayman Islands)(NON) 856 8,483 Amplitude Healthcare Acquisition Corp.(NON) 2,947 29,529 B. Riley Principal Merger Corp. II(NON) 2,620 26,174 CC Neuberger Principal Holdings I(NON) 2,652 27,024 Chardan Healthcare Acquisition 2 Corp.(NON) 2,652 26,493 CHP Merger Corp.(NON) 2,747 27,745 CIIG Merger Corp.(NON) 4,529 45,335 Collective Growth Corp.(NON) 2,803 27,890 DFP Healthcare Acquisitions Corp.(NON) 2,866 28,746 dMY Technology Group, Inc.(NON) 2,885 29,196 East Stone Acquisition Corp.(NON) 4,230 42,089 FinServ Acquisition Corp.(NON) 831 8,194 Foley Trasimene Acquisition Corp.(NON) 2,626 26,917 Fortress Value Acquisition Corp.(NON) 2,652 26,547 Galileo Acquisition Corp.(NON) 888 8,827 GigCapital3, Inc.(NON) 2,833 28,160 Gores Holdings IV, Inc.(NON) 1,306 13,844 Greenrose Acquisition Corp.(NON) 3,350 32,931 GX Acquisition Corp.(NON) 417 4,233 Healthcare Merger Corp.(NON) 2,705 28,105 InterPrivate Acquisition Corp.(NON) 2,918 29,180 Jaws Acquisition Corp.(NON) 2,620 27,038 Juniper Industrial Holdings, Inc.(NON) 841 8,418 Landcadia Holdings II, Inc.(NON) 1,165 12,174 LGL Systems Acquisition Corp.(NON) 2,568 25,629 Lifesci Acquisition Corp.(NON) 2,866 29,806 LIV Capital Acquisition Corp. -

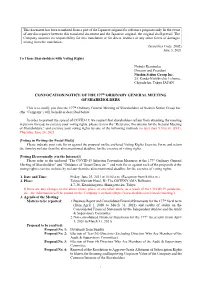

Convocation Notice of the 170 Ordinary General

This document has been translated from a part of the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. (Securities Code: 2002) June 4, 2014 To Those Shareholders with Voting Rights Hiroshi Oeda Director and President Nisshin Seifun Group Inc. 25, Kanda-Nishiki-cho 1-chome, Chiyoda-ku, Tokyo JAPAN CONVOCATION NOTICE OF THE 170th ORDINARY GENERAL MEETING OF SHAREHOLDERS You are cordially invited to attend the 170th Ordinary General Meeting of Shareholders of Nisshin Seifun Group Inc. (the “Company”). The meeting will be held as described below. If you are unable to attend the meeting, you can exercise your voting rights by one of the following methods. Please review the “Reference Documents for the General Meeting of Shareholders,” and exercise your voting rights by 7:00 p.m. (JST), Wednesday, June 25, 2014. [Voting in Writing (by Postal Mail)] Please indicate your vote for or against each of the proposals on the enclosed Voting Rights Exercise Form, and return the form by no later than the aforementioned deadline for the exercise of voting rights. [Voting Electronically (via the Internet)] Please refer to the enclosed “Exercising your Voting Rights via the Internet,” and vote for or against each of the proposals at the voting rights exercise website (http://www.web54.net) by no later than the aforementioned deadline for the exercise of voting rights. -

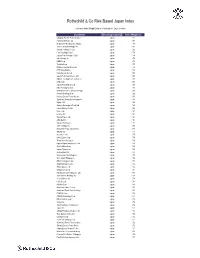

Rothschild & Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chugoku Electric Power Co Inc/ Japan 1.01 Yamada Denki Co Ltd Japan 0.91 McDonald's Holdings Co Japan L Japan 0.88 Sushiro Global Holdings Ltd Japan 0.82 Skylark Holdings Co Ltd Japan 0.82 Fast Retailing Co Ltd Japan 0.78 Japan Post Holdings Co Ltd Japan 0.78 Ain Holdings Inc Japan 0.78 KDDI Corp Japan 0.77 Toshiba Corp Japan 0.75 Mizuho Financial Group Inc Japan 0.74 NTT DOCOMO Inc Japan 0.73 Kobe Bussan Co Ltd Japan 0.72 Japan Post Insurance Co Ltd Japan 0.69 Nippon Telegraph & Telephone C Japan 0.69 LINE Corp Japan 0.69 Japan Post Bank Co Ltd Japan 0.68 Nitori Holdings Co Ltd Japan 0.67 MS&AD Insurance Group Holdings Japan 0.66 Konami Holdings Corp Japan 0.66 Kyushu Electric Power Co Inc Japan 0.65 Sumitomo Realty & Development Japan 0.65 Fujitsu Ltd Japan 0.63 Suntory Beverage & Food Ltd Japan 0.63 Japan Airlines Co Ltd Japan 0.62 NEC Corp Japan 0.61 Lawson Inc Japan 0.60 Sekisui House Ltd Japan 0.60 ABC-Mart Inc Japan 0.60 Kyushu Railway Co Japan 0.60 ANA Holdings Inc Japan 0.59 Mitsubishi Heavy Industries Lt Japan 0.58 ORIX Corp Japan 0.57 Secom Co Ltd Japan 0.57 Seiko Epson Corp Japan 0.56 Trend Micro Inc/Japan Japan 0.56 Nippon Paper Industries Co Ltd Japan 0.56 Suzuki Motor Corp Japan 0.56 Japan Tobacco Inc Japan 0.55 Aozora Bank Ltd Japan 0.55 Sony Financial Holdings Inc Japan 0.55 West Japan Railway Co Japan 0.54 MEIJI Holdings Co Ltd Japan 0.54 Sugi Holdings Co Ltd Japan 0.54 Tokyo -

CONVOCATION NOTICE of the 177Th ORDINARY GENERAL MEETING of SHAREHOLDERS

This document has been translated from a part of the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. (Securities Code: 2002) June 3, 2021 To Those Shareholders with Voting Rights Nobuki Kemmoku Director and President Nisshin Seifun Group Inc. 25, Kanda-Nishiki-cho 1-chome, Chiyoda-ku, Tokyo JAPAN CONVOCATION NOTICE OF THE 177th ORDINARY GENERAL MEETING OF SHAREHOLDERS This is to notify you that the 177th Ordinary General Meeting of Shareholders of Nisshin Seifun Group Inc. (the “Company”) will be held as described below. In order to prevent the spread of COVID-19, we request that shareholders refrain from attending the meeting in person. Instead, to exercise your voting rights, please review the “Reference Documents for the General Meeting of Shareholders,” and exercise your voting rights by one of the following methods no later than 5:30 p.m. (JST), Thursday, June 24, 2021. [Voting in Writing (by Postal Mail)] Please indicate your vote for or against the proposal on the enclosed Voting Rights Exercise Form, and return the form by no later than the aforementioned deadline for the exercise of voting rights. [Voting Electronically (via the Internet)] Please refer to the enclosed “The COVID-19 Infection Prevention Measures at the 177th Ordinary General Meeting of Shareholders” and “Guidance of ‘Smart Exercise,’” and vote for or against each of the proposals at the voting rights exercise website by no later than the aforementioned deadline for the exercise of voting rights. -

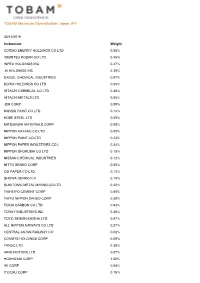

TOBAM Maximum Diversification Japan JPY

TOBAM Maximum Diversification Japan JPY 30/12/2019 Instrument Weight COSMO ENERGY HOLDINGS CO LTD 0.05% IDEMITSU KOSAN CO LTD 0.46% INPEX HOLDINGS INC 0.47% JX HOLDINGS INC 0.35% DAICEL CHEMICAL INDUSTRIES 0.07% DOWA HOLDINGS CO LTD 0.05% HITACHI CHEMICAL CO LTD 0.38% HITACHI METALS LTD 0.05% JSR CORP 0.09% KANSAI PAINT CO LTD 0.14% KOBE STEEL LTD 0.05% MITSUBISHI MATERIALS CORP 0.08% NIPPON KAYAKU CO LTD 0.05% NIPPON PAINT CO LTD 0.23% NIPPON PAPER INDUSTRIES CO L 0.24% NIPPON SHOKUBAI CO LTD 0.18% NISSAN CHEMICAL INDUSTRIES 0.12% NITTO DENKO CORP 0.05% OJI PAPER CO LTD 0.13% SHOWA DENKO K K 0.10% SUMITOMO METAL MINING CO LTD 0.20% TAIHEIYO CEMENT CORP 0.05% TAIYO NIPPON SANSO CORP 0.30% TOKAI CARBON CO LTD 0.93% TORAY INDUSTRIES INC 0.26% TOYO SEIKAN KAISHA LTD 0.07% ALL NIPPON AIRWAYS CO LTD 0.27% CENTRAL JAPAN RAILWAY CO 0.02% COMSYS HOLDINGS CORP 0.09% FANUC LTD 0.38% HINO MOTORS LTD 0.07% HOSHIZAKI CORP 1.50% IHI CORP 0.08% ITOCHU CORP 0.16% TOBAM Maximum Diversification Japan JPY 30/12/2019 Instrument Weight JAPAN AIRLINES CO LTD 0.49% JGC HOLDINGS CORP 0.09% JS GROUP CORP 0.85% KEIHAN ELECTRIC RAILWAY CO 0.13% KEIO CORP 0.18% KINTETSU CORP 0.26% KOMATSU LTD 0.07% KYOWA EXEO CORP 0.06% KYUSHU RAILWAY COMPANY 0.13% MAKITA CORP 0.22% MITSUBISHI CORP 0.69% MITSUBISHI HEAVY INDUSTRIES 0.31% NAGOYA RAILROAD CO LTD 0.14% NANKAI ELECTRIC RAILWAY CO 0.08% OBAYASHI CORP 0.13% ODAKYU ELECTRIC RAILWAY CO 0.20% PARK24 CO LTD 1.15% RECRUIT HOLDINGS CO LTD 0.10% SANKYU INC 0.07% SECOM CO LTD 0.06% SEIBU HOLDINGS INC 0.09% SEINO HOLDINGS CO LTD -

Corporate Profile

Corporate Profile Namiki Shoji Co., Ltd.: A trading company involved in marketing pharmaceuticals, compounds for drug discovery, intermediates, and health foods; and providing various biological evaluation services of compounds. Continues to be chosen as a strategic partner by numerous clients, including major Japanese pharmaceutical companies. Launched in 1974 as a company trading in raw materials of generic pharmaceuticals. We later started importing and marketing drug-discovery compounds (compounds for new drug development), first time in Japan. We continue to supply high-quality drug-discovery compounds and intermediates required at the cutting edge of new drug development, and we are holding a firm position with a top share in this field. With the support of our Pharmaceutical Dept., Drug Discovery Chemicals Dept., and Biological Research Dept., we constantly strive to supply products and services giving our clients 100% satisfaction. We hope, by means of these commercial activities, to play a significant role in radical new drug development, and our satisfaction lies in any contribution to human health. 1 Corporate Profile Greetings from the President "By mutually beneficial commercial activities, we grow together with our clients" Tatsuya Namiki Company President With our philosophy of "By mutually beneficial commercial activities, we grow together with our clients", at Namiki Shoji our aim is to expand our business energetically, in our role as the strategic partner of pharmaceutical companies. Since the founding of Namiki Shoji, we have constantly striven to develop radical new products and services to satisfy our clients, in a creative manner, rising to all challenges presented. Our business now has two pillars: Pharmaceuticals, and compounds for drug discovery. -

A List of Companies and Organizations for Human Rights Due Diligence Workshop in Japan

A list of Companies and Organizations for Human Rights Due Diligence Workshop in Japan *This list shows companies and organizations that participated in Human Rights Due Diligence Workshop in Japan *Names of the participants are listed in final reports of each year`s workshop. Developed on 3rd of April, 2020 A list of Companies for the Workshop Asahi Glass Co., Ltd., ASICS Corporation, Ajinomoto Co., Inc., ANA HOLDINGS INC., ABeam Consulting Ltd., ALPSELECTRICCO.,LTD., ANRITSU CORPORATION, E-Square Inc, EQ Management Limited, AEON CO., LTD., Insight Consulting Inc., The Walt Disney Company (Japan) Ltd., SGS Japan Inc., SG Holdings Co., Ltd., NTT DATA Corporation, NTT DOCOMO, INC., KAO Corporation, Kawasaki Kisen Kaisha, Ltd., Kawasaki Heavy Industries, Ltd., Casley Consulting, Inc., Kewpie Corporation, Kyodo Printing Co., Ltd., QUICK Corp ESG Research Center, Cuore C3 Co., Ltd., KUREHA CORPORATION, KOSÉ Corporation, INPEX CORPORATION, KONICA MINOLTA, INC., SUSCOM, Sanofi K.K., YUIDEA Inc., JSR Corporation, JCB Co., Ltd., Shiseido Company, Limited, NIPPON STEEL ENGINEERING CO., LTD., Sumitomo Chemical Company, Limited, SEKISUI CHEMICAL CO., LTD., Seven & i Holdings Co., Ltd., Sony Corporation, Sompo Risk Management Inc., DAIICHI SANKYO COMPANY, LIMITED, Takenaka Corporation, Duskin Co., Ltd., CHUGAI PHARMACEUTICAL CO., LTD., TDK Corporation, Teijin Limited, Taylor Made Golf Company, Inc., Deloitte Tohmatsu Consulting LLC, TOKIO MARINE & NICHIDO RISK CONSULTING CO.,LTD., Tokyo Foundation, TOSHIBA CORPORATION, TOTO LTD., TOYO SEIKAN GROUP -

Convocation Notice of the 169 Ordinary General Meeting

This document has been translated from a part of the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. The Company assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. (Securities Code: 2002) June 4, 2013 To Those Shareholders with Voting Rights Hiroshi Oeda Director and President Nisshin Seifun Group Inc. 25, Kanda-Nishiki-cho 1-chome, Chiyoda-ku, Tokyo JAPAN CONVOCATION NOTICE OF THE 169th ORDINARY GENERAL MEETING OF SHAREHOLDERS You are cordially invited to attend the 169th Ordinary General Meeting of Shareholders of Nisshin Seifun Group Inc. (the “Company”). The meeting will be held as described below. If you are unable to attend the meeting, you can exercise your voting rights by one of the following methods. Please review the “Reference Documents for the General Meeting of Shareholders,” and exercise your voting rights by 7:00 p.m. (JST), Tuesday, June 25, 2013. [Voting in Writing (by Postal Mail)] Please indicate your vote for or against each of the proposals on the enclosed Voting Rights Exercise Form, and return the form by no later than the aforementioned deadline for the exercise of voting rights. [Voting Electronically (via the Internet)] Please vote for or against each of the proposals at the voting rights exercise website (http://www.web54.net) by the aforementioned deadline for the exercise of voting rights. 1. Date and Time: Wednesday, June 26, 2013 at 10:00 a.m. 2. -

Published on 7 October 2015 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 30 October 2015) Published on 7 October 2015 1. Constituents Change Addition( 80 ) Deletion( 72 ) Code Issue Code Issue 1712 Daiseki Eco.Solution Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 1930 HOKURIKU ELECTRICAL CONSTRUCTION CO.,LTD. 2410 CAREER DESIGN CENTER CO.,LTD. 2183 Linical Co.,Ltd. 2692 ITOCHU-SHOKUHIN Co.,Ltd. 2198 IKK Inc. 2733 ARATA CORPORATION 2266 ROKKO BUTTER CO.,LTD. 2735 WATTS CO.,LTD. 2372 I'rom Group Co.,Ltd. 3004 SHINYEI KAISHA 2428 WELLNET CORPORATION 3159 Maruzen CHI Holdings Co.,Ltd. 2445 SRG TAKAMIYA CO.,LTD. 3204 Toabo Corporation 2475 WDB HOLDINGS CO.,LTD. 3361 Toell Co.,Ltd. 2729 JALUX Inc. 3371 SOFTCREATE HOLDINGS CORP. 2767 FIELDS CORPORATION 3396 FELISSIMO CORPORATION 2931 euglena Co.,Ltd. 3580 KOMATSU SEIREN CO.,LTD. 3079 DVx Inc. 3636 Mitsubishi Research Institute,Inc. 3093 Treasure Factory Co.,LTD. 3639 Voltage Incorporation 3194 KIRINDO HOLDINGS CO.,LTD. 3669 Mobile Create Co.,Ltd. 3197 SKYLARK CO.,LTD 3770 ZAPPALLAS,INC. 3232 Mie Kotsu Group Holdings,Inc. 4007 Nippon Kasei Chemical Company Limited 3252 Nippon Commercial Development Co.,Ltd. 4097 KOATSU GAS KOGYO CO.,LTD. 3276 Japan Property Management Center Co.,Ltd. 4098 Titan Kogyo Kabushiki Kaisha 3385 YAKUODO.Co.,Ltd. 4275 Carlit Holdings Co.,Ltd. 3553 KYOWA LEATHER CLOTH CO.,LTD. 4295 Faith, Inc. 3649 FINDEX Inc. 4326 INTAGE HOLDINGS Inc. 3660 istyle Inc. 4344 SOURCENEXT CORPORATION 3681 V-cube,Inc. 4671 FALCO HOLDINGS Co.,Ltd. 3751 Japan Asia Group Limited 4779 SOFTBRAIN Co.,Ltd. 3844 COMTURE CORPORATION 4801 CENTRAL SPORTS Co.,LTD. -

Calvert VP EAFE International Index Portfolio 1St Quarter Holdings

Calvert VP EAFE International Index Portfolio March 31, 2020 Schedule of Investments (Unaudited) Common Stocks — 98.5% Security Shares Value Australia (continued) Security Shares Value Australia — 5.8% Ramsay Health Care, Ltd. 1,442 $ 50,704 REA Group, Ltd. 537 25,155 AGL Energy, Ltd. 6,090 $ 63,734 Rio Tinto, Ltd. 3,172 163,420 Alumina, Ltd.(1) 14,501 12,996 Santos Ltd., 13,517 27,761 AMP,Ltd.(1)(2) 22,416 18,306 Scentre Group 45,895 43,959 APA Group(1) 11,361 72,094 Seek, Ltd.(1) 3,323 30,366 Aristocrat Leisure, Ltd. 4,773 61,847 Sonic Healthcare, Ltd. 4,020 60,420 ASX, Ltd. 1,623 76,185 South32, Ltd. 48,353 53,377 Aurizon Holdings, Ltd. 16,477 42,701 Stockland 19,317 29,704 AusNet Services(1) 27,031 28,383 Suncorp Group, Ltd.(1) 11,330 62,918 Australia & New Zealand Banking Group, Ltd. 24,210 253,900 Sydney Airport 8,748 30,225 Bendigo & Adelaide Bank, Ltd. 4,706 18,080 Tabcorp Holdings, Ltd.(1) 15,814 24,474 BGP Holdings PLC(2)(3) 77,172 — Telstra Corp., Ltd. 37,215 69,858 BHP Group, Ltd. 26,250 476,209 TPG Telecom, Ltd.(1) 3,460 14,735 BlueScope Steel, Ltd. 4,388 22,973 Transurban Group(1) 24,274 180,808 Boral, Ltd. 10,917 13,712 Treasury Wine Estates, Ltd. 6,449 40,039 Brambles, Ltd. 14,024 90,648 Vicinity Centres 25,959 16,238 Caltex Australia, Ltd. 1,867 25,210 Washington H. -

Ief-I Q3 2020

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 96.98% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 1,012 2,330 2,115 ACCENT GROUP LTD 3,078 2,769 3,636 ADBRI LTD 222,373 489,412 455,535 AFTERPAY LTD 18,738 959,482 1,095,892 AGL ENERGY LTD 3,706 49,589 36,243 ALTIUM LTD 8,294 143,981 216,118 ALUMINA LTD 4,292 6,887 4,283 AMP LTD 15,427 26,616 14,529 ANSELL LTD 484 8,876 12,950 APA GROUP 14,634 114,162 108,585 APPEN LTD 11,282 194,407 276,316 AUB GROUP LTD 224 2,028 2,677 AUSNET SERVICES 9,482 10,386 12,844 AUSTRALIA & NEW ZEALAND BANKIN 19,794 340,672 245,226 AUSTRALIAN PHARMACEUTICAL INDU 4,466 3,770 3,377 BANK OF QUEENSLAND LTD 1,943 13,268 8,008 BEACH ENERGY LTD 3,992 4,280 3,824 BEGA CHEESE LTD 740 2,588 2,684 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 11,180 BHP GROUP LTD 16,897 429,820 435,111 BHP GROUP PLC 83,670 1,755,966 1,787,133 BLUESCOPE STEEL LTD 9,170 73,684 83,770 BORAL LTD 6,095 21,195 19,989 BRAMBLES LTD 135,706 987,557 1,022,317 BRICKWORKS LTD 256 2,997 3,571 BWP TRUST 2,510 6,241 7,282 CENTURIA INDUSTRIAL REIT 1,754 3,538 3,919 CENTURIA OFFICE REIT 154,762 199,550 226,593 CHALLENGER LTD 2,442 13,473 6,728 CHAMPION IRON LTD 1,118 2,075 2,350 CHARTER HALL LONG WALE REIT 2,392 8,444 8,621 CHARTER HALL RETAIL REIT 174,503 464,770 421,358 CHARTER HALL SOCIAL INFRASTRUC 1,209 2,007 2,458 CIMIC GROUP LTD 4,894 73,980 65,249 COCA-COLA AMATIL LTD 2,108 12,258 14,383 COCHLEAR LTD 1,177 155,370 167,412 COMMONWEALTH BANK OF AUSTRALIA 12,637 659,871 577,971 CORONADO GLOBAL RESOURCES INC 1,327