European Esg-Sri Virtual Conference

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PARETURN Société D'investissement À Capital Variable RCS Luxembourg N° B 47 104 Annual Report Including Audited Financial Statements As at September 30, 2018 PARETURN

PARETURN Société d'Investissement à Capital Variable RCS Luxembourg N° B 47 104 Annual Report including Audited Financial Statements as at September 30, 2018 PARETURN Pareturn Best Selection Pareturn Best Selection Side - Pocket Pareturn Croissance 2000 Pareturn Cartesio Equity Pareturn Cartesio Income Pareturn Stamina Systematic* Pareturn Stamina Systematic Plus* Pareturn Mutuafondo Global Fixed Income Pareturn Barwon Listed Private Equity Pareturn Global Balanced Unconstrained Pareturn Cervino World Investments Pareturn Entheca Patrimoine Pareturn Ataun Pareturn Invalux Fund Pareturn Gladwyne Absolute Credit Pareturn Mutuafondo España Lux Pareturn EtendAR* Pareturn GVC Gaesco Patrimonial Fund Pareturn GVC Gaesco Euro Small Caps Equity Fund Pareturn GVC Gaesco Absolute Return Fund Pareturn GVC Gaesco Columbus European Mid-Cap Equity Fund* Pareturn Mapfre Euro Bonds Fund* Pareturn Diversified Fund Pareturn Security Latam Corporate Debt Pareturn Rivendale Pareturn Fidelius Global Pareturn Santalucia Espabolsa (Luxembourg)* Pareturn Santalucia Fonvalor* PARETURN Pareturn Imantia USD Global High Yield Bond No subscription can be received on the basis of these financial statements. Subscriptions are only valid if made on the basis of the current prospectus and relevant Key Investor Information Document ("KIID") which will be accompanied by a copy of the latest annual report including audited financial statements and a copy of the latest available unaudited semi-annual report, if published after such annual report. * Please see note 1 for -

Financial Report and Registration Document 2018 Contents

FINANCIAL REPORT AND REGISTRATION DOCUMENT 2018 CONTENTS Editorial from the Chairman and CEO 2 An extensive and diversified offering 4 5 Consolidated Financial Statements 199 Business model 6 5.1. Financial Statements 200 5.2. Notes to the Consolidated Financial Corporate Social Responsibility 8 Statements 205 5.3. Statutory Auditors’ report Board of Directors 10 on the consolidated fi nancial statements 268 5.4. History of signifi cant consolidated items Key figures 2018 12 and ratios 273 1 Introduction to the Group 15 6 Company financial statements 275 1.1. Business sector 16 6.1. Financial statements 276 1.2. A profi table growth strategy 19 6.2. Notes to the SEB S.A. fi nancial statements 278 1.3. Organization and internal control 29 6.3. Five-year fi nancial summary 294 1.4. Risk factors 36 6.4. Statutory auditors’ report on the fi nancial statements 295 2 Corporate governance 53 7 Information concerning the company 2.1. Implementation framework for corporate governance principles 54 and its share capital 299 2.2. Management structure 54 7.1. Information concerning the company 300 2.3. Composition, organization and operation 7.2. Information on share capital 303 of the Board of Directors 55 7.3. Financial authorizations 309 2.4. Group management bodies 82 7.4. Employee shareholding 310 2.5. Remuneration policy 83 7.5. Stock market and dividend information 313 3 Corporate Social Responsibility 113 8 Annual General Meeting 315 3.1. Commitment and management 114 8.1. Agenda for the Combined Annual General 3.2. Non-Financial Performance Statement Meeting of 22 May 2019 316 (DPEF) & Duty of Vigilance 117 8.2. -

The Most Attractive Employers in the France Professionals

The Most Attractive Employers in the France Professionals 1 About us Universum is a global leader in employer branding. Over the past 30 years, we have established ourselves in 50 markets globally and our diverse workforce is physically present in 20 countries. Our services include actionable research, strategic consulting, and data-driven communications and social media solutions for talent branding, sourcing, and analytics. We are a trusted partner to over 1,700 clients, including many Fortune 500 companies, as well as to global media partners that publish our annual rankings and trend reports. We work with over 2,000 universities, alumni groups, and professional organizations to gather insights from students and professionals in order to advise employers on how to attract and retain talent that fits their culture and purpose. On an annual basis, Universum surveys over 1,500,000 students and professionals worldwide. Did your company rank in the top 100? Learn more Please contact us to receive your badge. 2 Where do you rank? AN ESSENTIAL RESOURCE by the respondents. It’s so important to secure the very best young ACTIONABLE ASSESSMENTS talent out there, which is why HR and C-level But this preview is only the beginning. By leaders around the world refer to Universum’s becoming a member you can access research. Drawing on the opinions of more Universum’s full report, which contains than 10.000 professionals in France, this company-specific findings and custom insights preview of the 2018 Talent Survey gives a and recommendations that are critical when it clear indication of where your organization comes to developing your employer branding ranks when it comes to its potential to attract strategy. -

Business Proposals in View of a 2015 International Climate Change Agreement at COP 21 in Paris

20 May 2015 Business proposals in view of a 2015 international climate change agreement at COP 21 in Paris * By May 20th 2015, Chairmen / Chief Executive Officers (CEOs) of 59 international companies and 7 organizations already support the “Business proposals for COP 21”. In order to ensure worldwide awareness of the Business community before COP 21, they call on their counterparts to join them in the coming weeks before the September Climate Week in New York (contact: [email protected] jointly managed by French Business Associations: MEDEF, Afep and Cercle de l’Industrie). 7 supporting organizations: UN GLOBAL President of Business Europe Afep Cercle de l’Industrie MEDEF SYNTEC INGENIERIE COMPACT WBCSD Emma Pierre PRINGUET Philippe VARIN Pierre GATTAZ Nicolas JACHIET Peter BAKKER MARCEGAGLIA President President President President President 59 supporting Chairmen / CEOs from international companies: AIRBUS GROUPE AIR LIQUIDE ALSTOM AREVA ARKEMA AVIVA France AXA Denis RANQUE Benoît POTIER Patrick KRON Philippe VARIN Thierry le HENAFF Nicolas SCHIMEL Henri de CASTRIES Chairman Chairman & CEO Chairman & CEO Chairman Chairman & CEO CEO Chairman & CEO BASF BNP PARIBAS BOUYGUES BPCE COMPAGNIE DE SAINT CREDIT AGRICOLE SA DCNS Kurt BOCK Jean LEMIERRE Martin BOUYGUES François PEROL GOBAIN Jean-Marie SANDER Hervé GUILLOU Chairman & CEO Chairman Chairman & CEO Chairman Pierre-André de Chairman & CEO Chairman CHALENDAR Chairman & CEO DSM EDF EGIS ENGIE ERAMET FFP FONCIERE DES Feike SIJBESMA Jean-Bernard LEVY Nicolas JACHIET Gérard MESTRALLET Patrick -

La Place Du Risque De Réputation Et Du Risque De Mauvaise Gouvernance

La place du risque de réputation et du risque de mauvaise gouvernance dans les comptes annuels et plus généralement dans les “ Documents de référence ”, ou les “ Documents d’enregistrement universel ” élaborés par les sociétés du SBF 120 soumises aux normes comptables françaises pour l’exercice comptable 2018 et 2019 Jean-Louis Navarro To cite this version: Jean-Louis Navarro. La place du risque de réputation et du risque de mauvaise gouvernance dans les comptes annuels et plus généralement dans les “ Documents de référence ”, ou les “ Documents d’enregistrement universel ” élaborés par les sociétés du SBF 120 soumises aux normes comptables françaises pour l’exercice comptable 2018 et 2019. [Rapport de recherche] Université Lumière (Lyon 2). 2020. hal-02963783 HAL Id: hal-02963783 https://hal.univ-lyon2.fr/hal-02963783 Submitted on 11 Oct 2020 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. 1 La place du risque de réputation et du risque de mauvaise gouvernance dans les comptes annuels et plus généralement dans les « Documents de référence », ou les « Documents d’enregistrement universel » élaborés par les sociétés du SBF 120 soumises aux normes comptables françaises pour l’exercice comptable 2018 et 2019 Etude empirique réalisée par M. -

Mieux Vivre 2014

rapport d’activité et de développement durable 2014 2014www.groupeseb.com mieux vivre une relation de confiance et d’engagement Actionnaires, une écoute personnalisée Le Service Actionnaires est votre interlocuteur privilégié pour toutes vos questions relatives à l’action SEB et à vos démarches (transfert de votre compte au nominatif, fiscalité…). Jacqueline SALAÜN – Responsable du Service Actionnaires – et Delphine LE GOUEVEC – Gestionnaire Service Relations Actionnaires – sont à votre écoute et vous accompagnent au quotidien. Service Actionnaires +33 (0)4 72 18 16 41 - [email protected] Parallèlement, le Service Titres assure la gestion des actions inscrites au nominatif : prise en charge des ordres d’achat ou de vente, gestion des données personnelles, convocation à l’Assemblée Générale, paiement du dividende. Service Titres SEB - BP2S – Corporate Trust Services [email protected] +33 (0)1 57 43 90 00 - https://planetshares.bnpparibas.com Investisseurs et analystes, une relation active et transparente Le Groupe SEB place la relation avec ses publics financiers (analystes financiers, investisseurs institutionnels, actionnaires...) sous le signe de la confiance et du respect. Tout au long de l’année, Isabelle POSTH – Directrice de la Communication Financière et des Relations Investisseurs – et Emmanuel FOURRET – Investor Relations Manager – vont à la rencontre de ces publics dans le cadre de réunions régulières, de roadshows, de rendez-vous ponctuels en France et à l’étranger ainsi qu’à travers des conférences téléphoniques. Direction de la Communication Financière et des Relations Investisseurs [email protected] +33 (0)4 72 18 16 40 Parties prenantes, un engagement responsable La préservation des grands équilibres passe par une philosophie d’entreprise fondée sur le sens de la responsabilité, la solidarité et l’engagement. -

FINAL DISTRIBUTION.Xlsx

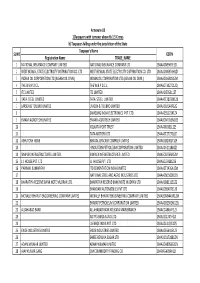

Annexure-1B 1)Taxpayers with turnover above Rs 1.5 Crores b) Taxpayers falling under the jurisdiction of the State Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 NATIONAL INSURANCE COMPANY LIMITED NATIONAL INSURANCE COMPANY LTD 19AAACN9967E1Z0 2 WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD 19AAACW6953H1ZX 3 INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) 19AAACI1681G1ZM 4 THE W.B.P.D.C.L. THE W.B.P.D.C.L. 19AABCT3027C1ZQ 5 ITC LIMITED ITC LIMITED 19AAACI5950L1Z7 6 TATA STEEL LIMITED TATA STEEL LIMITED 19AAACT2803M1Z8 7 LARSEN & TOUBRO LIMITED LARSEN & TOUBRO LIMITED 19AAACL0140P1ZG 8 SAMSUNG INDIA ELECTRONICS PVT. LTD. 19AAACS5123K1ZA 9 EMAMI AGROTECH LIMITED EMAMI AGROTECH LIMITED 19AABCN7953M1ZS 10 KOLKATA PORT TRUST 19AAAJK0361L1Z3 11 TATA MOTORS LTD 19AAACT2727Q1ZT 12 ASHUTOSH BOSE BENGAL CRACKER COMPLEX LIMITED 19AAGCB2001F1Z9 13 HINDUSTAN PETROLEUM CORPORATION LIMITED. 19AAACH1118B1Z9 14 SIMPLEX INFRASTRUCTURES LIMITED. SIMPLEX INFRASTRUCTURES LIMITED. 19AAECS0765R1ZM 15 J.J. HOUSE PVT. LTD J.J. HOUSE PVT. LTD 19AABCJ5928J2Z6 16 PARIMAL KUMAR RAY ITD CEMENTATION INDIA LIMITED 19AAACT1426A1ZW 17 NATIONAL STEEL AND AGRO INDUSTRIES LTD 19AAACN1500B1Z9 18 BHARATIYA RESERVE BANK NOTE MUDRAN LTD. BHARATIYA RESERVE BANK NOTE MUDRAN LTD. 19AAACB8111E1Z2 19 BHANDARI AUTOMOBILES PVT LTD 19AABCB5407E1Z0 20 MCNALLY BHARAT ENGGINEERING COMPANY LIMITED MCNALLY BHARAT ENGGINEERING COMPANY LIMITED 19AABCM9443R1ZM 21 BHARAT PETROLEUM CORPORATION LIMITED 19AAACB2902M1ZQ 22 ALLAHABAD BANK ALLAHABAD BANK KOLKATA MAIN BRANCH 19AACCA8464F1ZJ 23 ADITYA BIRLA NUVO LTD. 19AAACI1747H1ZL 24 LAFARGE INDIA PVT. LTD. 19AAACL4159L1Z5 25 EXIDE INDUSTRIES LIMITED EXIDE INDUSTRIES LIMITED 19AAACE6641E1ZS 26 SHREE RENUKA SUGAR LTD. 19AADCS1728B1ZN 27 ADANI WILMAR LIMITED ADANI WILMAR LIMITED 19AABCA8056G1ZM 28 AJAY KUMAR GARG OM COMMODITY TRADING CO. -

Palmarès De La Féminisation Des Instances Dirigeantes Des

Note totale Note totale Note totale Présidente du Conseil Présence d'un réseau de Note totale Note globale Part des Femmes dans le Part des femmes dans le Part des femmes dans le Femme Présidente de Part de femmes dans le Part des femmes dans le Féminisation Note obtenue à Note obtenue au Sensibilisation / Rang Société Féminisation Féminisation et/ou DG / Présidente du femmes / réseau de Politiques de obtenue Conseil Comité de Nomination Comité de Rémunération Comité Comex Top 100 de la l'Index dernier indicateur Formation des dirigeants du Conseil des dirigeants Directoire mixité féminisation Présidence 100 20 5 5 5 35 30 10 40 5 5 5 5 5 5 20 1 90,10 GECINA 50,00% 20,00 66,67% 5,00 66,67% 5,00 Oui 5,00 35,00 40,00% 24,00 43,00% 8,60 32,60 Oui 5,00 5,00 92 5,00 5 2,50 100,00% 5,00 Oui 5,00 17,50 2 85,60 SODEXO 60,00% 20,00 100,00% 5,00 75,00% 5,00 Oui 5,00 35,00 30,00% 18,00 38,00% 7,60 25,60 Oui 5,00 5,00 99 5,00 10 5,00 100,00% 5,00 Oui 5,00 20,00 3 80,50 L'OREAL 53,85% 20,00 25,00% 2,50 66,67% 5,00 Oui 5,00 32,50 30,00% 18,00 51,00% 10,00 28,00 Non 0,00 0,00 95 5,00 10 5,00 100,00% 5,00 Oui 5,00 20,00 4 80,36 MERCIALYS 54,55% 20,00 60,00% 5,00 60,00% 5,00 Oui 5,00 35,00 50,00% 30,00 61,00% 10,00 40,00 Non 0,00 0,00 NA 0,00 NA 0,00 7,14% 0,36 Oui 5,00 5,36 5 80,20 MAISONS DU MONDE 57,14% 20,00 33,33% 3,33 33,33% 3,33 Oui 5,00 31,67 40,00% 24,00 47,69% 9,54 33,54 Oui 5,00 5,00 83 5,00 10 5,00 0,00% 0,00 Non 0,00 10,00 6 80,11 ENGIE 45,45% 18,18 40,00% 4,00 40,00% 4,00 Oui 5,00 31,18 35,71% 21,43 25,00% 5,00 26,43 Oui 5,00 5,00 87 5,00 -

Leleux Press Review

Leleux Press Review Tuesday 9/6/2020 BEL 20 (Belgium) Last Price 3535,11 Minimum Price 1046,07 (02/09/1992) Maximum Price 4759,01 (23/05/2007) Gainers 8 Losers 12 GBL BE 79,68 +0,02% AB INBEV 50,70 -0,91% SOLVAY BE 77,98 +0,00% BARCO 167,50 -0,53% ING GROEP NV 7,27 +1,99% APERAM 27,10 -0,07% CAC 40 (France) Last Price 5175,52 Minimum Price 2693,21 (23/09/2011) Maximum Price 7347,94 (21/10/2009) Gainers 21 Losers 19 VIVENDI FR 22,89 +0,88% VINCI 89,60 -0,79% BNP PARIBAS FR 39,45 +0,85% ORANGE FR 11,48 -0,43% PEUGEOT SA 15,56 +0,84% CAPGEMINI FR 97,48 -0,28% AEX (The Netherlands) Last Price 566,20 Minimum Price 194,99 (09/03/2009) Maximum Price 806,41 (21/10/2009) Gainers 7 Losers 18 NN GROUP 31,83 +0,95% UNILEVER NV 47,40 -0,94% ABN AMRO BANK NV 9,07 +0,68% VOPAK 47,80 -0,89% AKZO NOBEL 79,00 +0,56% KONINKLIJKE PHILIPS 41,60 -0,88% DAX (Germany) Last Price 12819,59 Minimum Price 8255,65 (16/03/2020) Maximum Price 13795,24 (17/02/2020) Gainers 13 Losers 17 DAIMLER AG DE 40,10 +0,70% HEIDELBERGER ZEMENT 51,74 -0,88% DEUTSCHE POST DE 31,82 +0,41% ALLIANZ DE 191,74 -0,75% BASF SE DE 57,66 +0,40% SAP AG DE 120,22 -0,75% FTSE 100 (United Kingdom) Last Price 6472,59 Minimum Price 3277,50 (12/03/2003) Maximum Price 53548,10 (16/11/2009) Gainers 53 Losers 46 BP PLC UK 3,66 +0,98% PRUDENTIAL UK 12,57 -0,97% WHITBREAD PLC OR SHS 27,74 +0,98% STANDCHART ORD USD05 4,60 -0,92% POLYMETAL INTERNATIO 14,28 +0,95% RELX PLC 18,92 -0,91% MIB 30 (Italy) Last Price 20231,38 Minimum Price 12320,50 (24/07/2012) Maximum Price 48766,00 (05/04/2001) Gainers 18 Losers -

REGISTRATION DOCUMENT 2015 Including the Annual fi Nancial Report

REGISTRATION DOCUMENT 2015 including the annual fi nancial report A strong tradition of entrepreneurship supporting long-term investing” WENDEL at a glance 1 à 15 GROUP PRESENTATION 17 INFORMATION ON THE COMPANY AND 171.1Corporate history 18 SHARE CAPITAL 341 1.2Business 197.1 Information on the Company 342 1.3Corporate governance 207.2 Principal by-laws 342 1.4Internal organization 227.3 How to take part in Shareholders’ Meetings 345 1.5 Investment model and business 7.4Information on share capital 346 development strategy 28 7.5 Principal new investments and acquisitions 1.6Corporate Social Responsibility (CSR) 31 of controlling interests 350 1.7Subsidiaries and associated companies 347.6 Financial authorizations 351 1.8Shareholder information 677.7 Share buybacks 353 7.8 Transactions on Company securities by corporate officers 357 CORPORATE GOVERNANCE 73 7.9Shareholder agreements 358 2.1Governing and supervisory bodies 74 7.10 Factors likely to have an impact in the event of a 2 2.2Risk factors 117 takeover offer 362 2.3Report on risk management and internal control 124 2.4 Statutory auditors’ report, prepared in accordance with article L.225-235 of the French commercial code SHAREHOLDERS’ MEETING OF JUNE 1, (code de commerce), on the report prepared by the 2016 363 chairman of the supervisory board of Wendel 134 8 8.1 Statutory Auditors' special report on related party agreements and commitments 364 8.2 Statutory Auditors’ report on the issue of shares and WENDEL’S CORPORATE SOCIAL various securities with or without cancellation of -

CDP Climate Change Report 2016 France and Benelux Edition

CDP Climate Change Report 2016 France and Benelux edition On behalf of 827 investors with US$100 trillion in assets CDP Report 2016 | October 2016 Report writer Scoring Partners Key Messages 21 companies achieved the top score entering the CDP A List. 151 companies responded Their emissions represent 28% of the total reported emissions, and a decrease of 6 Mt of CO2e. to CDP in Benelux and Schneider Electrics, Royal Philips, L’Oréal, Atos, France, accounting for 81% Proximus ING Group and Royal BAM Group were also leaders in 2016. Bic scored A also in 2013, of the market capitalization KPN was graded A in 2011, 2012 and 2013 and in the region. Renault was part of the leaders in 2014. AkzoNobel, Bouygues, DSM, EDF, ENGIE, Group PSA, ICADE, Klépierre, Michelin, SUEZ and VEOLIA , are joining the list for the first time this year. Integrating climate change into business strategy is becoming main stream but targets lack ambition. 131 out of 141 companies have included climate change into their business strategy. 114 of them set specific targets and initiatives to reduce their climate impact. 2020 is the most common target year, while leaders distinguish themselves by setting long term targets, as far as 2050 and beyond. 53% of the companies managed to decrease their emissions in 2016. For 115 companies that responded also last year the emissions decreased from 723 Mt CO2e to 712 Mt CO2e meaning a 2% decrease of total emissions. From these 115 15% of the companies companies, 61 decreased their emissions by average of 14%. achieved A. -

Chiffres Clés & P Lmarès

2020 | 11E ÉDITION DES GRANDS PRIX DE LA TRANSPARENCE CHIFFRES CLÉS & P LMARÈS Analyse réalisée du 27 avril au 31 juillet 2020 portant sur l’information réglementée des sociétés de droit français du SBF 120 et Hors SBF 120 Sommaire L’édito de Laurent Rouyrès ................................................................................................p. 01 La Transparence en 2020 ......................................................................................................p. 02 Palmarès Transparence 2020 ..................................................................................p. 04 Lauréats des 9 Grands Prix 2020 ..................................................................p. 05 Panel étudié ....................................................................................................................................................................p. 06 Une méthodologie unique et labellisée .....................................p. 07 Méthodologie Langage clair .......................................................................................p. 08 Critères Transparence et Langage clair 2020 .......p. 09 CHIFFRES CLÉS & P LMARÈS | Grands Prix de la Transparence 2020 ÉDITO Les entreprises transparentes sont courageuses LAURENT ROUYRÈS Président de Labrador et créateur des Grands Prix de la Transparence La situation totalement exceptionnelle que nous vivons nous rappelle que la seule Elles recherchent des indicateurs comparables chose que nous pouvons prévoir à coup sûr quitte à ce qu’ils ne soient pas les