REGISTRATION DOCUMENT 2015 Including the Annual fi Nancial Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PARETURN Société D'investissement À Capital Variable RCS Luxembourg N° B 47 104 Annual Report Including Audited Financial Statements As at September 30, 2018 PARETURN

PARETURN Société d'Investissement à Capital Variable RCS Luxembourg N° B 47 104 Annual Report including Audited Financial Statements as at September 30, 2018 PARETURN Pareturn Best Selection Pareturn Best Selection Side - Pocket Pareturn Croissance 2000 Pareturn Cartesio Equity Pareturn Cartesio Income Pareturn Stamina Systematic* Pareturn Stamina Systematic Plus* Pareturn Mutuafondo Global Fixed Income Pareturn Barwon Listed Private Equity Pareturn Global Balanced Unconstrained Pareturn Cervino World Investments Pareturn Entheca Patrimoine Pareturn Ataun Pareturn Invalux Fund Pareturn Gladwyne Absolute Credit Pareturn Mutuafondo España Lux Pareturn EtendAR* Pareturn GVC Gaesco Patrimonial Fund Pareturn GVC Gaesco Euro Small Caps Equity Fund Pareturn GVC Gaesco Absolute Return Fund Pareturn GVC Gaesco Columbus European Mid-Cap Equity Fund* Pareturn Mapfre Euro Bonds Fund* Pareturn Diversified Fund Pareturn Security Latam Corporate Debt Pareturn Rivendale Pareturn Fidelius Global Pareturn Santalucia Espabolsa (Luxembourg)* Pareturn Santalucia Fonvalor* PARETURN Pareturn Imantia USD Global High Yield Bond No subscription can be received on the basis of these financial statements. Subscriptions are only valid if made on the basis of the current prospectus and relevant Key Investor Information Document ("KIID") which will be accompanied by a copy of the latest annual report including audited financial statements and a copy of the latest available unaudited semi-annual report, if published after such annual report. * Please see note 1 for -

European Esg-Sri Virtual Conference

SAVE THE DATE PARTICIPATING COMPANIES SOCIETE GENERALE CORPORATE & INVESTMENT BANKING IS DELIGHTED TO INVITE YOU TO THE ADEVINTA GECINA SAINT GOBAIN AGEAS GLAXOSMITHKLINE SHELL AIR FRANCE KLM GROUPE BRUXELLES SALZGITTER EUROPEAN AIR LIQUIDE LAMBERT SANOFI AKZO NOBEL GROUPE PSA SAP ALBIOMA GROUPE SEB SARTORIUS STEDIM BIOTECH ESG-SRI ALLIANZ HEIDELBERGCEMENT SCOR ALD AUTOMOTIVE HOCHTIEF SCHNEIDER ELECTRIC ALSTOM HSBC SIEMENS AMUNDI INTESA SANPAOLO SIGNIFY VIRTUAL KINGFISHER ARCELORMITTAL SIKA ASML KLEPIERRE SODEXO ASSA ABLOY ENI SOCIETE GENERALE CONFERENCE ASTRAZENECA LEGRAND SOITEC ATLAS COPCO LEONARDO SPA SOLVAY SA ATOS LINDE SPIE BASF LLOYDS BANKING STMICROELECTRONICS Sustainable & Positive Impact BAYER AG METRO SUEZ BBVA MERSEN SWEDISH MATCH Finance BOOHOO NATIXIS SWISS RE BP NATURGY TARKETT BUREAU VERITAS NEXANS THALES CAPGEMINI NEXITY TELEPERFORMANCE 17, 18 & 19 NOVEMBER 2020 - “Generating impact in a world in transition” CARLSBERG NESTLE TIKEHAU CAPITAL • Dialogues on ESG and SRI involving over 110 companies and institutional investors, in one CASINO NORMA GROUP TOTAL to one / one to few / fireside chat. COVESTRO NOVARTIS UNIPER CREDIT AGRICOLE NOVO NORDISK VALEO • 7 panels and keynote webinars dedicated to Sustainable & Positive Impact Finance CREDIT SUISSE OMV VEOLIA open to all participants: CRODA ORANGE VESTAS PERNOD RICARD The green economic relaunch post pandemic crisis, placing fight against climate change and loss of DAIMLER VICAT biodiversity at the heart of economic policies DEUTSCHE POST PHILIPS VINCI EDF PLASTIC OMNIUM -

La Place Du Risque De Réputation Et Du Risque De Mauvaise Gouvernance

La place du risque de réputation et du risque de mauvaise gouvernance dans les comptes annuels et plus généralement dans les “ Documents de référence ”, ou les “ Documents d’enregistrement universel ” élaborés par les sociétés du SBF 120 soumises aux normes comptables françaises pour l’exercice comptable 2018 et 2019 Jean-Louis Navarro To cite this version: Jean-Louis Navarro. La place du risque de réputation et du risque de mauvaise gouvernance dans les comptes annuels et plus généralement dans les “ Documents de référence ”, ou les “ Documents d’enregistrement universel ” élaborés par les sociétés du SBF 120 soumises aux normes comptables françaises pour l’exercice comptable 2018 et 2019. [Rapport de recherche] Université Lumière (Lyon 2). 2020. hal-02963783 HAL Id: hal-02963783 https://hal.univ-lyon2.fr/hal-02963783 Submitted on 11 Oct 2020 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. 1 La place du risque de réputation et du risque de mauvaise gouvernance dans les comptes annuels et plus généralement dans les « Documents de référence », ou les « Documents d’enregistrement universel » élaborés par les sociétés du SBF 120 soumises aux normes comptables françaises pour l’exercice comptable 2018 et 2019 Etude empirique réalisée par M. -

FINAL DISTRIBUTION.Xlsx

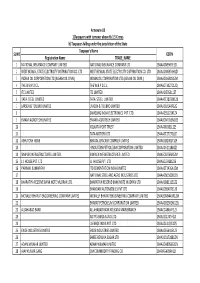

Annexure-1B 1)Taxpayers with turnover above Rs 1.5 Crores b) Taxpayers falling under the jurisdiction of the State Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 NATIONAL INSURANCE COMPANY LIMITED NATIONAL INSURANCE COMPANY LTD 19AAACN9967E1Z0 2 WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD 19AAACW6953H1ZX 3 INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) 19AAACI1681G1ZM 4 THE W.B.P.D.C.L. THE W.B.P.D.C.L. 19AABCT3027C1ZQ 5 ITC LIMITED ITC LIMITED 19AAACI5950L1Z7 6 TATA STEEL LIMITED TATA STEEL LIMITED 19AAACT2803M1Z8 7 LARSEN & TOUBRO LIMITED LARSEN & TOUBRO LIMITED 19AAACL0140P1ZG 8 SAMSUNG INDIA ELECTRONICS PVT. LTD. 19AAACS5123K1ZA 9 EMAMI AGROTECH LIMITED EMAMI AGROTECH LIMITED 19AABCN7953M1ZS 10 KOLKATA PORT TRUST 19AAAJK0361L1Z3 11 TATA MOTORS LTD 19AAACT2727Q1ZT 12 ASHUTOSH BOSE BENGAL CRACKER COMPLEX LIMITED 19AAGCB2001F1Z9 13 HINDUSTAN PETROLEUM CORPORATION LIMITED. 19AAACH1118B1Z9 14 SIMPLEX INFRASTRUCTURES LIMITED. SIMPLEX INFRASTRUCTURES LIMITED. 19AAECS0765R1ZM 15 J.J. HOUSE PVT. LTD J.J. HOUSE PVT. LTD 19AABCJ5928J2Z6 16 PARIMAL KUMAR RAY ITD CEMENTATION INDIA LIMITED 19AAACT1426A1ZW 17 NATIONAL STEEL AND AGRO INDUSTRIES LTD 19AAACN1500B1Z9 18 BHARATIYA RESERVE BANK NOTE MUDRAN LTD. BHARATIYA RESERVE BANK NOTE MUDRAN LTD. 19AAACB8111E1Z2 19 BHANDARI AUTOMOBILES PVT LTD 19AABCB5407E1Z0 20 MCNALLY BHARAT ENGGINEERING COMPANY LIMITED MCNALLY BHARAT ENGGINEERING COMPANY LIMITED 19AABCM9443R1ZM 21 BHARAT PETROLEUM CORPORATION LIMITED 19AAACB2902M1ZQ 22 ALLAHABAD BANK ALLAHABAD BANK KOLKATA MAIN BRANCH 19AACCA8464F1ZJ 23 ADITYA BIRLA NUVO LTD. 19AAACI1747H1ZL 24 LAFARGE INDIA PVT. LTD. 19AAACL4159L1Z5 25 EXIDE INDUSTRIES LIMITED EXIDE INDUSTRIES LIMITED 19AAACE6641E1ZS 26 SHREE RENUKA SUGAR LTD. 19AADCS1728B1ZN 27 ADANI WILMAR LIMITED ADANI WILMAR LIMITED 19AABCA8056G1ZM 28 AJAY KUMAR GARG OM COMMODITY TRADING CO. -

Palmarès De La Féminisation Des Instances Dirigeantes Des

Note totale Note totale Note totale Présidente du Conseil Présence d'un réseau de Note totale Note globale Part des Femmes dans le Part des femmes dans le Part des femmes dans le Femme Présidente de Part de femmes dans le Part des femmes dans le Féminisation Note obtenue à Note obtenue au Sensibilisation / Rang Société Féminisation Féminisation et/ou DG / Présidente du femmes / réseau de Politiques de obtenue Conseil Comité de Nomination Comité de Rémunération Comité Comex Top 100 de la l'Index dernier indicateur Formation des dirigeants du Conseil des dirigeants Directoire mixité féminisation Présidence 100 20 5 5 5 35 30 10 40 5 5 5 5 5 5 20 1 90,10 GECINA 50,00% 20,00 66,67% 5,00 66,67% 5,00 Oui 5,00 35,00 40,00% 24,00 43,00% 8,60 32,60 Oui 5,00 5,00 92 5,00 5 2,50 100,00% 5,00 Oui 5,00 17,50 2 85,60 SODEXO 60,00% 20,00 100,00% 5,00 75,00% 5,00 Oui 5,00 35,00 30,00% 18,00 38,00% 7,60 25,60 Oui 5,00 5,00 99 5,00 10 5,00 100,00% 5,00 Oui 5,00 20,00 3 80,50 L'OREAL 53,85% 20,00 25,00% 2,50 66,67% 5,00 Oui 5,00 32,50 30,00% 18,00 51,00% 10,00 28,00 Non 0,00 0,00 95 5,00 10 5,00 100,00% 5,00 Oui 5,00 20,00 4 80,36 MERCIALYS 54,55% 20,00 60,00% 5,00 60,00% 5,00 Oui 5,00 35,00 50,00% 30,00 61,00% 10,00 40,00 Non 0,00 0,00 NA 0,00 NA 0,00 7,14% 0,36 Oui 5,00 5,36 5 80,20 MAISONS DU MONDE 57,14% 20,00 33,33% 3,33 33,33% 3,33 Oui 5,00 31,67 40,00% 24,00 47,69% 9,54 33,54 Oui 5,00 5,00 83 5,00 10 5,00 0,00% 0,00 Non 0,00 10,00 6 80,11 ENGIE 45,45% 18,18 40,00% 4,00 40,00% 4,00 Oui 5,00 31,18 35,71% 21,43 25,00% 5,00 26,43 Oui 5,00 5,00 87 5,00 -

Leleux Press Review

Leleux Press Review Tuesday 9/6/2020 BEL 20 (Belgium) Last Price 3535,11 Minimum Price 1046,07 (02/09/1992) Maximum Price 4759,01 (23/05/2007) Gainers 8 Losers 12 GBL BE 79,68 +0,02% AB INBEV 50,70 -0,91% SOLVAY BE 77,98 +0,00% BARCO 167,50 -0,53% ING GROEP NV 7,27 +1,99% APERAM 27,10 -0,07% CAC 40 (France) Last Price 5175,52 Minimum Price 2693,21 (23/09/2011) Maximum Price 7347,94 (21/10/2009) Gainers 21 Losers 19 VIVENDI FR 22,89 +0,88% VINCI 89,60 -0,79% BNP PARIBAS FR 39,45 +0,85% ORANGE FR 11,48 -0,43% PEUGEOT SA 15,56 +0,84% CAPGEMINI FR 97,48 -0,28% AEX (The Netherlands) Last Price 566,20 Minimum Price 194,99 (09/03/2009) Maximum Price 806,41 (21/10/2009) Gainers 7 Losers 18 NN GROUP 31,83 +0,95% UNILEVER NV 47,40 -0,94% ABN AMRO BANK NV 9,07 +0,68% VOPAK 47,80 -0,89% AKZO NOBEL 79,00 +0,56% KONINKLIJKE PHILIPS 41,60 -0,88% DAX (Germany) Last Price 12819,59 Minimum Price 8255,65 (16/03/2020) Maximum Price 13795,24 (17/02/2020) Gainers 13 Losers 17 DAIMLER AG DE 40,10 +0,70% HEIDELBERGER ZEMENT 51,74 -0,88% DEUTSCHE POST DE 31,82 +0,41% ALLIANZ DE 191,74 -0,75% BASF SE DE 57,66 +0,40% SAP AG DE 120,22 -0,75% FTSE 100 (United Kingdom) Last Price 6472,59 Minimum Price 3277,50 (12/03/2003) Maximum Price 53548,10 (16/11/2009) Gainers 53 Losers 46 BP PLC UK 3,66 +0,98% PRUDENTIAL UK 12,57 -0,97% WHITBREAD PLC OR SHS 27,74 +0,98% STANDCHART ORD USD05 4,60 -0,92% POLYMETAL INTERNATIO 14,28 +0,95% RELX PLC 18,92 -0,91% MIB 30 (Italy) Last Price 20231,38 Minimum Price 12320,50 (24/07/2012) Maximum Price 48766,00 (05/04/2001) Gainers 18 Losers -

Chiffres Clés & P Lmarès

2020 | 11E ÉDITION DES GRANDS PRIX DE LA TRANSPARENCE CHIFFRES CLÉS & P LMARÈS Analyse réalisée du 27 avril au 31 juillet 2020 portant sur l’information réglementée des sociétés de droit français du SBF 120 et Hors SBF 120 Sommaire L’édito de Laurent Rouyrès ................................................................................................p. 01 La Transparence en 2020 ......................................................................................................p. 02 Palmarès Transparence 2020 ..................................................................................p. 04 Lauréats des 9 Grands Prix 2020 ..................................................................p. 05 Panel étudié ....................................................................................................................................................................p. 06 Une méthodologie unique et labellisée .....................................p. 07 Méthodologie Langage clair .......................................................................................p. 08 Critères Transparence et Langage clair 2020 .......p. 09 CHIFFRES CLÉS & P LMARÈS | Grands Prix de la Transparence 2020 ÉDITO Les entreprises transparentes sont courageuses LAURENT ROUYRÈS Président de Labrador et créateur des Grands Prix de la Transparence La situation totalement exceptionnelle que nous vivons nous rappelle que la seule Elles recherchent des indicateurs comparables chose que nous pouvons prévoir à coup sûr quitte à ce qu’ils ne soient pas les -

Securitisation & Asset-Backed Finance

SECURITISATION & ASSET-BACKED FINANCE Gide’s Securitisation & Asset-backed Finance practice is recognised as an undisputed leader in its fi eld by arrangers, rating agencies and originators alike. The fi rm, at the very origin of the concept of securitisation in France, chairs the Securitisation Committee of Paris Europlace and has been actively involved in all legislative and regulatory developments in the domain since 1988. Gide’s Securitisation & Asset-backed Finance practice is simply unique in terms of the sheer volume, size and variety of transactions structured and negotiated in the setting up of innovative structured programmes for both credit and non-credit institutions, in France and abroad. Our Paris, London and New York o ces constitute a dynamic, integrated platform for the practice. Led by one French, two English and one US partners, together with multinational associates, the team is organised around a cross-disciplinary approach which provides the highest level of expertise in French, English, US and international aspects of securitisation transactions. The practice benefi ts from the active support of other teams as the need arises. Our lawyers co-operate regularly with specialists in Tax, Mergers & Acquisitions, Derivatives, Capital Markets, Corporate Law, Real Estate Financing, Projects and Infrastructure, Labour Law, Administrative and Public Law, etc. The international team, coordinated by our Paris and London o ces, is dedicated to the development of local structured securitisation activities in the emerging markets (Asia and the MENA and CEE regions) in collaboration with our specialists in the relevant jurisdictions. Brochures relating to securitisation in emerging markets in which the fi rm is implanted are available upon request. -

2018 COMBINED GENERAL MEETING CONVENING NOTICE Tuesday 12 June 2018 at 2:30 P.M

2018 COMBINED GENERAL MEETING CONVENING NOTICE Tuesday 12 June 2018 at 2:30 p.m. Pavillon Dauphine, Place du Maréchal de Lattre de Tassigny, 75116 Paris CONTENTS A WORD FROM THE CHAIRMAN 3 INSTRUCTIONS FOR PARTICIPATING 1 IN THE MEETING 4 HOW TO GET TO THE SHAREHOLDERS 2 MEETING 7 3 CORPORATE GOVERNANCE 8 SOPRA STERIA’S ACTIVITIES 4 AND STRATEGY 28 MEETING AGENDA 5 FOR THE COMBINED GENERAL MEETING 45 6 SUMMARY OF RESOLUTIONS 47 7 PROPOSED RESOLUTIONS 65 ELECTRONIC NOTICES 79 REQUEST FOR DOCUMENTS AND INFORMATION 81 This document is a free translation into English. It is not a binding document. In the event of a conflict in interpretation, reference should be made to the French version, which is the authentic text. The English PDF and PDFi version of Notice of Meetings is available on the website: https://soprasteria.com/en/investors Sopra Steria Group – Founded 1968 Société anonyme with share capital of 20 547 701 € – 326 820 065 RCS Annecy Registered Office: PAE Les Glaisins, Annecy-le-Vieux, F-74940 Annecy Head office: 9 bis, rue de Presbourg, F-75116 Paris Telephone: +33 (0)1 40 67 29 29 - Fax: +33 (0)1 40 67 29 30 [email protected] – https://www.soprasteria.com 2 SOPRA STERIA CONVENING NOTICE 2018 SOPRA STERIA REACHED A NEW MILESTONE IN ITS DEVELOPMENT IN 2017 Dear Shareholders, With this in mind, our strategy is predicated on four key principles: pp independence, which underpins our long-term vision and our It is my pleasure to invite you to attend the Combined General entrepreneurial model; Meeting of Sopra Steria Group shareholders, to be held on Tuesday, 12 June 2018 starting at 2:30 p.m. -

Revue De Presse Sommaire

24/04/21 Revue de presse Sommaire Hitechpros 3 Mettez du rendement dans votre portefeuille 4 Investir-Le journal des Finances - 24/04/2021 P.2 Hitechpros P.3 PAYS : France RUBRIQUE : Événement PAGE(S) : 4 DIFFUSION : 70624 SURFACE : 93 % JOURNALISTE : Rémi Le Bailly PERIODICITE : Hebdomadaire 24 avril 2021 - N°2468 ÉVÉNEMENT Rémunérationde l’actionnaire Mettez du rendement dans votre portefeuille Sélection Un rendement élevé, c’est bien, mais encore faut-il qu’il le reste. Nous vous présentons 25 sociétés qui ont démontré leur capacité à augmenter ou, au moins, à maintenir leurs dividendes sur la durée. e printemps est, en Bourse,la saison Dans notre sélection, nous avonschoisi de vous des dividendes. Elle met donc en proposer une palette assezlarge.Nousavonsbien lumière les valeurs de rendement, sûr retenu des valeurs immobilières, car ce sont celles qui se montrent les plus géné- ellesqui redistribuent leplus leursbénéficesàleurs reuses avec les actionnaires. Rappe- actionnaires enraison deleur statut fiscal particu- lons que le dividende est une lier. Mais cedernier apour inconvénient collatéral Lcomposante essentielle dela performance à long delesexclure duPEA.C’estd’ailleurspour celaque terme des marchés (lire lespistesd’investissement, nous avonspris soin deretenir aussideux immobi- page2).Maiscelane veutpasdire qu’il faut acheter lières éligiblesàce pland’épargne.Nousavonséga- aveuglémentlessociétésqui affichent lesplus gros lement misl’accentsur lesecteurfinancier,d’autant rendements.Celaéquivaudraitbien souventàmet- plus générateur -

Delivering Digital Transformation Together

DELIVERINGle 11/05/2018 à 09:41 DIGITAL TRANSFORMATION TOGETHER REGISTRATION DOCUMENT ANNUAL FINANCIAL REPORT 2017 WorldReginfo - eaea1338-80f8-430e-9ce2-69e2bfa7fe26 ABOUT SOPRA STERIA GROUP 2 Message from the C hairman 2 5 PARENT COMPANY FINANCIAL Key figures 3 STATEMENTS 197 Business model 4 Balance sheet 198 Breakdown of revenue 5 Corporate plan 6 Income statement 199 Strategy 7 1. Significant events 199 Governance 8 2. Accounting principles and policies 200 Corporate responsibility 9 3. Notes to the balance sheet 203 Materiality matrix 10 4. Notes to the income statement 212 Dialogue with investors 11 5. Other information 215 Financial performance 12 Statutory Auditors’ report on the parent company financial statements 221 1 INTRODUCTION TO SOPRA STERIA 13 6 SOPRA STERIA GROUP 1. History of Sopra Steria Group 14 AND THE STOCK MARKET 227 2. Overview of the digital services sector 15 3. Strategy and objectives 16 1. General information 228 4. Sopra Steria’s activities 17 2. Share ownership structure 229 5 2017 key figures and consolidated financial statements 22 3. Employee share ownership 230 6. 2017 parent company financial statements of Sopra 4. Voting rights 230 Steria Group SA 29 5. Threshold crossings 230 7. Simplified Group structure at 31 December 2017 32 6. Shareholders’ agreements 231 8. Group organisation 33 7. Control 232 9. Risk management and control 35 8. Share buyback programme 232 9. Changes in share capital 234 10. Securities with an equity component – potential dilution 234 11. Information on transactions in securities 2 CORPORATE GOVERNANCE 49 by Directors or persons mentioned in Article L. -

Agir Pour La Parité, Performance À La Clé

Agir pour la parité, performance à la clé NOTE JUILLET 2019 Think tank indépendant créé en 2000, l’Institut Montaigne est une plateforme de réflexion, de propositions et d’expérimentations consacrée aux politiques publiques en France et en Europe. À travers ses publications et les événements qu’il organise, il souhaite jouer pleinement son rôle d’acteur du débat démocratique avec une approche transpartisane. Ses travaux sont le fruit d’une méthode d’analyse et de recherche rigoureuse et critique, ouverte sur les comparaisons internationales. Association à but non lucratif, l’Institut Montaigne réunit des chefs d’entreprise, des hauts fonctionnaires, des universitaires et des personnalités issues d’horizons divers. Ses financements sont exclusivement privés, aucune contribution n’excédant 1,5 % d’un budget annuel de 5,6 millions d’euros. Agir pour la parité, performance à la clé NOTE - JUILLET 2019 Il n’est désir plus naturel que le désir de connaissance SOMMAIRE Préface 4 Introduction 6 I - Pourquoi être gender fair ? 8 1.1 La diversité de genre 8 1.2 La diversité de genre comme facteur de performance 12 1.3 Un lien de causalité utilisé par les investisseurs 19 II - Bilan des politiques conduites en France 26 2.1 La représentation des femmes dans le secteur privé 29 2.2 La représentation des femmes dans le secteur public 36 2.3 La question de l’égalité des salaires est toujours un sujet 47 III - Devenir gender fair, quelles propositions ? 57 3.1 Poursuivre le partage du pouvoir 57 3.2 Dégenrer les problématiques subies par les femmes pour accompagner la transformation de la société 70 3.3 Responsabiliser l’ensemble des acteurs 81 Conclusion 93 Remerciements 96 PRÉFACE Dans le monde, 17,9 % des sièges des conseils d’administration sont occupés par des femmes1, et une entreprise sur cinq fonctionne avec un conseil d’administration exclusivement masculin.