CDP Climate Change Report 2016 France and Benelux Edition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

Ishares, Inc. Form NPORT-P Filed 2021-07-28

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-07-28 | Period of Report: 2021-05-31 SEC Accession No. 0001752724-21-159023 (HTML Version on secdatabase.com) FILER iShares, Inc. Mailing Address Business Address 400 HOWARD STREET 400 HOWARD STREET CIK:930667| IRS No.: 510396525 | State of Incorp.:MD | Fiscal Year End: 0831 SAN FRANCISCO CA 94105 SAN FRANCISCO CA 94105 Type: NPORT-P | Act: 40 | File No.: 811-09102 | Film No.: 211121066 (415) 670-2000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Schedule of Investments (unaudited) iShares® MSCI Eurozone ETF May 31, 2021 (Percentages shown are based on Net Assets) Security Shares Value Common Stocks Austria — 0.6% Erste Group Bank AG 329,035 $ 13,477,023 OMV AG 173,018 9,869,717 Raiffeisen Bank International AG 174,780 4,143,945 Verbund AG 80,105 7,319,840 voestalpine AG 136,442 6,137,868 40,948,393 Belgium — 2.6% Ageas SA/NV 204,774 13,342,470 Anheuser-Busch InBev SA/NV 895,037 66,929,866 Elia Group SA/NV 36,295 3,873,987 Etablissements Franz Colruyt NV 64,934 3,939,867 Groupe Bruxelles Lambert SA 132,846 15,005,785 KBC Group NV 294,112 23,969,586 Proximus SADP 178,918 3,620,324 Sofina SA 18,344 7,588,286 Solvay SA 87,264 11,736,541 UCB SA 148,716 13,850,568 Umicore SA 230,261 13,760,841 177,618,121 Finland — 3.1% Elisa OYJ 167,775 9,872,502 Fortum OYJ 523,048 14,860,326 Kesko OYJ, Class B 322,190 11,103,618 Kone OYJ, Class B 398,352 32,117,085 Neste OYJ 496,242 32,609,530 Nokia OYJ(a) 6,349,095 -

Liste Des Actions Concernées Par L'interdiction De Positions Courtes Nettes

Liste des actions concernées par l'interdiction de positions courtes nettes L’interdiction s’applique aux actions listées sur une plate-forme française et relevant de la compétence de l’AMF au titre du règlement 236/2012 (information disponible dans les registres ESMA). Cette liste est fournie à titre informatif. L'AMF n'est pas en mesure de garantir que le contenu disponible est complet, exact ou à jour. Compte tenu des diverses sources de données sous- jacentes, des modifications pourraient être apportées régulièrement. Isin Nom FR0010285965 1000MERCIS FR0013341781 2CRSI FR0010050773 A TOUTE VITESSE FR0000076887 A.S.T. GROUPE FR0010557264 AB SCIENCE FR0004040608 ABC ARBITRAGE FR0013185857 ABEO FR0012616852 ABIONYX PHARMA FR0012333284 ABIVAX FR0000064602 ACANTHE DEV. FR0000120404 ACCOR FR0010493510 ACHETER-LOUER.FR FR0000076861 ACTEOS FR0000076655 ACTIA GROUP FR0011038348 ACTIPLAY (GROUPE) FR0010979377 ACTIVIUM GROUP FR0000053076 ADA BE0974269012 ADC SIIC FR0013284627 ADEUNIS FR0000062978 ADL PARTNER FR0011184241 ADOCIA FR0013247244 ADOMOS FR0010340141 ADP FR0010457531 ADTHINK FR0012821890 ADUX FR0004152874 ADVENIS FR0013296746 ADVICENNE FR0000053043 ADVINI US00774B2088 AERKOMM INC FR0011908045 AG3I ES0105422002 AGARTHA REAL EST FR0013452281 AGRIPOWER FR0010641449 AGROGENERATION CH0008853209 AGTA RECORD FR0000031122 AIR FRANCE -KLM FR0000120073 AIR LIQUIDE FR0013285103 AIR MARINE NL0000235190 AIRBUS FR0004180537 AKKA TECHNOLOGIES FR0000053027 AKWEL FR0000060402 ALBIOMA FR0013258662 ALD FR0000054652 ALES GROUPE FR0000053324 ALPES (COMPAGNIE) -

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Europe's Altice Enters US Cable Frenzy with Suddenlink Deal 20 May 2015, Bytali Arbel

Europe's Altice enters US cable frenzy with Suddenlink deal 20 May 2015, byTali Arbel At the same time, the cable companies' costs for the channels have grown. Suddenlink is the seventh-largest cable operator in the U.S., with 1.5 million residential customers in smaller markets in the South, West and Midwest. Like other smaller cable companies, it is having a harder time in the pay-TV market. Such companies say their costs, per subscriber, are higher than those of cable giants such as Comcast. Comcast's own $45 billion quest for No. 2 rival Time Warner Cable was recently quashed by regulators wary of the bigger company's potential power to undermine competition from online video In this Wednesday, March 18, 2015 file photo, Altice providers. That bid's failure has set off expectations group's Chairman Patrick Drahi poses for photographers that Charter Communications, backed by cable at the Scopus Awards of the French Friends of the magnate John Malone, will try to buy Time Warner Hebrew University, in Paris, France. Luxembourg-based Cable. Charter is also pursuing Bright House, a Altice SA said Wednesday MAY 20, 2015 it will buy 70 cable company with operations focused in Florida. percent of Missouri-based cable TV provider Suddenlink Meanwhile, AT&T is waiting for regulators to clear with a combined debt and cash offer from existing its $48.5 billion purchase of satellite TV provider owners BC Partners and CPP Investment Board, and company management. (AP Photo/Thibault Camus, File) DirecTV. Reports that Altice is also interested in Time Warner Cable means industry consolidation is likely There's a new player in the U.S. -

Annual Report 2012

Annual Report 2012 Groupe Bruxelles Lambert Online additional information www.gbl.be Investors information Additional information can be found on Online registration in order to receive the website, among which: investors information (notices, • Historical information of GBL press releases, ...) through the • The yearly and half-yearly reports and Company website. also quarterly press releases • Adjusted net assets on a weekly basis • The press releases • The portfolio Investor relations Axelle Henry [email protected] Tel.: +32 (0)2 289 17 17 Annual Report 2012 Overview of GBL 2 THE ESSENTIAL Message from the Chairman of the Board of Directors 4 Message from the CEO and the Managing Directors 6 Value creation 8 Highlights 10 Key fi gures 12 Risk management 14 Corporate and Social Responsibility 16 Evolution of the share in 2012 18 SHAREHOLDERS Distribution policy and proposed dividend 19 INFORMATION AND Investor relations 19 MARKET DATA Financial calendar 19 Market data and indicators 20 Resolutions proposed to Shareholders 22 Portfolio and adjusted net assets 24 ACTIVITY REPORT Consolidated fi gures IFRS (economic analysis) 28 Strategic investments 34 Total 34 GDF SUEZ 36 Lafarge 38 Pernod Ricard 40 Imerys 42 Suez Environnement 44 Breakdown of turnover by geographical area 46 Financial Pillar 47 Ergon Capital Partners 48 Sagard 49 Consolidated fi nancial statements 52 ACCOUNTS Condensed statutory balance sheet and income statement 100 AT 31 DECEMBER 2012 Dividend policy 102 Historical data 103 Corporate governance statement 106 CORPORATE Board of -

Actions Synthétiques France Heures De Négociation : 9:00 - 17:30 (CET) Frais Et Commissions : 0.1% Du Montant De La Transaction, Min

Actions Synthétiques France Heures de négociation : 9:00 - 17:30 (CET) Frais et Commissions : 0.1% du montant de la transaction, min. 8 EUR (Marge sur commission: 70% - 99.9%). Symbole Instrument dont le prix est basé sur Nombre d'actions par lot Taille minimale d'un ordre en lots Vente à découvert Taux d'emprunt de titre (%) AC.FR Accor SA CFD 1 1 OUI -3 ACA.FR Credit Agricole SA CFD 1 1 OUI -3 ADP.FR Aeroports de Paris CFD 1 1 OUI -3 AF.FR Air France-KLM CFD 1 1 OUI -3 AI.FR Air Liquide SA CFD 1 1 OUI -3 AIR.FR Airbus Group NV CFD 1 1 NON - AKE.FR Arkema SA CFD 1 1 OUI -3 ALO.FR Alstom SA CFD 1 1 OUI -3 ALT.FR Altran Technologies SA CFD 1 1 OUI -3 ATO.FR AtoS CFD 1 1 OUI -3 BB.FR Societe BIC SA CFD 1 1 OUI -3 BIM.FR BioMerieux CFD 1 1 OUI -3 BN.FR Danone CFD 1 1 OUI -3 BNP.FR BNP Paribas CFD 1 1 OUI -3 BOL.FR Bollore SA CFD 1 1 OUI -3 BVI.FR Bureau Veritas SA CFD 1 1 OUI -3 CA.FR Carrefour SA CFD 1 1 OUI -3 CAP.FR Cap Gemini SA CFD 1 1 OUI -3 CGG.FR CGG SA CFD 1 1 NON - CNP.FR CNP Assurances CFD 1 1 OUI -3 CO.FR Casino Guichard Perrachon SA CFD 1 1 OUI -3 COFA.FR Coface SA CFD 1 1 OUI -4,5 CS.FR AXA SA CFD 1 1 OUI -3 DEC.FR JCDecaux SA CFD 1 1 OUI -3 DG.FR Vinci SA CFD 1 1 OUI -3 DSY.FR Dassault Systemes CFD 1 1 OUI -3 EDEN.FR Edenred CFD 1 1 OUI -3 EDF.FR EDF SA CFD 1 1 OUI -3 EI.FR Essilor International SA CFD 1 1 OUI -3 ELE.FR Euler Hermes Group CFD 1 1 OUI -4,5 EN.FR Bouygues SA CFD 1 1 OUI -3 ENGI.FR ENGIE CFD 1 1 OUI -3 ENX.FR Euronext NV CFD 1 1 OUI -3 EO.FR Faurecia CFD 1 1 OUI -3 ERA.FR Eramet CFD 1 1 OUI -5 ERF.FR Eurofins -

Prospectus Établi a L’Occasion De L’Émission Et De L’Admission Des Actions Gdf Suez Résultant De La Fusion Par Absorption De Suez Par Gaz De France

PROSPECTUS ÉTABLI A L’OCCASION DE L’ÉMISSION ET DE L’ADMISSION DES ACTIONS GDF SUEZ RÉSULTANT DE LA FUSION PAR ABSORPTION DE SUEZ PAR GAZ DE FRANCE A ANNEXER AUX RAPPORTS DES CONSEILS D’ADMINISTRATION DE GAZ DE FRANCE ET SUEZ PRÉSENTÉS A LEURS ASSEMBLÉES GÉNÉRALES DU 16 JUILLET 2008 Visa de l’Autorité des marchés financiers En application des articles L.412-1 et L.621-8 du Code monétaire et financier, ainsi que des articles 211-1 à 216-1 de son règlement général, l’Autorité des marchés financiers a apposé sur le présent prospectus le visa n™08-126, en date du 13 juin 2008. Le présent prospectus a été établi par Suez et Gaz de France et engage la responsabilité de ses signataires. Ce visa a été attribué, conformément aux dispositions de l’article L.621-8-1-I du Code monétaire et financier, après que l’AMF a vérifié si le document est complet et compréhensible et si les informations qu’il contient sont cohérentes. Il n’implique ni approbation de l’opportunité de l’opération, ni authentification des éléments comptables et financiers présentés. Il atteste que l’information contenue dans ce prospectus correspond aux exigences réglementaires en vue de l’admission ultérieure aux négociations sur le marché Euronext Paris des actions nouvelles de Gaz de France qui, sous réserve de l’accord des assemblées générales des actionnaires, seront émises en rémunération de la fusion. L’avis de publicité relatif au traité de fusion entre Suez et Gaz de France, ainsi que les avis de réunion des assemblées générales de Suez et Gaz de France appelées à statuer sur la fusion ont été publiés au Bulletin des annonces légales obligatoires (BALO) le 11 juin 2008 (Bulletin n™0808234). -

Press Release

SUEZ ENVIRONNEMENT TOUR CB21 16, PLACE DE L’IRIS 92040 PARIS LA DÉFENSE CEDEX, FRANCE TEL +33 (0)1 58 81 20 00 WWW.SUEZ-ENVIRONNEMENT.COM PRESS RELEASE Paris, 27 November 2014 SUEZ ENVIRONNEMENT WELCOMES SYCTOM ’S ANNOUNCEMENT OF THE DECISION TO AWARD IT THE DESIGN -BUILD -OPERATE CONTRACT FOR THE ENERGY -FROM -WASTE RECOVERY FACILITY AT IVRY -PARIS XIII SYCTOM, the consortium in charge of treating and recovering the waste of 84 Ile-de-France districts, has announced that the contract to design, build and operate the energy-from-waste recovery facility at IVRY-PARIS XIII has been awarded to the consortium headed by SUEZ Environnement and its subsidiary SITA. 1 This contract is worth a total €1.8 billion over its 23-year lifetime, half of it going to SUEZ ENVIRONNEMENT. 2 A symbol of urban ecology, the future facility will harness the best technologies to turn waste into new resources and will be at the cutting edge of environmental performance. Having managed the facility since 2011, SITA will continue to operate the existing plant before starting work with its partners. SUEZ ENVIRONNEMENT and its subsidiary SITA are delighted with this contract award decision. SUEZ Environnement Press Contact: Isabelle Herrier Naufle Tel: +33 1 58 81 55 62 [email protected] Analysts/Investors Contact: Tel: + 33 1 58 81 24 05 ABOUT SUEZ ENVIRONNEMENT Natural resources are not infinite. SUEZ ENVIRONNEMENT (Paris: SEV, Brussels: SEVB) and its subsidiaries are committed to meeting the challenge of protecting resources by providing innovative solutions to millions of people and to industries on a daily basis. -

Carbon Footprint & Energy Transition Report

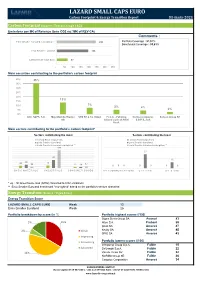

LAZARD SMALL CAPS EURO Carbon Footprint & Energy Transition Report 31-mars-2021 Carbon Footprint (Source : Trucost, scope 1&2) Emissions per M€ of Revenue (tons CO2 éq.*/M€ of REV CA) Comments : Emix Smaller Euroland reweighted ** 242 Portfolio Coverage : 97,51% Benchmark Coverage : 93,61% Emix Smaller Euroland 196 Lazard Small Caps Euro 67 - 50 100 150 200 250 300 350 Main securities contributing to the portfolio's carbon footprint 40% 35% 35% 30% 25% 20% 13% 15% 10% 7% 5% 4% 5% 2% 0% Altri, SGPS, S.A. Mayr-Melnhof Karton STO SE & Co. KGaA F.I.L.A. - Fabbrica Corticeira Amorim, Surteco Group SE AG Italiana Lapis ed Affini S.G.P.S., S.A. S.p.A. Main sectors contributing to the portfolio's carbon footprint* Sectors contributing the most Sectors contributing the least Lazard Small Caps Euro Lazard Small Caps Euro Emix Smaller Euroland Emix Smaller Euroland Emix Smaller Euroland reweighted ** Emix Smaller Euroland reweighted ** 193 27 87 12 35 28 24 13 17 12 11 00 0 0 0 0 0 BASIC MATERIALS INDUSTRIALS CONSUMER GOODS TELECOMMUNICATIONS UTILITIES OIL & GAS * eq. : All Greenhouse Gas (GHG) converted to CO2 emissions ** Emix Smaller Euroland benchmark "reweighted" based on the portfolio's sectors allocation Energy Transition (Source : Vigeo Eiris) Energy Transition Score LAZARD SMALL CAPS EURO Weak 13 Emix Smaller Euroland Weak 25 Portfolio breakdown by score (in %) Portfolio highest scores (/100) Sopra Steria Group SA Avancé 83 5% 10% Alten S.A. Probant 59 Ipsos SA Amorcé 47 2% Weak Nexity SA Amorcé 45 SPIE SA Amorcé 43 Improving Portfolio lowest scores (/100) Convincing Interpump Group S.p.A. -

Financial Report and Registration Document 2018 Contents

FINANCIAL REPORT AND REGISTRATION DOCUMENT 2018 CONTENTS Editorial from the Chairman and CEO 2 An extensive and diversified offering 4 5 Consolidated Financial Statements 199 Business model 6 5.1. Financial Statements 200 5.2. Notes to the Consolidated Financial Corporate Social Responsibility 8 Statements 205 5.3. Statutory Auditors’ report Board of Directors 10 on the consolidated fi nancial statements 268 5.4. History of signifi cant consolidated items Key figures 2018 12 and ratios 273 1 Introduction to the Group 15 6 Company financial statements 275 1.1. Business sector 16 6.1. Financial statements 276 1.2. A profi table growth strategy 19 6.2. Notes to the SEB S.A. fi nancial statements 278 1.3. Organization and internal control 29 6.3. Five-year fi nancial summary 294 1.4. Risk factors 36 6.4. Statutory auditors’ report on the fi nancial statements 295 2 Corporate governance 53 7 Information concerning the company 2.1. Implementation framework for corporate governance principles 54 and its share capital 299 2.2. Management structure 54 7.1. Information concerning the company 300 2.3. Composition, organization and operation 7.2. Information on share capital 303 of the Board of Directors 55 7.3. Financial authorizations 309 2.4. Group management bodies 82 7.4. Employee shareholding 310 2.5. Remuneration policy 83 7.5. Stock market and dividend information 313 3 Corporate Social Responsibility 113 8 Annual General Meeting 315 3.1. Commitment and management 114 8.1. Agenda for the Combined Annual General 3.2. Non-Financial Performance Statement Meeting of 22 May 2019 316 (DPEF) & Duty of Vigilance 117 8.2.