Full Portfolio Holdings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Impatto COVID-19 Sui Primi Nove Mesi 2020 (Mnes Mondiali E FTSE MIB)

BRIEFING NOTE: IMPACTS OF COVID-19 PANDEMIC ON 9 MONTHS 2020 (MNES AND FTSE MIB) Area Studi Mediobanca Milan, 19 November 2020 1 ASM SHEDS LIGHT ON THE IMPACT OF PANDEMIC FOR 9M 2020 The survey analyses trends on results for 9M 2020 of: 1) Large industrial companies that have disclosed the results for the period January- September by November 16, 2020, sector by sector 2) 26 industrial and service companies listed on the FTSE MIB*: A2A, Amplifon, Atlantia, Buzzi Unicem, CNH Industrial, Davide Campari-Milano, DiaSorin, ENEL, ENI, FCA, Ferrari, Hera, Interpump Group, Inwit, Italgas, Leonardo, Moncler, Pirelli & C., Prysmian, Recordati, Saipem, Snam, STM, Telecom Italia, Tenaris, Terna That are 15 privately held and 11 state-owned companies, 16 manufacturing industry, 6 energy/utilities, 3 service companies and 1 oil and gas At the end of September 2020 the FTSE MIB companies analyzed were worth 318 €billion on the stock market and represented 76% of the total capitalization (excluding finance and insurance) 2 * Escluding Exor because does not publish quarterly reports SUMMARY 1. Impact on results for 9M 2020: Large industrial companies 2. Impact on results for 9M 2020: FTSE MIB (industry and services) 3. Overall look 3 IMPACT ON RESULTS FOR 9M 2020: LARGE INDUSTRIAL COMPANIES Section 1 4 REVENUES GROWTH IN 9M 2020/2019 Net sales 9M 2020/2019, percentage change – Multinational companies by sectors 18.4 8.8 5.7 3.7 3.1 0.3 -1.8 -5.4 -9.4 -17.4 -21.3 -30.6 -32.3 The world multinational companies average is equal to: -4.3% 5 REVENUES GROWTH IN DIFFERENT QUARTERS 2020 Net sales 9M 2020/2019, percentage change - Multinational companies by sectors 1Q 2020/2019 2Q 2020/2019 3Q 2020/2019 20.4 17.3 17.5 10.5 7.3 8.5 6.5 5.9 6.3 5.5 4.5 3.8 5.0 4.6 4.3 2.4 2.2 -0.2 -1.6 -0.8 -2.3 -2.5 -3.2 -3.0 -5.7 -9.2 -8.7 -9.8 -12.5 -13.1 -14.8 -21.7 -21.9 -28.0 -31.6 -40.5 -41.6 -42.1 -51.5 WebSoft, large-scale distribution, electronics and food are the only sectors to grow the net sales in all the different quarters of 2020. -

Annual Report and Financial Statements 2018 Sainsbury’S Group Helping Customers Live Well for Less Has Been at the Heart of What We Do Since 1869

Live Well For Less Annual Report and Financial Statements 2018 Sainsbury’s Group Helping customers live well for less has been at the heart of what we do since 1869. We employ over 185,000 colleagues who work hard every day to make our customers’ lives easier and to provide them with great products, quality and service whenever and wherever it is convenient to access them. Food Our strategic focus is to help 608 our customers live well for less. Sainsbury’s supermarkets We offer customers quality and convenience as well as great value. Our distinctive ranges and innovative 102 partnerships differentiate stores offering Same Day our offer. More customers delivery to 40 per cent are shopping with us than of the UK population ever before and our share of customer transactions has increased. See more on page 12 General Merchandise 191 and Clothing Argos stores in Sainsbury’s We are one of the largest general supermarkets merchandise and clothing retailers in the UK, offering a wide range of products across our Argos, Sainsbury’s Home and 16 Habitat brands, in stores and Habitat stores and online. We are a market leader in Click & Collect available toys, electricals and technology in over 2,300 locations and Tu clothing offers high street style at supermarket prices. See more on page 14 Financial Services Financial Services are an 3.9m integral part of our business. Active customers Sainsbury’s Bank offers at Sainsbury’s Bank and accessible products such as Argos Financial Services credit cards, insurance, travel money and personal loans that reward loyalty. -

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2

2020 Annual Report HIGHLIGHTS SHAREHOLDER MANAGEMENT SUSTAINABILITY CORPORATE COMPENSATION FINANCIAL APPENDIX LETTER COMMENTARY REPORT GOVERNANCE REPORT REPORT 2 CONTENTS #TogetherStrong Highlights 3 #TogetherStrong is a tag-name that covers #TogetherStrong aptly describes how we countless initiatives we took to address progressed through and emerged from this Letter to shareholders 7 pressing needs in the dental community extraordinary year. Management commentary 11 in 2020. Straumann Group in brief 12 Strategy in action 17 #TogetherStrong is forward-looking; it Products, solutions and services 21 It started with a website offering scientific expresses purpose, teamwork, courage, Innovation 26 and practical information to help Markets 29 determination, perseverance, moving Business performance (Group) 35 customers and staff through the corona forward and succeeding in turbulent Business performance (Regions) 38 virus crisis. Soon it became a holistic, Business performance (Financials) 44 surroundings – themes that are captured Share performance 46 omni-channel response including a in the pictures and contents of this report. Risk management 49 massive education platform. Sustainability report 57 The #TogetherStrong concept has Corporate governance 80 extended to thousands of activities Compensation report 107 and millions of communications. It demonstrates how the events of 2020 Financial report 123 fuelled our resourcefulness, innovation Appendix 184 and passion for creating opportunities. Global Reporting Initiative (GRI) 185 GRI content -

Report on Remuneration Policy and Compensation Paid 2021

Report on theremuneration Remuneration policy Policyand compensation and remuneration paid paid 2021 energy to inspire the world COMPANY PROFILE Snam is one of the world’s leading energy infrastructure operators and ranks among Italy’s largest listed companies, by market capitalization. Through a sustainable and technologically advanced network, Snam guarantees the security of supply and is a key enabler in the energy transition. Through its international footprint Snam operates in Albania (AGSCo), Austria (TAG, GCA), France (Teréga), Greece (DESFA), Italy, UAE (ADNOC Gas Pipelines) and UK (Interconnector UK) and has recently started activities in China and India. Snam is also one of the leading shareholders in TAP (Trans Adriatic Pipeline). The Group has the largest natural gas transportation network (over 41,000 km including international assets) and storage capacity (approx. 20 bcm including international assets) among its European peers and is also a leading player in regasification, through the LNG terminal in Panigaglia (GNL Italia) and its stakes in the Livorno (OLT) and Rovigo (Adriatic LNG) terminals in Italy and in the Revithoussa (DESFA) terminal in Greece. In its 2020-2024 strategic plan, Snam plans an increase in investments to 7.4 billion euros and more focus on the energy transition businesses: biomethane (Snam4Environment), energy efficiency (Renovit), sustainable mobility (Snam4Mobility) and hydrogen. The company also operates in forestation (Arbolia) and is committed to achieving carbon neutrality (Scope 1 and Scope 2) by 2040. The Group’s business model is based on sustainable growth, transparency, the promotion of talents and diversity and the social development of local areas also through the initiatives of Fondazione Snam. -

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

Nippon COMSYS Corporation Annual Report 1999

ANNUAL REPORT 1999 Fiscal Year Ended March 31, 1999 COMSYS — For Excellence in Telecommunications Profile Financial Highlights • Nippon COMSYS Corporation • • Years ended March 31, 1998 and 1999 • • • • • Thousands of Nippon COMSYS Corporation was founded in 1951 to assume the duties of the Millions of yen U.S. dollars Change 1998 1999 1999 (%) Construction Division of Nippon Telegraph and Telephone Public Corporation (NTT). Contract backlog at beginning of the year ¥ 57,684 ¥ 68,458 $ 570,483 18.7% Since its establishment, the Company has been a leader in the telecommunications New orders received during the year 234,877 228,838 1,906,983 –2.6% Net sales 224,103 219,764 1,831,366 –1.9% engineering field. A specialist in communications and computer technology, Contract backlog at end of year 68,458 77,532 646,100 13.3% COMSYS, is striving to grow its business to meet the 21st century, and to make a Net income ¥ 7,611 ¥ 5,075 $ 42,292 –33.3% contribution to the development of the information-based society. We are fostering Total assets 160,561 166,002 1,383,350 3.4% a corporate culture characterized by fresh thinking and open communication, in Shareholders’ equity 90,101 96,635 805,292 7.3% which each employee can take pride, each employee can thrive, and each employee Ye n U.S. dollars can give full expression to his talents and capabilities. We are a creative organization, Per share: Net income ¥ 60.96 ¥ 38.78 $ 0.32 –36.4% working toward a better future. Cash dividends 14.25 10.00 0.08 –29.8% Note: Yen figures have been converted from U.S. -

SEB Fund 1 AR 31122019 Final Post BM

Annual Report SEB Fund 1 Status: 31 December 2019 R.C.S K 49 Notice The sole legally binding basis for the purchase of units of the Fund described in this report is the latest valid Sales Prospectus with its terms of contract. Table of Contents Page Additional Information to the Investors in Germany 2 Organisation 3 General Information 5 Management Report 9 Schedule of Investments: SEB Fund 1 - SEB Asset Selection Fund 10 SEB Fund 1 - SEB Europe Index Fund 14 SEB Fund 1 - SEB Global Fund 24 SEB Fund 1 - SEB Global Chance / Risk Fund 33 SEB Fund 1 - SEB Norway Focus Fund 39 SEB Fund 1 - SEB Sustainability Fund Europe 41 SEB Fund 1 - SEB Sustainability Nordic Fund 46 SEB Fund 1 - SEB US All Cap 48 Combined Statement of Operations 50 Combined Statement of Changes in Net Assets 54 Combined Statement of Net Assets 58 Statistical Information 62 Notes to the Financial Statements 74 Audit Report 81 Risk Disclosure (unaudited) 84 Remuneration Disclosure (unaudited) 86 1 Additional Information to the Investors in Germany As at 31 December 2019 Units in circulation: The following Sub-Funds are publicly approved for distribution in Germany: • SEB Fund 1 - SEB Asset Selection Fund • SEB Fund 1 - SEB Global Fund • SEB Fund 1 - SEB Global Chance / Risk Fund • SEB Fund 1 - SEB Sustainability Fund Europe • SEB Fund 1 - SEB Sustainability Nordic Fund The following Sub-Funds are not distributed in Germany: • SEB Fund 1 - SEB Europe Index Fund • SEB Fund 1 - SEB Norway Focus Fund • SEB Fund 1 - SEB US All Cap The information disclosed above is as at 31 December 2019 and this may change after the year end. -

Goodwill Impairment Test of the Cellular Segment June 30Th, 2019

Bezeq The Israel Telecommunication Corporation Limited Goodwill Impairment Test of the Cellular Segment June 30th, 2019 August 2019 14 Kreminitzky St., Tel Aviv 6789912 I Tel.: 03-5617801 I Fax: 077-3181607 Introduction and Limit of Liability • We were retained by Bezeq The Israel Telecommunication Corp. Ltd. (hereunder “Bezeq” and/or “Bezeq Group” and/or the ”Client”) to prepare a goodwill impairment test report (the “Report”) of the cellular business unit (hereunder: “Pelephone” and/or the “Cellular Segment”) as of June 30th, 2019. • The Report intended solely for the use of the Client and is . This Report may not be reproduced, in whole or in part, and the findings of this Report may not be used by a third party for any purpose, without our expressed written consent. Notwithstanding any of the above, this Report may be included in the Client’s financial statements of as of June. 30, 2017. • For the purpose of preparing this Report, we relied upon financial and other information including prospective financial information obtained from the Company and/or the Client and/or anyone on their behalf (the “Information”). We assumed that the Information is credible and therefore did not perform an independent audit of the information. In addition, nothing suggesting that the Information may be unreasonable has come to our attention. The Information has not been examined in an independent manner, and therefore this Report does not constitute a verification of the Information’s correctness, completeness and accuracy. If the case that the Information is not complete nor accurate or credible, the results of this valuation might change. -

BT Group PLC: Wholesale-Only Overhang

Equity Research Telecommunications | European Telecom Services BT Group PLC 3 May 2018 Stock Rating EQUAL WEIGHT Wholesale-Only overhang from Overweight Industry View POSITIVE In a separate report published today, The Rise of Wholesale Only, we analyse the Unchanged impact Open Fiber is having in Italy and the extent to which it can be replicated Price Target GBp 280 elsewhere. Italy appears an ideal market for fostering alternative infrastructure lowered -20% from GBp 350 build (and increased retail competition). We note actual competitor builds to date in the UK have been few and far between, even if the narrative has been consistently Price (01-May-2018) GBp 245 noisy. However, we do see BT as potentially vulnerable, especially given the Potential Upside/Downside +14.3% increased focus of numerous infrastructure funds and regulatory direction. Tickers BT/A LN / BT.L Resolution of this overhang for BT looks unlikely, in our view. Reflecting this, we lower our medium-term forecasts, cut our PT to 280p and move BT to Equal Weight. Market Cap (GBP mn) 24591 Shares Outstanding (mn) 9921.90 Wholesale-only is not new – Why worry now? We have become accustomed to a Free Float (%) 84.31 spate of alternative FTTH build announcements in recent months from numerous 52 Wk Avg Daily Volume (mn) 22.4 players. In reality, FTTH build has been limited. However, having met recently with 52 Wk Avg Daily Value (GBP mn) 60.93 Open Fiber in Italy, we see an opportunity to make double-digit IRRs for alternative Dividend Yield (%) 6.3 build in markets like Italy/the UK/Germany. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

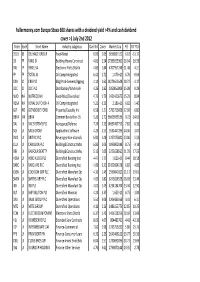

Fullermoney.Com Europe Stoxx 600 Shares with a Dividend Yield >4

Fullermoney.com Europe Stoxx 600 shares with a dividend yield >4% and cash dividend cover >1 July 2nd 2012 Ticker Exch Short Name industry subgroup Dvd Yld Cover Market Cap P/E TR YTD DELB BB DELHAIZE GROUP Food-Retail 6.09 2.65 3696837120 6.10 -31.17 DG FP VINCI SA Building-Heavy Construct 4.81 1.54 27399055360 10.64 10.33 RXL FP REXEL SA Electronic Parts Distrib 4.83 1.84 4707957248 11.48 4.21 FP FP TOTAL SA Oil Comp-Integrated 6.42 2.72 1.07E+11 6.76 -9.63 CRH ID CRH PLC Bldg Prod-Cement/Aggreg 4.14 1.62 14079643648 18.72 -1.17 DCC ID DCC PLC Distribution/Wholesale 4.26 1.82 1950855808 15.08 0.29 NUO NA NUTRECO NV Food-Misc/Diversified 4.73 1.79 2431420672 15.29 8.04 RDSA NA ROYAL DUTCH SH-A Oil Comp-Integrated 5.21 3.23 2.18E+11 6.82 -5.40 GJF NO GJENSIDIGE FORSI Property/Casualty Ins 6.58 1.21 5795755008 12.60 6.80 BBVA SM BBVA Commer Banks Non-US 5.26 1.71 36606939136 9.72 -14.65 BA/ LN BAE SYSTEMS PLC Aerospace/Defense 7.24 2.13 14692467712 7.82 6.36 SGE LN SAGE GROUP Applications Software 4.23 2.57 5531447296 14.36 -1.07 BVIC LN BRITVIC PLC Beverages-Non-alcoholic 6.03 1.48 1257075840 13.06 5.33 CLLN LN CARILLION PLC Building&Construct-Misc 6.80 2.09 1890802048 8.75 -3.14 BBY LN BALFOUR BEATTY Building&Construct-Misc 5.15 2.05 3222658560 11.29 17.55 HSBA LN HSBC HLDGS PLC Diversified Banking Inst 4.47 1.77 1.62E+11 9.44 18.58 BARC LN BARCLAYS PLC Diversified Banking Inst 4.09 3.10 32422064128 6.82 -4.85 CKSN LN COOKSON GRP PLC Diversified Manufact Op 4.10 1.49 2590840320 11.17 19.61 SMIN LN SMITHS GRP PLC Diversified Manufact -

Annual Report 2012

Annual Report 2012 Groupe Bruxelles Lambert Online additional information www.gbl.be Investors information Additional information can be found on Online registration in order to receive the website, among which: investors information (notices, • Historical information of GBL press releases, ...) through the • The yearly and half-yearly reports and Company website. also quarterly press releases • Adjusted net assets on a weekly basis • The press releases • The portfolio Investor relations Axelle Henry [email protected] Tel.: +32 (0)2 289 17 17 Annual Report 2012 Overview of GBL 2 THE ESSENTIAL Message from the Chairman of the Board of Directors 4 Message from the CEO and the Managing Directors 6 Value creation 8 Highlights 10 Key fi gures 12 Risk management 14 Corporate and Social Responsibility 16 Evolution of the share in 2012 18 SHAREHOLDERS Distribution policy and proposed dividend 19 INFORMATION AND Investor relations 19 MARKET DATA Financial calendar 19 Market data and indicators 20 Resolutions proposed to Shareholders 22 Portfolio and adjusted net assets 24 ACTIVITY REPORT Consolidated fi gures IFRS (economic analysis) 28 Strategic investments 34 Total 34 GDF SUEZ 36 Lafarge 38 Pernod Ricard 40 Imerys 42 Suez Environnement 44 Breakdown of turnover by geographical area 46 Financial Pillar 47 Ergon Capital Partners 48 Sagard 49 Consolidated fi nancial statements 52 ACCOUNTS Condensed statutory balance sheet and income statement 100 AT 31 DECEMBER 2012 Dividend policy 102 Historical data 103 Corporate governance statement 106 CORPORATE Board of