Winter 2015 Cosmic Shift: the Commercial Space Revolution

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 Nano/Microsatellite Market Forecast, 9Th Edition

2019 NANO/MICROSATELLITE MARKET FORECAST, 9TH EDITION Copyright 2018, SpaceWorks Enterprises, Inc. (SEI) APPROVED FOR PUBLIC RELEASE. SPACEWORKS ENTERPRISES, INC., COPYRIGHT 2018. 1 Since 2008, SpaceWorks has actively monitored companies and economic activity across both the satellite and launch sectors 0 - 50 kg 50 - 250kg 250 - 1000kg 1000 - 2000kg 2000kg+ Custom market assessments are available for all mass classes NANO/MICROSATELLITE DEFINITION Picosatellite Nanosatellite Microsatellite Small/Medium Satellite (0.1 – 0.99 kg) (1 – 10 kg) (10 – 100 kg) (100 – 1000 kg) 0 kg 1 kg 10 kg 100 kg 1000 kg This report bounds the upper range of interest in microsatellites at 50 kg given the relatively large amount of satellite development activity in the 1 – 50 kg range FORECASTING METHODOLOGY SpaceWorks’ proprietary Launch Demand Database (LDDB) Downstream serves as the data source for all satellite market Demand assessments ▪ Planned The LDDB is a catalogue of over 10,000+ historical and Constellations future satellites containing both public and non-public (LDDB) satellite programs Launch Supply SpaceWorks newly updated Probabilistic Forecast Model (PFM) is used to generate future market potential SpaceWorks PFM Model ▪ The PFM considers down-stream demand, announced/planed satellite constellations, and supply-side dynamics, among other relevant factors Expert Analysis The team of expert industry analysts at SpaceWorks SpaceWorks further interprets and refines the PFM results to create Forecast accurate market forecasts Methodology at a Glance 2018 SpaceWorks forecasted 2018 nano/microsatellite launches with unprecedented accuracy – actual satellites launched amounted to just 5% below our analysts’ predictions. In line with SpaceWorks’ expectations, the industry corrected after a record launch year in 2017, sending 20% less nano/microsatellites to orbit than in 2018. -

Spectrum and the Technological Transformation of the Satellite Industry Prepared by Strand Consulting on Behalf of the Satellite Industry Association1

Spectrum & the Technological Transformation of the Satellite Industry Spectrum and the Technological Transformation of the Satellite Industry Prepared by Strand Consulting on behalf of the Satellite Industry Association1 1 AT&T, a member of SIA, does not necessarily endorse all conclusions of this study. Page 1 of 75 Spectrum & the Technological Transformation of the Satellite Industry 1. Table of Contents 1. Table of Contents ................................................................................................ 1 2. Executive Summary ............................................................................................. 4 2.1. What the satellite industry does for the U.S. today ............................................... 4 2.2. What the satellite industry offers going forward ................................................... 4 2.3. Innovation in the satellite industry ........................................................................ 5 3. Introduction ......................................................................................................... 7 3.1. Overview .................................................................................................................. 7 3.2. Spectrum Basics ...................................................................................................... 8 3.3. Satellite Industry Segments .................................................................................... 9 3.3.1. Satellite Communications .............................................................................. -

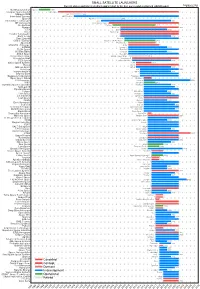

Small Satellite Launchers

SMALL SATELLITE LAUNCHERS NewSpace Index 2020/04/20 Current status and time from development start to the first successful or planned orbital launch NEWSPACE.IM Northrop Grumman Pegasus 1990 Scorpius Space Launch Demi-Sprite ? Makeyev OKB Shtil 1998 Interorbital Systems NEPTUNE N1 ? SpaceX Falcon 1e 2008 Interstellar Technologies Zero 2021 MT Aerospace MTA, WARR, Daneo ? Rocket Lab Electron 2017 Nammo North Star 2020 CTA VLM 2020 Acrux Montenegro ? Frontier Astronautics ? ? Earth to Sky ? 2021 Zero 2 Infinity Bloostar ? CASIC / ExPace Kuaizhou-1A (Fei Tian 1) 2017 SpaceLS Prometheus-1 ? MISHAAL Aerospace M-OV ? CONAE Tronador II 2020 TLON Space Aventura I ? Rocketcrafters Intrepid-1 2020 ARCA Space Haas 2CA ? Aerojet Rocketdyne SPARK / Super Strypi 2015 Generation Orbit GoLauncher 2 ? PLD Space Miura 5 (Arion 2) 2021 Swiss Space Systems SOAR 2018 Heliaq ALV-2 ? Gilmour Space Eris-S 2021 Roketsan UFS 2023 Independence-X DNLV 2021 Beyond Earth ? ? Bagaveev Corporation Bagaveev ? Open Space Orbital Neutrino I ? LIA Aerospace Procyon 2026 JAXA SS-520-4 2017 Swedish Space Corporation Rainbow 2021 SpinLaunch ? 2022 Pipeline2Space ? ? Perigee Blue Whale 2020 Link Space New Line 1 2021 Lin Industrial Taymyr-1A ? Leaf Space Primo ? Firefly 2020 Exos Aerospace Jaguar ? Cubecab Cab-3A 2022 Celestia Aerospace Space Arrow CM ? bluShift Aerospace Red Dwarf 2022 Black Arrow Black Arrow 2 ? Tranquility Aerospace Devon Two ? Masterra Space MINSAT-2000 2021 LEO Launcher & Logistics ? ? ISRO SSLV (PSLV Light) 2020 Wagner Industries Konshu ? VSAT ? ? VALT -

Study of Future Perspectives of Micro/Nanosatellites Constellations in the Earth Observation Market

Study of future perspectives of Micro/Nano-satellites constellations in the Earth Observation market Master’s thesis Master’s Degree in Aeronautical Engineering ANNEX Mariona Costa Rabionet June 2019 Supervisor of the TFM: Miquel Sureda Anfres Co-Supervisor of TFM: Silvia Rodríguez Donaire Study of future perspectives of micro/nanosatellites constellations in the Earth Observation market Content ANNEX 1: New Space companies .................................................................................................. 3 ANNEX 2: Flock satellites status. ................................................................................................. 11 ANNEX 3: TLE number of Flock constellation satellites .............................................................. 31 ANNEX 4: Flock satellites orbital parameters. ............................................................................ 42 ANNEX 4: SaVi configuration ....................................................................................................... 56 Bibliography ................................................................................................................................ 65 2 Study of future perspectives of micro/nanosatellites constellations in the Earth Observation market ANNEX 1: New Space companies In this annex, it can be found the list of New space companies that has been analysed to be included in the qualitative analysis (table 1). Table 1. New space companies[1] Planned Organization Launched First launch Form factor Field Technical -

The Impact of New Trends in Satellite Launches on Orbital Debris Environment

THE IMPACT OF NEW TRENDS IN SATELLITE LAUNCHES ON ORBITAL DEBRIS ENVIRONMENT Arif Göktuğ Karacalıoğlu STC / NASA Ames Research Center, United States, [email protected] Jan Stupl SGT / NASA Ames Research Center, United States The main goal of this study is to examine the impact of new trends in satellite launch activities on the orbital debris environment and collision risk. Starting from the launch of the first artificial satellite in 1957, space borne technology has become an indispensable part of our lives. More than 6,000 satellites have been launched into Earth orbit. Though the annual number of satellites launched stayed flat for many decades, the trend has recently changed. The satellite market has been undergoing a major evolution with new space companies replacing the traditional approach of deploying a few large, complex and costly satellites with an approach to use a multitude of smaller, less complex and cheaper satellites. This new approach creates a sharp increase in the number of satellites and so the historic trends are no longer representative. As a foundation for this study, a scenario for satellite deployments based on publicly announced future satellite missions has been developed. These constellation-deploying companies include, but are not limited to, Blacksky, CICERO, EROS, Landmapper, Leosat, Northstar, O3b, OmniEarth, OneWeb, Orbcomm, OuterNet, PlanetIQ, Planet Labs, Radarsat, RapidEye Next Generation, Sentinel, Skybox, SpaceX, and Spire. Information such as the annual number of launches, the number of orbital planes to be used by the constellation, as well as apogee, perigee, inclination, spacecraft mass and area were included or approximated. -

88 Satellite Deployment and Frequency Licensing for Planet's Earth Imaging Constellation

88 Satellite Deployment and Frequency Licensing for Planet's Earth Imaging Constellation Bryan Klofas [email protected] CubeSat Developers’ Workshop San Luis Obispo, California 27 April 2017 1 Uluru, Australia, DEC 2, 2015 Launch • Launched 88 Dove Satellites on PSLV-C37 (Cartosat-2D) • 15 Feb 2017 UTC • Total 104 satellites, 101 CubeSats, 25 QuadPacks • Everything went really smoothly • Not the first time QuadPacks were launched on PSLV • Sequencer needed to be built and tested • Extra QuadPacks supported another 20 satellites • Pathfinder: PSLV-C34 • 12 Doves deployed on 22 June 2016 • This launched proved that Planet, ISIS, and ISRO/Antrix knew how to handle large amounts of satellites Disclaimer: I am not a lawyer. I am not intending to provide legal advice or counseling, and the audience should seek their own counsel. Slide 2 Credit: Planet Slide 3 Credit: ISIS Slide 4 Valentine’s Day Launch I DOVE YOU I’M CRAZY3 U YOU SPIN MY WHEELS Credit: ISRO Slide 5 Credit: ISRO Slide 6 Credit: ISRO Slide 7 Credit: ISRO Slide 8 Commissioning Status ● All satellites contacted and health data downloaded 3 hours after launch (second pass) ● Upload 3 MBytes of software updates ● Status as of April 20th: ○ 40 fully commissioned and imaging ○ 46 undergoing commissioning ○ 2 non-responsive (expected 5%) ○ Expect commissioning complete in June 2017 ○ Non-overlapping ground tracks in June 2017 ○ Not fully phased until Oct 2017 ● Total satellite fleet (April 20th): ○ 84 imaging from all launches Slide 9 Ground Station Status • Up to 16 S/X-band dishes, -

Redalyc.Status and Trends of Smallsats and Their Launch Vehicles

Journal of Aerospace Technology and Management ISSN: 1984-9648 [email protected] Instituto de Aeronáutica e Espaço Brasil Wekerle, Timo; Bezerra Pessoa Filho, José; Vergueiro Loures da Costa, Luís Eduardo; Gonzaga Trabasso, Luís Status and Trends of Smallsats and Their Launch Vehicles — An Up-to-date Review Journal of Aerospace Technology and Management, vol. 9, núm. 3, julio-septiembre, 2017, pp. 269-286 Instituto de Aeronáutica e Espaço São Paulo, Brasil Available in: http://www.redalyc.org/articulo.oa?id=309452133001 How to cite Complete issue Scientific Information System More information about this article Network of Scientific Journals from Latin America, the Caribbean, Spain and Portugal Journal's homepage in redalyc.org Non-profit academic project, developed under the open access initiative doi: 10.5028/jatm.v9i3.853 Status and Trends of Smallsats and Their Launch Vehicles — An Up-to-date Review Timo Wekerle1, José Bezerra Pessoa Filho2, Luís Eduardo Vergueiro Loures da Costa1, Luís Gonzaga Trabasso1 ABSTRACT: This paper presents an analysis of the scenario of small satellites and its correspondent launch vehicles. The INTRODUCTION miniaturization of electronics, together with reliability and performance increase as well as reduction of cost, have During the past 30 years, electronic devices have experienced allowed the use of commercials-off-the-shelf in the space industry, fostering the Smallsat use. An analysis of the enormous advancements in terms of performance, reliability and launched Smallsats during the last 20 years is accomplished lower prices. In the mid-80s, a USD 36 million supercomputer and the main factors for the Smallsat (r)evolution, outlined. -

Do Not Circulate

LA-7328-PR Progress Report a . Laser Fusion Program July 1—December 31, 1977 ,- .. .. .. ..-— — DO NOT CIRCULATE PERMANENT RETENTION ! REQUIREDBY CONTRACT v LOS ALAMOS SCIENTIFIC LABORATORY Lail!lik — post Office Box 1663 Los Alamos, New Mexico 87545 An AffumativeAction/EqualOpportunityEmployex . The four most recent reports in this series,un- classified, are LA-65 10-PR, LAY6 16-PR, LA4834-PR, and LA-6982-PR. This work was supported by the US Department of Energy, Office of Laser Fusion. TM. report was prep.rcd as m .CLWUII1O( work sponsored by the United SUICS Go”enlme”l. Neither the Un,ted Stiles I nor the United Slates Department cd Enersy. nor any of their employees. nor any 0( their CO.114C10rS. subcontrar tom. or their ●w.loyecs. makes any warranty. .xD,,!s O, irnPlled. ., P .isume. any Iesal Ii. biiity or responsibkbw for the accuracy. cmnpletcncm. y usefulness of any information. app.; .t.s. product. or Pro..= dl=losed. or rrpreacnm that its w would “.1 i“fri”le privately owned rlthls. UNITED STATES DEPARTMENT OF CNCRGV CONTRACT W-7408 -CNO. S6 LA-7328-PR Progress Report UC-21 IssI,W: December 1978 . Laser Fusion Program at LASL July 1—December 31, 1977 Compiled by Frederick Skoberne 4 .! L-. — .— - . ABSTRACT . ...”” 1 SUMMARY . ...0000oo 2 Introduction . 2 CO, Laser Program . 2 Antares . 2 CO, Laser Technology . 3 Laser Fusion Theory, Experiments, and Target Design . 3 Laser Fusion Target Fabrication . 4 1, CO, LASER PROGRAM . 6 Single-Beam System . 6 llvo-Beam System . 6 Eight-Beam System . 8 II. ANTARES-HIGH-ENERGY GAS IJM3ERFAClLITY . -

Orbital Sciences 2013 Annual Report Final Version.Pdf

Orbital Sciences Corporation 2013 ANNUAL REPORT Antares Test Flight Launched 9 Research Rockets Launched in Second Wallops Island, VA Quarter Orbital Sciences Corporation YEAR IN REVIEW 41 Space Missions Conducted and 37 Rockets and Satellites Sold in 2013 Coyote Target Launched Azerspace/Africasat-1a San Nicolas Island, CA Satellite Launched Orbital Wins Order for Kourou, French Guiana Thaicom 8 Satellite Missile Defense Interceptor Launched Vandenberg AFB, CA Orbital Selected to Develop Stratolaunch Vehicle Coyote Target Launched San Nicolas Island, CA JANUARY FEBRUARY MARCH APRIL MAY JUNE Landsat 8 Satellite 3 Coyote Targets Launched Orbital Wins NASA Launched Vandenberg AFB, CA TESS Satellite Contract San Nicolas Island, CA Orbital Wins New Satellite to identify Earth- Interceptor Order like planets Antares Stage One Hot-Fire Test Conducted Wallops Island, VA Orbital Wins NASA ICON Satellite Contract Satellite to study the Sun’s effect on the Ionosphere Coyote Target Launched 5 Antares Engines Tested 3 Research Rockets San Nicolas Island, CA Launched in First Quarter 9 Research Rockets 4 Research Rockets Launched in Second Launched in Third Quarter Quarter 2 Coyote Targets Launched Orbital Receives New San Nicolas Island, CA Target Vehicle Order Pegasus Launched IRIS Satellite Vandenberg AFB, CA Minotaur V Debut Additional Military Launched LADEE Lunar SES-8 Satellite Satellite Order Received Probe Launched 2 Coyote Targets Wallops Island, VA Cape Canaveral, FL Launched Kauai, HI JULY AUGUST SEPTEMBER OCTOBER NOVEMBER DECEMBER Antares -

The ANTARES Collaboration

PROCEEDINGS OF THE 31st ICRC, ŁOD´ Z´ 2009 1 The ANTARES Collaboration: contributions to the 31st International Cosmic Ray Conference (ICRC 2009), Lodz, Poland, July 2009 Abstract The Antares neutrino telescope, operating at 2.5 km depth in the Mediterranean Sea, 40 km off the Toulon shore, represents the world’s largest operational underwater neutrino telescope, optimized for the detection of Cerenkov light produced by neutrino-induced muons. The main goal of Antares is the search of high energy neutrinos from astrophysical point or transient sources. Antares is taking data in its full 12 lines configuration since May 2008: in this paper we collect the 16 contributions by the ANTARES collaboration that were submitted to the 31th International Cosmic Ray Conference ICRC 2009. These contributions includes the detector performances, the first preliminary results on neutrino events and the current physics analysis including the sensitivity to point like sources, the possibility to detect high energy neutrinos in coincidence with GRB, the search for dark matter or exotic particles. arXiv:1002.0701v1 [astro-ph.HE] 3 Feb 2010 2 THE ANTARES COLLABORATION ANTARES Collaboration J.A. Aguilar1, I. Al Samarai2, A. Albert3, M. Anghinolfi4, G. Anton5, S. Anvar6, M. Ardid7, A.C. Assis Jesus8, T. Astraatmadja8; a, J.J. Aubert2, R. Auer5, B. Baret9, S. Basa10, M. Bazzotti11; 12, V. Bertin2, S. Biagi11; 12, C. Bigongiari1, M. Bou-Cabo7, M.C. Bouwhuis8, A. Brown2, J. Brunner2; b, J. Busto2, F. Camarena7, A. Capone13; 14, C.C^arloganu15, G. Carminati11; 12, J. Carr2, E. Castorina16; 17, V. Cavasinni16; 17, S. Cecchini12; 18, Ph. -

Sale Price Drives Potential Effects on DOD and Commercial Launch Providers

United States Government Accountability Office Report to Congressional Addressees August 2017 SURPLUS MISSILE MOTORS Sale Price Drives Potential Effects on DOD and Commercial Launch Providers Accessible Version GAO-17-609 August 2017 SURPLUS MISSILE MOTORS Sale Price Drives Potential Effects on DOD and Commercial Launch Providers Highlights of GAO-17-609, a report to congressional addressees Why GAO Did This Study What GAO Found The U.S. government spends over a The Department of Defense (DOD) could use several methods to set the sale billion dollars each year on launch prices of surplus intercontinental ballistic missile (ICBM) motors that could be activities as it strives to help develop a converted and used in vehicles for commercial launch if current rules prohibiting competitive market for space launches such sales were changed. One method would be to determine a breakeven and assure its access to space. Among price. Below this price, DOD would not recuperate its costs, and, above this others, one launch option is to use price, DOD would potentially save. GAO estimated that DOD could sell three vehicles derived from surplus ICBM Peacekeeper motors—the number required for one launch, or, a “motor set”—at motors such as those used on the Peacekeeper and Minuteman missiles. a breakeven price of about $8.36 million and two Minuteman II motors for about The Commercial Space Act of 1998 $3.96 million, as shown below. Other methods for determining motor prices, such prohibits the use of these motors for as fair market value as described in the Federal Accounting Standards Advisory commercial launches and limits their Board Handbook, resulted in stakeholder estimates ranging from $1.3 million per use in government launches in part to motor set to $11.2 million for a first stage Peacekeeper motor. -

Debris Mitigation, Assembly, Integration, and Test, in the Context of the Istsat-1 Project

Debris Mitigation, Assembly, Integration, and Test, in the context of the ISTsat-1 project Paulo Luís Granja Macedo Thesis to obtain the Master of Science Degree in Aerospace Engineering Supervisors: Prof. Paulo Jorge Soares Gil Prof. Agostinho Rui Alves da Fonseca Examination Committee Chairperson: Prof. José Fernando Alves da Silva Supervisor: Prof. Paulo Jorge Soares Gil Member of the Committee: Prof. Elsa Maria Pires Henriques November 2018 ii Dedicado ao meu Pai, Mae˜ e Irma˜ iii iv Acknowledgments I want to thank my supervisors, Professor Paulo Gil and Professor Agostinho Fonseca, for guiding me thorough the project. I also want to thank the ISTsat-1 team members, both professors and students, for giving me the opportunity to be part of such a great project and for the availability they had for my questions. The project would not happen if we did not have the University help and the ESA initiative Fly Your Satellite. I want to thank both organizations, that provided and will keep providing financial support, development rooms, test facilities and expertise in Space related matters. I want to thank all the other people that helped me through this phase, my fiends and girlfriend, thank you. Tambem´ quero agradecer aos meus pais e irma,˜ que me ajudaram em tudo o que foi preciso para chegar a este dia, sem eles nao˜ seria poss´ıvel. Obrigado. v vi Resumo O ISTsat-1 e´ um CubeSat desenvolvido por estudantes e professores do Instituto Superior Tecnico´ (IST), com a ajuda de um programa da ESA chamado Fly Your Satellite (FYS). O objectivo principal e´ educar estudantes em cienciaˆ e tecnologia espacial.