Small Launch Vehicles – a 2018 State of the Industry Survey

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ariane-5 Completes Flawless Third Test Flight

r bulletin 96 — november 1998 Ariane-5 Completes Flawless Third Test Flight A launch-readiness review conducted on Friday engine shut down and Maqsat-3 was 16 and Monday 19 October had given the go- successfully injected into GTO. The orbital ahead for the final countdown for a launch just parameters at that point were: two days later within a 90-minute launch Perigee: 1027 km, compared with the window between 13:00 to 14:30 Kourou time. 1028 ± 3 km predicted The launcher’s roll-out from the Final Assembly Apogee: 35 863 km, compared with the Building to the Launch Zone was therefore 35 898 ± 200 km predicted scheduled for Tuesday 20 October at 09:30 Inclination: 6.999 deg, compared with the Kourou time. 6.998 ± 0.05 deg predicted. On 21 October, Europe reconfirmed its lead in providing space Speaking in Kourou immediately after the flight, transportation systems for the 21st Century. Ariane-5, on its third Fredrik Engström, ESA’s Director of Launchers qualification flight, left no doubts as to its ability to deliver payloads and the Ariane-503 Flight Director, confirmed reliably and accurately to Geostationary Transfer Orbit (GTO). The new that: “The third Ariane-5 flight has been a heavy-lift launcher lifted off in glorious sunshine from the Guiana complete success. It qualifies Europe’s new Space Centre, Europe’s spaceport in Kourou, French Guiana, at heavy-lift launcher and vindicates the 13:37:21 local time (16:37:21 UT). technological options chosen by the European Space Agency.” This third Ariane-5 test flight was intended ESA’s Director -

Frequently Asked Questions

Frequently Asked Questions What Types of Companies Are on the "Don't Test" List? This list includes companies that make cosmetics, personal-care products, household-cleaning products, and other common household products. All companies that are included on PETA's "don't test" list have signed our statement of assurance verifying that they and their ingredient suppliers don't conduct, commission, pay for, or allow any tests on animals for ingredients, formulations, or finished products anywhere in the world and will not do so in the future. We encourage consumers to support the companies on this list, since we know that they're committed to making products without harming animals. Companies on the "Do Test" list should be shunned until they implement a policy that prohibits animal testing. The "do test" list doesn't include companies that manufacture only products that are required by law to be tested on animals (e.g., pharmaceuticals and garden chemicals). Although PETA is opposed to all animal testing, our focus in those instances is less on the individual companies and more on the regulatory agencies that require animal testing. _________________________________________________________________________________________________________________ Legend V - The company makes or sells strictly vegan products. L - The company has licensed PETA's official cruelty-free bunny logo. F - The company is a PETA Business Friend, and shopping at this company supports an innovative partnership for compassionate companies willing to assist in PETA's groundbreaking work to stop animal abuse and suffering. Companies Whose Products Are Available in Russian Federation L F 100% Pure 510-836-6500 http://www.100percentpure.com L 3INA https://3ina.com/ V L 66°30 https://66-30.com/en/ V L Abyssal Japan Co. -

Cape Canaveral Air Force Station Support to Commercial Space Launch

The Space Congress® Proceedings 2019 (46th) Light the Fire Jun 4th, 3:30 PM Cape Canaveral Air Force Station Support to Commercial Space Launch Thomas Ste. Marie Vice Commander, 45th Space Wing Follow this and additional works at: https://commons.erau.edu/space-congress-proceedings Scholarly Commons Citation Ste. Marie, Thomas, "Cape Canaveral Air Force Station Support to Commercial Space Launch" (2019). The Space Congress® Proceedings. 31. https://commons.erau.edu/space-congress-proceedings/proceedings-2019-46th/presentations/31 This Event is brought to you for free and open access by the Conferences at Scholarly Commons. It has been accepted for inclusion in The Space Congress® Proceedings by an authorized administrator of Scholarly Commons. For more information, please contact [email protected]. Cape Canaveral Air Force Station Support to Commercial Space Launch Colonel Thomas Ste. Marie Vice Commander, 45th Space Wing CCAFS Launch Customers: 2013 Complex 41: ULA Atlas V (CST-100) Complex 40: SpaceX Falcon 9 Complex 37: ULA Delta IV; Delta IV Heavy Complex 46: Space Florida, Navy* Skid Strip: NGIS Pegasus Atlantic Ocean: Navy Trident II* Black text – current programs; Blue text – in work; * – sub-orbital CCAFS Launch Customers: 2013 Complex 39B: NASA SLS Complex 41: ULA Atlas V (CST-100) Complex 40: SpaceX Falcon 9 Complex 37: ULA Delta IV; Delta IV Heavy NASA Space Launch System Launch Complex 39B February 4, 2013 Complex 46: Space Florida, Navy* Skid Strip: NGIS Pegasus Atlantic Ocean: Navy Trident II* Black text – current programs; -

6. the INTELSAT 17 Satellite

TWO COMMUNICATIONS SATELLITES READY FOR LAUNCH Arianespace will orbit two communications satellite on its fifth launch of the year: INTELSAT 17 for the international satellite operator Intelsat, and HYLAS 1 for the European operator Avanti Communications. The choice of Arianespace by leading space communications operators and manufacturers is clear international recognition of the company’s excellence in launch services. Based on its proven reliability and availability, Arianespace continues to confirm its position as the world’s benchmark launch system. Ariane 5 is the only commercial satellite launcher now on the market capable of simultaneously launching two payloads. Arianespace and Intelsat have built up a long-standing relationship based on mutual trust. Since 1983, Arianespace has launched 48 satellites for Intelsat. Positioned at 66 degrees East, INTELSAT 17 will deliver a wide range of communication services for Europe, the Middle East, Russia and Asia. Built by Space Systems/Loral of the United States, this powerful satellite will weigh 5,540 kg at launch. It will also enable Intelsat to expand its successful Asian video distrubution neighborhood. INTELSAT 17 will replace INTELSAT 702. HYLAS 1 is Avanti Communications’ first satellite. A new European satellite operator, Avanti Communications also chose Arianespace to orbit its HYLAS 2 satellite, scheduled for launch in the first half of 2012. HYLAS 1 was built by an industrial consortium formed by EADS Astrium and the Indian Space Research Organisation (ISRO), using a I-2K platform. Fitted with Ka-band and Ku-band transponders, the satellite will be positioned at 33.5 degrees West, and will be the first European satellite to offer high-speed broadband services across all of Europe. -

Constellation Program Overview

Constellation Program Overview October 2008 hris Culbert anager, Lunar Surface Systems Project Office ASA/Johnson Space Center Constellation Program EarthEarth DepartureDeparture OrionOrion -- StageStage CrewCrew ExplorationExploration VehicleVehicle AresAres VV -- HeavyHeavy LiftLift LaunchLaunch VehicleVehicle AltairAltair LunarLunar LanderLander AresAres II -- CrewCrew LaunchLaunch VehicleVehicle Lunar Capabilities Concept Review EstablishedEstablished Lunar Lunar Transportation Transportation EstablishEstablish Lunar Lunar Surface SurfaceArchitecturesArchitectures ArchitectureArchitecture Point Point of of Departure: Departure: StrategiesStrategies which: which: Satisfy NASA NGO’s to acceptable degree ProvidesProvides crew crew & & cargo cargo delivery delivery to to & & from from the the Satisfy NASA NGO’s to acceptable degree within acceptable schedule moonmoon within acceptable schedule Are consistent with capacity and capabilities ProvidesProvides capacity capacity and and ca capabilitiespabilities consistent consistent Are consistent with capacity and capabilities withwith candidate candidate surface surface architectures architectures ofof the the transportation transportation systems systems ProvidesProvides sufficient sufficient performance performance margins margins IncludeInclude set set of of options options fo for rvarious various prioritizations prioritizations of cost, schedule & risk RemainsRemains within within programmatic programmatic constraints constraints of cost, schedule & risk ResultsResults in in acceptable -

GB-ASTRA 3B-Comsatbw-21Mai V

A BOOST FOR SPACE COMMUNICATIONS SATELLITES For its first launch of the year, Arianespace will orbit two communications satellites: ASTRA 3B for the Luxembourg-based operator SES ASTRA, and COMSATBw-2 for Astrium as part of a contract with the German Ministry of Defense. The choice of Arianespace by leading space communications operators and manufacturers is clear international recognition of the company’s excellence in launch services. Because of its reliability and availability, the Arianespace launch system continues to set the global standard. Ariane 5 is the only commercial satellite launcher now on the market capable of simultaneously launching two payloads. Over the last two decades, Arianespace and SES have developed an exceptional relationship. ASTRA 3B will be the 33rd satellite from the SES group (Euronext Paris and Luxembourg Bourse: SESG) to have chosen the European launcher. SES ASTRA operates the leading direct-to-home TV broadcast system in Europe, serving more than 125 million households via DTH and cable networks. ASTRA 3B was built by Astrium using a Eurostar E 3000 platform, and will weigh approximately 5,500 kg at launch. Fitted with 60 active Ku-band transponders and four Ka-band transponders, ASTRA 3B will be positioned at 23.5 degrees East. It will deliver high-power broadcast services across all of Europe, and offers a design life of 15 years. Astrium chose Arianespace for the launch of two military communications satellites, COMSATBw-1 and COMSATBw-2, as part of a satellite communications system supplied to the German Ministry of Defense. The first satellite in this family, COMSATBw-1, was launched by Arianespace in October 2009. -

ESPA Ring Datasheet

PAYLOAD ADAPTERS | ESPA ESPA THE EVOLVED SECONDARY PAYLOAD ADAPTER ESPA mounts to the standard NSSL (formerly EELV) interface bolt pattern (Atlas V, Falcon 9, Delta IV, OmegA, Vulcan, Courtesy of Lockheed Martin New Glenn) and is a drop-in component in the launch stack. Small payloads mount to ESPA ports featuring either a Ø15-inch bolt circle with 24 fasteners or a 4-point mount with pads at each corner of a 15-inch square; both of these interfaces have become small satellite standards. ESPA is qualified to carry 567 lbs (257 kg), and a Heavy interface Courtesy of NASA (with Ø5/16” fastener hardware) has been introduced with a capacity of 991 lbs (450 kg). All small satellite mass capabilities require the center of gravity (CG) to be within 20 inches (50.8 cm) of the ESPA port surface. Alternative configurations can be accommodated. ESPA GRANDE ESPA Grande is a more capable version of ESPA with Ø24-inch ports; the ring height is typically 42 inches. The Ø24-inch port has been qualified by test to Courtesy of ORBCOMM & Sierra Nevada Corp. carry small satellites up to 1543 lb (700 kg). ESPA ESPA IS ADAPTABLE TO UNIQUE MISSION REQUIREMENTS • The Air Force’s STP-1 mission delivered multiple small satellites on an Atlas V. • NASA’s Lunar Crater Observation and Sensing Satellite (LCROSS): ESPA was the spacecraft hub for the LCROSS shepherding satellite in 2009. • ORBCOMM Generation 2 (OG2) launched stacks of two and three ESPA Grandes on two different Falcon 9 missions and in total deployed 17 satellites. -

Trade Studies Towards an Australian Indigenous Space Launch System

TRADE STUDIES TOWARDS AN AUSTRALIAN INDIGENOUS SPACE LAUNCH SYSTEM A thesis submitted for the degree of Master of Engineering by Gordon P. Briggs B.Sc. (Hons), M.Sc. (Astron) School of Engineering and Information Technology, University College, University of New South Wales, Australian Defence Force Academy January 2010 Abstract During the project Apollo moon landings of the mid 1970s the United States of America was the pre-eminent space faring nation followed closely by only the USSR. Since that time many other nations have realised the potential of spaceflight not only for immediate financial gain in areas such as communications and earth observation but also in the strategic areas of scientific discovery, industrial development and national prestige. Australia on the other hand has resolutely refused to participate by instituting its own space program. Successive Australian governments have preferred to obtain any required space hardware or services by purchasing off-the-shelf from foreign suppliers. This policy or attitude is a matter of frustration to those sections of the Australian technical community who believe that the nation should be participating in space technology. In particular the provision of an indigenous launch vehicle that would guarantee the nation independent access to the space frontier. It would therefore appear that any launch vehicle development in Australia will be left to non- government organisations to at least define the requirements for such a vehicle and to initiate development of long-lead items for such a project. It is therefore the aim of this thesis to attempt to define some of the requirements for a nascent Australian indigenous launch vehicle system. -

Programa De Pós-Graduação Em Ecologia Fluxo De

INSTITUTO NACIONAL DE PESQUISAS DA AMAZÔNIA - INPA PROGRAMA DE PÓS-GRADUAÇÃO EM ECOLOGIA FLUXO DE ENERGIA EM TEIAS ALIMENTARES DE ECOSSISTEMAS AQUÁTICOS TROPICAIS: DAS FONTES AUTOTRÓFICAS ATÉ OS GRANDES CONSUMIDORES ECTOTÉRMICOS FRANCISCO VILLAMARÍN Manaus, Amazonas i Agosto, 2016 Page i FRANCISCO VILLAMARÍN FLUXO DE ENERGIA EM TEIAS ALIMENTARES DE ECOSSISTEMAS AQUÁTICOS TROPICAIS: DAS FONTES AUTOTRÓFICAS ATÉ OS GRANDES CONSUMIDORES ECTOTÉRMICOS Orientador: WILLIAM E. MAGNUSSON Tese apresentada ao Instituto Nacional de Pesquisas da Amazônia como parte dos requisitos para obtenção do titulo de Doutor em BIOLOGIA-ECOLOGIA Manaus, Amazonas ii Agosto, 2016 Page ii V715 Villamarín, Francisco Fluxo de energia em teias alimentares de ecossistemas aquáticos tropicais: das fontes autotróficas até os grandes consumidores ectotérmicos / Francisco Villamarín. --- Manaus: [s.n.], 2016. 87 f.: il Tese (Doutorado) --- INPA, Manaus, 2016. Orientador: William E. Magnusson Área de concentração: Ecologia 1. Ecossistema aquático. 2. Teia alimentar. 3. Ecologia. I. Título. CDD 574.52632 iii Page iii Sinopse: Estudou-se o fluxo de energia em teias alimentares de ecossistemas aquáticos tropicais do Território Norte da Austrália e da Amazônia central. Aspectos como alocação de energia para reprodução em um peixe herbívoro-detritívoro e origens da energia e posição trófica de crocodilianos amazônicos foram avaliados. Palavras chave: isótopos estáveis, RNA:DNA, energia, consumidores ectotérmicos iv Page iv Dedicatória Mis abuelas Cecilia y Aída me enseñaron con cariño la importancia de la simplicidad y perseverancia en la vida. A ellas, dedico v Page v Agradecimentos O presente trabalho não seria possível sem o incentivo de todas as pessoas que acreditaram e que, de muitas maneiras, contribuiram sempre para que essa pesquisa seja realizada ao longo de todo esse tempo de Amazônia. -

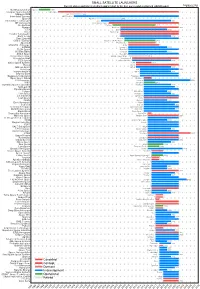

Small Satellite Launchers

SMALL SATELLITE LAUNCHERS NewSpace Index 2020/04/20 Current status and time from development start to the first successful or planned orbital launch NEWSPACE.IM Northrop Grumman Pegasus 1990 Scorpius Space Launch Demi-Sprite ? Makeyev OKB Shtil 1998 Interorbital Systems NEPTUNE N1 ? SpaceX Falcon 1e 2008 Interstellar Technologies Zero 2021 MT Aerospace MTA, WARR, Daneo ? Rocket Lab Electron 2017 Nammo North Star 2020 CTA VLM 2020 Acrux Montenegro ? Frontier Astronautics ? ? Earth to Sky ? 2021 Zero 2 Infinity Bloostar ? CASIC / ExPace Kuaizhou-1A (Fei Tian 1) 2017 SpaceLS Prometheus-1 ? MISHAAL Aerospace M-OV ? CONAE Tronador II 2020 TLON Space Aventura I ? Rocketcrafters Intrepid-1 2020 ARCA Space Haas 2CA ? Aerojet Rocketdyne SPARK / Super Strypi 2015 Generation Orbit GoLauncher 2 ? PLD Space Miura 5 (Arion 2) 2021 Swiss Space Systems SOAR 2018 Heliaq ALV-2 ? Gilmour Space Eris-S 2021 Roketsan UFS 2023 Independence-X DNLV 2021 Beyond Earth ? ? Bagaveev Corporation Bagaveev ? Open Space Orbital Neutrino I ? LIA Aerospace Procyon 2026 JAXA SS-520-4 2017 Swedish Space Corporation Rainbow 2021 SpinLaunch ? 2022 Pipeline2Space ? ? Perigee Blue Whale 2020 Link Space New Line 1 2021 Lin Industrial Taymyr-1A ? Leaf Space Primo ? Firefly 2020 Exos Aerospace Jaguar ? Cubecab Cab-3A 2022 Celestia Aerospace Space Arrow CM ? bluShift Aerospace Red Dwarf 2022 Black Arrow Black Arrow 2 ? Tranquility Aerospace Devon Two ? Masterra Space MINSAT-2000 2021 LEO Launcher & Logistics ? ? ISRO SSLV (PSLV Light) 2020 Wagner Industries Konshu ? VSAT ? ? VALT -

Study of a 100Kwe Space Reactor for Exploration Missions

Preliminary study of a 100 kWe space reactor concept for exploration missions Elisa CLIQUET, Jean-Marc RUAULT 1), Jean-Pierre ROUX, Laurent LAMOINE, Thomas RAMEE 2), Christine POINOT-SALANON, Alexey LOKHOV, Serge PASCAL 3) 1) CNES Launchers Directorate,Evry, France 2) AREVA TA, Aix en Provence, France 3) CEA DEN/DM2S, F-91191 Gif-sur-Yvette, France NETS 2011 Overview ■ General context of the study ■ Requirements ■ Methodology of the study ■ Technologies selected for final trade-off ■ Reactor trade-off ■ Conversion trade-off ■ Critical technologies and development philosophy ■ Conclusion and perspectives CNES Directorate of Launchers Space transportation division of the French space agency ■ Responsible for the development of DIAMANT, ARIANE 1 to 4, ARIANE 5, launchers ■ System Architect for the Soyuz at CSG program ■ Development of VEGA launcher first stage (P80) ■ Future launchers preparation activities Multilateral and ESA budgets • To adapt the current launchers to the needs for 2015-2020 • To prepare launcher evolutions for 2025 - 2030, if needed • To prepare the new generation of expandable launchers (2025-2030) • To prepare the long future after 2030 with possible advanced launch vehicles ■ Future space transportation prospective activities, such as Exploration needs (including in particular OTV missions) Advanced propulsion technologies investigation General context ■ Background Last French studies on space reactors : • ERATO (NEP) in the 80’s, • MAPS (NTP) in the 90’s • OPUS (NEP) 2002-2004 ■ Since then Nuclear safe orbit -

A Low-Cost Launch Assistance System for Orbital Launch Vehicles

Hindawi Publishing Corporation International Journal of Aerospace Engineering Volume 2012, Article ID 830536, 10 pages doi:10.1155/2012/830536 Review Article A Low-Cost Launch Assistance System for Orbital Launch Vehicles Oleg Nizhnik ERATO Maenaka Human-Sensing Fusion Project, 8111, Shosha 2167, Hyogo-ken, Himeji-shi, Japan Correspondence should be addressed to Oleg Nizhnik, [email protected] Received 17 February 2012; Revised 6 April 2012; Accepted 16 April 2012 Academic Editor: Kenneth M. Sobel Copyright © 2012 Oleg Nizhnik. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. The author reviews the state of art of nonrocket launch assistance systems (LASs) for spaceflight focusing on air launch options. The author proposes an alternative technologically feasible LAS based on a combination of approaches: air launch, high-altitude balloon, and tethered LAS. Proposed LAS can be implemented with the existing off-the-shelf hardware delivering 7 kg to low-earth orbit for the 5200 USD per kg. Proposed design can deliver larger reduction in price and larger orbital payloads with the future advances in the aerostats, ropes, electrical motors, and terrestrial power networks. 1. Introduction point to the progress in the orbital delivery systems for these additional payload classes. Spaceflight is the mature engineering discipline—54 years old as of 2012. But seemingly paradoxically, it still relies solely 2. Overview of Previously Proposed LAS on the hardware and methodology developed in the very beginning of the spaceflight era. Modernly, still heavily-used A lot of proposals have been made to implement nonrocket Soyuz launch vehicle systems (LVSs) are the evolutionary LASandarelistedinTable 1.