De Beers' New Strategy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Competition Policy

ISSN 1025-2266 COMPETITION POLICY NEWSLETTER EC COMPETITION POLICY NEWSLETTER Editors: 2008 Æ NUMBER 3 Inge Bernaerts Kevin Coates Published three times a year by the Thomas Deisenhofer Competition Directorate-General of the European Commission Address: European Commission, Also available online: J-70, 04/136 http://ec.europa.eu/competition/publications/cpn/ Brussel B-1049 Bruxelles E-mail: [email protected] World Wide Web: http://ec.europa.eu/ competition/index_en.html I N S I D E : • The design of competition policy institutions for the 21st century by Philip Lowe • The new State aid General Block Exemption Regulation • The new Guidelines on the application of Article 81 of the EC Treaty to the maritime sector • The new settlement procedure in selected cartel cases • The CISAC decision • The Hellenic Shipyards decision: Limits to the application of Article 296 and indemnification provision in privatisation contracts MAIN DEVELOPMENTS ON • Antitrust — Cartels — Merger control — State aid control EUROPEAN COMMISSION Contents Articles 1 The design of competition policy institutions for the 21st century — the experience of the European Commission and DG Competition by Philip LOWE 12 The General Block Exemption Regulation (GBER): bigger, simpler and more economic by Harold NYSSENS 19 Rolling back regulation in the telecoms sector: a practical example by Ágnes SZARKA 25 The new Guidelines on the application of Article 81 of the EC Treaty to the maritime sector by Carsten BERMIG and Cyril RITTER 30 The new settlement procedure in selected -

Helmsec's Annual Mining Forum 2011

THE MANDARIN ORIENTAL HELMSEC’S 5 CONNAUGHT ROAD, CENTRAL ANNUAL MINING HONG KONG FORUM 2011 THURSDAY, 24TH MARCH 2011 SYDNEY | MELBOURNE | HONG KONG | SINGAPORE TABLE OF CONTENT PG FORUM SCHEDULE 3 INDIVIDUAL COMPANY INFORMATION SHEETS 8 ALPHABETIC BY COMPANY HELMSEC STAFF AT THE CONFERENCE 50 WHO WE ARE – THE PAN-ASIAN MINING INVESTMENT HOUSE 52 HELMSEC’S GLOBAL NETWORK & RECENT TRANSACTION 53 DIRECTORY & CONTACTS 54 This Helmsec Global Markets Limited and Helmsec Global Capital Limited (Individually and collectively “Helmsec”) publication is intended for the use of licensed Investment professionals. Past performance is not a reliable indicator of future performance. Any express or implied recommendations or advice presented in this document is limited to “General Advice” and based solely on consideration of the investment and/or trading merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs of any particular person. Before making an investment decision based on the recommendations of advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances or should seek further advice in its appropriateness. Disclaimer: This document is only intended to provide background information and does not purport to be complete and/or to contain all the information that an investor may consider when making an investment decision. This document is not an offer, invitation, solicitation or recommendation with respect to the subscription for, purchase or sale of any securities. This note does not form the basis of any contract or commitment. Helmsec and its respective affiliates, agents, officers or employees make no recommendation as to whether you should participate in any securities in any Company referred to in this document (Company) nor do they make any recommendation or warranty to you concerning any Company an/or the accuracy, reliability or completeness of the information provided herein and/or the performance of any Company. -

HESTA Share Voting Record Australian Equities Managers 1 Jan-30 Jun 2016

HESTA Share Voting Record - Australian Equities Managers 1 January to 30 June 2016 Resolutio Management/ Company Name Country Market Identifier Meeting Date Meeting Type Details of Resolution HESTA Vote n No. Shareholder Proposal ADELAIDE BRIGHTON LTD, ADELAIDE Australia AU000000ABC7 25-May-2016 Annual General Meeting 2 RE-ELECTION OF MR GF PETTIGREW Management For ADELAIDE BRIGHTON LTD, ADELAIDE Australia AU000000ABC7 25-May-2016 Annual General Meeting 3 ISSUE OF AWARDS TO THE MANAGING DIRECTOR Management For ADELAIDE BRIGHTON LTD, ADELAIDE Australia AU000000ABC7 25-May-2016 Annual General Meeting 4 ADOPTION OF REMUNERATION REPORT Management For AINSWORTH GAME TECHNOLOGY LTD, NEWINGTON Australia AU000000AGI3 27-Jun-2016 Ordinary General Meeting 1 APPROVAL FOR ACQUISITION OF SHARES BY NOVOMATIC AG Management For (NOVOMATIC) AIRXPANDERS, INC United States AU000000AXP3 17-May-2016 Annual General Meeting 1.A ELECTION OF MR. GREGORY LICHTWARDT AS A DIRECTOR OF THE Management For COMPANY AIRXPANDERS, INC United States AU000000AXP3 17-May-2016 Annual General Meeting 1.B ELECTION OF MS. ZITA PEACH AS A DIRECTOR OF THE COMPANY Management For AIRXPANDERS, INC United States AU000000AXP3 17-May-2016 Annual General Meeting 2 APPROVAL OF 10% PLACEMENT FACILITY Management Against AIRXPANDERS, INC United States AU000000AXP3 17-May-2016 Annual General Meeting 3 GRANT OF OPTIONS TO MR SCOTT DODSON Management Against AIRXPANDERS, INC United States AU000000AXP3 17-May-2016 Annual General Meeting 4.A GRANT OF OPTIONS TO MR BARRY CHESKIN Management Against -

NEWSLETTER Wetstraat 200, Rue De La Loi Brussel B-1049 Bruxelles Tel.: (32-2) 295 76 20 Fax: (32-2) 295 54 37

EC Editors: Address: World Wide Web: ISSN COMPETITION Bernhard Friess European Commission, http://europa.eu.int/comm/ 1025-2266 POLICY Nicola Pesaresi J-70, 00/123 competition/index_en.html NEWSLETTER Wetstraat 200, rue de la Loi Brussel B-1049 Bruxelles Tel.: (32-2) 295 76 20 Fax: (32-2) 295 54 37 competition policy 2001 Number 3 October NEWSLETTER Published three times a year by the Competition Directorate-General of the European Commission Also available online: http://europa.eu.int/comm/competition/publications/cpn/ Inside: La politique européenne de la concurrence dans les services postaux hors monopole General Electric/Honeywell — An insight into the Commission's investigation and decision B2B e-marketplaces and EC competition law: where do we stand? Ports italiens: Les meilleures histoires ont une fin BASF/Pantochim/Eurodiol: Change of direction in European merger control? Adoption by the Commission of a Methodology for analysing State aid linked to stranded costs European Competition Day in Stockholm, 11 June 2001 Main developments on: Antitrust — Merger control — State aid control Contents Articles 1 La politique européenne de la concurrence dans les services postaux hors monopole, par Jean-François PONS et Tilman LUEDER 5 General Electric/Honeywell — An Insight into the Commission's Investigation and Decision, by Dimitri GIOTAKOS, Laurent PETIT, Gaelle GARNIER and Peter DE LUYCK 14 B2B e-marketplaces and EC competition law: where do we stand?, by Joachim LÜCKING Opinions and comments 17 Ports italiens: Les meilleures histoires -

Global Rough Diamond Production Since 1870

GLOBAL ROUGH DIAMOND PRODUCTION SINCE 1870 A. J. A. (Bram) Janse Data for global annual rough diamond production (both carat weight and value) from 1870 to 2005 were compiled and analyzed. Production statistics over this period are given for 27 dia- mond-producing countries, 24 major diamond mines, and eight advanced projects. Historically, global production has seen numerous rises—as new mines were opened—and falls—as wars, political upheavals, and financial crises interfered with mining or drove down demand. Production from Africa (first South Africa, later joined by South-West Africa [Namibia], then West Africa and the Congo) was dominant until the middle of the 20th century. Not until the 1960s did production from non-African sources (first the Soviet Union, then Australia, and now Canada) become impor- tant. Distinctions between carat weight and value affect relative importance to a significant degree. The total global production from antiquity to 2005 is estimated to be 4.5 billion carats valued at US$300 billion, with an average value per carat of $67. For the 1870–2005 period, South Africa ranks first in value and fourth in carat weight, mainly due to its long history of production. Botswana ranks second in value and fifth in carat weight, although its history dates only from 1970. Global production for 2001–2005 is approximately 840 million carats with a total value of $55 billion, for an average value per carat of $65. For this period, USSR/Russia ranks first in weight and second in value, but Botswana is first in value and third in weight, just behind Australia. -

Appendix A: Proof of Eap Qualifications

SLR Consulting (Africa) (Pty) Ltd Page A APPENDIX A: PROOF OF EAP QUALIFICATIONS SECTION 24G ENVIRONMENTAL ASSESSMENT REPORT FOR SLR Ref. 710.23031.00002 THE TSHIPI BORWA MINE August 2017 Report No.1 SLR Consulting (Africa) (Pty) Ltd Page B APPENDIX B: CURRICULUM VITAE OF EAP SECTION 24G ENVIRONMENTAL ASSESSMENT REPORT FOR SLR Ref. 710.23031.00002 THE TSHIPI BORWA MINE August 2017 Report No.1 Alessandra (Alex) Pheiffer Environmental Assessment Practitioner Curriculum Vitae Qualifications BSc 1998 Biological Sciences BSc (Hons) 1999 Zoology MSc 2004 Environmental Management Professional affiliations and registrations Registered with the South African Council for Natural Scientific Professions as a Professional Natural Scientist (PrSciNat) in Environmental Science (Reg. No. 400183/05) Registered with the Environmental Assessment Professionals of Namibia (EAPAN) as a Lead Practitioner (Membership No. 121) Member of the International Association for Impact Assessments (IAIA), South African Affiliate Summary of Key Areas of Expertise Management and facilitation of permitting and licensing processes Management of stakeholder engagement processes Overall Project Management Due Diligence, Reviews Summary of Experience and Capability Alex is a Director (since March 2013) and Operations Manager: Environmental Management, Planning and Approvals (EMPA) with SLR Africa and is responsible for co-ordinating SLR’s environmental management team. Alex has 16 years’ experience in the field of Environmental Management. Alex has managed a wide range of permitting and licensing projects including environmental assessments, water use license applications and waste management license applications, mainly in the exploration, mining and industrial sectors. These included project management and co-ordination; specialist and engineering team management; co-ordination, facilitation and undertaking of stakeholder engagement processes including for contentious projects, and environmental assessment. -

2011 Registration Document Annual Financial Report SUMMARY

2011 Registration Document Annual Financial Report SUMMARY 1 PRESENTATION OF THE GROUP 3 6 ADDITIONAL INFORMATION 227 1.1 Main key figures 4 6.1 Information about the Company 228 1.2 The Group’s strategy and general structure 5 6.2 Information about the share capital 232 1.3 Minerals 10 6.3 Shareholding 238 1.4 Minerals for Ceramics, Refractories, 6.4 Elements which could have an impact Abrasives & Foundry 17 in the event of a takeover bid 241 1.5 Performance & Filtration Minerals 26 6.5 Imerys stock exchange information 242 1.6 Pigments for Paper & Packaging 32 6.6 Dividends 244 1.7 Materials & Monolithics 36 6.7 Shareholder relations 244 1.8 Innovation 43 6.8 Parent company/subsidiaries organization 245 1.9 Sustainable Development 48 ORDINARY AND EXTRAORDINARY REPORTS ON THE FISCAL YEAR 2011 65 7 SHAREHOLDERS’ GENERAL MEETING 2 OF APRIL 26, 2012 247 2.1 Board of Directors’ management report 66 2.2 Statutory Auditors' Reports 77 7.1 Presentation of the resolutions by the Board of Directors 248 7.2 Agenda 254 7.3 Draft resolutions 255 3 CORPORATE GOVERNANCE 83 3.1 Board of Directors 84 3.2 Executive Management 103 PERSONS RESPONSIBLE FOR THE 3.3 Compensation 105 8 REGISTRATION DOCUMENT AND THE AUDIT 3.4 Stock options 109 OF ACCOUNTS 261 3.5 Free shares 114 8.1 Person responsible for the Registration Document 262 3.6 Specific terms and restrictions applicable to grants 8.2 Certificate of the person responsible to the Chairman and Chief Executive Officer 116 for the Registration Document 262 3.7 Corporate officers’ transactions in securities -

Sierra Leone and Conflict Diamonds: Establshing a Legal Diamond Trade and Ending Rebel Control Over the Country's Diamond Resources

SIERRA LEONE AND CONFLICT DIAMONDS: ESTABLSHING A LEGAL DIAMOND TRADE AND ENDING REBEL CONTROL OVER THE COUNTRY'S DIAMOND RESOURCES "Controlof resourceshas greaterweight than uniform administrativecontrol over one's entire comer of the world, especially in places such as Sierra Leone where valuable resources are concentratedand portable.' I. INTRODUCTION Sierra Leone2 is in the midst of a civil war that began in 1991, when the Revolutionary United Front (RUF) invaded the country from neighboring Liberia.3 RUF rebels immediately sought control over one of the country's richest resources--diamonds.4 Since gaining control over the most productive diamond fields, the rebels have at their fingertips an endless supply of wealth with which to fund their insurgencies against the Government of Sierra Leone.' The RUF rebels illicitly trade diamonds for arms in open smuggling operations. 6 Diamonds sold by the RUF, in order to fund the rebel group's military action in opposition to Sierra Leone's legitimate and internationally recognized government, are called "conflict diamonds."7 1. WIulIAM RENO, WARLORD POLITICS AND AFRICAN STATES 140 (1998). 2. Sierra Leone is located on the west coast of Africa north of Liberia and south of Guinea. The country has 4,900,000 residents, almost all of whom belong to one of 13 native African tribes. Country: Sierra Leone, Sept. 3,2000, availableat LEXIS, Kaleidoscope File. One of the primary economic activities in Sierra Leone is mining of its large diamond deposits that are a major source of hard currency. Countries that predominantly import goods from Sierra Leone include Belgium, the United States, and India. -

De Beers and Beyond: the History of the International Diamond Cartel∗

De Beers and Beyond: The History of the International Diamond Cartel∗ Diamonds are forever hold of them. The idea of making diamonds available to the general public seemed un- A gemstone is the ultimate luxury thinkable. When diamonds were first found product. It has no material use. Men in South Africa in 1867, however, supply in- and women desire to have diamonds creased rapidly, although the notion of dia- not for what they [diamonds] can do monds as a precious and rare commodity re- but for what they desire.1 mained to the present day. Similar to the gold miners in California, dia- To hear these words from a person who at- mond miners in South Africa tended to rush to tributes his entire wealth and power to the the latest findings.2 As a matter of principle, trade of diamonds illustrates the peculiar na- diamond miners preferred to work by them- ture of the diamond market: Jewelry dia- selves. However, the scarcity of resourceful monds are unjustifiably expensive, given they land and the need for a minimum of common are not actually scarce and would fetch a price infrastructure forced them to live together in of $2 to $30 if put to industrial use. Still, limited areas. In order to fight off latecom- by appealing to the customers’ sentiment, di- ers and to settle disputes, Diggers Committees amonds are one of the most precious lux- were formed and gave out claims in a region. ury items and enjoy almost global acceptance. Each digger would be allocated one claim, or, This fact is often attributed to the history at most, two. -

Devoir De Vigilance: Reforming Corporate Risk Engagement

Devoir de Vigilance: Reforming Corporate Risk Engagement Copyright © Development International e.V., 2020 ISBN: 978-3-9820398-5-5 Authors: Juan Ignacio Ibañez, LL.M. Chris N. Bayer, PhD Jiahua Xu, PhD Anthony Cooper, J.D. Title: Devoir de Vigilance: Reforming Corporate Risk Engagement Date published: 9 June 2020 Funded by: iPoint-systems GmbH www.ipoint-systems.com 1 “Liberty consists of being able to do anything that does not harm another.” Article 4, Declaration of the Rights of the Man and of the Citizen of 1789, France 2 Executive Summary The objective of this systematic investigation is to gain a better understanding of how the 134 confirmed in-scope corporations are complying with – and implementing – France’s progressive Devoir de Vigilance law (LOI n° 2017-399 du 27 Mars 2017).1 We ask, in particular, what subject companies are doing to identify and mitigate social and environmental risk/impact factors in their operations, as well as for their subsidiaries, suppliers, and subcontractors. This investigation also aims to determine practical steps taken regarding the requirements of the law, i.e. how the corporations subject to the law are meeting these new requirements. Devoir de Vigilance is at the legislative forefront of the business and human rights movement. A few particular features of the law are worth highlighting. Notably, it: ● imposes a duty of vigilance (devoir de vigilance) which consists of a substantial standard of care and mandatory due diligence, as such distinct from a reporting requirement; ● sets a public reporting requirement for the vigilance plan and implementation report (compte rendu) on top of the substantial duty of vigilance; ● strengthens the accountability of parent companies for the actions of subsidiaries; ● encourages subject companies to develop their vigilance plan in association with stakeholders in society; ● imposes civil liability in case of non-compliance; ● allows stakeholders with a legitimate interest to seek injunctive relief in the case of a violation of the law. -

A Brief History of Wine in South Africa Stefan K

European Review - Fall 2014 (in press) A brief history of wine in South Africa Stefan K. Estreicher Texas Tech University, Lubbock, TX 79409-1051, USA Vitis vinifera was first planted in South Africa by the Dutchman Jan van Riebeeck in 1655. The first wine farms, in which the French Huguenots participated – were land grants given by another Dutchman, Simon Van der Stel. He also established (for himself) the Constantia estate. The Constantia wine later became one of the most celebrated wines in the world. The decline of the South African wine industry in the late 1800’s was caused by the combination of natural disasters (mildew, phylloxera) and the consequences of wars and political events in Europe. Despite the reorganization imposed by the KWV cooperative, recovery was slow because of the embargo against the Apartheid regime. Since the 1990s, a large number of new wineries – often, small family operations – have been created. South African wines are now available in many markets. Some of these wines can compete with the best in the world. Stefan K. Estreicher received his PhD in Physics from the University of Zürich. He is currently Paul Whitfield Horn Professor in the Physics Department at Texas Tech University. His biography can be found at http://jupiter.phys.ttu.edu/stefanke. One of his hobbies is the history of wine. He published ‘A Brief History of Wine in Spain’ (European Review 21 (2), 209-239, 2013) and ‘Wine, from Neolithic Times to the 21st Century’ (Algora, New York, 2006). The earliest evidence of wine on the African continent comes from Abydos in Southern Egypt. -

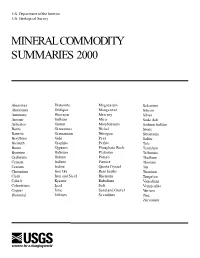

Mineral Commodity Summaries 2000

U.S. Department of the Interior U.S. Geological Survey MINERAL COMMODITY SUMMARIES 2000 Abrasives Diatomite Magnesium Selenium Aluminum Feldspar Manganese Silicon Antimony Fluorspar Mercury Silver Arsenic Gallium Mica Soda Ash Asbestos Garnet Molybdenum Sodium Sulfate Barite Gemstones Nickel Stone Bauxite Germanium Nitrogen Strontium Beryllium Gold Peat Sulfur Bismuth Graphite Perlite Talc Boron Gypsum Phosphate Rock Tantalum Bromine Hafnium Platinum Tellurium Cadmium Helium Potash Thallium Cement Indium Pumice Thorium Cesium Iodine Quartz Crystal Tin Chromium Iron Ore Rare Earths Titanium Clays Iron and Steel Rhenium Tungsten Cobalt Kyanite Rubidium Vanadium Columbium Lead Salt Vermiculite Copper Lime Sand and Gravel Yttrium Diamond Lithium Scandium Zinc Zirconium CONTENTS Page Page General: The Role of Nonfuel Minerals in the U.S. Economy ... 3 Appendix A—Units of Measure ................ 194 1999 U.S. Net Import Reliance for Selected Nonfuel Appendix B—Terms Used for Materials in the National Mineral Materials ........................... 4 Defense Stockpile ........................ 194 Significant Events, Trends, and Issues ............ 5 Appendix C—Resource/Reserve Definitions ...... 195 Commodities: Abrasives (Manufactured) .................... 20 Mercury .................................. 108 Aluminum ................................. 22 Mica (Natural), Scrap and Flake ............... 110 Antimony .................................. 24 Mica (Natural), Sheet ....................... 112 Arsenic ................................... 26