2011 Registration Document Annual Financial Report SUMMARY

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Liste Des Actions Concernées Par L'interdiction De Positions Courtes Nettes

Liste des actions concernées par l'interdiction de positions courtes nettes L’interdiction s’applique aux actions listées sur une plate-forme française et relevant de la compétence de l’AMF au titre du règlement 236/2012 (information disponible dans les registres ESMA). Cette liste est fournie à titre informatif. L'AMF n'est pas en mesure de garantir que le contenu disponible est complet, exact ou à jour. Compte tenu des diverses sources de données sous- jacentes, des modifications pourraient être apportées régulièrement. Isin Nom FR0010285965 1000MERCIS FR0013341781 2CRSI FR0010050773 A TOUTE VITESSE FR0000076887 A.S.T. GROUPE FR0010557264 AB SCIENCE FR0004040608 ABC ARBITRAGE FR0013185857 ABEO FR0012616852 ABIONYX PHARMA FR0012333284 ABIVAX FR0000064602 ACANTHE DEV. FR0000120404 ACCOR FR0010493510 ACHETER-LOUER.FR FR0000076861 ACTEOS FR0000076655 ACTIA GROUP FR0011038348 ACTIPLAY (GROUPE) FR0010979377 ACTIVIUM GROUP FR0000053076 ADA BE0974269012 ADC SIIC FR0013284627 ADEUNIS FR0000062978 ADL PARTNER FR0011184241 ADOCIA FR0013247244 ADOMOS FR0010340141 ADP FR0010457531 ADTHINK FR0012821890 ADUX FR0004152874 ADVENIS FR0013296746 ADVICENNE FR0000053043 ADVINI US00774B2088 AERKOMM INC FR0011908045 AG3I ES0105422002 AGARTHA REAL EST FR0013452281 AGRIPOWER FR0010641449 AGROGENERATION CH0008853209 AGTA RECORD FR0000031122 AIR FRANCE -KLM FR0000120073 AIR LIQUIDE FR0013285103 AIR MARINE NL0000235190 AIRBUS FR0004180537 AKKA TECHNOLOGIES FR0000053027 AKWEL FR0000060402 ALBIOMA FR0013258662 ALD FR0000054652 ALES GROUPE FR0000053324 ALPES (COMPAGNIE) -

Competition Policy

ISSN 1025-2266 COMPETITION POLICY NEWSLETTER EC COMPETITION POLICY NEWSLETTER Editors: 2008 Æ NUMBER 3 Inge Bernaerts Kevin Coates Published three times a year by the Thomas Deisenhofer Competition Directorate-General of the European Commission Address: European Commission, Also available online: J-70, 04/136 http://ec.europa.eu/competition/publications/cpn/ Brussel B-1049 Bruxelles E-mail: [email protected] World Wide Web: http://ec.europa.eu/ competition/index_en.html I N S I D E : • The design of competition policy institutions for the 21st century by Philip Lowe • The new State aid General Block Exemption Regulation • The new Guidelines on the application of Article 81 of the EC Treaty to the maritime sector • The new settlement procedure in selected cartel cases • The CISAC decision • The Hellenic Shipyards decision: Limits to the application of Article 296 and indemnification provision in privatisation contracts MAIN DEVELOPMENTS ON • Antitrust — Cartels — Merger control — State aid control EUROPEAN COMMISSION Contents Articles 1 The design of competition policy institutions for the 21st century — the experience of the European Commission and DG Competition by Philip LOWE 12 The General Block Exemption Regulation (GBER): bigger, simpler and more economic by Harold NYSSENS 19 Rolling back regulation in the telecoms sector: a practical example by Ágnes SZARKA 25 The new Guidelines on the application of Article 81 of the EC Treaty to the maritime sector by Carsten BERMIG and Cyril RITTER 30 The new settlement procedure in selected -

2012-13 Annual Report of Private Giving

MAKING THE EXTRAORDINARY POSSIBLE 2012–13 ANNUAL REPORT OF PRIVATE GIVING 2 0 1 2–13 ANNUAL REPORT OF PRIVATE GIVING “Whether you’ve been a donor to UMaine for years or CONTENTS have just made your first gift, I thank you for your Letter from President Paul Ferguson 2 Fundraising Partners 4 thoughtfulness and invite you to join us in a journey Letter from Jeffery Mills and Eric Rolfson 4 that promises ‘Blue Skies ahead.’ ” President Paul W. Ferguson M A K I N G T H E Campaign Maine at a Glance 6 EXTRAORDINARY 2013 Endowments/Holdings 8 Ways of Giving 38 POSSIBLE Giving Societies 40 2013 Donors 42 BLUE SKIES AHEAD SINCE GRACE, JENNY AND I a common theme: making life better student access, it is donors like you arrived at UMaine just over two years for others — specifically for our who hold the real keys to the ago, we have truly enjoyed our students and the state we serve. While University of Maine’s future level interactions with many alumni and I’ve enjoyed many high points in my of excellence. friends who genuinely care about this personal and professional life, nothing remarkable university. Events like the surpasses the sense of reward and Unrestricted gifts that provide us the Stillwater Society dinner and the accomplishment that accompanies maximum flexibility to move forward Charles F. Allen Legacy Society assisting others to fulfill their are one of these keys. We also are luncheon have allowed us to meet and potential. counting on benefactors to champion thank hundreds of donors. -

Devoir De Vigilance: Reforming Corporate Risk Engagement

Devoir de Vigilance: Reforming Corporate Risk Engagement Copyright © Development International e.V., 2020 ISBN: 978-3-9820398-5-5 Authors: Juan Ignacio Ibañez, LL.M. Chris N. Bayer, PhD Jiahua Xu, PhD Anthony Cooper, J.D. Title: Devoir de Vigilance: Reforming Corporate Risk Engagement Date published: 9 June 2020 Funded by: iPoint-systems GmbH www.ipoint-systems.com 1 “Liberty consists of being able to do anything that does not harm another.” Article 4, Declaration of the Rights of the Man and of the Citizen of 1789, France 2 Executive Summary The objective of this systematic investigation is to gain a better understanding of how the 134 confirmed in-scope corporations are complying with – and implementing – France’s progressive Devoir de Vigilance law (LOI n° 2017-399 du 27 Mars 2017).1 We ask, in particular, what subject companies are doing to identify and mitigate social and environmental risk/impact factors in their operations, as well as for their subsidiaries, suppliers, and subcontractors. This investigation also aims to determine practical steps taken regarding the requirements of the law, i.e. how the corporations subject to the law are meeting these new requirements. Devoir de Vigilance is at the legislative forefront of the business and human rights movement. A few particular features of the law are worth highlighting. Notably, it: ● imposes a duty of vigilance (devoir de vigilance) which consists of a substantial standard of care and mandatory due diligence, as such distinct from a reporting requirement; ● sets a public reporting requirement for the vigilance plan and implementation report (compte rendu) on top of the substantial duty of vigilance; ● strengthens the accountability of parent companies for the actions of subsidiaries; ● encourages subject companies to develop their vigilance plan in association with stakeholders in society; ● imposes civil liability in case of non-compliance; ● allows stakeholders with a legitimate interest to seek injunctive relief in the case of a violation of the law. -

In the United States Bankruptcy Court for the District of Delaware

Case 19-10684 Doc 16 Filed 04/01/19 Page 1 of 1673 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE x In re: : Chapter 11 : HEXION HOLDINGS LLC, et al.,1 : Case No. 19-10684 ( ) : Debtors. : Joint Administration Requested x NOTICE OF FILING OF CREDITOR MATRIX PLEASE TAKE NOTICE that the above-captioned debtors and debtors in possession have today filed the attached Creditor Matrix with the United States Bankruptcy Court for the District of Delaware, 824 North Market Street, Wilmington, Delaware 19801. 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Hexion Holdings LLC (6842); Hexion LLC (8090); Hexion Inc. (1250); Lawter International Inc. (0818); Hexion CI Holding Company (China) LLC (7441); Hexion Nimbus Inc. (4409); Hexion Nimbus Asset Holdings LLC (4409); Hexion Deer Park LLC (8302); Hexion VAD LLC (6340); Hexion 2 U.S. Finance Corp. (2643); Hexion HSM Holdings LLC (7131); Hexion Investments Inc. (0359); Hexion International Inc. (3048); North American Sugar Industries Incorporated (9735); Cuban-American Mercantile Corporation (9734); The West India Company (2288); NL Coop Holdings LLC (0696); and Hexion Nova Scotia Finance, ULC (N/A). The address of the Debtors’ corporate headquarters is 180 East Broad Street, Columbus, Ohio 43215. RLF1 20960951V.1 Case 19-10684 Doc 16 Filed 04/01/19 Page 2 of 1673 Dated: April 1, 2019 Wilmington, Delaware /s/ Sarah E. Silveira Mark D. Collins (No. 2981) Michael J. Merchant (No. 3854) Amanda R. Steele (No. 5530) Sarah E. Silveira (No. 6580) RICHARDS, LAYTON & FINGER, P.A. -

At the Centre of an Evolving Industrial World

REGISTRATION AT THE CENTRE DOCUMENT 2011 OF AN EVOLVING INDUSTRIAL WORLD CONTENT 5.6. Major projects 130 1 Group overview 5 5.7. Responsibility for chemicals 133 5.8. Health and Safety 136 1.1. Group profi le 6 5.9. Human Resources 142 1.2. Key fi gures/Comments on the fi nancial year 7 5.10. Assurance report by one of the Statutory 1.3. History and development of the Company 12 Auditors on a selection of environmental, social and safety indicators 151 2 Activities 15 2.1. Group structure 16 6 Financial statements 153 2.2. The Nickel Division 16 6.1. 2011 consolidated fi nancial statements 154 2.3. The Manganese Division 26 6.2. 2011 separate fi nancial statements 233 2.4. Alloys Division 39 6.3. Consolidated fi nancial statements for 2010 2.5. Organisational Structure of ERAMET SA/ and 2009 260 ERAMET Holding company 48 6.4. Dividend policy 260 2.6. Activity of the Divisions in 2011 49 6.5. Fees paid to the Statutory Auditors 261 2.7. Production sites, plant and equipment 51 2.8. Research and Development/Reserves and Resources 52 7 Corporate and 3 share-capital information 263 Risk factors 65 7.1. Market in the Company’s shares 264 3.1. Commodity risk 66 7.2. Share capital 268 3.2. Special relationships with Group partners 66 7.3. Company information 275 3.3. Mining and industrial risks 68 7.4. Shareholders’ agreements 279 3.4. Legal and tax risks/Disputes 71 3.5. Liquidity, market and counterparty risks 73 3.6. -

2019 Annual Report Annual 2019

a force for good. 2019 ANNUAL REPORT ANNUAL 2019 1, cours Ferdinand de Lesseps 92851 Rueil Malmaison Cedex – France Tel.: +33 1 47 16 35 00 Fax: +33 1 47 51 91 02 www.vinci.com VINCI.Group 2019 ANNUAL REPORT VINCI @VINCI CONTENTS 1 P r o l e 2 Album 10 Interview with the Chairman and CEO 12 Corporate governance 14 Direction and strategy 18 Stock market and shareholder base 22 Sustainable development 32 CONCESSIONS 34 VINCI Autoroutes 48 VINCI Airports 62 Other concessions 64 – VINCI Highways 68 – VINCI Railways 70 – VINCI Stadium 72 CONTRACTING 74 VINCI Energies 88 Eurovia 102 VINCI Construction 118 VINCI Immobilier 121 GENERAL & FINANCIAL ELEMENTS 122 Report of the Board of Directors 270 Report of the Lead Director and the Vice-Chairman of the Board of Directors 272 Consolidated nancial statements This universal registration document was filed on 2 March 2020 with the Autorité des Marchés Financiers (AMF, the French securities regulator), as competent authority 349 Parent company nancial statements under Regulation (EU) 2017/1129, without prior approval pursuant to Article 9 of the 367 Special report of the Statutory Auditors on said regulation. The universal registration document may be used for the purposes of an offer to the regulated agreements public of securities or the admission of securities to trading on a regulated market if accompanied by a prospectus or securities note as well as a summary of all 368 Persons responsible for the universal registration document amendments, if any, made to the universal registration document. The set of documents thus formed is approved by the AMF in accordance with Regulation (EU) 2017/1129. -

IEA: the Role of Critical Minerals in Clean Energy Transitions

The Role of Critical Minerals in Clean Energy Transitions World Energy Outlook Special Report INTERNATIONAL ENERGY AGENCY The IEA examines the full spectrum of IEA member countries: Spain energy issues including oil, gas and Australia Sweden coal supply and demand, renewable Austria Switzerland energy technologies, electricity Belgium Turkey markets, energy efficiency, access to Canada United Kingdom energy, demand side management Czech Republic United States and much more. Through its work, the Denmark IEA advocates policies that will Estonia IEA association countries: enhance the reliability, affordability Finland Brazil and sustainability of energy in its 30 France China member countries, 8 association Germany India countries and beyond. Greece Indonesia Hungary Morocco Please note that this publication is Ireland Singapore subject to specific restrictions that Italy South Africa limit its use and distribution. The Japan Thailand terms and conditions are available Korea online at www.iea.org/t&c/ Luxembourg Mexico This publication and any map included herein are Netherlands without prejudice to the status of or sovereignty New Zealand over any territory, to the delimitation of international frontiers and boundaries and to the Norway name of any territory, city or area. Poland Portugal Slovak Republic Source: IEA. All rights reserved. International Energy Agency Website: www.iea.org The Role of Critical Minerals in Clean Energy Transitions Foreword Foreword Ever since the International Energy Agency (IEA) was founded in world to anticipate and navigate possible disruptions and avoid 1974 in the wake of severe disruptions to global oil markets that damaging outcomes for our economies and our planet. shook the world economy, its core mission has been to foster secure This special report is the most comprehensive global study of this and affordable energy supplies. -

De Beers' New Strategy

Personal copy; not for onward transmission De Beers’ new td. pany L strategy om In what is described by its chairman, Instead, it aims to be the ‘supplier of Nicky Oppenheimer, as “one of the choice’. However, it currently sells ron & C most significant developments the dia- about two thirds of the world’s annual mond industry has seen since the supply of rough diamonds, and the Georgian House 1930s”, De Beers this week unveiled a mines that it manages contribute about oeb A 63, Coleman Street new strategy whereby it will abandon 40% of world production. Hence it L London EC2R 5BB Tel :+44 (0)20 7628-1128 its long-held role as custodian of the remains very much the dominant play- REGULATED BY THE SFA diamond market, and focus instead on er, and intends to continue to sell dia- boosting demand. Since the depression monds to selected clients through its years of the 1930s when the price of dia- regular sales or ‘sights’ held roughly monds slumped, De Beers has stock- every five weeks. piled the world’s surplus diamonds as a There will be some marked changes means of controlling supply (and though in how the sights are conducted. prices). Under the new strategy, the At present, they are characterised by stockpile is not being eliminated but it their opacity. The 125 selected will be substantially reduced – to a sightholders or diamantaires – it is esti- working level of around six months’ mated that as many as 900 diaman- supply, equivalent to some US$2.5 bil- taires are on the ‘waiting list’ – have no lion. -

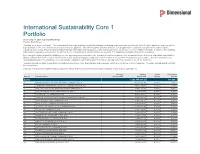

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions -

In Re Johnson & Johnson Talcum Powder Prods. Mktg., Sales

Neutral As of: May 5, 2020 7:00 PM Z In re Johnson & Johnson Talcum Powder Prods. Mktg., Sales Practices & Prods. Litig. United States District Court for the District of New Jersey April 27, 2020, Decided; April 27, 2020, Filed Civil Action No.: 16-2738(FLW), MDL No. 2738 Reporter 2020 U.S. Dist. LEXIS 76533 * MONTGOMERY, AL; CHRISTOPHER MICHAEL PLACITELLA, COHEN, PLACITELLA & ROTH, PC, IN RE: JOHNSON & JOHNSON TALCUM POWDER RED BANK, NJ. PRODUCTS MARKETING, SALES PRACTICES AND PRODUCTS LITIGATION For ADA RICH-WILLIAMS, 16-6489, Plaintiff: PATRICIA LEIGH O'DELL, LEAD ATTORNEY, COUNSEL NOT ADMITTED TO USDC-NJ BAR, MONTGOMERY, AL; Prior History: In re Johnson & Johnson Talcum Powder Richard Runft Barrett, LEAD ATTORNEY, COUNSEL Prods. Mktg., Sales Practices & Prods. Liab. Litig., 220 NOT ADMITTED TO USDC-NJ BAR, LAW OFFICES F. Supp. 3d 1356, 2016 U.S. Dist. LEXIS 138403 OF RICHARD L. BARRETT, PLLC, OXFORD, MS; (J.P.M.L., Oct. 5, 2016) CHRISTOPHER MICHAEL PLACITELLA, COHEN, PLACITELLA & ROTH, PC, RED BANK, NJ. For DOLORES GOULD, 16-6567, Plaintiff: PATRICIA Core Terms LEIGH O'DELL, LEAD ATTORNEY, COUNSEL NOT ADMITTED TO USDC-NJ BAR, MONTGOMERY, AL; studies, cancer, talc, ovarian, causation, asbestos, PIERCE GORE, LEAD ATTORNEY, COUNSEL NOT reliable, Plaintiffs', cells, talcum powder, ADMITTED TO USDC-NJ BAR, PRATT & epidemiological, methodology, cohort, dose-response, ASSOCIATES, SAN JOSE, CA; CHRISTOPHER unreliable, products, biological, exposure, case-control, MICHAEL PLACITELLA, COHEN, PLACITELLA & Defendants', relative risk, testing, scientific, opines, ROTH, PC, RED BANK, [*2] NJ. inflammation, consistency, expert testimony, in vitro, causes, laboratory For TOD ALAN MUSGROVE, 16-6568, Plaintiff: AMANDA KATE KLEVORN, LEAD ATTORNEY, PRO HAC VICE, COUNSEL NOT ADMITTED TO USDC-NJ Counsel: [*1] For HON. -

Plan of Reorganization of Imerys Talc America, Inc

Case 19-10289-LSS Doc 2864 Filed 01/28/21 Page 1 of 371 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x In re: : Chapter 11 : IMERYS TALC AMERICA, INC., et al.,1 : Case No. 19-10289 (LSS) : Debtors. : (Jointly Administered) : ------------------------------------------------------------ : In re: : Chapter 11 : IMERYS TALC ITALY S.P.A.,2 : Case No. [Not yet filed] : Potential Debtor. : [Joint Administration To Be Requested] : ------------------------------------------------------------ x NINTH AMENDED JOINT CHAPTER 11 PLAN OF REORGANIZATION OF IMERYS TALC AMERICA, INC. AND ITS DEBTOR AFFILIATES UNDER CHAPTER 11 OF THE BANKRUPTCY CODE THIS SOLICITATION IS BEING CONDUCTED NOT ONLY FOR THE DEBTORS IN THESE CHAPTER 11 CASES, BUT ALSO FOR IMERYS TALC ITALY S.P.A. NO CHAPTER 11 CASE HAS BEEN COMMENCED AT THIS TIME FOR IMERYS TALC ITALY S.P.A. THE DISCLOSURE STATEMENT AND SOLICITATION MATERIALS ACCOMPANYING THIS JOINT CHAPTER 11 PLAN HAVE NOT YET BEEN APPROVED BY THE BANKRUPTCY COURT FOR IMERYS TALC ITALY S.P.A. IF THE REQUISITE NUMBER OF ACCEPTANCES BY HOLDERS OF CLAIMS IN CLASS 4 ARE RECEIVED, IMERYS TALC ITALY S.P.A. WILL COMMENCE A CHAPTER 11 CASE. FOLLOWING THE COMMENCEMENT OF SUCH A CASE AND ENTRY OF AN ORDER FOR JOINT ADMINISTRATION, IMERYS TALC ITALY S.P.A. WILL SEEK TO HAVE THE DISCLOSURE STATEMENT ORDER MADE APPLICABLE TO IT AND THE CONFIRMATION HEARING ON THIS JOINT CHAPTER 11 PLAN WILL APPLY TO IMERYS TALC ITALY S.P.A. EVEN THOUGH A CHAPTER 11 CASE HAS NOT BEEN COMMENCED FOR IMERYS TALC ITALY S.P.A., THIS JOINT CHAPTER 11 PLAN IS DRAFTED TO ACCOUNT FOR SUCH A FILING FOR EASE OF READING.