Plan of Reorganization of Imerys Talc America, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Liste Des Actions Concernées Par L'interdiction De Positions Courtes Nettes

Liste des actions concernées par l'interdiction de positions courtes nettes L’interdiction s’applique aux actions listées sur une plate-forme française et relevant de la compétence de l’AMF au titre du règlement 236/2012 (information disponible dans les registres ESMA). Cette liste est fournie à titre informatif. L'AMF n'est pas en mesure de garantir que le contenu disponible est complet, exact ou à jour. Compte tenu des diverses sources de données sous- jacentes, des modifications pourraient être apportées régulièrement. Isin Nom FR0010285965 1000MERCIS FR0013341781 2CRSI FR0010050773 A TOUTE VITESSE FR0000076887 A.S.T. GROUPE FR0010557264 AB SCIENCE FR0004040608 ABC ARBITRAGE FR0013185857 ABEO FR0012616852 ABIONYX PHARMA FR0012333284 ABIVAX FR0000064602 ACANTHE DEV. FR0000120404 ACCOR FR0010493510 ACHETER-LOUER.FR FR0000076861 ACTEOS FR0000076655 ACTIA GROUP FR0011038348 ACTIPLAY (GROUPE) FR0010979377 ACTIVIUM GROUP FR0000053076 ADA BE0974269012 ADC SIIC FR0013284627 ADEUNIS FR0000062978 ADL PARTNER FR0011184241 ADOCIA FR0013247244 ADOMOS FR0010340141 ADP FR0010457531 ADTHINK FR0012821890 ADUX FR0004152874 ADVENIS FR0013296746 ADVICENNE FR0000053043 ADVINI US00774B2088 AERKOMM INC FR0011908045 AG3I ES0105422002 AGARTHA REAL EST FR0013452281 AGRIPOWER FR0010641449 AGROGENERATION CH0008853209 AGTA RECORD FR0000031122 AIR FRANCE -KLM FR0000120073 AIR LIQUIDE FR0013285103 AIR MARINE NL0000235190 AIRBUS FR0004180537 AKKA TECHNOLOGIES FR0000053027 AKWEL FR0000060402 ALBIOMA FR0013258662 ALD FR0000054652 ALES GROUPE FR0000053324 ALPES (COMPAGNIE) -

2012-13 Annual Report of Private Giving

MAKING THE EXTRAORDINARY POSSIBLE 2012–13 ANNUAL REPORT OF PRIVATE GIVING 2 0 1 2–13 ANNUAL REPORT OF PRIVATE GIVING “Whether you’ve been a donor to UMaine for years or CONTENTS have just made your first gift, I thank you for your Letter from President Paul Ferguson 2 Fundraising Partners 4 thoughtfulness and invite you to join us in a journey Letter from Jeffery Mills and Eric Rolfson 4 that promises ‘Blue Skies ahead.’ ” President Paul W. Ferguson M A K I N G T H E Campaign Maine at a Glance 6 EXTRAORDINARY 2013 Endowments/Holdings 8 Ways of Giving 38 POSSIBLE Giving Societies 40 2013 Donors 42 BLUE SKIES AHEAD SINCE GRACE, JENNY AND I a common theme: making life better student access, it is donors like you arrived at UMaine just over two years for others — specifically for our who hold the real keys to the ago, we have truly enjoyed our students and the state we serve. While University of Maine’s future level interactions with many alumni and I’ve enjoyed many high points in my of excellence. friends who genuinely care about this personal and professional life, nothing remarkable university. Events like the surpasses the sense of reward and Unrestricted gifts that provide us the Stillwater Society dinner and the accomplishment that accompanies maximum flexibility to move forward Charles F. Allen Legacy Society assisting others to fulfill their are one of these keys. We also are luncheon have allowed us to meet and potential. counting on benefactors to champion thank hundreds of donors. -

2011 Registration Document Annual Financial Report SUMMARY

2011 Registration Document Annual Financial Report SUMMARY 1 PRESENTATION OF THE GROUP 3 6 ADDITIONAL INFORMATION 227 1.1 Main key figures 4 6.1 Information about the Company 228 1.2 The Group’s strategy and general structure 5 6.2 Information about the share capital 232 1.3 Minerals 10 6.3 Shareholding 238 1.4 Minerals for Ceramics, Refractories, 6.4 Elements which could have an impact Abrasives & Foundry 17 in the event of a takeover bid 241 1.5 Performance & Filtration Minerals 26 6.5 Imerys stock exchange information 242 1.6 Pigments for Paper & Packaging 32 6.6 Dividends 244 1.7 Materials & Monolithics 36 6.7 Shareholder relations 244 1.8 Innovation 43 6.8 Parent company/subsidiaries organization 245 1.9 Sustainable Development 48 ORDINARY AND EXTRAORDINARY REPORTS ON THE FISCAL YEAR 2011 65 7 SHAREHOLDERS’ GENERAL MEETING 2 OF APRIL 26, 2012 247 2.1 Board of Directors’ management report 66 2.2 Statutory Auditors' Reports 77 7.1 Presentation of the resolutions by the Board of Directors 248 7.2 Agenda 254 7.3 Draft resolutions 255 3 CORPORATE GOVERNANCE 83 3.1 Board of Directors 84 3.2 Executive Management 103 PERSONS RESPONSIBLE FOR THE 3.3 Compensation 105 8 REGISTRATION DOCUMENT AND THE AUDIT 3.4 Stock options 109 OF ACCOUNTS 261 3.5 Free shares 114 8.1 Person responsible for the Registration Document 262 3.6 Specific terms and restrictions applicable to grants 8.2 Certificate of the person responsible to the Chairman and Chief Executive Officer 116 for the Registration Document 262 3.7 Corporate officers’ transactions in securities -

In the United States Bankruptcy Court for the District of Delaware

Case 19-10684 Doc 16 Filed 04/01/19 Page 1 of 1673 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE x In re: : Chapter 11 : HEXION HOLDINGS LLC, et al.,1 : Case No. 19-10684 ( ) : Debtors. : Joint Administration Requested x NOTICE OF FILING OF CREDITOR MATRIX PLEASE TAKE NOTICE that the above-captioned debtors and debtors in possession have today filed the attached Creditor Matrix with the United States Bankruptcy Court for the District of Delaware, 824 North Market Street, Wilmington, Delaware 19801. 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Hexion Holdings LLC (6842); Hexion LLC (8090); Hexion Inc. (1250); Lawter International Inc. (0818); Hexion CI Holding Company (China) LLC (7441); Hexion Nimbus Inc. (4409); Hexion Nimbus Asset Holdings LLC (4409); Hexion Deer Park LLC (8302); Hexion VAD LLC (6340); Hexion 2 U.S. Finance Corp. (2643); Hexion HSM Holdings LLC (7131); Hexion Investments Inc. (0359); Hexion International Inc. (3048); North American Sugar Industries Incorporated (9735); Cuban-American Mercantile Corporation (9734); The West India Company (2288); NL Coop Holdings LLC (0696); and Hexion Nova Scotia Finance, ULC (N/A). The address of the Debtors’ corporate headquarters is 180 East Broad Street, Columbus, Ohio 43215. RLF1 20960951V.1 Case 19-10684 Doc 16 Filed 04/01/19 Page 2 of 1673 Dated: April 1, 2019 Wilmington, Delaware /s/ Sarah E. Silveira Mark D. Collins (No. 2981) Michael J. Merchant (No. 3854) Amanda R. Steele (No. 5530) Sarah E. Silveira (No. 6580) RICHARDS, LAYTON & FINGER, P.A. -

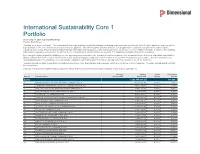

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions -

In Re Johnson & Johnson Talcum Powder Prods. Mktg., Sales

Neutral As of: May 5, 2020 7:00 PM Z In re Johnson & Johnson Talcum Powder Prods. Mktg., Sales Practices & Prods. Litig. United States District Court for the District of New Jersey April 27, 2020, Decided; April 27, 2020, Filed Civil Action No.: 16-2738(FLW), MDL No. 2738 Reporter 2020 U.S. Dist. LEXIS 76533 * MONTGOMERY, AL; CHRISTOPHER MICHAEL PLACITELLA, COHEN, PLACITELLA & ROTH, PC, IN RE: JOHNSON & JOHNSON TALCUM POWDER RED BANK, NJ. PRODUCTS MARKETING, SALES PRACTICES AND PRODUCTS LITIGATION For ADA RICH-WILLIAMS, 16-6489, Plaintiff: PATRICIA LEIGH O'DELL, LEAD ATTORNEY, COUNSEL NOT ADMITTED TO USDC-NJ BAR, MONTGOMERY, AL; Prior History: In re Johnson & Johnson Talcum Powder Richard Runft Barrett, LEAD ATTORNEY, COUNSEL Prods. Mktg., Sales Practices & Prods. Liab. Litig., 220 NOT ADMITTED TO USDC-NJ BAR, LAW OFFICES F. Supp. 3d 1356, 2016 U.S. Dist. LEXIS 138403 OF RICHARD L. BARRETT, PLLC, OXFORD, MS; (J.P.M.L., Oct. 5, 2016) CHRISTOPHER MICHAEL PLACITELLA, COHEN, PLACITELLA & ROTH, PC, RED BANK, NJ. For DOLORES GOULD, 16-6567, Plaintiff: PATRICIA Core Terms LEIGH O'DELL, LEAD ATTORNEY, COUNSEL NOT ADMITTED TO USDC-NJ BAR, MONTGOMERY, AL; studies, cancer, talc, ovarian, causation, asbestos, PIERCE GORE, LEAD ATTORNEY, COUNSEL NOT reliable, Plaintiffs', cells, talcum powder, ADMITTED TO USDC-NJ BAR, PRATT & epidemiological, methodology, cohort, dose-response, ASSOCIATES, SAN JOSE, CA; CHRISTOPHER unreliable, products, biological, exposure, case-control, MICHAEL PLACITELLA, COHEN, PLACITELLA & Defendants', relative risk, testing, scientific, opines, ROTH, PC, RED BANK, [*2] NJ. inflammation, consistency, expert testimony, in vitro, causes, laboratory For TOD ALAN MUSGROVE, 16-6568, Plaintiff: AMANDA KATE KLEVORN, LEAD ATTORNEY, PRO HAC VICE, COUNSEL NOT ADMITTED TO USDC-NJ Counsel: [*1] For HON. -

March 24, 20162017 the FOUR-RING CIRCUS

THE FOUR-RING CIRCUS - ROUND TWENTYTWENTY-ONE; A FURTHER UPDATED VIEW OF THE MATING DANCE AMONG ANNOUNCED MERGER PARTNERS AND AN UNSOLICITED SECOND OR THIRD BIDDER By: Robert E. Spatt, Esq. Eric M. Swedenburg, Esq. March 24, 20162017 _______________ Copyright © 20162017 Robert E. Spatt & Eric M. Swedenburg. All rights reserved. Special thanks to Lauren M. Colasacco, Jonathan G. Stradling, Paul Bennett and Christian E. WitzkeJake M. Phillips, associates at Simpson Thacher & Bartlett LLP (and to Jennifer J. Levitt, senior counsel at Simpson Thacher & Bartlett LLP, and Lauren M. Colasacco, associate at Simpson Thacher & Bartlett LLP, with respect to prior versions), for their invaluable assistance in updating this article. All or part of this article (or earlier versions thereof) may have been or be used in other materials published by the authors or their colleagues. A downloadable version of this article can be found on the Simpson Thacher & Bartlett LLP website (www.stblaw.com/FourRingCircus20162017.pdf), along with a marked version showing changes from the prior “Round NineteenTwenty” of this article (www.stblaw.com/FourRingUpdates20162017.pdf) to facilitate the identification of updated data. Simpson Thacher & Bartlett LLP The Four-Ring Circus - Round TwentyTwenty-One; A Further Updated View Of The Mating Dance Among Announced Merger Partners And An Unsolicited Second Or Third Bidder Congratulatory handshakes and champagne toasts often accompany the execution and announcement of a merger agreement between a public company and its chosen merger partner. All too often, though, the celebration is premature. In the U.S., the incidence of unsolicited second and even third bidders surfacing after two companies have announced a definitive friendly merger agreement (or in the case of some foreign jurisdictions, a target-endorsed friendly offer) has become a standard execution risk of getting a deal done, and tends to reflect the ebb and flow of hostile acquisition activity. -

Ief-I Q3 2020

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 96.98% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 1,012 2,330 2,115 ACCENT GROUP LTD 3,078 2,769 3,636 ADBRI LTD 222,373 489,412 455,535 AFTERPAY LTD 18,738 959,482 1,095,892 AGL ENERGY LTD 3,706 49,589 36,243 ALTIUM LTD 8,294 143,981 216,118 ALUMINA LTD 4,292 6,887 4,283 AMP LTD 15,427 26,616 14,529 ANSELL LTD 484 8,876 12,950 APA GROUP 14,634 114,162 108,585 APPEN LTD 11,282 194,407 276,316 AUB GROUP LTD 224 2,028 2,677 AUSNET SERVICES 9,482 10,386 12,844 AUSTRALIA & NEW ZEALAND BANKIN 19,794 340,672 245,226 AUSTRALIAN PHARMACEUTICAL INDU 4,466 3,770 3,377 BANK OF QUEENSLAND LTD 1,943 13,268 8,008 BEACH ENERGY LTD 3,992 4,280 3,824 BEGA CHEESE LTD 740 2,588 2,684 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 11,180 BHP GROUP LTD 16,897 429,820 435,111 BHP GROUP PLC 83,670 1,755,966 1,787,133 BLUESCOPE STEEL LTD 9,170 73,684 83,770 BORAL LTD 6,095 21,195 19,989 BRAMBLES LTD 135,706 987,557 1,022,317 BRICKWORKS LTD 256 2,997 3,571 BWP TRUST 2,510 6,241 7,282 CENTURIA INDUSTRIAL REIT 1,754 3,538 3,919 CENTURIA OFFICE REIT 154,762 199,550 226,593 CHALLENGER LTD 2,442 13,473 6,728 CHAMPION IRON LTD 1,118 2,075 2,350 CHARTER HALL LONG WALE REIT 2,392 8,444 8,621 CHARTER HALL RETAIL REIT 174,503 464,770 421,358 CHARTER HALL SOCIAL INFRASTRUC 1,209 2,007 2,458 CIMIC GROUP LTD 4,894 73,980 65,249 COCA-COLA AMATIL LTD 2,108 12,258 14,383 COCHLEAR LTD 1,177 155,370 167,412 COMMONWEALTH BANK OF AUSTRALIA 12,637 659,871 577,971 CORONADO GLOBAL RESOURCES INC 1,327 -

CONSTRUIRE DURABLE », Une Question D'énergie Et De

« CONSTRUIRE DURABLE » UNE QUESTION D’ENERGIE ET DE FINANCEMENT ? BONNES PRATIQUES DE REPORTING mai 2007 Sommaire PRESENTATION DES BONNES PRATIQUES DE REPORTING ............................................4 I LES BONNES PRATIQUES DES INVESTISSEURS..............................................................5 La gouvernance et les engagements.........................................................................................................................................6 Engagements ...........................................................................................................................................................................6 Conscience des enjeux ............................................................................................................................................................6 La mise en œuvre et les pratiques ............................................................................................................................................7 Les mesures et contrôles ...........................................................................................................................................................8 Notation et normes ..................................................................................................................................................................8 Indicateurs...............................................................................................................................................................................8 -

Presentation Speaker

Capital Markets Day 13th June 2019 POSITIONING IMERYS FOR PROFITABLE GROWTH Disclaimer More comprehensive information about Imerys may be obtained on its website (www.imerys.com), under Regulated Information, including its Registration Document filed under No. D.19-0175 March 20, 2019 with Autorité des Marchés Financiers. Imerys draws the attention of investors to the “Risk factors and Internal control” set forth in section 4 of the Registration Document. This document contains projections and other forward-looking statements. Investors are cautioned that such projections and forward-looking statements are subject to various risks and uncertainties (many of which are difficult to predict and generally beyond the control of Imerys) that could cause actual results and developments to differ materially from those expressed or implied. Photo credits: Imerys Photo Library, Reserved Rights, xxx. Capital Markets Day June 13, 2019 2 Capital Markets Day agenda TIME PRESENTATION SPEAKER 9:00am Welcome coffee 9:30am Imerys’ strengths and ambition Conrad KEIJZER – CEO 10:15am Imerys strategy for profitable growth Olivier HAUTIN – CSO 11:00am Break 11:30am Business areas presentations Conrad KEIJZER and SVPs 12:30pm Lunch break 13:30pm Capital allocation to ensure long term value creation Olivier PIROTTE – CFO 14:15pm Closing remarks Conrad KEIJZER – CEO 14:30pm Q&A Capital Markets Day June 13, 2019 3 Imerys’ strengths and ambition Conrad KEIJZER – Chief Executive Officer Capital Markets Day June 13, 2019 4 A new senior leadership team Who you will -

Cyprus /Imerys /Luzenac/RTM Corporate History

Cyprus /Imerys /Luzenac/RTM Corporate history 1873 Rio Tinto is incorporated in London. - Spanish company 1880s Imerys founded to perform mining and metallurgy. 1905 Talc de Luzenac (French) is founded. 1907 Talco e Grafite Val Chisone (The Val Chisone Talc and Graphite Co) is founded and gradually absorbs smaller mining companies in the region like "Anglo Italian Talc and Plumbago Mines Company. 1964 Cyprus Mines Corporation acquires Sierra Talc Company and begins :nining talc in the US. 1964-1966 Cyprus sold asbestos fiber. 84 1965 Cyprus purchased the Southwestern Talc Co 1967 THAN markets Cyprus talc. 85 History of J&J's history with Luzenac/Imerys:86 84 CAM-6 NY Times CAM-1 Question 7 85 CAM-112 86 CONFIDENTIAL. IMERYS089960 • -1968 : Ea:51:em Magnesisocmtrsctsto build adedioatedfl.oat plant inWinds01, VTte> male baby powder tsl cfor Johnson and Johnson • '1988: Eastern l\.t'sgnesiafsilsto oompletethe plant.J sndJtales over ownership, finishes plant. operates facility as Windsor Minerals • '1988: J&J sellsWindS01 Minerals to Cyprus: signs 10 year oontractto purchase talctrorn Windsor plant • '1992: Cyp1ussells talc business to Luzen,ac(Rio Tinto) • '1995: Tai c Purchase Contract 1enegotiated and extend'edto 200 3 • 2003: J&J qualifiesChinesetalcin NA at IO\ver price; Luzenscooukf ne>t-ope-ateWindsar plant profitably; Luz en scsuppl ies J&-J Chinese based product from Houston: Windsor ci osed • 2005: Escalation of high quali1'/ Chinese ore prices begins • 200-9: LuzenachelpsJ-t,Jtodefenditself inChinaancf develop a n,ewgloba.lrtand'.Sld -

Rothschild & Co: 2020

Rothschild & Co Annual Report 2020 Annual Report 2020 One Group organised around 3 businesses • Global Advisory • Wealth and Asset Management • Merchant Banking 3,587 employees 62 locations 43 countries Contents Message from the Chairman of the Supervisory Board 2 Message from the Management Board 4 1. Overview Overview of businesses 8 Rothschild & Co business model 10 World presence 12 Corporate governance 14 Organisation chart as at 31 December 2020 17 Corporate Responsibility 18 Rothschild & Co and its shareholders 22 2. Business review Global Advisory 28 Wealth and Asset Management 34 Merchant Banking 38 3. Management report A. Activities and results for the 2020 financial year 50 B. Information on the Company and its share capital 60 C. Internal control, risk management and accounting procedures 76 D. Corporate Responsibility 83 E. Report on corporate governance 128 4. Financial statements Consolidated financial statements 172 Statutory auditors’ report on the consolidated financial statements 236 Parent Company financial statements 239 Statutory auditors’ report on the parent company financial statements 251 General Information Abbreviations and glossary 256 Statement by the persons responsible for the annual financial report 259 Other information 260 Rothschild & Co | Annual Report 2020 1 Message from the Chairman of the Supervisory Board Dear Shareholders, At the end of what can only be described a tumultuous François Henrot retired from his position as observer on year, when the world faced unprecedented challenges, the Board in May 2020. François first joined the Board I would like to thank the Supervisory Board members of Rothschild & Co in 2010 and was appointed to be for their continued support and engagement with Vice-Chairman of the Board at the time of the Group’s Rothschild & Co.