Printmgr File

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Liste Des Actions Concernées Par L'interdiction De Positions Courtes Nettes

Liste des actions concernées par l'interdiction de positions courtes nettes L’interdiction s’applique aux actions listées sur une plate-forme française et relevant de la compétence de l’AMF au titre du règlement 236/2012 (information disponible dans les registres ESMA). Cette liste est fournie à titre informatif. L'AMF n'est pas en mesure de garantir que le contenu disponible est complet, exact ou à jour. Compte tenu des diverses sources de données sous- jacentes, des modifications pourraient être apportées régulièrement. Isin Nom FR0010285965 1000MERCIS FR0013341781 2CRSI FR0010050773 A TOUTE VITESSE FR0000076887 A.S.T. GROUPE FR0010557264 AB SCIENCE FR0004040608 ABC ARBITRAGE FR0013185857 ABEO FR0012616852 ABIONYX PHARMA FR0012333284 ABIVAX FR0000064602 ACANTHE DEV. FR0000120404 ACCOR FR0010493510 ACHETER-LOUER.FR FR0000076861 ACTEOS FR0000076655 ACTIA GROUP FR0011038348 ACTIPLAY (GROUPE) FR0010979377 ACTIVIUM GROUP FR0000053076 ADA BE0974269012 ADC SIIC FR0013284627 ADEUNIS FR0000062978 ADL PARTNER FR0011184241 ADOCIA FR0013247244 ADOMOS FR0010340141 ADP FR0010457531 ADTHINK FR0012821890 ADUX FR0004152874 ADVENIS FR0013296746 ADVICENNE FR0000053043 ADVINI US00774B2088 AERKOMM INC FR0011908045 AG3I ES0105422002 AGARTHA REAL EST FR0013452281 AGRIPOWER FR0010641449 AGROGENERATION CH0008853209 AGTA RECORD FR0000031122 AIR FRANCE -KLM FR0000120073 AIR LIQUIDE FR0013285103 AIR MARINE NL0000235190 AIRBUS FR0004180537 AKKA TECHNOLOGIES FR0000053027 AKWEL FR0000060402 ALBIOMA FR0013258662 ALD FR0000054652 ALES GROUPE FR0000053324 ALPES (COMPAGNIE) -

DFA INVESTMENT DIMENSIONS GROUP INC Form NPORT-P Filed 2021-03-25

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-03-25 | Period of Report: 2021-01-31 SEC Accession No. 0001752724-21-062357 (HTML Version on secdatabase.com) FILER DFA INVESTMENT DIMENSIONS GROUP INC Mailing Address Business Address 6300 BEE CAVE ROAD 6300 BEE CAVE ROAD CIK:355437| IRS No.: 363129984 | State of Incorp.:MD | Fiscal Year End: 1031 BUILDING ONE BUILDING ONE Type: NPORT-P | Act: 40 | File No.: 811-03258 | Film No.: 21771544 AUSTIN TX 78746 AUSTIN TX 78746 (512) 306-7400 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document DFA INVESTMENT DIMENSIONS GROUP INC. FORM N-Q REPORT January 31, 2021 (UNAUDITED) Table of Contents DEFINITIONS OF ABBREVIATIONS AND FOOTNOTES T.A. U.S. Core Equity 2 Portfolio Tax-Managed DFA International Value Portfolio T.A. World ex U.S. Core Equity Portfolio VA U.S. Targeted Value Portfolio VA U.S. Large Value Portfolio VA International Value Portfolio VA International Small Portfolio VA Short-Term Fixed Portfolio VA Global Bond Portfolio VIT Inflation-Protected Securities Portfolio VA Global Moderate Allocation Portfolio U.S. Large Cap Growth Portfolio U.S. Small Cap Growth Portfolio International Large Cap Growth Portfolio International Small Cap Growth Portfolio DFA Social Fixed Income Portfolio DFA Diversified Fixed Income Portfolio U.S. High Relative Profitability Portfolio International High Relative Profitability Portfolio VA Equity Allocation Portfolio DFA MN Municipal Bond Portfolio DFA California Municipal Real Return Portfolio DFA Global Core Plus Fixed Income Portfolio Emerging Markets Sustainability Core 1 Portfolio Emerging Markets Targeted Value Portfolio DFA Global Sustainability Fixed Income Portfolio DFA Oregon Municipal Bond Portfolio NOTES TO FINANCIAL STATEMENTS Organization Security Valuation Financial Instruments Federal Tax Cost Recently Issued Accounting Standards Other Subsequent Event Evaluations Table of Contents TABLE OF CONTENTS CONTINUED THE DFA INVESTMENT TRUST COMPANY SCHEDULES OF INVESTMENTS The U.S. -

2012-13 Annual Report of Private Giving

MAKING THE EXTRAORDINARY POSSIBLE 2012–13 ANNUAL REPORT OF PRIVATE GIVING 2 0 1 2–13 ANNUAL REPORT OF PRIVATE GIVING “Whether you’ve been a donor to UMaine for years or CONTENTS have just made your first gift, I thank you for your Letter from President Paul Ferguson 2 Fundraising Partners 4 thoughtfulness and invite you to join us in a journey Letter from Jeffery Mills and Eric Rolfson 4 that promises ‘Blue Skies ahead.’ ” President Paul W. Ferguson M A K I N G T H E Campaign Maine at a Glance 6 EXTRAORDINARY 2013 Endowments/Holdings 8 Ways of Giving 38 POSSIBLE Giving Societies 40 2013 Donors 42 BLUE SKIES AHEAD SINCE GRACE, JENNY AND I a common theme: making life better student access, it is donors like you arrived at UMaine just over two years for others — specifically for our who hold the real keys to the ago, we have truly enjoyed our students and the state we serve. While University of Maine’s future level interactions with many alumni and I’ve enjoyed many high points in my of excellence. friends who genuinely care about this personal and professional life, nothing remarkable university. Events like the surpasses the sense of reward and Unrestricted gifts that provide us the Stillwater Society dinner and the accomplishment that accompanies maximum flexibility to move forward Charles F. Allen Legacy Society assisting others to fulfill their are one of these keys. We also are luncheon have allowed us to meet and potential. counting on benefactors to champion thank hundreds of donors. -

2011 Registration Document Annual Financial Report SUMMARY

2011 Registration Document Annual Financial Report SUMMARY 1 PRESENTATION OF THE GROUP 3 6 ADDITIONAL INFORMATION 227 1.1 Main key figures 4 6.1 Information about the Company 228 1.2 The Group’s strategy and general structure 5 6.2 Information about the share capital 232 1.3 Minerals 10 6.3 Shareholding 238 1.4 Minerals for Ceramics, Refractories, 6.4 Elements which could have an impact Abrasives & Foundry 17 in the event of a takeover bid 241 1.5 Performance & Filtration Minerals 26 6.5 Imerys stock exchange information 242 1.6 Pigments for Paper & Packaging 32 6.6 Dividends 244 1.7 Materials & Monolithics 36 6.7 Shareholder relations 244 1.8 Innovation 43 6.8 Parent company/subsidiaries organization 245 1.9 Sustainable Development 48 ORDINARY AND EXTRAORDINARY REPORTS ON THE FISCAL YEAR 2011 65 7 SHAREHOLDERS’ GENERAL MEETING 2 OF APRIL 26, 2012 247 2.1 Board of Directors’ management report 66 2.2 Statutory Auditors' Reports 77 7.1 Presentation of the resolutions by the Board of Directors 248 7.2 Agenda 254 7.3 Draft resolutions 255 3 CORPORATE GOVERNANCE 83 3.1 Board of Directors 84 3.2 Executive Management 103 PERSONS RESPONSIBLE FOR THE 3.3 Compensation 105 8 REGISTRATION DOCUMENT AND THE AUDIT 3.4 Stock options 109 OF ACCOUNTS 261 3.5 Free shares 114 8.1 Person responsible for the Registration Document 262 3.6 Specific terms and restrictions applicable to grants 8.2 Certificate of the person responsible to the Chairman and Chief Executive Officer 116 for the Registration Document 262 3.7 Corporate officers’ transactions in securities -

The Global State of Sustainable Insurance Understanding and Integrating Environmental, Social and Governance Factors in Insurance

www.unep.org United Nations Environment Programme P.O. Box 30552 Nairobi, Kenya Tel.: ++254-(0)20-62 1234 Fax: ++254-(0)20-62 3927 E-mail: [email protected] United Nations Environment Programme Finance Initiative (UNEP FI) UNEP FI is a strategic public-private partnership between UNEP and the global financial sector. UNEP works with over 180 banks, insurers and investment firms, and a range of partner organisations, to understand the impacts of environmental, social The global and governance factors on financial performance and sustainable development. state of Through a comprehensive work programme encompassing research, sustainable training, events and regional activities, UNEP FI carries out its mission to identify, promote and insurance realise the adoption of best environmental and sustainability practice at all levels of financial Understanding and integrating ROGRAMME institution operations. P environmental, social and governance factors in insurance A report by the Insurance Working Group of the NVIRONMENT E United Nations Environment Programme Finance Initiative Based on the IWG’s pioneering 2009 global survey International Environment House on ESG factors and insurance underwriting 15 Chemin des Anémones ATIONS and product development 1219 Chatelaine, Geneva, Switzerland N Tel: (41) 22 917 8178 Fax: (41) 22 796 9240 [email protected] NITED www.unepfi.org U UNEP job n° DTI/1207/GE The global state of sustainable insurance Understanding and integrating environmental, social and governance factors in insurance A report by the Insurance Working Group of the United Nations Environment Programme Finance Initiative Based on the IWG’s pioneering 2009 global survey on ESG factors and insurance underwriting and product development October 2009 Disclaimer notice The information contained in the report is meant for informational purposes only and is subject to change without notice. -

In the United States Bankruptcy Court for the District of Delaware

Case 19-10684 Doc 16 Filed 04/01/19 Page 1 of 1673 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE x In re: : Chapter 11 : HEXION HOLDINGS LLC, et al.,1 : Case No. 19-10684 ( ) : Debtors. : Joint Administration Requested x NOTICE OF FILING OF CREDITOR MATRIX PLEASE TAKE NOTICE that the above-captioned debtors and debtors in possession have today filed the attached Creditor Matrix with the United States Bankruptcy Court for the District of Delaware, 824 North Market Street, Wilmington, Delaware 19801. 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Hexion Holdings LLC (6842); Hexion LLC (8090); Hexion Inc. (1250); Lawter International Inc. (0818); Hexion CI Holding Company (China) LLC (7441); Hexion Nimbus Inc. (4409); Hexion Nimbus Asset Holdings LLC (4409); Hexion Deer Park LLC (8302); Hexion VAD LLC (6340); Hexion 2 U.S. Finance Corp. (2643); Hexion HSM Holdings LLC (7131); Hexion Investments Inc. (0359); Hexion International Inc. (3048); North American Sugar Industries Incorporated (9735); Cuban-American Mercantile Corporation (9734); The West India Company (2288); NL Coop Holdings LLC (0696); and Hexion Nova Scotia Finance, ULC (N/A). The address of the Debtors’ corporate headquarters is 180 East Broad Street, Columbus, Ohio 43215. RLF1 20960951V.1 Case 19-10684 Doc 16 Filed 04/01/19 Page 2 of 1673 Dated: April 1, 2019 Wilmington, Delaware /s/ Sarah E. Silveira Mark D. Collins (No. 2981) Michael J. Merchant (No. 3854) Amanda R. Steele (No. 5530) Sarah E. Silveira (No. 6580) RICHARDS, LAYTON & FINGER, P.A. -

Scheme Document

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. PART II (EXPLANATORY STATEMENT) OF THIS DOCUMENT COMPRISES AN EXPLANATORY STATEMENT IN COMPLIANCE WITH SECTION 897 OF THE COMPANIES ACT 2006. This Document contains a proposal which, if implemented, will result in the cancellation of the listing of RSA Shares on the Official List and of trading of RSA Shares on the London Stock Exchange. If you are in any doubt as to the contents of this Document or the action you should take, you are recommended to seek your own financial advice immediately from your stockbroker, bank manager, accountant or other independent financial adviser authorised under the Financial Services and Markets Act 2000, if you are in the United Kingdom, or from another appropriately authorised independent financial adviser if you are taking advice in a territory outside the United Kingdom. If you sell or have sold or otherwise transferred all of your RSA Shares or RSA ADSs, please send this Document together with the accompanying documents (other than documents or forms personal to you) at once to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected, for transmission to the purchaser or transferee. However, such documents should not be forwarded or transmitted in or into or from any jurisdiction in which such act would constitute a violation of the relevant laws of such jurisdiction. If you sell or have sold or otherwise transferred only part of your holding of RSA Shares or RSA ADSs, you should retain these documents and contact the bank, stockbroker or other agent through whom the sale or transfer was effected. -

Canada Rothschild/Soros Clan Lost Huge Investment in China's Ouster of Bo Xilai More Below Bilderber Timeline, Rothsch / China

NewsFollowUp.com Obama / CIA Franklin Scandal Omaha pictorial Index sitemap home Canada North American Union? ... Secret agenda is to dissolve the United States of America into the North Your browser does not support inline frames or American Union. ... is currently configured not to display inline controlled by frames. corporations ... no accountability. go to Immigration page WMR: Bilderberg Rothschild/Soros clan lost huge Timeline, Rothschild Canada investment in / China Your browser does not China's ouster of support inline frames or is currently configured not to Bo Xilai more display inline frames. below America for sale, How does this tie into NAU? North American Union Politics Resources related topics related topics related topics Environment Economics De-regulation Indigenous Rights Immigration Pharmaceuticals Labor Latin America Taxes War Global Collectivism PROGRESSIVE REFERENCE CONSERVATIVE* Americas American Society of International Law, see also Accenture formerly Andersen Consulting, see Amnesty International ECOSOC on North American Union. Enron, Kenneth Lay, Jeffrey Skilling, Bush from Canadians.org Deep Integration of U.S. and Center for North American Studies, American Accuracy in Media portrays NAU as a left-wing Canadian economies regulation, standards University, Professor Robert Pastor, said to be conspiracy ..."AIM has previously documented governing health, food safety, father of NAU, and his book "Towards a North that Pastor's campaign for a North American wages. Harmonization process a demand -

Distribution Strategies in Insurance Understanding the Customer View DISTRIBUTION STRATEGIES in INSURANCE

Distribution Strategies in Insurance Understanding the Customer View DISTRIBUTION STRATEGIES IN INSURANCE Executive Insurers are, by their very nature, cautious. As a result, they will often focus more on the risks of summary new developments as much as the potential opportunities. The evolution of the insurance as likely to use instant messaging or sales process however, and the web chats as they are face-to-face widespread adoption of digital meetings (5%) when communicating channels in every walk of life, has with their insurer. made insurers sit up and take note. Most now realise that they must The survey cautions against making interact with their customers – at simplistic assumptions, however. least to some extent – whenever, Respondents most comfortable with however and through whichever technology were not the youngest channel their customer desires. We group, as you might expect, but have commissioned this research those aged 35-44. In fact, surprisingly, to better understand consumers’ the youngest respondents were most expectations and gauge how well likely to interact face-to-face than any insurers currently measure up. other age group. The survey, based on the responses A key aspect of the findings is clear: of more than 2,000 working age insurers need both compelling adults in the UK, highlights that traditional and digital channels. It consumers are becoming more savvy is on the latter, however, that they when purchasing their insurance. seem most at risk of falling short. The For example, consumers are almost research found that more than one in as likely to prioritise the ease of three consumers find buying or obtaining a quote (36%) as much as renewing a policy online “very the brand of the insurer (42%). -

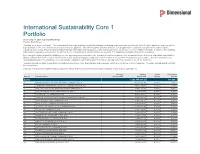

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions -

2019 Insurance Fact Book

2019 Insurance Fact Book TO THE READER Imagine a world without insurance. Some might say, “So what?” or “Yes to that!” when reading the sentence above. And that’s understandable, given that often the best experience one can have with insurance is not to receive the benefits of the product at all, after a disaster or other loss. And others—who already have some understanding or even appreciation for insurance—might say it provides protection against financial aspects of a premature death, injury, loss of property, loss of earning power, legal liability or other unexpected expenses. All that is true. We are the financial first responders. But there is so much more. Insurance drives economic growth. It provides stability against risks. It encourages resilience. Recent disasters have demonstrated the vital role the industry plays in recovery—and that without insurance, the impact on individuals, businesses and communities can be devastating. As insurers, we know that even with all that we protect now, the coverage gap is still too big. We want to close that gap. That desire is reflected in changes to this year’s Insurance Information Institute (I.I.I.)Insurance Fact Book. We have added new information on coastal storm surge risk and hail as well as reinsurance and the growing problem of marijuana and impaired driving. We have updated the section on litigiousness to include tort costs and compensation by state, and assignment of benefits litigation, a growing problem in Florida. As always, the book provides valuable information on: • World and U.S. catastrophes • Property/casualty and life/health insurance results and investments • Personal expenditures on auto and homeowners insurance • Major types of insurance losses, including vehicle accidents, homeowners claims, crime and workplace accidents • State auto insurance laws The I.I.I. -

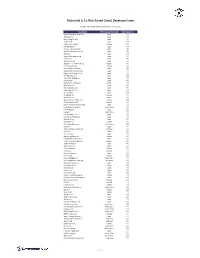

Rothschild & Co Risk-Based Global Developed Index

Rothschild & Co Risk-Based Global Developed Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Nippon Telegraph & Telephone C Japan 1.11 Softbank Corp Japan 1.10 Nitori Holdings Co Ltd Japan 0.75 Toshiba Corp Japan 0.67 Kirkland Lake Gold Ltd Canada 0.61 NTT DOCOMO Inc Japan 0.58 Mizuho Financial Group Inc Japan 0.54 Takeda Pharmaceutical Co Ltd Japan 0.50 KDDI Corp Japan 0.49 Japan Post Holdings Co Ltd Japan 0.48 Subaru Corp Japan 0.48 Sekisui House Ltd Japan 0.45 Singapore Telecommunications L Singapore 0.45 Franco-Nevada Corp Canada 0.43 Oriental Land Co Ltd/Japan Japan 0.43 Chugai Pharmaceutical Co Ltd Japan 0.40 Nippon Paint Holdings Co Ltd Japan 0.39 Fast Retailing Co Ltd Japan 0.38 Tokio Marine Holdings Inc Japan 0.38 ITOCHU Corp Japan 0.38 Bandai Namco Holdings Inc Japan 0.37 Bridgestone Corp Japan 0.36 MEIJI Holdings Co Ltd Japan 0.35 Japan Airlines Co Ltd Japan 0.34 Unicharm Corp Japan 0.33 Aroundtown SA Germany 0.33 Ajinomoto Co Inc Japan 0.33 Algonquin Power & Utilities Co Canada 0.32 Deutsche Wohnen SE Germany 0.32 MS&AD Insurance Group Holdings Japan 0.32 Lamb Weston Holdings Inc United States 0.32 ANA Holdings Inc Japan 0.32 Evergy Inc United States 0.32 Kirin Holdings Co Ltd Japan 0.32 Asahi Group Holdings Ltd Japan 0.32 Shiseido Co Ltd Japan 0.32 Wesfarmers Ltd Australia 0.32 Cboe Global Markets Inc United States 0.32 Canon Inc Japan 0.31 Jardine Matheson Holdings Ltd Singapore 0.31 Kao Corp Japan 0.31 Secom Co Ltd Japan 0.31 Agnico Eagle Mines Ltd Canada 0.31