Global Rough Diamond Production Since 1870

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ASX Market Announcements Australian Securities Exchange SYDNEY NSW 2000 13 September 2012 Dear Sir, Attached Is a Presentati

120 Collins Street Melbourne 3000 Australia Postal Address: GPO Box 384D Melbourne 3001 Australia T +61 (0) 3 9283 3333 F +61 (0) 3 9283 3707 ASX Market Announcements Australian Securities Exchange SYDNEY NSW 2000 13 September 2012 Dear Sir, Attached is a presentation given by Alan Davies, Chief executive, Rio Tinto Diamonds & Minerals, Bruce Cox, Managing director, Rio Tinto Diamonds, Jean-Francois Turgeon, Managing director, Rio Tinto Iron & Titanium and Xiaoling Liu, President and Chief executive, Rio Tinto Minerals, as part of a financial community visit in Montreal, Canada. Yours faithfully, Stephen Consedine Company Secretary Registered in Australia Rio Tinto Limited 120 Collins Street Melbourne 3000 Australia ABN 96 004 458 404 Rio Tinto Diamonds & Minerals Fuelling consumer-driven economic growth Alan Davies Chief executive 12 September 2012 Cautionary statement This presentation has been prepared by Rio Tinto plc and Rio Tinto Limited (“Rio Tinto”) and consisting of the slides for a presentation concerning Rio Tinto. By reviewing/attending this presentation you agree to be bound by the following conditions. Forward-looking statements This presentation includes forward-looking statements. All statements other than statements of historical facts included in this presentation, including, without limitation, those regarding Rio Tinto’s financial position, business strategy, plans and objectives of management for future operations (including development plans and objectives relating to Rio Tinto’s products, production forecasts and reserve and resource positions), are forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Rio Tinto, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward- looking statements. -

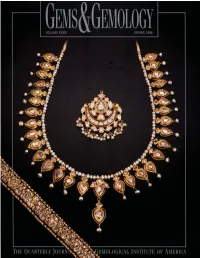

Spring 1998 Gems & Gemology

VOLUME 34 NO. 1 SPRING 1998 TABLE OF CONTENTS EDITORIAL 1 The Dr. Edward J. Gübelin Most Valuable Article Award FEATURE ARTICLE 4 The Rise to pProminence of the Modern Diamond Cutting Industry in India Menahem Sevdermish, Alan R. Miciak, and Alfred A. Levinson pg. 7 NOTES AND NEW TECHNIQUES 24 Leigha: The Creation of a Three-Dimensional Intarsia Sculpture Arthur Lee Anderson 34 Russian Synthetic Pink Quartz Vladimir S. Balitsky, Irina B. Makhina, Vadim I. Prygov, Anatolii A. Mar’in, Alexandr G. Emel’chenko, Emmanuel Fritsch, Shane F. McClure, Lu Taijing, Dino DeGhionno, John I. Koivula, and James E. Shigley REGULAR FEATURES pg. 30 44 Gem Trade Lab Notes 50 Gem News 64 Gems & Gemology Challenge 66 Book Reviews 68 Gemological Abstracts ABOUT THE COVER: Over the past 30 years, India has emerged as the dominant sup- plier of small cut diamonds for the world market. Today, nearly 70% by weight of the diamonds polished worldwide come from India. The feature article in this issue discuss- es India’s near-monopoly of the cut diamond industry, and reviews India’s impact on the worldwide diamond trade. The availability of an enormous amount of small, low-cost pg. 42 Indian diamonds has recently spawned a growing jewelry manufacturing sector in India. However, the Indian diamond jewelery–making tradition has been around much longer, pg. 46 as shown by the 19th century necklace (39.0 cm long), pendant (4.5 cm high), and bracelet (17.5 cm long) on the cover. The necklace contains 31 table-cut diamond panels, with enamels and freshwater pearls. -

NEWSLETTER Wetstraat 200, Rue De La Loi Brussel B-1049 Bruxelles Tel.: (32-2) 295 76 20 Fax: (32-2) 295 54 37

EC Editors: Address: World Wide Web: ISSN COMPETITION Bernhard Friess European Commission, http://europa.eu.int/comm/ 1025-2266 POLICY Nicola Pesaresi J-70, 00/123 competition/index_en.html NEWSLETTER Wetstraat 200, rue de la Loi Brussel B-1049 Bruxelles Tel.: (32-2) 295 76 20 Fax: (32-2) 295 54 37 competition policy 2001 Number 3 October NEWSLETTER Published three times a year by the Competition Directorate-General of the European Commission Also available online: http://europa.eu.int/comm/competition/publications/cpn/ Inside: La politique européenne de la concurrence dans les services postaux hors monopole General Electric/Honeywell — An insight into the Commission's investigation and decision B2B e-marketplaces and EC competition law: where do we stand? Ports italiens: Les meilleures histoires ont une fin BASF/Pantochim/Eurodiol: Change of direction in European merger control? Adoption by the Commission of a Methodology for analysing State aid linked to stranded costs European Competition Day in Stockholm, 11 June 2001 Main developments on: Antitrust — Merger control — State aid control Contents Articles 1 La politique européenne de la concurrence dans les services postaux hors monopole, par Jean-François PONS et Tilman LUEDER 5 General Electric/Honeywell — An Insight into the Commission's Investigation and Decision, by Dimitri GIOTAKOS, Laurent PETIT, Gaelle GARNIER and Peter DE LUYCK 14 B2B e-marketplaces and EC competition law: where do we stand?, by Joachim LÜCKING Opinions and comments 17 Ports italiens: Les meilleures histoires -

Sierra Leone and Conflict Diamonds: Establshing a Legal Diamond Trade and Ending Rebel Control Over the Country's Diamond Resources

SIERRA LEONE AND CONFLICT DIAMONDS: ESTABLSHING A LEGAL DIAMOND TRADE AND ENDING REBEL CONTROL OVER THE COUNTRY'S DIAMOND RESOURCES "Controlof resourceshas greaterweight than uniform administrativecontrol over one's entire comer of the world, especially in places such as Sierra Leone where valuable resources are concentratedand portable.' I. INTRODUCTION Sierra Leone2 is in the midst of a civil war that began in 1991, when the Revolutionary United Front (RUF) invaded the country from neighboring Liberia.3 RUF rebels immediately sought control over one of the country's richest resources--diamonds.4 Since gaining control over the most productive diamond fields, the rebels have at their fingertips an endless supply of wealth with which to fund their insurgencies against the Government of Sierra Leone.' The RUF rebels illicitly trade diamonds for arms in open smuggling operations. 6 Diamonds sold by the RUF, in order to fund the rebel group's military action in opposition to Sierra Leone's legitimate and internationally recognized government, are called "conflict diamonds."7 1. WIulIAM RENO, WARLORD POLITICS AND AFRICAN STATES 140 (1998). 2. Sierra Leone is located on the west coast of Africa north of Liberia and south of Guinea. The country has 4,900,000 residents, almost all of whom belong to one of 13 native African tribes. Country: Sierra Leone, Sept. 3,2000, availableat LEXIS, Kaleidoscope File. One of the primary economic activities in Sierra Leone is mining of its large diamond deposits that are a major source of hard currency. Countries that predominantly import goods from Sierra Leone include Belgium, the United States, and India. -

De Beers and Beyond: the History of the International Diamond Cartel∗

De Beers and Beyond: The History of the International Diamond Cartel∗ Diamonds are forever hold of them. The idea of making diamonds available to the general public seemed un- A gemstone is the ultimate luxury thinkable. When diamonds were first found product. It has no material use. Men in South Africa in 1867, however, supply in- and women desire to have diamonds creased rapidly, although the notion of dia- not for what they [diamonds] can do monds as a precious and rare commodity re- but for what they desire.1 mained to the present day. Similar to the gold miners in California, dia- To hear these words from a person who at- mond miners in South Africa tended to rush to tributes his entire wealth and power to the the latest findings.2 As a matter of principle, trade of diamonds illustrates the peculiar na- diamond miners preferred to work by them- ture of the diamond market: Jewelry dia- selves. However, the scarcity of resourceful monds are unjustifiably expensive, given they land and the need for a minimum of common are not actually scarce and would fetch a price infrastructure forced them to live together in of $2 to $30 if put to industrial use. Still, limited areas. In order to fight off latecom- by appealing to the customers’ sentiment, di- ers and to settle disputes, Diggers Committees amonds are one of the most precious lux- were formed and gave out claims in a region. ury items and enjoy almost global acceptance. Each digger would be allocated one claim, or, This fact is often attributed to the history at most, two. -

Ecological Comparison of Synthetic Versus Mined Diamonds

Ecological Comparison of Synthetic versus Mined Diamonds Saleem H. Ali Working Paper, Institute for Environmental Diplomacy and Security University of Vermont, January, 2011 http://www.uvm.edu/ieds Abstract The energy usage and emissions in mined versus lab-created diamonds was evaluated, based on industrial data, since these two factors are often a general indicator of environmental impact that can be useful in product comparisons. Depending on the process and the location of the mine, the data can be highly divergent and cannot be used as a singular measure of environmental impact. There is a need to develop life cycle analysis techniques from industrial ecology to conduct a detailed comparison of synthetic versus mined stones. Introduction Synthetic diamonds have come of age, and the year 2010 will be remembered as a landmark year in this regard since for the first time labs of the Gemological Institute of America (GIA) in New York were able to grade a gem quality near-colorless synthetic diamond (formed by chemical vapor deposition) , greater than 1 carat. The history of synthetic diamonds at the industrial level, goes back to patents for super-abrasives at General Electric can be traced back to several decades (Hazen, 1996). However, gem quality synthetic diamonds have only risen to prominence in the last decade with the rise of a few key companies who are taking on this growing market in concert with boutique jewelry brands. As jewelers consider environmental social responsibility more seriously in marketing their gemstone products, energy usage in mined versus lab-created gems can be an important factor in determining comparative environmental impact. -

A Brief History of Wine in South Africa Stefan K

European Review - Fall 2014 (in press) A brief history of wine in South Africa Stefan K. Estreicher Texas Tech University, Lubbock, TX 79409-1051, USA Vitis vinifera was first planted in South Africa by the Dutchman Jan van Riebeeck in 1655. The first wine farms, in which the French Huguenots participated – were land grants given by another Dutchman, Simon Van der Stel. He also established (for himself) the Constantia estate. The Constantia wine later became one of the most celebrated wines in the world. The decline of the South African wine industry in the late 1800’s was caused by the combination of natural disasters (mildew, phylloxera) and the consequences of wars and political events in Europe. Despite the reorganization imposed by the KWV cooperative, recovery was slow because of the embargo against the Apartheid regime. Since the 1990s, a large number of new wineries – often, small family operations – have been created. South African wines are now available in many markets. Some of these wines can compete with the best in the world. Stefan K. Estreicher received his PhD in Physics from the University of Zürich. He is currently Paul Whitfield Horn Professor in the Physics Department at Texas Tech University. His biography can be found at http://jupiter.phys.ttu.edu/stefanke. One of his hobbies is the history of wine. He published ‘A Brief History of Wine in Spain’ (European Review 21 (2), 209-239, 2013) and ‘Wine, from Neolithic Times to the 21st Century’ (Algora, New York, 2006). The earliest evidence of wine on the African continent comes from Abydos in Southern Egypt. -

The World of Pink Diamonds and Identifying Them

GEMOLOGY GEMOLOGY as to what dealers can do to spot them using standard, geologists from Ashton Joint Venture found certain indicator The World of Pink Diamonds inexpensive instruments. The commercial signifcance of minerals (such as ilmenite, chromite, chrome diopside, the various types will also be touched on. and pyrope garnet) in stream-gravel concentrates which indicated the presence of diamond-bearing host rocks. and Identifying Them Impact of Auction Sales Lamproites are special ultrapotassic magnesium-rich In the late 1980s, the public perception surrounding fancy- mantle-derived volcanic rocks with low CaO, Al2O3, Na2O colored diamonds began to change when the 0.95-carat and high K2O. Leucite, glass, K-richterite, K-feldspar and Cr- By Branko Deljanin, Dr Adolf Peretti, ‘Hancock Red’ from Brazil was sold for almost $1 million per spinel are unique to lamproites and are not associated with and Matthias Alessandri carat at a Christie’s auction. This stone was studied by one kimberlites. The diamonds in lamproites are considered to be of the authors (Dr. Adolf Peretti) at that time. Since then, xenocrysts and derived from parts of the lithospheric mantle Dr. Peretti has documented the extreme impact this one that lies above the regions of lamproite genesis. Kimberlites sale has had on subsequent prices and the corresponding are also magmatic rocks but have a different composition recognition of fancy diamonds as a desirable asset class. The and could contain non-Argyle origin pink diamonds. demand for rare colors increased and the media began to play a more active role in showcasing new and previously Impact of Mining Activities unknown such stones. -

Tackling Tax Evasion: Transfer Price Manipulation, Extractive Natural Resources and a Strategy for the Southern African Customs Union

University of Denver Digital Commons @ DU Electronic Theses and Dissertations Graduate Studies 1-1-2012 Tackling Tax Evasion: Transfer Price Manipulation, Extractive Natural Resources and a Strategy for the Southern African Customs Union Patrick Grant McLennan University of Denver Follow this and additional works at: https://digitalcommons.du.edu/etd Part of the African Studies Commons, Economics Commons, International Relations Commons, and the Natural Resource Economics Commons Recommended Citation McLennan, Patrick Grant, "Tackling Tax Evasion: Transfer Price Manipulation, Extractive Natural Resources and a Strategy for the Southern African Customs Union" (2012). Electronic Theses and Dissertations. 422. https://digitalcommons.du.edu/etd/422 This Thesis is brought to you for free and open access by the Graduate Studies at Digital Commons @ DU. It has been accepted for inclusion in Electronic Theses and Dissertations by an authorized administrator of Digital Commons @ DU. For more information, please contact [email protected],[email protected]. Tackling Tax Evasion: Transfer Price Manipulation, Extractive Natural Resources and a Strategy for the Southern African Customs Union __________ A Thesis Presented to the Faculty of the Josef Korbel School of International Studies University of Denver __________ In Partial Fulfillment of the Requirements for the Degree Master of Arts __________ by Patrick G. McLennan August 2012 Advisor: Dr. Barry B. Hughes Author: Patrick G. McLennan Title: Tackling Tax Evasion: Transfer Price Manipulation, Extractive Natural Resources and a Strategy for the Southern African Customs Union Advisor: Dr. Barry B. Hughes Degree Date: August 2012 ABSTRACT An increase in the number of multinational enterprises (MNEs) has increased the attention on cross-border challenges, such as transfer price manipulation (TPM). -

Ÿþm Icrosoft W

UNITED NATIONS UNITED NATIONS GENERAL ASSEMBLY U'v Distr. GENERAL A/6868/Add .l ,0 October 1967 ORIGINAL: ENGLISH Twenty-second session Agenda item 24 ACTIVITIES OF FOREIGN ECONOMIC AND OTHER INTERESTS WHICH ARE IMPEDING THE IMPLEMENTATION OF THE DECLARATION ON THE GRANTING OF INDEPENDENCE TO COLONIAL COUNTRIES AND PEOPLES IN SOUTHERN RHODESIA, SOUTH WEST AFRICA AND TERRITORIES UNDER PORTUGUESE DOMINATION AND IN ALL OTHER TERRITORIES UNDER COLONIAL DOMINATION AND EFFORTS TO ELIMINATE COLONIALISM, APARTHEID ADD RACIAL DISCRIMINATION IN SOUTHERN AFRICA Report bf the Special Committ . on the Situation with regard to the Implementation of the Declaration on the Granting of Independence to Colonial Countries and Peoples Annex REPORT OF SUB-COMMITTTEE I* Rapporteur: Mr. Rafic JOUEJATI (Syria) CONTENTS Paragraphs INTRODUCTION ...... ........................ .....1 - 6 CONSIDERATION BY THE SUB-OMMITTEE ....... .............. 7 - 134 A. Statements by members ............... Page 3 7 - 80 B. Conclusions ........ .................... .81 - 132 C. Recommendations. ................ 133 D. Adoption of report ....... ................. 134 * Previously issued under the symbol A/AC.109/L.434. 67-25207 ... A/6868/Add.l English Page 2 CONTENTS (continued) APPENDICES: I. Economic conditions in Southern Rhodesia with particular reference to foreign economic interests II. Economic conditions in South West Africa witn particular reference to foreign economic interests III. Territories under Portuguese administration: Economic activities in selected sectors with special reference to foreign interests IV. Economic conditions in Fiji, with particular reference to foreign economic interests V. Economic conditions in Mauritius with particular reference to foreign economic interests VI. Economic conditions in Papua and the Trust Territory of New Guinea with particular reference to foreign economic interests VII. Economic conditions in the Bahamas with particular reference to foreign economic interests VIII. -

A Crude Awakening

Dedicated to the inspiration of Jeffrey Reynolds ISBN 0 9527593 9 X Published by Global Witness Ltd P O Box 6042, London N19 5WP,UK Telephone:+ 44 (0)20 7272 6731 Fax: + 44 (0)20 7272 9425 e-mail: [email protected] a crude awakening The Role of the Oil and Banking Industries in Angola’s Civil War and the Plunder of State Assets http://www.oneworld.org/globalwitness/ 1 a crude awakening The Role of the Oil and Banking Industries in Angola’s Civil War and the Plunder of State Assets “Most observers, in and out of Angola, would agree that “There should be full transparency.The oil companies who corruption, and the perception of corruption, has been a work in Angola, like BP—Amoco, Elf,Total and Exxon and the critical impediment to economic development in Angola.The diamond traders like de Beers, should be open with the full extent of corruption is unknown, but the combination of international community and the international financial high military expenditures, economic mismanagement, and institutions so that it is clear these revenues are not syphoned corruption have ensured that spending on social services and A CRUDE AWAKENING A CRUDE development is far less than is required to pull the people of off but are invested in the country. I want the oil companies Angola out of widespread poverty... and the governments of Britain, the USA and France to co- operate together, not seek a competitive advantage: full Our best hope to ensure the efficient and transparent use of oil revenues is for the government to embrace a comprehensive transparency is in our joint interests because it will help to program of economic reform.We have and will continue to create a more peaceful, stable Angola and a more peaceful, encourage the Angolan Government to move in this stable Africa too.” direction....” SPEECH BY FCO MINISTER OF STATE, PETER HAIN,TO THE ACTION FOR SECRETARY OF STATE, MADELEINE ALBRIGHT, SUBCOMMITTEE ON FOREIGN SOUTHERN AFRICA (ACTSA) ANNUAL CONFERENCE, SCHOOL OF ORIENTAL OPERATIONS, SENATE COMMITTEE ON APPROPRIATIONS, JUNE 16 1998. -

De Beers' New Strategy

Personal copy; not for onward transmission De Beers’ new td. pany L strategy om In what is described by its chairman, Instead, it aims to be the ‘supplier of Nicky Oppenheimer, as “one of the choice’. However, it currently sells ron & C most significant developments the dia- about two thirds of the world’s annual mond industry has seen since the supply of rough diamonds, and the Georgian House 1930s”, De Beers this week unveiled a mines that it manages contribute about oeb A 63, Coleman Street new strategy whereby it will abandon 40% of world production. Hence it L London EC2R 5BB Tel :+44 (0)20 7628-1128 its long-held role as custodian of the remains very much the dominant play- REGULATED BY THE SFA diamond market, and focus instead on er, and intends to continue to sell dia- boosting demand. Since the depression monds to selected clients through its years of the 1930s when the price of dia- regular sales or ‘sights’ held roughly monds slumped, De Beers has stock- every five weeks. piled the world’s surplus diamonds as a There will be some marked changes means of controlling supply (and though in how the sights are conducted. prices). Under the new strategy, the At present, they are characterised by stockpile is not being eliminated but it their opacity. The 125 selected will be substantially reduced – to a sightholders or diamantaires – it is esti- working level of around six months’ mated that as many as 900 diaman- supply, equivalent to some US$2.5 bil- taires are on the ‘waiting list’ – have no lion.