World Bank Document

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

I N D I C a T E U R K U R S B U C H Važi Od 9.12.2018. Do 14.12.2019

Akcionarsko društvo za železnički prevoz putnika „Srbija Voz“, Beograd I N D I C A T E U R K U R S B U C H Važi od 9.12.2018. do 14.12.2019. godine B E O G R A D 2019. “Srbija Voz” a.d. zadržava pravo na izmenu podataka. Informacije o izmenama dostupne su na informativnim punktovima “Srbija Voz” a.d. Grafička obrada: Boban Suljić Dizajn korica: Borko Milojević Tiraž 1.530 primeraka SADRŽAJ A. INFORMATIVNI DEO .................................. 4 (štampan plavom bojom) B. RED VOŽNJE VOZOVA U MEĐUNARODNOM SAOBRAĆAJU .. 29 (štampan zelenom bojom) PREGLED SASTAVA I PERIODI SAOBRAĆAJA VOZOVA I DIREKTNIH KOLA U MEĐUNARODNOM PUTNIČKOM SAOBRAĆAJU .................................................................................... 30 C. RED VOŽNJE VOZOVA U UNUTRAŠNJEM PUTNIČKOM SAOBRAĆAJU ..................................................................................... 49 (štampan plavom bojom) Beograd Centar - Šid ....................................................................... 50 Ruma - Šabac - Loznica - Zvornik ................................................... 52 Novi Sad - Bogojevo - Sombor - Subotica ....................................... 53 Novi Sad - Vrbas - Sombor ............................................................. 55 Beograd (Beograd Centar) - Novi Sad - Subotica ........................... 56 Novi Sad - Orlovat stajalište – Zrenjanin .......................................... 62 Subotica - Senta - Kikinda ............................................................... 63 (Beograd Centar) - Pančevo Glavna - Zrenjanin -

Dr Zoran Pavlović

Visoka železnička škola strukovnih studija Zdravka Čelara 14, Beograd PROFIL NASTAVNIKA Ime i prezime: Zoran G. Pavlović Datum rođenja: 28.02.1975. Mesto i država rođenja: Bela Palanka, Republika Srbija Kontakt (e-mail): [email protected] Obrazovanje: Doktor tehničkih nauka doktorat: Univerzitet u Beogradu, Fakultet organizacionih nauka (2020) master: Univerzitet u Beogradu, Fakultet organizacionih nauka (2011) diploma: Univerzitet u Novom Sadu, Tehnički fakultet „Mihajlo Pupin” Zrenjanin (2006); Viša železnička škola, Beograd (2005) Izbor u zvanje Viši predavač (oblasti i datum izbora): (Matematika i informatika i Tehničko sporazumevanje i inženjerska informatika, 23.11.2020.) Ostalo iskustvo i • Nastavnik, dopunski rad 1/3 radnog vremena, Visoka železnička angažovanje: škola strukovnih studija 2017.-2018. • Vodeći organizator, Samostalni organizator za obračune u unutrašnjem saobraćaju, CKP, Srbija Voz a.d. 2019.-2020. • Pomoćnik šefa OJ za SKP Beograd, Srbija Voz a.d. 2018.- 2019. • Pomoćnik šefa stanice Beograd, Srbija Voz a.d. 2017.-2018. • Pomoćnik šefa Sekcije za prevoz putnika Beograd, Železnice Srbije a.d. 2014.-2016. • Vodeći inženjer tehnolog, Železnice Srbije a.d. 2010.-2014. • Izvršni menadžer za vozopratnju, J.P. Železnice Srbije,2006. - 2009. • Kontrolor putničke blagajne, J.P. Železnice Srbije, 2006. • Kondukter u železničkom saobraćaju, Ž.T.P. Beograd, 1994.- 2005. Učešće na projektima: Usavršavanje: Položen stručni ispit po Pravilniku 646, ZJŽ, Sekcija za STP Beograd, 1994. Reference: Časopis međunarodnog značaja na SCI listi (М20): 1. Zoran Pavlović, Milorad Banjanin, Jovanka Vukmirović, Dragan Vukmirović (2020,05,04): Contactless ICT Transaction Model Of The Urban Transport Service; Research journal TRANSPORT, ISSN: 1648-4142 / eISSN: 1648-3480, Special Issue on the Emerging Applications of Internet of Vehicles in Intelligent Transportation Systems, pp 1-11. -

6Th Annual Report

6th Annual Report On the Development of women’s employment in the European railway sector Data of 2018 Contents I. Executive Summary ................................................................................................................................. 1 II. Background ............................................................................................................................................. 2 III. Methods .................................................................................................................................................. 3 A. Participating companies ..................................................................................................................... 6 IV. Women’s presence in the surveyed companies (Development 2017 – 2018) ....................................... 7 A. Women’s presence in the surveyed companies (Development 2017 – 2018) .................................. 7 B. Share of women in different professions ........................................................................................... 9 C. Share of women in three different levels of management .............................................................. 10 D. Share of women in initial vocational training, in continuous training, in part time and in part time with managerial responsibilities ............................................................................................................... 11 V. Women’s presence in comparable companies (Development 2012-2018) ........................................ -

Casopis-Zeleznice-Br.-1-2017-1.Pdf

. IZDAJE Uvodna reč glavnog urednika ........................................................................ 5 Intervju sa generalnim direktorom „Železnica Srbije” ad ..................... 6 Uvodna reč predsednika Društva diplomiranih inženjera železničkog saobraćaja Srbije (DIŽS) ..................................................... 8 Društvo diplomiranih inženjera železničkog saobraćaja Srbije (DIŽS) ORIGINALNI NAUČNI RAD OdgovornoBeograd, Nemanjina lice izdavača 6 Danko Trninić Miroslav Pejić, Sanjin Milinković, Slavko Vesković Simulacioni modeli za analizu organizacije saobraćaja , dipl. inž. saob. vozova na industrijskoj železnici „TENT“ ............................................ 10 REDAKCIJApredsednik Glavni urednik PREGLEDNI RADOVI Prof. dr Milan Marković Nenad Kecman, Života Đorđević Odgovorni urednik, dipl. inž. saob. Restrukturiranje Železnica Srbije ad ........................................................ 21 Vesna Gojić Vučićević Rajko Ković Tehnički urednik, dipl. nov. Organizacija projektnog portfolija u firmama železnice ............. 31 Miodrag Ivanović Lektor, dipl. inž. saob. PRETHODNA SAOPŠTENJA Ksenija Petrović Snežana Mladenović, Slavko Vesković, Slađana Janković, Dizajn korica, dipl. fil. Slaviša Aćimović, Irina Branović mr Nenad Vojičić, akad. slik. Softver za rešavanje poremećaja u železničkom redu vožnje ............. 41 TIRAŽ Željko Stević, Marko Vasiljević, Gordan Stojić, Ilija Tanackov Integrisani Fazi model za rešavanje lokacijskog problema .............. 49 300 primeraka ŠTAMPA STRUČNI RADOVI Života -

SEE RAIL Perspective

SEE RAIL Perspective QUARTERLY NEWSLETTER OF RAIL CLUSTER FOR SOUTH-EASTERN EUROPE I Year IV, Issue 12, March 2019 08 - 09.05. Belgrade N 12 01/2019 www.see-mobility.com Welcome! CONTENT March SEE RAIL Perspective 2019 s. 4 - 9 I FACTORY NEWS BiH: Record operating profit "Railway of the Federation of B&H" in 2018 BiH: The new software solution of the railway infrastructure Croatia:The annual Assembly of the Croatian Pro Rail Alliance Serbia: Reconstruction of Nis - Zaječar railway line started Slovenia: The development of Corridor X Plus is important Montenegro: Awarding the "Brand Leader Award 2019" to the Railway Infrastructure of Montenegro s. 10 - 12 RCSEE ACTIVITIES: B2B Meetings at PERES Event in Belgrade Presentation by Mrs. Vida Jerković at a gathering in the Railways of Serbia s. 13 Time Machine Whay is the (US) standard Railroad Gauge 4 feet, 8,5 in ches (1435 mm) ? Editor in Chief: Milan Vučković Translation and marketing: Marko Radović Design and LayOut: BSN I www.bsn.rs Editorial: Andrijana Stefanovski, Dragoljub Rajić, Lela Ignjatović i Marko Radović Publisher: Business Support Netvork / Mreža za poslovnu podršku (BSN) Strumička 100, 11050 Beograd I E-mail: [email protected] I PIB: 108639092 I MB: 28151829 (Cover photo: InnoTrans) 02 SEE RAIL Perspective I N. 12 Word from the editor and RCSEE director: After nearly two years, Belgrade will again host the only fair in the region on SEE Mobility 2019 orga- nized by the Railway Cluster for South East Europe. This will again be an opportunity for a greater number of people from our profession not only from the region but also from larger part of Europe, to gather in one place, exchange information and learn more about next major projects in the region and opportunities and chances for successful business in this part of Europe. -

Restructuring of Serbian Railways Jsc

pregledni rAD NENAD KECMAN1, ŽIVOTA ĐORĐEVIĆ2 RESTRUKTURIRANJE ŽELEZNICA SRBIJE AD RESTRUCTURING OF SERBIAN RAILWAYS JSC Datum prijema rada: 15.6.2016. god. UDK: 656.2:330.342(497.11) 338.47:656.2(497.11) REZIME Proces restrukturiranja „Železnica Srbije“ ad započet je 1991. godine i zbog različitih razloga nije realizovan do 2015. godine. Posle 25 godina „pripreme“ realizovan je na način koji će samo formalno zadovoljiti Vladu, Svetsku banku, MMF i EU - a suštinski će kompaniju dovesti u još veću neizvesnost i borbu za opstanak. U poslednjih 25 godina železnica je od strane Države bila zapostavljena i zaboravljena. Cilj je bio samo da se obezbedi socijalni mir i namire partijski kadrovi. U zadnje četiri godine se vrše značajnija ulaganja, ali kompanija nije pripremljena da se taj kapital oplemeni i valorizuje na transportnom tržištu. Ključne reči: „Železnice Srbije“ ad, Vlada Srbije, MMF, Svetska banka, Evropska unija, restrukturiranje. SUMMARY The restructuring process of „Serbian Railways“ JSC (SR) was launched in 1991 and due to various reasons has not been implemented until 2015. After 25 years of „preparation“ restructuring process was carried out in a way that only formally satisfy the government, World Bank, IMF and the EU and essentially will lead the Company to even greate run certainty ands truggle for survival.During the last 25 years, the railways has been neglected and forgotten by the State. The aim was only to ensure social peace and the settlement of party cadres. In the last two years significant investments are going on, however the Company is not prepared to enrich the capital and valorizes it on the transport market. -

Tržište-Prevoza-Robe-U-Železničkom-Saobraćaju-U

Објављени текст садржи заштићене податке. Заштићени подаци приказани су ознаком [поверљиво] или у распону који Комисија сматра одговарајућим начином заштите Истраживање тржишта превоза робе у железничком саобраћају у Републици Србији је спроводено у сарадњи са представницима Светске банке у оквиру Програма за унапређење пословног окружења за Србију. У склопу Програма, потписан је Споразум о сарадњи између Владе Републике Србије и Међународне финансијске корпорације којим је, између осталог, предвиђено да Светска банка пружи Комисији за заштиту конкуренције техничку подршку за унапређење конкуренције и регулацију тржишта у Републици Србији. Одабир и приоритизација сектора извршени су на основу Инструментаријума за процену тржишта и политике заштите конкуренције Светске банке (MCPAT). Студија је израђена од стране конзорцијума Compass Lexecon и Karanović & Partners, за потребе наведеног пројекта. Tržište prevoza robe u železničkom saobraćaju u Republici Srbiji Izveštaj 10. jun 2020. Predgovor Studija je izrađena od strane konzorcijuma Compass Lexecon i Karanović & Partners u ime Svetske banke i Komisije za zaštitu konkurencije Republike Srbije. Studije je deo projekta Svetske banke i Međunarodne finansijske korporacije (IFC) vezano za analizu investicione klime u Srbiji. Projekat investicione klime u Srbiji je implementiran od strane IFC-a u saradnji sa Fondom za dobru upravu Ujedinjenog Kraljevstva i ambasadom Ujedinjenog Kraljevstva u Beogradu. Studiju su izradili Gregor Langus, Vilen Lipatov i Guido Paolini (Compass Lexecon), Bojan Vučković, Leonid Ristev, Srđan Dabetić, Igor Radovanović i Stefan Savić (Karanović & Partners). Maciej Drozd, Igor Nikolić Eugeniu Osmochescu i Olga Šipka (Svetska banka). Predstavnici Komisije za zaštitu konkurencije su slali upitnike koje su izradili eksperti angažovani od strane Svetske banke i pružali komentare koji se tiču predmetne analize. -

Handbuch Für Reisen Mit Den ÖBB Ins Ausland Tarifbestimmungen Mit Den Allgemeinen Geschäftsbedingungen

Handbuch für Reisen mit den ÖBB ins Ausland Tarifbestimmungen mit den Allgemeinen Geschäftsbedingungen Version: 2021.02 Gültig ab: 01.04.2021 Seite: 1 / 203 Auf eine gute Verbindung.............................................................................. 12 Änderungen zur letztgültigen Version.......................................................... 13 A. Beförderungsbedingungen ........................................................................... 14 A.1 Allgemeine Beförderungsbedingungen für die Beförderung von Personen (GCC-CIV/ 14 PRR) ......................................................................................................................................... A.1.1 Präambel................................................................................................................................... 14 A.1.2 Beförderungsbedingungen ....................................................................................................... 14 A.1.3 Rechtsgrundlagen..................................................................................................................... 14 A.1.4 Beförderungsvertrag ................................................................................................................. 15 A.1.5 Beförderungsausweise und Reservierungen............................................................................ 15 A.1.6 Pflichten des Reisenden ........................................................................................................... 16 A.1.7 Handgepäck............................................................................................................................. -

Analysis of the Process Related to the Operations Management of the Rail Traction Vehicles in Jsc "Serbian Railways"

JOURNAL OF ENGINEERING MANAGEMENT AND COMPETITIVENESS (JEMC) VOL . 6, NO. 2, 2016, 111-119 ANALYSIS OF THE PROCESS RELATED TO THE OPERATIONS MANAGEMENT OF THE RAIL TRACTION VEHICLES IN JSC "SERBIAN RAILWAYS" UDC: 625.1(497.11) Original Scientific Paper Vojislav VUKADINOVI Ć1, Cariša BEŠI Ć2, Snežana BEŠI Ć3 1Srbija Voz a.d., 11000 Belgrade, Nemanjina 6, Republic of Serbia 2University of Kragujevac, Faculty of Technical Sciences in Čačak, 32000 Čačak, Svetog Save 65, Republic of Serbia E-mail: [email protected] 3Higher Education Railway School of Professional Studies, 11000 Beograd, Zdravka Čelara 14, Republic of Serbia Paper received: 14.11.2016.; Paper accepted: 28.11.2016. In the study, issues related to the operations management in railway were elaborated, with special emphasis on the operations management of rail vehicles and main parameters in its activities and in the railway functioning. The analysis of the current status, operation and functioning of the Serbian Railways was also provided, with a special focus on the study of the technical condition regarding exploitation, reliability, and availability of traction vehicles operation which is always actual and particularly important for ensuring the regular and safe functioning of train traffic in all railways in the world as well as in the railway of Serbia. The issue related to the exploitation reliability and availability regarding traction vehicles operation is also being analyzed which is reflected in development of the concept and creation of the methodology for assessment of the technical condition and indicators for determining the level of exploitation reliability, availability of the traction vehicle operation as well as functioning of train traffic and the models related to the operations management of rail traction vehicles. -

Red-Voznje-2017.Pdf

Akcionarsko društvo za železnički prevoz putnika „Srbija Voz“, Beograd I N D I C A T E U R K U R S B U C H Važi od 11.12.2016. do 9.12.2017. godine B E O G R A D 2016. “Srbija Voz” a.d. zadržava pravo na izmenu podataka. Informacije o izmenama dostupne su na informativnim punktovima “Srbija Voz” a.d. Grafička obrada: Boban Suljić Dizajn korica: Borko Milojević Tiraž 2.460 primeraka SADRŽAJ A. INFORMATIVNI DEO .................................. 4 (štampan plavom bojom) B. RED VOŽNJE VOZOVA U MEĐUNARODNOM SAOBRAĆAJU .... 29 (štampan zelenom bojom) PREGLED SASTAVA I PERIODI SAOBRAĆAJA VOZOVA I DIREKTNIH KOLA U MEĐUNARODNOM SAOBRAĆAJU ................. 30 C. RED VOŽNJE VOZOVA U UNUTRAŠNJEM SAOBRAĆAJU ......... 53 (štampan plavom bojom) 4 A. INFORMATIVNI DEO UPUTSTVO ZA KORIŠĆENJE REDA VOŽNJE Putnički red vožnje podeljen je na tri dela. A. INFORMATIVNI DEO, štampan u plavoj boji, sadrži sva osnovna obaveštenja o organizaciji i uslovima prevoza putnika, prtljaga i praćenih automobila, o rezervaciji sedišta, ležaja i postelja u direktnim kolima, u unutrašnjem i međunarodnom saobraćaju. U spisku stanica, na železničkoj mreži RS pored naziva stanica, dat je broj odnosnog polja u kom se ona nalazi. U okviru poglavlja o sastavima vozova, koje se takođe nalazi u ovom delu, prikazan je i period saobraćaja vozova i kola u unutrašnjem i međunarodnom saobraćaju. B. RED VOŽNJE VOZOVA U MEĐUNARODNOM SAOBRAĆAJU, štampan u zelenoj boji, sadrži najosnovnije podatke o redu vožnje vozova u međunarodnom saobraćaju i predviđene veze s ostalim vozovima. Na šematskoj karti Evrope, koja se nalazi na unutrašnjoj strani prednjih korica, identifikuje se slovna oznaka za traženu relaciju, odnosno zemlju. -

List of Numeric Codes for Railway Companies

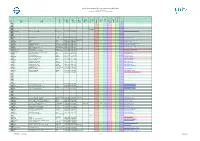

List of numeric codes for railway companies (RICS Code) contact : [email protected] reference : http://www.uic.org/spip.php?article311 code short name full name country request date allocation date modified date beginof validity of end validity recent Freight Passenger Infra- structure Holding Integrated Other url 0001 0002 0003 0004 0005 01/02/2011 0006 StL Holland Stena Line Holland BV Netherlands 01/07/2004 01/07/2004 x http://www.stenaline.nl/ferry/ 0007 0008 0009 0010 VR VR-Yhtymä Oy Finland 30/06/1999 30/06/1999 x http://www.vr.fi/fi/ 0011 0012 TF Transfesa Spain 30/06/1999 30/06/1999 10/09/2013 x http://www.transfesa.com/ 0013 OSJD OSJD Poland 12/07/2000 12/07/2000 x http://osjd.org/ 0014 CWL Compagnie des Wagons-Lits France 30/06/1999 30/06/1999 x http://www.cwl-services.com/ 0015 RMF Rail Manche Finance United Kingdom 30/06/1999 30/06/1999 x http://www.rmf.co.uk/ 0016 RD RAILDATA Switzerland 30/06/1999 30/06/1999 x http://www.raildata.coop/ 0017 ENS European Night Services Ltd United Kingdom 30/06/1999 30/06/1999 x 0018 THI Factory THI Factory SA Belgium 06/05/2005 06/05/2005 01/12/2014 x http://www.thalys.com/ 0019 Eurostar I Eurostar International Limited United Kingdom 30/06/1999 30/06/1999 x http://www.eurostar.com/ 0020 OAO RZD Joint Stock Company 'Russian Railways' Russia 30/06/1999 30/06/1999 x http://rzd.ru/ 0021 BC Belarusian Railways Belarus 11/09/2003 24/11/2004 x http://www.rw.by/ 0022 UZ Ukrainski Zaliznytsi Ukraine 15/01/2004 15/01/2004 x http://uz.gov.ua/ 0023 CFM Calea Ferată din Moldova Moldova 30/06/1999 30/06/1999 -

Travelling by Night Train Saves CO the Greens in the European Transport Committee

Narvik 4 Kiruna TravellingWilli Sitte 2 across Europe Luleå 3 by night train Umeå Åre Duved Östersund 5 Sundsvall Helsinki 7 Saint Petersburg 1 3 Stockholm 4 5 2 Gothenburg Inverness 37 Aberdeen Fort William 37 36 Edinburgh Moscow Copenhagen Lund Glasgow Malmö 7 27 1 30 6 Smolensk Minsk Hamburg Crewe 11 12 6 13 Berlin Frankfurt (Oder) Poznań Warsaw Hanover 9 Brest 27 8 35 Magdeburg 10 27 36 30 37 41 42 Göttingen Kovel Wrocław London Brussels Cologne Aachen 35 Opole 42 Bonn 18 Exeter Katowice Plymouth 19 Liège Fulda Prague Kiev Koblenz Frankfurt Kraków Lviv 24 Würzburg Penzance Mainz 10 11 Ostrava 13 43 Przemyśl Khmelnytskyi Nuremberg Mannheim Temopil Regensburg Břeclav 14 Paris 27 15 Passau 11 Chop 16 18 Vienna Strasbourg 17 28 Augsburg Munich Bratislava 29 Linz 20 Freiburg 25 8 Bregenz 12 Salzburg 16 Budapest Basel 20 19 23 Dijon 21 24 22 Zurich Innsbruck 30 41 9 25 Feldkirch 44 13 26 Villach 43 Bolzano Ljubljana 38 Arad 22 Udine 15 39 40 29 Zagreb Braşov Venice 17 Milan Verona Rijeka Turin Belgrade 26 34 23 Genua Bologna 44 Rimini 45 30 Bucharest Pisa Florence Nice Toulouse Ferrol Livorno Hendaye 21 34 A Coruña 31 28 Vigo Portbou 14 38 Skopje 32 Zaragoza Barcelona Rome Valladolid 32 Salamanca Naples 39 45 Salerno Brindisi Thessaloniki Lecce 33 Madrid 34 31 33 Lisbon Messina Palermo Reggio di Calabria 40 Travelling by night train saves CO The Greens in the European Transport Committee Daniel Freund Every trip on the night train makes the journey unforgettable.