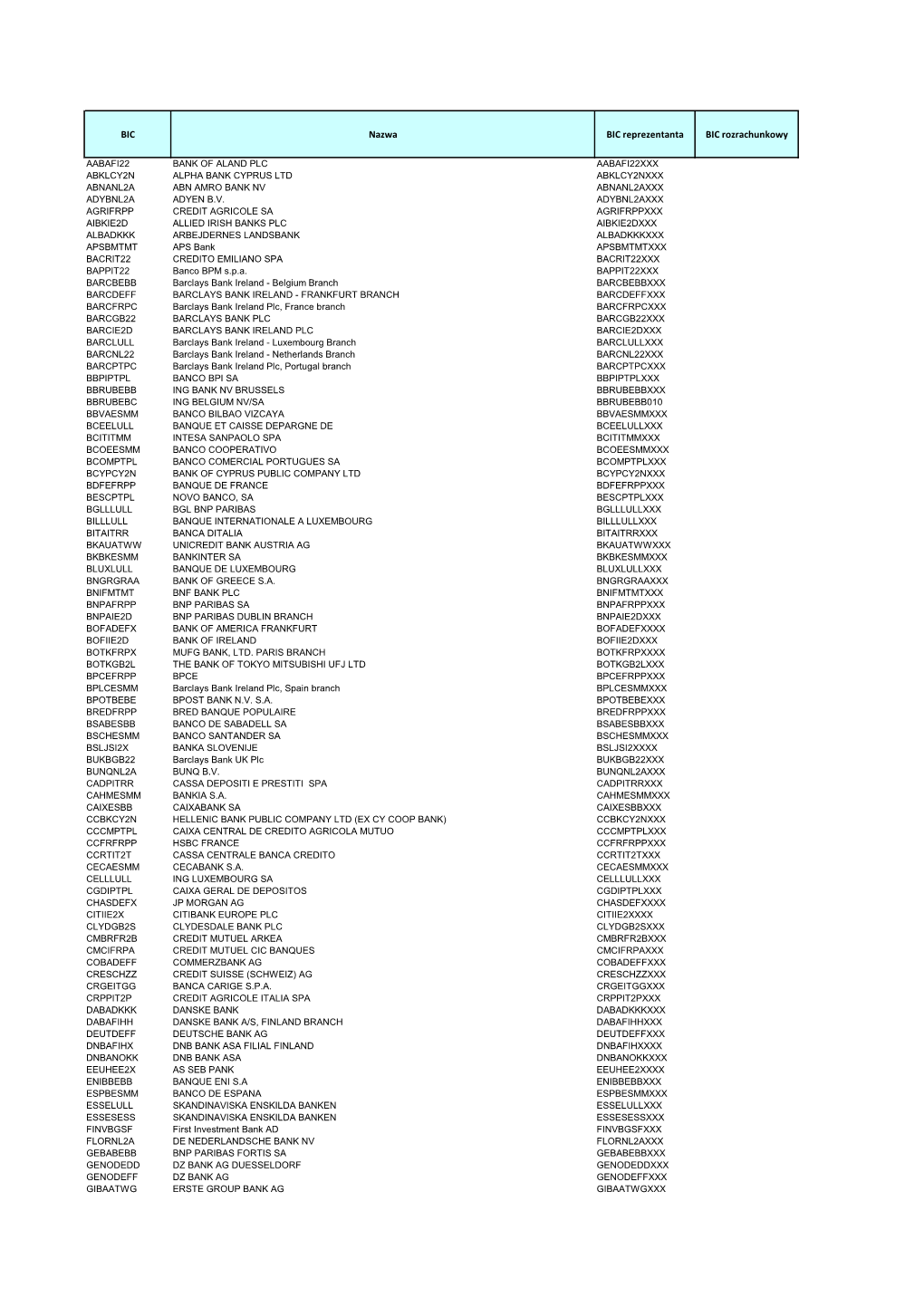

BIC Nazwa BIC Reprezentanta BIC Rozrachunkowy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Banking Automation Bulletin | Media Pack 2021

Banking Automation BULLETIN Media Pack 2021 Reaching and staying in touch with your commercial targets is more important than ever Curated news, opinions and intelligence on Editorial overview banking and cash automation, self-service and digital banking, cards and payments since 1979 Banking Automation Bulletin is a subscription newsletter Independent and authoritative insights from focused on key issues in banking and cash automation, industry experts, including proprietary global self-service and digital banking, cards and payments. research by RBR The Bulletin is published monthly by RBR and draws 4,000 named subscribers of digital and printed extensively on the firm’s proprietary industry research. editions with total, monthly readership of 12,000 The Bulletin is valued by its readership for providing independent and insightful news, opinions and 88% of readership are senior decision makers information on issues of core interest. representing more than 1,000 banks across 106 countries worldwide Regular topics covered by the Bulletin include: Strong social media presence through focused LinkedIn discussion group with 8,500+ members • Artificial intelligence and machine learning and Twitter @RBRLondon • Biometric authentication 12 issues per year with bonus distribution at key • Blockchain and cryptocurrency industry events around the world • Branch and digital transformation Unique opportunity to reach high-quality • Cash usage and automation readership via impactful adverts and advertorials • Deposit automation and recycling • Digital banking and payments Who should advertise? • Financial inclusion and accessibility • Fintech innovation Banking Automation Bulletin is a unique and powerful • IP video and behavioural analytics advertising medium for organisations providing • Logical, cyber and physical bank security solutions to retail banks. -

Life After PSD2

52 Hogan Lovells Open everything and improved security: life after PSD2 PSD2 is a significant piece of legislation, aimed at disrupting the traditional banking and payment services market, improving competition and promoting innovation. One of the ways it does this is by forcing providers to allow access to customer accounts to disruptors who can offer new services to customers by exploiting the wealth of information which can be obtained through access to customers’ account information. Nearly two years after PSD2 first came into force, how is this brave new era of open banking working out for both sides? What might the next twelve months bring? We provide a snapshot of the current state of play and some crystal ball gazing from our European and UK teams below. It’s not just about disruption though. PSD2 also were potential issues at all stages of payment looks to protect consumers by imposing a higher transactions, impacting retailers, card issuers, level of security for online activity and card merchant acquirers and the major card schemes. payments. This now requires “strong customer A concerted lobbying effort to delay full authentication” or “SCA”– involving 2 out of 3 implementation for online transactions resulted in elements of possession, knowledge or inherence – an EBA opinion, published in June 2019, setting for example, confirming a card payment by typing out a structure for national regulators to allow a in a one-time password sent to a mobile phone. degree of tolerance (or “supervisory flexibility”) Whilst the implementation date for these new for delayed implementation of SCA in their requirements was set for 14 September 2019, it jurisdictions. -

RABO 296 Broch EACB P5.Indd

Co-operative banks: Catalysts for economic and social cohesion in Europe 1 Co-operative Banks: Catalysts for economic and social cohesion in Europe Impressum: European Association of Cooperative Banks (EACB) Contact: E-mail : [email protected] • Telephone: (+ 32 )2 230 11 24 • Web: www.eurocoopbanks.coop © Copyright March 2007: European Association of Co-operative Banks 2 Co-operative Banks: Catalysts for economic and social cohesion in Europe The European Association of Co-operative Banks The Association of Co-operative Banks was established in 1970. It represents, promotes and defends the interests of its members and co-operative banks in general. In this role, the Association is the offi cial spokesman vis-à-vis the European institutions. With a view to fulfi lling these objectives, the mission of the Association is: • To provide information to members on all initiatives and measures taken by the European Union that affect the banking sector; • To organize an exchange of views and experiences and to co-ordinate member organisations’ positions on issues of common interest; • To carry out effi cient and active lobbying of European institutions; • To develop positions on issues of common interest. The European Association of Co-operative Banks fosters co- operation between co-operative banking groups. Furthermore, with the other representative co-operative organisations, the Association promotes the spirit of co-operation throughout the banking sector and beyond. In order to fulfi l these goals, the Association is one of the founding members of the European Banking Industry Committee (EBIC), the European Payments Council (EPC), the former European Committee for Banking Standards (ECBS) and the European Financial Reporting Advisory Group (EFRAG). -

Collective Bargaining Agreement for Bank Personnel

ASSOCIATION DES BANQUES ET BANQUIERS LUXEMBOURG COLLECTIVE BARGAINING AGREEMENT FOR BANK EMPLOYEES 2011 – 2013 This text is a translation of the French version. In case of any divergence between the French text and the English text, the French text shall prevail. Contents Art. 1. - Area of application ................................................................. 6 Art. 2. - Duration - Notice of termination ............................................. 6 Art. 3. - Recruitment ........................................................................... 6 Art. 4. - Trial period ............................................................................ 7 Art. 5. - Cessation of the contract ....................................................... 7 Art. 6. - Working hours........................................................................ 9 Art. 7. - Working time ......................................................................... 9 Art. 8. - Overtime work ..................................................................... 11 I. Overtime work ...................................................................................................... 11 II. Qualification of additional hours ........................................................................... 12 III. Work on Sundays.................................................................................................. 13 IV. Work on public holidays........................................................................................ 13 V. Night work ........................................................................................................... -

List of Supervised Entities

List of supervised entities Cut-off date for significance decisions: 1 April 2017# Number of significant supervised entities: 124 This list displays the significant (part A) and less significant credit institutions (part B) which are supervised entities. The list is compiled on the basis of significance decisions adopted and notified by the ECB up to the cut-off date. If the authorisation of a credit institution is withdrawn by the ECB after the cut-off date it will be marked by (#) in this list. While it is regularly reviewed whether an authorisation of a listed bank is withdrawn, it should be noted that there might be a time gap between the withdrawal of the authorisation and the time when the institution is marked with (#). Furthermore, it should be noted that other reasons for the ending of the authorisation as credit institution than the withdrawal of the authorisation will only be reflected in the list after the next cut-off date A. List of significant supervised entities Belgium 1 Investeringsmaatschappij Argenta nv Size (total assets EUR 30 - 50 bn) Argenta Bank- en Verzekeringsgroep nv Belgium Argenta Spaarbank NV Belgium 2 AXA Bank Europe SA Size (total assets EUR 30-50 bn) AXA Bank Europe SCF France 3 Banque Degroof Petercam SA Significant cross-border assets Banque Degroof Petercam France S.A. France Banque Degroof Petercam Luxembourg S.A. Luxembourg Bank Degroof Petercam Spain, S.A. Spain 4 Belfius Banque S.A. Size (total assets EUR 150-300 bn) 5 Dexia NV Size (total assets EUR 150-300 bn) Dexia Crédit Local France Dexia CLF Banque France Dexia Kommunalbank Deutschland AG Germany Dexia Crediop S.p.A. -

Annual Report 2018

DIGITAL BANKING & FINTECH MOVE FORWARD AND INNOVATE EMPLOYMENT SKILLED AND MULTICULTURAL WORKFORCE BANKS STRONG, INTERNATIONAL AND DIVERSIFIED ANNUAL REPORT 2018 PRIVATE BANKING TAILOR-MADE SOLUTIONS FOR INTERNATIONAL CLIENTS RETAIL BANKING WE FINANCE THE ECONOMY Association des Banques et Banquiers, Luxembourg The Luxembourg Bankers’ Association Luxemburger Bankenvereinigung Member of ANNUAL REPORT 2018 - TABLE OF CONTENTS P-1 TABLE OF CONTENTS FOREWORD BY OUR CHAIRMAN 2 FOREWORD BY OUR CEO 4 KEY FIGURES 6 ABBL CLUSTERS 16 Private Banking 16 Retail Banking 18 Corporate Finance, Capital Markets and Cash Management 20 Digital Banking and FinTech Innovation 22 Depositary Banking 25 Market Infrastructures 26 ABBL/ALFI EU REPRESENTATIVE OFFICE 27 Preparing for Brexit and actively closing the legislative cycle 27 TECHNICAL & REGULATORY MATTERS 28 Financial Markets 28 Banking Supervision 30 Legal & Compliance 33 Taxation 37 PSD2 38 Instant payments 39 Trust and Cybersecurity 39 ABBL PROJECTS 40 Employers' Affairs 40 Collective bargaining agreement for bank employees 2018-2020 41 ABBL communication 42 Financial education 42 ABBL publications 44 Corporate social responsibility (CSR) 45 LATEST DEVELOPMENTS IN BANKING 47 AND FINANCIAL LAW GLOSSARY 52 ANNUAL WHO REPORT WE ARE P-2 ANNUAL REPORT 2018 - FOREWORDS For many years Luxembourg has Guy Hoffmann been an attractive and successful CHAIRMAN country with the best credit ratings. Its international banking centre is part of a well-diversified financial ecosystem, with a long-standing expertise in many fields such as corporate, depository and private banking, fintech and other financial services. Our banking and financial community is globally recognised for its expertise in international finance. ANNUAL WHO REPORT WE ARE ANNUAL REPORT 2018 - FOREWORDS P-3 FOREWORD BY OUR CHAIRMAN Many reasons are behind this success. -

EBA CLEARING Shareholders Meeting Report of the Board 30 Th June 2009 Contents

EBA CLEARING Shareholders Meeting Report of the Board 30 th June 2009 Contents 1. The Company’s activities in 2008 3 1.1 Introduction 3 1.2 EURO1 / STEP1 Services 4 1.3 STEP2 Services 8 1.4 Operations of the Clearing Systems 12 1.5 Other relevant matters of interest 14 1.6 Activities of Board Committees 14 1.7 Corporate matters 16 1.8 Financial situation 18 2. The Company’s activities in 2009 21 2.1 EURO1 / STEP1 Services 21 2.2 STEP2 Services 23 2.3 Operations of the Clearing Systems 25 2.4 Other relevant matters of interest 26 Table of Appendices Appendix 1: Changes in EURO1/STEP1 participation 27 Appendix 2: List of direct participants in EURO1/STEP1 33 Appendix 3: List of STEP2 direct participants 41 Appendix 4: Annual accounts for 2008 47 layout: www. quadratpunkt.de photo credit: © Mihai Simonia - Fotolia.com 2 EBA CLEARING Shareholders Meeting 30 th June 2009 // Report of the Board 1. The Company’s activities in 2008 The period under report is 1 st January 2008 to 31 st December 2008. 1.1 Introduction 2008 was a year of unprecedented turmoil in the financial markets. The payments business has proved resilient during the crisis – providing stable and recurring revenue for banks – but it has not remained unaffected by the major changes marking the financial industry as a whole. The high profile of SEPA, the impact of regulation and the amount spent on bank-internal implementation and compliance pushes banks to realise savings based on the new payments infrastructure they have built. -

LUXEMBOURG Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT LUXEMBOURG Executive Summary Banking Luxembourg’s central bank is the Banque centrale du Luxembourg (BCL). As Luxembourg is a participant in the eurozone, some central bank functions are shared with the other members of the European System of Central Banks (ESCB). Bank supervision is performed by the Financial Sector Supervisory Authority (CSSF). All transactions between residents and non-resident companies must be reported on a monthly basis to the BCL. Resident entities are permitted to hold fully convertible foreign currency bank accounts domestically and outside Luxembourg. Residents are also permitted to hold fully-convertible domestic currency (EUR) bank accounts outside Luxembourg. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Luxembourg. Of the 154 banks operating in Luxembourg, over 90% are foreign-owned; 108 are incorporated under Luxembourg law, while 46 are branches of foreign banks. Luxembourg’s only significant domestic bank is the state-owned Banque et Caisse d’Epargne de l’Etat. Payments The two main payment systems used in Luxembourg are the pan-European TARGET2 RTGS system and the Euro Banking Association’s pan-European automated clearing house (ACH), STEP2. The most important cashless payment instruments in Luxembourg are credit transfers, both in terms of volume and value. A high proportion of credit transfers are cross-border, reflecting the key role of the financial sector in Luxembourg’s economy. Card payments are also widely used in the retail sector, while direct debit volumes are also growing. Checks are rarely used and volumes continue to diminish. -

The European Banking Sector and the Co-Operative Banks

The European banking sector and the co-operative banks Economic Research Department December 24th, 2008 Preface Co-operative banks perform a strong role in the European economies and the banking sectors. They impact the daily life of almost 160 million citizens. In total co-operative banks have more than 4,000 local and regional banks, approximately 60,000 branches, 49 million members and they employ 750,000 staff members. This report provides an overview of the key figures of the co-operative banks and their structures. Many data can also be found in annual reports but a comprehensive overview has so far been lacking. The report goes on to explain the main features of the banking sectors in which the co-operative banks operate. In this way the data and the market positions can be put in perspective. We invite you to read the report and take note of the features, similarities and differences of the banks. We are pleased to answer questions you might have. Economic Research Department December 2008 Bouke de Vries Willem Pieter de Groen [email protected] 2 Economic Research Department Content Groupement 4 Unico 5 CIBP 6 Austria 7 Belgium 8 Cyprus 11 France 13 Germany 18 Greece 22 Italy 24 Ireland 27 Luxembourg 30 The Netherlands 32 Portugal 34 Scandinavia 36 Spain 41 Switzerland 43 United Kingdom 45 References 48 3 Economic Research Department EACB The European Association of Co-operative Banks (EACB), or Members (in the studied regions) ‘Groupement Européen des Banques Coopératives’ in French, is the AUSTRIA Fachverband der umbrella body and spokesman for Europe's 4,500 co-operative Raiffeisenbanken (RZB) banks. -

Collective Bargaining Agreement for Bank Employees Undertake to Invest an Annual Budget Equivalent to at Least 1% of the Reference Salary Bill Defined in Article 23

ASSOCIATION DES BANQUES ET BANQUIERS LUXEMBOURG COLLECTIVE BARGAINING AGREEMENT FOR BANK EMPLOYEES 2014 – 2016 This text is a translation of the French version. In case of any divergence between the French text and the English text, the French text shall prevail. Contents Art. 1. - Area of application ...................................................................................................... 6 Art. 2. - Duration - Notice of termination ................................................................................. 6 Art. 3. - Recruitment .................................................................................................................. 6 Art. 4. - Trial period ................................................................................................................... 7 Art. 5. - Termination of the contract ........................................................................................ 7 Art. 6. - Working hours ............................................................................................................. 9 Art. 7. - Working time ................................................................................................................ 9 Art. 8. - Overtime work ............................................................................................................ 11 I. OVERTIME WORK ........................................................................................................... 11 II. QUALIFICATION OF ADDITIONAL HOURS ........................................................................... -

EBA CLEARING Shareholders Meeting Report of the Board 14 Th June 2011 Contents

EBA CLEARING Shareholders Meeting Report of the Board 14 th June 2011 Contents 1. The Company’s activities in 2010 3 1.1 Introduction 3 1.2 EURO1/STEP1 Services 3 1.3 STEP2 Services 6 1.4 Operations of the Clearing Systems 10 1.5 Activities of Board Committees 12 1.6 Corporate matters 16 1.7 Financial situation 18 2. The Company’s activities in 2011 22 2.1 EURO1/STEP1 Services 22 2.2 STEP2 Services 25 2.3 Operations of the Clearing Systems 27 2.4 E-services 28 2.5 Other relevant matters of interest 29 Table of Appendices 30 Appendix 1: Changes in EURO1/STEP1 participation 30 Appendix 2: List of direct participants in EURO1/STEP1 33 Appendix 3: List of direct STEP2 participants 42 Appendix 4: Annual accounts for 20 10 54 layout: www. quadratpunkt.de photo credit: © Jean Schweitzer/Shutterstock.com 2 EBA CLEARING Shareholders Meeting 14 th June 2011 // Report of the Board 1. The Company’s activities in 2010 The period under report is 1 st January 2010 to 31 st December 2010. 1.1 Introduction Over the past year, EBA CLEARING continued to maintain and evolve its pan-European payment infrastructure in line with the needs and expectations of its shareholders and users. The Company closely coordinated all develop - ment and implementation activities with its users to ensure that the pace of change suited all parties involved. At the same time, EBA CLEARING continued to leverage its core competencies of operational robustness and strong cost management. The Company also strove to maintain the dynamism to underpin its core ongoing activities. -

LUXEMBOURG Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT LUXEMBOURG Executive Summary Banking Luxembourg’s central bank is the Banque centrale du Luxembourg (BCL). As Luxembourg is a participant in the eurozone, some central bank functions are shared with the other members of the European System of Central Banks (ESCB). Bank supervision is performed by the Financial Sector Supervisory Authority (CSSF). All transactions between residents and non-resident companies must be reported on a monthly basis to the BCL. Resident entities are permitted to hold fully convertible foreign currency bank accounts domestically and outside Luxembourg. Residents are also permitted to hold fully-convertible domestic currency (EUR) bank accounts outside Luxembourg. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Luxembourg. Of the 154 banks operating in Luxembourg, over 90% are foreign-owned; 111 are incorporated under Luxembourg law, while 43 are branches of foreign banks. Luxembourg’s only significant domestic bank is the state-owned Banque et Caisse d’Epargne de l’Etat. Payments The two main payment systems used in Luxembourg are the pan-European TARGET2 RTGS system and the Euro Banking Association’s pan-European automated clearing house (ACH), STEP2. The most important cashless payment instruments in Luxembourg are credit transfers, both in terms of volume and value. A high proportion of credit transfers are cross-border, reflecting the key role of the financial sector in Luxembourg’s economy. Card payments are also widely used in the retail sector, while direct debit volumes are also growing. Checks are rarely used and volumes continue to diminish.