Banking Automation Bulletin | Media Pack 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

International Comparison of Bank Fraud

Journal of Cybersecurity, 3(2), 2017, 109–125 doi: 10.1093/cybsec/tyx011 Research paper Research paper International comparison of bank fraud reimbursement: customer perceptions and contractual terms Ingolf Becker,1,* Alice Hutchings,2 Ruba Abu-Salma,1 Ross Anderson,2 Nicholas Bohm,3 Steven J. Murdoch,1 M. Angela Sasse,1 and Gianluca Stringhini1 1Computer Science Department, University College London, Gower Street, London WC1E 6BT; 2 University of Cambridge Computer Laboratory, 15 JJ Thomson Avenue, CB3 0FD; 3Foundation for Information Policy Research *Corresponding author: E-mail: [email protected] Received 7 May 2017; accepted 17 November 2017 Abstract The study presented in this article investigated to what extent bank customers understand the terms and conditions (T&Cs) they have signed up to. If many customers are not able to understand T&Cs and the behaviours they are expected to comply with, they risk not being compensated when their accounts are breached. An expert analysis of 30 bank contracts across 25 countries found that most contract terms were too vague for customers to infer required behaviour. In some cases the rules vary for different products, meaning the advice can be contradictory at worst. While many banks allow customers to write Personal identification numbers (PINs) down (as long as they are disguised and not kept with the card), 20% of banks categorically forbid writing PINs down, and a handful stipulate that the customer have a unique PIN for each account. We tested our findings in a survey with 151 participants in Germany, the USA and UK. They mostly agree: only 35% fully understand the T&Cs, and 28% find important sections are unclear. -

An Empirical Analysis of the Black Market Exchange Rate in Iran

University of Wollongong Research Online Faculty of Commerce - Papers (Archive) Faculty of Business and Law March 2004 An Empirical Analysis of the Black Market Exchange Rate in Iran Abbas Valadkhani University of Wollongong, [email protected] Follow this and additional works at: https://ro.uow.edu.au/commpapers Part of the Business Commons, and the Social and Behavioral Sciences Commons Recommended Citation Valadkhani, Abbas: An Empirical Analysis of the Black Market Exchange Rate in Iran 2004. https://ro.uow.edu.au/commpapers/395 Research Online is the open access institutional repository for the University of Wollongong. For further information contact the UOW Library: [email protected] An Empirical Analysis of the Black Market Exchange Rate in Iran Abstract The Iranian rial has been depreciated on average about 13 per cent per annum against the U.S dollar during the last four decades. This paper examines the long- and short-run determinants of the black market exchange rate employing the cointegration techniques and the annual time series data from 1960 to 2002. Consistent with previous studies and the monetary approach to the exchange-rate determination, it is found that the black market exchange rate is cointegrated with the relative consumer price indices in Iran and the U.S., real GDP and the relative import prices. However, in the short run only the rising relative prices and a meagre real GDP growth have been responsible for the depreciation of Iranian currency. Keywords Black market, exchange rate, Iran, Cointegration Disciplines Business | Social and Behavioral Sciences Publication Details This article was originally published as Valadkhani, A, An Empirical Analysis of the Black Market Exchange Rate in Iran, Asian-African Journal of Economics and Econometrics, 4(2), 2004, 141-52. -

BRANDFINANCE Banking

BRANDFINANCE® banKING 500 THE ANNUAL REPORT ON THE World’S MOST VALUABLE Banking brands | MARCH 2013 Is the global banking crisis nearly over? 2 | BRANDFINANCE® BANKING 500 | MARCH 2013 Contents Contents BRANDFINANCE® 3 FOREWORD BANKING 500 4 EXECUTIVE SUMMARY The BrandFinance® Banking 500 Is the global banking crisis nearly over? is published by Brand Finance plc and is the only study to rank the 6 THE TOP 20: PROFILES top 500 most valuable banks in Worthy winners the world A run-down of the world’s most valuable banking brands 15 WINNERS AND LOSERS East beats West Agricultural Bank of China enjoyed the biggest gain in brand value this year, and HSBC suffered the biggest loss Brand Finance plc 3rd Floor, Finland House, 16 REGIONAL RESULTS 56 Haymarket, London A shifting picture SW1Y 4RN United Kingdom The overall result masks important regional and country Tel: +44 (0) 207 389 9400 variations Fax: +44 (0) 207 389 9401 www.brandfinance.com 19 SECTOR RESULTS [email protected] 20 BANKING FORUM 2013 Welcome to the age of Apple Bank? Pundits at Brand Finance’s fourth annual Banking Forum in February challenged banks to think outside the banking box when it comes to customer focus. 24 METHODOLOGY How do we value brands? 25 BESPOKE REPORTS 26 THE TOP 500 MOST VALUABLE BANKING BRANDS Five pages of league table results Publishing partner Every year the BrandFinance® Banking 500 is published by The Banker magazine, the world’s premier banking and finance resource MARCH 2013 | BRANDFINANCE® BANKING 500 | 3 Foreword David Haigh CEO Brand Finance plc The improved performance of banks around the world reflects a concerted effort‘ to get their houses in order Since it was first compiled THE STORM CLOUDS over the global ’increasingly targeted at the specific needs in 2005 the BrandFinance® banking industry seem, at last, to be clearing. -

The Cause of Misfire in Counter-Terrorist Financing Regulation

UNIVERSITY OF CALIFORNIA RIVERSIDE Making a Killing: The Cause of Misfire in Counter-Terrorist Financing Regulation A Dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in Political Science by Ian Oxnevad June 2019 Dissertation Committee: Dr. John Cioffi, Chairperson Dr. Marissa Brookes Dr. Fariba Zarinebaf Copyright by Ian Oxnevad 2019 The Dissertation of Ian Oxnevad is approved: ________________________________________________ ________________________________________________ ________________________________________________ Committee Chairperson University of California, Riverside ABSTRACT OF THE DISSERTATION Making a Killing: The Cause of Misfire in Counter-Terrorist Financing Regulation by Ian Oxnevad Doctor of Philosophy, Graduate Program in Political Science University of California, Riverside, June 2019 Dr. John Cioffi, Chairperson Financial regulations designed to counter the financing of terrorism have spread internationally over past several decades, but little is known about their effectiveness or why certain banks get penalized for financing terrorism while others do not. This research addresses this question and tests for the effects of institutional linkages between banks and states on the enforcement of these regulations. It is hypothesized here that a bank’s institutional link to its home state is necessary to block attempted enforcement. This research utilizes comparative studies of cases in which enforcement and penalization were attempted, and examines the role of institutional links between the bank and state in these outcomes. The case comparisons include five cases in all, with three comprising positive cases in which enforcement was blocked, and two in which penalty occurred. Combined, these cases control for rival variables such as rule of law, state capacity, iv authoritarianism, and membership of a country in a regulatory body while also testing for the impact of institutional linkage between a bank and its state in the country’s national political economy. -

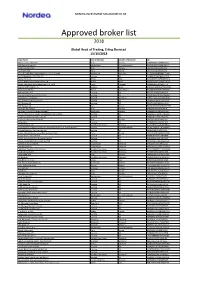

External Borkers List

NORDEA INVESTMENT MANAGEMENT AB Approved broker list 2018 Global Head of Trading, Erling Skorstad 15/10/2018 Legal Name City of Domicile Country of Domicile LEI ABG Sundal Collier ASA Oslo Norway 2138005DRCU66B8BNY04 ABN Amro Group NV Amsterdam The Netherlands BFXS5XCH7N0Y05NIXW11 Arctic Securities AS Oslo Norway 5967007LIEEXZX4RVS72 Aurel BGC SAS Paris France 5RJTDGZG4559ESIYLD31 Australia and New Zealand Banking Group Limited Melbourne Australia JHE42UYNWWTJB8YTTU19 AUTONOMOUS RESEARCH LLP London UK 213800LBM6PT85IGM996 Banca IMI S.p.A Milan Italy QV4Q8OGJ7OA6PA8SCM14 Banco Bilbao Vizcaya Argentaria S.A Bilbao Spain K8MS7FD7N5Z2WQ51AZ71 Banco Português de Investimento, S.A. (BPI) Porto Portugal 213800NGLJLXOSRPK774 BANCO SANTANDER S.A Madrid Spain 5493006QMFDDMYWIAM13 Bank Vontobel AG Zurich Switzerland 549300L7V4MGECYRM576 Barclays Bank PLC London UK G5GSEF7VJP5I7OUK5573 Barclays Capital Securities Limited London UK K9WDOH4D2PYBSLSOB484 Bayerische Landesbank Munich Germany VDYMYTQGZZ6DU0912C88 BCS Prime Brokerage Limited London UK 213800UU8AHE2B6QUI26 BGC Brokers LP London UK ZWNFQ48RUL8VJZ2AIC12 BNP Paribas SA Paris France R0MUWSFPU8MPRO8K5P83 Carnegie AS Norway Oslo Norway 5967007LIEEXZX57BC18 Carnegie Investment Bank AB (publ) Stockholm Sweden 529900BR5NZNQZEVQ417 China International Capital Corporation (UK) Limited London UK 213800STG3UV87MDGA96 Citigroup Global Markets Limited London UK XKZZ2JZF41MRHTR1V493 Clarksons Platou Securities AS Oslo Norway 5967007LIEEXZXA40G44 CLSA (UK) London UK 213800VZMAGVIU2IJA72 Commerzbank AG Frankfurt -

United States District Court Eastern District of New

Case 1:14-cv-06601-DLI-CLP Document 120 Filed 11/10/16 Page 1 of 37 PageID #: 5985 UNITED STATES DISTRICT COURT EASTERN DISTRICT OF NEW YORK CHARLOTTE FREEMAN, et al., Plaintiffs, -against- 14-CV-6601 (DLI/CLP) HSBC HOLDINGS PLC, et al., Defendants. DEFENDANTS’ JOINT MEMORANDUM IN SUPPORT OF MOTION TO DISMISS September 14, 2016 Case 1:14-cv-06601-DLI-CLP Document 120 Filed 11/10/16 Page 2 of 37 PageID #: 5986 TABLE OF CONTENTS Page TABLE OF AUTHORITIES .......................................................................................................... ii INTRODUCTION ...........................................................................................................................1 BACKGROUND .............................................................................................................................3 I. STATUTORY BACKGROUND.........................................................................................3 II. PLAINTIFFS’ ALLEGATIONS .........................................................................................4 ARGUMENT .................................................................................................................................11 I. THE RULE 12(b)(6) STANDARD ...................................................................................11 II. THE COMPLAINT FAILS PLAUSIBLY TO ALLEGE PROXIMATE CAUSE ...........12 A. Rothstein and Its Progeny Hold That the Alleged Provision of Financial Services to Iran, Even When in Violation of U.S. Law, Is Too Remote to Support Civil -

Gauging the Potential in Thai Banking* Introduction Overview

Financial Services Back on the investment radar: Gauging the potential in Thai banking* Introduction Overview The Thai banking sector is attracting increasing international • Economy set to rebound as confidence returns following interest as the market opens up to foreign investment and the return to democracy. the return to democracy helps to reinvigorate consumer • Banking sector recording steady growth. Strong confidence and demand. opportunities for the development of retail lending. Bad debt ratios have gradually declined and the balance • Foreign banks account for 12% of the market by assets and sheets of Thailand’s leading banks have strengthened 10% of lending by value.7 Strong presence in high-value considerably since the Asian financial crisis of 1997.1 niche segments including auto finance, mortgages and The moves to Basel II and IAS 39 are set to enhance credit cards. transparency and risk management within the sector, while accelerating the demand for foreign capital and expertise. • Organic entry strategies curtailed by licensing and branch opening restrictions. Reforms already in place include the ‘single presence’ rule, which by seeking to limit cross-ownership of the country’s • Acquisition of minority stakes in existing banks proving banks is leading to increased consolidation and the opening increasingly popular. Ceiling on foreign holdings set to be up of sizeable holdings for new investment. The Financial raised to 49%, though there are no firm plans to allow Sector Master Plan and forthcoming Financial Institution outright control. Business Act (2008), which will come into force in August • Demand for capital and foreign expertise is encouraging 2008, could ease restrictions on branch openings and the more domestic banks to seek foreign investment, especially size of foreign investment holdings. -

Sıra No Kod Banka Adı Kod Banka

Tablo: TCMB Ödeme Sistemleri Katılımcı Listesi (2020) Koda Göre Sıralama Alfabetik Sıralama SIRA NO KOD BANKA ADI KOD BANKA ADI 1 0001 T.C. MERKEZ BANKASI 0100 ADABANK A.Ş. 2 0004 İLLER BANKASI A.Ş. 0046 AKBANK T.A.Ş. 3 0010 T.C.ZİRAAT BANKASI A.Ş. 0143 AKTİF YATIRIM BANKASI A.Ş. 4 0012 T. HALK BANKASI A.Ş. 0203 ALBARAKA TÜRK KATILIM BANKASI A.Ş. 5 0014 T. SINAİ KALKINMA BANKASI A.Ş. 0124 ALTERNATİFBANK A.Ş. 6 0015 T. VAKIFLAR BANKASI T.A.O 0135 ANADOLUBANK A.Ş. 7 0016 T. EXİMBANK 0091 ARAP TÜRK BANKASI 8 0017 T. KALKINMA BANKASI A.Ş. 0149 BANK OF CHINA TURKEY A.Ş. 9 0029 BİRLEŞİK FON BANKASI A.Ş. 0142 BANKPOZİTİF KREDİ VE KALK.BANK.A.Ş. 10 0032 T. EKONOMİ BANKASI A.Ş. 0029 BİRLEŞİK FON BANKASI A.Ş. 11 0046 AKBANK T.A.Ş. 0125 BURGAN BANK A.Ş. 12 0059 ŞEKERBANK T.A.Ş. 0092 CITIBANK A.Ş. 13 0062 T. GARANTİ BANKASI A.Ş. 0134 DENİZBANK A.Ş. 14 0064 T. İŞ BANKASI A.Ş. 0115 DEUTSCHE BANK A.Ş. 15 0067 YAPI VE KREDİ BANKASI A.Ş. 0138 DİLER YATIRIM BANKASI A.Ş. 16 0091 ARAP TÜRK BANKASI 0103 FİBABANKA A.Ş. 17 0092 CITIBANK A.Ş. 0150 GOLDEN GLOBAL YATIRIM BANKASI A.Ş.(*) 18 0096 TURKISH BANK A.Ş. 0139 GSD YATIRIM BANKASI A.Ş. 19 0098 JPMORGAN CHASE BANK N.A. 0123 HSBC BANK A.Ş. 20 0099 ING BANK A.Ş. 0109 ICBC TURKEY BANK A.Ş. 21 0100 ADABANK A.Ş. -

CE Banking Outlook Winning in the Digital Arms Race October 2016 Contents

CE Banking Outlook Winning in the Digital Arms Race October 2016 www.deloitte.com\cebankingoutlook Contents Foreword Index of Banks Covered by Digital Maturity Executive Summary Analysis Banking Outlook Contacts in Central Europe Bulgaria Croatia The Czech Republic Hungary Poland Romania Slovakia Slovenia Foreword Although the performance of the banking sector in Central (1.3-1.5 percentage points above the eurozone). This relatively Foreword Europe (CE) is shifting up a gear as lending growth accelerates healthy economy has led a faster recovery of loan growth in CE to Executive and asset quality improves, profitability is still well below 3.4% y/y in 2015 (3 p.p. above Euro area) and should allow a further Summary pre-crisis levels. With low interest rates driving margin pick up to 5.0% y/y in 2018. Banking compression and a rising regulatory burden, banks need to Outlook improve operating efficiency. Asset quality has also been improving, with the non-performing loan Banks covered (NPL) ratio in CE down from a peak of 11.0% in 2013 to 8.8% in 2015 by Digital Maturity The digital maturity of banks in CE countries varies greatly but and is expected to fall to a level of 7.0% in 2018. As the region’s digitalization is a strategic priority for all. It can not only provide a key recovery progresses, the disparities between the leading countries in Contacts avenue for banks to reduce their cost to serve, it is also an imperative the north (Poland, the Czech Republic and Slovakia) and those in the that enables them to keep pace with the expectations of customers south (Hungary, Romania, Bulgaria, Croatia and Slovenia) are who are increasingly online and mobile. -

Palestinian Forces

Center for Strategic and International Studies Arleigh A. Burke Chair in Strategy 1800 K Street, N.W. • Suite 400 • Washington, DC 20006 Phone: 1 (202) 775 -3270 • Fax : 1 (202) 457 -8746 Email: [email protected] Palestinian Forces Palestinian Authority and Militant Forces Anthony H. Cordesman Center for Strategic and International Studies [email protected] Rough Working Draft: Revised February 9, 2006 Copyright, Anthony H. Cordesman, all rights reserved. May not be reproduced, referenced, quote d, or excerpted without the written permission of the author. Cordesman: Palestinian Forces 2/9/06 Page 2 ROUGH WORKING DRAFT: REVISED FEBRUARY 9, 2006 ................................ ................................ ............ 1 THE MILITARY FORCES OF PALESTINE ................................ ................................ ................................ .......... 2 THE OSLO ACCORDS AND THE NEW ISRAELI -PALESTINIAN WAR ................................ ................................ .............. 3 THE DEATH OF ARAFAT AND THE VICTORY OF HAMAS : REDEFINING PALESTINIAN POLITICS AND THE ARAB - ISRAELI MILITARY BALANCE ................................ ................................ ................................ ................................ .... 4 THE CHANGING STRUCTURE OF PALESTINIAN AUTHORITY FORC ES ................................ ................................ .......... 5 Palestinian Authority Forces During the Peace Process ................................ ................................ ..................... 6 The -

STOXX Asia 100 Last Updated: 03.07.2017

STOXX Asia 100 Last Updated: 03.07.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 256.2 1 1 JP3633400001 6900643 7203.T 690064 Toyota Motor Corp. JP JPY Y 128.5 2 2 TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.6 3 3 JP3902900004 6335171 8306.T 659668 Mitsubishi UFJ Financial Group JP JPY Y 83.5 4 4 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 77.2 5 5 JP3436100006 6770620 9984.T 677062 Softbank Group Corp. JP JPY Y 61.7 6 7 JP3735400008 6641373 9432.T 664137 Nippon Telegraph & Telephone C JP JPY Y 58.7 7 8 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 58.2 8 6 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 52.6 9 12 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 52.0 10 10 JP3890350006 6563024 8316.T 656302 Sumitomo Mitsui Financial Grou JP JPY Y 48.3 11 15 INE040A01026 B5Q3JZ5 HDBK.BO IN00CH HDFC Bank Ltd IN INR Y 45.4 12 13 JP3854600008 6435145 7267.T 643514 Honda Motor Co. Ltd. JP JPY Y 43.3 13 14 JP3435000009 6821506 6758.T 682150 Sony Corp. JP JPY Y 42.3 14 17 JP3496400007 6248990 9433.T 624899 KDDI Corp. JP JPY Y 42.2 15 16 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.1 16 19 JP3885780001 6591014 8411.T 625024 Mizuho Financial Group Inc. -

ID Periodo De Inicio (Mes/Año)

Periodo de Periodo de ID inicio conclusión Denominación de la Institución o empresa Cargo o puesto desempeñado Campo de experiencia (mes/año) (mes/año) 43028 06/01/92 12/1994 ESCUELA BANCARIA COMERCIAL COORDINADOR DE CARRERA 67725 27/02/90 3/1991 PROSPECTIVA ECONÓMICA Y SOCIAL. S.C. (DESPACHO CONSULTOR EN SISTEMAS) ANALISTA PROGRAMADOR 68233 2016 A LA FECHA BANOBRAS DIRECTOR DE CRÉDITO 68233 2014 2016 BANOBRAS GERENTE DE EVALUACIÓN DE CRÉDITO AL SECTOR PRIVADO 68233 2011 2014 BANOBRAS GERENTE DE MESA DE CONTROL Y NORMATIVIDAD CREDITICIA 68233 2004 2011 BANOBRAS SUBGERENTE DE EVALUACION FINANCIERA DE LA FUENTE DE PAGO 68233 2000 2004 BANOBRAS SUBGERENTE DE SECTOR PUBLICO 68233 1991 2000 BANOBRAS ESPECIALISTA TÉCNICO, EXPERTO TÉCNICO, SUBGERENTE DE MODERNIZACIÓN DEL TRANSPORTE 68276 01/02/88 5/1992 PROCURADURIA GENERAL DE LA REPUBLICA DIRECTOR DE AREA 70777 2014 A LA FECHA BANOBRAS, S.N.C. GERENTE DE EVALUACIÓN DE PROYECTOS 70823 16/09/89 3/1993 CONSORCIO CONSTRUMERK S.A. DE C.V. GERENTE DE SISTEMAS 70823 02/09/85 1/1998 TELEFONOS DE MEXICO ANALISTA DE SISTEMAS 70823 01/02/88 8/1989 AUTOMANUFACTURAS S.A DE C.V. COORDINADOR DE PLANEACION Y ANALISIS DE SISTEMAS 71412 1991 1992 PROYECTOS Y CONSTRUCCIONES COVFER, S.A. DE C.V. AUXILIAR ADMINISTRATIVO Y CONTABLE 71412 1989 1991 BEJAR, GALINDO, LOZANO Y CÍA, S.C. AUXILIAR CONTABLE 72834 2014 A LA FECHA BANOBRAS SUBGERENTE DE PROYECTOS CARRETEROS ESTATALES 1 72834 1996 2014 BANOBRAS EXPERTO TÉCNICO A 72834 1994 1996 BANOBRAS ESPECIALISTA TÉCNICO 72834 1993 1994 G.A. INGENIEROS S.A. DE C.V.