LUXEMBOURG Executive Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Euro: Internationalised at Birth

The euro: internationalised at birth Frank Moss1 I. Introduction The birth of an international currency can be defined as the point in time at which a currency starts meaningfully assuming one of the traditional functions of money outside its country of issue.2 In the case of most currencies, this is not straightforwardly attributable to a specific date. In the case of the euro, matters are different for at least two reasons. First, internationalisation takes on a special meaning to the extent that the euro, being the currency of a group of countries participating in a monetary union is, by definition, being used outside the borders of a single country. Hence, internationalisation of the euro should be understood as non-residents of this entire group of countries becoming more or less regular users of the euro. Second, contrary to other currencies, the launch point of the domestic currency use of the euro (1 January 1999) was also the start date of its international use, taking into account the fact that it had inherited such a role from a number of legacy currencies that were issued by countries participating in Europe’s economic and monetary union (EMU). Taking a somewhat broader perspective concerning the birth period of the euro, this paper looks at evidence of the euro’s international use at around the time of its launch date as well as covering subsequent developments during the first decade of the euro’s existence. It first describes the birth of the euro as an international currency, building on the international role of its predecessor currencies (Section II). -

Bgl Bnp Paribas

“COMMIT TO MORE SUSTAINABLE, BETTER SHARED GROWTH” GEOFFROY BAZIN, CEO BGL BNP PARIBAS 2018 SUSTAINABILITY REPORT 2018 SUSTAINABILITY REPORT The gardens of the BGL BNP Paribas head office 2018 SUSTAINABILITY REPORT CONTENT 01 MESSAGE FROM GEOFFROY BAZIN 6 02 BGL BNP PARIBAS IN A NUTSHELL 8 03 OUR CSR APPROACH 18 04 THE 4 PILLARS OF OUR CSR APPROACH 24 Our economic responsibility 26 Our civic responsibility 30 Our social responsibility 34 Our environmental responsibility 38 05 NON-FINANCIAL RATINGS 42 GLOSSARY 44 USEFUL LINKS 45 01 MESSAGE FROM GEOFFROY BAZIN Country Manager, BNP Paribas Group in Luxembourg, Chairman of the BGL BNP Paribas Executive Committee 01 Message from Geoffroy Bazin Geoffroy Message from We commit to continually improving the integration of social and environmental responsibility into the bank’s operational processes and major projects, while inventing new solutions and partnerships combining support for our clients and benefits to the world around us. We are readying ourselves for causes for which we have powerful leverage, by converging commercial offer, partnerships, employer actions, procurement policies, inclusive projects, sponsorship, volunteering and intrapreneurship. Beyond our responsibilities towards our clients, employees, society and the environment, we have identifiedfour priorities on which to focus our efforts: Climate , by acting in conjunction with our clients and partners as an accelerator for energy transition, and focusing on renewable energy, energy efficiency, sustainable mobility and the circular economy. Geoffroy Bazin Youth, by facilitating their inclusion in society, supporting the projects they value most and For nearly 100 years, BGL BNP Paribas has been strengthening intergenerational dialogue. one of the largest financial institutions in the Entrepreneurs , by encouraging creativity and deve- Grand Duchy. -

March 31, 2013 Foreign Currency Country-Currency to $1.00

04/29/15 Page: 1 TREASURY REPORTING RATES OF EXCHANGE As of March 31, 2013 Foreign Currency Country-Currency To $1.00 Afghanistan-Afghani 53.1800 Albania-Lek 109.0700 Algeria-Dinar 78.9000 Angola-Kwanza 95.0000 Antigua & Barbuda-E. Caribbean Dollar 2.7000 Argentina-Peso 5.1200 Armenia-RUBLE 415.0000 Australia-Dollar .9600 Austria-Euro .7800 Austria-Schilling .0000 Azerbaidjan-Ruble .8000 Azerbaijan-New Manat .0000 Bahamas-Dollar 1.0000 Bahrain-Dinar .3800 Bangladesh-Conv. Taka .0000 Bangladesh-Non-Conv. Taka 80.0000 Barbados-Dollar 2.0200 Belarus-Ruble 8,680.0000 Belgium-Euro .7800 Belgium-Franc .0000 Belize-Dollar 2.0000 Benin-CFA Franc 511.6700 Bermuda-Dollar 1.0000 Bolivia-Boliviano 6.9600 Bosnia-Dinar 1.5300 Botswana-Pula 8.2400 Brazil-Cruzados .0000 Brazil-Cruzeiro 2.0200 Brunei-Dollar 1.2400 Bulgaria-Lev 1.5300 Burkina Faso-CFA Franc 511.6700 Burma-Kyat 878.0000 Burundi-Franc 1,650.0000 Cambodia (Khmer)-Riel 4,103.0000 Cameroon-CFA Franc 511.6700 Canada-Dollar 1.0200 Cape Verde-Escudo 84.1800 Cayman Island-Dollar .8200 Central African Rep.-CFA Franc 511.6700 Chad-CFA Franc 511.6700 Chile-Peso 471.5000 China-Renminbi 6.2100 China-Yuan .0000 Colombia-Peso 1,824.0000 Comoros-CFA Franc 361.3500 Congo-CFA Franc 511.6700 Costa Rica-Colon 498.6000 Croatia-KUNA 5.8300 Cuba-Peso 1.0000 Cyprus-Euro .7800 Cyprus-Pound .7890 Czech. Republic-Koruna 19.7000 Czechoslovakia-Tuzex Koruna .0000 CFA Franc-CFA Franc .0000 Dem. Rep. of Congo-Congolese Franc 920.0000 Denmark-Kroner 5.8200 Djibouti-Franc 177.0000 Dominican Republic-Peso 40.8600 East Germany-GDR Mark .0000 Ecuador-Dollar 1.0000 Ecuador-Sucre .0000 Egypt-Pound 6.8000 El Salvador-Colon 1.0000 Equatorial Guinea-CFA Franc 511.6700 Eritrea-Birr 15.0000 Estonia-EURO .7800 Estonia-Kroon 11.6970 04/29/15 Page: 2 TREASURY REPORTING RATES OF EXCHANGE As of March 31, 2013 Foreign Currency Country-Currency To $1.00 Ethiopia-Birr 18.4000 Euro-Euro .7800 European Community-European Comm. -

English Annual Report 2013

Déclaration du Conseil d’administration Annual report 2013 bgl.lu 1 Légende oeuvre ANNUAL REPORT 2013 The SELECTED WORKS exhibition As a corporate citizen BGL BNP Paribas is one of the Overall, this exhibition consisted of objects from main partners in the arts and cultural communities of the 1980s and 1990s and allowed the public to Luxembourg. Our institution supports art and creativity discover the works of artists such as Frank Stella, Roy and therefore hosts each year on its premises a number Lichtenstein, Claude Viallat, Günther Förg, A.R. Penck of prestigious exhibitions from famous museums and Fernand Roda, Imi Knoebel, Emil Schumacher, Jan Voss, of artists with local and international fame. Markus Lüpertz, Sam Francis and Rosemarie Trockel and thereby a wide range of artistic movements such The SELECTED WORKS exhibition which was held from as pop art recent research into pictorial forms or even 10 January to 28 February 2014 in the Private Banking conceptual art. Centre – the “Villa” of BGL BNP Paribas presented works from the private collection of the Bank to the The photos published in this Annual Report, represent public for the first time. those works of art which were on show in the SELECTED WORKS exhibition. Cover: Frank Stella (*1936) - The Prophet, 1990 - De la série Moby Dick - Acrylic on wood and metal ANNUAL REPORT 2013 Contents 12 Per Kirkeby (*1938) - Sans Titre, 1991 - Mixed technique on paper Contents Consolidated key figures 07 BGL BNP Paribas and its shareholders 09 The Group BNP Paribas in Luxembourg 10 History -

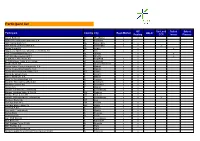

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

Annual Report 2018

ANNUAL REPORT 2018 ANNUAL REPORT 2018 CONTENTS 01 CONSOLIDATED KEY FIGURES 6 02 BGL BNP PARIBAS AND ITS SHAREHOLDERS 8 03 THE BNP PARIBAS GROUP IN LUXEMBOURG 10 04 HISTORY OF BGL BNP PARIBAS 14 05 DIRECTORS AND OFFICERS 16 06 STATEMENT BY THE BOARD OF DIRECTORS 20 07 MANAGEMENT REPORT BY THE BOARD OF DIRECTORS 22 Preamble 23 Consolidated management report 24 Outlook for 2019 35 08 CONSOLIDATED FINANCIAL STATEMENTS AT 31 DECEMBER 2018 36 Audit report 37 Consolidated financial statements prepared according to the IFRS accounting standards adopted by the European Union 44 Consolidated profit and loss 44 Statement of consolidated net income and changes in assets and liabilities recognised directly in consolidated equity 45 Consolidated balance sheet 46 Statement of changes in consolidated equity from 1 January 2017 to 31 December 2018 47 Consolidated cash flow statement 49 09 NOTES TO THE FINANCIAL STATEMENTS 50 General remarks 51 1. Summary of accounting principles applied by the Group 51 2. Effects of changes in presentation and accounting principles, and the application of IFRS 9 and IFRS 15 73 3. Notes to the profit and loss account 84 4. Sector information 92 5. Risk management and capital adequacy 94 6. Notes to the balance sheet 133 7. Financing commitments and guarantee commitments 157 8. Salaries and employee benefits 159 9. Additional information 164 10 UNCONSOLIDATED FINANCIAL STATEMENTS AT 31 DECEMBER 2018 180 Unconsolidated balance sheet 181 Unconsolidated profit and loss account 183 11 APPROPRIATION OF PROFIT 184 12 BRANCH NETWORK 186 13 SUBSIDIARIES/BRANCH, PARTICIPATING INTERESTS, BUSINESS CENTERS AND OTHER COMPANIES OF THE GROUP IN LUXEMBOURG 188 The English language version of this report is a free translation from the original, which was prepared in French. -

'Foreign Exchange Markets Welcome the Start of the EMS' from Le Monde (14 March 1979)

'Foreign exchange markets welcome the start of the EMS' from Le Monde (14 March 1979) Caption: On 14 March 1979, the day after the implementation of the European Monetary System (EMS), the French daily newspaper Le Monde describes the operation of the EMS and highlights its impact on the European currency exchange market. Source: Le Monde. dir. de publ. Fauvet, Jacques. 14.03.1979, n° 10 612; 36e année. Paris: Le Monde. "Le marché des changes a bien accueilli l'entrée en vigueur du S.M.E.", auteur:Fabra, Paul , p. 37. Copyright: (c) Translation CVCE.EU by UNI.LU All rights of reproduction, of public communication, of adaptation, of distribution or of dissemination via Internet, internal network or any other means are strictly reserved in all countries. Consult the legal notice and the terms and conditions of use regarding this site. URL: http://www.cvce.eu/obj/foreign_exchange_markets_welcome_the_start_of_the_ems _from_le_monde_14_march_1979-en-c5cf1c8f-90b4-4a6e-b8e8-adeb58ce5d64.html Last updated: 05/07/2016 1/3 Foreign exchange markets welcome the start of the EMS With a little more than three months’ delay, the European Monetary System (EMS) came into force on Tuesday 13 March. The only definite decision taken by the European Council, it was announced in an official communiqué published separately at the end of Monday afternoon. In the official text, the European Council stated that ‘all the conditions had now been met for the implementation of the exchange mechanism of the European Monetary System.’ As a result, the eight full members of the exchange rate mechanism, i.e. all the EEC Member States except for the United Kingdom, which signed the agreement but whose currency will continue to float, have released their official exchange rates. -

Banking Automation Bulletin | Media Pack 2021

Banking Automation BULLETIN Media Pack 2021 Reaching and staying in touch with your commercial targets is more important than ever Curated news, opinions and intelligence on Editorial overview banking and cash automation, self-service and digital banking, cards and payments since 1979 Banking Automation Bulletin is a subscription newsletter Independent and authoritative insights from focused on key issues in banking and cash automation, industry experts, including proprietary global self-service and digital banking, cards and payments. research by RBR The Bulletin is published monthly by RBR and draws 4,000 named subscribers of digital and printed extensively on the firm’s proprietary industry research. editions with total, monthly readership of 12,000 The Bulletin is valued by its readership for providing independent and insightful news, opinions and 88% of readership are senior decision makers information on issues of core interest. representing more than 1,000 banks across 106 countries worldwide Regular topics covered by the Bulletin include: Strong social media presence through focused LinkedIn discussion group with 8,500+ members • Artificial intelligence and machine learning and Twitter @RBRLondon • Biometric authentication 12 issues per year with bonus distribution at key • Blockchain and cryptocurrency industry events around the world • Branch and digital transformation Unique opportunity to reach high-quality • Cash usage and automation readership via impactful adverts and advertorials • Deposit automation and recycling • Digital banking and payments Who should advertise? • Financial inclusion and accessibility • Fintech innovation Banking Automation Bulletin is a unique and powerful • IP video and behavioural analytics advertising medium for organisations providing • Logical, cyber and physical bank security solutions to retail banks. -

Life After PSD2

52 Hogan Lovells Open everything and improved security: life after PSD2 PSD2 is a significant piece of legislation, aimed at disrupting the traditional banking and payment services market, improving competition and promoting innovation. One of the ways it does this is by forcing providers to allow access to customer accounts to disruptors who can offer new services to customers by exploiting the wealth of information which can be obtained through access to customers’ account information. Nearly two years after PSD2 first came into force, how is this brave new era of open banking working out for both sides? What might the next twelve months bring? We provide a snapshot of the current state of play and some crystal ball gazing from our European and UK teams below. It’s not just about disruption though. PSD2 also were potential issues at all stages of payment looks to protect consumers by imposing a higher transactions, impacting retailers, card issuers, level of security for online activity and card merchant acquirers and the major card schemes. payments. This now requires “strong customer A concerted lobbying effort to delay full authentication” or “SCA”– involving 2 out of 3 implementation for online transactions resulted in elements of possession, knowledge or inherence – an EBA opinion, published in June 2019, setting for example, confirming a card payment by typing out a structure for national regulators to allow a in a one-time password sent to a mobile phone. degree of tolerance (or “supervisory flexibility”) Whilst the implementation date for these new for delayed implementation of SCA in their requirements was set for 14 September 2019, it jurisdictions. -

Annexure 2 Standard XML Reporting - Instructions and Specifications

Annexure 2 Standard XML Reporting - Instructions and Specifications - Draft - © FIU Deutschland Last Update: 22-Jan-2018 Table of Contents 1. Summary ...................................................................................................................................................... 1 2. Conventions used in this document ....................................................................................................... 2 3. Description of XML Nodes ........................................................................................................................ 2 3.1 Node “report” ......................................................................................................................... 2 3.2 Subnode report_indicators ..................................................................................................... 5 3.3 Node transaction ..................................................................................................................... 6 3.4 Node Activity (New in Schema 4.0) ......................................................................................... 9 3.5 Node t_from_my_client ........................................................................................................ 10 3.6 Node t_from .......................................................................................................................... 11 3.7 Node t_to_my_client ............................................................................................................ 13 3.8 -

RABO 296 Broch EACB P5.Indd

Co-operative banks: Catalysts for economic and social cohesion in Europe 1 Co-operative Banks: Catalysts for economic and social cohesion in Europe Impressum: European Association of Cooperative Banks (EACB) Contact: E-mail : [email protected] • Telephone: (+ 32 )2 230 11 24 • Web: www.eurocoopbanks.coop © Copyright March 2007: European Association of Co-operative Banks 2 Co-operative Banks: Catalysts for economic and social cohesion in Europe The European Association of Co-operative Banks The Association of Co-operative Banks was established in 1970. It represents, promotes and defends the interests of its members and co-operative banks in general. In this role, the Association is the offi cial spokesman vis-à-vis the European institutions. With a view to fulfi lling these objectives, the mission of the Association is: • To provide information to members on all initiatives and measures taken by the European Union that affect the banking sector; • To organize an exchange of views and experiences and to co-ordinate member organisations’ positions on issues of common interest; • To carry out effi cient and active lobbying of European institutions; • To develop positions on issues of common interest. The European Association of Co-operative Banks fosters co- operation between co-operative banking groups. Furthermore, with the other representative co-operative organisations, the Association promotes the spirit of co-operation throughout the banking sector and beyond. In order to fulfi l these goals, the Association is one of the founding members of the European Banking Industry Committee (EBIC), the European Payments Council (EPC), the former European Committee for Banking Standards (ECBS) and the European Financial Reporting Advisory Group (EFRAG). -

A Responsible Bank for a Sustainable Economy

#POSITIVEBANKING A RESPONSIBLE BANK FOR A SUSTAINABLE ECONOMY 2019 INTEGRATED REPORT The bank for a changing world of service and offer customers the digital solutions which we encourage them to use as a priority. Furthermore, our individual customers can benefit from personalised solutions to give them the flexibility they need at this time of great uncertainty, whether deferring loan repayments, obtaining BNP PARIBAS MOBILISES credit or managing savings and payments. To assist and support companies, especially SMEs and pro- fessional clients affected by the crisis, we are also taking TO TACKLE COVID-19 all necessary measures, such as deferring repayments, faci- litating cash management and providing faster financing. n light of the Covid-19 health crisis, the BNP Paribas, through its businesses, Foundation, and BNP Paribas Group has mobilised to help Rescue & Recover Fund, has been committed since the begin- I customers, support the global economy and ning of the crisis to supporting hospitals, medical research, contribute to assisting those in need. This is and organisations helping the most vulnerable in the com- first of all a particularly difficult and human munity as well as disadvantaged young people facing great ordeal that we are experiencing, and our first thoughts go out difficulty because of the crisis. This action to help the com- to all those whose loved ones have been directly affected by munity has been the focus of our emergency aid plan, put in the epidemic. And as bankers we have a special responsibility place in mid-April and which represents a commitment of to ensure continuity of financial services while helping not only €55 million.