Annual Report 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Supervised Entities (As of 1 September 2020)

List of supervised entities Cut-off date for changes: 1 September 2020 Number of significant entities directly supervised by the ECB: 114 This list displays the significant supervised entities, which are directly supervised by the ECB (part A) and the less significant supervised entities which are indirectly supervised by the ECB (Part B). Based on Article 2(20) of Regulation (EU) No 468/2014 of the European Central Bank of 16 April 2014 establishing the framework for cooperation within the Single Supervisory Mechanism between the European Central Bank and national competent authorities and with national designated authorities (OJ L 141, 14.5.2014, p. 1 - SSM Framework Regulation) a ‘supervised entity’ means any of the following: (a) a credit institution established in a participating Member State; (b) a financial holding company established in a participating Member State; (c) a mixed financial holding company established in a participating Member State, provided that the coordinator of the financial conglomerate is an authority competent for the supervision of credit institutions and is also the coordinator in its function as supervisor of credit institutions (d) a branch established in a participating Member State by a credit institution which is established in a non-participating Member State. The list is compiled on the basis of significance decisions which have been adopted and notified by the ECB to the supervised entity and that have become effective up to the cut-off date. A. List of significant entities directly supervised by the ECB Country of LEI Type Name establishment Grounds for significance MFI code for branches of group entities Belgium Article 6(5)(b) of Regulation (EU) No 1 LSGM84136ACA92XCN876 Credit Institution AXA Bank Belgium SA ; AXA Bank Belgium NV 1024/2013 CVRWQDHDBEPUUVU2FD09 Credit Institution AXA Bank Europe SCF France 2 549300NBLHT5Z7ZV1241 Credit Institution Banque Degroof Petercam SA ; Bank Degroof Petercam NV Significant cross-border assets 54930017BFF0C5RWQ245 Credit Institution Banque Degroof Petercam France S.A. -

Q4 Outlook 2020

Q4 2020 OUTLOOK Banque Havilland is a Private Banking Group established in 2009. The Bank is headquartered in Luxembourg with offices in London, Monaco, Liechtenstein, Dubai and Switzerland. The Group provides private banking, asset and wealth management services and institutional banking services to High Net Worth families and individuals from all over the world. TABLE OF CONTENTS MARKET ENVIRONMENT 4 EQUITIES 9 BONDS 12 COMMODITIES AND CURRENCIES 15 MARKET ENVIRONMENT As we move into the final three months of at home’ theme and certain technological what has been a quite extraordinary year, trends were brought forward by the Covid investors are faced with both imminent outbreak, but even since then the Nasdaq and long-term challenges that on the has rallied a further 30% before the recent surface will require perhaps more intricate pull-back. The performance of growth and and thoughtful planning than has been momentum stocks versus so-called value necessary for some time. stocks has also widened to extreme levels, more so than any point in history, with At global level, the rebound of risk assets earnings per share in the value category since the Covid-inspired nadir of March 23rd having declined by 50% year-on-year by has been so furious that we have reached an aggregate compared with a 15% decline inflection point far earlier than could have for growth. Conversely, many other global been anticipated, as unprecedented central indices are still very much in the red and bank and government stimulus has seen many even then with big gaps between the indices financial assets recover or surpass their pre- of neighbouring economies (eg. -

GLOBAL LIST of FGDR MEMBERS Updated on March 24Th, 2021

GLOBAL LIST OF FGDR MEMBERS Updated on March 24th, 2021 Note : to view the guarantee mechanism(s) (deposit, securities, or performance bonds) of which each institution is a member, please use the 'Bank Search engine' on this web site. CIB DENOMINATION 16688 AGENCE FRANCE LOCALE 41829 Al Khaliji France 12240 Allianz banque 19073 ALPHEYS INVEST 19530 Amundi 14758 Amundi ESR 14328 Amundi finance 17273 Amundi Intermédiation 15638 Andbank Monaco S.A.M. 13383 AQUIS EXCHANGE EUROPE 18979 ARAB BANKING CORPORATION SA 17473 Arfinco 16298 Arkéa banking services 18829 Arkéa banque entreprises et institutionnels 15980 Arkéa crédit bail 14518 ARKEA DIRECT BANK 16088 Arkéa Home Loans SFH 16358 Arkéa public sector SCF 23890 Attijariwafa bank europe 45340 Aurel - BGC 16668 Australia and New Zealand banking group limited 13558 Auxifip 16318 AXA BANK EUROPE SCF 12548 Axa banque 25080 Axa banque financement 15573 Axa épargne entreprise 17188 AXA HOME LOAN SFH 17373 Axa Investment Managers IF 11078 BAIL ACTEA IMMOBILIER 14908 Banca popolare di Sondrio (Suisse) 18089 Bank Audi France 14508 Bank Julius Baer (Monaco) S.A.M. 41259 Bank Melli Iran 18769 Bank of China limited 14879 Bank of India 44269 Bank Saderat Iran 17799 Bank Sepah 17579 Bank Tejarat 12579 Banque BCP 12179 Banque BIA 17499 Banque calédonienne d'investissement - B.C.I. 12468 Banque cantonale de Genève (France) S.A. 17519 Banque centrale de compensation 41439 Banque Chaabi du Maroc 24659 Banque Chabrières 10188 Banque Chalus 30087 Banque CIC Est 30027 Banque CIC Nord Ouest 30047 Banque CIC Ouest -

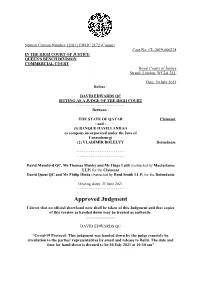

High Court Judgment Template

Neutral Citation Number: [2021] EWHC 2172 (Comm) Case No: CL-2019-000238 IN THE HIGH COURT OF JUSTICE QUEEN'S BENCH DIVISION COMMERCIAL COURT Royal Courts of Justice Strand, London, WC2A 2LL Date: 30 July 2021 Before : DAVID EDWARDS QC SITTING AS A JUDGE OF THE HIGH COURT - - - - - - - - - - - - - - - - - - - - - Between : THE STATE OF QATAR Claimant - and - (1) BANQUE HAVILLAND SA (a company incorporated under the laws of Luxembourg) (2) VLADIMIR BOLELYY Defendants - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - David Mumford QC, Mr Thomas Munby and Mr Hugo Leith (instructed by Macfarlanes LLP) for the Claimant David Quest QC and Mr Philip Hinks (instructed by Reed Smith LLP) for the Defendants Hearing dates: 21 June 2021 - - - - - - - - - - - - - - - - - - - - - Approved Judgment I direct that no official shorthand note shall be taken of this Judgment and that copies of this version as handed down may be treated as authentic. ............................. DAVID EDWARDS QC “Covid-19 Protocol: This judgment was handed down by the judge remotely by circulation to the parties’ representatives by email and release to Bailii. The date and time for hand-down is deemed to be 30 July 2021 at 10:30 am” DAVID EDWARDS QC Qatar v Banque Havilland SA & Another SITTING AS A JUDGE OF THE HIGH COURT Approved Judgment David Edwards QC : Introduction 1. On 5 March 2020 a first case management conference (“CMC”) in this action was heard by Cockerill J. Her order gave directions to trial in the usual way. Paragraph 15 provided that there should be a further CMC on the first available date after 9 December 2020 for the determination of any outstanding matters relating to disclosure and expert evidence. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

DATA PROTECTION NOTICE May 2018 Version the Following Data

DATA PROTECTION NOTICE May 2018 version The following data protection notice applies to the online offering of Advanzia Bank S.A., a Luxembourg financial institution registered in the Luxembourg companies' register under the number B 109 476 and with the following contact details: Advanzia Bank S.A. 9, rue Gabriel Lippmann 5365 Munsbach, Luxembourg Tel. 0800 880 2120 Fax 00352 263875 699 [email protected] www.advanzia.com Advanzia Bank S.A. ("we", "us" or "our") collects and processes information about natural persons, who are our customers or those of partner banks, for whom we issue credit cards ("you" or "your"). This data protection notice provides information about what information we collect, how and why we process it, and with whom we share it. This notice applies to all aforementioned natural persons, regardless of their place of residence and the type of service or product, offered by us. The data protection notice should be read along with the general terms and conditions, which are notified to you at the beginning of the business relationship and which describe the product we offer. We must collect and process certain information about you in order to conclude and execute a contract with you, as well as to maintain our contractual relationship. Unless you provide us with such information, we may not be able to enter into, execute or fulfil any contract with you. We will notify you of the rejection of your application or termination of the contract that may result from your refusal to provide us with certain information or to exercise your statutory rights. -

UCITS IV Plenum CAT Bond Fund

UCITS IV Trust Agreement Including the fund-specific Appendix and Prospectus July 1st 2016 Plenum CAT Bond Fund UCITS according to Liechtenstein law in the legal form of a trusteeship (hereinafter referred to as “UCITS”) (Single fund) Management Company CAIAC Fund Management AG Haus Atzig, Industriestrasse 2, FL-9487 Bendern, www.caiac.li Plenum CAT Bond Fund Trust Agreement & Prospectus Organization of the UCITS at a glance Management Company: CAIAC Fund Management AG Haus Atzig, Industriestrasse 2, FL-9487 Bendern Board of Directors: Dr. Roland Müller Dr. Dietmar Loretz Gerhard Lehner Executive Board: Thomas Jahn Raimond Schuster Asset manager: Plenum Investments AG Brandschenkestrasse 41, CH-8002 Zürich Custodian: Banque Havilland (Liechtenstein) AG Austrasse 61, FL-9490 Vaduz Share register: Banque Havilland (Liechtenstein) AG Austrasse 61, FL-9490 Vaduz Sales Office: CAIAC Fund Management AG Haus Atzig, Industriestrasse 2, FL-9487 Bendern Auditor UCITS: Deloitte (Liechtenstein) AG Landstrasse 123, FL-9495 Triesen Auditor Management Company: ReviTrust Grant Thornton AG Bahnhofstrasse 15, FL-9494 Schaan Representatives and Distributors ACOLIN Fund Services AG in Switzerland: Affolternstrasse 56, CH-8050 Zürich Paying agent in Switzerland: Frankfurter Bankgesellschaft (Switzerland) AG Börsenstrasse 16, P.O. Box, CH-8022 Zurich Paying and information agent DZ BANK AG in Germany: Platz der Republik 60, D-60265 Frankfurt Paying agent in Austria: Erste Bank der österreichischen Sparkassen AG Graben 21, A-1010 Vienna Tax representative in -

Banking Automation Bulletin | Media Pack 2021

Banking Automation BULLETIN Media Pack 2021 Reaching and staying in touch with your commercial targets is more important than ever Curated news, opinions and intelligence on Editorial overview banking and cash automation, self-service and digital banking, cards and payments since 1979 Banking Automation Bulletin is a subscription newsletter Independent and authoritative insights from focused on key issues in banking and cash automation, industry experts, including proprietary global self-service and digital banking, cards and payments. research by RBR The Bulletin is published monthly by RBR and draws 4,000 named subscribers of digital and printed extensively on the firm’s proprietary industry research. editions with total, monthly readership of 12,000 The Bulletin is valued by its readership for providing independent and insightful news, opinions and 88% of readership are senior decision makers information on issues of core interest. representing more than 1,000 banks across 106 countries worldwide Regular topics covered by the Bulletin include: Strong social media presence through focused LinkedIn discussion group with 8,500+ members • Artificial intelligence and machine learning and Twitter @RBRLondon • Biometric authentication 12 issues per year with bonus distribution at key • Blockchain and cryptocurrency industry events around the world • Branch and digital transformation Unique opportunity to reach high-quality • Cash usage and automation readership via impactful adverts and advertorials • Deposit automation and recycling • Digital banking and payments Who should advertise? • Financial inclusion and accessibility • Fintech innovation Banking Automation Bulletin is a unique and powerful • IP video and behavioural analytics advertising medium for organisations providing • Logical, cyber and physical bank security solutions to retail banks. -

The 2008 Icelandic Bank Collapse: Foreign Factors

The 2008 Icelandic Bank Collapse: Foreign Factors A Report for the Ministry of Finance and Economic Affairs Centre for Political and Economic Research at the Social Science Research Institute University of Iceland Reykjavik 19 September 2018 1 Summary 1. An international financial crisis started in August 2007, greatly intensifying in 2008. 2. In early 2008, European central banks apparently reached a quiet consensus that the Icelandic banking sector was too big, that it threatened financial stability with its aggressive deposit collection and that it should not be rescued. An additional reason the Bank of England rejected a currency swap deal with the CBI was that it did not want a financial centre in Iceland. 3. While the US had protected and assisted Iceland in the Cold War, now she was no longer considered strategically important. In September, the US Fed refused a dollar swap deal to the CBI similar to what it had made with the three Scandinavian central banks. 4. Despite repeated warnings from the CBI, little was done to prepare for the possible failure of the banks, both because many hoped for the best and because public opinion in Iceland was strongly in favour of the banks and of businessmen controlling them. 5. Hedge funds were active in betting against the krona and the banks and probably also in spreading rumours about Iceland’s vulnerability. In late September 2008, when Glitnir Bank was in trouble, the government decided to inject capital into it. But Glitnir’s major shareholder, a media magnate, started a campaign against this trust-building measure, and a bank run started. -

Life After PSD2

52 Hogan Lovells Open everything and improved security: life after PSD2 PSD2 is a significant piece of legislation, aimed at disrupting the traditional banking and payment services market, improving competition and promoting innovation. One of the ways it does this is by forcing providers to allow access to customer accounts to disruptors who can offer new services to customers by exploiting the wealth of information which can be obtained through access to customers’ account information. Nearly two years after PSD2 first came into force, how is this brave new era of open banking working out for both sides? What might the next twelve months bring? We provide a snapshot of the current state of play and some crystal ball gazing from our European and UK teams below. It’s not just about disruption though. PSD2 also were potential issues at all stages of payment looks to protect consumers by imposing a higher transactions, impacting retailers, card issuers, level of security for online activity and card merchant acquirers and the major card schemes. payments. This now requires “strong customer A concerted lobbying effort to delay full authentication” or “SCA”– involving 2 out of 3 implementation for online transactions resulted in elements of possession, knowledge or inherence – an EBA opinion, published in June 2019, setting for example, confirming a card payment by typing out a structure for national regulators to allow a in a one-time password sent to a mobile phone. degree of tolerance (or “supervisory flexibility”) Whilst the implementation date for these new for delayed implementation of SCA in their requirements was set for 14 September 2019, it jurisdictions. -

RABO 296 Broch EACB P5.Indd

Co-operative banks: Catalysts for economic and social cohesion in Europe 1 Co-operative Banks: Catalysts for economic and social cohesion in Europe Impressum: European Association of Cooperative Banks (EACB) Contact: E-mail : [email protected] • Telephone: (+ 32 )2 230 11 24 • Web: www.eurocoopbanks.coop © Copyright March 2007: European Association of Co-operative Banks 2 Co-operative Banks: Catalysts for economic and social cohesion in Europe The European Association of Co-operative Banks The Association of Co-operative Banks was established in 1970. It represents, promotes and defends the interests of its members and co-operative banks in general. In this role, the Association is the offi cial spokesman vis-à-vis the European institutions. With a view to fulfi lling these objectives, the mission of the Association is: • To provide information to members on all initiatives and measures taken by the European Union that affect the banking sector; • To organize an exchange of views and experiences and to co-ordinate member organisations’ positions on issues of common interest; • To carry out effi cient and active lobbying of European institutions; • To develop positions on issues of common interest. The European Association of Co-operative Banks fosters co- operation between co-operative banking groups. Furthermore, with the other representative co-operative organisations, the Association promotes the spirit of co-operation throughout the banking sector and beyond. In order to fulfi l these goals, the Association is one of the founding members of the European Banking Industry Committee (EBIC), the European Payments Council (EPC), the former European Committee for Banking Standards (ECBS) and the European Financial Reporting Advisory Group (EFRAG). -

Page 01 New Nov 10.Indd

3rd Best News Website in the Middle East BUSINESSB | 17 QATAR SPORT | 24 UNDER SIEGE Qatar-India trade TH Maikel guides VDL volume at 159 Groep Verdi Tn to QR31bn last year DAY spectacular win Friday 10 November 2017 | 21 Safar 1439 www.thepeninsulaqatar.com Volume 22 | Number 7341 | 2 Riyals Emir performs Emir visits Emiri Guard buildings at Barzan Camp Istisqaa prayer Emir H H Sheikh Tamim bin Hamad Al Thani visited the Emiri Guard buildings at the Barzan Camp yesterday morning. During the visit, the Emir was briefed on the various facilities at the camp and listened to a detailed explanation about the technical equipment that it contains. mir H H Sheikh Tamim bin Hamad Al Thani performed the Istisqaa (rain-seeking) prayer Eat Al-Wajbah prayer ground yesterday Emir invites morning. Exposed: UAE planned to wage H H Sheikh Jassim bin Hamad Al Thani, Per- Advisory Council sonal Representative of H H the Emir; H H Sheikh Abdullah bin Khalifa Al Thani and H E Sheikh Jas- to convene on sim bin Khalifa Al Thani took part in the prayer. financial war, steal FIFA 2022 A number of Their Excellencies Sheikhs and November 14 Ministers, Speaker of the Advisory Council, his Dep- uty and members of the Council, as well as a mir H H Sheikh Tamim gathering of citizens also performed the prayer. The plan was found in the bin Hamad Al Thani UAE planned to force Qatar to share 2022 World Cup, In a sermon after the prayer, Dr. Sheikh Thaqeel task folder of an email Eissued yesterday Decree Al Shammari urged the worshippers to repent, ask according to the outline.