EBA CLEARING Shareholders Meeting Report of the Board 30 Th June 2009 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Capital FI SRI - PVC H USD

April 2021 Lazard Capital FI SRI - PVC H USD International bonds and debt securities Share classes ISIN code* NAV $ Net assets ($ million) Total net assets (€ million) PVC H-USD Unit FR0013072733 1 603,87 5,24 821,14 * Not all share classes of the relevant sub-fund are registered for marketing in German and Austria MANAGEMENT INVESTMENT POLICY The fund’s investment objective is to outperform the Barclays Global Contingent Capital € Hedged index for units PVC EUR, PVD EUR, RVC EUR, RVD EUR, SC EUR and TVD EUR, Barclays Global Contingent Capital Hedged USD for unit PVC H-USD and Barclays Global Contingent Capital Hedged CHF for PVC H-CHF. To attain this objective, the strategy will rely on an active management of the portfolio mainly invested in subordinated securities (this type of debt is more risky than Senior Unsecured or Securitized debts), or any securities, not considered as common stocks, issued by European financial institutions. The investment process combine both a Top-down approach (strategic and geographical allocation approach which takes into consideration the macro and sectorial environments) and a Bottom-up approach (stock-picking based on fundamental analysis of the issuer and its securities) and then integrating the regulatory environment in which this asset class evolves. The modified duration will be managed in a 0 to 8 range. The fund only invests in bonds or securities issued by companies having their head office in an OECD member country and/or in issues or securities listed in a stock market of one of these countries.The FCP invests only in obligations negotiated in Euro, USD or Sterling. -

KPMG Oy Ab 2014–2015

Läpinäkyvyys- kertomus KPMG Oy Ab 2014–2015 KPMG.fi ”KPMG Oy Ab:n läpinäkyvyys- kertomus 30.9.2015 päätty- neeltä tilikaudelta antaa tietoa siitä, miten yhtiömme organi- saatio ja hallinnointi on järjes- tetty ja kuinka huolehdimme työmme laadusta ja riskien- hallinnasta.” Sisällys Toimitusjohtajalta 03 Organisaatio ja hallinnointi 05 Hallitus 08 Johtoryhmä 09 Laadunvalvontajärjestelmä 10 Liitteet Liite 1 19 Yleisen edun kannalta merkittävät tilintarkastusasiakkaamme 19 Liite 2 23 Konsernin organisaatio 23 Toimitusjohtajalta KPMG Oy Ab:n läpinäkyvyyskertomus 30.9.2015 päät- tyneeltä tilikaudelta antaa tietoa siitä, miten yhtiömme organisaatio ja hallinnointi on järjestetty ja kuinka huoleh- dimme työmme laadusta ja riskienhallinnasta. Toimialamme muuttuvassa toiminta- ja sääntely-ympäristössä ensiluokkai- sen laadun ja riippumattomuuden varmistaminen edellyttää toimintatapojemme jatkuvaa arviointia ja kehittämistä. Tilintarkastusalaa koskevaan sääntelyyn on tekeillä merkittäviä muutoksia Suomessa ja EU:ssa. Kasvavien vaatimusten lisäksi uusi sääntely tarjoaa myös uusia liiketoimintamahdollisuuksia ja uudenlaisia monipuolisia urapolkuja henkilöstöllemme. Osallistumme aktiivisesti uuteen sääntelyyn liittyvään vuoropuheluun ja käytännön tulkintoihin ja haluamme parhaamme mukaan tukea toimi- alan kehittämistä. Meille on kunnia-asia, että teemme työmme laadukkaasti. Läpinäkyvyys ja avoin keskustelu sidosryhmiemme kanssa ja KPMG:n sisällä tukevat toimintamme laatua ja riippumat- tomuutta. Käytössämme on KPMG:n kansainvälisen verkos- ton laajat -

BRANDFINANCE Banking

BRANDFINANCE® banKING 500 THE ANNUAL REPORT ON THE World’S MOST VALUABLE Banking brands | MARCH 2013 Is the global banking crisis nearly over? 2 | BRANDFINANCE® BANKING 500 | MARCH 2013 Contents Contents BRANDFINANCE® 3 FOREWORD BANKING 500 4 EXECUTIVE SUMMARY The BrandFinance® Banking 500 Is the global banking crisis nearly over? is published by Brand Finance plc and is the only study to rank the 6 THE TOP 20: PROFILES top 500 most valuable banks in Worthy winners the world A run-down of the world’s most valuable banking brands 15 WINNERS AND LOSERS East beats West Agricultural Bank of China enjoyed the biggest gain in brand value this year, and HSBC suffered the biggest loss Brand Finance plc 3rd Floor, Finland House, 16 REGIONAL RESULTS 56 Haymarket, London A shifting picture SW1Y 4RN United Kingdom The overall result masks important regional and country Tel: +44 (0) 207 389 9400 variations Fax: +44 (0) 207 389 9401 www.brandfinance.com 19 SECTOR RESULTS [email protected] 20 BANKING FORUM 2013 Welcome to the age of Apple Bank? Pundits at Brand Finance’s fourth annual Banking Forum in February challenged banks to think outside the banking box when it comes to customer focus. 24 METHODOLOGY How do we value brands? 25 BESPOKE REPORTS 26 THE TOP 500 MOST VALUABLE BANKING BRANDS Five pages of league table results Publishing partner Every year the BrandFinance® Banking 500 is published by The Banker magazine, the world’s premier banking and finance resource MARCH 2013 | BRANDFINANCE® BANKING 500 | 3 Foreword David Haigh CEO Brand Finance plc The improved performance of banks around the world reflects a concerted effort‘ to get their houses in order Since it was first compiled THE STORM CLOUDS over the global ’increasingly targeted at the specific needs in 2005 the BrandFinance® banking industry seem, at last, to be clearing. -

Elenco Collocatori Robeco Capital Growth Fund

ROBECO CAPITAL GROWTH FUNDS Società d’Investimento a Capitale Variabile – SICAV ELENCO DEI SOGGETTI INCARICATI DEL COLLOCAMENTO IN ITALIA Denominazione Soggetto Collocatore Classi Collocate Soggetto incaricato dei pagamenti Alpenbank AG Filiale Bolzano** D, DH, B, BH, E, EH Allfunds Bank S.A. Milan Branch Alto Adige Banca S.p.A.** D, DH, B, BH, E, EH Allfunds Bank S.A. Milan Branch Azimut Capital Management SGR S.p.a** D, DH, B, BH, E, EH Allfunds Bank S.A. Milan Branch Banca Aletti S.p.A.** D, DH, B, BH, E, EH Allfunds Bank S.A. Milan Branch Banca CARIGE S.p.A.** D, DH, B, BH, E, EH Allfunds Bank S.A. Milan Branch Banca Cesare Ponti S.p.A.** D, DH, B, BH, E, EH Allfunds Bank S.A. Milan Branch Banca del Monte di Lucca S.p.A.** D, DH, B, BH, E, EH Allfunds Bank S.A. Milan Branch Banca di Pisa e Fornacette S.C.P.A.** D, DH, B, BH, E, EH Allfunds Bank S.A. Milan Branch Banca Finnat Euramerica S.p.A** D, DH, B, BH, E, EH Allfunds Bank S.A. Milan Branch Banca Generali S.p.A.** D, DH, B, BH, E, EH Allfunds Bank S.A. Milan Branch Banca Ifigest S.p.A. D, DH, B, BH, E, EH Société Générale Securities Services S.p.A. Banca Leonardo S.p.A.* D, DH, B, BH, E, EH BNP Paribas Securities Services Banca Nazionale del Lavoro S.p.A. D, DH, B, BH, E, EH BNP Paribas Securities Services Banca Popolare del Lazio S.c.p.A.** D, DH, B, BH, E, EH Allfunds Bank S.A. -

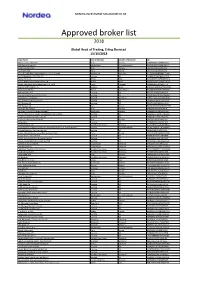

External Borkers List

NORDEA INVESTMENT MANAGEMENT AB Approved broker list 2018 Global Head of Trading, Erling Skorstad 15/10/2018 Legal Name City of Domicile Country of Domicile LEI ABG Sundal Collier ASA Oslo Norway 2138005DRCU66B8BNY04 ABN Amro Group NV Amsterdam The Netherlands BFXS5XCH7N0Y05NIXW11 Arctic Securities AS Oslo Norway 5967007LIEEXZX4RVS72 Aurel BGC SAS Paris France 5RJTDGZG4559ESIYLD31 Australia and New Zealand Banking Group Limited Melbourne Australia JHE42UYNWWTJB8YTTU19 AUTONOMOUS RESEARCH LLP London UK 213800LBM6PT85IGM996 Banca IMI S.p.A Milan Italy QV4Q8OGJ7OA6PA8SCM14 Banco Bilbao Vizcaya Argentaria S.A Bilbao Spain K8MS7FD7N5Z2WQ51AZ71 Banco Português de Investimento, S.A. (BPI) Porto Portugal 213800NGLJLXOSRPK774 BANCO SANTANDER S.A Madrid Spain 5493006QMFDDMYWIAM13 Bank Vontobel AG Zurich Switzerland 549300L7V4MGECYRM576 Barclays Bank PLC London UK G5GSEF7VJP5I7OUK5573 Barclays Capital Securities Limited London UK K9WDOH4D2PYBSLSOB484 Bayerische Landesbank Munich Germany VDYMYTQGZZ6DU0912C88 BCS Prime Brokerage Limited London UK 213800UU8AHE2B6QUI26 BGC Brokers LP London UK ZWNFQ48RUL8VJZ2AIC12 BNP Paribas SA Paris France R0MUWSFPU8MPRO8K5P83 Carnegie AS Norway Oslo Norway 5967007LIEEXZX57BC18 Carnegie Investment Bank AB (publ) Stockholm Sweden 529900BR5NZNQZEVQ417 China International Capital Corporation (UK) Limited London UK 213800STG3UV87MDGA96 Citigroup Global Markets Limited London UK XKZZ2JZF41MRHTR1V493 Clarksons Platou Securities AS Oslo Norway 5967007LIEEXZXA40G44 CLSA (UK) London UK 213800VZMAGVIU2IJA72 Commerzbank AG Frankfurt -

Report of the Board Annual General Meeting 12Th June 2014 Contents

Report of the Board Annual General Meeting 12th June 2014 Contents Executive Summary 3 1. Report on EBA Activities in 2013 and outlook for 2014+ 5 1.1 Report on work streams 5 1.2 Marketing and communications 8 1.3 Changes in the Board of the Association 9 1.4 Changes in EBA membership 11 1.5 Outlook for 2014+ 11 2. Financial situation, P&L statement as of 31st December 2013 17 2.1 Overall expenses incurred in 2013 17 2.2 Revenues in 2013 18 2.3 Income tax and results for 2013 20 2.4 EBA budget for 2014 20 2.5 Projected revenues for 2014 21 Appendix 1: 23 Accounts as of 31st December 2013 23 Appendix 2: 24 List of EBA Full Members 24 List of EBA User Members 26 List of EBA Associate Members 29 layout: www.quadratpunkt.de photo credit: © fotolia.com / Julien Eichinger 2 Euro Banking Association ANNUAL GENERAL MEETING // 12th June 2014 // Report of the Board Executive Summary As a community of like-minded European payment practitioners, EBA continued to capture the demands of its members and the wider payments industry throughout 2013. The activities undertaken in pursuit of the overarching strategy for the Association evolved during the year to reflect changing market realities. The EBA has a very simple set of objectives. To serve its members by delivering value in three strategic pillars, each designed to deliver benefits to their wholesale and retail payment divisions. Each strategic pillar is reflective of specific work initiatives. 1. Thought Leadership – to help members develop policies, strategies and roadmaps for rapid and complex payments change. -

Press Release Fitch Has Downgraded the Long Term

PRESS RELEASE FITCH HAS DOWNGRADED THE LONG TERM ISSUER DEFAULT RATINGS OF CREDITO VALTELLINESE AND THE SUBSIDIARY CREDITO ARTIGIANO FROM BBB TO BB+ OUTLOOK NEGATIVE Sondrio, 29 August 2012. Fitch Ratings has downgraded the Long-term Issuer Default Ratings (IDR) of Credito Valtellinese and its subsidiary Credito Artigiano as follows: LONG TERM IDR: form (BBB) to (BB+); Outlook Negative SHORT TERM IDR: from F3 to B VIABILITY RATING: from (bbb) to (bb+). The rating actions follow a periodic review of several mid-sized banking groups. The Negative Outlook on the banks’ Long-term IDRs reflects the pressure arising from the current challenges in the operating environment. The full text of Fitch Ratings press release follows. Company contacts Investor relations Media relations telephone + 39 02 80637471 telephone + 39 02 80637403 Email: [email protected] Email: [email protected] FITCH DOWNGRADES 7 ITALIAN MID-SIZED BANKS; AFFIRMS 2 Fitch Ratings-Milan/London-28 August 2012: Fitch Ratings has downgraded the Long-term Issuer Default Ratings (IDR) of Banca Popolare di Sondrio (BPSondrio) and Banco di Desio e della Brianza (BDB) to 'BBB+' from 'A-', and the Long-term IDR of Banca Popolare di Milano (BPMilano) to 'BBB-' from 'BBB'. The agency has also downgraded the Long-term IDRs of Banca Carige, Banca Popolare di Vicenza (BPVicenza), Credito Valtellinese (CreVal) and Veneto Banca to 'BB+' from 'BBB'. Simultaneously, Fitch has affirmed the Long-term IDRs of Banca Popolare dell'Emilia Romagna (BPER) at 'BBB' and of Credito Emiliano (Credem) at 'BBB+'. The Outlooks on all the banks' Long-term IDRs is Negative. A full list of rating actions is at the end of this rating action commentary. -

A New Era in Retail Banking 2Q: a Record Quarter Acquisitions Fire up Growth Strategy

03 August 2007 A new era in retail banking 2Q: A record quarter Acquisitions fire up growth strategy ING Shareholder 03 – August 2007 Dear reader, In the past few months, ING has been in the ING’s goal is to be a leading global provider of This magazine is a quarterly publication news with several major announcements about wealth accumulation and retirement services for by ING Group for shareholders and others acquisitions, divestments and a major investment individuals. ING’s three insurance executive board interested in ING. in the Dutch retail banking market. They are all members, Jacques de Vaucleroy, Tom McInerney Subscribe to ING Shareholder part of ING’s strategy of efficiently using capital and Hans van der Noordaa explain how insurance Fax (+3) 4 65 2 25 to create long term growth. In this issue, we take is changing and how companies such as ING Mail P.O. Box 258, 5280 AG Boxtel a look at some of these projects and discuss the have the capacity to play a major role in wealth The Netherlands strategy underlying them. In the Netherlands, the accumulation. Internet: www.ing.com Postbank and ING Bank combination was indeed big news. As our story explains, it is all about In the ten years ING Direct has been in business, Editorial office bringing together the best of both entities and the direct bank has become the largest direct ING Group, Corporate Communications building a bank with the best selected range of bank in the world. We profile one of ING Direct’s Investor Relations Department products and services. -

CE Banking Outlook Winning in the Digital Arms Race October 2016 Contents

CE Banking Outlook Winning in the Digital Arms Race October 2016 www.deloitte.com\cebankingoutlook Contents Foreword Index of Banks Covered by Digital Maturity Executive Summary Analysis Banking Outlook Contacts in Central Europe Bulgaria Croatia The Czech Republic Hungary Poland Romania Slovakia Slovenia Foreword Although the performance of the banking sector in Central (1.3-1.5 percentage points above the eurozone). This relatively Foreword Europe (CE) is shifting up a gear as lending growth accelerates healthy economy has led a faster recovery of loan growth in CE to Executive and asset quality improves, profitability is still well below 3.4% y/y in 2015 (3 p.p. above Euro area) and should allow a further Summary pre-crisis levels. With low interest rates driving margin pick up to 5.0% y/y in 2018. Banking compression and a rising regulatory burden, banks need to Outlook improve operating efficiency. Asset quality has also been improving, with the non-performing loan Banks covered (NPL) ratio in CE down from a peak of 11.0% in 2013 to 8.8% in 2015 by Digital Maturity The digital maturity of banks in CE countries varies greatly but and is expected to fall to a level of 7.0% in 2018. As the region’s digitalization is a strategic priority for all. It can not only provide a key recovery progresses, the disparities between the leading countries in Contacts avenue for banks to reduce their cost to serve, it is also an imperative the north (Poland, the Czech Republic and Slovakia) and those in the that enables them to keep pace with the expectations of customers south (Hungary, Romania, Bulgaria, Croatia and Slovenia) are who are increasingly online and mobile. -

Finnish Banking in 2013 Publications and Surveys 2014

FINNISH BANKING IN 2013 PUBLICATIONS AND SURVEYS 2014 30 APRIL 2014 FINNISH BANKING IN 2013 | 1 FINNISH BANKING IN 2013 2 | FINNISH BANKING IN 2013 CONTENTS 1 Financial environment 2 2 Banks operating in Finland 3 2.1 Market shares of credit institutions in Finland 5 2.2 Banking group employees and offi ces 6 2.3 Fast growth in corporate lending 7 2.4 Slowing growth in housing loans 8 2.5 Good access to funding 9 2.6 Banking tax added to banks’ costs in 2013 10 2.7 Banks maintained strong capital adequacy 11 Appendix: Banking groups’ performance 2012–2013 FINNISH BANKING IN 2013 | 3 FINNISH BANKING IN 2013 1 FINANCIAL ENVIRONMENT The Finnish banking sector attained relatively good non-performing claims. Tightening regulation and a new results and maintained its capital adequacy despite the banking tax also created new costs that will be present challenging operating environment. Banks adapted to in the future as well. changes by cutting back on personnel, closing offi ces, making corporate restructurings and renewing their Banks’ tightening capital adequacy and liquidity business models. These changes stem from tightening requirements imposed by the CRR and CRD IV will enter regulation, weak macro-economic development, gradually into force starting 2014. They will manifest as low overall interest rate level, and services moving tightening lending conditions, and will encourage banks increasingly online. to be careful with risk-prone lending. Banks operating in Finland have good capital adequacy, however, enabling Low interest rates lowered banks’ net interest income, access to inexpensive funding, which supports their threatening their core profi tability. -

Monte Titoli

Monte Titoli PARTECIPANTI AL SERVIZIO DI RISCONTRO E RETTIFICA GIORNALIERO X-TRM - 30 settembre 2014 PARTICIPANTS IN THE X-TRM - DAILY MATCHING AND ROUTING SERVICE - 30 th September 2014 CODICE CED CODICE ABI DESCRIZIONE ANAGRAFICA INTERMEDIARIO PARTECIPANTE CED CODE ABI CODE INTERMEDIARY 2331 1003 BANCA D'ITALIA 425 1005 BANCA NAZIONALE DEL LAVORO SPA 339 1010 SANPAOLO BANCO DI NAPOLI 382 1015 BANCO DI SARDEGNA SPA 3319 1025 INTESA SANPAOLO SPA 357 1030 BANCA MONTE DEI PASCHI DI SIENA SPA 1550 2008 UNICREDIT BANCA SPA 564 3011 HIPO ALPE ADRIA BANK SPA 2187 3015 BANCA FINECO SPA 2470 3017 INVEST BANCA SPA 2281 3025 BANCA PROFILO SPA 8664 3030 DEXIA CREDIOP SPA 302 3032 CREDITO EMILIANO SPA 7504 3041 UBS (ITALIA) SPA 4197 3043 BANCA INTERMOBILIARE INV. GESTIONI SPA 1994 3045 BANCA AKROS SPA 3301 3048 BANCA DEL PIEMONTE SPA 303 3051 BARCLAYS BANK PLC 3892 3058 CHEBANCA! 3049 3059 BANCA CIS SPA 1740 3062 BANCA MEDIOLANUM SPA 1105 3069 INTESA SANPAOLO SPA 547 3075 BANCA GENERALI SPA 4690 3081 UNICREDIT BANK AG 644 3084 BANCA CESARE PONTI SPA 560 3087 BANCA FINNAT EURAMERICA SPA 5937 3089 CREDIT SUISSE (ITALY) SPA 580 3102 BANCA ALETTI E C. SPA 308 3104 DEUTSCHE BANK SPA 315 3111 UNIONE DI BANCHE ITALIANE SCPA 2657 3124 BANCA DEL FUCINO SPA 1050 3126 GRUPPO BANCA LEONARDO SPA 3964 3127 UNIPOL BANCA SPA 1210 3138 BANCA REALE 3768 3141 BANCA DI TREVISO S.p.A. 3636 3151 HYPO TIROL BANK AG SUCCURSALE ITALIA 1862 3158 BANCA SISTEMA SPA 1847 3162 MORGAN STANLEY BANK INTERNATIONAL LIMITED - MILAN BRANCH 1770 3163 STATE STREET BANK S.p.A. -

Annual Report 2013

AKTIA BANK PLC ANNUAL REPORT 2013 Bank | Asset Management | Insurance | Real Estate Agency Aktia provides individual Operating income and Net Interest Income (NII) solutions in banking, asset 300 227.0 224.2 217.9 218.5 management, insurance 201.9 200 and real estate services. 149.2 152.2 112.6 117.3 128.6 Aktia operates in the Hel- EUR million 100 sinki region, in the coastal 0 area and in growth centres 2013 2012 2011 2010 2009 of Finland. Operating income NII Operating profi t from continuing operations 100 80 76.2 65.4 60 56.0 54.7 44.6 The year 40 EUR million 20 2013 in brief 0 2013 2012 2011 2010 2009 . Operating pro t from continuing Earnings and dividend per share operations was EUR 65.4 (56.0) million 1,0 and the pro t for the year from continuing 0.83 0.78 operations was EUR 52.4 (40.3) million. 0,8 0.74 Earning per share stood at EUR 0.78 (0.74). 0,6 0.53 0.52 EUR . Write-downs on credits and other 0,4 commitments decreased to EUR 2.7 (6.4) million. 0,2 . The Board of Directors propose a 0,0 higher dividend of EUR 0.42 (0.36). 2013 2012 2011 2010 2009 Earnings per share (EPS) Dividend per share . Aktia Bank plc is the new parent company for the Group. As part of the Action Plan Capital adequacy ratio 2015, Aktia plc was merged into Aktia Bank plc 1 July 2013 with the aim to reduce costs.