Annual Report 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bgl Bnp Paribas

“COMMIT TO MORE SUSTAINABLE, BETTER SHARED GROWTH” GEOFFROY BAZIN, CEO BGL BNP PARIBAS 2018 SUSTAINABILITY REPORT 2018 SUSTAINABILITY REPORT The gardens of the BGL BNP Paribas head office 2018 SUSTAINABILITY REPORT CONTENT 01 MESSAGE FROM GEOFFROY BAZIN 6 02 BGL BNP PARIBAS IN A NUTSHELL 8 03 OUR CSR APPROACH 18 04 THE 4 PILLARS OF OUR CSR APPROACH 24 Our economic responsibility 26 Our civic responsibility 30 Our social responsibility 34 Our environmental responsibility 38 05 NON-FINANCIAL RATINGS 42 GLOSSARY 44 USEFUL LINKS 45 01 MESSAGE FROM GEOFFROY BAZIN Country Manager, BNP Paribas Group in Luxembourg, Chairman of the BGL BNP Paribas Executive Committee 01 Message from Geoffroy Bazin Geoffroy Message from We commit to continually improving the integration of social and environmental responsibility into the bank’s operational processes and major projects, while inventing new solutions and partnerships combining support for our clients and benefits to the world around us. We are readying ourselves for causes for which we have powerful leverage, by converging commercial offer, partnerships, employer actions, procurement policies, inclusive projects, sponsorship, volunteering and intrapreneurship. Beyond our responsibilities towards our clients, employees, society and the environment, we have identifiedfour priorities on which to focus our efforts: Climate , by acting in conjunction with our clients and partners as an accelerator for energy transition, and focusing on renewable energy, energy efficiency, sustainable mobility and the circular economy. Geoffroy Bazin Youth, by facilitating their inclusion in society, supporting the projects they value most and For nearly 100 years, BGL BNP Paribas has been strengthening intergenerational dialogue. one of the largest financial institutions in the Entrepreneurs , by encouraging creativity and deve- Grand Duchy. -

English Annual Report 2013

Déclaration du Conseil d’administration Annual report 2013 bgl.lu 1 Légende oeuvre ANNUAL REPORT 2013 The SELECTED WORKS exhibition As a corporate citizen BGL BNP Paribas is one of the Overall, this exhibition consisted of objects from main partners in the arts and cultural communities of the 1980s and 1990s and allowed the public to Luxembourg. Our institution supports art and creativity discover the works of artists such as Frank Stella, Roy and therefore hosts each year on its premises a number Lichtenstein, Claude Viallat, Günther Förg, A.R. Penck of prestigious exhibitions from famous museums and Fernand Roda, Imi Knoebel, Emil Schumacher, Jan Voss, of artists with local and international fame. Markus Lüpertz, Sam Francis and Rosemarie Trockel and thereby a wide range of artistic movements such The SELECTED WORKS exhibition which was held from as pop art recent research into pictorial forms or even 10 January to 28 February 2014 in the Private Banking conceptual art. Centre – the “Villa” of BGL BNP Paribas presented works from the private collection of the Bank to the The photos published in this Annual Report, represent public for the first time. those works of art which were on show in the SELECTED WORKS exhibition. Cover: Frank Stella (*1936) - The Prophet, 1990 - De la série Moby Dick - Acrylic on wood and metal ANNUAL REPORT 2013 Contents 12 Per Kirkeby (*1938) - Sans Titre, 1991 - Mixed technique on paper Contents Consolidated key figures 07 BGL BNP Paribas and its shareholders 09 The Group BNP Paribas in Luxembourg 10 History -

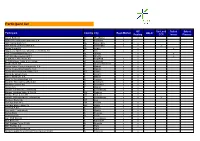

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

A Responsible Bank for a Sustainable Economy

#POSITIVEBANKING A RESPONSIBLE BANK FOR A SUSTAINABLE ECONOMY 2019 INTEGRATED REPORT The bank for a changing world of service and offer customers the digital solutions which we encourage them to use as a priority. Furthermore, our individual customers can benefit from personalised solutions to give them the flexibility they need at this time of great uncertainty, whether deferring loan repayments, obtaining BNP PARIBAS MOBILISES credit or managing savings and payments. To assist and support companies, especially SMEs and pro- fessional clients affected by the crisis, we are also taking TO TACKLE COVID-19 all necessary measures, such as deferring repayments, faci- litating cash management and providing faster financing. n light of the Covid-19 health crisis, the BNP Paribas, through its businesses, Foundation, and BNP Paribas Group has mobilised to help Rescue & Recover Fund, has been committed since the begin- I customers, support the global economy and ning of the crisis to supporting hospitals, medical research, contribute to assisting those in need. This is and organisations helping the most vulnerable in the com- first of all a particularly difficult and human munity as well as disadvantaged young people facing great ordeal that we are experiencing, and our first thoughts go out difficulty because of the crisis. This action to help the com- to all those whose loved ones have been directly affected by munity has been the focus of our emergency aid plan, put in the epidemic. And as bankers we have a special responsibility place in mid-April and which represents a commitment of to ensure continuity of financial services while helping not only €55 million. -

The Bank for a Changing World ANNUAL REPORT 2016 ANNUAL REPORT 2016 CONTENTS SOMMAIRE

ANNUAL REPORT The bank for a changing world ANNUAL REPORT 2016 ANNUAL REPORT 2016 CONTENTS SOMMAIRE 01 CONSOLIDATED KEY FIGURES 07 02 BGL BNP PARIBAS AND ITS SHAREHOLDERS 09 03 THE GROUP BNP PARIBAS IN LUXEMBOURG 10 04 HISTORY OF BGL BNP PARIBAS 13 05 DIRECTORS AND OFFICERS 15 06 STATEMENT OF THE BOARD OF DIRECTORS 19 07 MANAGEMENT REPORT OF THE BOARD OF DIRECTORS 21 Preamble 21 Consolidated management report 22 Unconsolidated management report 31 Outlook for 2017 34 Governance bodies 35 08 CONSOLIDATED FINANCIAL STATEMENTS TO 31 DECEMBER 2016 36 Audit report 37 Consolidated pro t and loss account 2016 39 Statement of consolidated net income and changes in assets 40 and liabilities recognised directly in consolidated equity Consolidated balance sheet 2016 41 Statement of changes in the consolidated shareholders’ equity 42 Consolidated cash ow statement 2016 44 09 NOTES TO THE FINANCIAL STATEMENTS 46 Generalities 46 1. Summary of signi cant accounting principles applied by the Group 46 2. Notes to the pro t and loss account for the year ended 31 December 2016 67 3. Segment information 73 4. Risk Management and Capital Adequacy 76 5. Notes to the balance sheet at 31 December 2016 114 6. Financing commitments and guarantee commitments 142 7. Salaries and employee bene ts 144 8. Additional information 150 10 UNCONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2016 166 Unconsolidated balance sheet 167 Unconsolidated pro t and loss account 169 11 BRANCH NETWORK 171 12 SUBSIDIARIES/BRANCH, PARTICIPATING INTERESTS, BUSINESS CENTERS 173 AND OTHER COMPANIES OF THE GROUP IN LUXEMBOURG The English language version of this report is a free translation from the original, which was prepared in French. -

2014 Annual Report

NEW DYNAMICS 2014 ANNUAL REPORT The bank for a changing world UNDERSTAND 3 – 14 New trends by Philippe Torres 7 billion mobile phones in the world Sharing across 4 generations 36 billion tonnes of CO2 €24 billion worth of sharing 4 hours to respond to clients PROGRESS 15 – 46 BNP Paribas strengthens its control system The Board of Directors Interview with Jean-Laurent Bonnafé The Executive Committee Our worldwide presence 2014 annual results Retail Banking & Services Corporate & Institutional Banking Act as a responsible bank Cultivating talent BNP Paribas at the service of its shareholders ACT 47 – 58 Act in a more complex world Act in a more responsible world Act in a more global world PARTICIPATE 59 – 64 30 years of initiatives and commitment How collective ingenuity is changing the world Lights, camera, action! Match point To read and learn more about BNP Paribas’ projects and initiatives in 2014, consult the digital version of the Annual Report. Visit our website annualreport.bnpparibas.com/2014/ We live in a changing world, a world which is evolving and which requires us to evolve with it, a world which is inventing itself and which we can also invent. For the BNP Paribas Group, being the bank for a changing world means that we need to: UNDERSTAND its evolution, PROGRESS in our methods, ACT to serve you, PARTICIPATE in the initiatives that inspire us. The photos in this Annual Report were taken with smartphones in order to reflect our new relationship with the world. We thank all employees who captured their day in different countries around the world. -

Collective Bargaining Agreement for Bank Personnel

ASSOCIATION DES BANQUES ET BANQUIERS LUXEMBOURG COLLECTIVE BARGAINING AGREEMENT FOR BANK EMPLOYEES 2011 – 2013 This text is a translation of the French version. In case of any divergence between the French text and the English text, the French text shall prevail. Contents Art. 1. - Area of application ................................................................. 6 Art. 2. - Duration - Notice of termination ............................................. 6 Art. 3. - Recruitment ........................................................................... 6 Art. 4. - Trial period ............................................................................ 7 Art. 5. - Cessation of the contract ....................................................... 7 Art. 6. - Working hours........................................................................ 9 Art. 7. - Working time ......................................................................... 9 Art. 8. - Overtime work ..................................................................... 11 I. Overtime work ...................................................................................................... 11 II. Qualification of additional hours ........................................................................... 12 III. Work on Sundays.................................................................................................. 13 IV. Work on public holidays........................................................................................ 13 V. Night work ........................................................................................................... -

Banking in Luxembourg

Banking in Luxembourg Trends & Figures 2019 Unless stated otherwise, all information used and presented in this publication relates to the data provided in the CSSF’s 2018 annual report and in the individual annual accounts of legally independent banking companies (e.g. S.A.s and S.C.A.s). As there is no publication requirement, it was not possible for us to carry out an analysis of the data in the annual reports of legally dependent branches that are not recognised separately. In case banks have changed country segment, the previous year figures are adapted accordingly in both country segments. Therefore, previous year figures may vary from the figures disclosed in the previous year version of this brochure. The values used and calculated have been rounded up or down as appropriate. Annual accounts reported in a different currency (USD/CHF) were converted at the exchange rate on the relevant closing date. To accommodate the differences between Lux GAAP and IFRS, we have depicted these banks’ balance sheet and income-statement data in a schematic representation that we use with Lux GAAP, and have therefore presented a number of assumptions in a simplified manner. The main assumptions are the following: • The unused risk provisioning presented pursuant to IFRS has been deducted on a pro rata basis from loans and advances to customers and credit institutions; • Financial instruments valued at fair value through profit or loss (transferable securities and derivatives) have been assigned to the “bonds and other transferable securities or other -

ECB and SSM – One Year on SRM – Taking Shape

www.pwc.com ECB and SSM – one year on SRM – taking shape Experiences so far and key priorities for 2016 March 2016 What is the Banking Union? Banking Union Single Supervisory Mechanism Single Resolution Mechanism (SSM) nly (SRM) Aim: Aim: • Ensure that banks comply with the EU banking rules • Ensure an orderly resolution of failing banks with • Be in a position to tackle problems early on minimal costs for the real economy and taxpayers • Key components: Single Resolution Board (SRB) and Eurozone o Eurozone • Direct supervision of ”significant“ banks by ECB; Single Resolution Fund (SRF) for medium-term close cooperation of ECB and National Competent funding Authorities (NCAs) for ”less-significant“ institutions Single Rulebook Aim: To standardise rules within EU area EU Bank Recovery and Resolution Deposit Guarantee Schemes Directive CRD IV/CRR Directive (BRRD) (DGSD) March 2016 PwC 2 SSM and SRM – Status of Luxembourg institutions SSM – ECB list dated 30 December 2015 The list includes: € • Significant entities ECB • Less significant institutions SRM – SRB list dated 1 March 2016 • All significant entities • 16 other cross-border banking groups March 2016 PwC 3 Significant Supervised Entities in Luxembourg 1. Banque et Caisse d’Epargne de l’Etat, Luxembourg 2. J.P. Morgan Bank Luxembourg S.A. 3. Precision Capital S.A. including: - Banque Internationale à Luxembourg S.A. - KBL European Private Bankers S.A. - Banque Puilaetco Dewaay Luxembourg S.A. 4. RBC Investor Services Bank S.A. 5. State Street Bank Luxembourg S.A. 6. UBS (Luxembourg) S.A. March 2016 PwC 4 Luxembourg Subsidiaries of Significant Supervised Entities 1 ABLV Bank Luxembourg S.A. -

LUXEMBOURG Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT LUXEMBOURG Executive Summary Banking Luxembourg’s central bank is the Banque centrale du Luxembourg (BCL). As Luxembourg is a participant in the eurozone, some central bank functions are shared with the other members of the European System of Central Banks (ESCB). Bank supervision is performed by the Financial Sector Supervisory Authority (CSSF). All transactions between residents and non-resident companies must be reported on a monthly basis to the BCL. Resident entities are permitted to hold fully convertible foreign currency bank accounts domestically and outside Luxembourg. Residents are also permitted to hold fully-convertible domestic currency (EUR) bank accounts outside Luxembourg. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Luxembourg. Of the 154 banks operating in Luxembourg, over 90% are foreign-owned; 108 are incorporated under Luxembourg law, while 46 are branches of foreign banks. Luxembourg’s only significant domestic bank is the state-owned Banque et Caisse d’Epargne de l’Etat. Payments The two main payment systems used in Luxembourg are the pan-European TARGET2 RTGS system and the Euro Banking Association’s pan-European automated clearing house (ACH), STEP2. The most important cashless payment instruments in Luxembourg are credit transfers, both in terms of volume and value. A high proportion of credit transfers are cross-border, reflecting the key role of the financial sector in Luxembourg’s economy. Card payments are also widely used in the retail sector, while direct debit volumes are also growing. Checks are rarely used and volumes continue to diminish. -

GENERAL TERMS and CONDITIONS GENERAL TERMS of BUSINESS Table of Contents

GENERAL TERMS AND CONDITIONS GENERAL TERMS OF BUSINESS Table of contents 1. SCOPE 34. PLACE OF PERFORMANCE OF OBLIGATIONS 2. OPENING BANK ACCOUNTS 35. COMPLAINTS AND COMMUNICATIONS 3. OPERATION OF BANK ACCOUNTS 36. JURISDICTION AND APPLICABLE LAW 4. DEPOSITS AND MANAGEMENT OF FINANCIAL INSTRUMENTS 1. SCOPE 5. INFORMATION AND RISKS RELATING TO FINANCIAL 1.1. Relations between BGL BNP PARIBAS (the “Bank”) and its customers INSTRUMENTS (the “Customer”) are governed by these general terms and conditions 6. PROTECTION OF DEPOSITORS AND INVESTORS (the “Terms and Conditions”) and by any special agreements that may 7. USE OF FINANCIAL INSTRUMENTS BY THE BANK be entered into between the Bank and the Customer. 8. PAYMENT SERVICES 1.2. The Bank may amend these Terms and Conditions at any time, 9. COLLECTIONS particularly in order to take account of amendments to the laws or 10. DOCUMENTARY CREDITS regulations or changes in BNP Paribas Group policies, the customs and 11. FINANCIAL PRODUCTS AND SERVICES SUBSCRIBED practices of the Luxembourg financial centre, or the financial market situation. ELECTRONICALLY ON THE BANK’S PREMISES OR REMOTELY 1.3. Any such changes will be brought to the Customer’s attention in 12. INVESTMENT SERVICES AND ANCILLARY SERVICES accordance with clause 23 of these Terms and Conditions. Modifications will be deemed to have been approved if no written objection is notified 13. CATEGORISATION OF CUSTOMERS WHEN PROVIDING by the Customer before the date the modifications come into effect. INVESTMENT AND ANCILLARY SERVICES If the Customer gives notice of his objection in accordance with this 14. CUSTOMER PROFILE, SUITABILITY AND paragraph, the parties will be entitled to terminate their business relationship. -

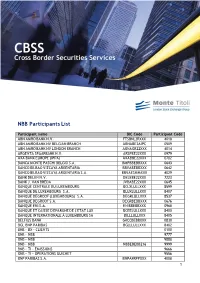

NBB Participants List

NBB Participants List Participant name BIC Code Participant Code ABN AMRO BANK N.V. FTSBNL2RXXX 4018 ABN AMRO BANK NV BELGIAN BRANCH ABNABE2AIPC 0509 ABN AMRO BANK NV LONDON BRANCH ABNAGB22XXX 4014 ARGENTA SPAARBANK N.V. ARSPBE22XXX 0979 AXA BANK EUROPE (IPPA) AXABBE22XXX 0702 BANCA MONTE PASCHI BELGIO S.A. BMPBBEBBXXX 0643 BANCO BILBAO VIZCAYA ARGENTARIA BBVABEBBXXX 0642 BANCO BILBAO VIZCAYA ARGENTARIA S.A. BBVAESMMXXX 4029 BANK DELEN N.V. DELEBE22XXX 7223 BANK J. VAN BREDA JVBABE22XXX 0645 BANQUE CENTRALE DU LUXEMBOURG BCLXLULLXXX 8599 BANQUE DE LUXEMBOURG S.A. BLUXLULLXXX 8407 BANQUE DEGROOF (LUXEMBOURG) S.A. DEGRLULLXXX 8537 BANQUE DEGROOF S.A. DEGRBEBBXXX 0676 BANQUE ENI S.A. ENIBBEBBXXX 0968 BANQUE ET CAISSE D'EPARGNE DE L'ETAT LUX BCEELULLXXX 8400 BANQUE INTERNATIONALE À LUXEMBOURG SA BILLLULLXXX 8405 BELFIUS BANK GKCCBEBBXXX 0830 BGL BNP PARIBAS BGLLLULLXXX 8402 BNB - BX - CLIENTS 0100 BNB - NBB 9777 BNB - NBB 9888 BNB - NBB NBBEBEBB216 9999 BNB - TI - EMISSIONS 9666 BNB - TI - OPERATIONS GUICHET 9556 BNP PARIBAS S.A. BNPAFRPPXXX 4008 1 BNP PARIBAS SECURITIES SERVICES PARIS PARBFRPPXXX 4017 BNP PARIBAS SECURITIES SERVICES(GCM) PARBFRPPBEC 4028 CBC BANK NV (klanten)-KBC BANK VCD8255 CREGBEBBNBB 4190 CBC BANQUE S.A. CREGBEBBXXX 0190 CENTEA SPAABE22XXX 0850 CITIBANK BELGIUM S.A. CTBKBEBXXXX 0595 CITIBANK INTERNATIONAL CITIBEBXXXX 0570 CITIBANK INTERNATIONAL PLC CITTGB2LXXX 4012 CLEARSTREAM BANKING S.A. CEDELULLXXX 0301 COMMERZBANK AG COBADEFFXXX 4026 CREDIT AGRICOLE NICABEBBXXX 0103 CREDIT AGRICOLE CORPORATE & INVEST.BANK BSUIFRPPXXX 4005 CREDIT PROFESSIONNEL BKCPBEBBXXX 0110 DELTA LLOYD BANK S.A. BNAGBEBBXXX 0635 DEUTSCHE BANK AG FRANKFURT DEUTDEFFDSO 4003 DEUTSCHE BANK AG LONDON DEUTGB2LGLO 4001 DEUTSCHE BK FRANKFURT CLIENTS/DB AMSTERD DEUTNL2AXXX 4015 DIERICKX, LEYS & CIE N.V.