Climate Change Information Request

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Climate Action Plan Executive Summary

Climate Action Plan Executive Summary Commission on Climate Change August 2008 Executive Summary climate action plan • 3 Report Overview n April 20, 2007, Governor Martin O’Malley signed Executive Order 01.01.2007.07 (the Order) establishing the Maryland Commission on Climate Change (the Commission). Sixteen State agency heads and six members of the General Assembly comprise the Commission. The principal Ocharge of the Commission is to develop a Plan of Action (the Climate Action Plan) to address the drivers of climate change, to prepare for its likely impacts in Maryland, and to establish goals and timetables for implementation. The Order emphasized Maryland’s particular vulnerability to climate change impacts of sea level rise, increased storm intensity, extreme droughts and heat waves, and increased wind and rainfall events. It recognized that human activities such as coastal development, burning of fossil fuels, and increasing greenhouse gas (GHG) emissions are contributing to the causes and consequences of climate change. While noting Maryland’s recent climate initiatives, the Order emphasized that continued leadership by example by Maryland State and local governments is imperative. The Commission is supported by three Working Groups whose members were appointed by the Commission Chair, Shari T. Wilson, Secretary, Maryland Department of the Environment (MDE): Scientific and Technical Working Group (STWG), chaired by Donald Boesch, President, University of Maryland Center for Environmental Science, and co-chaired by Frank W. Dawson, Assistant Secretary of Maryland’s Department of Natural Resources (DNR); Greenhouse Gas and Carbon Mitigation Working Group (MWG), chaired by George (Tad) Aburn, Director of MDE’s Air and Radiation Management Administration, and co-chaired by Malcolm Woolf, Director, Maryland Energy Administration (MEA); and Adaptation and Response Working Group (ARWG), chaired by John R. -

Second Progress Report on the German Strategy for Adaptation to Climate Change (DAS)

Second Progress Report on the German Strategy for Adaptation to Climate Change (DAS) CONTENTS A. The German Adaptation Strategy (DAS): objectives, principles and processes ............................... 4 A.1. The DAS: principles and objectives ................................................................................................................. 4 A.2. The DAS reporting cycle ................................................................................................................................. 5 A.3. The DAS, APA and Progress Report in review ................................................................................................. 8 A.4. European Union and international integration ............................................................................................ 11 B. Current findings and results ........................................................................................................ 13 B.1. Monitoring: climatic changes, impacts and adaptation responses ............................................................. 13 B.2. Vulnerability assessment ............................................................................................................................. 18 B.3. APA II implementation and APA III preparation process .............................................................................. 33 B.4. Adaptation measures by other actors .......................................................................................................... 35 B.5. Evaluation of -

Bgl Bnp Paribas

“COMMIT TO MORE SUSTAINABLE, BETTER SHARED GROWTH” GEOFFROY BAZIN, CEO BGL BNP PARIBAS 2018 SUSTAINABILITY REPORT 2018 SUSTAINABILITY REPORT The gardens of the BGL BNP Paribas head office 2018 SUSTAINABILITY REPORT CONTENT 01 MESSAGE FROM GEOFFROY BAZIN 6 02 BGL BNP PARIBAS IN A NUTSHELL 8 03 OUR CSR APPROACH 18 04 THE 4 PILLARS OF OUR CSR APPROACH 24 Our economic responsibility 26 Our civic responsibility 30 Our social responsibility 34 Our environmental responsibility 38 05 NON-FINANCIAL RATINGS 42 GLOSSARY 44 USEFUL LINKS 45 01 MESSAGE FROM GEOFFROY BAZIN Country Manager, BNP Paribas Group in Luxembourg, Chairman of the BGL BNP Paribas Executive Committee 01 Message from Geoffroy Bazin Geoffroy Message from We commit to continually improving the integration of social and environmental responsibility into the bank’s operational processes and major projects, while inventing new solutions and partnerships combining support for our clients and benefits to the world around us. We are readying ourselves for causes for which we have powerful leverage, by converging commercial offer, partnerships, employer actions, procurement policies, inclusive projects, sponsorship, volunteering and intrapreneurship. Beyond our responsibilities towards our clients, employees, society and the environment, we have identifiedfour priorities on which to focus our efforts: Climate , by acting in conjunction with our clients and partners as an accelerator for energy transition, and focusing on renewable energy, energy efficiency, sustainable mobility and the circular economy. Geoffroy Bazin Youth, by facilitating their inclusion in society, supporting the projects they value most and For nearly 100 years, BGL BNP Paribas has been strengthening intergenerational dialogue. one of the largest financial institutions in the Entrepreneurs , by encouraging creativity and deve- Grand Duchy. -

Integrating Insurance Into Climate Risk Management

INTEGRATING INSURANCE INTO CLIMATE RISK MANAGEMENT Conceptual Framework, Tools and Guiding Questions: Examples from the Agricultural Sector HOSTED BY Authors Gaby Ramm (Munich Climate Insurance Initiative − MCII advisory group member) Kehinde Balogun (Munich Climate Insurance Initiative − MCII) Matthias Range (Deutsche Gesellschaft für Internationale Zusammenarbeit GmbH − GIZ) Co-authors Maxime Souvignet (MCII) We thank our contributors for their • Olu Ajayi (Technical Centre for Agricultural and Rural Cooperation − CTA) strong partnership and dedication • Florent Baarsch ( International Fund for Agricultural Development – IFAD) to provide in-depth feedback as • Daniela Bohl (GIZ) Peer Reviewers to this document: • Toon Bullens (Microinsurance Association Netherlands − MIAN) • Emily Coleman (IFAD) • Massimo Giovanola (IFAD) • Michael Hamp (IFAD) • Rachael Hansen (MCII) • Jon Hellin (International Maize and Wheat Improvement Center − CIMMYT) • Peter Hoeppe (MCII Chairman) • Vilma Hossini (Bundesanstalt Technisches Hilfswerk − THW) • Rhea Katsanakis (United Nations International Strategy for Disaster Reduction − UNISDR) • Nina Koeksalan (Food and Agriculture Organization – FAO) • Soenke Kreft (MCII) • Thomas Loster (Munich Re Foundation) • Jennifer Phillips (MCII) • Sandra Schuster (GIZ) • Mia Thom (Centre for Financial Regulation and Inclusion − CENFRI) • Branko Wehnert (GIZ) • Sebastian Wiegele (GIZ) • Michael Zissener (MCII) • Sabrina Zwick (MCII) 2 Abstract Today, emerging new risks from climate change and increasing GmbH (GIZ) have -

CDP Climate Change Questionnaire 2018

CDP Climate Change Questionnaire 2018 Page 1 CDP Climate Change Questionnaire 2018 C0 Introduction Introduction (C0.1) Give a general description and introduction to your organization. Response options This is an open text question. MetLife, Inc. (NYSE: MET), through its subsidiaries and affiliates (“MetLife”), is one of the world’s leading financial services companies, providing insurance, annuities, employee benefits and asset management to help its individual and institutional customers navigate their changing world. Founded in 1868, MetLife has operations in more than 40 countries and holds leading market positions in the United States, Japan, Latin America, Asia, Europe and the Middle East. MetLife is providing the answers to this Questionnaire at the request of CDP. The statements contained herein do not constitute warranties, guarantees, obligations or commitments. Any forward-looking statements contained herein are based on present knowledge and circumstances, may turn out to be incorrect and are not guarantees of future performance. MetLife is not obligated to correct, revise or update information given in this Questionnaire. (C0.2) State the start and end date of the year for which you are reporting data. Response options Please complete the following table. You are able to add rows by using the “Add Row” button at the bottom of the table. 2017-01-01 - 2017-12-31 (C0.3) Select the countries for which you will be supplying data. Response options Please complete the following table: Page 2 Country Hong Kong Greece Select all that apply: India Hungary [Country drop-down list] Japan Ireland Brazil Malaysia Italy Chile Nepal Poland Argentina South Korea Portugal Australia Vietnam Romania Bangladesh Bulgaria Russia Colombia Cyprus Slovakia Ecuador Czech Republic Spain Mexico France Turkey United States of America China Oman Uruguay Ukraine Qatar Egypt United Kingdom Saudi Arabia Jordan Bahrain United Arab Emirates Kuwait Lebanon (C0.4) Select the currency used for all financial information disclosed throughout your response. -

Annual Directors Remuneration Report 2019

Annual Directors Remuneration Report Financial Year 2019 ISSUER IDENTIFICATION 31/12/2019 YEAR-END DATE TAX IDENTIFICATION CODE (C.I.F.) A-48010615 Company Name: IBERDROLA, S.A. Registered Office: Plaza Euskadi número 5, Bilbao 48009 Biscay, Spain ANNUAL REPORT ON THE REMUNERATION OF DIRECTORS OF LISTED COMPANIES A. REMUNERATION POLICY OF THE COMPANY FOR THE CURRENT FINANCIAL YEAR A.1 Explain the current director remuneration policy applicable to the year in progress. To the extent that it is relevant, certain information may be included in relation to the remuneration policy approved by the General Shareholders’ Meeting, provided that these references are clear, specific and concrete. The specific determinations for the year in progress should be described, both the remuneration of directors in their status as such and as a result of their executive functions carried out for the Board pursuant to the contracts signed with executive directors and to the remuneration policy approved by the General Shareholders’ Meeting. In any event, the following aspects should be reported: - Description of the procedures and company bodies involved in determining and approving the remuneration policy and its terms and conditions. - Indicate and, where applicable, explain whether comparable companies have been taken into account in order to establish the company's remuneration policy. 1 - Information on whether any external advisors took part in this process and, if so, their identity. Pursuant to article 48.1 of the By-Laws, the overall limit to the -

California Climate Risk: Insurance-Based Approaches to Mitigation and Resilience

California Climate Risk: Insurance-Based Approaches to Mitigation and Resilience July 23, 2019 UCLA School of Law Welcome California Climate Risk: Insurance-Based Approaches to Mitigation and Resilience July 23, 2019 | UCLA School of Law Keynote Address: California Insurance Commissioner Ricardo Lara California Climate Risk: Insurance-Based Approaches to Mitigation and Resilience July 23, 2019 | UCLA School of Law Panel 1: Physical Risk Assessment, Impact Mitigation, and Insurance • Alex Hall, UCLA Center for Climate Science • Alice Hill, Hoover Institution • Kristen Torres Pawling, County of Los Angeles • LeRoy Westerling, UC Merced School of Engineering Moderator: Sean Hecht, UCLA School of Law California Climate Risk: Insurance-Based Approaches to Mitigation and Resilience July 23, 2019 | UCLA School of Law Break California Climate Risk: Insurance-Based Approaches to Mitigation and Resilience July 23, 2019 | UCLA School of Law Panel 2: Nature-based Solutions • Secretary of Ecology and Environment Alfredo Arellano, State of Quintana Roo, Mexico • David BurtonPerry, Swiss Re • Deborah Halberstadt, UC Davis Coastal and Marine Sciences Institute • Raghuveer Vinukollu, Munich Re Moderator: Louis Blumberg, Blumberg West Consulting California Climate Risk: Insurance-Based Approaches to Mitigation and Resilience July 23, 2019 | UCLA School of Law Parametric Insurance Policy to Cover Beaches Recovery and Coral Reefs Quintana Roo, México California Climate Risk: Insurance-Based Approaches to Mitigation and Resilience Panel 2: Nature-based Solutions July, 23, 2019 Alfredo Arellano Guillermo Ministry of Environment State Government of Quintana Roo, México [email protected] Beach Erosion 2010 Playa del Carmen 2017 Hotel Porto Real Coastline 2010 Coastline 2017 Coral Reefs on Risk Coral Reefs are affected by: • Diseases • Water Pollution • Bleaching • Recreational activities • Hurricanes: Experts consider that hurricanes category 4 and 5 passing less than 65 km from the reefs are very likely to damage it (Alvarez-Filipp, et.al. -

English Annual Report 2013

Déclaration du Conseil d’administration Annual report 2013 bgl.lu 1 Légende oeuvre ANNUAL REPORT 2013 The SELECTED WORKS exhibition As a corporate citizen BGL BNP Paribas is one of the Overall, this exhibition consisted of objects from main partners in the arts and cultural communities of the 1980s and 1990s and allowed the public to Luxembourg. Our institution supports art and creativity discover the works of artists such as Frank Stella, Roy and therefore hosts each year on its premises a number Lichtenstein, Claude Viallat, Günther Förg, A.R. Penck of prestigious exhibitions from famous museums and Fernand Roda, Imi Knoebel, Emil Schumacher, Jan Voss, of artists with local and international fame. Markus Lüpertz, Sam Francis and Rosemarie Trockel and thereby a wide range of artistic movements such The SELECTED WORKS exhibition which was held from as pop art recent research into pictorial forms or even 10 January to 28 February 2014 in the Private Banking conceptual art. Centre – the “Villa” of BGL BNP Paribas presented works from the private collection of the Bank to the The photos published in this Annual Report, represent public for the first time. those works of art which were on show in the SELECTED WORKS exhibition. Cover: Frank Stella (*1936) - The Prophet, 1990 - De la série Moby Dick - Acrylic on wood and metal ANNUAL REPORT 2013 Contents 12 Per Kirkeby (*1938) - Sans Titre, 1991 - Mixed technique on paper Contents Consolidated key figures 07 BGL BNP Paribas and its shareholders 09 The Group BNP Paribas in Luxembourg 10 History -

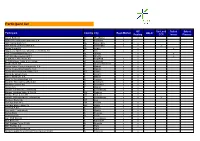

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

Open Letter to Ms. Ursula Von Der Leyen, President, European Commission and Executive Vice President Commissioner Timmermans

Friday 10 July 2021 Open letter to Ms. Ursula von der Leyen, President, European Commission and Executive Vice President Commissioner Timmermans Call for a massive acceleration of capacity build-up of renewable energy in Europe Dear President von der Leyen, Dear Executive Vice President Timmermans A successful transformation towards climate neutrality fundamentally rests on a European approach towards the massive acceleration of renewable energy deployment for industrial transformation. As a unique alliance between Members of the European Parliament and CEOs from leading companies, which have pledged climate neutrality by 2050, we are jointly calling upon the Commission to show more ambition and determination when it comes to making Europe’s energy system fit, already for 2030. All planned policies and measures being decided now are paving the road to climate neutrality in 2050, and that is why today’s action counts. Today, a massive ramp-up of renewable energy production must ensure that the EU renewable energy system is operational as soon as possible. Although EU’s Renewed Industrial strategy falls short in this regard, with the upcoming legislative package we have another chance to set this right. If the EU is to be a front runner for climate friendly manufacturing through the deployment of low carbon process technologies and ground-breaking innovations, the key enablers are infrastructure, access to abundant renewable electricity supply and rapid commercialization of new processes at competitive energy prices. Without a stronger European policy focus and increased investments boosting the availability of renewables for industrial use, we not only risk delaying needed GHG reductions, affecting industrial competitiveness but also our overall credibility to deliver on our common commitments. -

Annual Report 2018

ANNUAL REPORT 2018 ANNUAL REPORT 2018 CONTENTS 01 CONSOLIDATED KEY FIGURES 6 02 BGL BNP PARIBAS AND ITS SHAREHOLDERS 8 03 THE BNP PARIBAS GROUP IN LUXEMBOURG 10 04 HISTORY OF BGL BNP PARIBAS 14 05 DIRECTORS AND OFFICERS 16 06 STATEMENT BY THE BOARD OF DIRECTORS 20 07 MANAGEMENT REPORT BY THE BOARD OF DIRECTORS 22 Preamble 23 Consolidated management report 24 Outlook for 2019 35 08 CONSOLIDATED FINANCIAL STATEMENTS AT 31 DECEMBER 2018 36 Audit report 37 Consolidated financial statements prepared according to the IFRS accounting standards adopted by the European Union 44 Consolidated profit and loss 44 Statement of consolidated net income and changes in assets and liabilities recognised directly in consolidated equity 45 Consolidated balance sheet 46 Statement of changes in consolidated equity from 1 January 2017 to 31 December 2018 47 Consolidated cash flow statement 49 09 NOTES TO THE FINANCIAL STATEMENTS 50 General remarks 51 1. Summary of accounting principles applied by the Group 51 2. Effects of changes in presentation and accounting principles, and the application of IFRS 9 and IFRS 15 73 3. Notes to the profit and loss account 84 4. Sector information 92 5. Risk management and capital adequacy 94 6. Notes to the balance sheet 133 7. Financing commitments and guarantee commitments 157 8. Salaries and employee benefits 159 9. Additional information 164 10 UNCONSOLIDATED FINANCIAL STATEMENTS AT 31 DECEMBER 2018 180 Unconsolidated balance sheet 181 Unconsolidated profit and loss account 183 11 APPROPRIATION OF PROFIT 184 12 BRANCH NETWORK 186 13 SUBSIDIARIES/BRANCH, PARTICIPATING INTERESTS, BUSINESS CENTERS AND OTHER COMPANIES OF THE GROUP IN LUXEMBOURG 188 The English language version of this report is a free translation from the original, which was prepared in French. -

Banco Santander, S.A. Announces Results of Tender Offer for Notes Issued by Iberdrola Finanzas, S.A.U

BANCO SANTANDER, S.A. ANNOUNCES RESULTS OF TENDER OFFER FOR NOTES ISSUED BY IBERDROLA FINANZAS, S.A.U. and IBERDROLA INTERNATIONAL B.V. NOT FOR DISTRIBUTION TO ANY PERSON RESIDENT AND/OR LOCATED IN THE UNITED STATES This announcement does not constitute an invitation to participate in the Solicitation of Offers to Sell (as defined herein) in or from any jurisdiction in or from which, or to or from whom, it is unlawful to make such offer under applicable securities laws or otherwise. The distribution of this announcement in certain jurisdictions (in particular the United States, the United Kingdom, Italy, France, Belgium and Spain) may be restricted by law. Persons into whose possession this document comes are required by the Offeror, the Issuers, the Guarantor and the Dealer Managers to inform themselves about, and to observe, any such restrictions. No action that would permit a public offer has been or will be taken in any jurisdiction by the Offeror, the Issuers, the Guarantor or the Dealer Managers. London, 14 September 2015. Further to its announcements on 7 September 2015 and 14 September 2015, Banco Santander, S.A. (the “Offeror”) hereby announces the final results and pricing of its invitation to holders of the (i) €750,000,000 3.500% Guaranteed Notes due 13 October 2016 issued by Iberdrola Finanzas, S.A.U. (the “Series 92 Notes”) and (ii) €1,400,000,000 4.250% Guaranteed Notes due 11 October 2018 issued by Iberdrola International B.V. (together with Iberdrola Finanzas, S.A.U., the “Issuers”) (the “Series 100 Notes”) each guaranteed by Iberdrola S.A.