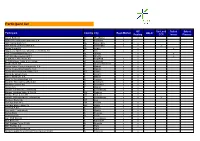

NBB Participants List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bgl Bnp Paribas

“COMMIT TO MORE SUSTAINABLE, BETTER SHARED GROWTH” GEOFFROY BAZIN, CEO BGL BNP PARIBAS 2018 SUSTAINABILITY REPORT 2018 SUSTAINABILITY REPORT The gardens of the BGL BNP Paribas head office 2018 SUSTAINABILITY REPORT CONTENT 01 MESSAGE FROM GEOFFROY BAZIN 6 02 BGL BNP PARIBAS IN A NUTSHELL 8 03 OUR CSR APPROACH 18 04 THE 4 PILLARS OF OUR CSR APPROACH 24 Our economic responsibility 26 Our civic responsibility 30 Our social responsibility 34 Our environmental responsibility 38 05 NON-FINANCIAL RATINGS 42 GLOSSARY 44 USEFUL LINKS 45 01 MESSAGE FROM GEOFFROY BAZIN Country Manager, BNP Paribas Group in Luxembourg, Chairman of the BGL BNP Paribas Executive Committee 01 Message from Geoffroy Bazin Geoffroy Message from We commit to continually improving the integration of social and environmental responsibility into the bank’s operational processes and major projects, while inventing new solutions and partnerships combining support for our clients and benefits to the world around us. We are readying ourselves for causes for which we have powerful leverage, by converging commercial offer, partnerships, employer actions, procurement policies, inclusive projects, sponsorship, volunteering and intrapreneurship. Beyond our responsibilities towards our clients, employees, society and the environment, we have identifiedfour priorities on which to focus our efforts: Climate , by acting in conjunction with our clients and partners as an accelerator for energy transition, and focusing on renewable energy, energy efficiency, sustainable mobility and the circular economy. Geoffroy Bazin Youth, by facilitating their inclusion in society, supporting the projects they value most and For nearly 100 years, BGL BNP Paribas has been strengthening intergenerational dialogue. one of the largest financial institutions in the Entrepreneurs , by encouraging creativity and deve- Grand Duchy. -

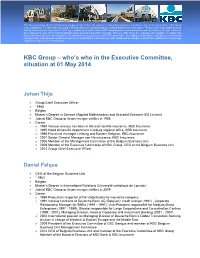

Frequently Asked Questions

This document is provided for informational purposes only. It does not constitute a solicitation to buy/sell any product or security issued by the KBC Group or its subsidiaries. The information provided in this document is condensed and/or simplified and therefore incomplete. The document may contain forward- looking statements with respect to the strategy, earnings and capital trends of KBC, involving numerous assumptions and uncertainties. The risk exists that these statements may not be fulfilled and that future developments differ materially. Moreover, KBC does not undertake any obligation to update this document in line with new developments. The document may also contain non-IFRS information. By reading this document, each person is deemed to represent that he/she possesses sufficient expertise to understand the risks involved. KBC Group and its subsidiaries cannot be held liable for any damage resulting from the use of the information. KBC Group – who’s who in the Executive Committee, situation at 01 May 2014 Johan Thijs Group Chief Executive Officer °1965 Belgian Master’s Degree in Science (Applied Mathematics) and Actuarial Sciences (KU Leuven) Joined KBC Group or its pre-merger entities in 1988 Career o 1988 Various actuary functions in life and non-life insurance, ABB Insurance o 1995 Head of non-life department, Limburg regional office, ABB Insurance o 1998 Provincial manager Limburg and Eastern Belgium, KBC Insurance o 2001 Senior General Manager non-life insurance, KBC Insurance o 2006 Member of the Management Committee -

2021 VIB Belg BT Infomemo 04-08-2021.Pdf

Volkswagen International Belgium – Information Memorandum This Information Memorandum dated August 4, 2021 amends and replaces the information memorandum dated 18 October 2018 as supplemented from time to time. VOLKSWAGEN INTERNATIONAL BELGIUM SA (incorporated as naamloze vennootschap / société anonyme under the laws of Belgium, with enterprise number 443.615.642 (RPM/RPR Brussels)). EUR 5,000,000,000 Belgian Short-Term Treasury Notes Programme This Programme has been submitted to the STEP Secretariat in order to apply for the Short-Term European Paper (STEP- label). The status of STEP compliance of this Programme can be checked on the STEP Market website (www.stepmarket.org). The Programme is rated A-2 by Standard & Poor’s Ratings Services, a division of the McGraw-Hill Companies Inc. and P-2 by Moody’s Investors Service, Inc. Arranger Dealers BNP Paribas ING Bank N.V. Belgian Branch Crédit Agricole Corporate and Investment Bank Crédit Industriel et BNP Paribas Fortis SA/NV ING Belgium SA/NV Commercial BRED Banque Populaire KBC Bank NV Société Générale Issuing and Paying Agent – Domiciliary Agent BNP Paribas Fortis SA/NV Volkswagen International Belgium – Information Memorandum Potential investors are invited to read this Information Memorandum, the Conditions and the selling restrictions, prior to investing. Each holder of Treasury Notes from time to time represents through its acquisition of a Treasury Note that it is and, as long as it holds any Treasury Notes, shall remain an Eligible Holder. Nevertheless, a decision to invest in -

KBC Bank Half-Year Report

KBC Bank Half-Year Report - 1H2020 Interim Report – KBC Bank – 1H2020 p. 1 Company name ‘KBC’ or ‘KBC Bank’ as used in this report refer to the consolidated bank entity (i.e. KBC Bank NV including all companies that are included in the scope of consolidation). ‘KBC Bank NV’ refers solely to the non-consolidated entity. KBC Group or the KBC group refers to the parent company of KBC Bank (see below). Difference between KBC Bank and KBC Group KBC Bank is a subsidiary of KBC Group. Simplified, the KBC Group's legal structure has one single entity – KBC Group NV – in control of two underlying companies, viz. KBC Bank and KBC Insurance. Forward-looking statements The expectations, forecasts and statements regarding future developments that are contained in this report are, of course, based on assumptions and are contingent on a number of factors that will come into play in the future. Consequently, the actual situation may turn out to be (substantially) different. Glossary of ratios used (including the alternative performance measures) See separate section at the end of this report. Investor Relations contact details [email protected] www.kbc.com/kbcbank KBC Bank NV Investor Relations Office (IRO) Havenlaan 2 BE-1080 Brussels Belgium Management certification ‘I, Rik Scheerlinck, Chief Financial Officer of KBC Bank, certify on behalf of the Executive Committee of KBC Bank NV that, to the best of my knowledge, the abbreviated financial statements included in the interim report are based on the relevant accounting standards and fairly present in all material respects the financial condition and results of KBC Bank NV including its consolidated subsidiaries, and that the interim report provides a fair overview of the main events, the main transactions with related parties in the period under review and their impact on the abbreviated financial statements, and an overview of the main risks and uncertainties for the remainder of the current year.’ Interim Report – KBC Bank – 1H2020 p. -

English Annual Report 2013

Déclaration du Conseil d’administration Annual report 2013 bgl.lu 1 Légende oeuvre ANNUAL REPORT 2013 The SELECTED WORKS exhibition As a corporate citizen BGL BNP Paribas is one of the Overall, this exhibition consisted of objects from main partners in the arts and cultural communities of the 1980s and 1990s and allowed the public to Luxembourg. Our institution supports art and creativity discover the works of artists such as Frank Stella, Roy and therefore hosts each year on its premises a number Lichtenstein, Claude Viallat, Günther Förg, A.R. Penck of prestigious exhibitions from famous museums and Fernand Roda, Imi Knoebel, Emil Schumacher, Jan Voss, of artists with local and international fame. Markus Lüpertz, Sam Francis and Rosemarie Trockel and thereby a wide range of artistic movements such The SELECTED WORKS exhibition which was held from as pop art recent research into pictorial forms or even 10 January to 28 February 2014 in the Private Banking conceptual art. Centre – the “Villa” of BGL BNP Paribas presented works from the private collection of the Bank to the The photos published in this Annual Report, represent public for the first time. those works of art which were on show in the SELECTED WORKS exhibition. Cover: Frank Stella (*1936) - The Prophet, 1990 - De la série Moby Dick - Acrylic on wood and metal ANNUAL REPORT 2013 Contents 12 Per Kirkeby (*1938) - Sans Titre, 1991 - Mixed technique on paper Contents Consolidated key figures 07 BGL BNP Paribas and its shareholders 09 The Group BNP Paribas in Luxembourg 10 History -

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

High-Quality Service Is Key Differentiator for European Banks 2018 Greenwich Leaders: European Large Corporate Banking and Cash Management

High-Quality Service is Key Differentiator for European Banks 2018 Greenwich Leaders: European Large Corporate Banking and Cash Management Q1 2018 After weathering the chaos of the financial crisis and the subsequent restructuring of the European banking industry, Europe’s largest companies are enjoying a welcome phase of stability in their banking relationships. Credit is abundant (at least for big companies with good credit ratings), service is good and getting better, and banks are getting easier to work with. Aside from European corporates, the primary beneficiaries of this new stability are the big banks that already count many of Europe’s largest companies as clients. At the top of that list sits BNP Paribas, which is used for corporate banking by 65% of Europe’s largest companies. HSBC is next at 56%, followed by Deutsche Bank at 43%, UniCredit at 38% and Citi at 37%. These banks are the 2018 Greenwich Share Leaders℠ in European Top-Tier Large Corporate Banking. Greenwich Share Leaders — 2018 GREENWICH ASSOCIATES Greenwich Share20 1Leade8r European Top-Tier Large Corporate Banking Market Penetration Eurozone Top-Tier Large Corporate Banking Market Penetration Bank Market Penetration Statistical Rank Bank Market Penetration Statistical Rank BNP Paribas 1 BNP Paribas 1 HSBC 2 HSBC 2 Deutsche Bank 3 UniCredit 3T UniCredit 4T Deutsche Bank 3T Citi 4T Commerzbank 5T ING Bank 5T Note: Based on 576 respondents from top-tier companies. Note: Based on 360 respondents from top-tier companies. European Top-Tier Large Corporate Eurozone Top-Tier Large Corporate Cash Management Market Penetration Cash Management Market Penetration Bank Market Penetration Statistical Rank Bank Market Penetration Statistical Rank BNP Paribas ¡ 1 BNP Paribas 1 HSBC 2 HSBC 2T Deutsche Bank 3 UniCredit 2T Citi 4T Deutsche Bank 4 UniCredit 4T Commerzbank 5T ING Bank 5T Note: Based on 605 respondents from top-tier companies. -

26 January 2018 Results of the Mandatory

26 JANUARY 2018 RESULTS OF THE MANDATORY PUBLIC TAKEOVER BID IN CASH AND SQUEEZE-OUT BY Natixis Belgique Investissements SA, a public limited company incorporated under Belgian law (the « Bidder ») ON ALL SHARES AND WARRANTS NOT YET OWNED BY THE BIDDER ISSUED BY Dalenys SA, a public limited company incorporated under Belgian law (the « Target Company »). Results of the bid The initial acceptance period of the mandatory takeover bid launched on 11 December 2017 by the Bidder on 8,620,827 shares representing 45,71% of the share capital and 38,67% of the voting rights of the Target Company and on 5,000 warrants (the “Bid”) ended on 22 January 2018. Following the initial acceptance period, the Bidder and the persons affiliated to him hold 18,401,437 shares and 3,432,944 profit shares representing 97,6 % of the share capital and 97,97 % of the voting rights in the Target Company. Payment of the bid price for the transferred shares will be made on 5 February 2018. Squeeze-out As the Bidder and the persons affiliated to him hold at least 95 % of the shares and securities with voting rights in the Target Company following the initial acceptance period, the Bidder decided to proceed with a squeeze out (in accordance with Article 513 of the Companies Code and Articles 42 and 43 in conjunction with Article 57 of the royal decree of 27 April 2007 on Takeover Bids) (the “Squeeze-out”) in order to acquire the shares and warrants issued by the Target Company not yet acquired by the Bidder, under the same terms and conditions as the Bid. -

ADB's Trade Finance Program Confirming Banks List

Trade Finance Program Confirming Banks List As of 31 July 2016 AFGHANISTAN Bank Alfalah Limited (Afghanistan Branch) 410 Chahri-e-Sadarat Shar-e-Nou, Kabul, Afghanistan National Bank of Pakistan (Jalalabad Branch) Bank Street Near Haji Qadeer House Nahya Awal, Jalalabad, Afghanistan National Bank of Pakistan (Kabul Branch) House No. 2, Street No. 10 Wazir Akbar Khan, Kabul, Afghanistan ALGERIA HSBC Bank Middle East Limited, Algeria 10 Eme Etage El-Mohammadia 16212, Alger, Algeria ANGOLA Banco Millennium Angola SA Rua Rainha Ginga 83, Luanda, Angola ARGENTINA Banco Patagonia S.A. Av. De Mayo 701 24th floor C1084AAC, Buenos Aires, Argentina Banco Rio de la Plata S.A. Bartolome Mitre 480-8th Floor C1306AAH, Buenos Aires, Argentina AUSTRALIA Australia and New Zealand Banking Group Limited Level 20, 100 Queen Street, Melbourne, VIC 3000, Australia Australia and New Zealand Banking Group Limited (Adelaide Branch) Level 20, 11 Waymouth Street, Adelaide, Australia Australia and New Zealand Banking Group Limited (Adelaide Branch - Trade and Supply Chain) Level 20, 11 Waymouth Street, Adelaide, Australia Australia and New Zealand Banking Group Limited (Brisbane Branch) Level 18, 111 Eagle Street, Brisbane QLD 4000, Australia Australia and New Zealand Banking Group Limited (Brisbane Branch - Trade and Supply Chain) Level 18, 111 Eagle Street, Brisbane QLD 4000, Australia Australia and New Zealand Banking Group Limited (Perth Branch) Level 6, 77 St Georges Terrace, Perth, Australia Australia and New Zealand Banking Group Limited (Perth Branch - Trade -

Annual Report 2018

ANNUAL REPORT 2018 ANNUAL REPORT 2018 CONTENTS 01 CONSOLIDATED KEY FIGURES 6 02 BGL BNP PARIBAS AND ITS SHAREHOLDERS 8 03 THE BNP PARIBAS GROUP IN LUXEMBOURG 10 04 HISTORY OF BGL BNP PARIBAS 14 05 DIRECTORS AND OFFICERS 16 06 STATEMENT BY THE BOARD OF DIRECTORS 20 07 MANAGEMENT REPORT BY THE BOARD OF DIRECTORS 22 Preamble 23 Consolidated management report 24 Outlook for 2019 35 08 CONSOLIDATED FINANCIAL STATEMENTS AT 31 DECEMBER 2018 36 Audit report 37 Consolidated financial statements prepared according to the IFRS accounting standards adopted by the European Union 44 Consolidated profit and loss 44 Statement of consolidated net income and changes in assets and liabilities recognised directly in consolidated equity 45 Consolidated balance sheet 46 Statement of changes in consolidated equity from 1 January 2017 to 31 December 2018 47 Consolidated cash flow statement 49 09 NOTES TO THE FINANCIAL STATEMENTS 50 General remarks 51 1. Summary of accounting principles applied by the Group 51 2. Effects of changes in presentation and accounting principles, and the application of IFRS 9 and IFRS 15 73 3. Notes to the profit and loss account 84 4. Sector information 92 5. Risk management and capital adequacy 94 6. Notes to the balance sheet 133 7. Financing commitments and guarantee commitments 157 8. Salaries and employee benefits 159 9. Additional information 164 10 UNCONSOLIDATED FINANCIAL STATEMENTS AT 31 DECEMBER 2018 180 Unconsolidated balance sheet 181 Unconsolidated profit and loss account 183 11 APPROPRIATION OF PROFIT 184 12 BRANCH NETWORK 186 13 SUBSIDIARIES/BRANCH, PARTICIPATING INTERESTS, BUSINESS CENTERS AND OTHER COMPANIES OF THE GROUP IN LUXEMBOURG 188 The English language version of this report is a free translation from the original, which was prepared in French. -

Lloyds Banking Group PLC

Lloyds Banking Group PLC Primary Credit Analyst: Nigel Greenwood, London (44) 20-7176-1066; [email protected] Secondary Contact: Richard Barnes, London (44) 20-7176-7227; [email protected] Table Of Contents Major Rating Factors Outlook Rationale Related Criteria Related Research WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 5, 2020 1 THIS WAS PREPARED EXCLUSIVELY FOR USER CIARAN TRELLIS. NOT FOR REDISTRIBUTION UNLESS OTHERWISE PERMITTED. Lloyds Banking Group PLC Major Rating Factors Issuer Credit Rating BBB+/Negative/A-2 Strengths: Weaknesses: • Market-leading franchise in U.K. retail banking, and • Geographically concentrated in the U.K., which is strong positions in U.K. corporate banking and now in recession owing to the impact of COVID-19. insurance. • Our risk-adjusted capital (RAC) ratio is lower than • Cost-efficient operating model that supports strong the average for U.K. peers, which partly reflects the pre-provision profitability, business stability, and deduction of Lloyds' material investment in its competitiveness. insurance business. • Supportive funding and liquidity profiles anchored by strong deposit franchise. WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 5, 2020 2 THIS WAS PREPARED EXCLUSIVELY FOR USER CIARAN TRELLIS. NOT FOR REDISTRIBUTION UNLESS OTHERWISE PERMITTED. Lloyds Banking Group PLC Outlook The negative outlook on Lloyds Banking Group reflects potential earnings pressures arising from the economic and market impact of the COVID-19 pandemic. Downside scenario If we saw clear signs that the U.K. systemwide domestic loan loss rate was going to exceed 100 basis points in 2020, and not be offset by the prospect of a quick economic recovery, we would likely lower the anchor, our starting point for rating U.K. -

A Responsible Bank for a Sustainable Economy

#POSITIVEBANKING A RESPONSIBLE BANK FOR A SUSTAINABLE ECONOMY 2019 INTEGRATED REPORT The bank for a changing world of service and offer customers the digital solutions which we encourage them to use as a priority. Furthermore, our individual customers can benefit from personalised solutions to give them the flexibility they need at this time of great uncertainty, whether deferring loan repayments, obtaining BNP PARIBAS MOBILISES credit or managing savings and payments. To assist and support companies, especially SMEs and pro- fessional clients affected by the crisis, we are also taking TO TACKLE COVID-19 all necessary measures, such as deferring repayments, faci- litating cash management and providing faster financing. n light of the Covid-19 health crisis, the BNP Paribas, through its businesses, Foundation, and BNP Paribas Group has mobilised to help Rescue & Recover Fund, has been committed since the begin- I customers, support the global economy and ning of the crisis to supporting hospitals, medical research, contribute to assisting those in need. This is and organisations helping the most vulnerable in the com- first of all a particularly difficult and human munity as well as disadvantaged young people facing great ordeal that we are experiencing, and our first thoughts go out difficulty because of the crisis. This action to help the com- to all those whose loved ones have been directly affected by munity has been the focus of our emergency aid plan, put in the epidemic. And as bankers we have a special responsibility place in mid-April and which represents a commitment of to ensure continuity of financial services while helping not only €55 million.