Frequently Asked Questions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 VIB Belg BT Infomemo 04-08-2021.Pdf

Volkswagen International Belgium – Information Memorandum This Information Memorandum dated August 4, 2021 amends and replaces the information memorandum dated 18 October 2018 as supplemented from time to time. VOLKSWAGEN INTERNATIONAL BELGIUM SA (incorporated as naamloze vennootschap / société anonyme under the laws of Belgium, with enterprise number 443.615.642 (RPM/RPR Brussels)). EUR 5,000,000,000 Belgian Short-Term Treasury Notes Programme This Programme has been submitted to the STEP Secretariat in order to apply for the Short-Term European Paper (STEP- label). The status of STEP compliance of this Programme can be checked on the STEP Market website (www.stepmarket.org). The Programme is rated A-2 by Standard & Poor’s Ratings Services, a division of the McGraw-Hill Companies Inc. and P-2 by Moody’s Investors Service, Inc. Arranger Dealers BNP Paribas ING Bank N.V. Belgian Branch Crédit Agricole Corporate and Investment Bank Crédit Industriel et BNP Paribas Fortis SA/NV ING Belgium SA/NV Commercial BRED Banque Populaire KBC Bank NV Société Générale Issuing and Paying Agent – Domiciliary Agent BNP Paribas Fortis SA/NV Volkswagen International Belgium – Information Memorandum Potential investors are invited to read this Information Memorandum, the Conditions and the selling restrictions, prior to investing. Each holder of Treasury Notes from time to time represents through its acquisition of a Treasury Note that it is and, as long as it holds any Treasury Notes, shall remain an Eligible Holder. Nevertheless, a decision to invest in -

KBC Bank Half-Year Report

KBC Bank Half-Year Report - 1H2020 Interim Report – KBC Bank – 1H2020 p. 1 Company name ‘KBC’ or ‘KBC Bank’ as used in this report refer to the consolidated bank entity (i.e. KBC Bank NV including all companies that are included in the scope of consolidation). ‘KBC Bank NV’ refers solely to the non-consolidated entity. KBC Group or the KBC group refers to the parent company of KBC Bank (see below). Difference between KBC Bank and KBC Group KBC Bank is a subsidiary of KBC Group. Simplified, the KBC Group's legal structure has one single entity – KBC Group NV – in control of two underlying companies, viz. KBC Bank and KBC Insurance. Forward-looking statements The expectations, forecasts and statements regarding future developments that are contained in this report are, of course, based on assumptions and are contingent on a number of factors that will come into play in the future. Consequently, the actual situation may turn out to be (substantially) different. Glossary of ratios used (including the alternative performance measures) See separate section at the end of this report. Investor Relations contact details [email protected] www.kbc.com/kbcbank KBC Bank NV Investor Relations Office (IRO) Havenlaan 2 BE-1080 Brussels Belgium Management certification ‘I, Rik Scheerlinck, Chief Financial Officer of KBC Bank, certify on behalf of the Executive Committee of KBC Bank NV that, to the best of my knowledge, the abbreviated financial statements included in the interim report are based on the relevant accounting standards and fairly present in all material respects the financial condition and results of KBC Bank NV including its consolidated subsidiaries, and that the interim report provides a fair overview of the main events, the main transactions with related parties in the period under review and their impact on the abbreviated financial statements, and an overview of the main risks and uncertainties for the remainder of the current year.’ Interim Report – KBC Bank – 1H2020 p. -

High-Quality Service Is Key Differentiator for European Banks 2018 Greenwich Leaders: European Large Corporate Banking and Cash Management

High-Quality Service is Key Differentiator for European Banks 2018 Greenwich Leaders: European Large Corporate Banking and Cash Management Q1 2018 After weathering the chaos of the financial crisis and the subsequent restructuring of the European banking industry, Europe’s largest companies are enjoying a welcome phase of stability in their banking relationships. Credit is abundant (at least for big companies with good credit ratings), service is good and getting better, and banks are getting easier to work with. Aside from European corporates, the primary beneficiaries of this new stability are the big banks that already count many of Europe’s largest companies as clients. At the top of that list sits BNP Paribas, which is used for corporate banking by 65% of Europe’s largest companies. HSBC is next at 56%, followed by Deutsche Bank at 43%, UniCredit at 38% and Citi at 37%. These banks are the 2018 Greenwich Share Leaders℠ in European Top-Tier Large Corporate Banking. Greenwich Share Leaders — 2018 GREENWICH ASSOCIATES Greenwich Share20 1Leade8r European Top-Tier Large Corporate Banking Market Penetration Eurozone Top-Tier Large Corporate Banking Market Penetration Bank Market Penetration Statistical Rank Bank Market Penetration Statistical Rank BNP Paribas 1 BNP Paribas 1 HSBC 2 HSBC 2 Deutsche Bank 3 UniCredit 3T UniCredit 4T Deutsche Bank 3T Citi 4T Commerzbank 5T ING Bank 5T Note: Based on 576 respondents from top-tier companies. Note: Based on 360 respondents from top-tier companies. European Top-Tier Large Corporate Eurozone Top-Tier Large Corporate Cash Management Market Penetration Cash Management Market Penetration Bank Market Penetration Statistical Rank Bank Market Penetration Statistical Rank BNP Paribas ¡ 1 BNP Paribas 1 HSBC 2 HSBC 2T Deutsche Bank 3 UniCredit 2T Citi 4T Deutsche Bank 4 UniCredit 4T Commerzbank 5T ING Bank 5T Note: Based on 605 respondents from top-tier companies. -

26 January 2018 Results of the Mandatory

26 JANUARY 2018 RESULTS OF THE MANDATORY PUBLIC TAKEOVER BID IN CASH AND SQUEEZE-OUT BY Natixis Belgique Investissements SA, a public limited company incorporated under Belgian law (the « Bidder ») ON ALL SHARES AND WARRANTS NOT YET OWNED BY THE BIDDER ISSUED BY Dalenys SA, a public limited company incorporated under Belgian law (the « Target Company »). Results of the bid The initial acceptance period of the mandatory takeover bid launched on 11 December 2017 by the Bidder on 8,620,827 shares representing 45,71% of the share capital and 38,67% of the voting rights of the Target Company and on 5,000 warrants (the “Bid”) ended on 22 January 2018. Following the initial acceptance period, the Bidder and the persons affiliated to him hold 18,401,437 shares and 3,432,944 profit shares representing 97,6 % of the share capital and 97,97 % of the voting rights in the Target Company. Payment of the bid price for the transferred shares will be made on 5 February 2018. Squeeze-out As the Bidder and the persons affiliated to him hold at least 95 % of the shares and securities with voting rights in the Target Company following the initial acceptance period, the Bidder decided to proceed with a squeeze out (in accordance with Article 513 of the Companies Code and Articles 42 and 43 in conjunction with Article 57 of the royal decree of 27 April 2007 on Takeover Bids) (the “Squeeze-out”) in order to acquire the shares and warrants issued by the Target Company not yet acquired by the Bidder, under the same terms and conditions as the Bid. -

ADB's Trade Finance Program Confirming Banks List

Trade Finance Program Confirming Banks List As of 31 July 2016 AFGHANISTAN Bank Alfalah Limited (Afghanistan Branch) 410 Chahri-e-Sadarat Shar-e-Nou, Kabul, Afghanistan National Bank of Pakistan (Jalalabad Branch) Bank Street Near Haji Qadeer House Nahya Awal, Jalalabad, Afghanistan National Bank of Pakistan (Kabul Branch) House No. 2, Street No. 10 Wazir Akbar Khan, Kabul, Afghanistan ALGERIA HSBC Bank Middle East Limited, Algeria 10 Eme Etage El-Mohammadia 16212, Alger, Algeria ANGOLA Banco Millennium Angola SA Rua Rainha Ginga 83, Luanda, Angola ARGENTINA Banco Patagonia S.A. Av. De Mayo 701 24th floor C1084AAC, Buenos Aires, Argentina Banco Rio de la Plata S.A. Bartolome Mitre 480-8th Floor C1306AAH, Buenos Aires, Argentina AUSTRALIA Australia and New Zealand Banking Group Limited Level 20, 100 Queen Street, Melbourne, VIC 3000, Australia Australia and New Zealand Banking Group Limited (Adelaide Branch) Level 20, 11 Waymouth Street, Adelaide, Australia Australia and New Zealand Banking Group Limited (Adelaide Branch - Trade and Supply Chain) Level 20, 11 Waymouth Street, Adelaide, Australia Australia and New Zealand Banking Group Limited (Brisbane Branch) Level 18, 111 Eagle Street, Brisbane QLD 4000, Australia Australia and New Zealand Banking Group Limited (Brisbane Branch - Trade and Supply Chain) Level 18, 111 Eagle Street, Brisbane QLD 4000, Australia Australia and New Zealand Banking Group Limited (Perth Branch) Level 6, 77 St Georges Terrace, Perth, Australia Australia and New Zealand Banking Group Limited (Perth Branch - Trade -

Lloyds Banking Group PLC

Lloyds Banking Group PLC Primary Credit Analyst: Nigel Greenwood, London (44) 20-7176-1066; [email protected] Secondary Contact: Richard Barnes, London (44) 20-7176-7227; [email protected] Table Of Contents Major Rating Factors Outlook Rationale Related Criteria Related Research WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 5, 2020 1 THIS WAS PREPARED EXCLUSIVELY FOR USER CIARAN TRELLIS. NOT FOR REDISTRIBUTION UNLESS OTHERWISE PERMITTED. Lloyds Banking Group PLC Major Rating Factors Issuer Credit Rating BBB+/Negative/A-2 Strengths: Weaknesses: • Market-leading franchise in U.K. retail banking, and • Geographically concentrated in the U.K., which is strong positions in U.K. corporate banking and now in recession owing to the impact of COVID-19. insurance. • Our risk-adjusted capital (RAC) ratio is lower than • Cost-efficient operating model that supports strong the average for U.K. peers, which partly reflects the pre-provision profitability, business stability, and deduction of Lloyds' material investment in its competitiveness. insurance business. • Supportive funding and liquidity profiles anchored by strong deposit franchise. WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 5, 2020 2 THIS WAS PREPARED EXCLUSIVELY FOR USER CIARAN TRELLIS. NOT FOR REDISTRIBUTION UNLESS OTHERWISE PERMITTED. Lloyds Banking Group PLC Outlook The negative outlook on Lloyds Banking Group reflects potential earnings pressures arising from the economic and market impact of the COVID-19 pandemic. Downside scenario If we saw clear signs that the U.K. systemwide domestic loan loss rate was going to exceed 100 basis points in 2020, and not be offset by the prospect of a quick economic recovery, we would likely lower the anchor, our starting point for rating U.K. -

US Patriot Act Certification

CERTIFICATION REGARDING CORRESPONDENT ACCOUNTS FOR FOREIGN BANKS [OMB CONTROL NUMBER 1506-0043] The information contained in this Certification is sought pursuant to Sections 5318(j) and 5318(k) of Title 31 of the United State Code, as added by sections 313 and 319(b) of the USA PATRIOT Act of 2001 (Public Law 107-56). This Certification should be completed by any foreign bank that maintains a correspondent account with any U.S. bank or broker-dealer in securities (a covered financial institution as defined in 31 CFR 1010.605(e)). An entity that is not a foreign bank is not required to complete this Certification. A foreign bank is a bank organized under foreign law and located outside of the United States (see definition at 31 CFR 1010.100(u)). A bank includes offices, branches, and agencies of commercial banks or trust companies, private banks, national banks, thrift institutions, credit unions, and other organizations chartered under banking laws and 1 supervised by banking supervisors of any state (see definition at 31 CFR 1010.100(d)). A correspondent account for a foreign bank is any account to receive deposits from, make payments or other disbursements on behalf of a foreign bank, or handle other financial transactions related to the foreign bank. Special instructions for foreign branches of U.S. banks: A branch or office of a U.S. bank outside the United State is a foreign bank. Such a branch or office is not required to complete this Certification with respect to Correspondent Accounts with U.S. branches and offices of the same U.S. -

Belgian Prime News Belgian

BELGIAN PRIME NEWS Quarterly publication Participating Primary and Recognised Dealers : Barclays, Belfius Bank, BNP Paribas Fortis, Citigroup, Crédit Agricole CIB, HSBC, KBC Bank, Morgan Stanley, Natixis, NatWest (RBS), Nomura, Société Générale Corporate & Investment Banking N° 89 September 2020 Last update : 29 September 2020 Next issue : January 2021 • MACROECONOMIC DEVELOPMENTS : Huge uncertainties are curbing the post-lockdown recovery • SPECIAL TOPIC : Belgian banking sector in good shape to cope with the crisis • FINANCIAL MARKETS AND INTEREST RATES : Sovereign bond yields remain low in an uncertain environment • TREASURY HIGHLIGHTS : Belgian Debt Agency’s funding programme proceeds smoothly CONSENSUS Average of participants’ forecasts Belgium Euro area 2019 2020p 2021p 2019 2020p 2021p Real GDP (1) 1.4 -7.9 5.8 1.2 -7.6 5.7 Inflation (HICP) (1) 1.2 0.5 1.3 1.2 0.3 1.0 General government balance (2) -1.9 -9.9 -5.4 -0.6 -9.2 -4.6 Public debt (2) 98.7 114.9 113.4 86.0 103.3 102.1 (1) Percentage changes. (2) EDP definition ; percentages of GDP. SUCCESSIVE FORECASTS FOR BELGIUM eal rot HICP inflation 8 3 6 4 2 2 0 −2 −4 1 −6 −8 −10 0 III III IV III III IV III III IV III III IV 2020 2021 2020 2021 For 2020 For 2021 Source : Belgian Prime News. www.nbb.be 1 MACROECONOMIC Huge uncertainties are curbing the post-lockdown DEVELOPMENTS recovery In Belgium, as in the euro area and the rest of the world, the COVID-19 pandemic led to a sharp and deep drop in economic activity in the first half of 2020. -

Updated As of 01/06/2017 Changes Highlighted in Yellow

NEW QUARTER TOTAL PDship per Previous Quarter Firm Legal Entity Holding Dealership AT BE BG CZ DE DK ES FI FR GR HU IE IT LV LT NL PL PT RO SE SI SK UK Current Quarter Changes Bank March 2016) ABLV Bank ABLV Bank, AS 1 bank customer bank customer 0 Abanka Vipa Abanka Vipa d.d. 1 bank customer bank customer 0 ABN Amro ABN Amro Bank N.V. 3 bank inter dealer bank inter dealer 0 Alpha Bank Alpha Bank S.A. 1 bank customer bank customer 0 Allianz Group Allianz Bank Bulgaria AD 1 bank customer bank customer 0 Banca IMI Banca IMI S.p.A. 3 bank inter dealer bank inter dealer 0 Banca Transilvania Banca Transilvania 1 bank customer bank customer 0 Banco BPI Banco BPI + 1 bank customer bank customer 0 Banco Comercial Português Millenniumbcp + 1 bank customer bank customer 0 Banco Cooperativo Español Banco Cooperativo Español S.A. + 1 bank customer bank customer 0 Banco Santander S.A. + Banco Santander / Santander Group Santander Global Banking & Markets UK 6 bank inter dealer bank inter dealer 0 Bank Zachodni WBK S.A. Bank Millennium Bank Millennium S.A. 1 bank customer bank customer 0 Bankhaus Lampe Bankhaus Lampe KG 1 bank customer bank customer 0 Bankia Bankia S.A.U. 1 bank customer bank customer 0 Bankinter Bankinter S.A. 1 bank customer bank customer 0 Bank of America Merrill Lynch Merrill Lynch International 9 bank inter dealer bank inter dealer 0 Barclays Barclays Bank PLC + 17 bank inter dealer bank inter dealer 0 Bayerische Landesbank Bayerische Landesbank 1 bank customer bank customer 0 BAWAG P.S.K. -

Country Correspondent Bank Currency Swift Account No Australia Westpac Banking Corp

COUNTRY CORRESPONDENT BANK CURRENCY SWIFT ACCOUNT NO AUSTRALIA WESTPAC BANKING CORP. AUD WPACAU2S TVB0001979 AUSTRIA UNICREDIT BANK AUSTRIA AG EUR BKAUATWW 12617947701 EUR ERSTE GROUP BANK AG EUR GIBAATWG AT812010040433351400 BELGIUM BANQUE BRUX.LAMBERT (ING BELGIUM) EUR BBRUBEBB010 301-0179427-58-EUR KBC BANK NV EUR KREDBEBB 480-9163967-94 ING BELGIUM NV/SA USD BBRUBEBB010 301-0179427-58-011 CANADA CANADIAN IMPERIAL BANK CAD CIBCCATT 1875914 DENMARK DANSKE BANK A/S DKK DABADKKK 3007527543 NORDEA BANK DENMARK A/S DKK NDEADKKK 5000416022 ENGLAND WELLS FARGO EUR PNBPGB2L 18143162 BARCLAYS BANK PLC GBP BARCGB22 20325340761052 HSBC BANK PLC GBP MIDLGB22 00465381 STANDARD CHARTERED BANK GBP SCBLGB2L 01249002101 TURKISH BANK GBP TUBAGB2L 00006259 JPMORGAN CHASE BANK RUB CHASGB2L 0040462601 TURKISH BANK USD TUBAGB2L 00090038 HSBC BANK PLC EUR MIDLGB22 76889133 FINLAND NORDEA BANK FINLAND PLC EUR NDEAFIHH 20006701033592 FRANCE CREDIT AGRICOLE EUR AGRIFRPP 20533870000 BNP-PARIBAS SA EUR BNPAFRPP 5200318 NATIXIS - PARIS EUR NATXFRPP FR7630007999990696805488881EUR SOCIETE GENERALE EUR SOGEFRPP 002012526180 GERMANY BAYARISCHE LANDESBANK EUR BYLADEMM 0000001167674 CITIBANK FRF EUR CITIDEFF 4114513011 COMMERZBANK AG EUR COBADEFF 400886358101 EUR LANDESBANK HESSEN-THUERINGEN GIROZENTRALE EUR HELADEFF 0000010291 BAYERISCHE HYPO- UND VEREINSBANK EUR HYVEDEMM 69103618 T.IŞ BANKASI EUR ISBKDEFX 1708940018 STANDARD CHARTERED BANK EUR SCBLDEFX 018000406 SUMITOMO MITSUI BANKING CORP. EUR SMBCDEDD 597156 ZIRAAT BANKASI EUR TCZBDEFF 1000922011 SUMITOMO MITSUI BANKING CORP. GBP SMBCDEDD 597160 SUMITOMO MITSUI BANKING CORP. USD SMBCDEDD 597157 HOLLAND ING BANK N.V. EUR INGBNL2A 0050908294 ITALY INTESA SANPAOLO SPA EUR BCITITMM 100100003483 UNICREDIT S.P.A. EUR UNCRITMM 09958314900 JAPAN THE BANK OF TOKYO-MITSUBISHI UFJ LTD JPY BOTKJPJT 653-0442674 MIZUHA CORPORATE BANK JPY MHCBJPJT 3724010 SUMITOMO MITSU BANKING CORP. -

Press Release Outside Trading Hours – Regulated Information*

Press release Outside trading hours – Regulated information* Brussels, 16 March 2021 (8.00 a.m. CET, before trading hours) Changes at the top of KBC Group Subject to the approval of the Annual General Meeting of Shareholders on 6 May 2021, KBC Group will reshuffle its Executive Committee: - Rik Scheerlinck, KBC Group CFO, who reached the statutory age limit in January 2021, will retire after a career of 37 years with KBC. - Luc Popelier, the current CEO of the International Markets Business Unit, will succeed Rik Scheerlinck as CFO and Executive Director of KBC Group. Luc will also oversee Markets and KBC Securities. - On the recommendation of the KBC Group Nomination Committee, the Board of Directors has appointed Peter Andronov, the current CEO of UBB and Country CEO for Bulgaria, to the Executive Committee and successor to Luc Popelier as CEO of the International Markets Business Unit. Peter will also oversee KBC Asset Management. - The active career at KBC of Daniel Falque, the current CEO of the Belgium Business Unit, will end on 6 May 2021. Daniel has now decided to pursue other interests in the future after having spent 12 years at KBC as CEO of CBC Banque (2009-2012) and CEO of the KBC Belgium Business Unit and member of the Executive Committee of KBC Group (2012-present). - On the recommendation of the KBC Group Nomination Committee, the Board of Directors has appointed David Moucheron, the current CEO of K&H Bank & Insurance and Country CEO for Hungary, to the KBC Group Executive Committee and successor to Daniel Falque as CEO of the Belgium Business Unit. -

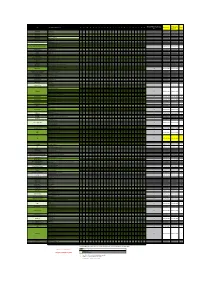

List of Market Makers and Authorised Primary Dealers Who Are Using the Exemption Under the Regulation on Short Selling and Credit Default Swaps

Last update 11 August 2021 List of market makers and authorised primary dealers who are using the exemption under the Regulation on short selling and credit default swaps According to Article 17(13) of Regulation (EU) No 236/2012 of the European Parliament and of the Council of 14 March 2012 on short selling and certain aspects of credit default swaps (the SSR), ESMA shall publish and keep up to date on its website a list of market makers and authorised primary dealers who are using the exemption under the Short Selling Regulation (SSR). The data provided in this list have been compiled from notifications of Member States’ competent authorities to ESMA under Article 17(12) of the SSR. Among the EEA countries, the SSR is applicable in Norway as of 1 January 2017. It will be applicable in the other EEA countries (Iceland and Liechtenstein) upon implementation of the Regulation under the EEA agreement. Austria Italy Belgium Latvia Bulgaria Lithuania Croatia Luxembourg Cyprus Malta Czech Republic The Netherlands Denmark Norway Estonia Poland Finland Portugal France Romania Germany Slovakia Greece Slovenia Hungary Spain Ireland Sweden Last update 11 August 2021 Austria Market makers Name of the notifying Name of the informing CA: ID code* (e.g. BIC): person: FMA ERSTE GROUP BANK AG GIBAATWW FMA OBERBANK AG OBKLAT2L FMA RAIFFEISEN CENTROBANK AG CENBATWW Authorised primary dealers Name of the informing CA: Name of the notifying person: ID code* (e.g. BIC): FMA BARCLAYS BANK PLC BARCGB22 BAWAG P.S.K. BANK FÜR ARBEIT UND WIRTSCHAFT FMA BAWAATWW UND ÖSTERREICHISCHE POSTSPARKASSE AG FMA BNP PARIBAS S.A.