26 January 2018 Results of the Mandatory

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ADV Part 2A: Firm Brochure

Firm Brochure Part 2A Natixis Advisors, LLC (“Natixis Advisors”) Natixis Investment Managers Solutions, a division of Natixis Advisors (“Solutions”) Boston Office San Francisco Office 888 Boylston Street 101 Second Street, Suite 1600 Boston, MA 02199 San Francisco, CA 94105 Phone: 617-449-2835 Phone: 617-449-2838 Fax: 617-369-9794 Fax: 617-369-9794 www.im.natixis.com This brochure provides information about the qualifications and business practices of Natixis Advisors. If you have any questions about the contents of this brochure, please contact us at 617-449-2838 or by email at [email protected]. The information in this brochure has not been approved or verified by the United States Securities and Exchange Commission (“SEC”) or by any state securities authority. Additional information about Natixis Advisors is available on the SEC’s website at www.adviserinfo.sec.gov. Registration does not imply that any particular level of skill or training has been met by Natixis Advisors or its personnel. August 4, 2021 1 Important Note about this Brochure This Brochure is not: • an offer or agreement to provide advisory services to any person; • an offer to sell interests (or a solicitation of an offer to purchase interests) in any fund that we advise; or • a complete discussion of the features, risks, or conflicts associated with any advisory service or fund. As required by the Investment Advisers Act of 1940, as amended (the “Advisers Act”), we provide this Brochure to current and prospective clients. We also, in our discretion, will provide this Brochure to current or prospective investors in a fund, together with other relevant offering, governing, or disclosure documents. -

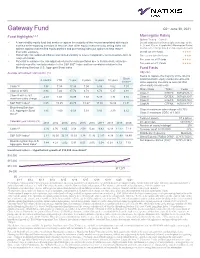

Gateway Fund

Gateway Fund Q2 • June 30, 2021 Fund Highlights1,2,3 Morningstar Rating Options Trading – Class Y • A low-volatility equity fund that seeks to capture the majority of the returns associated with equity Overall rating derived from weighted average of the markets while exposing investors to less risk than other equity investments by selling index call 3-, 5- and 10-year (if applicable) Morningstar Rating options against a diversified equity portfolio and purchasing index put options to help reduce metrics; other ratings based on risk-adjusted returns downside exposure Overall out of 81 funds ★★★★ • Historically has outpaced inflation and limited volatility to a level comparable to intermediate-term to Three years out of 81 funds ★★★ long term bonds Five years out of 57 funds • Potential to enhance the risk-adjusted returns for many portfolios due to its historically attractive ★★★★ risk/return profile, low beta relative to the S&P 500® Index and low correlation relative to the Ten years out of 11 funds ★★★★ Bloomberg Barclays U.S. Aggregate Bond Index Fund Facts Average annualized total returns† (%) Objective Seeks to capture the majority of the returns Since 3 months YTD 1 year 3 years 5 years 10 years associated with equity market investments, 1/1/88** while exposing investors to less risk than Class Y5 3.98 7.34 17.98 7.04 6.98 5.62 7.01 other equity investments Share Class Ticker Cusip Class A at NAV 3.94 7.24 17.72 6.78 6.72 5.37 6.91 Class Y GTEYX 367829-88-4 Class A with 5.75% -2.04 1.08 10.95 4.69 5.47 4.74 6.72 Class A GATEX 367829-20-7 maximum sales charge Class C GTECX 367829-70-2 ® 8 S&P 500 Index 8.55 15.25 40.79 18.67 17.65 14.84 11.31 Class N GTENX 367829-77-7 Bloomberg Barclays U.S. -

Third Supplemental Information Memorandum Dated 23 July 2019

Third Supplemental Information Memorandum dated 23 July 2019 LVMH FINANCE BELGIQUE SA (incorporated as société anonyme / naamloze vennootschap) under the laws of Belgium, with enterprise number 0897.212.188 RPR/RPM (Brussels)) EUR 4,000,000,000 Belgian Multi-currency Short-Term Treasury Notes Programme Irrevocably and unconditionally guaranteed by LVMH Moët Hennessy - Louis Vuitton SE (incorporated as European company under the laws of France, and registered under number 775 670 417 (R.C.S. Paris)) The Programme is rated A-1 by Standard & Poor’s Ratings Services, a division of the McGraw-Hill Companies, Inc. and, Arranger Dealers Banque Fédérative du Crédit Mutuel BNP Paribas BRED Banque Populaire Crédit Agricole Corporate and Investment Bank Crédit Industriel et Commercial BNP Paribas Fortis SA/NV Natixis Société Générale ING Belgium SA/NV ING Bank N.V. Belgian Branch Issuing and Paying Agent BNP Paribas Fortis SA/NV This third supplemental information memorandum is dated 23 July 2019 (the “Third Supplemental Information Memorandum”) and is supplemental to, and shall be read in conjunction with, the information memorandum dated 20 October 2015 as supplemented on 21 April 2016 and on 28 April 2017 (the “Information Memorandum”). Unless otherwise defined herein, terms defined in the Information Memorandum have the same respective meanings when used in this Third Supplemental Information Memorandum. As of the date of this Third Supplemental Information Memorandum: (i) The Issuer herby makes the following additional disclosure: Moody's assigned on 3 July 2019 a first-time A1 long-term issuer rating and Prime-1 (P-1) short-term rating to LVMH Moët Hennessy Louis Vuitton SE.; (ii) The paragraph 1.17 “Rating(s) of the Programme” of the section entitled “1. -

Frequently Asked Questions

This document is provided for informational purposes only. It does not constitute a solicitation to buy/sell any product or security issued by the KBC Group or its subsidiaries. The information provided in this document is condensed and/or simplified and therefore incomplete. The document may contain forward- looking statements with respect to the strategy, earnings and capital trends of KBC, involving numerous assumptions and uncertainties. The risk exists that these statements may not be fulfilled and that future developments differ materially. Moreover, KBC does not undertake any obligation to update this document in line with new developments. The document may also contain non-IFRS information. By reading this document, each person is deemed to represent that he/she possesses sufficient expertise to understand the risks involved. KBC Group and its subsidiaries cannot be held liable for any damage resulting from the use of the information. KBC Group – who’s who in the Executive Committee, situation at 01 May 2014 Johan Thijs Group Chief Executive Officer °1965 Belgian Master’s Degree in Science (Applied Mathematics) and Actuarial Sciences (KU Leuven) Joined KBC Group or its pre-merger entities in 1988 Career o 1988 Various actuary functions in life and non-life insurance, ABB Insurance o 1995 Head of non-life department, Limburg regional office, ABB Insurance o 1998 Provincial manager Limburg and Eastern Belgium, KBC Insurance o 2001 Senior General Manager non-life insurance, KBC Insurance o 2006 Member of the Management Committee -

2021 VIB Belg BT Infomemo 04-08-2021.Pdf

Volkswagen International Belgium – Information Memorandum This Information Memorandum dated August 4, 2021 amends and replaces the information memorandum dated 18 October 2018 as supplemented from time to time. VOLKSWAGEN INTERNATIONAL BELGIUM SA (incorporated as naamloze vennootschap / société anonyme under the laws of Belgium, with enterprise number 443.615.642 (RPM/RPR Brussels)). EUR 5,000,000,000 Belgian Short-Term Treasury Notes Programme This Programme has been submitted to the STEP Secretariat in order to apply for the Short-Term European Paper (STEP- label). The status of STEP compliance of this Programme can be checked on the STEP Market website (www.stepmarket.org). The Programme is rated A-2 by Standard & Poor’s Ratings Services, a division of the McGraw-Hill Companies Inc. and P-2 by Moody’s Investors Service, Inc. Arranger Dealers BNP Paribas ING Bank N.V. Belgian Branch Crédit Agricole Corporate and Investment Bank Crédit Industriel et BNP Paribas Fortis SA/NV ING Belgium SA/NV Commercial BRED Banque Populaire KBC Bank NV Société Générale Issuing and Paying Agent – Domiciliary Agent BNP Paribas Fortis SA/NV Volkswagen International Belgium – Information Memorandum Potential investors are invited to read this Information Memorandum, the Conditions and the selling restrictions, prior to investing. Each holder of Treasury Notes from time to time represents through its acquisition of a Treasury Note that it is and, as long as it holds any Treasury Notes, shall remain an Eligible Holder. Nevertheless, a decision to invest in -

KBC Bank Half-Year Report

KBC Bank Half-Year Report - 1H2020 Interim Report – KBC Bank – 1H2020 p. 1 Company name ‘KBC’ or ‘KBC Bank’ as used in this report refer to the consolidated bank entity (i.e. KBC Bank NV including all companies that are included in the scope of consolidation). ‘KBC Bank NV’ refers solely to the non-consolidated entity. KBC Group or the KBC group refers to the parent company of KBC Bank (see below). Difference between KBC Bank and KBC Group KBC Bank is a subsidiary of KBC Group. Simplified, the KBC Group's legal structure has one single entity – KBC Group NV – in control of two underlying companies, viz. KBC Bank and KBC Insurance. Forward-looking statements The expectations, forecasts and statements regarding future developments that are contained in this report are, of course, based on assumptions and are contingent on a number of factors that will come into play in the future. Consequently, the actual situation may turn out to be (substantially) different. Glossary of ratios used (including the alternative performance measures) See separate section at the end of this report. Investor Relations contact details [email protected] www.kbc.com/kbcbank KBC Bank NV Investor Relations Office (IRO) Havenlaan 2 BE-1080 Brussels Belgium Management certification ‘I, Rik Scheerlinck, Chief Financial Officer of KBC Bank, certify on behalf of the Executive Committee of KBC Bank NV that, to the best of my knowledge, the abbreviated financial statements included in the interim report are based on the relevant accounting standards and fairly present in all material respects the financial condition and results of KBC Bank NV including its consolidated subsidiaries, and that the interim report provides a fair overview of the main events, the main transactions with related parties in the period under review and their impact on the abbreviated financial statements, and an overview of the main risks and uncertainties for the remainder of the current year.’ Interim Report – KBC Bank – 1H2020 p. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP. -

High-Quality Service Is Key Differentiator for European Banks 2018 Greenwich Leaders: European Large Corporate Banking and Cash Management

High-Quality Service is Key Differentiator for European Banks 2018 Greenwich Leaders: European Large Corporate Banking and Cash Management Q1 2018 After weathering the chaos of the financial crisis and the subsequent restructuring of the European banking industry, Europe’s largest companies are enjoying a welcome phase of stability in their banking relationships. Credit is abundant (at least for big companies with good credit ratings), service is good and getting better, and banks are getting easier to work with. Aside from European corporates, the primary beneficiaries of this new stability are the big banks that already count many of Europe’s largest companies as clients. At the top of that list sits BNP Paribas, which is used for corporate banking by 65% of Europe’s largest companies. HSBC is next at 56%, followed by Deutsche Bank at 43%, UniCredit at 38% and Citi at 37%. These banks are the 2018 Greenwich Share Leaders℠ in European Top-Tier Large Corporate Banking. Greenwich Share Leaders — 2018 GREENWICH ASSOCIATES Greenwich Share20 1Leade8r European Top-Tier Large Corporate Banking Market Penetration Eurozone Top-Tier Large Corporate Banking Market Penetration Bank Market Penetration Statistical Rank Bank Market Penetration Statistical Rank BNP Paribas 1 BNP Paribas 1 HSBC 2 HSBC 2 Deutsche Bank 3 UniCredit 3T UniCredit 4T Deutsche Bank 3T Citi 4T Commerzbank 5T ING Bank 5T Note: Based on 576 respondents from top-tier companies. Note: Based on 360 respondents from top-tier companies. European Top-Tier Large Corporate Eurozone Top-Tier Large Corporate Cash Management Market Penetration Cash Management Market Penetration Bank Market Penetration Statistical Rank Bank Market Penetration Statistical Rank BNP Paribas ¡ 1 BNP Paribas 1 HSBC 2 HSBC 2T Deutsche Bank 3 UniCredit 2T Citi 4T Deutsche Bank 4 UniCredit 4T Commerzbank 5T ING Bank 5T Note: Based on 605 respondents from top-tier companies. -

Natixis U.S. Equity Opportunities Fund

Q2 | June 30, 2021 Natixis U.S. Equity Opportunities Fund QUARTERLY PORTFOLIO COMMENTARY Average annualized total returns (%) † as of 6/30/2021 3 months YTD 1 year 3 years 5 years 10 years Class Y 9.14 18.78 47.66 19.79 20.17 16.11 Class A at NAV 9.10 18.60 47.28 19.48 19.87 15.82 Class A with 5.75% maximum sales charge 2.82 11.79 38.81 17.15 18.46 15.13 S&P 500® Index 8.55 15.25 40.79 18.67 17.65 14.84 Russell 1000® Index 8.54 14.95 43.07 19.16 17.99 14.90 Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. †Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. You may not invest directly in an index. Gross expense ratio 1.17% (Class A share) / 0.92% (Class Y share). Net expense ratio 1.17% (Class A share) / 0.92% (Class Y share). As of the most recent prospectus, the investment advisor has contractually agreed to waive fees and/or reimburse expenses (with certain exceptions) once the expense cap of the fund has been exceeded. -

Transition Finance Toolkit

04. TRANSITION FINANCE TOOLKIT 1. April 2021 | BROWN INDUSTRIES: THE TRANSITION TIGHTROPE Tightrope.com C2 - Internal Natixis KEY TAKEAWAYS Chapter 4 Green Finance is now a core component of Climate Action and benefits from a strong impetus and legislative plans from policy-makers. The global Green/Sustainable/Social debt market reached $1.192 trillion threshold as of December 2020. There is increasing investors’ appetite for Brown industries are still largely absent from the Green transition KPI-linked products that could Bond market, which still focuses on green activities and include brown industries players The General Corporate Purpose model tied to a key performance • Investors are relatively less confident in predominantly and/or indicator on which different financial mechanism could be built allows a historically brown companies as they assess company’s profile & more holistic and forward-looking approach of climate finance. strategy in addition to the Use-of-Proceeds. UoP & General Corporate Purpose should not be opposed and can be • There is a lack of standards for activities in "grey areas" (whose complementary. "greenness" depends on observed performances like efficiency gains). The EU Taxonomy tries to address the lack of standards There is a new standard around for activities in grey areas Sustainability-Linked Bonds • Stringent thresholds can be fairly understood from the climate neutrality The ICMA has launched guidelines on the disclosures that should be objective but could lead to a niche of eligible companies or assets. made by issuers when raising funds in debt capital markets (the “Climate • The level of stringency, combined with its binary nature (i.e., without Transition Finance Handbook”). -

ADB's Trade Finance Program Confirming Banks List

Trade Finance Program Confirming Banks List As of 31 July 2016 AFGHANISTAN Bank Alfalah Limited (Afghanistan Branch) 410 Chahri-e-Sadarat Shar-e-Nou, Kabul, Afghanistan National Bank of Pakistan (Jalalabad Branch) Bank Street Near Haji Qadeer House Nahya Awal, Jalalabad, Afghanistan National Bank of Pakistan (Kabul Branch) House No. 2, Street No. 10 Wazir Akbar Khan, Kabul, Afghanistan ALGERIA HSBC Bank Middle East Limited, Algeria 10 Eme Etage El-Mohammadia 16212, Alger, Algeria ANGOLA Banco Millennium Angola SA Rua Rainha Ginga 83, Luanda, Angola ARGENTINA Banco Patagonia S.A. Av. De Mayo 701 24th floor C1084AAC, Buenos Aires, Argentina Banco Rio de la Plata S.A. Bartolome Mitre 480-8th Floor C1306AAH, Buenos Aires, Argentina AUSTRALIA Australia and New Zealand Banking Group Limited Level 20, 100 Queen Street, Melbourne, VIC 3000, Australia Australia and New Zealand Banking Group Limited (Adelaide Branch) Level 20, 11 Waymouth Street, Adelaide, Australia Australia and New Zealand Banking Group Limited (Adelaide Branch - Trade and Supply Chain) Level 20, 11 Waymouth Street, Adelaide, Australia Australia and New Zealand Banking Group Limited (Brisbane Branch) Level 18, 111 Eagle Street, Brisbane QLD 4000, Australia Australia and New Zealand Banking Group Limited (Brisbane Branch - Trade and Supply Chain) Level 18, 111 Eagle Street, Brisbane QLD 4000, Australia Australia and New Zealand Banking Group Limited (Perth Branch) Level 6, 77 St Georges Terrace, Perth, Australia Australia and New Zealand Banking Group Limited (Perth Branch - Trade -

Lloyds Banking Group PLC

Lloyds Banking Group PLC Primary Credit Analyst: Nigel Greenwood, London (44) 20-7176-1066; [email protected] Secondary Contact: Richard Barnes, London (44) 20-7176-7227; [email protected] Table Of Contents Major Rating Factors Outlook Rationale Related Criteria Related Research WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 5, 2020 1 THIS WAS PREPARED EXCLUSIVELY FOR USER CIARAN TRELLIS. NOT FOR REDISTRIBUTION UNLESS OTHERWISE PERMITTED. Lloyds Banking Group PLC Major Rating Factors Issuer Credit Rating BBB+/Negative/A-2 Strengths: Weaknesses: • Market-leading franchise in U.K. retail banking, and • Geographically concentrated in the U.K., which is strong positions in U.K. corporate banking and now in recession owing to the impact of COVID-19. insurance. • Our risk-adjusted capital (RAC) ratio is lower than • Cost-efficient operating model that supports strong the average for U.K. peers, which partly reflects the pre-provision profitability, business stability, and deduction of Lloyds' material investment in its competitiveness. insurance business. • Supportive funding and liquidity profiles anchored by strong deposit franchise. WWW.STANDARDANDPOORS.COM/RATINGSDIRECT JUNE 5, 2020 2 THIS WAS PREPARED EXCLUSIVELY FOR USER CIARAN TRELLIS. NOT FOR REDISTRIBUTION UNLESS OTHERWISE PERMITTED. Lloyds Banking Group PLC Outlook The negative outlook on Lloyds Banking Group reflects potential earnings pressures arising from the economic and market impact of the COVID-19 pandemic. Downside scenario If we saw clear signs that the U.K. systemwide domestic loan loss rate was going to exceed 100 basis points in 2020, and not be offset by the prospect of a quick economic recovery, we would likely lower the anchor, our starting point for rating U.K.