Natixis Model Portfolios Added to UBS's Separately Managed

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ADV Part 2A: Firm Brochure

Firm Brochure Part 2A Natixis Advisors, LLC (“Natixis Advisors”) Natixis Investment Managers Solutions, a division of Natixis Advisors (“Solutions”) Boston Office San Francisco Office 888 Boylston Street 101 Second Street, Suite 1600 Boston, MA 02199 San Francisco, CA 94105 Phone: 617-449-2835 Phone: 617-449-2838 Fax: 617-369-9794 Fax: 617-369-9794 www.im.natixis.com This brochure provides information about the qualifications and business practices of Natixis Advisors. If you have any questions about the contents of this brochure, please contact us at 617-449-2838 or by email at [email protected]. The information in this brochure has not been approved or verified by the United States Securities and Exchange Commission (“SEC”) or by any state securities authority. Additional information about Natixis Advisors is available on the SEC’s website at www.adviserinfo.sec.gov. Registration does not imply that any particular level of skill or training has been met by Natixis Advisors or its personnel. August 4, 2021 1 Important Note about this Brochure This Brochure is not: • an offer or agreement to provide advisory services to any person; • an offer to sell interests (or a solicitation of an offer to purchase interests) in any fund that we advise; or • a complete discussion of the features, risks, or conflicts associated with any advisory service or fund. As required by the Investment Advisers Act of 1940, as amended (the “Advisers Act”), we provide this Brochure to current and prospective clients. We also, in our discretion, will provide this Brochure to current or prospective investors in a fund, together with other relevant offering, governing, or disclosure documents. -

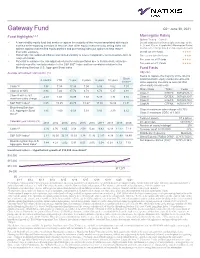

Gateway Fund

Gateway Fund Q2 • June 30, 2021 Fund Highlights1,2,3 Morningstar Rating Options Trading – Class Y • A low-volatility equity fund that seeks to capture the majority of the returns associated with equity Overall rating derived from weighted average of the markets while exposing investors to less risk than other equity investments by selling index call 3-, 5- and 10-year (if applicable) Morningstar Rating options against a diversified equity portfolio and purchasing index put options to help reduce metrics; other ratings based on risk-adjusted returns downside exposure Overall out of 81 funds ★★★★ • Historically has outpaced inflation and limited volatility to a level comparable to intermediate-term to Three years out of 81 funds ★★★ long term bonds Five years out of 57 funds • Potential to enhance the risk-adjusted returns for many portfolios due to its historically attractive ★★★★ risk/return profile, low beta relative to the S&P 500® Index and low correlation relative to the Ten years out of 11 funds ★★★★ Bloomberg Barclays U.S. Aggregate Bond Index Fund Facts Average annualized total returns† (%) Objective Seeks to capture the majority of the returns Since 3 months YTD 1 year 3 years 5 years 10 years associated with equity market investments, 1/1/88** while exposing investors to less risk than Class Y5 3.98 7.34 17.98 7.04 6.98 5.62 7.01 other equity investments Share Class Ticker Cusip Class A at NAV 3.94 7.24 17.72 6.78 6.72 5.37 6.91 Class Y GTEYX 367829-88-4 Class A with 5.75% -2.04 1.08 10.95 4.69 5.47 4.74 6.72 Class A GATEX 367829-20-7 maximum sales charge Class C GTECX 367829-70-2 ® 8 S&P 500 Index 8.55 15.25 40.79 18.67 17.65 14.84 11.31 Class N GTENX 367829-77-7 Bloomberg Barclays U.S. -

Third Supplemental Information Memorandum Dated 23 July 2019

Third Supplemental Information Memorandum dated 23 July 2019 LVMH FINANCE BELGIQUE SA (incorporated as société anonyme / naamloze vennootschap) under the laws of Belgium, with enterprise number 0897.212.188 RPR/RPM (Brussels)) EUR 4,000,000,000 Belgian Multi-currency Short-Term Treasury Notes Programme Irrevocably and unconditionally guaranteed by LVMH Moët Hennessy - Louis Vuitton SE (incorporated as European company under the laws of France, and registered under number 775 670 417 (R.C.S. Paris)) The Programme is rated A-1 by Standard & Poor’s Ratings Services, a division of the McGraw-Hill Companies, Inc. and, Arranger Dealers Banque Fédérative du Crédit Mutuel BNP Paribas BRED Banque Populaire Crédit Agricole Corporate and Investment Bank Crédit Industriel et Commercial BNP Paribas Fortis SA/NV Natixis Société Générale ING Belgium SA/NV ING Bank N.V. Belgian Branch Issuing and Paying Agent BNP Paribas Fortis SA/NV This third supplemental information memorandum is dated 23 July 2019 (the “Third Supplemental Information Memorandum”) and is supplemental to, and shall be read in conjunction with, the information memorandum dated 20 October 2015 as supplemented on 21 April 2016 and on 28 April 2017 (the “Information Memorandum”). Unless otherwise defined herein, terms defined in the Information Memorandum have the same respective meanings when used in this Third Supplemental Information Memorandum. As of the date of this Third Supplemental Information Memorandum: (i) The Issuer herby makes the following additional disclosure: Moody's assigned on 3 July 2019 a first-time A1 long-term issuer rating and Prime-1 (P-1) short-term rating to LVMH Moët Hennessy Louis Vuitton SE.; (ii) The paragraph 1.17 “Rating(s) of the Programme” of the section entitled “1. -

FINE-TUNED BNP PARIBAS EXCELS at the BUSINESS of BANKING BNP Paribas Is That Rarity: a Large Bank Actually Delivering on Its Promises to Stakeholders

Reprinted from July 2016 www.euromoney.com WORLD’S BEST BANK BNP PARIBAS EXCELS AT THE BUSINESS OF BANKING World’s best bank Reprinted from July 2016 Copyright© Euromoney magazine www.euromoney.com WORLD’S BEST BANK FINE-TUNED BNP PARIBAS EXCELS AT THE BUSINESS OF BANKING BNP Paribas is that rarity: a large bank actually delivering on its promises to stakeholders. It is producing better returns even than many of the US banks, despite being anchored in a low-growth home region, building capital and winning customers – all while proving the benefits of a diversified business model. Its cadre of loyal, long-serving senior executives look to have got the strategy right: staying the course in Asia and the US and running global customer franchises, but only in the select services it excels at By: Peter Lee Illustration: Jeff Wack eset by weak profitability, negative interest rates and Its third division, international financial services, includes banking low growth in their home markets, European banks in the US, Latin America and Asia, as well as specialist business such are losing out to US rivals that restructured and as consumer finance, asset and wealth management and insurance. recapitalized quickly after the global financial crisis At a time when peers are still shrinking, BNP Paribas is growing. and whose home economy has enjoyed a much more While new and uncertain management teams struggle to get back Brobust recovery since. to basics, the technicians at BNP Paribas embrace geographic and In April, the European Banking Authority published its latest update business diversity. Critics see a large bank running on six engines in on the vulnerabilities of the 154 biggest European banks and noted a the age of the monoplane. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP. -

Natixis U.S. Equity Opportunities Fund

Q2 | June 30, 2021 Natixis U.S. Equity Opportunities Fund QUARTERLY PORTFOLIO COMMENTARY Average annualized total returns (%) † as of 6/30/2021 3 months YTD 1 year 3 years 5 years 10 years Class Y 9.14 18.78 47.66 19.79 20.17 16.11 Class A at NAV 9.10 18.60 47.28 19.48 19.87 15.82 Class A with 5.75% maximum sales charge 2.82 11.79 38.81 17.15 18.46 15.13 S&P 500® Index 8.55 15.25 40.79 18.67 17.65 14.84 Russell 1000® Index 8.54 14.95 43.07 19.16 17.99 14.90 Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit im.natixis.com. Performance for other share classes will be greater or less than shown based on differences in fees and sales charges. †Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. You may not invest directly in an index. Gross expense ratio 1.17% (Class A share) / 0.92% (Class Y share). Net expense ratio 1.17% (Class A share) / 0.92% (Class Y share). As of the most recent prospectus, the investment advisor has contractually agreed to waive fees and/or reimburse expenses (with certain exceptions) once the expense cap of the fund has been exceeded. -

Monthly SN 2019.07.31

Olympic SE Code ISIN Code Instrument Name Issuer Name Ccy Maturity Date Market Date Market Price 0110277-000 XS0813926846 PPN100 SGIS-SGIS SPX/USDJPY 5.2% SG ISSUER USD 1/2/2023 7/29/2019 89.5 0110296-000 XS0813931762 PPN100 SGIS-SGIS SPX/USDJPY 4.75% SG ISSUER USD 1/17/2023 7/29/2019 89.41 0110349-000 XS0813931929 PPN100 SGIS-SGIS SPX/USDJPY 070228SG ISSUER USD 2/7/2028 7/29/2019 79.11 0110353-000 XS0836269174 PPN100 SGIS-SGIS SPX/USDJPY 100428SG ISSUER USD 4/10/2028 7/29/2019 78.65 0110346-000 XS0836274844 PPN100 SGIS-SGIS SPX/EURUSD 5.6% SG ISSUER USD 3/28/2023 7/29/2019 89.14 0110347-000 XS0836291186 PPN100 SGIS-SGIS SPX/EURUSD 5.9% SG ISSUER USD 5/22/2023 7/29/2019 88.83 0110246-000 XS0836291699 PPN100 SGIS-SGIS SPX/EURUSD 5.5% SG ISSUER USD 5/28/2023 7/29/2019 88.74 0110134-000 XS0883120825 PPN100 CA-CA USDJPY/SPX 5% 050223 CREDIT AGRICOLE CIB FINANCE (GUERNSUSD 2/5/2023 7/30/2019 90.87 0110135-000 XS0889322342 PPN100 CA-CA USDJPY/SPX 4.85% CREDIT AGRICOLE CIB FINANCE (GUERNSUSD 2/20/2023 7/30/2019 90.68 0110136-000 XS0897026232 PPN100 CA-CA USDJPY/SPX 5.1%080323CREDIT AGRICOLE CIB FINANCE (GUERNSUSD 3/8/2023 7/30/2019 90.55 0110137-000 XS0907516206 PPN100 CA-CA USDJPY/SPX 5.07% CREDIT AGRICOLE CIB FINANCE (GUERNSUSD 3/28/2023 7/30/2019 90.58 0110111-000 XS0930038962 PPN100 CA-CA EURUSD/SPX 10% 170523CREDIT AGRICOLE CIB FINANCE (GUERNSAUD 5/17/2023 7/30/2019 92.88 0117848-000 XS0962000724 CLN BNPP-BNP PEOPLE REP OF CHINABNP PARIBAS ISSUANCE B.V. -

Transition Finance Toolkit

04. TRANSITION FINANCE TOOLKIT 1. April 2021 | BROWN INDUSTRIES: THE TRANSITION TIGHTROPE Tightrope.com C2 - Internal Natixis KEY TAKEAWAYS Chapter 4 Green Finance is now a core component of Climate Action and benefits from a strong impetus and legislative plans from policy-makers. The global Green/Sustainable/Social debt market reached $1.192 trillion threshold as of December 2020. There is increasing investors’ appetite for Brown industries are still largely absent from the Green transition KPI-linked products that could Bond market, which still focuses on green activities and include brown industries players The General Corporate Purpose model tied to a key performance • Investors are relatively less confident in predominantly and/or indicator on which different financial mechanism could be built allows a historically brown companies as they assess company’s profile & more holistic and forward-looking approach of climate finance. strategy in addition to the Use-of-Proceeds. UoP & General Corporate Purpose should not be opposed and can be • There is a lack of standards for activities in "grey areas" (whose complementary. "greenness" depends on observed performances like efficiency gains). The EU Taxonomy tries to address the lack of standards There is a new standard around for activities in grey areas Sustainability-Linked Bonds • Stringent thresholds can be fairly understood from the climate neutrality The ICMA has launched guidelines on the disclosures that should be objective but could lead to a niche of eligible companies or assets. made by issuers when raising funds in debt capital markets (the “Climate • The level of stringency, combined with its binary nature (i.e., without Transition Finance Handbook”). -

Investec Bank Plc

REGISTRATION DOCUMENT INVESTEC BANK PLC (A company incorporated with limited liability in England and Wales with registered number 489604) This document (as amended and supplemented from time to time and including any document incorporated by reference herein) constitutes a registration document (the "Registration Document") for the purposes of (EU) 2017/1129 (the "Prospectus Regulation"). This Registration Document has been prepared for the purpose of providing information about Investec Bank plc (the "Bank") to enable any investors (including any persons considering an investment) in any debt or derivative securities issued by the Bank ("Securities") during the period of twelve months after the date hereof to make an informed assessment of the assets and liabilities, financial position, profit and losses and prospects of the Bank as issuer of such Securities. Information on any Securities can be found in a separate securities note containing disclosure on such Securities (and, where appropriate, in the relevant summary note applicable to the relevant Securities), which, together with this Registration Document, constitutes a prospectus issued in compliance with the Prospectus Regulation. Investors seeking to make an informed assessment of an investment in any Securities are advised to read the whole prospectus (including this Registration Document). This Registration Document has been approved by the Financial Conduct Authority (the "FCA") as competent authority under the Prospectus Regulation. The FCA only approves this Registration Document as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such approval should not be considered as an endorsement of the Issuer that is the subject of this Registration Document. This Registration Document is valid for a period of twelve months from the date of approval. -

LONDON (MARCH 17, 2021) – Loomis, Sayles & Company, an Affiliate of Natixis Investment Managers, Announced Today That Chri

\ CHRIS YIANNAKOU NAMED HEAD OF LOOMIS SAYLES INVESTMENTS LIMITED, LONDON Chris Yiannakou promoted to head of Loomis Sayles Investments Limited (LSIL), Loomis Sayles’ London-based entity Role was previously held by Christine Kenny, who is repatriating to the United States in a newly created role as strategic project leader Joseph Mukungu promoted to head of client relationship management, EMEA Valerie Miles, fixed income trader, replaces Christine Kenny on the board of Loomis Sayles Investments Limited LONDON (MARCH 17, 2021) – Loomis, Sayles & Company, an affiliate of Natixis Investment Managers, announced today that Chris Yiannakou has been named head of Loomis Sayles Investments Limited (LSIL), Loomis Sayles’ London-based entity. Chris reports jointly to Kevin Charleston, chairman and chief executive officer, and to Maurice Leger, director of global institutional services. Loomis Sayles opened the London office in 2012 to expand the firm’s global footprint and strategically support the unique needs of EMEA investors. Less than 10 years later, the European/MENA book of business accounts for about £28.3 billion ($38.4 billion) in assets under management. LSIL also has a significant trading and research presence, with deep relationships in the UK and Europe. In his new role, Chris is responsible for the overall operations of the firm’s London office in addition to his duties as head of EMEA institutional services, overseeing a team primarily responsible for client and consultant relationships as well as business development across the EMEA region. In 2015, Chris was named director of Europe, Middle East and Africa (EMEA) institutional services, managing director and board member of LSIL. -

26 January 2018 Results of the Mandatory

26 JANUARY 2018 RESULTS OF THE MANDATORY PUBLIC TAKEOVER BID IN CASH AND SQUEEZE-OUT BY Natixis Belgique Investissements SA, a public limited company incorporated under Belgian law (the « Bidder ») ON ALL SHARES AND WARRANTS NOT YET OWNED BY THE BIDDER ISSUED BY Dalenys SA, a public limited company incorporated under Belgian law (the « Target Company »). Results of the bid The initial acceptance period of the mandatory takeover bid launched on 11 December 2017 by the Bidder on 8,620,827 shares representing 45,71% of the share capital and 38,67% of the voting rights of the Target Company and on 5,000 warrants (the “Bid”) ended on 22 January 2018. Following the initial acceptance period, the Bidder and the persons affiliated to him hold 18,401,437 shares and 3,432,944 profit shares representing 97,6 % of the share capital and 97,97 % of the voting rights in the Target Company. Payment of the bid price for the transferred shares will be made on 5 February 2018. Squeeze-out As the Bidder and the persons affiliated to him hold at least 95 % of the shares and securities with voting rights in the Target Company following the initial acceptance period, the Bidder decided to proceed with a squeeze out (in accordance with Article 513 of the Companies Code and Articles 42 and 43 in conjunction with Article 57 of the royal decree of 27 April 2007 on Takeover Bids) (the “Squeeze-out”) in order to acquire the shares and warrants issued by the Target Company not yet acquired by the Bidder, under the same terms and conditions as the Bid. -

UBS CEO Speaks at the Deutsche Bank Global Financial Services Conference

UBS CEO speaks at the Deutsche Bank Global Financial Services Conference Q&A discussion 30 May 2018 Speakers: Sergio P. Ermotti, UBS Group AG CEO and Kinner Lakhani, Deutsche Bank head of European banks research Kinner Lakhani: Okay, good morning everyone! Welcome again to Deutsche Bank’s 8th Global Financial Services Conference. My name is Kinner Lakhani, I run the European banks research effort, and it is a great pleasure to have with us today UBS CEO Sergio Ermotti. So I thought maybe I will kick off with a few questions, and then hopefully the audience can come in and ask whatever questions they have. So we have 45 minutes this morning, so thanks again Sergio, for joining us. I guess thinking about strategic developments over the last 12 months, we have probably had the largest wealth management merger since UBS SBC, albeit an internal merger between your wealth management and wealth management Americas business. So I wonder if you could maybe spend a few minutes to map out what you see in the short term, maybe more in the medium term, as the opportunities for the group, perhaps both from a strategic perspective, from a cost perspective, and from a revenue perspective. Sergio P. Ermotti: Yes, actually if you think about that, the decision was almost a natural evolution of what happened in the last few years with the U.S. businesses and the international businesses, reshaping themselves into the new paradigm, and in the last two years they have been starting to converge in terms of how they look at services, how they look at products.