Investor Digest 17 Januari 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parcel Post Compendium Online PT Pos Indonesia IDA ID

Parcel Post Compendium Online ID - Indonesia PT Pos Indonesia IDA Basic Services CARDIT Carrier documents international Yes transport – origin post 1 Maximum weight limit admitted RESDIT Response to a CARDIT – destination Yes 1.1 Surface parcels (kg) 30 post 1.2 Air (or priority) parcels (kg) 30 6 Home delivery 2 Maximum size admitted 6.1 Initial delivery attempt at physical Yes delivery of parcels to addressee 2.1 Surface parcels 6.2 If initial delivery attempt unsuccessful, Yes 2.1.1 2m x 2m x 2m No card left for addressee (or 3m length & greatest circumference) 6.3 Addressee has option of paying taxes or Yes 2.1.2 1.5m x 1.5m x 1.5m Yes duties and taking physical delivery of the (or 3m length & greatest circumference) item 2.1.3 1.05m x 1.05m x 1.05m No 6.4 There are governmental or legally (or 2m length & greatest circumference) binding restrictions mean that there are certain limitations in implementing home 2.2 Air parcels delivery. 2.2.1 2m x 2m x 2m No 6.5 Nature of this governmental or legally (or 3m length & greatest circumference) binding restriction. 2.2.2 1.5m x 1.5m x 1.5m Yes (or 3m length & greatest circumference) 2.2.3 1.05m x 1.05m x 1.05m No 7 Signature of acceptance (or 2m length & greatest circumference) 7.1 When a parcel is delivered or handed over Supplementary services 7.1.1 a signature of acceptance is obtained Yes 3 Cumbersome parcels admitted No 7.1.2 captured data from an identity card are No registered 7.1.3 another form of evidence of receipt is No Parcels service features obtained 5 Electronic exchange of -

Indonesia's Sustainable Development Projects

a INDONESIA’S SUSTAINABLE DEVELOPMENT PROJECTS PREFACE Indonesia highly committed to implementing and achieving the Sustainable Development Goals (SDGs). Under the coordination of the Ministry of National Development Planning/Bappenas, Indonesia has mainstreamed SDGs into National Medium-Term Development Plan (RPJMN) and elaborated in the Government Work Plan (RKP) annual budget documents. In its implementation, Indonesia upholds the SDGs principles, namely (i) universal development principles, (ii) integration, (iii) no one left behind, and (iv) inclusive principles. Achievement of the ambitious SDGs targets, a set of international commitments to end poverty and build a better world by 2030, will require significant investment. The investment gap for the SDGs remains significant. Additional long-term resources need to be mobilized from all resources to implement the 2030 Agenda for Sustainable Development. In addition, it needs to be ensured that investment for the SDGs is inclusive and leaves no one behind. Indonesia is one of the countries that was given the opportunity to offer investment opportunities related to sustainable development in the 2019 Sustainable Development Goals Investment (SDGI) Fair in New York on April 15-17 2019. The SDGI Fair provides a platform, for governments, the private sectors, philanthropies and financial intermediaries, for “closing the SDG investment gap” through its focus on national and international efforts to accelerate the mobilization of sufficient investment for sustainable development. Therefore, Indonesia would like to take this opportunity to convey various concrete investment for SDGs. The book “Indonesia’s Sustainable Development Project” shows and describes investment opportunities in Indonesia that support the achievement of related SDGs goals and targets. -

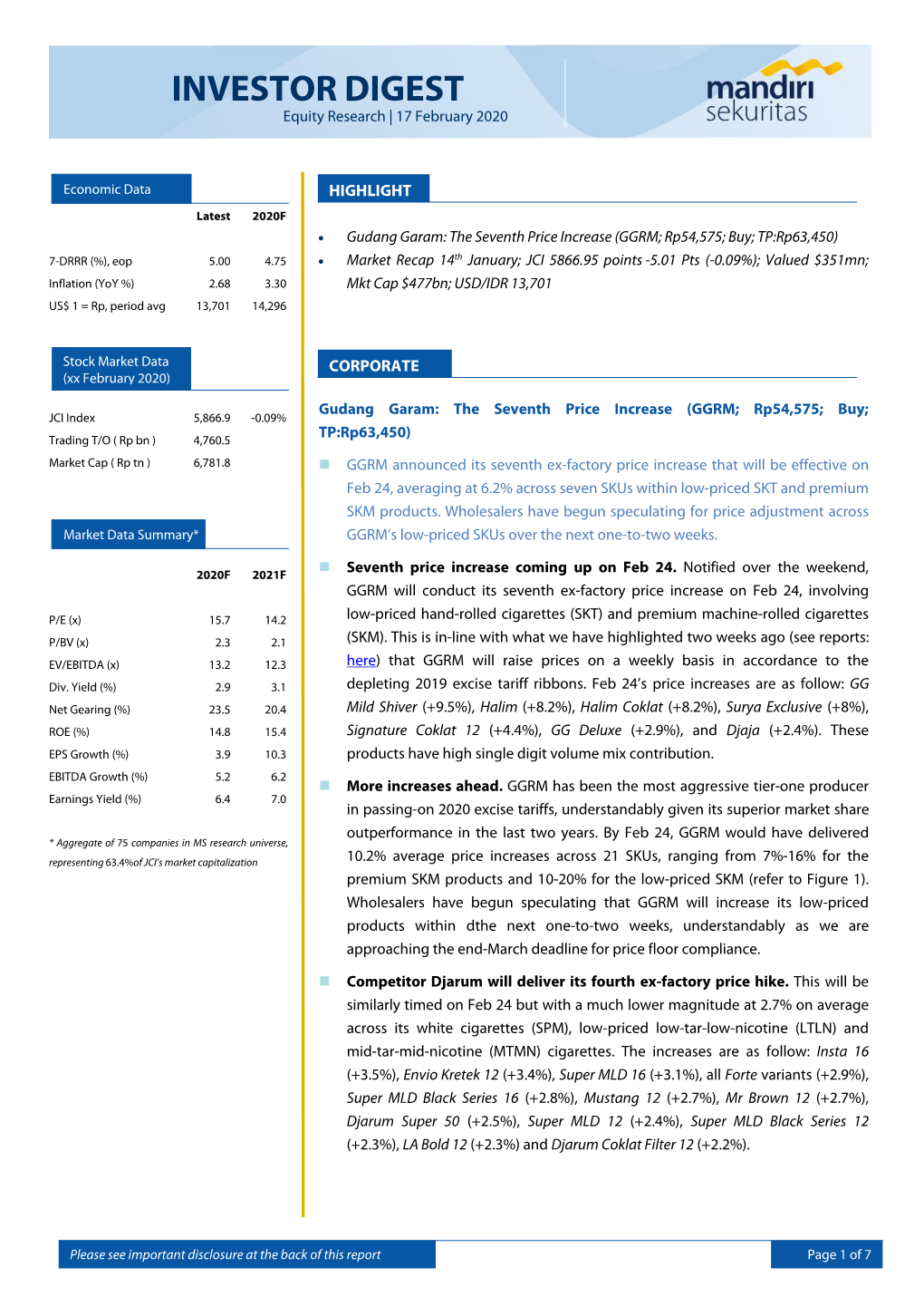

Gudang Garam

Indonesia Company Focus Gudang Garam Bloomberg: GGRM IJ | Reuters: GGRM.JK Refer to important disclosures at the end of this report DBS Group Research . Equity 17 Jan 2019 Finance L.P. BUY Lighting up (Initiating Coverage) The biggest beneficiary of the improvement in consumption Last Traded Price ( 16 Jan 2019): Rp84,300 (JCI : 6,413.4) power and absence of excise tax hike in FY19F Price Target 12-mth: Rp94,700 (12% upside) Expect revenue and earnings to grow by 12%/33% in FY19F Volume growth would be driven by SKM FF segment Potential Catalyst: No cigarettes excise tax hike in FY19F, improvement Initiate with a BUY call; our preferred pick in the sector in consumption, and improvement in market share. Initiate coverage with a BUY call and TP of Rp94,700. We like Analyst GGRM as (i) a beneficiary of potential higher consumption power, David Arie Hartono +62 2130034936 [email protected] (ii) the absence of excise tax hike should improve its earnings in Price Relative FY19F, and (iii) its valuation looks attractive at 15.7x FY19F PE - Rp Relative Index with the strong improvement in profitability, working capital, and 91,005.0 market share; we believe that GGRM should continue to narrow its 209 81,005.0 189 valuation gap to HMSP (currently, the discount is at 45%). 71,005.0 169 Potentially higher demand for machine made full flavour cigarettes 61,005.0 149 129 (SKM FF) segment. In our view, the gradual improvement in 51,005.0 109 41,005.0 consumption purchasing power, especially in low to mid-level 89 31,005.0 69 income groups, would improve demand for higher tar cigarettes in Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 the SKM FF segment (which is more favored by the low to mid- Gudang Garam (LHS) Relative JCI (RHS) income groups) rather than SPM or SKM LTN (low tar nicotine) Forecasts and Valuation which normally targets the mid to upper income groups. -

Terus Melangkah Maju Menuju Masa Depan Yang Berkelanjutan Sustainable Progress Sustainable Future

TERUS MELANGKAH MAJU MENUJU MASA DEPAN YANG BERKELANJUTAN SUSTAINABLE PROGRESS SUSTAINABLE FUTURE 2020 Laporan Keberlanjutan Sustainability Report PT Solusi Bangun Indonesia Tbk TERUS MELANGKAH MAJU MENUJU MASA DEPAN YANG BERKELANJUTAN Industri bahan bangunan dan konstruksi tengah Sebagai perusahaan bahan bangunan, SBI berfokus mengalami perubahan dalam hal keberlanjutan. Banyak pada peningkatan berkelanjutan yang memotivasi perusahaan telah melihat manfaat dari berbagai semua sumber daya kami untuk menjadi lebih baik di pendekatan alternatif terhadap perbaikan jadwal, masa depan. Karenanya, kami berusaha keras untuk anggaran, dan kualitas serta nilai proyek secara membangun hubungan jangka panjang dengan para keseluruhan. Peningkatan kolaborasi ini merupakan pelanggan kami dengan menawarkan rangkaian produk kunci keberlanjutan utama bagi SBI, dan kemampuan dan layanan yang lengkap, serta membangun sumber untuk menjalankannya sebaik mungkin tidak hanya akan daya manusia berkualitas yang terspesialisasi dalam menguntungkan Perseroan, tetapi juga para pemangku menciptakan solusi inovatif. kepentingan kami. SUSTAINABLE PROGRESS SUSTAINABLE FUTURE The building material and construction industry is As a building and construction materials company, SBI changing, particularly in regards to its sustainability focuses on continuous improvement that motivates all aspects. A lot of companies has witnessed the of our resources to be better. To that end, we strive to benefit from the various alternative approaches in the nurture long-term relationship with our customers by improvement of timeliness, budget, quality, and the overall offering a wide-range of products and services, as well as value of their projects. On this note, stronger collaboration nurturing our people to be highly qualified personnel and is central for SBI’s sustainability strategy. Hence, our ability experts in creating innovative solutions. -

Downloaded Via Apple App Store and Play Store)

Management Discussion & Analysis Corporate Governance Corporate Social Responsibility Strengthening Business and Portfolio, Enhancing Passenger Experience PT Angkasa Pura I (Persero) continues to strive to strengthen the effort to become one of the best airport operators in Asia by strengthening business and portfolios by building good financial performance, developing new airports, improving services, and applying international standards. Service quality and facility innovation at new and existing airports is a priority to improve the quality of passenger experience. Disclaimer This is the Annual Report of PT Angkasa Pura I due to various risk factors that can hinder the Company’s (Persero), hereinafter referred to as the “Annual Report”, efforts to realize these statements. which presents data and information regarding the performance of management and implementation The readers of this Annual Report can submit questions of corporate governance for the period of January to or responses, or request more information about PT December 2019. The use of terms “Angkasa Pura I”, Angkasa Pura I (Persero) through: “AP I”, or “Company” in the Annual Report refers to PT Angkasa Pura I (Persero). Awaluddin Corporate Communication Department The contents of the Annual Report are compiled based Graha Angkasa Pura I, Kota Baru Bandar Kemayoran on internal and external data sources and information Blok B12 Kav. 2, Kemayoran, Jakarta Pusat 10610 that are deemed necessary to be known by stakeholders. Phone : (+62) 21 6541 961 In addition to containing historical data and information, Fax : (+62) 21 6541 514 readers of the Annual Report will find several forward- Email : [email protected] looking statements. For information and complaints, contact 172 or via email PT Angkasa Pura I (Persero) is carefully presenting [email protected] forward-looking statements because they contain ideas, hopes, ideals, goals, or future targets. -

The Prospects for Airport Ppps in Indonesia

The prospects for airport PPPs in Indonesia By Julian Smith, Director, PT PricewaterhouseCoopers Indonesia Advisory This article sets out the current status of airport investment in Indonesia, explains the obstacles to greater private sector investment, and suggests some actions the Government could take in order to speed up investment in Indonesia's airport capacity. The prospects for airport PPPs in Indonesia 1 Introduction Options for financing new airports Civil aviation has been growing fast in Indonesia in line So far all new airports and expansions, including Terminal 3 with the economy. From 2012-2016, the number of at Soekarno-Hatta, have been funded directly by public domestic flights grew on average by 5.2% per annum and money, mainly through MoT, API or APII. The construction of the number of international flights by 4.4%. The number Kertajati airport in West Java has been funded by the of aircraft operated by the five biggest Indonesian airlines Provincial Government (but so far has only one scheduled grew from 331 in 2013 to 539 in 2017. Consequently, daily flight). The main exceptions have been in Denpasar, almost all of Indonesia’s major airports are operating in Bali, where the landside facilities are operated under a excess of their design capacity. This article summarizes management arrangement with GVK of India, and Bintan, the current status and plans for Indonesia’s airports and where a private group, Salim Group, is financing and building identifies the actions the Government needs to take to a new tourist airport which will be operated by AP II. secure significant foreign investment to upgrade the facilities in line with the needs of the economy. -

Preventing Violence in Local Elections

INDONESIA: PREVENTING VIOLENCE IN LOCAL ELECTIONS Asia Report N°197 – 8 December 2010 TABLE OF CONTENTS EXECUTIVE SUMMARY AND RECOMMENDATIONS ................................................. i I. INDONESIA’S LOCAL ELECTIONS ........................................................................... 1 A. DIRECT LOCAL ELECTIONS .......................................................................................................... 2 B. THE CURRENT ELECTION MACHINERY ........................................................................................ 4 1. Local election commissions (KPUD) .......................................................................................... 4 2. Local election oversight committee (Panwaslu) .......................................................................... 5 3. Constitutional Court (Mahkamah Konstitusi) .............................................................................. 5 C. KEY STAGES IN DIRECT LOCAL ELECTIONS ................................................................................. 5 II. THE DISQUALIFICATION OF A CANDIDATE IN MOJOKERTO ....................... 7 A. AN UNPOPULAR, UNELECTED BUPATI ......................................................................................... 7 B. UNEXPECTED DISQUALIFICATION ................................................................................................ 7 C. ATTACK AT THE LOCAL COUNCIL ................................................................................................ 8 III. CONFUSING “QUICK COUNTS” -

AIRPORT DEVELOPMENT International News Each Issue of Airport Development Focuses on a Different Region of the World, with Global News at the End of This Section

Page 1 of 14 10 December 2020 No. 1134 DEV Published biweekly – available by annual subscription only – details & order online at: www.mombergerairport.info Publisher: Martin Lamprecht [email protected] – Founding Editor: Manfred Momberger News Editors: Paul Ellis [email protected] – Marnix (Max) Groot [email protected] Momberger Airport Information by Air Trans Source Inc. – international news & data – published since 1973 AIRPORT DEVELOPMENT International News Each issue of Airport Development focuses on a different region of the world, with global news at the end of this section. A list of past focus regions published in recent years can be downloaded from the Bonus section in the subscriber pages of our website. Focus Region: Southeast Asia Other Regions from page 12 MYANMAR Construction and initial feasibility studies of the Hanthawaddy Airport in Bago have commenced in August, the Department of Civil Aviation said. Bago, formerly known as Hanthawaddy, is the capital of the Bago Region in Myanmar. It is located 91 kilometers north-east of Yangon. The first phase of the new airport, a joint venture between Myanmar and Japan, is slated to be complete in 2027 with help from the Japan International Cooperation Agency (JICA). JICA will now conduct an environmental impact assessment and the draft report was submitted to the Ministry of Natural Resources and Environmental Conservation in October. Located around 80 kilometers from Yangon, the new airport will cost between USD 1.5 billion and USD 2 billion to develop and when complete, will be the biggest airport in Myanmar. The Hathaway is expected to replace the Yangon International Airport, which government officials said will reach full passenger capacity by 2020, based on the passenger growth rate before COVID-19 The new airport is expected to bring additional tourists and cargo which will help to boost the economy and trade. -

Mobilitas Sosial Masyarakat Terdampak Pembangunan Bandara Di Desa Tarokan Kabupaten Kediri

Discovery Vol. 6 No. 1 Maret 2021 | Halaman 1 MOBILITAS SOSIAL MASYARAKAT TERDAMPAK PEMBANGUNAN BANDARA DI DESA TAROKAN KABUPATEN KEDIRI Mohammad Muhyidin1, Iwan Marwan2 IAIN Kediri [email protected] [email protected] Abstract: The airport construction project in Kediri is one of the biggest factors of social change in the community in Tarokan District, Kediri Regency. The land price bid made by this private company is very high. This study aims to determine the social changes in lifestyle and mindset of the people in Tarokan District and its surroundings in their daily life. This research uses social change theory of Gilin and Gillin, theory of lifestyle of Minor and Mowen, Dweck's mindset theory and Berger's social class theory. The method used in this research is a mixed method. Qualitative data collection was carried out by conducting in-depth interviews, observations, and FGDs. Meanwhile, quantitative data collection was done by filling out questionnaires. The results of this study are the existence of changes in social, suach as social class, lifestyle, and the mindset of the people affected by land acquisition at Kediri airport. The lifestyle adopted by the affected community is a modern lifestyle, a thrifty lifestyle, a healthy lifestyle, and a hedonistic lifestyle. The mindset possessed by most of the affected communities is a static mindset and only few affected people have a dynamic mindset. The static mindset of the community can be seen from the principle of land swaps and the spending of money from airport land acquisition to buy material things such as houses, cars and motorbikes for personal interest. -

Equity SNAPSHOT Wednesday, March 11, 2020

Equity SNAPSHOT Wednesday, March 11, 2020 FROM EQUITY RESEARCH KEY INDEX KEY INDEX Chg Ytd Vol Chg Ytd Vol Astra International: Resilient despite the challenges Close Close (ASII IJ. IDR 5,150 BUY TP. IDR 7,500) (%) (%) (US$ m) (%) (%) (US$ m) Looking forward, we expect Astra International’s automotive Asean - 5 Asean - 5 business to be adversely impacted by a) intense competition in the Indonesia 5,221 1.6 (17.1) 426 Indonesia 6,134 0.1 (1.0) 318 domestic car market and b) tepid domestic economic growth arising Thailand 1,271 1.2 (19.5) 2,385 Thailand 1,568 (0.1) 0.2 1,454 from anticipated global economic slowdown. Even so, we remain Philippines 6,318 0.1 (19.2) 145 Philippines 7,855 (0.3) 5.2 87 confident that ASII’s supply chain will remain resilient despite the Malaysia 1,430 0.4 (10.0) 854 Malaysia 1,562 (0.5) (7.6) 338 coronavirus outbreak as some indirect suppliers from China have Singapore 2,833 1.8 (12.1) 1,734 Singapore 3,173 (0.5) 3.4 908 indicated they are resuming operations. Maintain BUY with a lower Regional Regional target price of IDR7,500 (based on SOTP valuation) as we fine tune China 2,997 1.8 (1.7) 93,338 China 2,885 0.3 15.7 28,889 our earnings estimates post the results. Hong Kong 25,393 1.4 (9.9) 18,105 Hong Kong 26,391 (0.2) 2.1 9,093 To see the full version of this report, please click here Japan 19,867 0.9 (16.0) 22,327 Japan 23,380 (0.6) 16.8 10,278 Korea 1,966 0.1 (10.6) 7,411 Korea 2,068 (0.8) 1.3 3,790 Bank Negara Indonesia: Support from expanded NIM Taiwan 11,004 0.2 (8.3) 6,847 Taiwan 11,532 0.2 18.5 3,534 (BBNI IJ. -

Daily & Technical Update

DAILY & TECHNICAL UPDATE Friday, April 06, 2018 CIPTADANA SEKURITAS ASIA http://www.ciptadana.com GLOBAL Consumer Confidence Index lower in March 2018 Index Last Change % chg BI to release regulation on averaging minimum reserve requirement (GWM) Dow 24,505 240.92 0.99 BBCA pays out 27% of 2017 net profit as dividend S&P 500 2,663 18.15 0.69 Eido US 26.9 -0.41 -1.50 Gudang Garam plans on building Kediri airport at the end of 2018 H.S.I 29,519 -661.41 -2.19 Vale to focus on cost efficiency amid nickel price volatility Nikkei 21,645 325.87 1.53 Wika Gedung bags Rp2.6 tn new contract, 32.9% of target STI 3,406 65.95 1.97 JPFA plans Rp2.5 tn capex this year KLCI 1,836 20.19 1.11 Kospi 2,438 29.46 1.22 SET Thai 1,740 14.94 0.87 JCI STATISTIC tn COMMODITIES 7,000 40.0 Index Last Change % chg 35.0 6,500 Brent Crude Oil ($/bbl) 68.3 0.31 0.46 30.0 6,000 WTI Crude Oil ($/bbl) 63.5 0.17 0.27 25.0 CPO (MYR/ton) 2,442 14.00 0.58 5,500 20.0 Gold (US$/tr ounce) 1,327 -6.77 -0.51 15.0 5,000 Nickel (US$/ton) 13,273 173.00 1.32 10.0 4,500 Tin (US$/ton) 21,083 135.00 0.64 5.0 Pulp (US$/ton) weekly 1,097.1 0.00 0.00 4,000 0.0 16 17 16 17 18 16 17 18 16 17 18 16 17 16 17 16 17 16 17 18 16 17 16 17 16 17 Coal (US$/ton) 94.2 0.60 0.64 16 17 - - - - - - - - - - - - - - - - - - - - - - - - - - - - Jul Jul Oct Oct Apr Apr Apr Jan Jan Jan Jun Jun Feb Feb Feb Dec Dec Sep Sep Nov Nov Aug Aug Mar Mar Mar May May BEI STATISTICS Volume JCI Index JCI 6,183 Change (1 day) 0.42% DAILY TECHNICAL VIEW Change YTD -2.71% We expect JCI to trade between 6,130 (support) -

Sustainable Development for Sustainable Benefit

SUSTAINABLE DEVELOPMENT FOR SUSTAINABLE BENEFIT 2020 Laporan Tahunan Annual Report PT Solusi Bangun Indonesia Tbk SUSTAINABLE DEVELOPMENT FOR SUSTAINABLE BENEFIT PEMBANGUNAN BERKELANJUTAN UNTUK MANFAAT BERKELANJUTAN Seiring meningkatnya ekspektasi terhadap tanggung jawab As the expectations on corporate responsibility increase dan transparansi perusahaan, korporasi global saat ini kian and transparency becomes more prevalent, the need to menyadari adanya kebutuhan akan inisiatif keberlanjutan. act on sustainability is being widely recognized by global Pada tahun 2020, keberlanjutan menjadi tema terpenting corporations. In 2020, sustainability became the most yang dibahas di berbagai perusahaan di seluruh dunia. Di important theme discussed in corporate boardrooms SBI, keberlanjutan telah lama menjadi kunci penting dalam worldwide. At SBI, sustainability has long been the key menciptakan nilai bagi para pemangku kepentingan kami, message to create values for our stakeholders by taking into dengan mempertimbangkan dampak operasional Perseroan consideration how we operate in the ecological, social and terhadap lingkungan ekologi, sosial dan ekonomi. economic environment. SBI berfokus pada perbaikan yang memotivasi semua SBI is focusing on improvement that motivates all of our sumber daya kami untuk menjadi lebih baik di masa depan, resources towards being better tomorrow than we are serta memberikan manfaat yang berkesinambungan. today, as well as providing continuous benefits. We firmly Kami percaya bahwa komitmen Perseroan dalam believe