Annual Report 2005 OPEN Fraport

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2002/2003 Citibank Privatkunden AG Jones Day

We thank our friends and sponsors for their generous support to the Institute for Law and Finance. Allen & Overy Freshfields Bruckhaus Deringer Ashurst Morris Crisp Gleiss Lutz Hootz Hirsch Baker & McKenzie Haarmann Hemmelrath Bowne Frankfurt GmbH Hengeler Mueller Bundesanstalt für Finanzdienstleistungsaufsicht IHK Industrie- und Handelskammer Frankfurt am Main Bundesministerium der Finanzen IKB Deutsche Industriebank AG Bundesverband Deutscher Banken Yearbook ING BHF-Bank BVI Bundesverband Deutscher Investment- und Vermögensverwaltungsgesellschaften e.V. J.P. Morgan AG 2002/2003 Citibank Privatkunden AG Jones Day Cleary Gottlieb Steen & Hamilton Land Hessen Clifford Chance Pünder Landesbank Hessen-Thüringen Girozentrale Commerzbank AG Latham & Watkins Schön Nolte DekaBank Deutsche Girozentrale Linklaters Oppenhoff & Rädler DePfa Deutsche Pfandbriefbank AG McKinsey & Company Deutsche Bank AG Morgan Stanley Deutsche Bundesbank NATIONAL-BANK AG Deutsche Börse AG PwC Deutsche Revision AG Deutsche Postbank AG SEB AG INSTITUTE FOR LAW AND FINANCE JOHANN WOLFGANG GOETHE-UNIVERSITÄT FRANKFURT Deutscher Sparkassen- und Giroverband Stadt Frankfurt Dresdner Bank AG Verlag Dr. Otto Schmidt KG Eurohypo Stiftung White & Case, Feddersen European Central Bank Wissenschaftsförderung der Sparkassen-Finanzgruppe e. V. A Welcoming Note page 2/3 Dear Members and Friends, Our first year has been a rewarding success. We want to thank you all for making it possible. It would not have been possible without you, the students. The opening of the ILF was made possible by the Johann Wolfgang Your intellectual eagerness, the great diversity of your cultural backgro- Goethe University’s initial endowment.The Dresdner Bank AG agreed to unds, as well as your personalities, have given the Institute for Law and sponsor a permanent chair for the ILF’s Director. -

Politikszene 19.1

politik & �����������������Ausgabe���������� Nr. 267 � kommunikation politikszene 19.1. – 25.1.2010 �������������� Zwei neue Abteilungsleiter im BMI Stéphane Beemelmans (44) ist seit 1. Januar neuer Leiter der Grundsatzabteilung im Bundesinnen- ����������������������������������������������ministerium (BMI). Damit ist Beemelmans für Fragen zu internationalen Entwicklungen und die neuen Bundesländer zuständig. Vorgänger Beemelmans unter Wolfgang Schäuble war Markus Kerber, der ��������������������������������������������������������������inzwischen als Leiter der Grundsatzabteilung im Finanzministerium��������������������� arbeitet. �������� ������������������������������������������������������������������������������������������������ ����������������������������������������������������������������������������������������Juli bis November 2005 2005 bis 2009 2009 bis 2010 � �����������Stéphane Beemelmans �����������������������������������������������������������������������������������������������Leiter des Leitungsbüros im Sächsi- Büroleiter beim Chef des Bundes- Leitungsstabsleiter im BMI ����������������������������������������������������������schen Innenministerium kanzleramts���������������������� ����������������������������������������������������Beate Lohmann (48) ist seit 1. Januar neue Leiterin der Abteilung O Verwaltungsmodernisierung im Bundesinnenministerium. Lohmann folgt in dieser Position auf Reinhard Timmer, der im Herbst 2009 in den Ruhestand gegangen ist. ������������������������������������������������������������������������������������������� -

Corporate Responsibility Report 2013

Responsibility. Trust. Confidence. 2013 Corporate Responsibility Report Cover: for more information about Commerzbank’s environmental internship, see page 38 Selected key figures Key performance indicators 2010 2011 2012 Operating profit (€ million) 1,386 507 1,216 Pre-tax profit or loss (€ million) 1,353 507 905 Consolidated profit or loss 1 (€ million) 1,430 638 6 Total assets 2 (€ billion) 754.3 661.8 635.9 Staff Germany 3 45,301 44,474 42,857 Abroad 3 13,800 13,686 10,744 Total 3 59,101 58,160 53,601 Total proportion of women at management 23.0 23.1 24.0 levels 1– 4 (Commerzbank AG, Germany) (%) Environment 4 Direct energy consumption (MWh) 218,988 204,383 209,429 Indirect energy consumption (MWh) 445,887 442,515 379,200 CO2 emissions (t) 127,224 119,475 107,114 Paper consumption (t) 5,095 4,888 4,359 1 Insofar as attributable to Commerzbank shareholders. 2 As per 31 December of the year in question. 3 Headcount as per 31 December of the year in question. 4 All environmental data relate to Commerzbank AG in Germany. Responsibility. Trust. Confidence. About this report This 2013 Corporate Responsibility Report explains how Commerzbank understands the principle of corporate responsibility and how it applies this understanding to its business processes, business model, employees and corporate citizenship. Aimed equally at internal and external stakeholders, the report is intended to be read by employees, shareholders, customers and all those who have an interest in Commerzbank. It refers to Commerzbank AG in Germany and covers all our 2012 activity. -

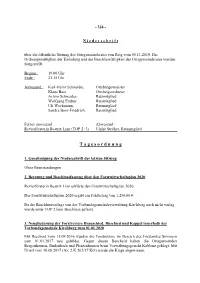

Niederschrift

Niederschrift über die öffentliche Sitzung des Ortsgemeinderates der Ortsgemeinde Raversbeuren vom 28.01.2020 Beginn: 19.30 Uhr Ende: 21.45 Uhr Der Ortsgemeinderat hat 7 Mitglieder. Anwesend waren unter dem Vorsitz von Horst Möhringer Ortsbürgermeister Michael Sonne 1. Beigeordneter und Ratsmitglied Marion Engelbach Ratsmitglied Michael Hammen Ratsmitglied Rolf Hammen Ratsmitglied Carsten Heidberg Ratsmitglied Birgit Hillerich Ratsmitglied Es fehlten entschuldigt: Ferner anwesend: Revierleiter Fischer bei TOP 2 Vor Einstieg in die Tagesordnung stellte der Vorsitzende fest, dass zu der Sitzung ordnungsgemäß eingeladen wurde und die Beschlussfähigkeit gegeben war. Einwände wurden nicht erhoben. Tagesordnung 1. Genehmigung der Niederschrift der letzten Sitzung Die Niederschrift der letzten Sitzung vom 18.06.2019 wurde einstimmig angenommen. 2. Beratung und Beschlussfassung über den Forstwirtschaftsplan 2020 Nach dem vorgelegten Forstwirtschaftsplan für das Haushaltsjahr 2020 betragen die Nettoerträge 65.900,00 € Nettoaufwendungen 76.800,00 € Es verbleibt somit ein Fehlbetrag von 10.900,00 €. Der Ortsgemeinderat stimmt nach Vortrag dem Forstwirtschaftsplan 2020 zu. Maßnahmen, für die ein Zuschuss des Landes vorgesehen ist, dürfen erst begonnen werden, wenn die Zustimmung zum vorzeitigen Baubeginn vorliegt oder die Zuweisung bewilligt wurde. Abstimmungsergebnis: einstimmig 3. Feststellung des Jahresabschlusses 2018 und Beschluss über die Entlastung A. Der Jahresabschluss 2018 der Ortsgemeinde Raversbeuren wurde am 11. November 2019 vom Rechnungsprüfungsausschuss geprüft und mit folgenden Ergebnissen festgestellt: 1. Die Bilanzsumme beläuft sich auf 2.518.778,00 €. 2. Die Kapitalrücklage weist einen Betrag von 1.931.081,81 € auf. Der Jahresüberschuss beläuft sich auf 30.052,24 €. Damit ist die Ergebnisrechnung ausgeglichen. 3. Der Ausgleich der Finanzrechnung ist mit einem Saldo aus ordentlichen und außerordentlichen Ein- und Auszahlungen und den Auszahlungen zur planmäßigen Tilgung von Investitionskrediten von 50.708,22 € gewährleistet. -

Wernerkapelle in Womrath

Jahrgang 51 DONNERSTAG, 07. Januar 2021 Nummer 1 Wernerkapelle in Womrath Mitteilungen für den Bereich der Verbandsgemeinde Kirchberg/Hunsrück und ihre Gemeinden Bärenbach, Belg, Büchenbeuren, Dickenschied, Dill, Dillendorf, Gehlweiler, Gemünden, Hahn, Hecken, Heinzenbach, Henau, Hirschfeld, Kappel, Kirchberg, Kludenbach, Laufersweiler, Lautzenhausen, Lindenschied, Maitzborn, Metzenhausen, Nieder Kostenz, Niedersohren, Niederweiler, Ober Kostenz, Raversbeuren, Reckershausen, Rödelhausen, Rödern, Rohrbach, Schlierschied, Schwarzen, Sohren, Sohrschied, Todenroth, Unzenberg, Wahlenau, Womrath, Woppenroth, Würrich. Sprechzeiten der Verwaltung: montags, dienstags, mittwochs und freitags 8.30 – 12.00 Uhr, donnerstags (durchgehend) 8.00 – 18.00 Uhr; Einwohnermeldeamt jeden 1. Samstag im Monat 9.00-12.00 Uhr; Telefon 0 67 63 / 910-0, Fax 0 67 63 / 910 699, www.kirchberg-hunsrueck.de, [email protected] @vgkirchberg Kirchberg/Hunsrück 2 Nr. 1/2021 Notrufe / Bereitschaftsdienste ■ Polizei, Verkehrsunfall, Überfall Betreuter Erinnerungstreffpunkt für Senioren und Seniorinnen im Erreichbarkeiten der Polizei Simmern Gesundheitszentrum Büchenbeuren. In dringenden Fällen: Notruf ............................................................... 110 Informationen Heike Wilhelm, Pflegedienstleitung In allen anderen Fällen: Tel........................................................................................ 06763-30110 Festnetz Schutz- und Kriminalpolizei ............................ 06761 / 921-0 E-mail [email protected] -

Gebäude Und Wohnungen Am 9. Mai 2011, Womrath

Gebäude und Wohnungen sowie Wohnverhältnisse der Haushalte Gemeinde Womrath am 9. Mai 2011 Ergebnisse des Zensus 2011 Zensus 9. Mai 2011 Womrath (Landkreis Rhein-Hunsrück-Kreis) Regionalschlüssel: 071405004163 Seite 2 von 32 Zensus 9. Mai 2011 Womrath (Landkreis Rhein-Hunsrück-Kreis) Regionalschlüssel: 071405004163 Inhaltsverzeichnis Einführung ................................................................................................................................................ 4 Rechtliche Grundlagen ............................................................................................................................. 4 Methode ................................................................................................................................................... 4 Systematik von Gebäuden und Wohnungen ............................................................................................. 5 Tabellen 1.1 Gebäude mit Wohnraum und Wohnungen in Gebäuden mit Wohnraum nach Baujahr, Gebäudetyp, Zahl der Wohnungen, Eigentumsform und Heizungsart .............. 6 1.2 Gebäude mit Wohnraum nach Baujahr und Gebäudeart, Gebäudetyp, Zahl der Wohnungen, Eigentumsform und Heizungsart ........................................................... 8 1.3.1 Gebäude mit Wohnraum nach regionaler Einheit und Baujahr, Gebäudeart, Gebäudetyp, Zahl der Wohnungen, Eigentumsform und Heizungsart ..................................... 10 1.3.2 Gebäude mit Wohnraum nach regionaler Einheit und Baujahr, Gebäudeart, Gebäudetyp, Zahl der Wohnungen, -

Jahrgang 49 DONNERSTAG, 13. Juni 2019 Nummer 24

Jahrgang 49 DONNERSTAG, 13. Juni 2019 Nummer 24 Freilichtbühne „Pützbacher Kopf“ - Theater in der Natur Am Sonntag, 23. Juni 2019 ist es wieder soweit: Hunsrücker Theatergruppen spielen Kurzstücke auf der Freilichtbühne „Pützbacher Kopf“ bei Gemünden Besser Bus&Bahn Theatergruppe Soonwaldschule Studio 61 Rheinböllen Gemünden „Chaos im „Gitterweisheiten“ & „Rendezvous Desaster“ Flecketeens Märchenland“ Theater im Flecke (TiF) Gemünden (Gastgeber) Dumnissus Kirchberg „Verbal Training oder „Ganz einfach“ & Invalidenfußball“ „Das Inserat“ Mer Merschbacher “Schokoguss“ & Gehlwilla „Die Eheberatung“ Theaterknäppcha Junge Bühne Ellern „Die Gerichts- „Der Krämerkorb“ verhandlung“ © Theater im Flecke (TiF) Die Aufführungen beginnen um 15.00 Uhr. Einlass ist ab 14.30 Uhr. Die Freilichtbühne „Pützbacher Kopf“ liegt zwischen Dickenschied und Gemünden an der Bundesstraße B421. Der Eintritt kostet 6,00 Euro, ermäßigt 3,00 Euro (Kinder und Schüler). Karten gibt es ausschließlich an der Tageskasse. Mitteilungen für den Bereich der Verbandsgemeinde Kirchberg/Hunsrück und ihre Gemeinden Bärenbach, Belg, Büchenbeuren, Dickenschied, Dill, Dillendorf, Gehlweiler, Gemünden, Hahn, Hecken, Heinzenbach, Henau, Hirschfeld, Kappel, Kirchberg, Kludenbach, Laufersweiler, Lautzenhausen, Lindenschied, Maitzborn, Metzenhausen, Nieder Kostenz, Niedersohren, Niederweiler, Ober Kostenz, Raversbeuren, Reckershausen, Rödelhausen, Rödern, Rohrbach, Schlierschied, Schwarzen, Sohren, Sohr- schied, Todenroth, Unzenberg, Wahlenau, Womrath, Woppenroth, Würrich. Sprechzeiten der -

T a G E S O R D N U N G

- 324 - N i e d e r s c h r i f t über die öffentliche Sitzung des Ortsgemeinderates von Belg vom 05.11.2019. Die Ordnungsmäßigkeit der Einladung und die Beschlussfähigkeit des Ortsgemeinderates wurden festgestellt. Beginn : 19.00 Uhr Ende : 21.15 Uhr Anwesend : Karl-Heinz Schneider, Ortsbürgermeister Klaus Bast, Ortsbeigeordneter Achim Schneider, Ratsmitglied Wolfgang Endres, Ratsmitglied Uli Weckmann, Ratsmitglied Sandra Boor-Friedrich, Ratsmitglied Ferner anwesend : Abwesend : Revierförsterin Beatrix Linn (TOP 2+3) Ulrike Ströher, Ratsmitglied T a g e s o r d n u n g 1. Genehmigung der Niederschrift der letzten Sitzung Ohne Beanstandungen 2. Beratung und Beschlussfassung über den Forstwirtschaftsplan 2020 Revierförsterin Beatrix Linn erklärte den Forstwirtschaftsplan 2020. Der Forstwirtschaftsplan 2020 ergibt ein Fehlbetrag von 1.250,00 €. Da die Beschlussvorlage von der Verbandsgemeindeverwaltung Kirchberg noch nicht vorlag wurde unter TOP 2 kein Beschluss gefasst. 3. Neugliederung der Forstreviere Brauschied, Buschied und Kappel innerhalb der Verbandsgemeinde Kirchberg zum 01.01.2020 Mit Bescheid vom 15.09.2016 wurden die Forstreviere im Bereich des Forstamtes Simmern zum 01.01.2017 neu gebildet. Gegen diesen Bescheid haben die Ortsgemeinden Bergenhausen, Budenbach und Pleizenhausen beim Verwaltungsgericht Koblenz geklagt. Mit Urteil vom 30.08.2017 (Az: 2 K 262/17.KO) wurde die Klage abgewiesen. - 325 - Auch die Berufung beim OVG Koblenz (Az: 8 A 10826/18) wurde abgewiesen. Eine Revision wurde nicht zugelassen, so dass die Revierneugliederung, die mit Bescheid vom 15.09.2016 zum 01.01.2017 festgesetzt wurde, rechtskräftig ist. Zwischenzeitlich haben die drei zuvor genannten Ortsgemeinden nach § 9 Landeswaldgesetz (LWaldG) ein Revierabgrenzungsverfahren eingeleitet und mit Zustimmung aller Waldbesitzenden des gleichen Forstrevieres die Abgrenzung eines eigenen Forstrevieres mit Schreiben vom 24.03.2019 beantragt. -

Annual Report 2003

Financial Calendar Contents May 13, 2004: 1st Quarter Interim Report 1 Profile June 2, 2004: Annual General Meeting Annual Report 2003 2Letter from the Chairman st August 13, 2004: 1 Half Interim Report 6 The Executive Board November 10, 2004: 3rd Quarter Interim Report Outstanding Assets and Potential 9 The Fraport Share 11 Corporate Governance Investor Relations 13 Human Resources Tel.: +49 (0) 69 690-74842 17 Renovation of Runway North Fax: +49 (0) 69 690-74843 21 Security E-mail: [email protected] 25 Environmental Management Internet: www.fraport.com 28 Strategy Interview with Dr. Wilhelm Bender 33 Financial Report 34 Group Management Report of Fraport AG 36 Business Strategy 38 Business Environment and Development of Air Traffic 41 Business Development 54 Report on Related Party Transactions 54 Corporate Governance Code 55 Risk Management 60 Significant Events After the Balance Sheet Date 60 Outlook 62 Consolidated Financial Statements of Fraport AG 62 Consolidated Income Statement 63 Consolidated Balance Sheet 64 Consolidated Cash Flow Statement 65 Movement of the Consolidated Shareholders’ Equity 66 Group Notes 68 Segment Reporting 110 List of Investments 114 Auditor’s Report 115 Report of the Supervisory Board 119 Economic Advisory Group 120 Six-year Overview 124 Glossary C3 Calendar of Events Ye s, C3 Financial Calendar I want additional Information! Financial Calendar Contents May 13, 2004: 1st Quarter Interim Report 1 Profile June 2, 2004: Annual General Meeting Annual Report 2003 2Letter from the Chairman st August 13, 2004: 1 Half Interim Report 6 The Executive Board November 10, 2004: 3rd Quarter Interim Report Outstanding Assets and Potential 9 The Fraport Share 11 Corporate Governance Investor Relations 13 Human Resources Tel.: +49 (0) 69 690-74842 17 Renovation of Runway North Fax: +49 (0) 69 690-74843 21 Security E-mail: [email protected] 25 Environmental Management Internet: www.fraport.com 28 Strategy Interview with Dr. -

Gebäude Und Wohnungen Am 9. Mai 2011, Würrich

Gebäude und Wohnungen sowie Wohnverhältnisse der Haushalte Gemeinde Würrich am 9. Mai 2011 Ergebnisse des Zensus 2011 Zensus 9. Mai 2011 Würrich (Landkreis Rhein-Hunsrück-Kreis) Regionalschlüssel: 071405004165 Seite 2 von 32 Zensus 9. Mai 2011 Würrich (Landkreis Rhein-Hunsrück-Kreis) Regionalschlüssel: 071405004165 Inhaltsverzeichnis Einführung ................................................................................................................................................ 4 Rechtliche Grundlagen ............................................................................................................................. 4 Methode ................................................................................................................................................... 4 Systematik von Gebäuden und Wohnungen ............................................................................................. 5 Tabellen 1.1 Gebäude mit Wohnraum und Wohnungen in Gebäuden mit Wohnraum nach Baujahr, Gebäudetyp, Zahl der Wohnungen, Eigentumsform und Heizungsart .............. 6 1.2 Gebäude mit Wohnraum nach Baujahr und Gebäudeart, Gebäudetyp, Zahl der Wohnungen, Eigentumsform und Heizungsart ........................................................... 8 1.3.1 Gebäude mit Wohnraum nach regionaler Einheit und Baujahr, Gebäudeart, Gebäudetyp, Zahl der Wohnungen, Eigentumsform und Heizungsart ..................................... 10 1.3.2 Gebäude mit Wohnraum nach regionaler Einheit und Baujahr, Gebäudeart, Gebäudetyp, Zahl der Wohnungen, -

Wahl Zum/Zur Oberbürgermeister

Bürgeramt, Statistik und Wahlen Frankfurter Wahlanalysen 55 Wahl der Oberbürgermeisterin/des Oberbürgermeisters am 11. März 2012 in Frankfurt am Main: Eine erste Analyse Impressum Titel Wahl der Oberbürgermeisterin/des Oberbürgermeisters am 11. März 2012 in Frankfurt am Main: Eine erste Analyse Reihe Frankfurter Wahlanalysen, Heft 55 Erscheinungsdatum 12. März 2012 Herausgeber Stadt Frankfurt am Main - Der Magistrat - Bürgeramt, Statistik und Wahlen Zeil 3 60313 Frankfurt am Main Telefon: (0 69) 2 12 - 3 36 70 Telefax: (0 69) 2 12 - 3 63 01 E-Mail: [email protected] Internet: www.frankfurt.de/wahlanalysen Verantwortlich Rudolf Schulmeyer Koordination und Redaktion Dr. Ralf Gutfleisch, Waltraud Schröpfer Druck Eigendruck Nachdruck ist mit Quellenangabe gestattet ISSN 0943-7053 Wahl der Oberbürgermeisterin/des Oberbürgermeisters am 11. März 2012 Frankfurt am Main Eine erste Analyse Inhalt Seite Schlagzeilen 5 1. Das vorläufige Ergebnis der OB-Wahl 2012 im Überblick 7 2. Das Wahlverhalten von Jung und Alt, Männern und Frauen 15 3. Das Wahlverhalten in den Frankfurter Stadtteilen 19 Anhang 35 Frankfurter Wahlanalysen 55 5 Schlagzeilen Wahlbeteiligung steigt, bleibt aber hinter den Erwartungen zurück Bei der Direktwahl des Stadtoberhauptes in Frankfurt am Main standen zehn Bewerberinnen und Bewerber zur Wahl. Sieben von ihnen waren von einer Partei oder Wählergruppe aufgestellt, drei waren Einzelbewerber. Von den rd. 463 000 Wahlberechtigten machten 173 700 von ihrem Wahl- recht Gebrauch. Dies entspricht einer Wahlbeteiligung von 37,5 % (+3,9 %-Punkte im Vergleich zur letzten OB-Wahl vor fünf Jahren). Wahlbeobachter hatten wegen des erhöhten Briefwahlauf- kommens mit einer höheren Wahlbeteiligung gerechnet. Das Briefwahlaufkommen war aber dies- mal kein Indikator für ein allgemeines gestiegenes Interesse an der Wahl. -

B669 Büchenbeuren

B 669 ➜ Büchenbeuren - Sohren - Kirchberg - Simmern V Am 24. und 31.12. Verkehr wie Samstag. Verkehrsbetriebe Mittelrhein Rosenmontag, Fastnachtdienstag, Tag nach Christi Himmelfahrt und Tel. 02633 2009600 Tag nach Fronleichnam Verkehr wie an Ferientagen. Montag - Freitag Verkehrsbeschränkungen SSSSSSSSSSSy-vS y-vS Hinweise w0 Lautzenhausen Gemeindehaus 6.38 - Bohr-Insel 6.39 Büchenbeuren Raiffeisenstr. 6.45 6.45 7.38 Büchenbeuren Schulzentrum C 7.40 Büchenbeuren Schulzentrum E 7.40 13.02 16.07 Sohren Michael-Felke-Str. 6.48 6.48 7.38 7.38 1 - Am Denkmal 6.52 6.52 7.41 7.41 - Niedersohrener Str. 6.55 6.55 Niedersohren Sportplatz 6.57 6.57 - An der Hunsrückbahn 6.59 6.59 Kirchberg (Hunsr) Oberstr. 6.52 - Paul-Schneider-Str. 6.53 6.54 - Willy-Brandt-Str. 6.55 6.56 Kirchberg (Hunsr) Schulzentrum 6 an 6.58 7.53 7.53 7.53 13.15 16.20 Kirchberg (Hunsr) Schulzentrum 6 ab 6.58 13.20 16.15 16.25 Kirchberg (Hunsr) Schulzentrum 7 6.57 6.59 7.53 7.53 - Kappeler Str. 6.59 7.00 7.01 - Simmerner Str. 7.03 7.04 7.05 Rödern Hirtenacker 7.05 7.06 7.07 Unzenberg Kauermühle 7.06 7.07 7.08 Ohlweiler Bundesstr. 13.28 16.33 Simmern (Hunsr) Schulzentrum A 7.18 7.20 Simmern (Hunsr) Schulzentrum B 7.19 7.20 Simmern (Hunsr) Schulzentrum C 7.20 - Gemündener Str. Y1624 Simmern (Hunsr) Alter Bahnhof A 13.36 16.41 Simmern (Hunsr) Alter Bahnhof G 16.28 S = an Schultagen w0 = nicht am 31.01.