Moscow Office Market Report • 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Significant Growth Potential for KONE in Russia

KONE Capital Markets Day 2008 Significant growth potential for KONE in Russia Klaus Cawén Executive Vice President, M&A and Strategic Alliances, Russia, Legal Affairs Significant growth potential for KONE in Russia Rapidly growing economy One of the top ten elevator markets KONE uniquely positioned to drive growth Capital City, Moscow 2 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén Rapidly growing economy Strong GDP growth 140 million population – mostly urban High disposable income – high consumption Antey-III, Yekaterinburg 3 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén Strong GDP growth 12 10 8 6 4 2 0 2000 2001 2002 2003 2004 2005 2006 2007 Note: Real GDP Growth Source: Bank of Finland 4 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén In addition to Moscow and St. Petersburg there are 11 cities with a population exceeding one million Cities by Number of Inhabitants (Millions) Moscow St Petersburg St Petersburg Novosibirsk Nizhny Novgorod Rural Moscow Yekaterinburg 26% Samara Omsk Nizhniy Novgorod Perm Perm Rostov-na-Donu Kazan Kazan Samara Yekaterinburg Ufa Urban Ufa Chelyabinsk Chelyabinsk 74% Rostov-on-Don Volgograd Omsk Volgograd 0 1 2 3 4 5 6 7 8 9 Novosibirsk Source: United Nations Population density and urbanization statistics 5 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén Source: United Nations Population Division estimates and projections High disposable income Unleashed hungry urban consumers 13% flat income tax Growing middle class -

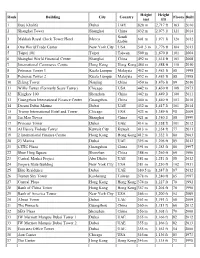

List of World's Tallest Buildings in the World

Height Height Rank Building City Country Floors Built (m) (ft) 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 2 Shanghai Tower Shanghai China 632 m 2,073 ft 121 2014 Saudi 3 Makkah Royal Clock Tower Hotel Mecca 601 m 1,971 ft 120 2012 Arabia 4 One World Trade Center New York City USA 541.3 m 1,776 ft 104 2013 5 Taipei 101 Taipei Taiwan 509 m 1,670 ft 101 2004 6 Shanghai World Financial Center Shanghai China 492 m 1,614 ft 101 2008 7 International Commerce Centre Hong Kong Hong Kong 484 m 1,588 ft 118 2010 8 Petronas Tower 1 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 8 Petronas Tower 2 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 10 Zifeng Tower Nanjing China 450 m 1,476 ft 89 2010 11 Willis Tower (Formerly Sears Tower) Chicago USA 442 m 1,450 ft 108 1973 12 Kingkey 100 Shenzhen China 442 m 1,449 ft 100 2011 13 Guangzhou International Finance Center Guangzhou China 440 m 1,440 ft 103 2010 14 Dream Dubai Marina Dubai UAE 432 m 1,417 ft 101 2014 15 Trump International Hotel and Tower Chicago USA 423 m 1,389 ft 98 2009 16 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 17 Princess Tower Dubai UAE 414 m 1,358 ft 101 2012 18 Al Hamra Firdous Tower Kuwait City Kuwait 413 m 1,354 ft 77 2011 19 2 International Finance Centre Hong Kong Hong Kong 412 m 1,352 ft 88 2003 20 23 Marina Dubai UAE 395 m 1,296 ft 89 2012 21 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 22 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 23 Central Market Project Abu Dhabi UAE 381 m 1,251 ft 88 2012 24 Empire State Building New York City USA 381 m 1,250 -

Moscow City Project Continues to Be Developed, with the Naberezhnaya Tower Complex Being Completed in 2007

Research Moscow Office market report • H2 2007 Contents Moscow office markets 2-3 Market breakdown 4 Market data 5 Executive summary • Demand for quality office space in Moscow clearly exceeds supply, with the vacancy rate for class A premises standing at just over 1%. Prime rents have continued to show rapid growth. • The quality of large-scale office accommodation is improving, while office complexes of over 100,000 sq m are becoming increasingly common. About six such projects are expected to open in 2008. • The geography of Moscow’s office market is expanding, with a number of large business parks being developed outside the city boundaries, such as Khimki Business Park, Greenwood Business Park and Western Gate. • The MIBC Moscow City project continues to be developed, with the Naberezhnaya Tower Complex being completed in 2007. However, some tenants are reluctant to move to Moscow City until there are improvements in the transport infrastructure and the availability of parking. In light of these factors, rents of over $2,000 per sq m per annum are viewed by many as being overpriced. • Investment in office properties has been growing at an unprecedented rate. Prime yields compressed by around 200 basis points during 2007 to stand at 8.00% at the end of the year. 2 Moscow office market report • H2 2007 Knight Frank Moscow City (Moscow International Business Center) 19 18 19 Complete 18 17 1st Krasnogvardeysky proezd 25 Partially 16a 16b 1 Complete 20 21 13 14 15 12 2008 11 Expocenter 8a 8b 7 6 2009 10 2 2010 9 4 3 Kra 2011 snop resne -

(Microsoft Powerpoint

RUMORUMO AOAO PACTOPACTO PELAPELA RMCRMC Experiências Internacionais de Pactos de Desenvolvimento Local e Regional AURÍLIO CAIADO CONSIDERAÇÕES INICIAIS GlobalizaGlobaliza ççãoão ee NeoliberalismoNeoliberalismo debilitadebilita ççãoão dodo planoplano nacionalnacional comocomo unidadeunidade espacialespacial dede referência;referência; ascendênciaascendência dede novosnovos territterrit óóriosrios estratestrat éégicosgicos –– asas regiõesregiões ee asas cidades.cidades. CONSIDERAÇÕES INICIAIS CidadesCidades ee RegiõesRegiões SeSe tornaramtornaram importantesimportantes arenasarenas dede desenvolvimento;desenvolvimento; UnidadesUnidades geogrgeogr ááficasficas maismais apropriadasapropriadas parapara aa emergênciaemergência ee afirmaafirma ççãoão dada competitividadecompetitividade territorial.territorial. AS CIDADES SÃO ESTRATÉGICAS PARA O DESENVOLVIMENTO AsAs cidadescidades sãosão estratestrat éégicasgicas parapara oo desenvolvimentodesenvolvimento econômicoeconômico ,, poispois éé nelasnelas queque asas economiaseconomias dede escalaescala ee dede aglomeraaglomera ççãoão operamoperam nono sentidosentido dede dardar maiormaior amplitudeamplitude ee eficiênciaeficiência aoao processoprocesso dede desenvolvimento.desenvolvimento. CIDADES = CENTROS DE COMANDO NaNa economiaeconomia globalizada,globalizada, asas cidadescidades sãosão pontospontos dede comandocomando ,, mercadosmercados globaisglobais ee locaislocais dede produprodu ççãoão parapara aa economiaeconomia dada informainforma çção,ão, porpor isso,isso, consideradasconsideradas ““centroscentros -

ON the ROAD City Moscow

a a a s r Hotel Hilton i a y t k li s D vo o u M t o e l li k va a t y u u uc ry k o 2-ya Brestskaya ulitsa e Ragout a a h p r k e a i y e h s e ulitsa Fadeeva t p s ga a v a s 4-ya 11Tverskaya Yamskaya ulitsa ele p k p M D o y i s e 3 Sad r r a tsa ova k s e s uli p - naya Samotechnaya ulitsa ya NII Skoroy Pomoshchi a it ya tech Sadovaya -S s S u l 1-ya Brestskaya ulitsa ovaya Samo uk ’ kor Sad ha l p lo u 1 rev Sklifosovskogo e S Kazansky s t n k ulitsa Chayanova 1 ka y a ya p a az T u s T v lit y vokzal sa o h t e a i r K n l s lok h iy u k y s B ’ p a l - Kalanchevskaya ulitsa l a y reu eu e o e r 1 o r a p A. A. Chernikhov Design e Dokuchaev pereulok y 6 l iy e n B a Y y ’ u e s am h p and Architecture Studio l k z o u h r Sukharevskaya s O v k o s v k o y o a h y y K k a i h a u L c li r Ryazanskiy proezd ts a e n Novoryazanskaya ulitsa 1-ya 11Tverskaya Yamskaya ulitsa s t a t la li n u a a iy o y l a K n Tsventoy bul’var u l’ p Sadovaya-Spasskaya ulitsa fa e m e r iu ultisa Petrovka r e a r e T p 52 k r Bol’shaya Gruzinskaya ulitsa 53 ya u n a a ulitsa Malaya Dmitrovka k v l iy o o e o lok v n l d reu ’ n pe k t Mayakovskaya eu Sa Maliy Karetniy l a e m r u s r 2-ya Brestskaya ulitsa pe b S iy V n y y o a o r s n he o t ulitsa Mashi poryvaevoy z i t t l ru ni pereulok 2-ya Brestskaya ulitsa etniy e O dniy Kar k u k Sad e v ereulo Orlikov pereulok o r arevskiy p Vasilyevskaya ulitsa S s kh Daev pereulok v T Bol’shoy Su 64 Ermitazh T o s Krasnovorotskiy proezd s v Mosproekt-2 k e i Tishinskaya ulitsa Yuliusa Fuchika y t p Pushkinskaya -

Regional Approaches in High-Rise Construction

E3S Web of Conferences 33, 01023 (2018) https://doi.org/10.1051/e3sconf/20183301023 HRC 2017 Regional approaches in high-rise construction O.G. Iconopisceva1, G.A. Proskurin1 Orenburg State University, 460018, Orenburg, prospect Pobedy, 13, Russia Abstracts. The evolutionary process of high-rise construction is in the article focus. The aim of the study was to create a retrospective matrix reflecting the tasks of the study such as: structuring the most iconic high-rise objects within historic boundaries. The study is based on contemporary experience of high-rise construction in different countries. The main directions and regional specifics in the field of high-rise construction as well as factors influencing the further evolution process are analyzed. The main changes in architectural stylistics, form-building, constructive solutions that focus on the principles of energy efficiency and bio positivity of "sustainable buildings", as well as the search for a new typology are noted. The most universal constructive methods and solutions that turned out to be particularly popular are generalized. The new typology of high-rises and individual approach to urban context are noted. The results of the study as a graphical scheme made it possible to represent the whole high-rise evolution. The new spatial forms of high-rises lead them to new role within the urban environments. Futuristic hyperscalable concepts take the autonomous urban space functions itself and demonstrate us how high-rises can replace multifunctional urban fabric, developing it inside their shells. 1 Introduction It's impossible nowadays to imagine the world without high-rises, which is the mainstream in the forming of high dense urban landscapes. -

Rank Building City Country Height (M) Height (Ft) Floors Built 1 Burj

Rank Building City Country Height (m) Height (ft) Floors Built 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 Makkah Royal Clock 2 Mecca Saudi Arabia 601 m 1,971 ft 120 2012 Tower Hotel 3 Taipei 101 Taipei Taiwan 509 m[5] 1,670 ft 101 2004 Shanghai World 4 Shanghai China 492 m 1,614 ft 101 2008 Financial Center International 5 Hong Kong Hong Kong 484 m 1,588 ft 118 2010 Commerce Centre Petronas Towers 1 6 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 and 2 Nanjing Greenland 8 Nanjing China 450 m 1,476 ft 89 2010 Financial Center 9 Willis Tower Chicago USA 442 m 1,450 ft 108 1973 10 Kingkey 100 Shenzhen China 442 m 1,449 ft 98 2011 Guangzhou West 11 Guangzhou China 440 m 1,440 ft 103 2010 Tower Trump International 12 Chicago USA 423 m 1,389 ft 98 2009 Hotel and Tower 13 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 14 Al Hamra Tower Kuwait City Kuwait 413 m 1,352 ft 77 2011 Two International 15 Hong Kong Hong Kong 416 m 1,364 ft 88 2003 Finance Centre 16 23 Marina Dubai UAE 395 m 1,296 ft 89 2012[F] 17 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 18 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 19 Empire State Building New York City USA 381 m 1,250 ft 102 1931 19 Elite Residence Dubai UAE 381 m 1,250 ft 91 2012[F] 21 Tuntex Sky Tower Kaohsiung Taiwan 378 m 1,240 ft 85 1994 Emirates Park Tower 22 Dubai UAE 376 m 1,234 ft 77 2010 1 Emirates Park Tower 22 Dubai UAE 376 m 1,234 ft 77 2010 2 24 Central Plaza Hong Kong Hong Kong 374 m 1,227 ft 78 1992[C] 25 Bank of China Tower Hong Kong Hong Kong 367 m 1,205 ft 70 1990 Bank -

PERSPECTIVAS E DESAFIOS AO DESENVOLVIMENTO NA RMC O MEIO AMBIENTE URBANO Seminário

Seminário PERSPECTIVAS E DESAFIOS AO DESENVOLVIMENTO NA RMC AGEMCAMP/PUCCAMP/FFORUM O MEIO AMBIENTE URBANO EixoEixo dede anan áálise:lise: AmbienteAmbiente UrbanoUrbano –– AA CidadeCidade QuestõesQuestões QuestõesQuestões ““TradicionaisTradicionais ”” ““AtuaisAtuais ”” Dicotomia Cidade – Campo Conectividade Cidade Industrial Cidade Terciária Elevada Tx de Crescimento Demográfico Menores Taxas de Crescimento Favelização – Periferização Urbanização e Saneamento Metropolização Crescimento das Aglomerações Urbanas Maior Crescimento do Núcleo Crescimento dos Municípios Periféricos Qualidade de Vida Ambiente Competitivo Funções Claras de Núcleo (com centro Centros de Serviços Localizados nos principal e subcentros) Grandes Eixos – Novas Centralidades? Expansão da Mancha Urbana Urbanização Dispersa Migrações Nacionais de Longa Distância Migração Internacional Deslocamentos Intra-urbanos Deslocamentos Pendulares Inter- regionais QuestõesQuestões AlternativasAlternativas Deslocamento de Plantas Busca de “Nova Identidade” Industriais e Redução do Emprego Industrial Existência de Áreas Projetos de Renovação Urbana Degradadas Redução das Funções do Projetos de Revitalização dos Centro Centros CompetitividadeCompetitividade ee NovaNova IdentidadeIdentidade AA BuscaBusca dede NovaNova IdentidadeIdentidade RequerRequer IntervenInterven ççõesões emem DiferentesDiferentes EscalasEscalas Espaciais.Espaciais. AAççõesões dede DistintosDistintos Atores:Atores: EscalasEscalas PropostasPropostas AAççõesões Escala Global e • Criação de “Ambiente” Atrativo à -

Façades That Express Perfect Synergy

1 2 FAÇADES THAT EXPRESS PERFECT SYNERGY Velko Group embraces three major companies that operate in the marble and plastic. As part of its long and fruitful working relationship architectural façades sector: Velko, ST Façade Technology and Taltos. with Schüco, Velko has over the years realized more than 150 projects, The companies work in perfect synergy, teaming up on one another’s including several skyscrapers for Moscow Internation Business Center projects to offer a full, turnkey service. Velko, the Group’s lead (Federation Tower, Evolution Tower, World Trade Center, Eurasia Tower company, has been operating for over 27 years, mainly on the Russian and Northern Tower). It has also worked on other iconic projects in market and in former Soviet Union countries. which translucent stained glass windows take on complex organic Velko uses traditional materials such as glass and aluminum, and shapes, one example being the dome of the Nevskaya Ratusha. leading-edge materials available on the market including acrylic Specialized in managing the entire design and construction process panels and composites, terracotta, ceramics, granite, natural stone, for its range of technological solutions, Velko has covered some 4 5 122 Q 1- Eurasia Tower skyscraper Moscow, Russia 2- Moskow International Business Center Aerial view Moscow, Russia 3- Nevskaya Ratusha Administrative and public center Saint Petersburg, Russia 4- Northern Tower business district Moscow, Russia 5- Evolution Tower Office building Moscow, Russia 6- Administrative and public center Moscow, Russia 7- Federation Tower skyscraper Moscow, Russia 3 VELKO 20,000 sq. m of production facilities around Moscow. In addition, Pionerskaya str., 4 - RU -141070 Korolev 10,000 sq. -

Q1 2015 IR Presentation FINANCIAL & BUSINESS RESULTS

Q1 2015 IR Presentation FINANCIAL & BUSINESS RESULTS May 2015 SECTION 1 Company Overview Company at Glance Market Cap, as of May 22, 2015 US$ 0.3 bn •Full cycle real estate Price per share, as of May 22, 2015 US$ 0,29 •Strong liquidity developer NAV (Equity), as of March 31, 2015 US$ 1.29 bn position: US$ 74,7 mn NAV per share, as of March 31, 2015 US$ 1,23 as at March 31, 2015 Portfolio Value* US$ 2.0 bn •Focus on unique large scale FINANCIAL BUSINESS •Secured financing for on- commercial and STABILITY PORTFOLIO VALUE* going projects residential projects Development Projects AFIMALL • 31% Debt to Total 29% 50% •Primary market: Assets** Moscow, Russia •14 completed projects •14 years on the with total c. 0,6 mln market sqm of space •Admitted to LSE in •Impeccable credit TRACK HISTORY 2007 history •Premium listing from RECORD 2010 Yielding Projects and Hotels •Market reputation for 21% high quality and •Free float – 35,12% professional property * Gross Asset Value of Portfolio based on C&W Valuation as management for 31 December 2014 and BV of Land Bank projects, Trading Properties and Hotels( inc. JV) •Strong global brand % Change since January 2015 60% •Affiliate of Africa •Substantial income 50% Israel Group generating portfolio. Major project AFIMALL 40% BRAND (64,88% owner) , a PORTFOLIO major conglomerate 30% 11% with global focus on •8 Development Projects real estate, & land bank 20% construction and 10% infrastructure 0% ** Bank loans only -10% AFID January-15 February-15 March-15 April-15 May-15 3 Key Projects in Moscow *** *** Information presented as for 31 Dec, 2014 Yielding Assets (retail, offices and hotels) Tverskaya IB Value** US$ 1.4 bn Riverside Station ( C&W, Dec, 31 2014): AFIMall GLA(excl. -

The Moscow International Business Center

LOADTEST O-Cell® Technology in Moscow City, Russian Federation The Moscow International Business Center The Moskva-City (also known as the Moscow International Business Center) Project is a $12 billion development close to the heart of Moscow. This new international business centre will consist of offices, hotels, retail and residential development. It will be the first of its kind in Eastern Europe and will offer the most up to date transport and telecommunications network. These large high-rise projects have required foundations into the Suvorov Limestone through the Voskrensky clay. RMJMs Twisting Wedding Since the behaviour of the Limestone is relatively unknown, Palace. pile tests have been recommended to verify the foundation designs. Bi-directional testing using O-cells was employed to verify rock socket behaviour. Tests were performed on piles of diameters between 900 mm and 1500 mm, located on several separate plots, mobilising total capacities in excess of 60 MN. Plots 2-3 required testing for the foundations of the City Palace, formerly known as the Wedding Tower, designed by RMJM as “a wedding chapel in the sky”. This 46 storey twisting skyscraper will incorporate a top floor ball room with stunning views over Red Square. Plot 4, Imperia Tower is a multipurpose 2 building complex located on plot 4 of the Moscow International Business Center, the mixed-use Building A and the water park entertainment complex in Building B. Office space, The City of Capitals apartments, a 280 room hotel and a water park will make up (photo Bradmoscu) the project and will be a focus of entertainment for MIBC with a shopping mall, restaurants and cafés. -

MIBC Moscow-City June 2016

RESEARCH MIBC Moscow-City June 2016 1 MIBC MOSCOW-CiTY JUNE 2016 RESEARCH Demand Office buildings delivered and under construction on the territory of MIBC Moscow-City The occupiers of Moscow-City are MIBC Moscow-City transnational companies, owning the whole Northern Tower Federation Tower (West) towers (Transneft JSC, VTB Group) as well 2-nd Krasnogvardeyskiy ln. Federation Tower (East) as companies leasing small representative Renaissance Mercury City Moscow Towers plot №20 Moscow-City is the largest investment project in Moscow based on offices (less than 1 thousand sq m). А the concept of the developed areas of the world business capitals, Vystavochniy ln. А comprising office, residential, retail and hotel components. Today public non-profit organizations, major А Grand Tower oil companies and commercial organizations 1-st Krasnogvardeyskiy ln. А mainly of Russian origin display a keen А interest in Moscow-City. These companies g n i Vystavochnaya r took advantage of the current market t А r А o conditions to consolidate their offices and p Delovoy s А n Center a optimize the rental costs. Nevertheless, the r T Supply Evolution Tower share of foreign tenants reached 60% at d А r - Vystavochnaya . 3 b the initial stage of the MIBC Moscow-City MezhdunarodnayMezhdunarodnaya a А m Russia Tower was projected to be the tallest their projects. The trend of office component e Today 11 buildings comprising office 4 B a development. - А ay t k building in Europe located at #17–18 plots reduction in favor of the increase of the areas h s premises are delivered with 905,5 thousand n ОКО K ne r А s of Moscow-City, but its construction was for apartments is actively spreading in the a re sq m GLA of offices.