Tax Controversy Leaders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Process of Brexit: What Comes Next?

LONDON’S GLOBAL UNIVERSITY THE PROCESS OF BREXIT: WHAT COMES NEXT? Alan Renwick Co-published with: Working Paper January 2017 All views expressed in this paper are those of the authors and do not necessarily represent the views of the UCL European Institute. © Alan Renwick (Image credit: Way out by Matt Brown; CC BY 2.0) The Process of Brexit: What Comes Next? Alan Renwick* * Dr Alan Renwick is Deputy Director of the UCL Constitution Unit. THE PROCESS OF BREXIT: WHAT COMES NEXT? DR ALAN RENWICK Executive Summary The phoney war around Brexit is almost over. The Supreme Court has ruled on Article 50. The government has responded with a bill, to which the House of Commons has given outline approval. The government has set out its negotiating objectives in a White Paper. By the end of March, if the government gets its way, we will be entering a new phase in the Brexit process. The question is: What comes next? What will the process of negotiating and agreeing Brexit terms involve? Can the government deliver on its objectives? What role might parliament play? Will the courts intervene again? Can the devolved administrations exert leverage? Is a second referendum at all likely? How will the EU approach the negotiations? This paper – so far as is possible – answers these questions. It begins with an overview of the Brexit process and then examines the roles that each of the key actors will play. The text was finalised on 2 February, shortly after publication of the government’s White Paper. Overview: Withdrawing from the EU Article 50 of the EU treaty sets out a four-step withdrawal process: the decision to withdraw; notification of that decision to the EU; negotiation of a deal; and agreement to the deal’s terms. -

Masaryk University Faculty of Education Department Of

Masaryk University Faculty of Education Department of English Language and Literature The Passive in the British Political News Bachelor thesis Brno 2017 Supervisor: Written by: Mgr. Renata Jančaříková, Ph.D. Karolína Šafářová Announcement I hereby declare that I have worked on this thesis independently and that I have used only the sources from the works cited list. Brno, 30 March 2017 ..…..………………… Karolína Šafářová Acknowledgement I would like to thank my supervisor, Mgr. Renata Jančaříková, Ph.D, for her guidance, kind support and valuable advice. Anotace Tato bakalářská práce The Passive in the British political news je zaměřena na užití trpného rodu v politických článcích na téma Brexit vyskytujících se v seriozních novinách The Guardian a bulváru The Daily Mail. V práci je použita kvantitatvní analýza za účelem srovnání výskytu činného a trpného rodu, vyhodnocení důvodů pro používání trpného rodu, analyzování výskytu významových a uvozovacích sloves, a poměru činitelů trpného rodu vyjádřených pomocí 'by'. Annotation This bachelor thesis The Passive in the British political news is focused on the use of the passive in the broadsheet The Guardian and the tabloid The Daily Mail on the topic of concerning Brexit. It uses quantitative analysis to compare the frequency of use of the active and the passive voice, to analyze reasons for using the passive, the frequency of occurrence of lexical and report verbs, and the proportion of agents expressed by 'by'. Klíčová slova trpný rod, činný rod, noviny, politické zprávy, The Guardian, The Daily Mail, analýza, kvalitní noviny, bulvár Key Words passive voice, active voice, newspaper, political news, The Guardian, The Daily Mail, analysis broadsheets, tabloids Content 1 Introduction ....................................................................................................................... -

Download the Guide

A Guide to Brexit Terminology This glossary has been designed to explain some of the key terms used in relation to Brexit. At the end of the glossary are links to additional resources and originals of key documents. The Glossary is not designed to be an exhaustive list and the authors hope that you find the explanations of key terms helpful. The UK which voted to join the EU had a different constitution to the UK that voted to leave the EU. This is reflected by some of the terminology used in the glossary and the inclusion of reference to the legislatures in Scotland, Wales and Northern Ireland. A | B | C | D | E | F | G | H | I | J | K | L | M | N |O| P | Q | R | S | T | U | V | W | X | Y | Z | A to Z of Brexit terms February 01 2019 version pg. 1 Advisory The Brexit referendum is often described as ‘only advisory’. The referendum was authorised and conducted under the European Union Referendum Act 2015. It is advisory because Parliament is sovereign and because the Act contained no enabling legislation. Enabling provisions are ones which explicitly state that Parliament is legally bound to implement the outcome of the referendum. Hence, Parliament was not legally obliged to enact the outcome of the Brexit referendum. In contrast, for countries with codified constitutions, the outcome of a referendum ‘may’, in some instances bind both parliament and the government to implement its result. In Britain, however, with an uncodified constitution, it is possible for the government to promise in advance that it would respect the result, but that promise would be only political and not legally binding as parliament cannot be bound be a previous parliament; it can change its mind. -

Annual Report 2016 • KBC Bank • 1 to the Reader

KBC Bank Annual Report for 2016 Annual Report 2016 • KBC Bank • 1 To the reader Company name ‘KBC’, ‘the group’, ‘we’ or ‘KBC Bank’ as used in this annual report refer (unless otherwise indicated) to the consolidated bank entity, i.e. KBC Bank NV including all group companies included in the scope of consolidation. ‘KBC Bank NV’ refers solely to the non-consolidated entity. The ‘Company annual accounts' section deals only with the non-consolidated entity. Difference between KBC Bank and KBC Group KBC Bank NV is a subsidiary of KBC Group NV. The KBC group's legal structure has one single entity – KBC Group NV – in control of two underlying companies, viz. KBC Bank NV and KBC Insurance NV. All KBC Bank NV shares are owned (directly and indirectly) by KBC Group NV. A number of KBC Bank NV’s debt instruments are exchange-listed. Where mention is made of KBC Group or the KBC group in this annual report, KBC Group NV is meant, including all group companies included in the scope of consolidation. Forward-looking statements The expectations, forecasts and statements regarding future developments that are contained in this annual report are based on assumptions and assessments made when drawing up this report. By their nature, forward-looking statements involve uncertainty. Various factors could cause actual results and developments to differ from the initial statements. Translation This annual report is available in Dutch and English. The Dutch version is the original and the English-language version an unofficial translation. KBC warrants that every reasonable effort has been made to avoid any discrepancies between the different language versions. -

EFS Top-Level Seminar EU VAT: Recent Developments and Outlook

EFS, ERASMUS UNIVERSITY ROTTERDAM EFS Top-Level Seminar EU VAT: Recent Developments and Outlook 3 DAY PROGRAMME 27 - 29 SEPTEMBER 2017 Prof. Ben Terra Oscar Henkow Prof. Marie Lamensch Andrea Parolini Thierry Charon Prof. René van der Paardt EU VAT: RECENT DEVELOPMENTS AND OUTLOOK EFS, ERASMUS UNIVERSITY ROTTERDAM ERASMUS UNIVERSITY ROTTERDAM EFS, Erasmus University Roterdam is a partnership between Erasmus University Rotterdamis a global, top-100 research the tax departments of the Erasmus University Rotterdam’s university, where ambitious students prepare for an excellent Schools of Law and Economics. career. EFS has been a leading education and research institute in the Erasmus University Rotterdam is one the biggest universities areas of international taxation and European taxation for over in the Netherlands, with a student population of 23,000 and a 25 years. research community of around 1,400. The work of EFS concentrates on the operation of both indirect On the lively and modern campus, students are constantly taxes, covering VAT and customs duties, and direct taxes, focusing encouraged to develop their talents achieve their ambitions in on individual taxation, corporate taxation and source taxation in an international classrooms of more than 100 nationalities. international and/or European context. Its intensive, career-oriented and research-driven studies are As well as regularly hosting academic symposia, conferences matched by an excellent student life in the dynamic and diverse and lectures, EFS offers a wide range of post-master programmes. city of Rotterdam. The university’s research is strongly focused on societal impact on health, wealth, governance and culture. 2 EU VAT: RECENT DEVELOPMENTS AND OUTLOOK Case law from the European Court of Justice in Luxembourg, proposals from the Commission in Brussels and, of course, Brexit: the VAT landscape is continually changing. -

1.Declaration of Estate: Significant Changes in Flanders

Lloyd Georgelaan 11 I 1000 Brussels www.berquinnotarissen.be Contents 1. Declaration of estate: significant changes in Flanders 2. ‘Misery tax’ reduced once again in cases of relational break-up? 3. Valuation of usufruct: at long last a (limited civil law) statutory system 1.Declaration of estate: significant changes in Flanders Eric Spruyt, notary-partner Berquin Notarissen cvba, Professor at KU Leuven and Fiscale Hogeschool (Tax College) April 2015 Since 1 January 2015, the Flemish Region has been collecting its own succession duties which, incidentally, now go by the name of “inheritance tax”. This name change is only a minor detail as also the rules of play, which can be found in a new codex, have changed. The most noteworthy of these undoubtedly relate to the formalities governing the declaration of estate and to the fact that fines have gone up dramatically! A new "coat" and name For quite some time now, the Regions in our country have enjoyed competence in matters of succession duties. They can set their own rules of play, rates, reductions and exemptions. Collection however - in official tax jargon known as the tax "administration" - has up and until now been ensured by the Federal Government (FPS Finance). Every Region is free to decide when it wishes to organise and manage its own collection. The Flemish Region decided it would do so as of 1 January 2015. Collection will henceforth be ensured by VLABEL (Flemish Tax Administration). The authorities took this opportunity to incorporate the Flemish succession duties into the existing Vlaamse Codex Fiscaliteit (Flemish Tax Code). -

Significant Growth Potential for KONE in Russia

KONE Capital Markets Day 2008 Significant growth potential for KONE in Russia Klaus Cawén Executive Vice President, M&A and Strategic Alliances, Russia, Legal Affairs Significant growth potential for KONE in Russia Rapidly growing economy One of the top ten elevator markets KONE uniquely positioned to drive growth Capital City, Moscow 2 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén Rapidly growing economy Strong GDP growth 140 million population – mostly urban High disposable income – high consumption Antey-III, Yekaterinburg 3 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén Strong GDP growth 12 10 8 6 4 2 0 2000 2001 2002 2003 2004 2005 2006 2007 Note: Real GDP Growth Source: Bank of Finland 4 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén In addition to Moscow and St. Petersburg there are 11 cities with a population exceeding one million Cities by Number of Inhabitants (Millions) Moscow St Petersburg St Petersburg Novosibirsk Nizhny Novgorod Rural Moscow Yekaterinburg 26% Samara Omsk Nizhniy Novgorod Perm Perm Rostov-na-Donu Kazan Kazan Samara Yekaterinburg Ufa Urban Ufa Chelyabinsk Chelyabinsk 74% Rostov-on-Don Volgograd Omsk Volgograd 0 1 2 3 4 5 6 7 8 9 Novosibirsk Source: United Nations Population density and urbanization statistics 5 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén Source: United Nations Population Division estimates and projections High disposable income Unleashed hungry urban consumers 13% flat income tax Growing middle class -

'Good Gigs: a Fairer Future for the UK's Gig Economy'

Good Gigs A fairer future for the UK’s gig economy Brhmie Balaram, Josie Warden and Fabian Wallace-Stephens April 2017 Contents About us 3 Acknowledgments 4 Summary 5 1. The nature of Britain’s gig economy 10 Part I: The current trend 12 Part II: Insight into different experiences 23 Part III: Future prospects 30 2. Gig work as ‘good work’ 34 Part I: Understanding and defining employment relationships in the gig economy 35 Part II: Understanding the interactions between employment law, tax and welfare 39 Part III: Getting beyond the system with ‘good work’ 47 3. The potential of peer-to-peer platforms 49 4. Transforming the labour market together 56 Rethinking regulatory approaches 57 The RSA’s recommendations 58 Concluding remarks 64 2 Good Gigs: A fairer future for the UK’s gig economy About us Brhmie Balaram is a Senior Researcher at the RSA. Josie Warden is a Researcher at the RSA. Fabian Wallace-Stephens is a Data Research Assistant at the RSA. All work in the Economy, Enterprise and Manufacturing Team. The RSA (Royal Society for the encouragement of Arts, Manufactures and Commerce) believes that everyone should have the freedom and power to turn their ideas into reality – we call this the Power to Create. Through our ideas, research and 28,000- strong Fellowship, we seek to realise a society where creative power is distributed, where concentrations of power are confronted, and where creative values are nurtured. The RSA Action and Research Centre combines practical experimentation with rigorous research to achieve these goals. MANGOPAY is an online payment technology designed for marketplaces, crowd- funding platforms and sharing economy businesses. -

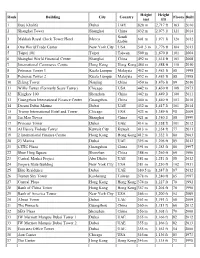

List of World's Tallest Buildings in the World

Height Height Rank Building City Country Floors Built (m) (ft) 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 2 Shanghai Tower Shanghai China 632 m 2,073 ft 121 2014 Saudi 3 Makkah Royal Clock Tower Hotel Mecca 601 m 1,971 ft 120 2012 Arabia 4 One World Trade Center New York City USA 541.3 m 1,776 ft 104 2013 5 Taipei 101 Taipei Taiwan 509 m 1,670 ft 101 2004 6 Shanghai World Financial Center Shanghai China 492 m 1,614 ft 101 2008 7 International Commerce Centre Hong Kong Hong Kong 484 m 1,588 ft 118 2010 8 Petronas Tower 1 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 8 Petronas Tower 2 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 10 Zifeng Tower Nanjing China 450 m 1,476 ft 89 2010 11 Willis Tower (Formerly Sears Tower) Chicago USA 442 m 1,450 ft 108 1973 12 Kingkey 100 Shenzhen China 442 m 1,449 ft 100 2011 13 Guangzhou International Finance Center Guangzhou China 440 m 1,440 ft 103 2010 14 Dream Dubai Marina Dubai UAE 432 m 1,417 ft 101 2014 15 Trump International Hotel and Tower Chicago USA 423 m 1,389 ft 98 2009 16 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 17 Princess Tower Dubai UAE 414 m 1,358 ft 101 2012 18 Al Hamra Firdous Tower Kuwait City Kuwait 413 m 1,354 ft 77 2011 19 2 International Finance Centre Hong Kong Hong Kong 412 m 1,352 ft 88 2003 20 23 Marina Dubai UAE 395 m 1,296 ft 89 2012 21 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 22 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 23 Central Market Project Abu Dhabi UAE 381 m 1,251 ft 88 2012 24 Empire State Building New York City USA 381 m 1,250 -

Moscow City Project Continues to Be Developed, with the Naberezhnaya Tower Complex Being Completed in 2007

Research Moscow Office market report • H2 2007 Contents Moscow office markets 2-3 Market breakdown 4 Market data 5 Executive summary • Demand for quality office space in Moscow clearly exceeds supply, with the vacancy rate for class A premises standing at just over 1%. Prime rents have continued to show rapid growth. • The quality of large-scale office accommodation is improving, while office complexes of over 100,000 sq m are becoming increasingly common. About six such projects are expected to open in 2008. • The geography of Moscow’s office market is expanding, with a number of large business parks being developed outside the city boundaries, such as Khimki Business Park, Greenwood Business Park and Western Gate. • The MIBC Moscow City project continues to be developed, with the Naberezhnaya Tower Complex being completed in 2007. However, some tenants are reluctant to move to Moscow City until there are improvements in the transport infrastructure and the availability of parking. In light of these factors, rents of over $2,000 per sq m per annum are viewed by many as being overpriced. • Investment in office properties has been growing at an unprecedented rate. Prime yields compressed by around 200 basis points during 2007 to stand at 8.00% at the end of the year. 2 Moscow office market report • H2 2007 Knight Frank Moscow City (Moscow International Business Center) 19 18 19 Complete 18 17 1st Krasnogvardeysky proezd 25 Partially 16a 16b 1 Complete 20 21 13 14 15 12 2008 11 Expocenter 8a 8b 7 6 2009 10 2 2010 9 4 3 Kra 2011 snop resne -

Tax Management International Forum

TAX MANAGEMENT INTERNATIONAL FORUM Comparative Tax Law for the International Practitioner >>>>>>>>>>>>>>>>>>>>>>>>>>> VOLUME 37, NUMBER 2 >>> JUNE 2016 www.bna.com Income and Indirect Tax Consequences of Cash Pooling Arrangements FACTS Host Co is a Host Country corporation that has three operating subsidiaries: H Sub, a Host Country corporation; X Sub, a Country X corporation; and Y Sub, a Country Y cor- poration. In order to minimize short-term bank financing costs and to manage the group’s cash flow requirements, Host Co plans to structure a cash pooling arrangement involving the three operating subsidiaries and FinCo, a newly formed Country Z corpo- ration that will be capitalized by Host Co with a combination of debt and equity and would be the cash pool leader; and Bank, an unrelated Country Z financial institution with branches in Host Country, Country X, Country Y and Country Z. FinCo’s activities would be limited to serving as the cash pool leader in the arrangements described below. The Host Co group has no other operations in Country Z, although it is considering cen- tralizing all of its treasury functions there. Host Co is considering two different types of cash pooling arrangements. The first would involve a zero target balancing cash pooling arrangement whereby, on a daily basis, the cash surpluses of any participant would be transferred to FinCo and FinCo would advance the necessary funds to any participant that experienced a cash deficit. FinCo would maintain an account with Bank in Country Z. Bank would finance any defi- cit in FinCo’s account at a floating rate of interest. -

Annual Reports 2017-05-22 00:00:00 Annual Report 2016

WORKING #together TOWARDS A SUSTAINABLE FUTURE Annual Report of KBC Group 2016 KBC Group of Report Annual Annual Report of KBC Group 2016 KBC group passport Net result (in millions of EUR) Our area of operation 2 639 We are an integrated bank-insurance group, catering mainly for retail, private banking, SME and mid-cap clients. Our core markets are Belgium, 765 2 427 the Czech Republic, Slovakia, Hungary, Bulgaria and Ireland. We are also present to a limited extent in several other countries to support corporate 1 762 clients from our core markets. Our clients, staff and network 2 218 Clients (estimate) over 10 million Staff 38 356 Bank branches 1 456 -344 Insurance network 427 agencies in Belgium, various distribution 2014 2015 2016 channels in Central and Eastern Europe impact of liquidation of KBC Financial Holding Inc. Our long-term credit ratings (20-03-2017) impact of goodwill impairment for a number of participating interests Fitch Moody’s Standard & Poor’s KBC Bank NV A A1 A KBC Insurance NV – – A- KBC Group NV A Baa1 BBB+ Breakdown of net result by business unit (2016, in millions of EUR) Our core shareholders 1 432 KBC Ancora 18.5% Cera 2.7% MRBB 11.4% Other core shareholders 7.6% 596 Data relates to year-end 2016, unless otherwise indicated. For definitions, please see the detailed tables 428 and analyses in this report. Outlook/watch/review data for our ratings is given elsewhere in this report. -29 Belgium Czech International Group Business Republic Markets Centre Unit Business Business Unit Unit 3.5 million clients 96 billion