Moscow City Project Continues to Be Developed, with the Naberezhnaya Tower Complex Being Completed in 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Q3 2014 IR Presentation FINANCIAL & BUSINESS RESULTS

Q3 2014 IR Presentation FINANCIAL & BUSINESS RESULTS November 2014 Disclaimer This document does not constitute or form part of and should not be construed as, an offer to sell or issue or the solicitation of an offer to buy or acquire securities of AFI Development Plc (the "Company") or any of its subsidiaries in any jurisdiction or an inducement to enter into investment activity. No part of this document, nor the fact of its distribution, should form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. No representation, warranty or undertaking, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or the opinions contained herein. None of the Company or any of its affiliates, advisors or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection with the document. This communication is only being distributed to and is only directed at (1) qualified institutional buyers (within the meaning of Rule 144A of the United States Securities Act of 1933, as amended (the "Securities Act") or (2) accredited investors (as defined in Rule 501(a) of Regulation D adopted pursuant to the Securities Act). Any person who is not a "qualified institutional buyer" or "accredited investor" should not act or rely on this document or any of its contents. This document contains "forward-looking statements", which include all statements other than statements of historical facts, including, without limitation, any statements preceded by, followed by or that include the words "targets", "believes", "expects", "aims", "intends", "will", "may", "anticipates", "would", "could" or similar expressions or the negative thereof. -

Vladimir Putin Just Wants to Be Friends P42 ADVERTISEMENT

September 12 — September 18, 2016 | bloomberg.com Vladimir Putin just wants to be friends p42 ADVERTISEMENT WORLD CLASS AS STANDARD Bringing It All Together For results to meet expectations, belief in preparation and teammates benefits world-class golfers and investors One nickname for them was the Spanish matches, European captain Tony Jacklin Rotella. “For some players it’s a new expe- Armada, although they fared much better sent his planned pairings out to play nine- ULHQFHDQGWKH\·YHQHYHUKDGWRVDFULÀFH DW7KH5\GHU&XSWKDQWKHLOOIDWHGÁHHW hole small-money matches. Ballesteros a lot for the good of the team. Other guys of 1588 did in war. Beginning in 1987, DQG2OD]iEDO³SOD\LQJWRJHWKHUIRUWKHÀUVW ORYHEHLQJXQVHOÀ V K W H D PSOD\HUV,Q7KH and paired together over four consecutive time ever as partners—squared off against Ryder Cup, knowing ahead of time who Ryder Cups for eight matches in foursomes Bernhard Langer and Ken Brown for $10, you are going to be paired with, and to be (alternate shot) and seven in four-ball and were two down with two holes to play. excited about that, is a big deal. When you (best ball), Spaniards Seve Ballesteros On the eighth hole, Ballesteros holed out UHDOO\ÀQGRXWLI\RX·UHFORVHO\NQLWLVZKHQ and José María Olazábal ran up a record from a bunker to win. One down. On the you get down in a match. That’s when you of 11-2-2—by far the most successful ninth, Olazábal rammed in a 20-foot birdie À Q G RXWLI\RXEHOLHYHLQHDFKRWKHUDQG partnership in the history of the event. putt to win. -

Significant Growth Potential for KONE in Russia

KONE Capital Markets Day 2008 Significant growth potential for KONE in Russia Klaus Cawén Executive Vice President, M&A and Strategic Alliances, Russia, Legal Affairs Significant growth potential for KONE in Russia Rapidly growing economy One of the top ten elevator markets KONE uniquely positioned to drive growth Capital City, Moscow 2 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén Rapidly growing economy Strong GDP growth 140 million population – mostly urban High disposable income – high consumption Antey-III, Yekaterinburg 3 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén Strong GDP growth 12 10 8 6 4 2 0 2000 2001 2002 2003 2004 2005 2006 2007 Note: Real GDP Growth Source: Bank of Finland 4 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén In addition to Moscow and St. Petersburg there are 11 cities with a population exceeding one million Cities by Number of Inhabitants (Millions) Moscow St Petersburg St Petersburg Novosibirsk Nizhny Novgorod Rural Moscow Yekaterinburg 26% Samara Omsk Nizhniy Novgorod Perm Perm Rostov-na-Donu Kazan Kazan Samara Yekaterinburg Ufa Urban Ufa Chelyabinsk Chelyabinsk 74% Rostov-on-Don Volgograd Omsk Volgograd 0 1 2 3 4 5 6 7 8 9 Novosibirsk Source: United Nations Population density and urbanization statistics 5 May 7, 2008 © KONE Corporation l Capital Markets Day l Klaus Cawén Source: United Nations Population Division estimates and projections High disposable income Unleashed hungry urban consumers 13% flat income tax Growing middle class -

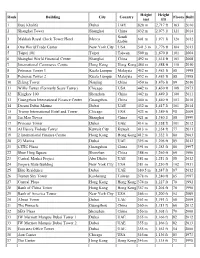

List of World's Tallest Buildings in the World

Height Height Rank Building City Country Floors Built (m) (ft) 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 2 Shanghai Tower Shanghai China 632 m 2,073 ft 121 2014 Saudi 3 Makkah Royal Clock Tower Hotel Mecca 601 m 1,971 ft 120 2012 Arabia 4 One World Trade Center New York City USA 541.3 m 1,776 ft 104 2013 5 Taipei 101 Taipei Taiwan 509 m 1,670 ft 101 2004 6 Shanghai World Financial Center Shanghai China 492 m 1,614 ft 101 2008 7 International Commerce Centre Hong Kong Hong Kong 484 m 1,588 ft 118 2010 8 Petronas Tower 1 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 8 Petronas Tower 2 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 10 Zifeng Tower Nanjing China 450 m 1,476 ft 89 2010 11 Willis Tower (Formerly Sears Tower) Chicago USA 442 m 1,450 ft 108 1973 12 Kingkey 100 Shenzhen China 442 m 1,449 ft 100 2011 13 Guangzhou International Finance Center Guangzhou China 440 m 1,440 ft 103 2010 14 Dream Dubai Marina Dubai UAE 432 m 1,417 ft 101 2014 15 Trump International Hotel and Tower Chicago USA 423 m 1,389 ft 98 2009 16 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 17 Princess Tower Dubai UAE 414 m 1,358 ft 101 2012 18 Al Hamra Firdous Tower Kuwait City Kuwait 413 m 1,354 ft 77 2011 19 2 International Finance Centre Hong Kong Hong Kong 412 m 1,352 ft 88 2003 20 23 Marina Dubai UAE 395 m 1,296 ft 89 2012 21 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 22 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 23 Central Market Project Abu Dhabi UAE 381 m 1,251 ft 88 2012 24 Empire State Building New York City USA 381 m 1,250 -

Ojsc “Lsr Group” 36 Kazanskaya Street, St

STRICTLY CONFIDENTIAL – FOR ADDRESSEE ONLY REPORT AND VALUATION FOR: OJSC “LSR GROUP” 36 KAZANSKAYA STREET, ST. PETERSBURG,190031, RUSSIA OF THE REAL ESTATE PROPERTIES TOGETHER KNOWN AS: “LSR GROUP PORTFOLIO” DATE OF VALUATION: DECEMBER 31, 2011 DATE OF REPORT ISSUE: FEBRUARY 29, 2012 PREPARED BY: OOO CUSHMAN & WAKEFIELD LLC DUCAT PLACE III 6 GASHEKA STREET 125047, MOSCOW, RUSSIA TEL: +7 (495) 797-9600 FAX: +7 (495) 797-9601 TABLE OF CONTENTS 1. SCOPE OF INSTRUCTIONS ................................................................................................... 3 2. BASIS OF VALUATION ........................................................................................................... 7 3. ASSUMPTIONS AND SOURCES OF INFORMATION ................................................... 7 4. TENURE AND TENANCIES .................................................................................................. 8 5. NET ANNUAL RENT.............................................................................................................. 10 6. TOWN PLANNING ................................................................................................................. 11 7. STRUCTURE .............................................................................................................................. 13 8. SITE AND CONTAMINATION ........................................................................................... 13 9. PLANT AND MACHINERY ................................................................................................. -

(Microsoft Powerpoint

RUMORUMO AOAO PACTOPACTO PELAPELA RMCRMC Experiências Internacionais de Pactos de Desenvolvimento Local e Regional AURÍLIO CAIADO CONSIDERAÇÕES INICIAIS GlobalizaGlobaliza ççãoão ee NeoliberalismoNeoliberalismo debilitadebilita ççãoão dodo planoplano nacionalnacional comocomo unidadeunidade espacialespacial dede referência;referência; ascendênciaascendência dede novosnovos territterrit óóriosrios estratestrat éégicosgicos –– asas regiõesregiões ee asas cidades.cidades. CONSIDERAÇÕES INICIAIS CidadesCidades ee RegiõesRegiões SeSe tornaramtornaram importantesimportantes arenasarenas dede desenvolvimento;desenvolvimento; UnidadesUnidades geogrgeogr ááficasficas maismais apropriadasapropriadas parapara aa emergênciaemergência ee afirmaafirma ççãoão dada competitividadecompetitividade territorial.territorial. AS CIDADES SÃO ESTRATÉGICAS PARA O DESENVOLVIMENTO AsAs cidadescidades sãosão estratestrat éégicasgicas parapara oo desenvolvimentodesenvolvimento econômicoeconômico ,, poispois éé nelasnelas queque asas economiaseconomias dede escalaescala ee dede aglomeraaglomera ççãoão operamoperam nono sentidosentido dede dardar maiormaior amplitudeamplitude ee eficiênciaeficiência aoao processoprocesso dede desenvolvimento.desenvolvimento. CIDADES = CENTROS DE COMANDO NaNa economiaeconomia globalizada,globalizada, asas cidadescidades sãosão pontospontos dede comandocomando ,, mercadosmercados globaisglobais ee locaislocais dede produprodu ççãoão parapara aa economiaeconomia dada informainforma çção,ão, porpor isso,isso, consideradasconsideradas ““centroscentros -

ON the ROAD City Moscow

a a a s r Hotel Hilton i a y t k li s D vo o u M t o e l li k va a t y u u uc ry k o 2-ya Brestskaya ulitsa e Ragout a a h p r k e a i y e h s e ulitsa Fadeeva t p s ga a v a s 4-ya 11Tverskaya Yamskaya ulitsa ele p k p M D o y i s e 3 Sad r r a tsa ova k s e s uli p - naya Samotechnaya ulitsa ya NII Skoroy Pomoshchi a it ya tech Sadovaya -S s S u l 1-ya Brestskaya ulitsa ovaya Samo uk ’ kor Sad ha l p lo u 1 rev Sklifosovskogo e S Kazansky s t n k ulitsa Chayanova 1 ka y a ya p a az T u s T v lit y vokzal sa o h t e a i r K n l s lok h iy u k y s B ’ p a l - Kalanchevskaya ulitsa l a y reu eu e o e r 1 o r a p A. A. Chernikhov Design e Dokuchaev pereulok y 6 l iy e n B a Y y ’ u e s am h p and Architecture Studio l k z o u h r Sukharevskaya s O v k o s v k o y o a h y y K k a i h a u L c li r Ryazanskiy proezd ts a e n Novoryazanskaya ulitsa 1-ya 11Tverskaya Yamskaya ulitsa s t a t la li n u a a iy o y l a K n Tsventoy bul’var u l’ p Sadovaya-Spasskaya ulitsa fa e m e r iu ultisa Petrovka r e a r e T p 52 k r Bol’shaya Gruzinskaya ulitsa 53 ya u n a a ulitsa Malaya Dmitrovka k v l iy o o e o lok v n l d reu ’ n pe k t Mayakovskaya eu Sa Maliy Karetniy l a e m r u s r 2-ya Brestskaya ulitsa pe b S iy V n y y o a o r s n he o t ulitsa Mashi poryvaevoy z i t t l ru ni pereulok 2-ya Brestskaya ulitsa etniy e O dniy Kar k u k Sad e v ereulo Orlikov pereulok o r arevskiy p Vasilyevskaya ulitsa S s kh Daev pereulok v T Bol’shoy Su 64 Ermitazh T o s Krasnovorotskiy proezd s v Mosproekt-2 k e i Tishinskaya ulitsa Yuliusa Fuchika y t p Pushkinskaya -

Regional Approaches in High-Rise Construction

E3S Web of Conferences 33, 01023 (2018) https://doi.org/10.1051/e3sconf/20183301023 HRC 2017 Regional approaches in high-rise construction O.G. Iconopisceva1, G.A. Proskurin1 Orenburg State University, 460018, Orenburg, prospect Pobedy, 13, Russia Abstracts. The evolutionary process of high-rise construction is in the article focus. The aim of the study was to create a retrospective matrix reflecting the tasks of the study such as: structuring the most iconic high-rise objects within historic boundaries. The study is based on contemporary experience of high-rise construction in different countries. The main directions and regional specifics in the field of high-rise construction as well as factors influencing the further evolution process are analyzed. The main changes in architectural stylistics, form-building, constructive solutions that focus on the principles of energy efficiency and bio positivity of "sustainable buildings", as well as the search for a new typology are noted. The most universal constructive methods and solutions that turned out to be particularly popular are generalized. The new typology of high-rises and individual approach to urban context are noted. The results of the study as a graphical scheme made it possible to represent the whole high-rise evolution. The new spatial forms of high-rises lead them to new role within the urban environments. Futuristic hyperscalable concepts take the autonomous urban space functions itself and demonstrate us how high-rises can replace multifunctional urban fabric, developing it inside their shells. 1 Introduction It's impossible nowadays to imagine the world without high-rises, which is the mainstream in the forming of high dense urban landscapes. -

Rank Building City Country Height (M) Height (Ft) Floors Built 1 Burj

Rank Building City Country Height (m) Height (ft) Floors Built 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 Makkah Royal Clock 2 Mecca Saudi Arabia 601 m 1,971 ft 120 2012 Tower Hotel 3 Taipei 101 Taipei Taiwan 509 m[5] 1,670 ft 101 2004 Shanghai World 4 Shanghai China 492 m 1,614 ft 101 2008 Financial Center International 5 Hong Kong Hong Kong 484 m 1,588 ft 118 2010 Commerce Centre Petronas Towers 1 6 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 and 2 Nanjing Greenland 8 Nanjing China 450 m 1,476 ft 89 2010 Financial Center 9 Willis Tower Chicago USA 442 m 1,450 ft 108 1973 10 Kingkey 100 Shenzhen China 442 m 1,449 ft 98 2011 Guangzhou West 11 Guangzhou China 440 m 1,440 ft 103 2010 Tower Trump International 12 Chicago USA 423 m 1,389 ft 98 2009 Hotel and Tower 13 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 14 Al Hamra Tower Kuwait City Kuwait 413 m 1,352 ft 77 2011 Two International 15 Hong Kong Hong Kong 416 m 1,364 ft 88 2003 Finance Centre 16 23 Marina Dubai UAE 395 m 1,296 ft 89 2012[F] 17 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 18 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 19 Empire State Building New York City USA 381 m 1,250 ft 102 1931 19 Elite Residence Dubai UAE 381 m 1,250 ft 91 2012[F] 21 Tuntex Sky Tower Kaohsiung Taiwan 378 m 1,240 ft 85 1994 Emirates Park Tower 22 Dubai UAE 376 m 1,234 ft 77 2010 1 Emirates Park Tower 22 Dubai UAE 376 m 1,234 ft 77 2010 2 24 Central Plaza Hong Kong Hong Kong 374 m 1,227 ft 78 1992[C] 25 Bank of China Tower Hong Kong Hong Kong 367 m 1,205 ft 70 1990 Bank -

PERSPECTIVAS E DESAFIOS AO DESENVOLVIMENTO NA RMC O MEIO AMBIENTE URBANO Seminário

Seminário PERSPECTIVAS E DESAFIOS AO DESENVOLVIMENTO NA RMC AGEMCAMP/PUCCAMP/FFORUM O MEIO AMBIENTE URBANO EixoEixo dede anan áálise:lise: AmbienteAmbiente UrbanoUrbano –– AA CidadeCidade QuestõesQuestões QuestõesQuestões ““TradicionaisTradicionais ”” ““AtuaisAtuais ”” Dicotomia Cidade – Campo Conectividade Cidade Industrial Cidade Terciária Elevada Tx de Crescimento Demográfico Menores Taxas de Crescimento Favelização – Periferização Urbanização e Saneamento Metropolização Crescimento das Aglomerações Urbanas Maior Crescimento do Núcleo Crescimento dos Municípios Periféricos Qualidade de Vida Ambiente Competitivo Funções Claras de Núcleo (com centro Centros de Serviços Localizados nos principal e subcentros) Grandes Eixos – Novas Centralidades? Expansão da Mancha Urbana Urbanização Dispersa Migrações Nacionais de Longa Distância Migração Internacional Deslocamentos Intra-urbanos Deslocamentos Pendulares Inter- regionais QuestõesQuestões AlternativasAlternativas Deslocamento de Plantas Busca de “Nova Identidade” Industriais e Redução do Emprego Industrial Existência de Áreas Projetos de Renovação Urbana Degradadas Redução das Funções do Projetos de Revitalização dos Centro Centros CompetitividadeCompetitividade ee NovaNova IdentidadeIdentidade AA BuscaBusca dede NovaNova IdentidadeIdentidade RequerRequer IntervenInterven ççõesões emem DiferentesDiferentes EscalasEscalas Espaciais.Espaciais. AAççõesões dede DistintosDistintos Atores:Atores: EscalasEscalas PropostasPropostas AAççõesões Escala Global e • Criação de “Ambiente” Atrativo à -

BUILDING Works

55°44’49.6”N | 37°32’12.6”E BUSINESS CENTERS & HIGH RISES ENKA Naberezhnaya Tower, Moscow, Russia INDUSTRIAL PLANTS MALLS AND SHOPPING CENTERS PUBLIC BUILDINGS URBAN DEVELOPMENT USA EMBASSY PROJECTS BUILDING works SELECTED PROJECTS BUSINESS CENTERS & HIGH RISES TAIF Business Center, Republic of Tatarstan, Russian Federation Esentai Park Complex, Kazakhstan 55°43’56.1”N | 37°38’49.3”E Moscow City Plot 12 Eurasia Tower, Russian Federation Hyatt Regency Hotel, Business&Residential Center, Kazakhstan Riverside Towers, Moscow, Russian Federation Moscow City Plot 4 Imperial Tower, Russian Federation Mosenka Office Buildings, Russian Federation Naberezhnaya Towe, Russian Federation Paveletskaya Square Business Center, Russian Federation Riverside Towers, Russian Federation Sadovaya Plaza, Russian Federation The Central Core of MIBC, Moscow International Business Center, Russian Federation Tsvetnoy Multifunctional Complex, Russian Federation White Square Office Center, Russian Federation INDUSTRIAL PLANTS General Motors New Car Assembly Plant, Russian Federation Mars Confectionery Plant, Russian Federation Toyota Car and Assembly Plant, Russian Federation Toyota-SA Automobile Factory, Turkey Derna Desalination Plant, Libya Soussa Desalination Plant, Libya CONTENTS Zawia Desalination Plant, Libya Zuara Desalination Plant, Libya Benghazi Cement Plant, Libya Hawari Cement Plant, Libya Souq Al-Khamis Cement Plant, Libya Al Khoms Cement Plant, Libya Tasluja Cement Plant, Iraq Kerbela Cement Plant, Iraq Falluja White Cement Plant, Iraq Badoosh Cement -

Façades That Express Perfect Synergy

1 2 FAÇADES THAT EXPRESS PERFECT SYNERGY Velko Group embraces three major companies that operate in the marble and plastic. As part of its long and fruitful working relationship architectural façades sector: Velko, ST Façade Technology and Taltos. with Schüco, Velko has over the years realized more than 150 projects, The companies work in perfect synergy, teaming up on one another’s including several skyscrapers for Moscow Internation Business Center projects to offer a full, turnkey service. Velko, the Group’s lead (Federation Tower, Evolution Tower, World Trade Center, Eurasia Tower company, has been operating for over 27 years, mainly on the Russian and Northern Tower). It has also worked on other iconic projects in market and in former Soviet Union countries. which translucent stained glass windows take on complex organic Velko uses traditional materials such as glass and aluminum, and shapes, one example being the dome of the Nevskaya Ratusha. leading-edge materials available on the market including acrylic Specialized in managing the entire design and construction process panels and composites, terracotta, ceramics, granite, natural stone, for its range of technological solutions, Velko has covered some 4 5 122 Q 1- Eurasia Tower skyscraper Moscow, Russia 2- Moskow International Business Center Aerial view Moscow, Russia 3- Nevskaya Ratusha Administrative and public center Saint Petersburg, Russia 4- Northern Tower business district Moscow, Russia 5- Evolution Tower Office building Moscow, Russia 6- Administrative and public center Moscow, Russia 7- Federation Tower skyscraper Moscow, Russia 3 VELKO 20,000 sq. m of production facilities around Moscow. In addition, Pionerskaya str., 4 - RU -141070 Korolev 10,000 sq.