GAO-03-395R Financial Statement Restatement Database

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chicago Board Options Exchange Annual Report 2001

01 Chicago Board Options Exchange Annual Report 2001 cv2 CBOE ‘01 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 CBOE is the largest and 01010101010101010most successful options 01010101010101010marketplace in the world. 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010ifc1 CBOE ‘01 ONE HAS OPPORTUNITIES The NUMBER ONE Options Exchange provides customers with a wide selection of products to achieve their unique investment goals. ONE HAS RESPONSIBILITIES The NUMBER ONE Options Exchange is responsible for representing the interests of its members and customers. Whether testifying before Congress, commenting on proposed legislation or working with the Securities and Exchange Commission on finalizing regulations, the CBOE weighs in on behalf of options users everywhere. As an advocate for informed investing, CBOE offers a wide array of educational vehicles, all targeted at educating investors about the use of options as an effective risk management tool. ONE HAS RESOURCES The NUMBER ONE Options Exchange offers a wide variety of resources beginning with a large community of traders who are the most experienced, highly-skilled, well-capitalized liquidity providers in the options arena. In addition, CBOE has a unique, sophisticated hybrid trading floor that facilitates efficient trading. 01 CBOE ‘01 2 CBOE ‘01 “ TO BE THE LEADING MARKETPLACE FOR FINANCIAL DERIVATIVE PRODUCTS, WITH FAIR AND EFFICIENT MARKETS CHARACTERIZED BY DEPTH, LIQUIDITY AND BEST EXECUTION OF PARTICIPANT ORDERS.” CBOE MISSION LETTER FROM THE OFFICE OF THE CHAIRMAN Unprecedented challenges and a need for strategic agility characterized a positive but demanding year in the overall options marketplace. The Chicago Board Options Exchange ® (CBOE®) enjoyed a record-breaking fiscal year, with a 2.2% growth in contracts traded when compared to Fiscal Year 2000, also a record-breaker. -

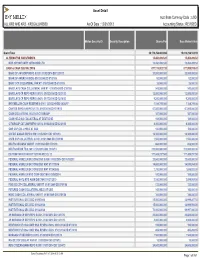

Asset Detail Acct Base Currency Code : USD ALL KR2 and KR3 - KR2GALLKRS00 As of Date : 12/31/2013 Accounting Status : REVISED

Asset Detail Acct Base Currency Code : USD ALL KR2 AND KR3 - KR2GALLKRS00 As Of Date : 12/31/2013 Accounting Status : REVISED . Mellon Security ID Security Description Shares/Par Base Market Value Grand Total 36,179,254,463.894 15,610,214,163.19 ALTERNATIVE INVESTMENTS 15,450,499.520 15,450,499.52 MKP OPPORTUNITY OFFSHORE LTD 15,450,499.520 15,450,499.52 CASH & CASH EQUIVALENTS 877,174,023.720 877,959,915.42 BANC OF AM CORP REPO 0.010% 01/02/2014 DD 12/31/13 20,000,000.000 20,000,000.00 BANK OF AMERICA (BOA) 01/01/2049 DD 07/01/08 52,000.000 52,000.00 BARC CCP COLLATERAL VAR RT 01/01/2049 DD 07/01/08 28,000.000 28,000.00 BARCLAYS CASH COLLATERAL VAR RT 01/01/2049 DD 07/01/08 543,000.000 543,000.00 BARCLAYS CP REPO REPO 0.010% 01/02/2014 DD 12/31/13 12,000,000.000 12,000,000.00 BARCLAYS CP REPO REPO 0.040% 01/17/2014 DD 12/18/13 9,200,000.000 9,200,000.00 BNY MELLON CASH RESERVE 0.010% 12/31/2049 DD 06/26/97 1,184,749.080 1,184,749.08 CANTOR REPO A REPO 0.170% 01/02/2014 DD 12/19/13 67,000,000.000 67,000,000.00 CASH COLLATERAL HELD AT CITIGROUP 387,000.000 387,000.00 CASH HELD AS COLLATERAL AT DEUTSCHE 169,000.000 169,000.00 CITIGROUP CAT 2MM REPO 0.010% 01/02/2014 DD 12/31/13 8,300,000.000 8,300,000.00 CME CCP COLL HELD AT GSC 100,000.000 100,000.00 CREDIT SUISSE REPO 0.010% 01/02/2014 DD 12/31/13 16,300,000.000 16,300,000.00 CSFB CCP COLLATERAL 0.010% 01/01/2049 DD 07/01/08 1,553,000.000 1,553,000.00 DEUTSCHE BANK VAR RT 01/01/2049 DD 07/01/08 668,000.000 668,000.00 DEUTSCHE BK TD 0.180% 01/02/2014 DD 12/18/13 270,000,000.000 270,000,000.00 -

6709BWOL Webstock

RIDING THE WEB-STOCK ROLLER COASTER Reprinted from the August 12, 2004 issue of BusinessWeek Online. Copyright © 2004 by The McGraw-Hill Companies. This reprint implies no endorsement, either tacit or expressed, of any company, product, service or investment opportunity. RIDING THE WEB-STOCK ROLLER COASTER Our BW Web 20 Index tracks a selection of favorite Net stocks, and this column will help interpret the ups and downs he past month has been rotten Just last week, Forrester Research christening the BW Web 20 Index Tfor Internet investors. Stocks raised its e-commerce forecast, pre- – is intended to help aggressive have been hammered since second- dicting U.S. online sales of $227 bil- investors accept the risk inherent in quarter earnings showed Web out- lion in 2007, up from earlier projec- the Web, but balance it by focusing fits growing pretty much as they had tions of $204 billion. Forrester on “real” companies with solid prod- promised – a change from their habit expects e-commerce in the U.S. to ucts, services, and profits. Every of slightly besting quarterly projec- grow 14% annually through 2010 – month, this column will do more than tions. The carnage has been just as three to four times faster than the track how stocks in our index trade – severe in the Real World Internet economy. Meanwhile, growth in it also will help investors figure out Index, a group of Web stocks we Europe is predicted to average 33% which rallies are sustainable and spot picked in 2002 to help ordinary annually through 2009. the bubblicious behavior that earned investors play the Internet without Net investing a bad rap. -

Software Industry Financial Report Contents

The Software Industry Financial Report SOFTWARE INDUSTRY FINANCIAL REPORT CONTENTS About Software Equity Group Leaders in Software M&A 4 Extensive Global Reach 5 Software Industry Macroeconomics Global GDP 8 U.S. GDP and Unemployment 9 Global IT Spending 10 E-Commerce and Digital Advertising Spend 11 SEG Indices vs. Benchmark Indices 12 Public Software Financial and Valuation Performance The SEG Software Index 14 The SEG Software Index: Financial Performance 15-17 The SEG Software Index: Market Multiples 18-19 The SEG Software Index by Product Category 20 The SEG Software Index by Product Category: Financial Performance 21 The SEG Software Index by Product Category: Market Multiples 22 Public SaaS Company Financial and Valuation Performance The SEG SaaS Index 24 The SEG SaaS Index Detail 25 The SEG SaaS Index: Financial Performance 26-28 The SEG SaaS Index: Market Multiples 29-30 The SEG SaaS Index by Product Category 31 The SEG SaaS Index by Product Category: Financial Performance 32 The SEG SaaS Index by Product Category: Market Multiples 33 Public Internet Company Financial and Valuation Performance The SEG Internet Index 35 The SEG Internet Index: Financial Performance 36-38 The SEG Internet Index: Market Multiples 39-40 The SEG Internet Index by Product Category 41 The SEG Internet Index by Product Category: Financial Performance 42 The SEG Internet Index by Product Category: Market Multiples 43 1 Q3 2013 Software Industry Financial Report Copyright © 2013 by Software Equity Group, LLC All Rights Reserved SOFTWARE INDUSTRY FINANCIAL -

Technology Fast 500

2001 Deloitte & Touche Technology Fast 500 www.fast500.com Leading the Way It’s been a tough year for the technology sector, and the com- Industry segments represented were relatively stable from panies on this year’s Deloitte & Touche Technology Fast 500 last year, with software companies again leading the way are not immune to the effects of the tech correction and the with 221 companies or 44 percent of the list. Notably, given slowing of the U.S. economy. Indeed, some Fast 500 compa- the malaise in the field, communications companies jumped nies have seen their businesses slow significantly in 2001 and from nine percent to 13 percent of the list.While Internet are struggling after five years of dramatic growth (the 2001 companies are prominent at the top of the list, as a group, Fast 500 measures five-year growth through fiscal 2000). they slid from 17 percent to 15 percent. With that said, this year’s Technology Fast 500 companies, as Geographical Shifts a group, found a way to grow even faster than their prede- After a one-year hiatus, the West resumed its position at the cessors.The 2001 Technology Fast 500 averaged a five-year head of the technology class, accounting for 32 percent of percentage revenue growth rate of 6,184 percent, compared the Fast 500, up from 27 percent. California was, by far, the to 3,956 percent for last year’s list.The top five companies biggest contributor to the list with 132 companies, including grew an average of 93,496 percent, compared to 59,367 percent two of the top three companies, calling the Golden State for last year’s top five. -

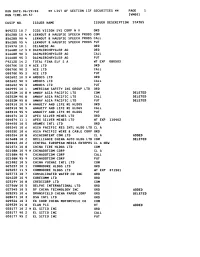

LIST of SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 Ivmool

RUN DATE:06/29/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS VISION SYS CORP N V ORD B5628B 10 4 * LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT & HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT 8 HAUSPIE SPEECH PRODS PUT D1497A 10 1 CELANESE AG ORD D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FINA ELF S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT GO2602 10 3 * AMDOCS LTD ORD GO2602 90 3 AMDOCS LTD CALL GO2602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD G0352M 10 8 * AMWAY ASIA PACIFIC LTD COM DELETED G0352M 90 8 AMWAY ASIA PACIFIC LTD CALL DELETED G0352M 95 8 AMWAY ASIA PACIFIC LTD PUT DELETED GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD GO3910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4074 11 1 APEX SILVER MINES LTD WT EXP 110402 GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE & CABLE CORP ORD GO5354 10 8 ASIACONTENT COM LTD CL A ADDED G1368B 10 2 BRILLIANCE CHINA AUTO HLDG LTD COM DELETED 620045 20 2 CENTRAL EUROPEAN MEDIA ENTRPRS CL A NEW G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 * CHINADOTCOM CORP CL A G2108N 90 9 CHINADOTCOM CORP CALL G2lO8N 95 9 CHINADOTCOM CORP PUT 621082 10 5 CHINA YUCHAI INTL LTD COM 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11 -

1 UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: September 30, 2000 Check here if Amendment [ ]; Amendment Number: This Amendment (Check only one.): [ ] is a restatement. [ ] adds new holdings entries Institutional Investment Manager Filing this Report: Name: AMERICAN INTERNATIONAL GROUP, INC. Address: 70 Pine Street New York, New York 10270 Form 13F File Number: 28-219 The Institutional Investment Manager filing this report and the person by whom it is signed represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Edward E. Matthews Title: Vice Chairman -- Investments and Financial Services Phone: (212) 770-7000 Signature, Place, and Date of Signing: /s/ Edward E. Matthews New York, New York November 14, 2000 - ------------------------------- ------------------------ ----------------- (Signature) (City, State) (Date) Report Type (Check only one.): [X] 13F HOLDINGS REPORT. (Check if all holdings of this reporting manager are reported in this report.) [ ] 13F NOTICE. (Check if no holdings reported are in this report, and all holdings are reported in this report and a portion are reported by other reporting manager(s).) [ ] 13F COMBINATION REPORT. (Check -

US Asian Wire Distribution Points

US Asian Wire Distribution Points NewMediaWire’s comprehensive US Asian Wire delivers your news to targeted media in the Asian American community. Reaches leading Asian−American media outlets and over 375 trades and magazines dealing with political, finance, education, community, lifestyle and legal issues impacting Asian Americans as well as Online databases and websites that feature or cover Asian−American news and issues and The Associated Press. Please note, NewMediaWire includes free distribution to trade publications and newsletters. Because these are unique to each industry, they are not included in the list below. To get your complete NewMediaWire distribution, please contact your NewMediaWire account representative at 310.492.4001. aahar Newspaper Adhra Pradesh Times Newspaper Afternoon Despatch and Courier Newspaper Agence Kampuchea Press Newspaper Akila Daily Newspaper Algorithmica Japonica Newspaper am730 Newspaper Anand Rupwate Newspaper Andhra News Newspaper Andrha Pradesh Times Newspaper ANTARA News Agency Newspaper ASAHI PASOCOM Newspaper ASAHI SHIMBUN Newspaper Asahi Shimbun Newspaper Asahi Shimbun International Satellite Ed Newspaper Asia Insurance Review Newspaper Asia Pacific Management News Newspaper Asia Source Newspaper ASIA TIMES Newspaper Asian Affairs: An American Review Newspaper Asian American Press Newspaper Asian American Times Online Newspaper Asian Enterprise Magazine Newspaper Asian Focus Newspaper Asian Fortune Newspaper Asian Herald Newspaper Asian Industrial Reporter Newspaper Asian Journal Newspaper -

BANK and BANKING E-Banking Managing Your Money And

Teach Yourself Today e-Banking Teach Yourself Today e-Banking Managing your money and transactions online Mary Dixon Brian Nixon 201 West 103rd Street, Indianapolis, Indiana 46290 Sams Teach Yourself e-Banking Acquisitions Editor Today Jeff Schultz Copyright ©2000 by Sams Publishing Development All rights reserved. No part of this book shall be reproduced, stored Editor in a retrieval system, or transmitted by any means, electronic, Alice Martina Smith mechanical, photocopying, recording, or otherwise, without written Managing Editor permission from the publisher. No patent liability is assumed with Charlotte Clapp respect to the use of the information contained herein. Although every precaution has been taken in the preparation of this book, the Project Editor publisher and author assume no responsibility for errors or omis- Andy Beaster sions. Nor is any liability assumed for damages resulting from the Copy Editor use of the information contained herein. Patricia Kinyon International Standard Book Number: 0-672-31882-2 Indexer Library of Congress Catalog Card Number: 99-69443 Greg Pearson Printed in the United States of America Proofreader First Printing: February, 2000 Candice Hightower 03 02 01 00 Team Coordinator 4 3 2 1 Amy Patton Interior Designer Trademarks Gary Adair All terms mentioned in this book that are known to be trademarks Cover Designer or service marks have been appropriately capitalized. Sams cannot Jay Corpus attest to the accuracy of this information. Use of a term in this book Copywriter should not be regarded as affecting the validity of any trademark or Eric Borgert service mark. Editorial Assistant Warning and Disclaimer Angela Boley Every effort has been made to make this book as complete and as accurate as possible, but no warranty or fitness is implied. -

August 2014 Software Business Services Internet & Digital Media

The Lighthouse August 2014 Software Business Services Internet & Digital Media A Pharus Advisors, LLC Publication | www.pharus.com August 2014 Software & Business Services Internet & Digital Media Table of Contents 1. Capital Market Trends 3 2. Public Market Valuations 4 3. Public Market Universe 13 4. M&A Transactions 15 5. Recent Transactions 23 6. Pharus Overview 24 If you would like to be included on (or removed from) the distribution list for the Software & Services version of The Lighthouse, please contact Nathan Bullock at: [email protected]. The information contained herein is obtained from sources we believe to be reliable but its accuracy and completeness, and that of the opinions based thereon, is not guaranteed. Pharus Advisors, or one or more of its partners, may have an interest in any of the securities or companies discussed herein. All rights reserved by Pharus Advisors. LLC. 2014 Copyright Pharus Advisors, LLC. Executive Contacts Telephone Email Michael E. Goodman, Co-Founder & Sr. Managing Director 212-904-0102 [email protected] Kenneth M. Harrell, Co- Founder & Sr. Managing Director 212-904-0101 [email protected] Pharus Advisors, LLC | www.pharus.com 2 August 2014 Software & Business Services Internet & Digital Media 1. Capital Market Trends Relative Performance of Major Stock Indices through August 31, 2014 (Base = 100, 7/31/2013) 140 130 120 110 100 90 Dow Jones Industrial Average (^DJI) - Index Value NASDAQ Composite Index (^COMP) - Index Value S&P 500 Index (^SPX) - Index Value Russell 2000 Index (^RUT) - Index Value As of Change % Index 31-Aug-14 1 Year 3 Months 1 Month Dow Jones 17,098.45 15.4% 2.3% 3.2% Nasdaq 4,580.27 27.6% 8.0% 4.8% S&P 500 2,003.37 22.7% 4.1% 3.8% Russell 2000 1,174.35 16.2% 3.5% 4.8% Pharus Advisors, LLC | www.pharus.com 3 August 2014 Software & Business Services Internet & Digital Media 2. -

Merrill Lynch Security Risk Evaluation 1-07

Security Risk Evaluation ALPHA January 2007 Price As of December 2006 Month End COPYRIGHT 1998 MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED (MLPF&S). APPROVED FOR PUBLICATION IN THE UNITED KINGDOM BY MERRILL LYNCH, PIERCE, FENNER & SMITH LIMITED, AN AFFILIATED COMPANY AND REGULATED BY THE SECURITIES AND FUTURES AUTHORITY LIMITED. THE INFORMATION HEREIN WAS OBTAINED FROM VARIOUS SOURCES; WE DO NOT GUARANTEE ITS ACCURACY. ADDITIONAL INFORMATION AVAILABLE. GLOBAL SECURITIES RESEARCH & ECONOMICS RESEARCH TECHNOLOGY ALPHA (1) 800 255-9107 CONTINENTAL UNITED STATES January 2007 (1) 212 449-1072 WORLD WIDE PRICE AS OF December 2006 MONTH END Merrill Lynch, Pierce, Fenner & Smith, Inc. Market Sensitivity Statistics 2006/ 12 Resid Number Ticker Close Std --Std Error-- Adjusted Of Symbol Security Name Price Beta Alpha R-Sqr Dev-n Beta Alpha Beta Observ DOWI DOW JONES & CO 30 INDUSTRIALS 12463.150 0.96 0.03 0.91 1.09 0.04 0.14 0.98 60 DJ 20 DOW JONES & CO 20 TRANS ACTUAL 4560.200 0.94 0.65 0.42 3.86 0.14 0.50 0.96 60 DJ 15 DOW JONES & CO 15 UTIL ACTUAL 456.770 0.57 0.60 0.19 4.12 0.15 0.54 0.72 60 DJ 65 DOW JONES & CO 65 STOCK COMPOSITE 4120.960 0.89 0.28 0.86 1.29 0.05 0.17 0.93 60 SPALNS S&P 500 500 STOCKS 1418.300 1.00 0.00 1.00 0.00 0.00 0.00 1.00 60 Based on S&P 500 Index Using Straight Regression Merrill Lynch, Pierce, Fenner & Smith, Inc. -

Efinance ENABLERS: EFFICIENTLY MOVING the BUCK

REVISED 10-19-00 eFINANCE ENABLERS: EFFICIENTLY MOVING THE BUCK Jeffery B. Baker [email protected] 415.551.8600 Stephen A. Laws [email protected] REVISED 10-19-00 eFinance Enablers: Efficiently Moving the Buck TABLE OF CONTENTS Executive Summary....................................................................................... 3 Industry Report.............................................................................................. 6 Initiating Coverage ...................................................................................... 36 CheckFree Holdings (CKFR)....................................................................................... 37 The InterCept Group (ICPT) ....................................................................................... 48 S1 Corp. (SONE)......................................................................................................... 58 Company Profiles ....................................................................................... 72 Financial Enterprise Enablers ...................................................................................... 73 Electronic Bill Presentment and Payment..................................................................... 91 Data Processors ......................................................................................................... 111 Payment Processors ................................................................................................... 118 Payment Enablers .....................................................................................................