Iraq Delivers Weapons Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Internet Economy 25 Years After .Com

THE INTERNET ECONOMY 25 YEARS AFTER .COM TRANSFORMING COMMERCE & LIFE March 2010 25Robert D. Atkinson, Stephen J. Ezell, Scott M. Andes, Daniel D. Castro, and Richard Bennett THE INTERNET ECONOMY 25 YEARS AFTER .COM TRANSFORMING COMMERCE & LIFE March 2010 Robert D. Atkinson, Stephen J. Ezell, Scott M. Andes, Daniel D. Castro, and Richard Bennett The Information Technology & Innovation Foundation I Ac KNOW L EDGEMEN T S The authors would like to thank the following individuals for providing input to the report: Monique Martineau, Lisa Mendelow, and Stephen Norton. Any errors or omissions are the authors’ alone. ABOUT THE AUTHORS Dr. Robert D. Atkinson is President of the Information Technology and Innovation Foundation. Stephen J. Ezell is a Senior Analyst at the Information Technology and Innovation Foundation. Scott M. Andes is a Research Analyst at the Information Technology and Innovation Foundation. Daniel D. Castro is a Senior Analyst at the Information Technology and Innovation Foundation. Richard Bennett is a Research Fellow at the Information Technology and Innovation Foundation. ABOUT THE INFORMATION TECHNOLOGY AND INNOVATION FOUNDATION The Information Technology and Innovation Foundation (ITIF) is a Washington, DC-based think tank at the cutting edge of designing innovation policies and exploring how advances in technology will create new economic opportunities to improve the quality of life. Non-profit, and non-partisan, we offer pragmatic ideas that break free of economic philosophies born in eras long before the first punch card computer and well before the rise of modern China and pervasive globalization. ITIF, founded in 2006, is dedicated to conceiving and promoting the new ways of thinking about technology-driven productivity, competitiveness, and globalization that the 21st century demands. -

View Annual Report

To Our Stockholders, Partners, Employees and the eBay Community: A year in review 1999 was a historic year for eBay, ®lled with astonishing growth and rapid change. We began the year with 2.2 million users, a vibrant community about the size of Portland, Oregon and ended the year with over 10 million con®rmed registered usersÐmore than Michigan, the eighth largest state in the country. And that phenomenal growth re¯ected itself in every measure of our business: the number of items listed in 1999 totaled 129.6 million compared to 33.7 million in 1998. In the fourth quarter of 1999, every two tenths of a second, someone, somewhere was listing an item for sale on eBay Ð that translates to $113 dollars of gross merchandise sales per second. And, most impressive, gross merchandise sales grew an astounding 276 percent from $745 million in 1998 to $2.8 billion in 1999. During 1999, our users generated more economic activity on eBay than on any other consumer e-commerce site. Underlying this strength is the incredible popularity of the site. In 1999, eBay became one of the most recognizable Internet brands around the world, with numerous mentions in the media, business press and television. eBay was featured in such high pro®le publications as Forbes, the Washington Post and Time Magazine. In Time magazine, eBay was voted number one in their ``Best of 1999'' in the Cybertech area. eBay also continues to be mentioned on television shows including ``Who Wants to be a Millionaire?'', ``The Simpsons'', ``The Tonight Show'', ``Suddenly Susan'', ``Sports Night'' and of course, ``David Letterman's Top Ten List''. -

5 the Da Vinci Code Dan Brown

The Da Vinci Code By: Dan Brown ISBN: 0767905342 See detail of this book on Amazon.com Book served by AMAZON NOIR (www.amazon-noir.com) project by: PAOLO CIRIO paolocirio.net UBERMORGEN.COM ubermorgen.com ALESSANDRO LUDOVICO neural.it Page 1 CONTENTS Preface to the Paperback Edition vii Introduction xi PART I THE GREAT WAVES OF AMERICAN WEALTH ONE The Eighteenth and Nineteenth Centuries: From Privateersmen to Robber Barons TWO Serious Money: The Three Twentieth-Century Wealth Explosions THREE Millennial Plutographics: American Fortunes 3 47 and Misfortunes at the Turn of the Century zoART II THE ORIGINS, EVOLUTIONS, AND ENGINES OF WEALTH: Government, Global Leadership, and Technology FOUR The World Is Our Oyster: The Transformation of Leading World Economic Powers 171 FIVE Friends in High Places: Government, Political Influence, and Wealth 201 six Technology and the Uncertain Foundations of Anglo-American Wealth 249 0 ix Page 2 Page 3 CHAPTER ONE THE EIGHTEENTH AND NINETEENTH CENTURIES: FROM PRIVATEERSMEN TO ROBBER BARONS The people who own the country ought to govern it. John Jay, first chief justice of the United States, 1787 Many of our rich men have not been content with equal protection and equal benefits , but have besought us to make them richer by act of Congress. -Andrew Jackson, veto of Second Bank charter extension, 1832 Corruption dominates the ballot-box, the Legislatures, the Congress and touches even the ermine of the bench. The fruits of the toil of millions are boldly stolen to build up colossal fortunes for a few, unprecedented in the history of mankind; and the possessors of these, in turn, despise the Republic and endanger liberty. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

\ UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13F Report for the Calendar Year or Quarter Ended SEPTEMBER 30, 2000 Check here if Amendment: / /; Amendment Number: ______ This Amendment (Check only one.): / / is a restatement. / / adds new holdings entries. Institutional Investment Manager Filing this Report: Name: U.S. Bancorp Address: 601 Second Avenue South Minneapolis, MN 55402-4302 -------------------------- Form 13F File Number: 28- 551 --- The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person signing this Report on Behalf of Reporting Manager: Name: Merita D. Schollmeier Title: Vice President Phone: 651-205-2030 --------------------- Signature, Place, and Date of Signing: /s/ Merita D. Schollmeier St. Paul, MN 11/9/00 - ------------------------- ------------ ------- Information contained on the attached Schedule 13(f) is provided solely to comply with the requirements of Section 13(f) of the Securities Exchange Act of 1934 and Regulations promulgated thereunder. It is the position of U.S. Bancorp, that for any purpose other than Schedule 13-F, it is not an institutional investment manager and does not, in fact, exercise investment discretion with regard to any securities held in a fiduciary or agency capacity by any subsidiary or trust company. Report Type (Check only one.): /x/ 13F HOLDINGS REPORT. (Check here if all holdings of this reporting manager are reported in this report.) / / 13F NOTICE. -

Chicago Board Options Exchange Annual Report 2001

01 Chicago Board Options Exchange Annual Report 2001 cv2 CBOE ‘01 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 CBOE is the largest and 01010101010101010most successful options 01010101010101010marketplace in the world. 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010ifc1 CBOE ‘01 ONE HAS OPPORTUNITIES The NUMBER ONE Options Exchange provides customers with a wide selection of products to achieve their unique investment goals. ONE HAS RESPONSIBILITIES The NUMBER ONE Options Exchange is responsible for representing the interests of its members and customers. Whether testifying before Congress, commenting on proposed legislation or working with the Securities and Exchange Commission on finalizing regulations, the CBOE weighs in on behalf of options users everywhere. As an advocate for informed investing, CBOE offers a wide array of educational vehicles, all targeted at educating investors about the use of options as an effective risk management tool. ONE HAS RESOURCES The NUMBER ONE Options Exchange offers a wide variety of resources beginning with a large community of traders who are the most experienced, highly-skilled, well-capitalized liquidity providers in the options arena. In addition, CBOE has a unique, sophisticated hybrid trading floor that facilitates efficient trading. 01 CBOE ‘01 2 CBOE ‘01 “ TO BE THE LEADING MARKETPLACE FOR FINANCIAL DERIVATIVE PRODUCTS, WITH FAIR AND EFFICIENT MARKETS CHARACTERIZED BY DEPTH, LIQUIDITY AND BEST EXECUTION OF PARTICIPANT ORDERS.” CBOE MISSION LETTER FROM THE OFFICE OF THE CHAIRMAN Unprecedented challenges and a need for strategic agility characterized a positive but demanding year in the overall options marketplace. The Chicago Board Options Exchange ® (CBOE®) enjoyed a record-breaking fiscal year, with a 2.2% growth in contracts traded when compared to Fiscal Year 2000, also a record-breaker. -

Ebusiness: the Hope, the Hype, the Power, the Pain

eBusiness: The hope, the hype, the power, the pain Jack M. Wilson J. Erik Jonsson, ’22 Distinguished Professor of Physics, Engineering Science, Information Technology, and Management President and CEO, JackMWilson Inc. Copyright 1999-2000 by Jack M. Wilson -www.JackMWilson.com What is happening to the world? • A few questions that we hope to answer: – Why has your life been so crazy for last few years? – Why is your CEO feeling uneasy? – What is happening to the stock market? – What is the Internet Tsunami? – How can you survive it? – How can you profit from it? Copyright 1999-2000 by Jack M. Wilson -www.JackMWilson.com In the beginning • In the beginning there was the net. –Jack Wilson • The secret of success is changing the way you think. –Jack Welch • Folks, they say that if you want to be a leader, find a parade and get in front of it. –Jim Barksdale, CEO Netscape. • Nobody is more surprised than me by what has happened over the last four years. –Jeff Bezos, CEO of Amazon.com [Business Week] Copyright 1999-2000 by Jack M. Wilson -www.JackMWilson.com What’s happening? • Do you think the pace of change is accelerating? $3.5 Market Value of Tech Companies $3.0 Initial Development… 1967 $ Trillions $ $2.5 University Networks… 1981 Regional Networks (NYSERNET)… 1988 $2.0 Early ISP,s… 1992 World Wide Web… 1995 $1.5 $1.0 $0.5 $0.0 Incl. Int’l Tech Companies Copyright 1999-2000 by Jack M. Wilson -www.JackMWilson.comSource: Securities Data Company Changing the Face of Industry! Top 40 US-Traded Tech. -

A Study on the Web Portal Industry

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by KDI School Archives A STUDY ON THE WEB PORTAL INDUSTRY: By Chan-Soo Park THESIS Submitted to School of Public Policy and Management, KDI In partial fulfillment of the requirements for the degree of MASTER OF STRATEGY & GLOBAL MANAGEMENT Department of Strategy & International Management 2000 A STUDY ON THE WEB PORTAL INDUSTRY: By Chan-Soo Park THESIS Submitted to School of Public Policy and Management, KDI In partial fulfillment of the requirements for the degree of MASTER OF STRATEGY & GLOBAL MANAGEMENT Department of Strategy & International Management 2000 Professor Seung-Joo Lee 1 ABSTRACT A STUDY ON THE WEB PORTAL INDUSTRY By Chan –Soo Park A portal is a site on the Internet that provides a one-stop experience for Internet users, allowing them to check e-mail, search the Web, and get personalized news and stock quotes. Since 1998, the “portal” has been considered the most successful Internet business model. Portal sites have characteristics such as community facilitated by services, revenue that relies on advertising, a highly competitive market, heavy traffic, and an uncertain business. The world wide portal industry is like a battle zone for America’s top three, broad-based and vertical portals. The Web portal industry is dominated by the “top three portals,” which are AOL, Yahoo and MSN, and “vertical portals” such as Go Network and NBC. The broad-based portals --Lycos, Excite@home, AltaVista and Infoseek—do not lag far behind as major competitors. Many challenges face the three key players and broad-based portals. -

Federal Register/Vol. 65, No. 199/Friday, October 13, 2000/Notices

60960 Federal Register / Vol. 65, No. 199 / Friday, October 13, 2000 / Notices Transaction No. Acquiring Acquired Entities 20004365 .......... Marubeni Corporation ...................... PLM International Inc ....................... PLM International, Inc. 20004366 .......... Intel Corporation .............................. Trillium Digital Systems, Inc ............ Trillium Digital Systems, Inc. 20004369 .......... Andrea L. Cunningham .................... Incepta Group Plc ............................ Incepta Group Plc. 20004370 .......... Incepta Group Plc ............................ Andrea L. Cunningham .................... Cunningham Communications, Inc. 20004371 .......... Insilco Holding Co ............................ Dale Fleming .................................... Precision Cable Manufacturing Corporation. 20004372 .......... American Reprographics Holdings, The Sandpoint Charitable Trust ...... Wilco Reprographics, Inc. L.L.C. 20004378 .......... James L. Barksdale ......................... Webvan Group, Inc .......................... Webvan Group, Inc. 20004380 .......... Kan S. Bajaj ..................................... Commerce One, Inc ........................ Commerce One, Inc. 20004382 .......... Sapa AB ........................................... Anodizing, Inc .................................. Anodizing, Inc. 20004421 .......... Reuters Group PLC ......................... The RiskMetrics Group, Inc ............. The RiskMetrics Group, Inc. Transactions Granted Early TerminationÐ08/17/2000 20002951 .......... Healtheon/WebMD -

Amy Liu, Et Al. V. Credit Suisse First Boston Corp., Et Al. 03-CV-20459

; fL V ~ UNITED STATES DISTRICT COUR ~ 2 0 9 SOUTHERN DISTRICT OF FLORID A Case No. CIV - MARTINE Z AMY LIU on behalf of herself and all others similarly situated, Plaintiff, vs. CREDIT SUISSE FIRST BOSTON CORPORATION, CREDIT SUISSE FIRST BOSTON, INCORPORATED, CREDIT SUISSE FIRST BOSTON-USA, CREDIT SUISSE FIRST BOSTON, CREDIT SUISSE GROUP, FRANK QUATTRONE, GEORGE BOUTROS, WILLIAM BRADY, JOHN M . HENNESSY, ALLEN D . WHEAT, RICHARD THORNBURGH, CHARLES WARD, DAVID A . DENUNZIO, EDWARD COMPLAINT-CLA§S,AGTION NADEL, JOHN HODGE, JACK TEJAVANIJA, JURY TRIAL DEMANDED AIRSPAN NETWORKS, INC ., ERIC D. STONESTROM, JOSEPH J . CAFFARELLI, AT ROAD, INC., KRISH PANU, THOMAS C. HOSTER, OCCAM NETWORKS INC . (formerly "ACCELERATED NETWORKS, INC ."), SURESH NIHALANI, FREDERIC T . BOYER, AVANTGO, INC., RICHARD OWEN, DAVID B . COOPER, JR ., AUTOWEB .COM, INC. (AUTOBYTEL, real party in interest), DEAN A . DEBIASE, SAMUEL M. HEDGPETH III, BSQUARE CORP ., WILLIAM T . BAXTER, BRIAN V. TURNER, BLUE COAT SYSTEMS, INC . (formerly "CACHEFLOW, INC."), BRIAN M. NESMITH, MICHAEL J. JOHNSON, CLARENT CORP. (VERSO TECHNOLOGIES, INC., real party in interest), JERRY SHAW-YAU CHANG, RICHARD J . HEAPS, COMMERCE ONE, INC., MARK B . HOFFMAN, PETER F . PERVERE, CORILLIAN CORP ., TED F. SPOONER, STEVEN SIPOWICZ, CENTILLIUM COMMUNICATIONS, INC., FARAJ AALAEI, JOHN W . LUHTALA, DIGITAL IMPACT, INC ., WILLIAM C. PARK, DAVID OPPENHEIMER, E MACHINES, INC ., \ yV-v STEPHEN A. DUKKER, STEVEN H . MILLER, EFFICIENT NETWORKS, INC., MARK A. FLOYD, JILL S . MANNING, E.PIPHANY, INC ., ROGER S . SIBONI, KEVIN J. YEAMAN, EVOLVE SOFTWARE, INC., JOHN P. BANTLEMAN, DOUGLAS S . SINCLAIR, HANDSPRING, INC., DONNA L. DUBINSKY, BERNARD J . WHITNEY, IMPROVENET, INC ., RONALD B. COOPER, RICHARD G. -

The Rise of Latham & Watkins

The M&A journal - Volume 7, Number 5 The Rise of Latham & Watkins In 2006, Latham & Watkins came in fifth in terms of deal value.” the U.S. for deal value in Thompson Financial’s Mr. Nathan sees the U.S. market as crucial. league tables and took second place for the num- “This is a big part of our global position,” he says, ber of deals. “Seven years before that,” says the and it is the Achilles’ heel of some of the firm’s firm’s Charles Nathan, global co-chair of the main competitors. “The magic circle—as they firm’s Mergers and Acquisitions Group, “we dub themselves—Allen & Overy, Freshfields, weren’t even in the top twenty.” Latham also Linklaters, Clifford Chance and Slaughters— came in fourth place for worldwide announced have very high European M&A rankings and deals with $470.103 million worth of transactions, global rankings, but none has a meaningful M&A and sixth place for worldwide completed deals presence in the U.S.,” Mr. Nathan says. Slaughter Charles Nathan worth $364.051 million. & May, he notes, has no offices abroad. What is behind the rise of Latham & Watkins Similarly, in the U.S., Mr. Nathan says that his in the world of M&A? firm has a much larger footprint than its domestic “If you look back to the late nineties,” Mr. rivals. “Unlike all the other major M&A firms,” Nathan says, “Latham was not well-recognized he says, “we have true national representation. as an M&A firm. We had no persona in M&A. -

Technology Fast 500

2001 Deloitte & Touche Technology Fast 500 www.fast500.com Leading the Way It’s been a tough year for the technology sector, and the com- Industry segments represented were relatively stable from panies on this year’s Deloitte & Touche Technology Fast 500 last year, with software companies again leading the way are not immune to the effects of the tech correction and the with 221 companies or 44 percent of the list. Notably, given slowing of the U.S. economy. Indeed, some Fast 500 compa- the malaise in the field, communications companies jumped nies have seen their businesses slow significantly in 2001 and from nine percent to 13 percent of the list.While Internet are struggling after five years of dramatic growth (the 2001 companies are prominent at the top of the list, as a group, Fast 500 measures five-year growth through fiscal 2000). they slid from 17 percent to 15 percent. With that said, this year’s Technology Fast 500 companies, as Geographical Shifts a group, found a way to grow even faster than their prede- After a one-year hiatus, the West resumed its position at the cessors.The 2001 Technology Fast 500 averaged a five-year head of the technology class, accounting for 32 percent of percentage revenue growth rate of 6,184 percent, compared the Fast 500, up from 27 percent. California was, by far, the to 3,956 percent for last year’s list.The top five companies biggest contributor to the list with 132 companies, including grew an average of 93,496 percent, compared to 59,367 percent two of the top three companies, calling the Golden State for last year’s top five. -

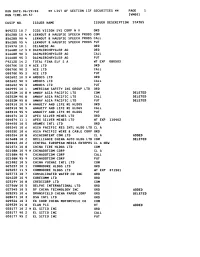

LIST of SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 Ivmool

RUN DATE:06/29/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS VISION SYS CORP N V ORD B5628B 10 4 * LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT & HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT 8 HAUSPIE SPEECH PRODS PUT D1497A 10 1 CELANESE AG ORD D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FINA ELF S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT GO2602 10 3 * AMDOCS LTD ORD GO2602 90 3 AMDOCS LTD CALL GO2602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD G0352M 10 8 * AMWAY ASIA PACIFIC LTD COM DELETED G0352M 90 8 AMWAY ASIA PACIFIC LTD CALL DELETED G0352M 95 8 AMWAY ASIA PACIFIC LTD PUT DELETED GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD GO3910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4074 11 1 APEX SILVER MINES LTD WT EXP 110402 GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE & CABLE CORP ORD GO5354 10 8 ASIACONTENT COM LTD CL A ADDED G1368B 10 2 BRILLIANCE CHINA AUTO HLDG LTD COM DELETED 620045 20 2 CENTRAL EUROPEAN MEDIA ENTRPRS CL A NEW G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 * CHINADOTCOM CORP CL A G2108N 90 9 CHINADOTCOM CORP CALL G2lO8N 95 9 CHINADOTCOM CORP PUT 621082 10 5 CHINA YUCHAI INTL LTD COM 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11