Technology Fast 500

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Internet As Emerging Critical Infrastructure: What Needs to Be Measured?

the Internet as emerging critical infrastructure: what needs to be measured? cooperative association for internet data analysis 30 november 2005 presented to lsn jet @ nsf (http://www.nitrd.gov/subcommittee/lsn/jet/) [email protected] outline of talk what is critical infrastructure top problems of Internet historical context (incongruity) what have we learned and how can we apply it? [ case study: scalability (separate talk) ] what we (all) can do to help critical infrastructure what is it? how does it get that way? what are common characteristics? is the Internet one? or will it be soon? what are the implications for public and private sectors? underlying goals: innovation, economic strength, democracy, freedom, health, science, arts, society. it really is about living in a better world... top Internet problems 16 operational internet problems • security • authentication • spam • scalable configuration management • robust scalability of routing system • compromise of e2e principle • dumb network • measurement • patch management • “normal accidents” • growth trends in traffic and user expectations • time management and prioritization of tasks • stewardship vs governance • intellectual property and digital rights • interdomain qos/emergency services • inter-provider vendor/business coordination persistently unsolved problems for 10+ years (see presentations at www.caida.org ) top Internet problems why we’re not making progress • top unsolved problems in internet operations and engineering are rooted in economics, ownership, and trust (EOT). • -

Chicago Board Options Exchange Annual Report 2001

01 Chicago Board Options Exchange Annual Report 2001 cv2 CBOE ‘01 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 CBOE is the largest and 01010101010101010most successful options 01010101010101010marketplace in the world. 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010ifc1 CBOE ‘01 ONE HAS OPPORTUNITIES The NUMBER ONE Options Exchange provides customers with a wide selection of products to achieve their unique investment goals. ONE HAS RESPONSIBILITIES The NUMBER ONE Options Exchange is responsible for representing the interests of its members and customers. Whether testifying before Congress, commenting on proposed legislation or working with the Securities and Exchange Commission on finalizing regulations, the CBOE weighs in on behalf of options users everywhere. As an advocate for informed investing, CBOE offers a wide array of educational vehicles, all targeted at educating investors about the use of options as an effective risk management tool. ONE HAS RESOURCES The NUMBER ONE Options Exchange offers a wide variety of resources beginning with a large community of traders who are the most experienced, highly-skilled, well-capitalized liquidity providers in the options arena. In addition, CBOE has a unique, sophisticated hybrid trading floor that facilitates efficient trading. 01 CBOE ‘01 2 CBOE ‘01 “ TO BE THE LEADING MARKETPLACE FOR FINANCIAL DERIVATIVE PRODUCTS, WITH FAIR AND EFFICIENT MARKETS CHARACTERIZED BY DEPTH, LIQUIDITY AND BEST EXECUTION OF PARTICIPANT ORDERS.” CBOE MISSION LETTER FROM THE OFFICE OF THE CHAIRMAN Unprecedented challenges and a need for strategic agility characterized a positive but demanding year in the overall options marketplace. The Chicago Board Options Exchange ® (CBOE®) enjoyed a record-breaking fiscal year, with a 2.2% growth in contracts traded when compared to Fiscal Year 2000, also a record-breaker. -

Flooding Attacks by Exploiting Persistent Forwarding Loops

Flooding Attacks by Exploiting Persistent Forwarding Loops Jianhong Xia, Lixin Gao and Teng Fei University of Massachusetts, Amherst MA 01003, USA Email: {jxia, lgao, tfei}@ecs.umass.edu Introduction • Routing determines forwarding paths X A Y C B Why Persistent Forwarding Loop Occurs --- Example on Neglecting Pull-up Route • Announces 18.0.0.0/16 to the Internet • Router A has default route pointing to B Internet • Router A uses 18.0.0.0/24 only BB 18.0.0.0/16 ute ult ro AA defa • Any traffic to 18.0.0.0/24 18.0.1.0~18.0.255.255 will enter a forwarding ` loop between A and B ` ` Risk of Persistent Forwarding Loops • Flooding Attacks to legitimate hosts X Traffic to X Imperiled Ra Rb Rc Addresses Traffic to Y Y Shadowed Addresses • How many shadowed addresses in the Internet? • How many imperiled addresses in the Internet? Measurement Design •Design – Balancing granularity and overhead – Samples 2 addresses in each /24 IP block • Addresses space collection – Addresses covered by RouteView table – De-aggregate prefixes to /24 prefixes • Fine-grained prefixes • Data traces – Traceroute to 5.5 million fine-grained prefixes – Measurement lasts for 3 weeks in Sep. 2005 Shadowed vs. Imperiled Addresses • Shadowed addresses/prefixes – 135,973 shadowed prefixes – 2.47% of routable addresses – Located in 5341 ASes • Imperiled addresses/prefixes – 42,887 imperiled prefixes – 0.78% of routable addresses – Located in 2117 ASes Validating Persistent Forwarding Loops • Validation from various locations – From Asia, Europe, West and East coast of US -

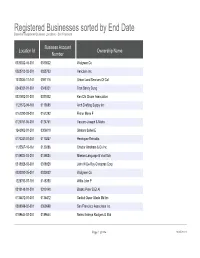

Registered Businesses Sorted by End Date Based on Registered Business Locations - San Francisco

Registered Businesses sorted by End Date Based on Registered Business Locations - San Francisco Business Account Location Id Ownership Name Number 0030032-46-001 0030032 Walgreen Co 0028703-02-001 0028703 Vericlaim Inc 1012834-11-141 0091116 Urban Land Services Of Cal 0348331-01-001 0348331 Tran Sandy Dung 0331802-01-001 0331802 Ken Chi Chuan Association 1121572-09-161 0113585 Arch Drafting Supply Inc 0161292-03-001 0161292 Fisher Marie F 0124761-06-001 0124761 Vaccaro Joseph & Maria 1243902-01-201 0306019 Shatara Suheil E 0170247-01-001 0170247 Henriquez Reinaldo 1125567-10-161 0130286 Chador Abraham & Co Inc 0189884-03-001 0189884 Mission Language & Vocl Sch 0318928-03-001 0318928 John W De Roy Chiroprac Corp 0030032-35-001 0030032 Walgreen Co 1228793-07-191 0148350 Willis John P 0310148-01-001 0310148 Blasko Peter B Et Al 0135472-01-001 0135472 Saddul Oscar Allado Md Inc 0369698-02-001 0369698 San Francisco Associates Inc 0189644-02-001 0189644 Neirro Erainya Rodgers G Etal Page 1 of 984 10/05/2021 Registered Businesses sorted by End Date Based on Registered Business Locations - San Francisco DBA Name Street Address City State Source Zipcode Walgreens #15567 845 Market St San Francisco CA 94103 Vericlaim Inc 500 Sansome St Ste 614 San Francisco CA 94111 Urban Land Services Of Cal 1170 Sacramento St 5d San Francisco CA 94108 Elizabeth Hair Studio 672 Geary St San Francisco CA 94102 Ken Chi Chuan Association 3626 Taraval St Apt 3 San Francisco CA 94116 Arch Drafting Supply Inc 10 Carolina St San Francisco CA 94103 Marie Fisher Interior -

The Great Telecom Meltdown for a Listing of Recent Titles in the Artech House Telecommunications Library, Turn to the Back of This Book

The Great Telecom Meltdown For a listing of recent titles in the Artech House Telecommunications Library, turn to the back of this book. The Great Telecom Meltdown Fred R. Goldstein a r techhouse. com Library of Congress Cataloging-in-Publication Data A catalog record for this book is available from the U.S. Library of Congress. British Library Cataloguing in Publication Data Goldstein, Fred R. The great telecom meltdown.—(Artech House telecommunications Library) 1. Telecommunication—History 2. Telecommunciation—Technological innovations— History 3. Telecommunication—Finance—History I. Title 384’.09 ISBN 1-58053-939-4 Cover design by Leslie Genser © 2005 ARTECH HOUSE, INC. 685 Canton Street Norwood, MA 02062 All rights reserved. Printed and bound in the United States of America. No part of this book may be reproduced or utilized in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without permission in writing from the publisher. All terms mentioned in this book that are known to be trademarks or service marks have been appropriately capitalized. Artech House cannot attest to the accuracy of this information. Use of a term in this book should not be regarded as affecting the validity of any trademark or service mark. International Standard Book Number: 1-58053-939-4 10987654321 Contents ix Hybrid Fiber-Coax (HFC) Gave Cable Providers an Advantage on “Triple Play” 122 RBOCs Took the Threat Seriously 123 Hybrid Fiber-Coax Is Developed 123 Cable Modems -

Research Articles in the American Economic Review, the RAND Journal Ofeconomics, The

3 I. Introduction And Qualifications 1. My name is Nicholas S. Economides. I am a Professor ofEconomics at the Stern School ofBusiness ofNew York University, located at 44 West 4th Street New York, NY 10012. 2. I received a B.Sc. degree in Mathematical Economics (first class honors) from the London School ofEconomics in 1976, a Masters degree in Economics from the University of California at Berkeley in 1979 and a Ph.D. degree in Economics from Berkeley in 1981, specializing in Industrial Organization. 3. From 1981 to 1988, I was assistant and then associate professor ofeconomics at Columbia University. From 1988 to 1990, I was associate professor ofeconomics at Stanford University. I have taught at the Stern School ofBusiness since 1990. During the academic year 1996-1997, I was visiting professor at Stanford University. 4. I have published more than seventy research papers in the areas ofindustrial organization, microeconomics, network economics, antitrust, finance, and telecommunications policy, and I have given numerous seminar presentations at academic and government institutions and conferences. I have published academic research articles in the American Economic Review, the RAND Journal ofEconomics, the International Journal ofIndustrial Organization, the International Economic Review, the Journal ofEconomic Theory, and the Journal ofIndustrial Economics, among others. I am currently editor ofthe International Journal ofIndustrial Organization and ofNetnomics. I have served as advisor and consultant to major telecommunications companies, a number of 4 the Federal Reserve Banks, the Bank ofGreece, and major Financial Exchanges. I teach graduate (MBA and Ph.D.) courses in antitrust, industrial organization, microeconomics, and telecommunications. A copy ofmy curriculum vitae is attached as Attachment 1. -

2. the Advertising-Supported Internet 21 2.1 Internet Advertising Segments 2.2 the Value of the Advertising-Supported Internet 3

Economic Value of the Advertising- Supported Internet Ecosystem June 10, 2009 Authored by Hamilton Consultants, Inc. With Dr. John Deighton, Harvard Business School, and Dr. John Quelch, Harvard Business School HAMILTON CONSULTANTS Cambridge, Massachusetts Executive Summary 1. Background 8 1.1 Purpose of the study 1.2 The Internet today 1.3 Structure of the Internet 2. The Advertising-Supported Internet 21 2.1 Internet advertising segments 2.2 The value of the advertising-supported Internet 3. Internet Companies and Employment by Internet Segment 26 3.1 Overview of Internet companies 3.2 Summary of employment 3.3 Internet service providers (ISPs) and transport 3.4 Hardware providers 3.5 Information technology consulting and solutions companies 3.6 Software companies 3.7 Web hosting and content management companies 3.8 Search engines/portals 3.9 Content sites: news, entertainment, research, information services. 3.10 Software as a service (SaaS) 3.11 Advertising agencies and ad support services 3.12 Ad networks 3.13 E-mail marketing and support 3.14 Enterprise-based Internet marketing, advertising and web design 3.15 E-commerce: e-tailing, e-brokerage, e-travel, and others 3.16 B2B e-commerce 4. Companies and Employment by Geography 50 4.1 Company headquarters and total employees by geography 4.2 Census data for Internet employees by geography 4.3 Additional company location data by geography 5. Benefits of the Ad-Supported Internet Ecosystem 54 5.1 Overview of types of benefits 5.2 Providing universal access to unlimited information 5.3 Creating employment 5.4 Providing one of the pillars of economic strength during the 2008-2009 recession 5.5 Fostering further innovation 5.6 Increasing economic productivity 5.7 Making a significant contribution to the U.S. -

Division of Investment Department of the Treasury State of New Jersey Pension Fund June 30, 2009 and 2008 (With Independent Auditors’ Report Thereon)

F INANCIAL S TATEMENTS, M ANAGEMENT’ S D ISCUSSION AND A NALYSIS AND S UPPLEMENTAL S CHEDULES Division of Investment Department of the Treasury State of New Jersey Pension Fund June 30, 2009 and 2008 (With Independent Auditors’ Report Thereon) Division of Investment Department of the Treasury State of New Jersey Pension Fund Financial Statements June 30, 2009 and 2008 Contents Independent Auditors’ Report ..........................................................................................................1 Management’s Discussion and Analysis .........................................................................................3 Basic Financial Statements: Statements of Net Assets .................................................................................................................7 Statements of Changes in Net Assets...............................................................................................8 Notes to Financial Statements ..........................................................................................................9 Supplemental Schedules: Schedule 1 – Combining Schedule of Net Assets ..........................................................................31 Schedule 2 – Combining Schedule of Changes in Net Assets .......................................................32 Schedule 3 – Portfolio of Investments – Common Fund A ...........................................................33 Schedule 4 – Portfolio of Investments – Common Fund B ...........................................................57 -

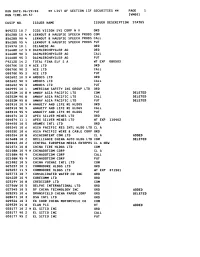

LIST of SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 Ivmool

RUN DATE:06/29/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS VISION SYS CORP N V ORD B5628B 10 4 * LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT & HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT 8 HAUSPIE SPEECH PRODS PUT D1497A 10 1 CELANESE AG ORD D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FINA ELF S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT GO2602 10 3 * AMDOCS LTD ORD GO2602 90 3 AMDOCS LTD CALL GO2602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD G0352M 10 8 * AMWAY ASIA PACIFIC LTD COM DELETED G0352M 90 8 AMWAY ASIA PACIFIC LTD CALL DELETED G0352M 95 8 AMWAY ASIA PACIFIC LTD PUT DELETED GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD GO3910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4074 11 1 APEX SILVER MINES LTD WT EXP 110402 GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE & CABLE CORP ORD GO5354 10 8 ASIACONTENT COM LTD CL A ADDED G1368B 10 2 BRILLIANCE CHINA AUTO HLDG LTD COM DELETED 620045 20 2 CENTRAL EUROPEAN MEDIA ENTRPRS CL A NEW G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 * CHINADOTCOM CORP CL A G2108N 90 9 CHINADOTCOM CORP CALL G2lO8N 95 9 CHINADOTCOM CORP PUT 621082 10 5 CHINA YUCHAI INTL LTD COM 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11 -

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C. 20554 In the Matter of ) ) SBC Communications, Inc. and AT&T Corp. ) WC Docket No. 05-65 ) Applications for Approval of Transfer of Control ) ) REPLY COMMENTS OF BT AMERICAS INC. AND BT INFONET USA BT AMERICAS INC. AND BT INFONET USA Joel S. Winnik A. Sheba Chacko David J. Saylor Chief Regulatory Counsel, The Americas David L. Sieradzki BT AMERICAS INC. HOGAN & HARTSON LLP 11440 Commerce Park Drive 555 – 13th St., NW Reston, VA 20191 Washington, D.C. 20004 (202) 637-5600 Kristen Neller Verderame VP, U.S. Regulation & Government Relations BT AMERICAS INC. 2025 M St., NW, Suite 450 Washington, D.C. 20036 Dated: May 10, 2005 TABLE OF CONTENTS Page Introduction and Summary ............................................................................................................. 1 I. The Merger Would Harm Competition For Global Telecommunications Services, To The Detriment Of Business Consumers .................................................................... 3 A. The Merger Would Increase Concentration in the GTS Market Because it Would Eliminate SBC as a Potentially Powerful New Entrant in the GTS Market........... 5 B. The Merger Would Harm GTS Competition By Increasing SBC’s Monopoly Market Power Over Local Special Access Connections For Enterprise Networks, A Critical Wholesale Input to GTS......................................................................... 7 1. GTS Consumers And Providers Are Highly Dependent on SBC’s Special Access Service for Local Connectivity....................................................... 7 2. SBC Already Has Enormous Market Power Over Special Access and Other Local Wholesale Services in Its Region ........................................... 9 3. The Merger Would Strengthen SBC’s Special Access Monopoly By Eliminating One of the Few Remaining Serious Special Access Competitors and the Largest Special Access Consumer.......................... -

1 UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: September 30, 2000 Check here if Amendment [ ]; Amendment Number: This Amendment (Check only one.): [ ] is a restatement. [ ] adds new holdings entries Institutional Investment Manager Filing this Report: Name: AMERICAN INTERNATIONAL GROUP, INC. Address: 70 Pine Street New York, New York 10270 Form 13F File Number: 28-219 The Institutional Investment Manager filing this report and the person by whom it is signed represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Edward E. Matthews Title: Vice Chairman -- Investments and Financial Services Phone: (212) 770-7000 Signature, Place, and Date of Signing: /s/ Edward E. Matthews New York, New York November 14, 2000 - ------------------------------- ------------------------ ----------------- (Signature) (City, State) (Date) Report Type (Check only one.): [X] 13F HOLDINGS REPORT. (Check if all holdings of this reporting manager are reported in this report.) [ ] 13F NOTICE. (Check if no holdings reported are in this report, and all holdings are reported in this report and a portion are reported by other reporting manager(s).) [ ] 13F COMBINATION REPORT. (Check -

Case No COMP/M.3752 - VERIZON / MCI

EN Case No COMP/M.3752 - VERIZON / MCI Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 07/10/2005 In electronic form on the EUR-Lex website under document number 32005M3752 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 07/10/2005 SG-Greffe(2005) D/205408 In the published version of this decision, some information has been omitted pursuant to Article PUBLIC VERSION 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are MERGER PROCEDURE shown thus […]. Where possible the information ARTICLE 6(1)(b) DECISION omitted has been replaced by ranges of figures or a general description. To the notifying party: Dear Sir/Madam, Subject: Case No COMP/M.3752 - Verizon/MCI Notification of 2 September 2005 pursuant to Article 4 of Council Regulation No 139/20041 1. On 2 September 2005, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which the undertaking Verizon Communications Inc. (“Verizon”, USA) acquires within the meaning of Article 3(1)(b) of the Council Regulation control of the whole of the undertaking MCI Inc (“MCI”, USA) by way of purchase of shares. I. THE PARTIES 2. Verizon provides telecommunications services to residential, small business and some large corporate and government customers in various regions of the U.S. These services include local, domestic long distance and international voice telephony services.