6709BWOL Webstock

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Ambulance the Squad Car & the Internet.Pdf

The Ambulance, the Squad Car, & the Internet The Harvard community has made this article openly available. Please share how this access benefits you. Your story matters Citation Susan P. Crawford, The Ambulance, the Squad Car, & the Internet, 21 Berkeley Tech. L.J. 873 (2006). Published Version http://scholarship.law.berkeley.edu/btlj/vol21/iss2/5/ Citable link http://nrs.harvard.edu/urn-3:HUL.InstRepos:12956284 Terms of Use This article was downloaded from Harvard University’s DASH repository, and is made available under the terms and conditions applicable to Other Posted Material, as set forth at http:// nrs.harvard.edu/urn-3:HUL.InstRepos:dash.current.terms-of- use#LAA Berkeley Technology Law Journal Volume 21 | Issue 2 Article 5 March 2006 The Ambulance, the Squad Car, & the Internet Susan P. Crawford Follow this and additional works at: http://scholarship.law.berkeley.edu/btlj Recommended Citation Susan P. Crawford, The Ambulance, the Squad Car, & the Internet, 21 Berkeley Tech. L.J. 873 (2006). Available at: http://scholarship.law.berkeley.edu/btlj/vol21/iss2/5 This Article is brought to you for free and open access by the Law Journals and Related Materials at Berkeley Law Scholarship Repository. It has been accepted for inclusion in Berkeley Technology Law Journal by an authorized administrator of Berkeley Law Scholarship Repository. For more information, please contact [email protected]. THE AMBULANCE, THE SQUAD CAR, & THE INTERNET By Susan P. Crawfordt TABLE OF CONTENTS I. IN T R OD U C T IO N ............................................................................................ 874 II. THE MARKET CONTEXT ........................................................................... 877 III. FCC INTERNET SOCIAL POLICIES ...................................................... -

2015 Valuation Handbook – Guide to Cost of Capital and Data Published Therein in Connection with Their Internal Business Operations

Market Results Through #DBDLADQ 2014 201 Valuation Handbook Guide to Cost of Capital Industry Risk Premia Company List Cover image: Duff & Phelps Cover design: Tim Harms Copyright © 2015 by John Wiley & Sons, Inc. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748- 6008, or online at http://www.wiley.com/go/permissions. The forgoing does not preclude End-users from using the 2015 Valuation Handbook – Guide to Cost of Capital and data published therein in connection with their internal business operations. Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. -

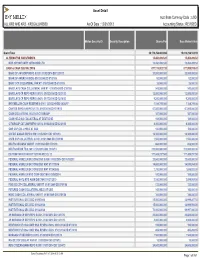

Asset Detail Acct Base Currency Code : USD ALL KR2 and KR3 - KR2GALLKRS00 As of Date : 12/31/2013 Accounting Status : REVISED

Asset Detail Acct Base Currency Code : USD ALL KR2 AND KR3 - KR2GALLKRS00 As Of Date : 12/31/2013 Accounting Status : REVISED . Mellon Security ID Security Description Shares/Par Base Market Value Grand Total 36,179,254,463.894 15,610,214,163.19 ALTERNATIVE INVESTMENTS 15,450,499.520 15,450,499.52 MKP OPPORTUNITY OFFSHORE LTD 15,450,499.520 15,450,499.52 CASH & CASH EQUIVALENTS 877,174,023.720 877,959,915.42 BANC OF AM CORP REPO 0.010% 01/02/2014 DD 12/31/13 20,000,000.000 20,000,000.00 BANK OF AMERICA (BOA) 01/01/2049 DD 07/01/08 52,000.000 52,000.00 BARC CCP COLLATERAL VAR RT 01/01/2049 DD 07/01/08 28,000.000 28,000.00 BARCLAYS CASH COLLATERAL VAR RT 01/01/2049 DD 07/01/08 543,000.000 543,000.00 BARCLAYS CP REPO REPO 0.010% 01/02/2014 DD 12/31/13 12,000,000.000 12,000,000.00 BARCLAYS CP REPO REPO 0.040% 01/17/2014 DD 12/18/13 9,200,000.000 9,200,000.00 BNY MELLON CASH RESERVE 0.010% 12/31/2049 DD 06/26/97 1,184,749.080 1,184,749.08 CANTOR REPO A REPO 0.170% 01/02/2014 DD 12/19/13 67,000,000.000 67,000,000.00 CASH COLLATERAL HELD AT CITIGROUP 387,000.000 387,000.00 CASH HELD AS COLLATERAL AT DEUTSCHE 169,000.000 169,000.00 CITIGROUP CAT 2MM REPO 0.010% 01/02/2014 DD 12/31/13 8,300,000.000 8,300,000.00 CME CCP COLL HELD AT GSC 100,000.000 100,000.00 CREDIT SUISSE REPO 0.010% 01/02/2014 DD 12/31/13 16,300,000.000 16,300,000.00 CSFB CCP COLLATERAL 0.010% 01/01/2049 DD 07/01/08 1,553,000.000 1,553,000.00 DEUTSCHE BANK VAR RT 01/01/2049 DD 07/01/08 668,000.000 668,000.00 DEUTSCHE BK TD 0.180% 01/02/2014 DD 12/18/13 270,000,000.000 270,000,000.00 -

The Internet and the Web T6 a Technical View of System Analysis and Design

Technology Guides T1 Hardware T2 Software T3 Data and Databases T4 Telecommunications ᮣ T5 The Internet and the Web T6 A Technical View of System Analysis and Design Technology Guide The Internet 5 and the Web T5.1 What Is the Internet? T5.2 Basic Characteristics and Capabilities of the Internet T5.3 Browsing and the World Wide Web T5.4 Communication Tools for the Internet T5.5 Other Internet Tools T5.1 T5.2 Technology Guide The Internet and the Web T5.1 What Is the Internet?1 The Internet (“the Net”) is a network that connects hundreds of thousands of inter- nal organizational computer networks worldwide. Examples of internal organiza- tional computer networks are a university computer system, the computer system of a corporation such as IBM or McDonald’s, a hospital computer system, or a system used by a small business across the street from you. Participating computer systems, called nodes, include PCs, local area networks, database(s), and mainframes.A node may include several networks of an organization, possibly connected by a wide area network. The Internet connects to hundreds of thousands of computer networks in more than 200 countries so that people can access data in other organizations, and can communicate and collaborate around the globe, quickly and inexpensively. Thus, the Internet has become a necessity in the conduct of modern business. The Internet grew out of an experimental project of the Advanced Research Proj- BRIEF HISTORY ect Agency (ARPA) of the U.S. Department of Defense.The project was initiated in 1969 as ARPAnet to test the feasibility of a wide area computer network over which researchers, educators, military personnel, and government agencies could share data, exchange messages, and transfer files. -

Software Industry Financial Report Contents

The Software Industry Financial Report SOFTWARE INDUSTRY FINANCIAL REPORT CONTENTS About Software Equity Group Leaders in Software M&A 4 Extensive Global Reach 5 Software Industry Macroeconomics Global GDP 8 U.S. GDP and Unemployment 9 Global IT Spending 10 E-Commerce and Digital Advertising Spend 11 SEG Indices vs. Benchmark Indices 12 Public Software Financial and Valuation Performance The SEG Software Index 14 The SEG Software Index: Financial Performance 15-17 The SEG Software Index: Market Multiples 18-19 The SEG Software Index by Product Category 20 The SEG Software Index by Product Category: Financial Performance 21 The SEG Software Index by Product Category: Market Multiples 22 Public SaaS Company Financial and Valuation Performance The SEG SaaS Index 24 The SEG SaaS Index Detail 25 The SEG SaaS Index: Financial Performance 26-28 The SEG SaaS Index: Market Multiples 29-30 The SEG SaaS Index by Product Category 31 The SEG SaaS Index by Product Category: Financial Performance 32 The SEG SaaS Index by Product Category: Market Multiples 33 Public Internet Company Financial and Valuation Performance The SEG Internet Index 35 The SEG Internet Index: Financial Performance 36-38 The SEG Internet Index: Market Multiples 39-40 The SEG Internet Index by Product Category 41 The SEG Internet Index by Product Category: Financial Performance 42 The SEG Internet Index by Product Category: Market Multiples 43 1 Q3 2013 Software Industry Financial Report Copyright © 2013 by Software Equity Group, LLC All Rights Reserved SOFTWARE INDUSTRY FINANCIAL -

Fox Interactive Media Ranks #1 in Page Views; Yahoo! Sites Attract the Most Unique Visitors Comscore Media Metrix Releases November Top 50 Web Rankings and Analysis

Fox Interactive Media Ranks #1 in Page Views; Yahoo! Sites Attract the Most Unique Visitors comScore Media Metrix Releases November Top 50 Web Rankings and Analysis RESTON, VA, December 19, 2006 - comScore Media Metrix today released its monthly analysis of U.S. consumer activity at top online properties and categories for November. Fox Interactive Media topped all properties with 39.5 billion page views in November, primarily driven by the 38.7 billion pages consumed at MySpace.com, based on traffic from home, work and university locations. While Fox Interactive Media supplanted Yahoo! Sites as the top Web property by page views in November, Yahoo! Sites retained the top spot in audience size with 129.9 million unique visitors. Further, Yahoo's increased integration of AJAX technology may have had a dampening effect on page views, as the technology enables real-time site updates without the need to refresh a page. An additional comScore analysis released this week highlighted the importance of including home, work and university audiences in measuring the Web's largest properties. In fact, if university usage is omitted, the comparison of page views at Fox Interactive Media and Yahoo! Sites tells a very different story: Yahoo! Sites, with 35.6 billion page views for November, would rank higher than Fox Interactive Media with 34.9 billion. "Inclusion of online activity occurring at university locations is critical to producing accurate online audience measurements," said Jack Flanagan, executive vice president of comScore Media Metrix. "The market was understandably perplexed by reports that offered seemingly conflicting opinions on whether Fox Interactive or Yahoo! had actually captured the top ranking in terms of page views." "The difference lies in whether the online activity of college students, which represents nearly 15 million people, is included in the measurements - a critically important detail when measuring activity at MySpace.com, which is included in the Fox Interactive property," Flanagan added. -

1 UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: September 30, 2000 Check here if Amendment [ ]; Amendment Number: This Amendment (Check only one.): [ ] is a restatement. [ ] adds new holdings entries Institutional Investment Manager Filing this Report: Name: AMERICAN INTERNATIONAL GROUP, INC. Address: 70 Pine Street New York, New York 10270 Form 13F File Number: 28-219 The Institutional Investment Manager filing this report and the person by whom it is signed represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Edward E. Matthews Title: Vice Chairman -- Investments and Financial Services Phone: (212) 770-7000 Signature, Place, and Date of Signing: /s/ Edward E. Matthews New York, New York November 14, 2000 - ------------------------------- ------------------------ ----------------- (Signature) (City, State) (Date) Report Type (Check only one.): [X] 13F HOLDINGS REPORT. (Check if all holdings of this reporting manager are reported in this report.) [ ] 13F NOTICE. (Check if no holdings reported are in this report, and all holdings are reported in this report and a portion are reported by other reporting manager(s).) [ ] 13F COMBINATION REPORT. (Check -

US Asian Wire Distribution Points

US Asian Wire Distribution Points NewMediaWire’s comprehensive US Asian Wire delivers your news to targeted media in the Asian American community. Reaches leading Asian−American media outlets and over 375 trades and magazines dealing with political, finance, education, community, lifestyle and legal issues impacting Asian Americans as well as Online databases and websites that feature or cover Asian−American news and issues and The Associated Press. Please note, NewMediaWire includes free distribution to trade publications and newsletters. Because these are unique to each industry, they are not included in the list below. To get your complete NewMediaWire distribution, please contact your NewMediaWire account representative at 310.492.4001. aahar Newspaper Adhra Pradesh Times Newspaper Afternoon Despatch and Courier Newspaper Agence Kampuchea Press Newspaper Akila Daily Newspaper Algorithmica Japonica Newspaper am730 Newspaper Anand Rupwate Newspaper Andhra News Newspaper Andrha Pradesh Times Newspaper ANTARA News Agency Newspaper ASAHI PASOCOM Newspaper ASAHI SHIMBUN Newspaper Asahi Shimbun Newspaper Asahi Shimbun International Satellite Ed Newspaper Asia Insurance Review Newspaper Asia Pacific Management News Newspaper Asia Source Newspaper ASIA TIMES Newspaper Asian Affairs: An American Review Newspaper Asian American Press Newspaper Asian American Times Online Newspaper Asian Enterprise Magazine Newspaper Asian Focus Newspaper Asian Fortune Newspaper Asian Herald Newspaper Asian Industrial Reporter Newspaper Asian Journal Newspaper -

BANK and BANKING E-Banking Managing Your Money And

Teach Yourself Today e-Banking Teach Yourself Today e-Banking Managing your money and transactions online Mary Dixon Brian Nixon 201 West 103rd Street, Indianapolis, Indiana 46290 Sams Teach Yourself e-Banking Acquisitions Editor Today Jeff Schultz Copyright ©2000 by Sams Publishing Development All rights reserved. No part of this book shall be reproduced, stored Editor in a retrieval system, or transmitted by any means, electronic, Alice Martina Smith mechanical, photocopying, recording, or otherwise, without written Managing Editor permission from the publisher. No patent liability is assumed with Charlotte Clapp respect to the use of the information contained herein. Although every precaution has been taken in the preparation of this book, the Project Editor publisher and author assume no responsibility for errors or omis- Andy Beaster sions. Nor is any liability assumed for damages resulting from the Copy Editor use of the information contained herein. Patricia Kinyon International Standard Book Number: 0-672-31882-2 Indexer Library of Congress Catalog Card Number: 99-69443 Greg Pearson Printed in the United States of America Proofreader First Printing: February, 2000 Candice Hightower 03 02 01 00 Team Coordinator 4 3 2 1 Amy Patton Interior Designer Trademarks Gary Adair All terms mentioned in this book that are known to be trademarks Cover Designer or service marks have been appropriately capitalized. Sams cannot Jay Corpus attest to the accuracy of this information. Use of a term in this book Copywriter should not be regarded as affecting the validity of any trademark or Eric Borgert service mark. Editorial Assistant Warning and Disclaimer Angela Boley Every effort has been made to make this book as complete and as accurate as possible, but no warranty or fitness is implied. -

August 2014 Software Business Services Internet & Digital Media

The Lighthouse August 2014 Software Business Services Internet & Digital Media A Pharus Advisors, LLC Publication | www.pharus.com August 2014 Software & Business Services Internet & Digital Media Table of Contents 1. Capital Market Trends 3 2. Public Market Valuations 4 3. Public Market Universe 13 4. M&A Transactions 15 5. Recent Transactions 23 6. Pharus Overview 24 If you would like to be included on (or removed from) the distribution list for the Software & Services version of The Lighthouse, please contact Nathan Bullock at: [email protected]. The information contained herein is obtained from sources we believe to be reliable but its accuracy and completeness, and that of the opinions based thereon, is not guaranteed. Pharus Advisors, or one or more of its partners, may have an interest in any of the securities or companies discussed herein. All rights reserved by Pharus Advisors. LLC. 2014 Copyright Pharus Advisors, LLC. Executive Contacts Telephone Email Michael E. Goodman, Co-Founder & Sr. Managing Director 212-904-0102 [email protected] Kenneth M. Harrell, Co- Founder & Sr. Managing Director 212-904-0101 [email protected] Pharus Advisors, LLC | www.pharus.com 2 August 2014 Software & Business Services Internet & Digital Media 1. Capital Market Trends Relative Performance of Major Stock Indices through August 31, 2014 (Base = 100, 7/31/2013) 140 130 120 110 100 90 Dow Jones Industrial Average (^DJI) - Index Value NASDAQ Composite Index (^COMP) - Index Value S&P 500 Index (^SPX) - Index Value Russell 2000 Index (^RUT) - Index Value As of Change % Index 31-Aug-14 1 Year 3 Months 1 Month Dow Jones 17,098.45 15.4% 2.3% 3.2% Nasdaq 4,580.27 27.6% 8.0% 4.8% S&P 500 2,003.37 22.7% 4.1% 3.8% Russell 2000 1,174.35 16.2% 3.5% 4.8% Pharus Advisors, LLC | www.pharus.com 3 August 2014 Software & Business Services Internet & Digital Media 2. -

Online Selling & Ecrm August 2002

Online Selling & eCRM August 2002 www.emarketer.com This report is the property of eMarketer, Inc. and is protected under both the United States Copyright Act and by contract. Section 106 of the Copyright Act gives copyright owners the exclusive rights of reproduction, adaptation, publication, performance and display of protected works. Accordingly, any use, copying, distribution, modification, or republishing of this report beyond that expressly permitted by your license agreement is prohibited. Violations of the Copyright Act can be both civilly and criminally prosecuted and eMarketer will take all steps necessary to protect its rights under both the Copyright Act and your contract. If you are outside of the United States: copyrighted United States works, including the attached report, are protected under international treaties. Additionally, by contract, you have agreed to be bound by United States law. Online Selling & eCRM Table of Contents 3 Methodology 5 The eMarketer Difference 6 The Benefits of eMarketer’s Aggregation Approach 7 “Benchmarking” and Projections 7 I Introduction 9 A. Estimating the Number of Commercial Websites 10 B. Estimating the Number of Website Visitors 15 C. The Growing Importance of the Internet Channel 20 II B2C Websites 23 A. Website Capabilities 24 Website Budgeting and ROI 26 E-Commerce and General Website Capabilities 35 Managing Website Traffic 43 B. Consumer Preferences 51 III B2B Websites 65 A. Website Capabilities 66 B. User Preferences 81 IV Online Customer Service & eCRM 87 A. Website Capabilities 88 B. User Preferences 105 Index of Charts 117 3 ©2002 eMarketer, Inc. Reproduction of information sourced as eMarketer is prohibited without prior, written permission. -

Merrill Lynch Security Risk Evaluation 1-07

Security Risk Evaluation ALPHA January 2007 Price As of December 2006 Month End COPYRIGHT 1998 MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED (MLPF&S). APPROVED FOR PUBLICATION IN THE UNITED KINGDOM BY MERRILL LYNCH, PIERCE, FENNER & SMITH LIMITED, AN AFFILIATED COMPANY AND REGULATED BY THE SECURITIES AND FUTURES AUTHORITY LIMITED. THE INFORMATION HEREIN WAS OBTAINED FROM VARIOUS SOURCES; WE DO NOT GUARANTEE ITS ACCURACY. ADDITIONAL INFORMATION AVAILABLE. GLOBAL SECURITIES RESEARCH & ECONOMICS RESEARCH TECHNOLOGY ALPHA (1) 800 255-9107 CONTINENTAL UNITED STATES January 2007 (1) 212 449-1072 WORLD WIDE PRICE AS OF December 2006 MONTH END Merrill Lynch, Pierce, Fenner & Smith, Inc. Market Sensitivity Statistics 2006/ 12 Resid Number Ticker Close Std --Std Error-- Adjusted Of Symbol Security Name Price Beta Alpha R-Sqr Dev-n Beta Alpha Beta Observ DOWI DOW JONES & CO 30 INDUSTRIALS 12463.150 0.96 0.03 0.91 1.09 0.04 0.14 0.98 60 DJ 20 DOW JONES & CO 20 TRANS ACTUAL 4560.200 0.94 0.65 0.42 3.86 0.14 0.50 0.96 60 DJ 15 DOW JONES & CO 15 UTIL ACTUAL 456.770 0.57 0.60 0.19 4.12 0.15 0.54 0.72 60 DJ 65 DOW JONES & CO 65 STOCK COMPOSITE 4120.960 0.89 0.28 0.86 1.29 0.05 0.17 0.93 60 SPALNS S&P 500 500 STOCKS 1418.300 1.00 0.00 1.00 0.00 0.00 0.00 1.00 60 Based on S&P 500 Index Using Straight Regression Merrill Lynch, Pierce, Fenner & Smith, Inc.