Interim Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nelson Airport's New Terminal – Overview of the Design of a Large

Conference issue Nelson Airport’s new terminal – overview of the design of a large-span engineered timber specialist building Evzˇen Novak, Samantha Zondag, Sarah Berry and Simon Hardy Engineered timber in the Nelson Airport Terminal under construction. Photo courtesy of David Evison Abstract more closely reflects the needs of the end users of the building. In providing this viewpoint, the authors hope The Nelson Airport Terminal is a new large-span that it facilitates a raised producer awareness of the building that replaces the existing terminal building at issues facing the incorporation of engineered timber the airport. The structure and interior of the building into any building and, more fundamentally, an increase relies on engineered timber (LVL and plywood) to in the use of engineered timber in the building stock achieve the open spans required and create a unique New Zealand produces each year. airport environment. Beginning with the brief and a short description This paper serves to outline a significant end use of the building, the paper goes on to discuss the design for engineered timber and sets out, from a designer’s drivers for the building and how the selected drivers perspective, the journey from initial idea to end result. supported the use of engineered timber, one very major The designer’s perspective is clearly not the same as element of the design strategy. An overview of the the producer’s. In general, the designer’s perspective design and construction processes, particularly dealing NZ Journal of Forestry, November 2018, Vol. 63, No. 3 11 Conference issue with innovations such as the use of resilient slip friction Initially, the design team investigated whether an joints (RSFJs) and pre-fabrication, is provided along expansion of the existing terminal would be feasible, or if with some preliminary learnings. -

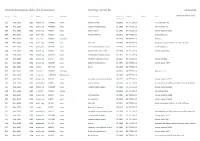

British Aerospace Bae J31 Jetstream Sorting: Serial Nr

British Aerospace BAe J31 Jetstream Sorting: Serial Nr. 29.08.2021 Ser.Nr. Type F/F Status Immatr. Operator Last Operator in service Engines Owner Rem. @airlinefleet.info M/Y until 601 BAe.J3102 1982 broken up G-WMCC none Maersk Air UK 08-1996 GA TPE331-10 Air Commuter ntu 602 BAe.J3101 1982 broken up N422MX none Eastern Metro Express 01-1998 GA TPE331-10 Mall Airways ntu 603 BAe.J3103 1982 broken up N603JS none Gold Aviation 01-2001 GA TPE331-10 broken up by 08-2005 604 BAe.J3101 1982 perm_wfu N78019 none Personal Airliner 05-2011 GA TPE331-10 to be broken up 605 BAe.J3102 1982 in service N408PP Corporate 06-2013 GA TPE331-10 Phil Pate 606 BAe.J3102 1982 perm_wfu LN-FAV none Coast Air 02-2007 GA TPE331-10 Royal Norwegian Air Force as instr. airframe 607 BAe.J3102 1983 perm_wfu N607BA none Professional Aviation Group 04-2008 GA TPE331-10 to be broken up 608 BAe.J3101 1983 broken up N608JX none Native American Air Serv. 03-1999 GA TPE331-10 broken up 03-2005 609 BAe.J3102 1983 broken up N609BA none Professional Aviation Group 05-2013 GA TPE331-10 610 BAe.J3103 1983 broken up G-JXTA none Jetstream Executive Travel 02-2011 GA TPE331-10 broken up 2016 611 BAe.J3101 1983 broken up N419MX none Eastern Metro Express 01-1991 GA TPE331-10 broken up 12-1997 612 BAe.J3102 1983 stored OM-NKD none SK Air 00-1999 GA TPE331-10 613 BAe.J3101 1983 in service N904EH Corporate 02-2019 GA TPE331-10 Aerostar 1 Inc. -

Services at Holy Trinity

RICHMOND PARISH PROFILE WHO ARE WE? We are a committed group of Christians who endeavour to make our church a welcoming church to all. Many visitors have favourably commented on the friendly welcome they receive among us. We are in an evangelical diocese and most of our congregation tend in that direction. There are, however, a number of parishioners with a more liberal theology. Our focus tends towards what unites us rather than what we disagree on. We are a predominantly older congregation with a small number of children and very few members in the 20-40 age group bracket. We value our evangelical, Anglican heritage which does provide a unique flavour to the Richmond church scene. Our two Sunday morning services attract just over 80 people to our wooden church on the hill near the centre of the Richmond township. WHERE ARE WE? Although Richmond is geographically close to Nelson, it is administered by the Tasman District Council (www.tasman.govt.nz) which has its main council offices in Richmond. Richmond is a thriving, growing centre for the rural townships to the south and the west. The population was estimated to be 17,250 in June 2020. In the 2018 census the main ethnic breakdown of the Tasman Region was European (92.6%), Maori (8.7%), Asian (2.8%) and Pacific (1.6%). (These figures exceed 100% as people can associate with more than one ethnic group). Due both to an increasing influx of retirees and the ageing population Tasman District’s older residents (65+) are predicted to rise from 21% in 2018 to 32% in 20 years. -

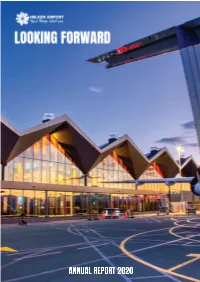

View the 2020 Annual Report

CONTENTS DIRECTORS' REPORT 6 FINANCIAL 10 INDEPENDENT AUDITOR’S REPORT 28 SERVICE PERFORMANCE REPORT 32 STATEMENT OF COMPREHENSIVE INCOME 40 STATEMENT OF CHANGES IN EQUITY 41 STATEMENT OF FINANCIAL POSITION 42 STATEMENT OF CASH FLOWS 43 NOTES TO THE FINANCIAL STATEMENTS 44 COMPANY DIRECTORY 74 2020 Annual Report photography credits: Jason Mann Photography Ltd, Brent McGilvary - Key Property Pix, Storyline Pictures, Luke Marshall Images OUR BOARD From left to right Paul Steere - Chair Catherine Taylor - Deputy Chair Matthew McDonald Mark Greening Matthew Clarke 4 NELSON AIRPORT LTD ANNUAL REPORT 2019 NELSON AIRPORT LTD ANNUAL REPORT 2019 5 DIRECTORS' REPORT For the Year Ended 30 June 2020 OVERVIEW The financial year ended June 2020 was very KEY POINTS With Jetstar’s withdrawal and the restrictions different to recent years. on travel from COVID-19 lockdown levels 3 & With the successful completion of the new 4, passenger numbers, at 782,000 for the year, terminal and its opening by the Prime Minister were down 27% on the previous year, as was Right Honourable Jacinda Ardern on the 19th available capacity. April saw only essential October 2019, we then had to confront the approved travel and we were 1.4% of the previous withdrawal of Jetstar from regional routes in April. As restrictions eased in May, June saw December and then in March the effects on passengers climb back to 40% and then July travel arising from the global pandemic COVID-19 climbed to 56% of the year previous. A new started to impact on our operations. lockdown level raise in August after year close, saw restricted travel mainly to Auckland but We have weathered the challenges well and while affecting other destinations as well. -

Services at Holy Trinity

RICHMOND PARISH PROFILE WHO ARE WE? We are a committed group of Christians who endeavour to make our church a welcoming church to all. Many visitors have favourably commented on the friendly welcome they receive among us. We are in an evangelical diocese and most of our congregation tend in that direction. There are, however, a number of parishioners with a more liberal theology. Our focus tends towards what unites us rather than what we disagree on. We are a predominantly older congregation with a small number of children and very few members in the 20-40 age group bracket. We value our evangelical, Anglican heritage which does provide a unique flavour to the Richmond church scene. Our two Sunday morning services attract just under 100 people to our wooden church on the hill near the centre of the Richmond township. WHERE ARE WE? Although Richmond is geographically close to Nelson, it is administered by the Tasman District Council (www.tasman.govt.nz) which has its main council offices in Richmond. Richmond is a thriving, growing centre for the rural townships to the south and the west. The population was estimated to be 15,500 in 2016. In the 2013 census the predominant ethnic group in the Tasman Region was European, with over 90%. Less than 1% of NZ Maori live in the Tasman Region. Due both to an increasing influx of retirees and the ageing population Tasman District’s older residents are predicted to rise from just under a quarter now to a third in 20 years. Richmond town centre photos. -

2035 Master Plan August 2016

2035 Master Plan June 2016 2035 MASTER PLAN AUGUST 2016 CONTENTS 1.0 INTRODUCING OUR PLAN 3 5.7.2 Fire Rescue Building Location 18 5.8 Major Aircraft Maintenance 20 Our Vision, Our Mission 4 5.9 Engine Testing Bay 21 5.10 General Aviation 22 2.0 THE KEY ELEMENTS OF THE MASTER PLAN 5 5.11 Navigation Aids 23 5.12 Apron Demand Scenarios 24 3.0 PROTECTING OUR ENVIRONMENT 6 5.13 Apron Layouts 25 5.14 Planning 26 4.0 AERONAUTICAL FORECASTS 7 5.15 Helicopters 27 4.1 Passenger Projections 7 4.1.1 Estimated Passenger & Movements Forecast 7 THE TERMINAL 28 4.1.2 Capacity Projections 8 6.1 Current Terminal 28 4.1.3 Movement Projections 8 6.2 The New Terminal 29 6.3 Growth Beyond the New Terminal 31 5.0 AIRSIDE 9 5.1 Design Aircraft 9 LANDSIDE TRANSPORT 32 5.2 Constraints 10 7.1 External Access 33 5.3 Runway Strip Width and Taxiway Separation 11 7.2 Vehicle Volumes and Forecast 34 5.3.1 Runway Strip Width 11 7.3 Parking Volumes and Forecast 35 5.3.2 Taxiway Separation 11 5.4 Parallel Taxiway 12 LANDSIDE DEVELOPMENTF 36 5.5 Fuel Storage 13 8.1 Non-Aeronautical Commercial Development 36 5.5.1 Location Rationale 13 5.5.2 Dependency 13 Appendix One: Existing Airport Plan 37 5.6 Control Tower 15 5.6.1 Location of New Control Tower 17 Appendix Two: 2035 Master Plan 39 5.7 Rescue Fire 18 5.7.1 Part 139 Categorisation 18 nelson airport master plan page 2 We are pleased to be able to present our vision for the next 20 years at Nelson Airport. -

Papa Rererangi I Puketapu Ltd New Plymouth Airport Quarterly Report

Papa Rererangi i Puketapu Ltd New Plymouth Airport Quarterly Report for the three months ended 30 September 2019 Philip Cory-Wright Chair Wayne Wootton Chief Executive New Plymouth Airport 192 Airport Drive New Plymouth 4373 Website: www.nplairport.co.nz Contents 1. Introduction ................................................................................................................................. 3 2. Responsibilities ............................................................................................................................ 3 3. Executive summary...................................................................................................................... 4 4. PRIP establishment ...................................................................................................................... 5 5. Operational summary .................................................................................................................. 5 6. Financial performance against Statement of Intent .................................................................... 6 7. Stakeholder relations .................................................................................................................. 7 8. Terminal redevelopment project ................................................................................................ 7 9. Civil Aviation Rule (CAA) Part 139 ............................................................................................... 9 10. Strategic outlook ........................................................................................................................ -

Abel Tasman National Park

Abel Tasman National Park businessevents.newzealand.com Nelson Tasman is a picturesque region in the middle of New Zealand with a reputation for the arts and sunshine. It offers fantastic opportunities for conferences, exhibitions, festivals and other events. There are three exceptional national parks within 90 minutes’ drive of the region’s largest settlement, Nelson city, and some of the country’s most inviting beaches are nearby. ACCESS Facts: Visitors flying to the region land at Nelson Airport, 8km from Nelson city centre. Domestic flights to and from major New Zealand centres are available through Air New Zealand and • Population: over 91,000 people Jetstar, while regional centres are also served by Kiwi Regional Airlines and Originair, and air • 8 km Airport to City transfers from Wellington and the upper South Island are offered by Sounds Air, Air2There and Golden Bay Air. Ferries operate between Wellington and Picton, for those who prefer to • Accommodation: 800 rooms arrive by sea. Onward coaches from Picton are easily arranged. • Venue capacity: 700 people Claim to fame: VENUES • Strong artisan community The region offers a range of venues, from heritage hotels and modern sporting events centres • Boutique wineries and craft to vineyards and purpose-built convention complexes. breweries Rutherford Hotel is Nelson’s classic conference venue, conveniently located in the centre of • Home to three spectacular the city. Of seven room options, the largest is the Maitai Room which can host 700 delegates national parks in theatre layout or for cocktail events. • Tasman’s Great Taste Cycle Trail Just south of Nelson Airport, the distinctive and charming Grand Mercure Nelson Monaco is • Arts and culture: World of a premium convention complex including conference rooms, accommodation, a village hall Wearable Arts and classic Cars (theatre capacity of 180), shops, a permanent marquee, a pool, an executive cottage which all Museum, Provincial Museum, provide the wow factor that brings life to a conference. -

Queenstown Bungy Limited and Taupo Bungy Limited Together Are Termed the Parties

Public Version COMMERCE ACT 1986: BUSINESS ACQUISITION SECTION 66: NOTICE SEEKING CLEARANCE Date: 30 August 2019 The Registrar Mergers and Acquisitions Commerce Commission PO Box 2351 Wellington Pursuant to section 66(1) of the Commerce Act 1986 notice is hereby given seeking clearance of a proposed business acquisition. Part 1: Overview This is an application for clearance pursuant to section 66(1) of the Commerce Act 1986 made by Queenstown Bungy Limited (Purchaser ) to acquire adventure tourism operations located at Taupo owned by Taupo Bungy Limited (the Vendor ) (the Proposed Acquisition ). Queenstown Bungy Limited and Taupo Bungy Limited together are termed the Parties . The assets the Purchaser will acquire in the Proposed Acquisition comprise the business and physical assets used for the Vendor’s bungy and swing business in Taupo, known as Taupo Bungy. The Purchaser operates bungy, swing, catapult jump sites, and related businesses in Queenstown and Auckland, but does not currently have any operations in the Taupo area or surrounding region. The Purchaser considers that Taupo Bungy’s operations occur within a broad retail tourism activities market, but appreciates that it may be appropriate to consider defining the relevant market for the purposes of this application as the market for the provision of retail tourism adventure activities in the Central North Island region. This is similar to the market defined in the Commission’s 2003 clearance of Bungy New Zealand’s acquisition of Pipeline Bungy in Queenstown. The Proposed Acquisition will not, and will not be likely to, cause a substantial lessening of competition as: 1.5.1 It will not result in any aggregation of market share, as the Purchaser does not currently operate in the Central North Island region. -

Ccos Committee Agenda (3 March 2020) - Agenda

CCOs Committee Agenda (3 March 2020) - Agenda MEETING AGENDA CCOs COMMITTEE Tuesday, 3 March 2020 at 11.15am COUNCIL CHAMBER LIARDET STREET NEW PLYMOUTH Chairperson: Cr Richard Jordan Members: Cr Colin Johnston (Deputy) Cr Sam Bennett Cr Gordon Brown Cr Anneka Carlson Cr Murray Chong Cr Dinnie Moeahu Mayor Neil Holdom 1 CCOs Committee Agenda (3 March 2020) - Agenda CCOS COMMITTEE PURPOSE Communicate the Council’s priorities and strategic outcomes to the Council’s CCOs Ensure delivery by CCOs through the development of Statement of Intent and integration of CCO outcomes with the Council’s Long-Term Plan and Annual Plan funding processes and decisions Monitoring the financial and non-financial performance and delivery on strategic outcomes of the Council’s CCOS through quarterly, half-yearly and annual reports. Purpose of Local Government The reports contained in this agenda address the requirements of the Local Government Act 2002 in relation to decision making. Unless otherwise stated, the recommended option outlined in each report meets the purpose of local government and: Promote the social, economic, environmental, and cultural well-being of communities in the present and for the future. Would not alter significantly the intended level of service provision for any significant activity undertaken by or on behalf of the Council, or transfer the ownership or control of a strategic asset to or from the Council. END 2 CCOs Committee Agenda (3 March 2020) - Health and Safety Health and Safety Message In the event of an emergency, please follow the instructions of Council staff. Please exit through the main entrance. Once you reach the footpath please turn right and walk towards Pukekura Park, congregating outside the Spark building. -

Palmerston North Airport Limited

PALMERSTON NORTH AIRPORT LIMITED DRAFT ANNUAL BUDGET FOR THE YEAR ENDING 30 JUNE 2017 INTERIM REPORT TO 31 DECEMBER 2015 INTERIM REPORT TO 31 DECEMBER 2015 PAGE 1 COMPANY DIRECTORY PALMERSTON NORTH AIRPORT LIMITED DIRECTORS: D N Walker (Chairman) G F Gillespie J E Nichols J M K B Adlam O B Stock (Retired September 2015) M A Georgel (Commenced October 2015) MANAGEMENT: D J Lanham Chief Executive G W Pleasants Manager Aeronautical & Infrastructure G E Clark Commercial Manager A C Scott Visitor Development Manager Z Palmer Acting Finance Manager REGISTERED OFFICE: Palmerston North Airport Terminal Building Airport Drive PALMERSTON NORTH 4442 Phone: +64 6 351 4415 Fax: +64 6 355 2262 e-mail: [email protected] Web: www.pnairport.co.nz TRADING BANKERS: Bank of New Zealand LEGAL ADVISORS: Cooper Rapley Lawyers AUDITORS: Audit New Zealand (on behalf of The Auditor-General) INTERIM REPORT TO 31 DECEMBER 2015 PAGE 2 CONTENTS: PAGE: Joint Report of Chairman and Chief Executive 3 - 4 Statement of Service Performance 5 Financial Statements 6 - 10 Notes to the Financial Statements 11 - 14 INTERIM REPORT TO 31 DECEMBER 2015 PAGE 3 JOINT REPORT OF CHAIRMAN and CHIEF EXECUTIVE OFFICER FOR THE SIX MONTHS ENDING 31 DECEMBER 2015 The Board and Management of Palmerston North Airport Limited (PNAL) continue to implement the Company’s strategy in pursuit of our vision to “grow shareholder and regional economic value by operating a safe, efficient, attractive and profitable airport that serves the Central Region”. The vision reflects the importance that Palmerston North Airport plays as a gateway to the wider region which extends from Ruapehu in the North, through Wanganui and Rangitikei, Manawatu, south to Horowhenua and across the ranges to Tararua and the Wairarapa. -

Originair Increases Services

MEDIA RELEASE For Immediate Release Originair Increases Services 26th April 2021 Originair is about to introduce a further Jetstream 32 aircraft to its fleet allowing increased services. Commencing Monday May 3rd, the airline will overnight an aircraft and crew in Hamilton allowing it to offer an early morning departure direct to Palmerston North and on to Nelson. The reverse will occur each weekday evening with the aircraft departing Nelson with a direct flight to Palmerston North and on to Hamilton departing at 5.10pm arriving at 6pm. Originair CEO, Robert Inglis, said since it commenced its’ services to and from Hamilton on October 19th last year, following Air New Zealand withdrawing from the Hamilton to Palmerston North route. Our intention had always been to introduce a morning departure between the two cities, allowing business travellers, from Hamilton, a full business day in Palmerston North with an evening direct return flight and we are pleased to now be able to commence these flights. The new services complement Originairs’ current services. These changes also allow an increase in services between Nelson and Palmerston North, reflecting growing demand on this popular direct service, where we shortly plan to offer double daily services between this city pair. The airlines’ direct Hamilton flights to Nelson each Friday evening, returning on Sunday evening, remain unchanged, as do the Friday and Sunday services between Nelson and Wellington. Mr Inglis said, the solid support the airline has received on its’ services is encouraging and appreciated. Background Originair has its’ roots in more than 30 years of professional passenger airline operation.