2035 Master Plan August 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nelson Airport's New Terminal – Overview of the Design of a Large

Conference issue Nelson Airport’s new terminal – overview of the design of a large-span engineered timber specialist building Evzˇen Novak, Samantha Zondag, Sarah Berry and Simon Hardy Engineered timber in the Nelson Airport Terminal under construction. Photo courtesy of David Evison Abstract more closely reflects the needs of the end users of the building. In providing this viewpoint, the authors hope The Nelson Airport Terminal is a new large-span that it facilitates a raised producer awareness of the building that replaces the existing terminal building at issues facing the incorporation of engineered timber the airport. The structure and interior of the building into any building and, more fundamentally, an increase relies on engineered timber (LVL and plywood) to in the use of engineered timber in the building stock achieve the open spans required and create a unique New Zealand produces each year. airport environment. Beginning with the brief and a short description This paper serves to outline a significant end use of the building, the paper goes on to discuss the design for engineered timber and sets out, from a designer’s drivers for the building and how the selected drivers perspective, the journey from initial idea to end result. supported the use of engineered timber, one very major The designer’s perspective is clearly not the same as element of the design strategy. An overview of the the producer’s. In general, the designer’s perspective design and construction processes, particularly dealing NZ Journal of Forestry, November 2018, Vol. 63, No. 3 11 Conference issue with innovations such as the use of resilient slip friction Initially, the design team investigated whether an joints (RSFJs) and pre-fabrication, is provided along expansion of the existing terminal would be feasible, or if with some preliminary learnings. -

Annual Report 20 07 Aviation Industry Association of New Zealand (Inc) Contents

AVIATION INDUSTRY ASSOCIATION OF NEW ZEALAND (INC) Annual Report 20 07 Aviation Industry Association of New Zealand (Inc) Contents General Association Officers 2 Past Officers/Life Members 3 President’s Report 5 Chief Executive Officer’s Report 13 Financial Statements 18 AIA Annual Conference Report 28 Aviation Training Report 52 Aviation Services Ltd 55 AIRCARE Annual Report 2007 57 List of Advertisers 60 Divisional Chair Reports NZAAA (Agricultural Aviation) 31 Air Rescue/Air Ambulance 34 Air Transport 35 Education and Research 37 Engineering 38 Flight Training 40 Annual Report Helicopter 42 Supply & Services 44 Tourist Flight Operators 49 20 Cover Photo: The Auckland Rescue Helicopter Trust’s BK117B2 ZK HLN over central Auckland being flown by the Trust’s Chief Pilot Dave Walley. The Single Pilot IFR, NVG Configured helicopter came into service with the Trust on 01January 2007 and completed its 300 hr check 01 July 2007. 07 ANNUAL REPORT 2007 2 Association Officers 2006–2007 Council Head Office President: Chief Executive: W.J. Funnell, Helicopter Services BOP Ltd I.S. King Vice-Presidents: W.P. Taylor, Eagle Airways Ltd Office Manager: W. Sattler, Ardmore Flying School Ltd P.A. Hirschman Immediate Past President: Membership Liaison Manager: D. Thompson, Dennis Thompson International Ltd D. Watson Councillors Technical Advisors: J. McGregor M. Chubb J. Lusty K. MacKenzie D. Webb B. Wyness P. Garden D. Lyon D. Morgan R. Wikaira F. Douglas D. Horrigan P. Mackay A. Peacock NZAAA Executive Officer: Divisional and Branch Chair J.F. Maber Agricultural Aviation Division Office Address: Chair: K.J. MacKenzie, MacKenzie Aviation Ltd Level 5 Deputy Chair & South Island Branch Chair: Agriculture House T. -

Air New Zealand Adjusted Its Business Quickly to Manage the Impact of Covid-19

Media release 27 August 2020 Air New Zealand adjusted its business quickly to manage the impact of Covid-19 Air New Zealand today announces its 2020 result, affirming the unprecedented effect of the Covid- 19 pandemic on its business and the global aviation industry following extensive travel and border restrictions which commenced from March. Air New Zealand is reporting a loss before other significant items and taxation of $87 million1 for the 2020 financial year, compared to earnings of $387 million in the prior year. Despite reporting a strong interim profit of $198 million2 for the first six months of the financial year, and seeing positive demand on North American and regional routes early in the second half, Covid- related travel restrictions resulted in a 74 percent drop in passenger revenue from April to the end of June compared to the prior year, which drove the airline’s operating losses. Statutory losses before taxation, which include $541 million of other significant items, were $628 million, compared to earnings of $382 million last year. Non-cash items of $453 million reflected most of the other significant items, including the $338 million aircraft impairment charge related to grounding of the Boeing 777-200ER fleet for the foreseeable future. The airline has responded to this crisis with urgency, including securing additional liquidity, structurally reducing its cost base and deferring significant capex spend, whilst ensuring that the business remains well positioned to grow profitably when travel restrictions are eventually removed and customer demand returns. Quick and decisive action in response to Covid-19 Air New Zealand’s Chairman Dame Therese Walsh says she is proud of the way the business has responded to this crisis, acting with speed and agility to lower the cost base, and pivoting quickly to ramp up domestic and cargo services to help keep the New Zealand economy moving. -

Change 3, FAA Order 7340.2A Contractions

U.S. DEPARTMENT OF TRANSPORTATION CHANGE FEDERAL AVIATION ADMINISTRATION 7340.2A CHG 3 SUBJ: CONTRACTIONS 1. PURPOSE. This change transmits revised pages to Order JO 7340.2A, Contractions. 2. DISTRIBUTION. This change is distributed to select offices in Washington and regional headquarters, the William J. Hughes Technical Center, and the Mike Monroney Aeronautical Center; to all air traffic field offices and field facilities; to all airway facilities field offices; to all international aviation field offices, airport district offices, and flight standards district offices; and to the interested aviation public. 3. EFFECTIVE DATE. July 29, 2010. 4. EXPLANATION OF CHANGES. Changes, additions, and modifications (CAM) are listed in the CAM section of this change. Changes within sections are indicated by a vertical bar. 5. DISPOSITION OF TRANSMITTAL. Retain this transmittal until superseded by a new basic order. 6. PAGE CONTROL CHART. See the page control chart attachment. Y[fa\.Uj-Koef p^/2, Nancy B. Kalinowski Vice President, System Operations Services Air Traffic Organization Date: k/^///V/<+///0 Distribution: ZAT-734, ZAT-464 Initiated by: AJR-0 Vice President, System Operations Services 7/29/10 JO 7340.2A CHG 3 PAGE CONTROL CHART REMOVE PAGES DATED INSERT PAGES DATED CAM−1−1 through CAM−1−2 . 4/8/10 CAM−1−1 through CAM−1−2 . 7/29/10 1−1−1 . 8/27/09 1−1−1 . 7/29/10 2−1−23 through 2−1−27 . 4/8/10 2−1−23 through 2−1−27 . 7/29/10 2−2−28 . 4/8/10 2−2−28 . 4/8/10 2−2−23 . -

Airlines Codes

Airlines codes Sorted by Airlines Sorted by Code Airline Code Airline Code Aces VX Deutsche Bahn AG 2A Action Airlines XQ Aerocondor Trans Aereos 2B Acvilla Air WZ Denim Air 2D ADA Air ZY Ireland Airways 2E Adria Airways JP Frontier Flying Service 2F Aea International Pte 7X Debonair Airways 2G AER Lingus Limited EI European Airlines 2H Aero Asia International E4 Air Burkina 2J Aero California JR Kitty Hawk Airlines Inc 2K Aero Continente N6 Karlog Air 2L Aero Costa Rica Acori ML Moldavian Airlines 2M Aero Lineas Sosa P4 Haiti Aviation 2N Aero Lloyd Flugreisen YP Air Philippines Corp 2P Aero Service 5R Millenium Air Corp 2Q Aero Services Executive W4 Island Express 2S Aero Zambia Z9 Canada Three Thousand 2T Aerocaribe QA Western Pacific Air 2U Aerocondor Trans Aereos 2B Amtrak 2V Aeroejecutivo SA de CV SX Pacific Midland Airlines 2W Aeroflot Russian SU Helenair Corporation Ltd 2Y Aeroleasing SA FP Changan Airlines 2Z Aeroline Gmbh 7E Mafira Air 3A Aerolineas Argentinas AR Avior 3B Aerolineas Dominicanas YU Corporate Express Airline 3C Aerolineas Internacional N2 Palair Macedonian Air 3D Aerolineas Paraguayas A8 Northwestern Air Lease 3E Aerolineas Santo Domingo EX Air Inuit Ltd 3H Aeromar Airlines VW Air Alliance 3J Aeromexico AM Tatonduk Flying Service 3K Aeromexpress QO Gulfstream International 3M Aeronautica de Cancun RE Air Urga 3N Aeroperlas WL Georgian Airlines 3P Aeroperu PL China Yunnan Airlines 3Q Aeropostal Alas VH Avia Air Nv 3R Aerorepublica P5 Shuswap Air 3S Aerosanta Airlines UJ Turan Air Airline Company 3T Aeroservicios -

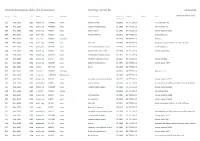

British Aerospace Bae J31 Jetstream Sorting: Serial Nr

British Aerospace BAe J31 Jetstream Sorting: Serial Nr. 29.08.2021 Ser.Nr. Type F/F Status Immatr. Operator Last Operator in service Engines Owner Rem. @airlinefleet.info M/Y until 601 BAe.J3102 1982 broken up G-WMCC none Maersk Air UK 08-1996 GA TPE331-10 Air Commuter ntu 602 BAe.J3101 1982 broken up N422MX none Eastern Metro Express 01-1998 GA TPE331-10 Mall Airways ntu 603 BAe.J3103 1982 broken up N603JS none Gold Aviation 01-2001 GA TPE331-10 broken up by 08-2005 604 BAe.J3101 1982 perm_wfu N78019 none Personal Airliner 05-2011 GA TPE331-10 to be broken up 605 BAe.J3102 1982 in service N408PP Corporate 06-2013 GA TPE331-10 Phil Pate 606 BAe.J3102 1982 perm_wfu LN-FAV none Coast Air 02-2007 GA TPE331-10 Royal Norwegian Air Force as instr. airframe 607 BAe.J3102 1983 perm_wfu N607BA none Professional Aviation Group 04-2008 GA TPE331-10 to be broken up 608 BAe.J3101 1983 broken up N608JX none Native American Air Serv. 03-1999 GA TPE331-10 broken up 03-2005 609 BAe.J3102 1983 broken up N609BA none Professional Aviation Group 05-2013 GA TPE331-10 610 BAe.J3103 1983 broken up G-JXTA none Jetstream Executive Travel 02-2011 GA TPE331-10 broken up 2016 611 BAe.J3101 1983 broken up N419MX none Eastern Metro Express 01-1991 GA TPE331-10 broken up 12-1997 612 BAe.J3102 1983 stored OM-NKD none SK Air 00-1999 GA TPE331-10 613 BAe.J3101 1983 in service N904EH Corporate 02-2019 GA TPE331-10 Aerostar 1 Inc. -

Download Issue 61 Complete

KiwiFlyer TM Magazine of the New Zealand Aviation Community Issue 61 2019 #1 $ 7.90 inc GST ISSN 1170-8018 P-40 Experience Autoflight’s Parallel Twin Bristol Scout arrives at Ardmore Products, Services, News, Events, Warbirds, Recreation, Training and more. KiwiFlyer Issue 61 2019 #1 From the Editor Features Welcome to an issue of KiwiFlyer that is packed 8 Living the Dream full of articles from people sharing their Bevan Dewes at the controls of a enthusiasm for aviation. These are spread right P-40 Kittyhawk. across the age spectrum - in regard to both pilots and aircraft. 20 The Story of RON Neil Hintz didn’t just build this 8 First up is a contribution from Kiwi pilot Bevan aircraft, he designed and built the Dewes who has been flying a P-40 Kittyhawk engine as well. in Australia. Keen on aviation since a teenager, and just 24 now, Bevan has taken all the right 24 Memories of a Chipmunk steps along the way to make ‘Living the Dream’ Alan Murgatroyd thought something possible, including winning one of the 2018 was familiar when he read about Warbirds Over Wanaka flying scholarships. Chipmunk ZK-LOM in our last issue. Neil Hintz is another person who grew up 30 Gavin Conroy’s Gallery surrounded by things aviation, and with an Part One of Gavin’s favourite images from 2018. inherited can-do attitude. Amongst other work, 44 Neil builds autogyros and with a self-confessed 42 Walsh Memorial Scout Flying School dislike of available ‘branded’ options, decided Noah Woolf writes of his experience to build and fly his own engine too. -

This Document Includes Interesting Facts and Figures Over the Last Year

A VIEW FROM ABOVE ›› FACTS & FIGURES 2019 ›› WELLINGTON AIRPORT Direct destinations AT A GLANCE 26 from Wellington Airport Total passengers a year 6.4M Airlines; Air New Zealand, Qantas, Virgin, Singapore Airlines, Fiji Airways, Jetstar, 9 Sounds Air, Air Chathams, Golden Bay Air Rongotai Airport became an aerodrome in 1929, but the Wellington Airport we know today opened officially on 24 October 1959 with thousands of spectators there to witness the event. The opening of the airport went ahead with a temporary terminal, affectionately called the “tin shed”; it ended up being a little more than temporary – lasting until 1999 when the new terminal was finally built in its place. Today, we take over 6 million passengers direct to 26 destinations around the world each year. 110ha Built on 110 hectares of land 60 Volunteer ambassadors assisting passengers 27 Qualified firefighters 28 Operational staff made up of Integrated Operations Controllers, Customer Service 66/34 Agents and dedicated airfield specialists Owned by Infratil and Wellington City Council ›› 2 Wellington Airport – A View from Above 2019 Direct destinations 26 from Wellington Airport 6.4M Total passengers a year Airlines; Air New Zealand, Qantas, Virgin, Singapore Airlines, Fiji Airways, Jetstar, 9 Sounds Air, Air Chathams, Golden Bay Air 84,000 Aircraft movements (number 7.7M of flights arriving and departing) Total number of aircraft seats 230 70+ Average daily flights 4,000T Flights per week to Australia, Fiji, and Singapore totalling 1.2 million seats 110ha Asphalt replaced -

Services at Holy Trinity

RICHMOND PARISH PROFILE WHO ARE WE? We are a committed group of Christians who endeavour to make our church a welcoming church to all. Many visitors have favourably commented on the friendly welcome they receive among us. We are in an evangelical diocese and most of our congregation tend in that direction. There are, however, a number of parishioners with a more liberal theology. Our focus tends towards what unites us rather than what we disagree on. We are a predominantly older congregation with a small number of children and very few members in the 20-40 age group bracket. We value our evangelical, Anglican heritage which does provide a unique flavour to the Richmond church scene. Our two Sunday morning services attract just over 80 people to our wooden church on the hill near the centre of the Richmond township. WHERE ARE WE? Although Richmond is geographically close to Nelson, it is administered by the Tasman District Council (www.tasman.govt.nz) which has its main council offices in Richmond. Richmond is a thriving, growing centre for the rural townships to the south and the west. The population was estimated to be 17,250 in June 2020. In the 2018 census the main ethnic breakdown of the Tasman Region was European (92.6%), Maori (8.7%), Asian (2.8%) and Pacific (1.6%). (These figures exceed 100% as people can associate with more than one ethnic group). Due both to an increasing influx of retirees and the ageing population Tasman District’s older residents (65+) are predicted to rise from 21% in 2018 to 32% in 20 years. -

Interim Report

PALMERSTON NORTH AIRPORT LIMITED INTERIM REPORT TO 31 DECEMBER 2020 FINAL INTERIM REPORT TO 31 DECEMBER 2020 PAGE 2 COMPANY DIRECTORY PALMERSTON NORTH AIRPORT LIMITED DIRECTORS: M A Georgel – Chair J E Nichols – Chair Audit & Risk Committee G F Gillespie S Vining C G Cardwell MANAGEMENT: D J Lanham Chief Executive G E Clark Commercial Manager J A Baker Finance Manager D J Yorke Infrastructure Manager D Balmer Marketing & Communications Manager B D Lawry Terminal Manager T B Cooney Safety and Security Manager B Parkinson Airfield Operations Manager REGISTERED OFFICE: Palmerston North Airport Terminal Building Airport Drive PALMERSTON NORTH 4442 Phone: +64 6 351 4415 e-mail: [email protected] Web: www.pnairport.co.nz TRADING BANKERS: Bank of New Zealand LEGAL ADVISORS: CR Law AUDITORS: Audit New Zealand (on behalf of The Auditor-General) INTERIM REPORT TO 31 DECEMBER 2020 PAGE 3 CONTENTS: PAGE: Joint Report of Chair and Chief Executive 4 Statement of Service Performance 6 Financial Statements 7 - 11 Notes to the Financial Statements 12 - 15 INTERIM REPORT TO 31 DECEMBER 2020 PAGE 4 JOINT REPORT OF THE CHAIR & CHIEF EXECUTIVE FOR THE SIX MONTHS ENDING 31 DECEMBER 2020 With a backdrop of the impact of the COVID-19 pandemic on financial performance, the company remained focused on the safety and wellbeing of its people, customers and tenants during the six months to December 2020. Highlights include zero lost time injuries, the ongoing development of the Company’s OneTeam Wellness programme, CAA certification of the Company’s Safety Management System (SMS), continued compliance with CAA Rule Part 139, and the ability to provide ongoing support to community groups including sponsorships and support of charities albeit on a smaller scale. -

Linking the Long White Cloud Why New Zealand’S Small and Isolated Communities Need to Secure the Future of Their Airports and Air Links a Position Paper

Linking the long white cloud Why New Zealand’s small and isolated communities need to secure the future of their airports and air links A position paper July 2017 Linking the long white cloud Why New Zealand’s smaller airports and their communities For more information contact: need a national infrastructure fund Kevin Ward Prepared by Message Shapers Public Affairs for Chief Executive the New Zealand Airports Association New Zealand Airports Association T: +64 4 384 3217 © 2017 NZ Airports, Wellington [email protected] Contents Foreword 2 Executive summary 3 Smaller airports in crisis 3 The solution 4 Recommendations 4 1. The problem 5 1.1 Commercial imperative 5 1.2 An uncertain future 6 1.3 Funding inconsistency 6 1.4 Disproportionate burden 7 1.5 Complex operations 7 2. The impact 8 2.1 Loss of airline service 8 2.2 Poorer disaster response 9 2.3 Connectivity decrease 9 2.4 Ageing aircraft 10 2.5 Lack of interconnectivity 10 3. Who’s affected? 12 3.1 The airports at risk 12 3.2 Communities at risk 13 3.3 Tourism at risk 13 4. Global benchmark 14 4.1 Route subsidies 14 4.2 Fund essential works 15 4.3 Fund communities 15 5. The solution 16 5.1 Isolated communities 16 5.2 National infrastructure 17 5.3 Essential services 17 5.4 Funding required 18 5.5 Revenue source 18 6. Conclusion 19 Page !1 Deposit Photos Foreword New Zealand’s air links are the only rapid NZ Airports is the representative body of New transit option for our long, thin country. -

Civil Aviation Rule Part 125 Update Agency Disclosure Statement

Regulatory Impact Statement Civil Aviation Rule Part 125 Update Agency Disclosure Statement This Regulatory Impact Statement (RIS) has been prepared by the Ministry of Transport (the Ministry), with assistance from the Civil Aviation Authority (CAA). It provides an analysis of options to address the safety risk associated with commercial passenger operations in medium sized aeroplanes (10-29 passenger seats), which are currently subject to less stringent operating requirements than larger aeroplanes (30 or more passenger seats), and to achieve compliance with International Civil Aviation Organization (ICAO) standards and recommended practices. The preferred option is to raise the operating standards for medium sized aeroplanes by amending Civil Aviation Rule Part 125, which governs commercial air transport in medium sized aeroplanes. It is reasonable to assume that higher operating standards will improve the level of safety afforded to passengers on medium sized aeroplanes. However, due to the minor and technical nature of the amendments, and a lack of relevent safety data for medium and large sized aeroplanes, the underlying risks and expected safety benefits are difficult to quantify. The proposed Rule amendment would impose compliance costs on operators of medium aeroplanes. Operators wishing to conduct extended over water operations1 will be required to train staff in aircraft ditching procedures, estimated at an initial cost of $7,500 per two person flight crew, with annual refresher training estimated at approximately $600 per crew member. Other compliance costs will arise where operators are required (if necessary) to amend their expositions2 ($400-$800 per operator), or amend their operations specifications (approximately $1,000 for each of the two operators affected).