Download (991Kb)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

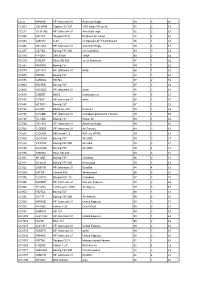

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

WORLD AVIATION Yearbook 2013 EUROPE

WORLD AVIATION Yearbook 2013 EUROPE 1 PROFILES W ESTERN EUROPE TOP 10 AIRLINES SOURCE: CAPA - CENTRE FOR AVIATION AND INNOVATA | WEEK startinG 31-MAR-2013 R ANKING CARRIER NAME SEATS Lufthansa 1 Lufthansa 1,739,886 Ryanair 2 Ryanair 1,604,799 Air France 3 Air France 1,329,819 easyJet Britis 4 easyJet 1,200,528 Airways 5 British Airways 1,025,222 SAS 6 SAS 703,817 airberlin KLM Royal 7 airberlin 609,008 Dutch Airlines 8 KLM Royal Dutch Airlines 571,584 Iberia 9 Iberia 534,125 Other Western 10 Norwegian Air Shuttle 494,828 W ESTERN EUROPE TOP 10 AIRPORTS SOURCE: CAPA - CENTRE FOR AVIATION AND INNOVATA | WEEK startinG 31-MAR-2013 Europe R ANKING CARRIER NAME SEATS 1 London Heathrow Airport 1,774,606 2 Paris Charles De Gaulle Airport 1,421,231 Outlook 3 Frankfurt Airport 1,394,143 4 Amsterdam Airport Schiphol 1,052,624 5 Madrid Barajas Airport 1,016,791 HE EUROPEAN AIRLINE MARKET 6 Munich Airport 1,007,000 HAS A NUMBER OF DIVIDING LINES. 7 Rome Fiumicino Airport 812,178 There is little growth on routes within the 8 Barcelona El Prat Airport 768,004 continent, but steady growth on long-haul. MostT of the growth within Europe goes to low-cost 9 Paris Orly Field 683,097 carriers, while the major legacy groups restructure 10 London Gatwick Airport 622,909 their short/medium-haul activities. The big Western countries see little or negative traffic growth, while the East enjoys a growth spurt ... ... On the other hand, the big Western airline groups continue to lead consolidation, while many in the East struggle to survive. -

Annual Report 2017 Contents & Financial Highlights

ANNUAL REPORT 2017 CONTENTS & FINANCIAL HIGHLIGHTS TUI GroupFinancial 2017 in numbers highlights Formats The Annual Report and 2017 2016 Var. % Var. % at the Magazine are also available online € 18.5 bn € 1,102.1restated m constant € million currency Turnover 18,535.0 17,153.9 + 8.1 + 11.7 Underlying EBITA1 1 1 + 11.7Hotels & %Resorts + 12.0356.5 % 303.8 + 17.3 + 19.2 Cruises 255.6 190.9 + 33.9 + 38.0 Online turnoverSource Markets underlying526.5 554.3 – 5.0 – 4.0 Northern Region 345.8 383.1 – 9.7 – 8.4 year-on-year Central Region 71.5 85.1 – 16.0 – 15.8 Western Region EBITA109.2 86.1 + 26.8 + 27.0 Other Tourism year-on-year13.4 7.9 + 69.6 + 124.6 Tourism 1,152.0 1,056.9 + 9.0 + 11.2 All other segments – 49.9 – 56.4 + 11.5 + 3.4 Mobile TUI Group 1,102.1 1,000.5 + 10.2 + 12.0 Discontinued operations – 1.2 92.9 n. a. Total 1,100.9 1,093.4 + 0.7 http://annualreport2017. tuigroup.com EBITA 2, 4 1,026.5 898.1 + 14.3 Underlying EBITDA4 1,541.7 1,379.6 + 11.7 56 %EBITDA2 4 23.61,490.9 % ROIC1,305.1 + 14.2 Net profi t for the period 910.9 464.9 + 95.9 fromEarnings hotels per share4 & € 6.751.36 % WACC0.61 + 123.0 Equity ratio (30 Sept.)3 % 24.9 22.5 + 2.4 cruisesNet capex and contentinvestments (30 Sept.) 1,071.9 634.8 + 68.9 comparedNet with cash 30 %(302 at Sept.) time 4of merger 583.0 31.8 n. -

14 Seduta Di Martedì 24 Ottobre 1989

SEDUTA DI MARTEDÌ 24 OTTOBRE 1989 257 14 SEDUTA DI MARTEDÌ 24 OTTOBRE 1989 PRESIDENZA DEL PRESIDENTE DELLA IX COMMISSIONE DELLA CAMERA ANTONIO TESTA SEDUTA DI MARTEDÌ 24 OTTOBRE 1989 259 La seduta comimcia alle 15,45. tenzione degli impianti visivi relativi alla navigazione aerea. (Le Commissioni approvano il processo Nella relazione abbiamo cercato di verbale della seduta precedente). dare un quadro sintetico della situazione concernente la gestione portuale. Il primo dato che emerge è che nel nostro paese Audizione dei rappresentanti dell'Assaero- esistono aeroporti gestiti in forma totale porti e della GESAP. ed altri in cui i gestori aeroportuali hanno solo la responsabilità dei servizi, PRESIDENTE. L'ordine del giorno ma non della gestione complessiva. Si reca il seguito dell'indagine conoscitiva tratta di un primo problema che segna• sulla sicurezza del volo. Nella seduta liamo alla vostra attenzione. In prospet• odierna sono previste le audizioni dei tiva sarebbe di aiuto al miglioramento rappresentanti dell'Assaeroporti e della del sistema complessivo una chiara iden• GESAP, dell'Alisarda, delle compagnie di tificazione, anche in termini di responsa• terzo livello, del presidente dell'Aeroclub bilità, di chi deve gestire l'aeroporto e di d'Italia, dell'ANIGAM e delle associazioni chi deve, invece, svolgere un'azione di co• dei consumatori. ordinamento ed effettuare un'opera di in• Nell'ambito dell'audizione dei rappre• dirizzo e di controllo, anche in relazione sentanti dell'Assaeroporti e della Gesap, ai piani nazionali. partecipano alla seduta odierna il dottor Attualmente, sono solo otto gli aero• Domenico Cempella, l'ingegner Francesco porti a gestione totale, nei quali cioè il Di Martino, l'ingegner Giuseppe Maritano, gestore ha la responsabilità del funziona• il comandante Agostino Ferrari e il dottor mento complessivo dello scalo. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876. -

Managing Globalization

Managing Globalization Managing Globalization: New Business Models, Strategies and Innovation Edited by Demetris Vrontis, Stefano Bresciani and Matteo Rossi Managing Globalization: New Business Models, Strategies and Innovation Edited by Demetris Vrontis, Stefano Bresciani and Matteo Rossi This book first published 2016 Cambridge Scholars Publishing Lady Stephenson Library, Newcastle upon Tyne, NE6 2PA, UK British Library Cataloguing in Publication Data A catalogue record for this book is available from the British Library Copyright © 2016 by Demetris Vrontis, Stefano Bresciani, Matteo Rossi and contributors All rights for this book reserved. No part of this book may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. ISBN (10): 1-4438-8897-4 ISBN (13): 978-1-4438-8897-4 TABLE OF CONTENTS Chapter One ................................................................................................. 1 New strategies in Italian Airports Giovanni Ossola, Guido Giovando and Chiara Crovini Chapter Two .............................................................................................. 25 The Business of Luxury Brands: Luxury Car Brand Relationship Elisa Giacosa, Francesca Culasso and Sandra Maria Correia Loureiro Chapter Three ............................................................................................ 50 The Relevance of Cultural Aspects in Cross Cultural Management -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

I Am Writing to Obtain Information About Flights Your Organisation Has Paid for Since 1 January 2015

Uned Rhyddid Gwybodaeth / Freedom of Information Unit Response Date: 20/02/2018 2018/149 – Flights In response to your recent request for information regarding; I am writing to obtain information about flights your organisation has paid for since 1 January 2015. Please include the following information: The name of the airline used The fare paid The class of ticket (eg economy, premium economy, business, first) The date The port of departure The port of arrival Please include flights that have been paid for directly as well as any flights staff or others have been reimbursed for. Please see attached information provided by Capita Travel and Events who book all of our air travel. We didn’t book any flights in 2015 so the information is from 2016 to date. Please note the cost of a return flight is allocated against the outward journey showing the inward journey as zero cost. THIS INFORMATION HAS BEEN PROVIDED IN RESPONSE TO A REQUEST UNDER THE FREEDOM OF INFORMATION ACT 2000, AND IS CORRECT AS AT 13/02/2018 Paid Airline Fare inc Class Date Depart Arrive Tax BMI REGIONAL 84.47 Economy 23/01/2018 INVERNESS MANCHESTER BMI REGIONAL 134.84 Economy 22/01/2018 MANCHESTER INVERNESS BMI REGIONAL 134.84 Economy 22/01/2018 MANCHESTER INVERNESS BMI REGIONAL 84.47 Economy 23/01/2018 INVERNESS MANCHESTER BMI REGIONAL 84.47 Economy 23/01/2018 INVERNESS MANCHESTER SCANDINAVIAN 166.54 Economy 23/01/2018 MANCHESTER COPENHAGEN AIRLINES SCANDINAVIAN 0.00 Economy 23/01/2018 COPENHAGEN GOTHENBURG AIRLINES SCANDINAVIAN 0.00 Economy 23/01/2018 GOTHENBURG -

Neil Cloughley, Managing Director, Faradair Aerospace

Introduction to Faradair® Linking cities via Hybrid flight ® faradair Neil Cloughley Founder & Managing Director Faradair Aerospace Limited • In the next 15 years it is forecast that 60% of the Worlds population will ® live in cities • Land based transportation networks are already at capacity with rising prices • The next transportation revolution faradair will operate in the skies – it has to! However THREE problems MUST be solved to enable this market; • Noise • Cost of Operations • Emissions But don’t we have aircraft already? A2B Airways, AB Airlines, Aberdeen Airways, Aberdeen Airways, Aberdeen London Express, ACE Freighters, ACE Scotland, Air 2000, Air Anglia, Air Atlanta Europe, Air Belfast, Air Bridge Carriers, Air Bristol, Air Caledonian, Air Cavrel, Air Charter, Air Commerce, Air Commuter, Air Contractors, Air Condor, Air Contractors, Air Cordial, Air Couriers, Air Ecosse, Air Enterprises, Air Europe, Air Europe Express, Air Faisal, Air Ferry, Air Foyle HeavyLift, Air Freight, Air Gregory, Air International (airlines) Air Kent, Air Kilroe, Air Kruise, Air Links, Air Luton, Air Manchester, Air Safaris, Air Sarnia, Air Scandic, Air Scotland, Air Southwest, Air Sylhet, Air Transport Charter, AirUK, Air UK Leisure, Air Ulster, Air Wales, Aircraft Transport and Travel, Airflight, Airspan Travel, Airtours, Airfreight Express, Airways International, Airwork Limited, Airworld Alderney, Air Ferries, Alidair, All Cargo, All Leisure, Allied Airways, Alpha One Airways, Ambassador Airways, Amber Airways, Amberair, Anglo Cargo, Aquila Airways, -

Airlines Codes

Airlines codes Sorted by Airlines Sorted by Code Airline Code Airline Code Aces VX Deutsche Bahn AG 2A Action Airlines XQ Aerocondor Trans Aereos 2B Acvilla Air WZ Denim Air 2D ADA Air ZY Ireland Airways 2E Adria Airways JP Frontier Flying Service 2F Aea International Pte 7X Debonair Airways 2G AER Lingus Limited EI European Airlines 2H Aero Asia International E4 Air Burkina 2J Aero California JR Kitty Hawk Airlines Inc 2K Aero Continente N6 Karlog Air 2L Aero Costa Rica Acori ML Moldavian Airlines 2M Aero Lineas Sosa P4 Haiti Aviation 2N Aero Lloyd Flugreisen YP Air Philippines Corp 2P Aero Service 5R Millenium Air Corp 2Q Aero Services Executive W4 Island Express 2S Aero Zambia Z9 Canada Three Thousand 2T Aerocaribe QA Western Pacific Air 2U Aerocondor Trans Aereos 2B Amtrak 2V Aeroejecutivo SA de CV SX Pacific Midland Airlines 2W Aeroflot Russian SU Helenair Corporation Ltd 2Y Aeroleasing SA FP Changan Airlines 2Z Aeroline Gmbh 7E Mafira Air 3A Aerolineas Argentinas AR Avior 3B Aerolineas Dominicanas YU Corporate Express Airline 3C Aerolineas Internacional N2 Palair Macedonian Air 3D Aerolineas Paraguayas A8 Northwestern Air Lease 3E Aerolineas Santo Domingo EX Air Inuit Ltd 3H Aeromar Airlines VW Air Alliance 3J Aeromexico AM Tatonduk Flying Service 3K Aeromexpress QO Gulfstream International 3M Aeronautica de Cancun RE Air Urga 3N Aeroperlas WL Georgian Airlines 3P Aeroperu PL China Yunnan Airlines 3Q Aeropostal Alas VH Avia Air Nv 3R Aerorepublica P5 Shuswap Air 3S Aerosanta Airlines UJ Turan Air Airline Company 3T Aeroservicios -

Elenco Codici IATA Delle Compagnie Aeree

Elenco codici IATA delle compagnie aeree. OGNI COMPAGNIA AEREA HA UN CODICE IATA Un elenco dei codici ATA delle compagnie aeree è uno strumento fondamentale, per chi lavora in agenzia viaggi e nel settore del turismo in generale. Il codice IATA delle compagnie aeree, costituito da due lettere, indica un determinato vettore aereo. Ad esempio, è utilizzato nelle prime due lettere del codice di un volo: – AZ 502, AZ indica la compagnia aerea Alitalia. – FR 4844, FR indica la compagnia aerea Ryanair -AF 567, AF, indica la compagnia aerea Air France Il codice IATA delle compagnie aeree è utilizzato per scopi commerciali, nell’ambito di una prenotazione, orari (ad esempio nel tabellone partenza e arrivi in aeroporto) , biglietti , tariffe , lettere di trasporto aereo e bagagli Di seguito, per una visione di insieme, una lista in ordine alfabetico dei codici di molte compagnie aeree di tutto il mondo. Per una ricerca più rapida e precisa, potete cliccare il tasto Ctrl ed f contemporaneamente. Se non doveste trovare un codice IATA di una compagnia aerea in questa lista, ecco la pagina del sito dell’organizzazione Di seguito le sigle iata degli aeroporti di tutto il mondo ELENCO CODICI IATA COMPAGNIE AEREE: 0A – Amber Air (Lituania) 0B – Blue Air (Romania) 0J – Jetclub (Svizzera) 1A – Amadeus Global Travel Distribution (Spagna) 1B – Abacus International (Singapore) 1C – Electronic Data Systems (Svizzera) 1D – Radixx Solutions International (USA) 1E – Travelsky Technology (Cina) 1F – INFINI Travel Information (Giappone) G – Galileo International -

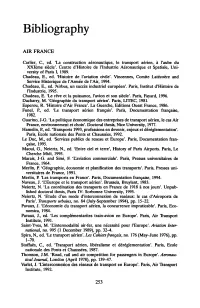

Bibliography

Bibliography AIR FRANCE Carlier, c., ed. 'La construction aeronautique, Ie transport aenen, a I'aube du XXIeme siecle'. Centre d'Histoire de l'Industrie Aeronautique et Spatiale, Uni versity of Paris I, 1989. Chadeau, E., ed. 'Histoire de I'aviation civile'. Vincennes, Comite Latecoere and Service Historique de l'Annee de l'Air, 1994. Chadeau, E., ed. 'Airbus, un succes industriel europeen'. Paris, Institut d'Histoire de l'Industrie, 1995. Chadeau, E. 'Le reve et la puissance, I'avion et son siecle'. Paris, Fayard, 1996. Dacharry, M. 'Geographie du transport aerien'. Paris, LITEC, 1981. Esperou, R. 'Histoire d'Air France'. La Guerche, Editions Ouest France, 1986. Funel, P., ed. 'Le transport aerien fran~ais'. Paris, Documentation fran~aise, 1982. Guarino, J-G. 'La politique economique des entreprises de transport aerien, Ie cas Air France, environnement et choix'. Doctoral thesis, Nice University, 1977. Hamelin, P., ed. 'Transports 1993, professions en devenir, enjeux et dereglementation'. Paris, Ecole nationale des Ponts et Chaussees, 1992. Le Due, M., ed. 'Services publics de reseau et Europe'. Paris, Documentation fran ~ise, 1995. Maoui, G., Neiertz, N., ed. 'Entre ciel et terre', History of Paris Airports. Paris, Le Cherche Midi, 1995. Marais, J-G. and Simi, R 'Caviation commerciale'. Paris, Presses universitaires de France, 1964. Merlin, P. 'Geographie, economie et planification des transports'. Paris, Presses uni- versitaires de France, 1991. Merlin, P. 'Les transports en France'. Paris, Documentation fran~aise, 1994. Naveau, J. 'CEurope et Ie transport aerien'. Brussels, Bruylant, 1983. Neiertz, N. 'La coordination des transports en France de 1918 a nos jours'. Unpub lished doctoral thesis, Paris IV- Sorbonne University, 1995.